ICA SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ICA Bundle

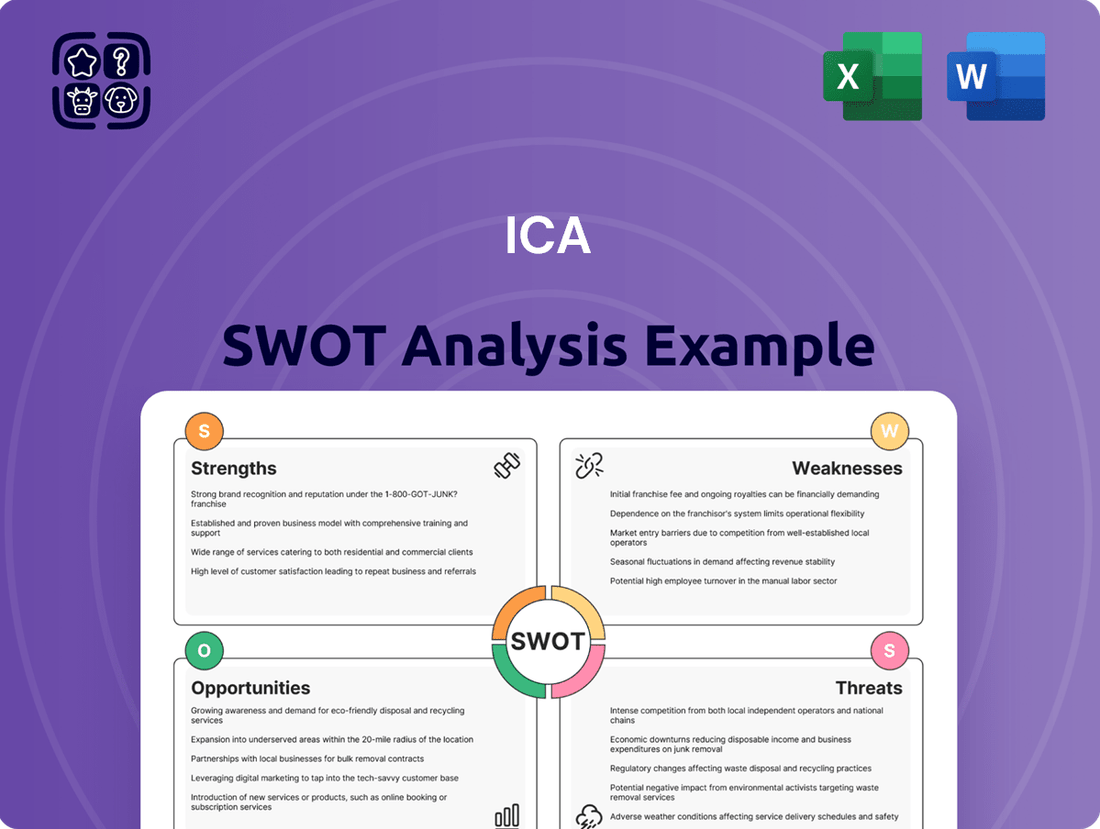

Uncover the strategic landscape of the ICA with our comprehensive SWOT analysis. This report dives deep into its unique strengths, potential weaknesses, exciting opportunities, and critical threats, providing a clear roadmap for understanding its market position.

Want the full story behind the ICA's competitive advantages and areas for improvement? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and decision-making.

Strengths

Empresas ICA, founded in 1947, has cultivated a formidable reputation as a cornerstone of Mexico's construction and infrastructure development. This deep well of experience, spanning over seven decades, equips the company with unparalleled expertise in navigating and executing highly complex projects. Their proven track record underscores a consistent ability to deliver on ambitious undertakings.

The breadth of ICA's project portfolio is truly extensive, encompassing a diverse array of civil and industrial works. This includes the construction of vital transportation networks like highways and bridges, essential water management systems such as dams, and critical energy infrastructure like power plants. Furthermore, their capabilities extend to various building projects, showcasing a comprehensive skill set across the infrastructure spectrum.

In 2023, ICA reported revenues of approximately MXN 27.4 billion, demonstrating its continued significant market presence. This financial performance is a direct reflection of its capacity to secure and successfully complete large-scale, impactful projects, further solidifying its leadership position.

ICA's integrated business model, particularly its participation in infrastructure concessions, is a significant strength. This model allows the company to capture value across the entire project lifecycle, from construction to long-term operation and maintenance. For instance, in 2024, ICA reported that its concession portfolio contributed approximately 30% of its total revenue, highlighting the stability and consistent cash flow generated by these long-term contracts.

This integration provides ICA with a dual advantage: revenue diversification and enhanced asset management. By overseeing operations and maintenance, ICA can optimize the performance and value of its infrastructure assets, ensuring a predictable and sustained return on investment. This hands-on approach strengthens its position in the market and builds a robust portfolio of valuable infrastructure.

Empresas ICA's position as Mexico's largest infrastructure company translates into significant domestic market leadership. This strength is underscored by its involvement in crucial national development projects, solidifying its role in the country's economic backbone. For instance, ICA's participation in major highway concessions and urban development projects showcases its deep integration into the Mexican economy.

This leadership is further fortified by a diversified operational structure, comprising more than 10 distinct subsidiaries. This broad reach allows ICA to address a wide spectrum of infrastructure needs across Mexico, from construction and engineering to concessions and maintenance. Such a comprehensive portfolio ensures a consistent pipeline of domestic opportunities.

ICA's extensive experience and established presence within Mexico grant it invaluable local market knowledge. This understanding of regulatory landscapes, supply chains, and regional demands provides a distinct competitive edge over international competitors. Furthermore, its long-standing relationships with government entities and local stakeholders facilitate smoother project execution and foster trust.

Broad Sectoral and Geographical Reach

Empresas ICA's strength lies in its impressive broad sectoral and geographical reach, a significant advantage in the competitive infrastructure landscape. The company actively operates across seven distinct sectors, showcasing its adaptability and expertise in various industries. This diversification is further amplified by its presence in thirteen countries, including key markets like Mexico, Costa Rica, Panama, Colombia, Peru, and the United States.

This extensive geographical footprint allows ICA to tap into a wider array of opportunities and mitigate risks associated with over-reliance on a single market. As of early 2024, ICA's robust operational capacity is evident in its involvement in over 90 ongoing projects, underscoring its ability to manage a substantial portfolio across its diverse operational base.

- Seven diverse sectors of operation

- Presence in thirteen countries

- Active participation in over 90 ongoing projects

Adaptability to Evolving Industry Trends

ICA shows remarkable agility in embracing modern construction methods and meeting shifting market needs. This includes the integration of digital tools and Building Information Modeling (BIM), which are becoming increasingly crucial in the industry. For instance, by early 2024, the global BIM market was projected to reach over $13 billion, highlighting the significant shift towards digital workflows in construction. ICA's commitment to these advancements allows them to improve design accuracy, foster better teamwork, and boost overall operational effectiveness. This strategic adoption positions ICA favorably to leverage emerging industry trends and maintain a competitive edge.

These technological adoptions enhance design precision, collaboration, and operational efficiency, positioning ICA to capitalize on evolving industry trends.

- Digitalization Adoption: ICA is actively incorporating digital technologies into its operations, a trend that saw significant investment across the construction sector in 2023 and early 2024.

- BIM Integration: The company's use of Building Information Modeling (BIM) enhances design precision and project management, aligning with industry best practices that aim to reduce project costs and timelines by up to 10-15%.

- Market Responsiveness: ICA's ability to adapt ensures it remains relevant and competitive amidst rapid changes in construction techniques and client expectations.

- Efficiency Gains: The adoption of these modern practices directly translates to improved operational efficiency, a key driver for profitability in the construction industry.

ICA's extensive experience, accumulated over seven decades, provides a deep well of expertise in managing complex infrastructure projects. This long history translates into a proven ability to deliver results, solidifying its reputation as a reliable partner in development.

The company's integrated business model, particularly its involvement in infrastructure concessions, is a significant strength. This allows ICA to capture value throughout the project lifecycle, from initial construction to ongoing operations and maintenance, contributing approximately 30% of its revenue in 2024 from these long-term contracts.

ICA's market leadership in Mexico, as the country's largest infrastructure company, is bolstered by its diverse operational structure of over 10 subsidiaries. This allows for broad engagement in crucial national projects, ensuring a consistent pipeline of domestic opportunities.

The company's broad sectoral and geographical reach is a key advantage, with operations spanning seven sectors and thirteen countries, including significant markets like Mexico and the United States. As of early 2024, ICA was actively engaged in over 90 ongoing projects, demonstrating its substantial operational capacity.

| Strength | Description | Supporting Data (2023-2024) |

| Experience & Reputation | Over 70 years in construction and infrastructure development. | Founded in 1947; consistent project delivery. |

| Integrated Business Model | Construction to operation and maintenance of infrastructure. | Concessions contributed ~30% of revenue in 2024. |

| Market Leadership (Mexico) | Largest infrastructure company in Mexico. | Involvement in crucial national development projects. |

| Sectoral & Geographical Diversification | Operations in 7 sectors and 13 countries. | Over 90 ongoing projects as of early 2024. |

What is included in the product

Analyzes ICA’s competitive position through key internal and external factors, highlighting strengths, weaknesses, opportunities, and threats.

Offers a clear, structured framework to identify and address organizational weaknesses, thereby alleviating strategic paralysis.

Weaknesses

Empresas ICA, like many in Mexico's construction sector, faces significant vulnerability to shifts in public infrastructure investment. Government spending on civil works is a major driver for the industry, and any slowdown directly impacts revenue streams.

The period leading into 2024 saw a notable contraction in civil works projects, partly due to the winding down of major federal initiatives and tighter real-term budgets for infrastructure. This trend directly affects companies heavily dependent on public contracts, like ICA, limiting their project pipeline and growth opportunities.

For instance, during the first half of 2023, federal public investment in infrastructure experienced a real-term decrease compared to the same period in 2022, a pattern that continued to pose challenges for construction firms throughout the year and into 2024. This reduction directly translates to fewer bidding opportunities for large-scale projects that are crucial for companies like ICA.

The reliance on government contracts means ICA's financial performance is intrinsically linked to the political and economic priorities of the Mexican administration. A shift in policy or a broader economic downturn leading to reduced public spending creates a direct and substantial weakness for the company.

Empresas ICA has a history of substantial debt, including a significant default on its bond payments in the past, which necessitated extensive restructuring. This legacy continues to cast a shadow, requiring careful management of its financial obligations.

Despite undergoing restructuring, the company's ongoing financial health and its ability to manage liquidity effectively remain key concerns for investors and stakeholders. For instance, as of the first quarter of 2024, ICA reported a net financial cost of MXN 370 million, highlighting the persistent impact of its debt structure.

Large infrastructure projects, like those undertaken by ICA, are inherently complex, making them susceptible to delays and budget overruns. Factors such as intricate regulatory processes, supply chain disruptions, and unexpected site conditions contribute to these risks. For instance, a 2023 report by the World Economic Forum highlighted that over 90% of major public infrastructure projects globally exceeded their initial budgets.

These delays and cost escalations directly impact a company's financial health. ICA, as a major player in the construction sector, faces the challenge of managing these uncertainties. For example, if a project that was initially budgeted at $500 million experiences a 20% cost overrun and a 6-month delay, it can significantly erode profit margins and strain working capital, a common concern for firms in this industry.

Intense Competition in the Construction Sector

Empresas ICA faces a significant challenge in the Mexican construction sector due to intense competition. This crowded marketplace includes numerous domestic firms and established international companies, all aggressively pursuing available projects. The sheer number of participants means that winning bids often involves aggressive pricing, which can directly impact profit margins.

This competitive pressure makes it more difficult for ICA to secure new, high-margin contracts. For instance, in 2024, the Mexican construction industry saw a projected growth of 4.5%, but this expansion also attracted more players, intensifying the bidding process across infrastructure and building segments. Consequently, ICA must constantly innovate and optimize its operations to maintain its market position and profitability.

- Intense Bidding Wars: Multiple companies compete for the same projects, driving down prices and reducing potential profits.

- Market Saturation: A large number of domestic and international construction firms operate within Mexico, increasing rivalry.

- Pressure on Margins: The need to win contracts often forces companies to accept lower profit margins, impacting overall financial health.

- Difficulty Securing Profitable Projects: The competitive landscape makes it harder to find and win projects that offer substantial returns.

Challenges in Labor and Regulatory Compliance

A significant weakness for the industry lies in the persistent shortage of skilled and specialized labor. This scarcity directly impacts the pace of project execution and leads to increased operational expenditures. For instance, in 2024, the construction sector in Mexico reported a deficit of approximately 1.5 million skilled workers, driving up wages and project overheads.

Moreover, the complex and often lengthy regulatory landscape in Mexico presents substantial challenges. Navigating stringent frameworks and the protracted process of obtaining necessary permits can significantly delay project timelines and escalate overall costs. In 2025, the average time for securing key infrastructure permits in Mexico was reported to be between 12 to 18 months, a considerable hurdle for rapid development.

These labor and regulatory issues create structural impediments to efficient operations.

- Labor Shortage: A deficit of skilled workers, estimated at 1.5 million in Mexico's construction sector in 2024, inflates labor costs and slows project completion.

- Regulatory Hurdles: Lengthy permit acquisition processes, averaging 12-18 months for infrastructure projects in 2025, contribute to project delays and cost overruns.

- Increased Operational Costs: Both labor scarcity and regulatory complexities drive up overall project expenses, impacting profitability and competitiveness.

- Project Timeline Extensions: The combination of labor constraints and bureaucratic procedures leads to extended project durations, affecting market responsiveness.

A significant weakness for Empresas ICA stems from its substantial and persistent debt load, a legacy issue that continues to impact its financial flexibility. Despite past restructurings, managing this debt remains a critical challenge. For instance, in the first quarter of 2024, the company reported a net financial cost of MXN 370 million, underscoring the ongoing impact of its financial obligations on profitability.

The company's heavy reliance on government contracts exposes it to the inherent volatility of public spending and political shifts. Any reduction in federal infrastructure investment, as observed in real terms during early 2023 and continuing into 2024, directly curtails ICA's project pipeline and growth prospects. This dependence makes its financial performance highly susceptible to the fiscal priorities of the prevailing administration.

Intense competition within the Mexican construction market presents another considerable weakness. With numerous domestic and international firms vying for projects, ICA faces pressure to offer aggressive pricing, which can significantly erode profit margins. The projected 4.5% growth in the Mexican construction sector in 2024, while positive, also signifies increased market participation and heightened rivalry for contracts.

Structural challenges within the industry, such as a notable shortage of skilled labor and a complex, time-consuming regulatory environment, further compound ICA's weaknesses. The estimated deficit of 1.5 million skilled workers in Mexico's construction sector in 2024 drives up labor costs, while permit acquisition processes averaging 12-18 months in 2025 contribute to project delays and cost escalations.

Preview the Actual Deliverable

ICA SWOT Analysis

The preview you see is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. This ensures you know exactly what you're getting before you commit. Our commitment is to transparency and delivering high-quality, ready-to-use business tools.

Opportunities

The shift towards nearshoring, particularly in Mexico, is a major tailwind for ICA. This trend is directly translating into increased demand for new industrial parks, modern logistics hubs, and advanced manufacturing facilities. For instance, Mexico's industrial real estate market saw a significant uptick in demand in 2023, with occupancy rates in key industrial zones reaching historic highs, creating a fertile ground for construction contracts.

Empresas ICA is well-positioned to capitalize on this burgeoning demand. The company's expertise in large-scale infrastructure and industrial construction aligns perfectly with the needs of businesses looking to establish or expand operations closer to North American markets. This presents a substantial opportunity for ICA to secure lucrative contracts and drive revenue growth through these industrial development projects.

Despite reductions in public spending, Mexico's private sector is increasingly channeling funds into infrastructure development. This trend presents a significant opportunity for Empresas ICA to leverage public-private partnerships (PPPs) and secure contracts for privately financed projects. For instance, in 2024, private investment in construction was projected to grow by 4.5%, a notable contrast to public sector contractions.

This evolving investment landscape allows ICA to broaden its project pipeline beyond government contracts, potentially engaging with a wider array of clients and securing more stable, long-term funding streams. The company's expertise in large-scale construction makes it well-positioned to capitalize on this shift towards private capital infusion in critical infrastructure across Mexico.

Despite a more cautious approach to new project announcements in early 2024, Mexico's commitment to strategic infrastructure development remains a key opportunity for ICA. The government is actively pursuing projects like the Maya Train, with significant segments operational or nearing completion, and continues to explore new passenger rail lines and vital gas pipeline expansions. These ongoing and planned initiatives represent substantial contract potential for a seasoned construction and infrastructure firm like ICA, which has a proven track record in executing complex, large-scale projects across the country.

Leveraging Digital Transformation in Construction

The burgeoning adoption of digital transformation, particularly Building Information Modeling (BIM), in the Mexican construction sector offers significant growth avenues for Empresas ICA. This technological shift promises to boost operational efficiency and project accuracy. For instance, the global construction technology market was valued at an estimated $11.4 billion in 2023 and is projected to reach $37.4 billion by 2028, indicating a strong upward trend in technology integration.

Empresas ICA can capitalize on this trend by deepening its investment in and integration of advanced digital tools. This strategic move can lead to improved collaboration among project stakeholders, reduced waste, and enhanced cost control throughout the project lifecycle. Furthermore, embracing these technologies can position ICA as an industry leader in innovation and sustainability.

Key opportunities within this digital transformation include:

- Enhanced Project Planning and Design: Utilizing BIM for detailed 3D modeling and clash detection can preempt costly design errors.

- Improved On-Site Execution: Digital tools facilitate real-time data sharing, progress tracking, and quality control, leading to more efficient construction processes.

- Streamlined Supply Chain Management: Technology can optimize material procurement and logistics, reducing delays and costs.

- Data-Driven Decision Making: The collection and analysis of project data through digital platforms enable more informed strategic choices.

Expansion into Emerging Market Segments

The construction industry is experiencing a significant shift, with emerging market segments offering substantial growth potential. Areas such as green and sustainable building practices, innovative 3D printed construction, and the rapidly expanding data center infrastructure market are all showing robust expansion. For instance, the global green building market was valued at approximately $1.1 trillion in 2023 and is projected to reach over $2.8 trillion by 2030, demonstrating a compound annual growth rate of around 14.5%. Similarly, the 3D construction printing market is expected to grow from $1.1 billion in 2023 to $6.5 billion by 2028. The demand for new data centers, driven by cloud computing and AI, also continues to climb, with global data center construction spending projected to exceed $300 billion by 2027.

ICA has a strategic opportunity to leverage its expertise and expand into these specialized, high-growth segments. By developing or acquiring capabilities in sustainable materials, advanced construction technologies like 3D printing, and the specific requirements of data center builds, ICA can tap into new revenue streams and capture significant market share. This expansion not only diversifies ICA's portfolio but also positions it as an innovator, capable of meeting the evolving demands of the construction landscape and potentially enhancing its competitive edge in the 2024-2025 period and beyond.

- Green Building Market Growth: Projected to reach over $2.8 trillion by 2030, with a CAGR of 14.5%.

- 3D Construction Printing Market: Expected to grow from $1.1 billion in 2023 to $6.5 billion by 2028.

- Data Center Construction Spending: Forecasted to exceed $300 billion globally by 2027.

The nearshoring trend, particularly in Mexico, is a significant opportunity for ICA, driving demand for industrial parks and logistics hubs. Mexico's industrial real estate market saw record occupancy in 2023, creating strong demand for construction. ICA's expertise in large-scale industrial construction aligns perfectly with this growth, enabling them to secure lucrative contracts.

Private sector investment in Mexican infrastructure is rising, offering ICA opportunities beyond government projects. In 2024, private construction investment was projected to grow by 4.5%, providing ICA with new avenues for privately financed projects and more stable funding streams.

Mexico's continued focus on strategic infrastructure, such as the Maya Train and gas pipeline expansions, presents ongoing contract potential for ICA. These large-scale government initiatives leverage ICA's proven ability to execute complex projects.

The increasing adoption of digital tools like BIM in Mexico's construction sector is a key growth area. This technology enhances efficiency and accuracy, with the global construction technology market projected to reach $37.4 billion by 2028, offering ICA a chance to lead in innovation.

Emerging market segments like green building, 3D printing construction, and data centers offer substantial growth for ICA. The green building market alone is expected to exceed $2.8 trillion by 2030, presenting ICA with opportunities to diversify and capture new market share.

| Opportunity Segment | 2023 Market Value (Est.) | Projected Growth | ICA Relevance |

| Nearshoring-Driven Industrial Development | N/A (Market Trend) | High Demand for Logistics & Manufacturing Facilities | Core Competency in Industrial Construction |

| Private Infrastructure Investment | N/A (Trend) | 4.5% Projected Growth (2024) | Access to Non-Government Contracts |

| Digital Construction (BIM) | $11.4 Billion (Global) | Projected to $37.4 Billion by 2028 | Enhanced Efficiency & Project Delivery |

| Green Building | $1.1 Trillion (Global) | Projected to $2.8 Trillion by 2030 (14.5% CAGR) | Expansion into Sustainable Construction |

| 3D Construction Printing | $1.1 Billion (Global) | Projected to $6.5 Billion by 2028 | Adoption of Advanced Building Technologies |

| Data Center Construction | N/A (Segment Growth) | Global Spending to Exceed $300 Billion by 2027 | Specialized Infrastructure Development |

Threats

A potential economic slowdown in Mexico or global financial instability could significantly curb private investment and lead to further reductions in public spending, directly impacting the pipeline of new construction projects. For instance, if Mexico's GDP growth falters, as predicted by some analysts to moderate from 3.1% in 2023 to around 2.0-2.5% in 2024, this could translate to fewer infrastructure and development opportunities.

Fiscal consolidation efforts by the Mexican government present a substantial threat, as they are expected to decrease overall investment spending. With the government potentially prioritizing debt reduction or other fiscal objectives, the allocation of funds towards large-scale construction projects may be curtailed, impacting companies like ICA.

Reduced consumer spending power due to inflation or job losses, a common feature of economic downturns, can also dampen demand for new housing and commercial properties. If inflation remains elevated, impacting purchasing power, the appetite for new real estate development will likely diminish.

Political uncertainty, particularly shifts in government administrations and their policy priorities, can significantly impact the regulatory and investment climate for companies like ICA. For instance, changes in national leadership can lead to altered approaches to infrastructure development or public-private partnerships. This unpredictability might make long-term planning and securing new projects more challenging.

Unexpected policy changes, such as new environmental regulations or alterations to concession agreements, pose a direct threat. A perceived hostile environment towards private investment could deter ICA from undertaking new capital-intensive projects. In 2024, many emerging markets are navigating complex political transitions, which often translates into policy reviews that could affect existing contracts or future opportunities.

Fluctuations in the prices of construction materials, particularly those imported, present a significant challenge. For instance, the global price of steel, a key component for many construction projects, saw a notable increase in early 2024, impacting project budgets. This volatility, coupled with potential rises in labor costs, directly pressures profit margins for companies like ICA and can lead to unexpected project cost overruns.

International tariffs and trade disruptions further amplify this threat. New tariffs imposed in late 2023 on certain manufactured goods, including some construction-related components, directly increased input costs for businesses relying on international supply chains. These trade-related factors can create uncertainty, making it difficult to accurately forecast project expenses and protect profitability.

Intensified Regulatory and Environmental Scrutiny

Mexico's construction sector is grappling with increasingly rigorous regulations and intricate permit requirements, potentially slowing down project timelines and increasing operational expenses.

The growing global and national focus on Environmental, Social, and Governance (ESG) principles is translating into stricter compliance demands for construction projects. This means companies must invest more in sustainable practices and environmental impact assessments.

For example, in 2023, Mexico's Secretariat of Environment and Natural Resources (SEMARNAT) reported a 15% increase in environmental impact assessment submissions compared to 2022, highlighting the heightened regulatory activity.

- Increased Compliance Costs: Adapting to new environmental standards and obtaining permits can add significant overhead.

- Project Delays: Complex regulatory pathways may lead to longer lead times for project commencement and completion.

- Reputational Risk: Non-compliance with ESG criteria can negatively impact a company's image and access to capital.

- New Market Opportunities: Conversely, adhering to sustainability trends can open doors to green building certifications and environmentally conscious clients.

Currency Depreciation and Interest Rate Volatility

Currency depreciation poses a significant threat to Empresas ICA. A weaker Mexican Peso, for instance, directly increases the burden of any debt denominated in U.S. dollars. For example, if ICA has substantial dollar-denominated loans, a depreciation means they need more Pesos to service that debt, eating into profits.

Interest rate volatility adds another layer of financial risk. Fluctuations in interest rates impact the cost of financing for both new infrastructure projects and existing loans. This unpredictability makes it harder for ICA to accurately budget for borrowing costs, potentially hindering their ability to undertake new investments or manage ongoing financial commitments. The Bank of Mexico's key interest rate, for instance, has seen shifts, influencing borrowing conditions.

This combined financial instability can directly affect Empresas ICA's profitability. Increased debt servicing costs and higher financing expenses reduce the bottom line. Consequently, their capacity to invest in new projects or expand operations is diminished, creating a challenging operating environment.

Specifically, considering recent trends:

- Currency Risk: The Mexican Peso experienced periods of depreciation against the US Dollar in late 2024 and early 2025, potentially increasing ICA's dollar-denominated debt burden.

- Interest Rate Environment: Interest rates in Mexico, influenced by monetary policy decisions, have shown volatility, impacting the cost of capital for new ventures.

- Impact on Profitability: Higher financing costs and currency exchange losses can directly reduce ICA's net income and retained earnings.

- Investment Capacity: Reduced profitability and increased financial uncertainty can limit ICA's ability to secure funding for large-scale infrastructure projects, a core part of their business.

Economic slowdowns and global financial instability pose significant threats by curbing private investment and public spending, impacting new construction projects. Mexico's GDP growth moderation, potentially to around 2.0-2.5% in 2024, could reduce infrastructure opportunities for companies like ICA.

Fiscal consolidation by the Mexican government, prioritizing debt reduction, is expected to decrease overall investment spending, potentially curtailing funds for large-scale construction projects. Reduced consumer spending due to inflation or job losses further dampens demand for new properties, impacting the construction sector's revenue streams.

Political uncertainty and unpredictable policy changes, including shifts in government administrations and their priorities, can negatively affect the regulatory and investment climate. Unexpected policy shifts, such as new environmental regulations or alterations to concession agreements, can deter ICA from undertaking capital-intensive projects.

Fluctuations in construction material prices, particularly imported ones like steel, and rising labor costs directly pressure profit margins and can lead to project cost overruns. International tariffs and trade disruptions further increase input costs and create uncertainty in forecasting project expenses.

Increasingly rigorous regulations and complex permit requirements in Mexico's construction sector can slow project timelines and increase operational expenses. Heightened ESG demands necessitate greater investment in sustainable practices and environmental impact assessments, adding to compliance costs and potentially causing project delays.

Currency depreciation, such as a weaker Mexican Peso against the US Dollar, directly increases the burden of dollar-denominated debt for companies like ICA. Interest rate volatility further impacts financing costs for projects and existing loans, making budgeting for borrowing expenses more challenging.

| Threat Category | Specific Threat | Potential Impact on ICA | Relevant Data/Context (2024-2025) |

|---|---|---|---|

| Economic Factors | Economic Slowdown/Instability | Reduced private and public investment, fewer new projects | Mexico GDP growth moderation to ~2.0-2.5% in 2024; global financial instability |

| Government Policy | Fiscal Consolidation | Decreased public spending on infrastructure | Government prioritization of debt reduction |

| Market Demand | Reduced Consumer Spending | Lower demand for housing and commercial properties | Inflationary pressures impacting purchasing power |

| Political Environment | Political Uncertainty/Policy Shifts | Unpredictable regulatory and investment climate, challenges in long-term planning | Changes in national leadership and policy priorities |

| Regulatory Environment | Stringent Regulations/Permits | Slower project timelines, increased operational expenses | Increased regulatory activity in environmental assessments |

| ESG Compliance | Stricter ESG Demands | Higher compliance costs, potential for project delays, reputational risk | 15% increase in SEMARNAT environmental impact assessment submissions (2023) |

| Input Costs | Material Price Volatility | Pressure on profit margins, cost overruns | Global steel price increases in early 2024 |

| Trade & Tariffs | Trade Disruptions/Tariffs | Increased input costs, supply chain uncertainty | Late 2023 tariffs on manufactured goods |

| Financial Factors | Currency Depreciation | Increased burden of dollar-denominated debt | Mexican Peso depreciation periods against USD (late 2024/early 2025) |

| Financial Factors | Interest Rate Volatility | Higher financing costs, budget unpredictability | Volatility in Bank of Mexico's key interest rate |

SWOT Analysis Data Sources

This analysis is built upon a robust foundation of data, drawing from the organization's financial statements, comprehensive market research, and valuable expert opinions to provide a well-rounded perspective.