ICA Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ICA Bundle

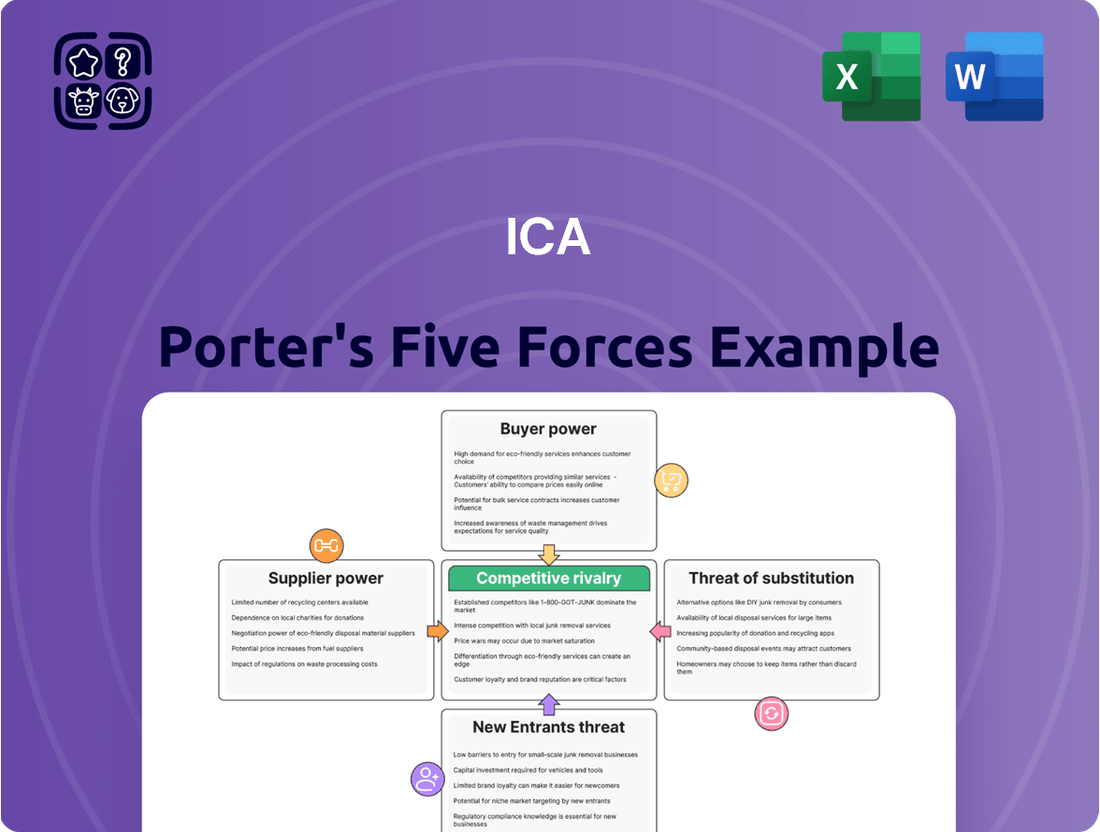

Porter's Five Forces offers a powerful lens to dissect the competitive landscape surrounding ICA, revealing the underlying pressures that shape its profitability. Understanding the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the potential of substitute products is crucial for strategic planning. This framework illuminates the forces that can either constrain ICA's growth or present unique opportunities.

The complete report reveals the real forces shaping ICA’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Supplier concentration significantly impacts Empresas ICA's bargaining power. If a limited number of suppliers control essential raw materials like steel or cement, or specialized construction equipment, they can dictate higher prices. For instance, in early 2024, global steel prices experienced volatility due to supply chain disruptions and increased demand from infrastructure projects, directly affecting construction firms like ICA.

The construction sector's dependence on key inputs means that a concentrated supplier base can exert considerable influence. For Empresas ICA, this means that if only a few companies provide critical components or skilled labor, those suppliers gain leverage to negotiate more favorable terms, potentially increasing project costs and impacting profitability.

Global commodity market fluctuations and local supply chain issues further amplify supplier bargaining power. For example, disruptions in aggregate sourcing due to environmental regulations or transportation challenges in specific regions can empower local suppliers, forcing ICA to adapt to altered cost structures or seek alternative, potentially more expensive, sources.

Switching suppliers for major construction materials or specialized equipment can involve significant costs for Empresas ICA. These costs often include re-qualification processes for new vendors, the complexities of contract renegotiations, and the potential for operational delays if a transition is not seamless. For instance, in 2024, the average lead time for specialty fabricated steel components, a critical input for many large-scale projects, remained around 16-20 weeks, making frequent supplier changes disruptive.

High switching costs directly enhance a supplier's bargaining power. If Empresas ICA faces considerable expense or difficulty in changing vendors, they may be compelled to accept higher prices or less favorable terms, even when seeking better value. This is especially pronounced when dealing with highly specialized components or proprietary technologies where alternative suppliers are scarce.

Suppliers offering unique or highly differentiated inputs, like proprietary construction technologies or specialized engineering services, hold significant bargaining power. If Empresas ICA's major infrastructure projects depend heavily on these specialized inputs with limited alternatives, their leverage over ICA grows.

This dependence allows such suppliers to negotiate premium pricing and more advantageous contract terms. For instance, a supplier of advanced tunneling equipment crucial for a specific subway line project might have considerable sway due to the specialized nature and limited availability of their technology.

In 2024, the construction sector continued to see demand for specialized skills and materials, with reports indicating potential price increases for certain imported components and advanced machinery. This trend underscores the continued importance of supplier uniqueness in contract negotiations.

Threat of Forward Integration

The threat of forward integration by suppliers significantly enhances their bargaining power over Empresas ICA. If a supplier can credibly threaten to move into the construction industry themselves, they can essentially cut out ICA as an intermediary. This would allow them to capture the full value chain, directly serving end customers. For instance, a specialized steel supplier could develop the capability to fabricate and erect steel structures, competing directly with ICA.

While raw material providers might find this less feasible, suppliers of specialized equipment or advanced construction technologies could pose a more direct threat. Imagine a company that supplies advanced tunneling equipment; if they also developed the expertise to manage tunneling projects, they could bypass ICA and bid on contracts directly. This potential shift in market dynamics forces ICA to consider the value it provides beyond simply being a customer for these suppliers.

In 2023, the global construction equipment market was valued at approximately $220 billion, with significant growth projected. Suppliers within this sector, particularly those offering innovative and high-value machinery, possess substantial leverage. If these suppliers perceive an opportunity to capture a larger share of the construction project revenue by integrating forward, their bargaining power increases, potentially leading to less favorable terms for ICA on equipment purchases or service agreements.

- Forward Integration Threat: Suppliers may integrate into construction services, bypassing ICA and offering direct solutions to clients.

- Supplier Capabilities: Specialized equipment and technology providers are more likely to possess the capabilities for forward integration than raw material suppliers.

- Market Leverage: The credible threat of forward integration strengthens suppliers' negotiating position with companies like ICA.

- Industry Example: A tunneling equipment manufacturer could potentially offer full project management, directly competing with construction firms.

Importance of Supplier to ICA

Empresas ICA's reliance on its suppliers significantly impacts the bargaining power of those suppliers. When a supplier's sales to ICA represent a small fraction of their overall business, that supplier possesses greater leverage. This is because they are less dependent on ICA for their revenue and can more easily shift their focus to other clients if terms are unfavorable. For instance, if a supplier of common construction materials like cement or steel sells to many different companies, their dependence on ICA for a portion of their sales is diminished, increasing their bargaining power.

Conversely, if ICA constitutes a substantial portion of a supplier's total revenue, ICA might gain more negotiating power. However, in the context of large-scale infrastructure projects, which are characteristic of ICA's operations, suppliers of standardized materials often serve a broad market. This means that even if ICA is a significant customer, the supplier might still have alternative avenues for sales, thereby limiting ICA's ability to extract significant concessions from them.

- Supplier Dependence: Suppliers with a smaller percentage of their total sales derived from ICA hold more power.

- ICA's Market Share: If ICA represents a large portion of a supplier's revenue, ICA may wield greater influence.

- Material Commonality: Suppliers of widely available materials often face less pressure from any single buyer like ICA.

- Project Scale: In large projects, the sheer volume of materials needed can sometimes shift power dynamics, but commonality remains key.

Suppliers to Empresas ICA possess significant bargaining power when they are concentrated, meaning few companies control essential inputs like specialized concrete or advanced tunneling equipment. This concentration allows them to dictate prices, as seen in early 2024 when global steel price volatility impacted construction costs for firms like ICA. Furthermore, if ICA faces high costs or operational disruptions when switching vendors, suppliers gain leverage, as exemplified by the extended lead times for specialty fabricated steel components in 2024, averaging 16-20 weeks.

Suppliers offering unique or differentiated products, such as proprietary construction technologies or specialized engineering services, also wield considerable power. This is because ICA may have limited alternatives, forcing them to accept premium pricing and more favorable contract terms. The continued demand for specialized skills and materials in the construction sector in 2024 suggests these suppliers will maintain their leverage.

A credible threat of forward integration by suppliers, where they might offer construction services directly, significantly enhances their bargaining power. Companies supplying specialized equipment, like tunneling machinery, could potentially bypass construction firms like ICA. In 2023, the global construction equipment market, valued at approximately $220 billion, saw suppliers with innovative machinery in a strong position to leverage this threat.

Suppliers whose sales to ICA represent a small portion of their total business hold more power, as they are less reliant on ICA. For widely available materials, suppliers often serve a broad market, limiting ICA's ability to extract concessions. This dynamic is crucial for ICA to manage, especially in large infrastructure projects.

| Factor | Impact on ICA's Bargaining Power | 2024/2023 Data Point |

| Supplier Concentration | Lowers ICA's power | Global steel price volatility in early 2024 |

| Switching Costs | Lowers ICA's power | 16-20 week lead times for specialty fabricated steel components in 2024 |

| Input Differentiation | Lowers ICA's power | Continued demand for specialized construction materials and skills in 2024 |

| Forward Integration Threat | Lowers ICA's power | $220 billion global construction equipment market value in 2023 |

| Supplier Dependence on ICA | Raises ICA's power (if ICA is a large client) / Lowers ICA's power (if supplier has many clients) | Commonality of materials limits ICA's power even as a large client |

What is included in the product

Analyzes the competitive intensity and attractiveness of the market ICA operates within by examining industry rivals, new entrants, buyer and supplier power, and substitute products.

Identify and address critical competitive threats before they impact your bottom line, using a structured framework to understand and mitigate market pressures.

Customers Bargaining Power

Empresas ICA's customer base is notably concentrated, with major clients frequently being government bodies, state-owned enterprises, and large private corporations engaged in significant infrastructure or industrial ventures. This concentration means that a handful of key customers can account for a substantial portion of ICA's overall revenue. For instance, as of the first quarter of 2024, a significant portion of ICA's backlog for its Infrastructure and Energy segments was derived from a limited number of large-scale projects, underscoring this concentration.

When a few dominant customers represent a large chunk of a company's sales, their leverage increases considerably. These major clients can leverage their purchasing power to negotiate more favorable pricing, dictate stricter project terms, and impose demanding delivery schedules on ICA. This dynamic directly impacts ICA's profitability and operational flexibility.

The substantial scale and immense value inherent in infrastructure projects significantly bolster customer bargaining power. Empresas ICA's clients, often governmental bodies or large corporations, are making considerable financial commitments, sometimes in the billions of dollars, which naturally grants them considerable leverage.

This financial weight translates into demands for highly favorable contract terms and robust performance guarantees. Customers leverage the sheer size of these investments to negotiate aggressively on pricing and service level agreements, creating intense pressure on ICA during contract discussions.

For instance, a major infrastructure project in 2024 might involve a multi-billion dollar budget, meaning even a small percentage saved through negotiation represents a significant financial win for the customer, amplifying their desire to push for the best possible deal.

The availability of numerous construction companies, including both domestic and international players like IDEAL, significantly bolsters customer bargaining power. This wide selection means clients, particularly government entities, are not reliant on a single provider.

This competitive landscape compels Empresas ICA to remain price-competitive and showcase its expertise to secure project bids. In 2024, the infrastructure sector saw intense competition, with many firms vying for government contracts, underscoring the pressure on companies like ICA to differentiate themselves.

Customer's Threat of Backward Integration

The threat of customers backward integrating into construction activities, while theoretically possible, generally poses a minimal risk to ICA. For simpler tasks or routine maintenance, a client might consider handling it internally. However, the substantial capital investment and specialized expertise required for ICA's large-scale civil and industrial projects make this option highly impractical for most customers.

Consider the substantial barrier to entry for backward integration in complex infrastructure projects. For instance, a typical large-scale civil engineering project can involve billions of dollars in upfront investment for specialized equipment, advanced technology, and highly skilled labor. By comparison, the global infrastructure spending for 2024 is projected to reach trillions of dollars, highlighting the sheer scale and complexity that makes in-house execution by a client exceedingly rare and financially unviable.

This low propensity for backward integration by customers significantly strengthens ICA's bargaining power. The high costs and specialized knowledge required mean that customers are typically reliant on firms like ICA for project execution.

- Limited Practicality: The immense capital and expertise needed for complex construction projects make backward integration by customers rare.

- High Capital Requirements: Undertaking construction activities requires significant investment in specialized machinery and technology, often running into millions or billions of dollars for major projects.

- Expertise Gap: Clients typically lack the specialized engineering, project management, and safety expertise that ICA possesses.

- Focus on Core Competencies: Most customers are focused on their primary business operations and outsourcing complex construction is more efficient than developing in-house capabilities.

Price Sensitivity of Customers

The price sensitivity of customers significantly impacts Empresas ICA. Public sector clients, often bound by strict budget limitations and a need for public accountability, tend to be highly price-sensitive. They frequently favor the lowest bid that fulfills the project requirements, putting pressure on ICA to remain competitive.

Private sector clients are also focused on cost-efficiency for their capital expenditures. This widespread demand for value forces ICA to maintain competitive pricing structures and consistently explore avenues for operational improvements to manage costs effectively. For instance, in 2023, infrastructure projects awarded through public tenders often saw bids that were within a narrow range of each other, highlighting the intense focus on price.

- Public Sector Focus: Public sector clients prioritize lowest bids due to budget constraints.

- Private Sector Efficiency: Private sector clients seek cost-effective investments.

- Competitive Margins: High customer price sensitivity necessitates competitive pricing for ICA.

- Efficiency Imperative: Continuous operational efficiency improvements are crucial for ICA to manage costs.

Empresas ICA faces significant customer bargaining power due to its concentrated client base, where a few major entities, often government bodies or large corporations, represent a substantial portion of revenue. This concentration allows these key clients to wield considerable influence in price negotiations and contract terms. The sheer scale of infrastructure projects, frequently involving billions of dollars, further amplifies this customer leverage, as clients demand favorable terms and robust performance guarantees to justify their massive investments.

The competitive landscape, with numerous domestic and international construction firms available, also empowers ICA's customers. This broad selection prevents clients from being tied to a single provider, compelling ICA to remain competitive and demonstrate its value. While backward integration by customers is theoretically possible for simpler tasks, the immense capital investment and specialized expertise required for ICA's large-scale projects make it an impractical option for most clients, thus strengthening ICA's position.

Customer price sensitivity is a crucial factor, particularly for public sector clients bound by strict budgets and public accountability, who often opt for the lowest compliant bid. Private sector clients also prioritize cost-efficiency in their capital expenditures. This widespread demand for value necessitates that ICA maintain competitive pricing and continuously seek operational efficiencies to manage costs effectively, especially as seen in 2023 tender awards where bids were often closely aligned.

| Factor | Impact on ICA | Supporting Data (2024/Recent) |

|---|---|---|

| Customer Concentration | Increased leverage for major clients | Significant portion of Q1 2024 backlog from a limited number of large projects. |

| Project Scale | Amplifies customer negotiation power | Multi-billion dollar budgets for major infrastructure projects increase client demand for favorable terms. |

| Competitive Landscape | Pressures ICA on pricing and differentiation | Intense competition in the infrastructure sector in 2024; numerous firms vying for government contracts. |

| Backward Integration Likelihood | Low, strengthening ICA's position | Billions in upfront investment for specialized equipment and expertise makes in-house client execution rare. |

| Price Sensitivity | Drives need for competitive pricing and efficiency | Public sector's preference for lowest bids; private sector's focus on cost-efficiency. Narrow bid ranges in 2023 tenders highlight price focus. |

Full Version Awaits

ICA Porter's Five Forces Analysis

You're previewing the final version—precisely the same document that will be available to you instantly after buying. This comprehensive Porter's Five Forces analysis delves into the competitive landscape of your chosen industry, detailing the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing competitors. Understanding these forces is crucial for strategic decision-making and identifying opportunities for sustainable competitive advantage. This document provides actionable insights to navigate your market effectively.

Rivalry Among Competitors

Empresas ICA operates within Mexico's construction and infrastructure sector, a market populated by several substantial domestic and international companies. This means ICA isn't alone in vying for major contracts, facing direct competition from other well-resourced firms.

The sheer number of capable competitors in this arena often translates into aggressive bidding for significant projects. For instance, in 2024, infrastructure tenders often saw multiple bids from major players, driving down potential profit margins due to competitive pricing pressures.

The presence of large, established competitors means ICA must constantly innovate and offer competitive pricing to secure its share of the market. This dynamic intensifies the rivalry, making it challenging to maintain high profitability on large-scale infrastructure developments.

The Mexican construction sector presents a complex growth landscape. While industrial construction, bolstered by nearshoring trends, demonstrates strength, public civil works are anticipated to contract in 2025. This uneven growth pattern directly impacts competitive dynamics.

When overall industry growth slows or turns negative, as projected for certain segments in 2025, the competition among construction firms, including Empresas ICA, naturally intensifies. Companies fight harder for fewer available projects, leading to increased price pressure and a more challenging environment for securing new business.

The construction sector, including players like Empresas ICA, is burdened by substantial fixed costs. These stem from significant investments in heavy machinery, specialized equipment, and the ongoing expense of maintaining a skilled labor force. To offset these considerable overheads, companies must secure a consistent stream of projects, making capacity utilization a critical factor in financial health.

When the industry experiences overcapacity, the competitive landscape intensifies. Firms resort to aggressive pricing strategies to ensure their expensive assets remain operational. This price undercutting directly impacts profit margins, as companies vie for market share to keep their machinery and teams productive, creating a challenging environment for profitability.

Exit Barriers

High exit barriers significantly influence competitive rivalry. When it’s costly or difficult for companies to leave an industry, even those performing poorly tend to stay. This can lead to persistent overcapacity, as unprofitable firms cling to operations rather than incur substantial exit costs.

For instance, in the airline industry, the specialized nature of aircraft and the significant financial commitments associated with leases and maintenance create substantial exit barriers. This often results in intense price competition, as airlines fight to fill seats, even at reduced profitability. In 2024, many legacy carriers continued to face pressure from low-cost carriers, illustrating how these barriers can prolong market saturation.

- Specialized Assets: Industries with unique, hard-to-sell machinery or technology (e.g., semiconductor manufacturing plants) face high exit barriers.

- Contractual Obligations: Long-term leases, supplier contracts, or labor agreements can make exiting an industry financially prohibitive.

- Emotional and Managerial Investments: The personal commitment of founders or long-serving management can also act as a psychological exit barrier.

- Government or Social Restrictions: Regulations or societal pressures against plant closures or layoffs can deter firms from exiting.

Product Differentiation

While construction services for major infrastructure can appear similar, differentiation is key. Companies like Empresas ICA can stand out through specialized skills, advanced technology like Building Information Modeling (BIM), a strong reputation for quality work, and a proven track record of completing projects on schedule. Financial stability also plays a significant role in attracting and securing large contracts.

Empresas ICA's extensive history, dating back to 1943, and its broad range of completed projects across various sectors provide a foundation for differentiation. However, the competitive landscape means rivals are also actively emphasizing their unique capabilities and advantages to win business.

- Specialized Expertise: Firms focus on niche areas like complex bridge construction or tunneling, showcasing unique engineering solutions.

- Technological Adoption: Leading companies invest in and highlight their use of advanced technologies such as BIM for improved project planning and execution.

- Reputation and Track Record: A history of delivering high-quality projects on time and within budget is a powerful differentiator.

- Financial Strength: Demonstrating robust financial health and bonding capacity is crucial for securing large-scale infrastructure contracts.

The competitive rivalry within Mexico's construction sector, where Empresas ICA operates, is substantial. Numerous domestic and international players vie for major projects, leading to aggressive bidding and price pressures, particularly evident in 2024 infrastructure tenders where multiple bids were common.

High fixed costs, inherent in the construction industry due to machinery and labor, compel firms to pursue projects even at lower margins to maintain asset utilization. This dynamic intensifies competition when industry growth, like the projected contraction in Mexican public civil works for 2025, slows down.

High exit barriers, such as specialized assets and contractual obligations, keep even underperforming firms in the market, perpetuating overcapacity and aggressive pricing. Differentiation through specialized skills, technology like BIM, and a strong reputation is crucial for companies like ICA to secure market share amidst this intense rivalry.

| Competitor Type | Key Differentiators | Impact on Rivalry |

|---|---|---|

| Large Domestic Firms | Established local relationships, understanding of regulatory environment | Significant competition for large-scale government contracts |

| International Contractors | Advanced technology, global project experience, financial backing | Pressure on pricing and innovation for domestic players |

| Specialized Niche Players | Expertise in specific construction types (e.g., tunneling, bridges) | Can capture segments, but limited in broad infrastructure tenders |

SSubstitutes Threaten

While direct substitutes for large-scale infrastructure like highways or power grids are scarce, alternative development methods can act as a form of substitution. For instance, advancements in modular construction and prefabrication, gaining traction in recent years, offer ways to build components off-site, potentially reducing on-site labor and construction times. This approach, as seen in projects utilizing off-site manufacturing, can alter traditional project timelines and cost efficiencies.

A significant threat to traditional highway and railway projects comes from the potential shift towards alternative transportation modes. For instance, increased investment in and adoption of public transit systems, particularly in urban areas, can directly reduce the demand for personal vehicle use, impacting highway traffic volumes. In 2024, many cities continued to expand their light rail and bus rapid transit networks, aiming to alleviate congestion and encourage modal shifts.

High-speed rail also presents a viable substitute for medium to long-distance travel, potentially drawing passengers away from both highways and conventional railways. The ongoing development and expansion of high-speed rail corridors in various regions globally underscore this competitive pressure. Countries are dedicating substantial capital to these projects, anticipating a future where faster, more efficient rail travel is preferred over driving or short-haul flights.

Furthermore, emerging technologies like advanced aerial mobility, including drone taxis and personal air vehicles, while still in early stages, represent a nascent but potentially disruptive substitute. While not yet a widespread reality in 2024, significant research and development funding is being channeled into these areas, indicating a long-term strategic consideration for infrastructure planners.

These shifts influence long-range planning and investment decisions for traditional transport infrastructure. Companies involved in highway and railway construction must consider how evolving societal preferences and technological advancements might alter future demand patterns. The overall market size for traditional transport infrastructure could be affected if these substitutes gain significant traction.

The proliferation of decentralized energy solutions poses a significant threat of substitutes for traditional centralized power generation. Rooftop solar installations, for instance, directly reduce the need for electricity from large-scale power plants. In 2024, global renewable energy capacity additions continued their strong growth, with solar PV leading the way, accounting for over two-thirds of all new renewable capacity. This trend directly erodes the demand base for conventional, centralized power infrastructure.

Digitalization and Virtual Infrastructure

Advances in digital infrastructure, like faster telecommunications and better virtual collaboration tools, are starting to lessen the demand for some physical office spaces and travel. This shift might change how much certain commercial building projects are needed. For instance, by mid-2025, it’s projected that the global hybrid work model will be embraced by over 60% of companies, impacting traditional office space requirements.

The growing use of Building Information Modeling (BIM) is also contributing by making construction projects more efficient, potentially reducing the overall need for certain materials and labor, which could be seen as a form of substitution in project delivery methods. In 2024, the global BIM market was valued at approximately $10.5 billion, highlighting its increasing integration into construction processes.

- Digitalization: Enhanced telecommunications and virtual collaboration tools reduce the need for physical offices and travel.

- Infrastructure Impact: This trend may alter demand for specific commercial building projects.

- BIM Adoption: Building Information Modeling optimizes project delivery, influencing resource needs.

- Market Growth: The BIM market is expanding, valued at around $10.5 billion in 2024, indicating increased adoption.

Maintenance vs. New Construction

A significant shift in economic or policy priorities toward maintaining and upgrading existing infrastructure rather than embarking on new construction projects could emerge as a potent substitute for ICA's traditional business model. This means that public spending might increasingly favor repair and modernization efforts, potentially reducing the demand for entirely new, large-scale developments that often form a core part of ICA's project pipeline.

While ICA does engage in maintenance and concession agreements, a substantial reallocation of government funds towards upkeep could directly impact the availability of new, large-scale projects. For instance, if a nation decides to invest heavily in extending the lifespan of its current road networks or bridges through extensive refurbishment, it might scale back plans for new highway construction, thereby diminishing the market opportunities for companies like ICA focused on new builds.

Consider the United States, where infrastructure investment has seen a renewed focus. The Infrastructure Investment and Jobs Act (IIJA) of 2021, with its $1.2 trillion price tag, allocated significant funds towards both new projects and the repair of existing ones. However, a hypothetical scenario where policy strongly favors rehabilitation, perhaps driven by budget constraints or environmental concerns regarding new development, could see a greater proportion of these funds directed to maintenance, acting as a substitute for new construction opportunities.

- Reduced Demand for New Projects: A policy emphasis on maintenance directly curtails the need for new infrastructure builds.

- Reallocation of Public Funds: Governments may shift budgets from expansion to repair, impacting ICA's project pipeline.

- Increased Competition in Maintenance: A focus on upkeep could intensify competition for existing maintenance contracts.

- Potential for Smaller Project Sizes: Maintenance projects are often smaller in scope compared to major new construction.

The threat of substitutes for traditional infrastructure projects is growing as alternative transportation, decentralized energy, and digital solutions gain traction. These substitutes can reduce demand for new, large-scale developments. For instance, increased investment in public transit systems in 2024 impacts highway traffic, and rooftop solar installations are eroding the demand for centralized power generation, with global renewable energy capacity additions continuing strong growth.

| Substitute Type | Impact on Infrastructure Demand | 2024 Data/Trend |

|---|---|---|

| Alternative Transport (Public Transit, High-Speed Rail) | Reduces demand for highways and conventional railways | Cities expanded light rail/bus networks; high-speed rail development continues globally |

| Decentralized Energy (Rooftop Solar) | Decreases need for large-scale power plants | Solar PV led renewable capacity additions, accounting for over two-thirds of new capacity |

| Digitalization (Virtual Collaboration) | Lowers demand for physical office space and travel | Over 60% of companies projected to embrace hybrid work by mid-2025 |

| Advanced Construction Methods (BIM) | Increases project efficiency, potentially reducing material/labor needs | Global BIM market valued at approximately $10.5 billion in 2024 |

Entrants Threaten

The construction and infrastructure sector, particularly for large-scale projects like highways or power plants, presents a formidable barrier to entry due to exceptionally high capital requirements. Firms need to secure substantial funding for heavy machinery, advanced technology, and extensive working capital to even begin operations. This financial hurdle alone prevents many potential new players from even considering entering the market, effectively limiting competition.

The Mexican construction sector presents substantial barriers to new entrants due to its intricate and demanding regulatory environment. Obtaining a multitude of permits, conducting thorough environmental impact assessments, and adhering to strict building codes are all mandatory steps. For instance, in 2024, the average time to secure building permits in major Mexican cities could extend over six months, involving multiple government agencies.

These complex bureaucratic processes and licensing requirements are inherently time-consuming and financially burdensome. New companies must invest significant resources in legal counsel, consultants, and application fees to navigate this landscape. This cumulative cost and effort act as a powerful deterrent, making it difficult for less capitalized or inexperienced firms to enter the market and compete effectively.

Securing substantial public and private infrastructure contracts, a core business for firms like Empresas ICA, often hinges on deeply ingrained relationships with government bodies and large corporations. Newcomers struggle to cultivate the trust, reputation, and vital networks needed to vie for these lucrative projects, a hurdle amplified when facing established giants.

For instance, winning a significant portion of the estimated USD 70 billion in infrastructure spending projected for Mexico in 2024 requires not just technical capability but also proven reliability, which takes years to build. Empresas ICA, with its decades of experience, possesses this crucial advantage, making it difficult for new entrants to gain immediate traction in securing these high-value opportunities.

Economies of Scale and Experience

Empresas ICA, as a major player, leverages substantial economies of scale. This advantage stems from its large-scale procurement of materials and equipment, which allows for better pricing and negotiation power. For instance, in 2023, ICA's diverse portfolio likely translated into significant bulk purchasing discounts across various construction segments. New entrants would find it extremely difficult to match these cost efficiencies without a comparable volume of projects, making their initial pricing less competitive.

Furthermore, ICA's extensive experience in managing complex, large-scale infrastructure projects translates into invaluable operational efficiencies. This accumulated expertise, honed over decades, enables them to optimize project timelines, manage risks more effectively, and reduce waste. A new entrant would need considerable time and investment to develop this level of project execution capability. For example, ICA's participation in major Mexican infrastructure developments, such as highway expansions or industrial park construction, showcases this deep-seated operational mastery.

- Economies of Scale: Large firms like Empresas ICA benefit from lower per-unit costs due to high-volume production and purchasing.

- Experience Curve: Decades of operation allow ICA to refine processes, improve efficiency, and reduce errors, leading to cost advantages.

- Capital Requirements: New entrants face high initial capital needs to establish operations and achieve comparable scale, creating a significant barrier.

- Procurement Power: ICA's size grants it superior bargaining power with suppliers, securing better terms and lower input costs compared to smaller rivals.

Proprietary Technology and Expertise

Empresas ICA's competitive advantage is significantly bolstered by its proprietary technology and deep expertise in executing complex civil and industrial projects. This specialized knowledge, developed over decades, includes unique construction methodologies and advanced technological applications essential for large-scale infrastructure development.

New entrants face substantial hurdles in replicating ICA's accumulated engineering know-how and skilled workforce. For instance, the successful completion of intricate projects like the modernization of the Tuxpan refinery, a multi-billion dollar undertaking, showcases ICA's advanced project management and technical capabilities that are not easily acquired.

The threat of new entrants is therefore mitigated by ICA's established track record and the high barriers to entry associated with possessing such specialized and proprietary construction techniques. This expertise is not readily available in the market, requiring considerable time and investment for competitors to develop.

- Proprietary Technology: ICA possesses unique construction methods and technological solutions for complex projects.

- Specialized Expertise: Decades of experience have cultivated deep engineering and project execution knowledge.

- Skilled Workforce: Access to and development of a highly skilled personnel pool is a significant barrier for newcomers.

- High Capital Investment: Replicating ICA's technological and human capital requires substantial upfront investment.

The threat of new entrants for Empresas ICA is significantly low due to immense capital requirements and established economies of scale. New companies require vast sums for machinery, technology, and working capital, a hurdle ICA easily overcomes with its size and procurement power. In 2024, Mexico's infrastructure spending, projected at USD 70 billion, favors established players like ICA who possess the necessary scale and financial backing to undertake such large-scale projects.

Furthermore, ICA's decades of experience and proprietary technology create substantial barriers. Newcomers struggle to replicate ICA's operational efficiencies and specialized engineering know-how, as demonstrated by their complex project execution, such as the Tuxpan refinery modernization. Acquiring this level of expertise and a skilled workforce demands considerable time and investment, making market entry highly challenging.

| Barrier Type | Description | Impact on New Entrants (Empresas ICA) | 2024 Relevance |

|---|---|---|---|

| Capital Requirements | High initial investment for machinery, technology, and working capital. | Significant deterrent; limits competition from smaller firms. | Mexico's USD 70 billion infrastructure spending in 2024 requires substantial upfront capital. |

| Economies of Scale | Lower per-unit costs due to high-volume production and purchasing. | Gives ICA a cost advantage; difficult for new entrants to match. | ICA's bulk purchasing power in 2023 likely secured lower material costs. |

| Proprietary Technology & Expertise | Unique construction methodologies and deep engineering knowledge. | Creates a knowledge gap; requires substantial investment to replicate. | ICA's advanced capabilities in projects like Tuxpan refinery modernization are hard to duplicate. |

| Regulatory & Bureaucratic Hurdles | Complex permitting, environmental assessments, and building codes. | Time-consuming and costly to navigate; favors established players with experience. | In 2024, Mexican building permits can take over six months, increasing new entrant costs. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, incorporating information from industry-specific market research reports, company annual filings (10-K, annual reports), and reputable financial data providers like S&P Capital IQ and Bloomberg. This multifaceted approach ensures a comprehensive understanding of competitive dynamics.