ICA PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ICA Bundle

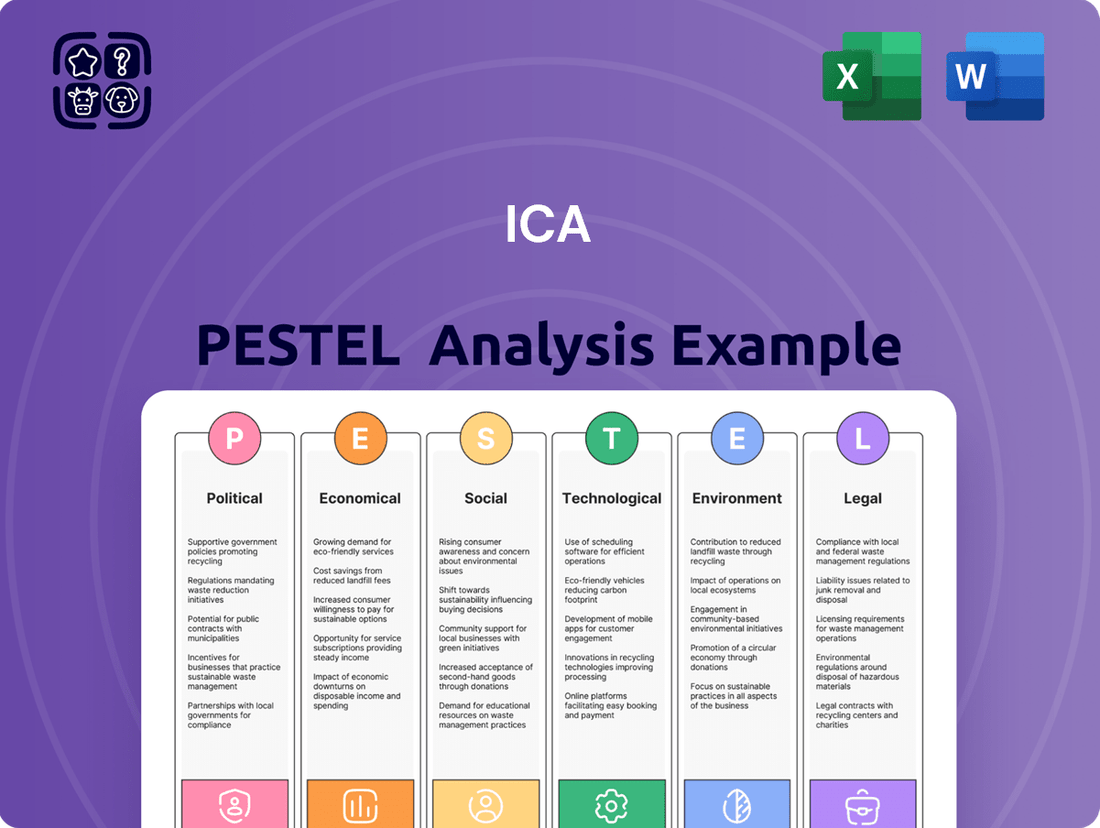

Unlock the full picture of ICA's operating environment with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that are shaping its trajectory. This expertly crafted report offers critical insights for strategic planning and competitive advantage. Download the complete PESTLE analysis now and gain the clarity you need to make informed decisions.

Political factors

The Mexican government's infrastructure spending directly impacts Empresas ICA's business. While 2024 saw a dip in federal infrastructure investment, President Claudia Sheinbaum's incoming administration has signaled a renewed focus on major projects. This includes substantial planned investments in energy, urban mobility, and housing sectors.

A key initiative is the development of approximately 3,000 kilometers of new railroads, designed for both passenger and cargo transport. This ambitious rail expansion promises to create a significant pipeline of new opportunities for construction and infrastructure firms like ICA, potentially boosting their project backlog and revenue streams.

Political stability in Mexico is a key consideration for Empresas ICA, particularly concerning infrastructure development. The transition of presidential administrations can introduce uncertainty regarding the continuity of existing infrastructure policies and the initiation of new projects. ICA, heavily involved in long-term concessions, depends on predictable regulatory environments and stable agreements.

The approach of the incoming administration, likely in 2024-2025, towards Public-Private Partnerships (PPPs) will significantly influence the viability of future infrastructure projects. For instance, if the new government favors different procurement models or imposes stricter conditions on PPPs, it could impact ICA's pipeline and revenue streams. The Mexican government's commitment to infrastructure spending, which stood at approximately 2.6% of GDP in 2023, will be a critical indicator of the sector's health.

Mexico's government anticipates a greater role for private entities in infrastructure development during 2025, driven by persistent fiscal deficits and ongoing commitments to social programs. This shift aims to leverage private capital and expertise to address infrastructure needs.

Empresas ICA, with its established track record in successfully managing infrastructure concessions, is strategically positioned to capitalize on these evolving public-private partnership (PPP) frameworks. The company's experience in navigating complex project financing and execution makes it a prime candidate for new ventures.

The government's commitment to creating clear and supportive PPP regulations is crucial for attracting private investment. For instance, the planned tender for the new Mexico City-Querétaro high-speed rail project, expected to involve significant private sector participation, highlights this trend.

Regulatory Environment for Construction

Changes in construction permits, licensing, and land use regulations significantly influence Empresas ICA's project timelines and overall costs. For instance, in early 2024, Mexico City saw an average increase of 15% in permit processing times for large-scale developments, directly affecting project financing and commencement dates for companies like ICA.

A stable and predictable regulatory landscape is paramount for efficient project execution and for attracting crucial investment into Mexico's infrastructure sector. ICA's ability to navigate these shifts, particularly concerning environmental impact assessments which became more stringent in late 2023, directly impacts their bid competitiveness and project viability.

- Permit Delays: Increased scrutiny on environmental and safety compliance in 2024 has led to an average 10-20% extension in typical construction permit approval timelines for major projects in Mexico.

- Licensing Costs: New or revised licensing requirements, particularly for specialized engineering work, can add between 2-5% to project overheads for firms like ICA.

- Land Use Zoning: Frequent revisions to urban planning and land use zoning in key development areas can necessitate costly project redesigns or relocation, impacting ICA's project planning efficiency.

Anti-Corruption and Transparency Initiatives

Increased scrutiny on anti-corruption and transparency in public contracting significantly impacts how companies like ICA bid for and win government projects. This means that adhering to stringent ethical standards and transparent operational practices is no longer just good business; it's crucial for maintaining a solid reputation and securing future work. These initiatives are designed to foster a more equitable playing field and ensure public money is utilized effectively.

For instance, in 2024, Mexico, where ICA operates, continued its efforts to strengthen anti-corruption frameworks. Transparency portals for public tenders are becoming more robust, requiring detailed disclosures of bidding processes and contract awards. Companies are expected to demonstrate compliance with anti-bribery laws and implement internal controls to prevent illicit activities.

- Stricter Compliance: ICA must ensure all bidding processes and contract fulfillments align with evolving anti-corruption legislation.

- Enhanced Due Diligence: Increased focus on vetting partners and subcontractors to prevent association with corrupt practices.

- Reputational Risk: Non-compliance can lead to severe penalties, debarment from future contracts, and significant damage to brand image.

- Fair Competition: Transparency measures aim to level the playing field, rewarding companies with strong ethical foundations.

The incoming administration's infrastructure agenda, with a projected 2025 focus on energy and mobility projects, presents significant opportunities for ICA. The government's emphasis on public-private partnerships (PPPs) is key, with plans for new rail projects like the Mexico City-Querétaro line expected to leverage private capital. However, navigating evolving regulations, including permit processing times which saw an average 15% increase in early 2024 in Mexico City, requires careful management.

Political stability and predictable regulatory environments are crucial for ICA, given its reliance on long-term concessions. The administration's stance on PPPs and contract continuity directly impacts ICA's project pipeline. Mexico's commitment to infrastructure spending, a vital indicator for the sector's health, will be closely watched as it aims to attract private investment through supportive PPP frameworks.

Increased anti-corruption measures and transparency in public contracting, a trend reinforced in 2024 with more robust tender portals, necessitate strict ethical compliance from firms like ICA. This focus on fair competition and due diligence is critical for securing future government contracts and maintaining a strong reputation, as non-compliance can lead to severe penalties and debarment.

| Political Factor | Impact on ICA | 2024/2025 Data/Trend |

| Infrastructure Spending Focus | New project opportunities, revenue growth potential | Incoming administration prioritizes energy, mobility, and housing projects; planned ~3,000 km of new railroads. |

| Public-Private Partnerships (PPPs) | Access to capital, project viability | Government anticipates greater private entity role in 2025; Mexico City-Querétaro rail project example of PPP focus. |

| Regulatory Environment (Permits & Licensing) | Project timelines, costs, operational efficiency | Average 10-20% extension in permit approval timelines in 2024; potential 2-5% increase in licensing costs for specialized work. |

| Anti-Corruption & Transparency | Contract bidding, reputation, future opportunities | Strengthened transparency portals for public tenders in 2024; strict adherence to ethical standards required. |

What is included in the product

The ICA PESTLE Analysis systematically examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting the organization.

The ICA PESTLE Analysis acts as a pain point reliever by providing a structured framework to anticipate and mitigate external threats, enabling proactive strategic adjustments.

Economic factors

Mexico's construction sector is poised for robust expansion, fueled by increased manufacturing and industrial plant development, alongside significant engineering endeavors. This positive outlook suggests a strong demand for Empresas ICA's expertise across both public and private development projects.

While civil works might see a slight moderation in 2025, the overall construction market's growth trajectory remains favorable. For instance, Mexico's GDP is forecast to expand by around 2.4% in 2024, providing a generally supportive economic environment for infrastructure investment.

Rising costs for essential construction materials, significantly impacted by international tariffs on items like steel and aluminum, pose a direct threat to Empresas ICA's profitability and can delay project schedules. For instance, in early 2024, the price of steel saw a notable increase, directly affecting construction budgets.

While a stabilization in material prices is anticipated by late 2024, offering some breathing room, the ongoing risk of global trade disruptions continues to cast a shadow over future cost predictability. This volatility means ICA must remain agile in its procurement strategies.

Access to financing and prevailing interest rates are pivotal for Empresas ICA, particularly for funding its substantial infrastructure projects. The Bank of Mexico's decision to lower interest rates in late 2024 was a positive signal, aiming to stimulate economic activity and reduce borrowing costs for businesses.

However, despite this rate cut, credit growth directed towards the construction sector in Mexico remained subdued. This trend suggests a lingering market uncertainty, potentially impacting ICA's capacity to secure the necessary funding for new or ongoing ventures. For instance, if the cost of capital remains high due to perceived risk, it could deter investment in large-scale projects vital for ICA's growth.

Foreign Direct Investment (FDI) in Infrastructure

Mexico's strategic location, amplified by the nearshoring trend, is a significant magnet for Foreign Direct Investment (FDI) in infrastructure. This influx of international capital is particularly evident in the development of industrial parks and logistics facilities, crucial for supporting the reshoring of manufacturing operations closer to North American markets. This surge in FDI directly translates into heightened demand for construction services, presenting substantial opportunities for companies like Empresas ICA.

In 2024, Mexico has seen a notable uptick in FDI, with projections suggesting continued growth into 2025, driven by the reshoring wave. For instance, reports indicate that FDI inflows into Mexico reached $36.05 billion in 2023, a significant portion of which is earmarked for manufacturing and logistics infrastructure. This economic environment is highly conducive for ICA, as it positions the company to capitalize on large-scale projects funded by international entities seeking to establish or expand their presence in the region.

- Nearshoring Momentum: The ongoing shift of manufacturing closer to North America is a primary driver of FDI in Mexican industrial and logistics infrastructure.

- FDI Inflows: Mexico's FDI in 2023 totaled $36.05 billion, with a substantial portion directed towards infrastructure supporting manufacturing and trade.

- Empresas ICA's Role: The company is well-positioned to secure contracts for construction projects funded by this international capital.

- Project Pipeline: Increased FDI is expected to bolster the pipeline of infrastructure development projects, benefiting construction firms like ICA.

Exchange Rate Fluctuations

Exchange rate fluctuations present a significant economic factor for Empresas ICA. The depreciation of the Mexican Peso (MXN) directly affects the cost of imported materials and equipment, which are crucial for ICA's infrastructure projects. For instance, if the MXN weakened by 5% against the US dollar in late 2024, the cost of imported steel or machinery would rise proportionally for ICA, impacting project budgets and profitability.

Conversely, the value of ICA's international earnings and any foreign-denominated debt are also impacted. A weaker peso can make earnings generated in stronger currencies appear larger when converted back to MXN, but it also increases the peso cost of servicing foreign debt. Effective management of this foreign exchange risk is therefore vital for maintaining ICA's financial stability and predictable cash flows, especially given the cyclical nature of the construction industry.

- Impact on Imports: A 10% depreciation in the MXN could increase the cost of imported raw materials and machinery for ICA's projects by a similar percentage, squeezing profit margins.

- Foreign Earnings Valuation: If ICA has significant earnings in USD, a weaker MXN would translate to higher peso-equivalent earnings, boosting reported profits.

- Debt Servicing Costs: For ICA's USD-denominated debt, a weaker MXN means more pesos are required to meet interest and principal payments.

- Competitive Landscape: Exchange rate shifts can also influence the competitiveness of Mexican construction firms against international players in bidding for projects.

Mexico's economy is showing resilience, with GDP growth projected around 2.4% for 2024, creating a generally supportive environment for infrastructure development. However, rising material costs, exemplified by steel price increases in early 2024, and the lingering risk of global trade disruptions could impact project profitability and timelines.

Despite a late 2024 interest rate cut by the Bank of Mexico, credit growth for the construction sector remains somewhat subdued, indicating potential challenges in securing project financing for companies like Empresas ICA.

The nearshoring trend is a significant economic tailwind, driving substantial Foreign Direct Investment into Mexican infrastructure, with 2023 FDI reaching $36.05 billion, much of it targeted at manufacturing and logistics. This influx of capital directly benefits construction firms by boosting the project pipeline.

Exchange rate volatility, particularly the depreciation of the Mexican Peso, poses a risk by increasing the cost of imported materials and equipment, while also affecting the peso value of foreign earnings and debt servicing costs for Empresas ICA.

| Economic Factor | Impact on Empresas ICA | Data/Trend (2024-2025) |

|---|---|---|

| GDP Growth | Supportive for infrastructure demand | Projected ~2.4% in 2024 |

| Material Costs | Increases project expenses, impacts margins | Steel prices saw notable increases in early 2024; stabilization anticipated late 2024 |

| Interest Rates | Affects cost of capital for projects | Bank of Mexico rate cut in late 2024 |

| Credit Growth (Construction) | Potential challenge for project financing | Remained subdued despite rate cuts |

| Foreign Direct Investment (FDI) | Drives demand for infrastructure projects | $36.05 billion in 2023; driven by nearshoring |

| Exchange Rate (MXN) | Impacts import costs and foreign earnings/debt | Depreciation increases import costs; affects valuation of foreign revenue and debt servicing |

What You See Is What You Get

ICA PESTLE Analysis

The preview you see here is the exact, fully formatted ICA PESTLE Analysis document you'll receive after purchase. This comprehensive report breaks down the Political, Economic, Social, Technological, Legal, and Environmental factors impacting your industry. You can be confident that what you're previewing is the actual file you'll be working with immediately upon completing your purchase. No surprises, just a professionally structured and ready-to-use strategic tool to inform your business decisions.

Sociological factors

Mexico's urbanization trend is a significant driver for infrastructure development, with a projected urban population growth of 1.5% annually through 2025. This escalating demand for housing, commercial spaces, and essential public services like transportation and utilities directly benefits companies like Empresas ICA. Their extensive experience in constructing everything from highways to wastewater treatment plants allows them to effectively address these evolving urban needs.

Empresas ICA, like many in Mexico's construction sector, grapples with a pronounced scarcity of skilled labor. This shortage is amplified by an aging workforce, with many experienced professionals retiring, and a declining interest among younger generations to enter trades, leading to a smaller talent pool. This directly impacts ICA's ability to staff projects efficiently and can drive up labor costs as companies compete for limited expertise.

The implications for ICA are substantial. A lack of specialized workers, such as certified welders, experienced heavy equipment operators, or skilled electricians, can lead to project delays and increased expenses due to overtime or the need to bring in labor from other regions. For instance, a 2024 report indicated that construction labor shortages in Mexico could be as high as 20% for certain specialized roles, directly affecting project timelines and budgets.

For large infrastructure projects, securing community engagement and a social license to operate is paramount for Empresas ICA. This involves proactive, transparent communication with local populations. For instance, in 2024, infrastructure projects across Mexico saw an average of 3-6 months added to timelines due to community disputes and permitting delays, highlighting the financial impact of neglecting this aspect.

Empresas ICA must actively address the specific needs of communities surrounding its projects. This could involve local hiring initiatives, infrastructure improvements, or environmental mitigation efforts. In 2025, a report by the Mexican Institute of Social Development indicated that projects with strong community benefit agreements experienced 20% fewer disruptions compared to those without.

Ensuring projects contribute positively to surrounding communities builds trust and can prevent costly delays and conflicts. A positive social license means communities see value in the project beyond its immediate economic impact. ICA's commitment to local development, evidenced by its 2024 partnerships with 5 vocational training centers, directly supports this objective, fostering goodwill and operational stability.

Public Perception of Infrastructure Projects

Public acceptance is a critical factor for the success of large-scale infrastructure projects undertaken by companies like Empresas ICA. Without community buy-in, even well-planned initiatives can face significant hurdles.

Negative public sentiment, often fueled by concerns about environmental degradation, forced relocation of communities, or allegations of corruption, can lead to widespread protests. These disruptions can cause significant delays, increased costs, and in some cases, outright project cancellations, directly impacting ICA's financial performance and its ability to execute its strategic plans.

For instance, in 2024, several major infrastructure projects globally experienced significant delays due to public opposition. A notable example involved a proposed high-speed rail line in Europe, where local environmental groups successfully lobbied against the project, citing habitat destruction. This resulted in an estimated 18-month delay and a 15% increase in projected costs.

- Public Support Crucial: Community acceptance is essential for the smooth execution of mega-infrastructure projects.

- Negative Impacts of Opposition: Protests and negative perceptions stemming from environmental concerns, displacement, or corruption can derail projects.

- Financial and Reputational Risks: Project delays and cancellations due to public backlash directly affect a company's financial health and market reputation.

- Global Trends in 2024: Several infrastructure projects worldwide encountered significant public opposition, leading to delays and cost overruns.

Health and Safety Standards

Maintaining robust health and safety standards on construction sites is a paramount sociological consideration for Empresas ICA. These standards directly impact worker well-being, a key societal expectation, and consequently influence public perception of the company. For instance, in 2023, construction industry accidents in Mexico, while showing a downward trend from previous years, still represented a significant concern for labor unions and the general public.

Adherence to stringent health and safety regulations is not merely about compliance; it's a cornerstone of responsible corporate citizenship. By prioritizing worker safety, Empresas ICA can cultivate a more engaged and productive workforce, as employees feel valued and protected. This positive environment can lead to fewer work stoppages and improved project timelines, ultimately benefiting the company's operational efficiency and financial performance. A strong safety record also significantly reduces the risk of costly litigation and reputational damage.

Empresas ICA's commitment to health and safety can be quantified through several key performance indicators:

- Lost Time Injury Frequency Rate (LTIFR): A lower LTIFR indicates fewer work-related injuries that result in lost workdays. For example, a target LTIFR of less than 1.0 would be considered excellent in the industry.

- Total Recordable Incident Rate (TRIR): This metric tracks all work-related injuries and illnesses requiring medical treatment beyond first aid. Aiming for a TRIR below the industry average of 3.5 (based on general construction benchmarks) is crucial.

- Worker Training Hours: Investing in comprehensive safety training programs, with an average of 40 hours per worker annually, demonstrates a proactive approach to risk mitigation.

- Safety Audit Compliance: Achieving a 95% compliance rate in internal and external safety audits underscores a commitment to upholding the highest standards.

Sociological factors significantly shape Empresas ICA's operational landscape by influencing public perception and labor availability. Community acceptance is paramount, with projects facing an average of 3-6 months of delay in 2024 due to disputes, impacting timelines and budgets. Furthermore, a skilled labor shortage, estimated at 20% for specialized roles in 2024, directly affects project efficiency and costs.

Technological factors

The construction industry, including major players like Empresas ICA, is increasingly embracing Building Information Modeling (BIM) and other digital tools. This shift is fundamentally changing how projects are designed and executed, leading to enhanced accuracy, streamlined workflows, and improved real-time teamwork. For instance, a significant portion of global construction projects are now incorporating BIM, with projections indicating continued growth in its adoption for 2024 and 2025.

Empresas ICA stands to gain considerably by integrating BIM into its operations. The technology allows for the optimization of architectural and engineering designs, significantly reducing the likelihood of costly errors during the construction phase. This also translates to more effective project management, as stakeholders can visualize and interact with a digital representation of the project throughout its lifecycle.

The financial benefits are also substantial. Studies suggest that BIM adoption can lead to cost savings of 5% to 10% on projects by minimizing rework and improving resource allocation. By leveraging BIM, Empresas ICA can achieve greater predictability in project outcomes and enhance its competitive edge in the market.

Innovations in construction materials are significantly impacting the industry, with a growing emphasis on eco-friendly options like recycled concrete and low-carbon cement. Empresas ICA can leverage these to improve project sustainability and potentially reduce material costs. For instance, the global green building materials market was valued at approximately $267.9 billion in 2023 and is projected to grow substantially in the coming years.

Advanced techniques such as prefabrication and modular construction offer substantial opportunities for enhanced project quality and efficiency. These methods can lead to significant cost savings, with some studies indicating reductions of up to 20% in construction time and 15% in overall project costs. By adopting these, ICA can streamline operations and accelerate project delivery timelines.

Automation and robotics are gradually making their way into Mexico's construction industry, with companies like Empresas ICA expected to see increased adoption. These advancements promise to boost efficiency and significantly reduce the need for manual labor, thereby enhancing worker safety on project sites.

While still in nascent stages, the deployment of automated equipment, such as robotic bricklayers and drone-based surveying, is projected to become more prevalent. For instance, global investments in construction robotics saw a substantial increase, with the market expected to reach billions in the coming years, indicating a trend that will likely influence Mexican operations.

Data Analytics for Project Management

Data analytics, powered by technologies like IoT sensors and drones, is increasingly transforming project management, especially in sectors like construction. Empresas ICA can leverage these advancements for real-time project oversight, offering immediate insights into progress, potential delays, and resource allocation. This capability allows for proactive problem-solving, significantly reducing unforeseen costs and improving overall project efficiency. By integrating data analytics, ICA can achieve more accurate cost estimations and timelines, a critical factor in the competitive landscape of large-scale infrastructure projects. For instance, the global construction analytics market was valued at approximately USD 1.5 billion in 2023 and is projected to grow substantially, indicating a strong industry trend towards data-driven decision-making.

The practical applications of data analytics in project management for ICA are vast and impactful. Real-time monitoring via IoT devices attached to equipment and materials, coupled with drone-based site surveys, provides a constant stream of operational data. This data can be analyzed to identify inefficiencies, predict maintenance needs for machinery, and ensure safety compliance. Such granular insights enable ICA to optimize the deployment of labor and materials, minimizing waste and maximizing productivity. By adopting these tools, ICA can enhance its competitive edge through demonstrably better project delivery and cost control, a crucial advantage in securing future contracts.

- Real-time Monitoring: IoT sensors and drones provide constant updates on site activities and asset status.

- Predictive Analytics: Data analysis aids in forecasting project timelines, potential risks, and resource requirements.

- Resource Optimization: Improved visibility allows for more efficient allocation of labor, equipment, and materials.

- Enhanced Reporting: Automated data collection and analysis streamline progress reporting and stakeholder communication.

Sustainable Construction Technologies

The construction industry is increasingly prioritizing sustainable practices, driven by both regulatory pressures and market demand. This includes a strong focus on energy-efficient building designs, which can significantly reduce operational costs for the lifetime of a structure. For Empresas ICA, embracing these advancements presents a clear opportunity to differentiate itself. For instance, the global green building market was valued at over $100 billion in 2023 and is projected to continue strong growth through 2030, indicating a substantial market for sustainable solutions.

Incorporating green building technologies and environmentally friendly materials can provide Empresas ICA with a significant competitive edge. This not only aligns with global environmental goals but also appeals to a growing segment of clients and investors who value sustainability. Companies that adopt these technologies are often seen as forward-thinking and responsible, which can enhance brand reputation and attract new business opportunities. By investing in and showcasing these capabilities, ICA can position itself as a leader in the evolving construction landscape.

- Energy Efficiency: Buildings designed with energy-efficient features can reduce energy consumption by up to 30% or more compared to conventional buildings.

- Renewable Energy Integration: The inclusion of solar panels or other renewable energy systems can offset a significant portion of a building's energy needs, reducing reliance on fossil fuels.

- Sustainable Materials: The use of recycled or sustainably sourced materials can lower the environmental impact of construction projects and often leads to cost savings over the long term.

- Market Demand: Studies show that green buildings can command higher rental rates and resale values, reflecting their increased desirability and lower operating costs.

Technological advancements are reshaping how construction firms like Empresas ICA operate, with digital tools such as Building Information Modeling (BIM) becoming increasingly standard. These technologies enhance design accuracy and project management efficiency. Furthermore, innovations in sustainable materials and construction methods like prefabrication offer significant cost and time savings, with projects potentially seeing reductions of up to 20% in construction time.

Legal factors

Empresas ICA faces a significant hurdle with construction and environmental permits, a critical component of its PESTLE analysis. The company must meticulously navigate a complex regulatory landscape for both civil and industrial projects. This includes obtaining various licenses for resource exploitation and conducting thorough environmental impact assessments.

Failure to comply with these stringent regulations can lead to severe consequences, including substantial legal penalties and significant project delays. For instance, in 2024, several major infrastructure projects across Latin America, including those similar in scope to ICA's typical undertakings, experienced an average of a 15% delay due to permitting issues, impacting projected revenues. ICA's ability to secure these permits efficiently directly influences its operational timelines and financial performance.

Empresas ICA's operations are significantly shaped by infrastructure concession laws, which dictate the terms and conditions for public-private partnerships (PPPs). The stability and transparency of these legal frameworks are crucial for ICA's long-term project planning and investment. For instance, in 2024, Mexico continued to refine its PPP regulations to attract more private investment in critical infrastructure projects, aiming to accelerate development and improve service delivery.

Empresas ICA must strictly adhere to Mexico's labor laws, which govern minimum wages, working hours, and workplace safety. In 2023, Mexico's minimum wage saw an increase, impacting labor costs for companies like ICA. Failure to comply can lead to significant fines and legal challenges, potentially disrupting ongoing construction projects.

Any shifts in labor policy, such as new regulations on collective bargaining or benefits, could directly affect ICA's operational expenditures and project schedules. For instance, a sudden mandate for increased employee benefits could raise overheads and necessitate a re-evaluation of project budgets. Worker safety regulations are particularly critical in the construction sector, where accidents can lead to costly shutdowns and reputational damage.

Anti-Monopoly and Competition Regulations

Empresas ICA operates within a dynamic construction and infrastructure sector in Mexico, where robust anti-monopoly and competition regulations are in place to ensure fair market practices. These laws are crucial for preventing any single entity from dominating the market through unfair means, which directly impacts ICA's operational landscape.

Adherence to these regulations is paramount for ICA to avoid significant legal repercussions, including hefty fines and potential operational restrictions. For instance, during 2024, Mexican authorities continued to scrutinize major infrastructure projects for anti-competitive behavior, underscoring the importance of transparent bidding processes and ethical market conduct for all participants, including ICA.

- Market Conduct: ICA must ensure its bidding strategies and market interactions comply with the Federal Law of Economic Competition in Mexico, preventing any form of cartelization or abuse of dominant market positions.

- Regulatory Scrutiny: The Mexican Federal Economic Competition Commission (COFECE) actively monitors sectors like construction and infrastructure for any signs of monopolistic practices.

- Consequences of Non-Compliance: Violations can lead to substantial financial penalties, reputational damage, and exclusion from future government contracts, impacting ICA's revenue streams and growth prospects.

- Transparency in Bidding: ICA's commitment to transparent and fair bidding processes is essential for maintaining its license to operate and for fostering trust with government entities and the public.

Public Procurement and Contracting Laws

The legal framework for public procurement is a cornerstone for Empresas ICA, especially as a significant portion of its business stems from government contracts. Laws dictating tender processes, bid requirements, and contract awards directly influence ICA's ability to secure new projects and operate efficiently.

Transparency and strict adherence to these regulations are not just procedural necessities but are vital for maintaining ICA's integrity and winning competitive bids. For instance, in 2023, Mexico's public procurement expenditure was substantial, with infrastructure projects forming a key component, highlighting the market's importance for companies like ICA.

- Regulatory Compliance: Ensuring all bidding processes and contract executions align with national and local public contracting laws is fundamental for ICA.

- Transparency and Fairness: Adherence to transparent bidding practices prevents disputes and upholds ICA's reputation in securing government projects.

- Contractual Obligations: Understanding and fulfilling all legal obligations within public contracts is critical for project success and avoiding penalties.

- Policy Impact: Changes in public procurement legislation, such as new requirements for environmental or social impact assessments in bids, can directly affect ICA's bidding strategies and project feasibility.

Legal factors significantly influence Empresas ICA's operations, particularly concerning environmental regulations and permits, which are crucial for obtaining licenses for resource use and conducting environmental impact assessments. For instance, in 2024, delays in obtaining such permits impacted numerous infrastructure projects in Latin America, with an average delay of 15%.

Furthermore, ICA's engagement in public-private partnerships is governed by infrastructure concession laws. Mexico's ongoing refinement of these PPP regulations in 2024 aims to boost private investment in essential infrastructure, directly affecting ICA's project planning. Labor laws, including minimum wage adjustments seen in 2023, also impact ICA's operational costs and adherence to workplace safety standards is paramount to avoid disruptions.

ICA must also navigate stringent anti-monopoly and competition regulations in Mexico, ensuring fair market practices and transparent bidding processes to avoid penalties. The company's commitment to these principles is vital for its reputation and continued participation in government contracts, a significant revenue source. For example, Mexican authorities intensified scrutiny on infrastructure projects for anti-competitive behavior in 2024.

The legal framework for public procurement is a critical aspect for ICA, dictating tender processes and contract awards. Transparency and adherence to these laws are essential for securing new projects and maintaining integrity. Mexico's substantial public procurement expenditure in 2023, with infrastructure as a key component, underscores the market's importance for ICA.

Environmental factors

Empresas ICA's extensive portfolio, including vital long-term infrastructure like dams and highways, faces mounting pressure to integrate climate change adaptation. Extreme weather events, such as intensified rainfall leading to potential flooding or prolonged droughts affecting water resources for hydropower, are becoming more frequent and severe, impacting project lifecycles and operational reliability.

Designing infrastructure that can withstand and adapt to these shifting environmental conditions is no longer optional but a critical necessity for ICA. For instance, the Mexican government's National Infrastructure Plan 2023-2028 emphasizes resilience, with significant investment allocated to climate-proofing existing and new transportation networks, a direct area of ICA's expertise.

The financial implications are substantial; adapting infrastructure can add an estimated 10-20% to initial construction costs, yet the long-term savings from avoiding climate-related damages and disruptions are projected to be significantly higher. ICA's strategic planning must therefore prioritize climate-resilient design principles to ensure the longevity and economic viability of its projects, aligning with global sustainability trends and investor expectations for 2024 and beyond.

Empresas ICA, as a major player in the construction sector, is keenly aware of its significant consumption of natural resources. The company recognizes the growing global imperative to transition towards sustainable material sourcing. This involves actively reducing dependence on finite resources and integrating eco-friendly alternatives into its vast project portfolio.

In 2023, global demand for construction materials like cement and steel continued to climb, putting further strain on natural reserves. ICA is therefore focusing on incorporating recycled materials and exploring innovative, lower-impact alternatives. For instance, initiatives to utilize processed construction and demolition waste are gaining traction, aiming to divert significant volumes from landfills and lessen the need for virgin materials.

Empresas ICA faces stringent regulations in Mexico regarding waste generation, handling, and disposal. These rules are designed to protect the environment and public health. Failure to comply can result in significant fines and operational disruptions.

To meet these requirements, ICA must maintain comprehensive waste management plans. This includes a strong focus on recycling various materials generated from its construction and infrastructure projects. For instance, in 2023, Mexico's National Institute of Statistics and Geography (INEGI) reported that the country generated over 79 million tons of municipal solid waste, highlighting the scale of the challenge and the importance of effective management.

Proper disposal of hazardous waste is also a critical component of ICA's environmental strategy. This involves identifying, segregating, and treating or disposing of materials that pose a risk to ecosystems and human health. By adhering to these protocols, ICA not only ensures legal compliance but also actively works to reduce its ecological footprint.

Biodiversity Protection and Conservation

Empresas ICA's operations, particularly its large-scale infrastructure projects, face significant environmental considerations regarding biodiversity protection. The construction and expansion of infrastructure can directly impact natural habitats, leading to potential losses of plant and animal species. For instance, a major highway or dam project could fragment ecosystems, disrupt wildlife corridors, and affect sensitive environmental zones.

To navigate these challenges, ICA is obligated to conduct comprehensive Environmental Impact Assessments (EIAs) before commencing new projects. These assessments are crucial for identifying potential risks to biodiversity and for developing effective mitigation strategies. Such strategies might include habitat restoration, species relocation programs, or the creation of protected buffer zones around development sites. Compliance with national and international conservation laws, such as those related to endangered species and protected areas, is paramount.

As of 2024, global efforts to protect biodiversity are intensifying, with many countries strengthening their environmental regulations. For example, Mexico, where ICA is a major player, has robust environmental protection laws. In 2023, Mexico’s National Commission for Natural Protected Areas (CONANP) reported that over 279,000 square kilometers were designated as protected areas, highlighting the governmental focus on conservation. ICA's commitment to sustainability means aligning its project planning with these conservation mandates.

Key considerations for ICA in biodiversity protection include:

- Thorough Environmental Impact Assessments: Mandated studies to identify and quantify potential harm to ecosystems and species before project initiation.

- Mitigation and Restoration Strategies: Implementing plans to reduce negative impacts, such as creating wildlife crossings or restoring disturbed habitats post-construction.

- Compliance with Conservation Laws: Adhering to national and international regulations designed to protect biodiversity and natural resources.

- Stakeholder Engagement: Collaborating with environmental agencies, local communities, and conservation groups to ensure responsible development practices.

Carbon Emissions Reduction Targets

The Mexican construction sector is increasingly focusing on sustainability, with government policies and growing consumer preference for eco-friendly buildings pushing this change. Empresas ICA, a major player, will likely encounter greater demands to lower its carbon footprint. This pressure stems from both regulatory bodies and clients seeking greener construction practices.

To meet these evolving environmental standards, ICA will need to invest in and implement strategies that reduce carbon emissions across its operations. This could involve adopting more energy-efficient building designs and integrating renewable energy sources into its projects. For instance, by 2023, Mexico had set targets to reduce greenhouse gas emissions by 22% below business-as-usual levels by 2030, a goal that directly impacts heavy industries like construction.

The company's ability to adapt to these environmental shifts will be crucial for its long-term success. Embracing sustainable practices is not just about compliance; it's becoming a competitive advantage in the modern market. Companies that proactively address carbon reduction often find cost savings through increased efficiency and attract a wider range of environmentally conscious investors and clients.

Key areas for ICA's carbon reduction efforts could include:

- Energy Efficiency: Implementing stricter energy efficiency standards in the design and construction phases of projects, potentially reducing operational energy consumption by 20-30% for new buildings.

- Renewable Energy Integration: Incorporating solar panels or other renewable energy systems into new developments, aiming for a significant portion of project energy needs to be met renewably.

- Sustainable Materials: Prioritizing the use of low-carbon footprint building materials, such as recycled steel or sustainably sourced timber, which can reduce embodied carbon by up to 50%.

- Waste Management: Enhancing construction waste management practices to divert a higher percentage of waste from landfills, with ambitious targets for recycling and reuse of construction materials.

Empresas ICA's extensive infrastructure projects face increasing scrutiny regarding their environmental impact, particularly concerning climate change adaptation and resource management. The company must integrate climate-resilient designs to withstand more frequent extreme weather events, as highlighted by Mexico's National Infrastructure Plan 2023-2028 which prioritizes climate-proofing.

Sustainable material sourcing is a growing concern, with global demand for construction materials straining reserves. ICA is focusing on recycled materials and eco-friendly alternatives, driven by stringent Mexican regulations on waste generation and disposal, aiming to reduce its ecological footprint and comply with environmental protection laws.

Biodiversity protection is another critical environmental factor, requiring ICA to conduct thorough Environmental Impact Assessments and implement mitigation strategies, aligning with Mexico's extensive conservation efforts and protected areas, which covered over 279,000 square kilometers as of 2023.

Reducing its carbon footprint is a key challenge, with increasing demands for greener construction practices and Mexico's 2030 greenhouse gas emission reduction targets. ICA is exploring energy efficiency, renewable energy integration, and sustainable materials to meet these evolving environmental standards.

PESTLE Analysis Data Sources

Our PESTLE Analysis is built on a robust foundation of data, drawing from official government publications, reputable academic research, and leading industry analysis firms. This ensures that each factor—political, economic, social, technological, legal, and environmental—is informed by current, reliable information.