Industrial Bank of Korea PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Industrial Bank of Korea Bundle

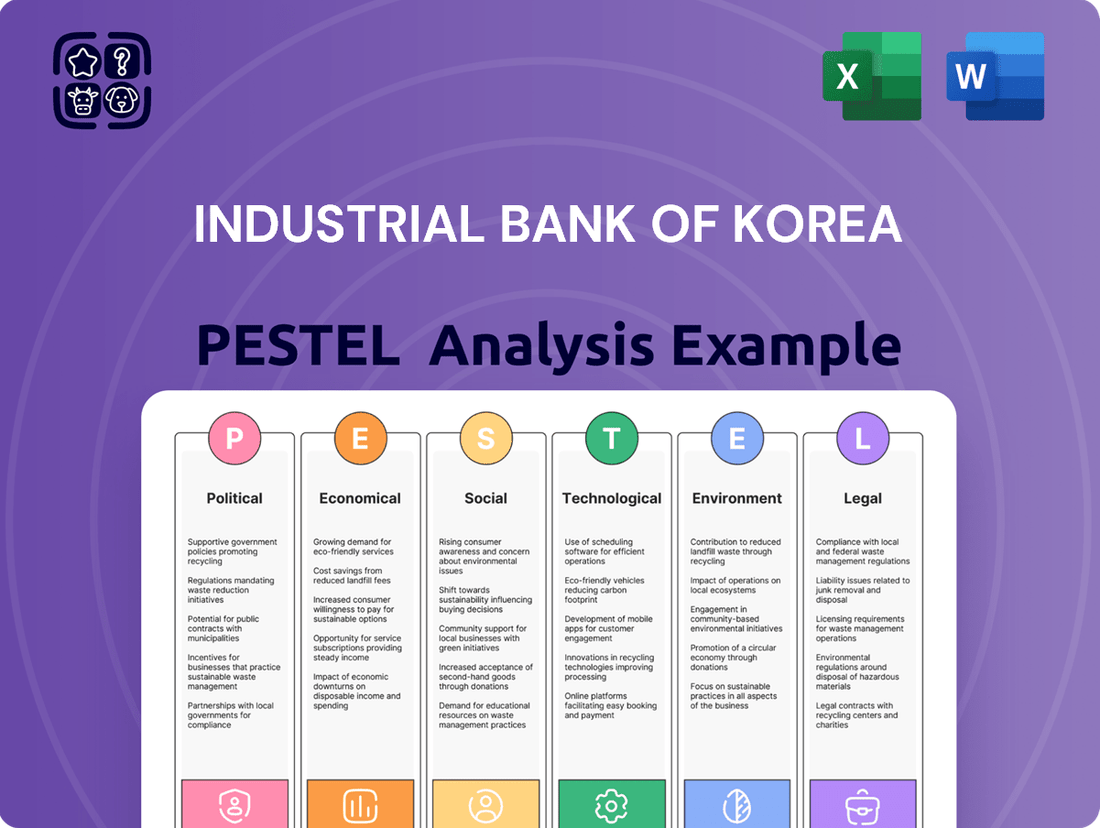

Navigate the complex external forces shaping the Industrial Bank of Korea's future with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements present both challenges and opportunities for the bank. Equip yourself with actionable intelligence to refine your market strategy and gain a competitive edge. Download the full report now for deep-dive insights.

Political factors

The South Korean government, through its Ministry of SMEs and Startups (MSS), is demonstrating robust support for small and medium-sized enterprises (SMEs). For 2025, a substantial budget of KRW 15.2488 trillion (roughly USD 10.6 billion) has been allocated, marking an increase from the previous year. This funding is specifically designed to foster innovation and accelerate growth within the SME and startup sectors.

Key initiatives are in place to bolster this support, such as the 'Jump Up Program'. This program is designed to assist promising small enterprises in their journey to becoming mid-sized companies. Furthermore, the government is actively promoting expanded public-private partnerships to strengthen supply chain collaborations, creating a more resilient ecosystem for businesses.

The Financial Services Commission (FSC) is prioritizing financial sector stability, with 2025 plans focused on maintaining market stabilization programs and enhancing the recovery and resolution framework for financial institutions. This proactive approach aims to mitigate systemic risks.

In 2025, the FSC approved recovery and resolution plans for Domestic Systemically Important Financial Institutions (D-SIFIs). This strategic move underscores a commitment to ensuring the resilience of key financial players.

As a state-owned institution, the Industrial Bank of Korea (IBK) operates under a specific mandate from the South Korean government, primarily focused on fostering the growth and stability of small and medium-sized enterprises (SMEs). This directive means IBK's strategic decisions and operational priorities are closely tied to national economic policy, particularly initiatives aimed at boosting the SME sector.

In 2024, IBK continued to emphasize its role as a market stabilizer, channeling significant resources to support SMEs and microbusiness owners. This focus aligns with broader government objectives to ensure national economic vitality, especially in the face of global economic uncertainties. For instance, IBK's lending to SMEs reached KRW 30 trillion in the first half of 2024, a 7% increase year-over-year.

Regulatory Reforms and Innovation Promotion

The Financial Services Commission's (FSC) 2025 work plan signals a significant shift toward adapting regulations and fostering innovation within the financial sector. A key aspect is the proposed easing of investment limits for financial holding companies in fintech businesses, directly impacting Industrial Bank of Korea's (IBK) ability to strategically invest in and integrate emerging technologies.

This regulatory evolution is designed to create a more dynamic financial ecosystem, potentially unlocking new avenues for growth and service development for institutions like IBK. IBK can leverage these reforms to enhance its digital offerings and competitive positioning.

- Easing of Investment Limits: The FSC's plan to relax restrictions on financial holding companies investing in fintech companies provides IBK with greater flexibility to partner with or acquire innovative technology firms.

- Innovation Promotion: Reforms aim to stimulate competition and the adoption of new technologies, encouraging IBK to accelerate its digital transformation efforts.

- Adaptability to Market Changes: The regulatory adjustments are a direct response to the rapidly evolving financial landscape, requiring IBK to remain agile and responsive to technological advancements and changing customer demands.

Trade Policy and Geopolitical Risks

South Korea's economy, heavily reliant on exports, faces significant headwinds from evolving global trade policies. For instance, the ongoing trade tensions and potential tariff escalations, particularly from major trading partners like the United States, can directly affect the profitability and operational stability of South Korean small and medium-sized enterprises (SMEs), a key customer base for Industrial Bank of Korea (IBK).

Geopolitical uncertainties and shifts in the monetary policies of influential economies continued to present a challenging landscape throughout 2024. These external factors can influence capital flows, currency valuations, and overall market sentiment, creating a dynamic and often unpredictable business environment for institutions like IBK. For example, a sudden interest rate hike by a major central bank can lead to capital outflows from emerging markets, impacting credit availability and demand for banking services in South Korea.

- Export Vulnerability: South Korea's export dependency means that changes in international trade agreements or the imposition of tariffs can significantly disrupt business operations for many Korean companies, impacting their ability to service loans.

- Monetary Policy Spillovers: Decisions by central banks in countries like the US and Eurozone directly influence global liquidity and interest rates, creating ripple effects on South Korean financial markets and IBK's lending environment.

- Geopolitical Instability: Regional tensions, such as those in Northeast Asia, can deter foreign investment and dampen consumer and business confidence, indirectly affecting IBK's growth prospects.

The South Korean government's continued focus on SME growth, evidenced by the KRW 15.2488 trillion budget for 2025, directly shapes IBK's strategic direction and operational priorities. Regulatory adjustments, such as the FSC's proposed easing of investment limits for financial holding companies in fintech, empower IBK with greater flexibility for technological integration and partnerships. These political factors create a supportive environment for IBK to fulfill its mandate of fostering SME development and driving digital innovation within the financial sector.

What is included in the product

This PESTLE analysis offers a comprehensive examination of the external macro-environmental factors impacting the Industrial Bank of Korea, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights and data-backed trends to help stakeholders identify strategic opportunities and navigate potential challenges within the Korean financial landscape.

This PESTLE analysis for the Industrial Bank of Korea offers a concise, easily shareable summary format ideal for quick alignment across teams or departments, acting as a pain point reliever by clarifying external factors impacting strategic decisions.

Economic factors

The Industrial Bank of Korea (IBK) has solidified its position as a key player in supporting small and medium-sized enterprises (SMEs). In 2024, IBK achieved a remarkable milestone, reporting a record-high outstanding balance of SME loans amounting to KRW 247.2 trillion. This figure underscores the bank's substantial commitment to the SME sector.

Maintaining a robust market share of 23.65% in SME financing, IBK's consistent loan growth is a testament to its strategic importance. This sustained expansion in lending has been a significant driver of the bank's financial performance, contributing positively to its net income even amidst a generally uncertain economic climate.

The Bank of Korea's economic outlook for 2025, as of May 2025, projects a slowdown in GDP growth to 0.8%. This downward revision is attributed to a slower-than-expected recovery in domestic demand and the impact of US tariff policies.

Despite this, some global investment banks have revised their 2025 growth forecasts upwards, anticipating that fiscal stimulus measures will provide a boost to economic activity. This divergence highlights the complex interplay of domestic and international factors influencing the economic landscape.

The Bank of Korea maintained its benchmark interest rate at 2.50% in July 2025. This decision came as inflation showed signs of stabilization, registering at 2.2% in June, a figure just above the central bank's target.

This period followed a series of rate adjustments, with the Bank of Korea having implemented cumulative cuts totaling 100 basis points since October 2024. Market watchers and analysts widely expected additional monetary policy easing in the near future, suggesting a continued focus on stimulating economic activity.

SME Financial Sentiment

A 2025 survey by the Industrial Bank of Korea (IBK) indicates a growing optimism among South Korean Small and Medium-sized Enterprises (SMEs). These businesses are anticipating a gradual economic upturn starting in 2026, with a notable increase in expectations for improved business conditions and a higher demand for financing.

This evolving sentiment among SMEs is a key economic factor for IBK. The projected rise in demand for funds suggests a potentially more robust lending environment. Specifically, the survey highlighted:

- Increased Demand for Funds: SMEs are projecting a greater need for capital to support their anticipated growth and operational improvements.

- Improved Business Conditions: A majority of surveyed SMEs expect their operational environments to become more favorable in the coming year.

- Positive Economic Outlook: The general sentiment points towards a gradual but steady economic recovery perceived by the SME sector.

Household Debt and Financial Stability

South Korea's persistent high household debt levels remain a significant consideration for financial stability, directly impacting the operating environment for institutions like the Industrial Bank of Korea (IBK). As of early 2024, household debt to disposable income ratios were still elevated, posing a constraint on monetary policy and a key focus for the Financial Services Commission (FSC).

The FSC's proactive stance includes the implementation of stricter debt service ratio (DSR) regulations. These measures, aimed at curbing the growth of household debt, are designed to bolster the resilience of the financial system against potential shocks.

- Household Debt Concerns: Elevated household debt levels in South Korea continue to be a primary concern for financial regulators and impact monetary policy flexibility.

- Regulatory Response: The Financial Services Commission (FSC) is actively managing household debt growth through enhanced Debt Service Ratio (DSR) rules.

- Impact on IBK: These economic factors directly influence the financial stability within which IBK operates, necessitating careful risk management.

South Korea's economic outlook for 2025, as projected by the Bank of Korea in May 2025, anticipates a GDP growth slowdown to 0.8%, influenced by weaker domestic demand and trade policies. Despite this, some global forecasts suggest fiscal stimulus could lift activity. The Bank of Korea's decision in July 2025 to hold the benchmark interest rate at 2.50% reflects stabilizing inflation at 2.2% in June, following prior rate cuts totaling 100 basis points since October 2024, signaling a potential for further easing to spur growth.

IBK's 2025 SME survey reveals growing optimism, with businesses expecting an economic upturn from 2026, anticipating increased demand for financing and improved business conditions. This positive sentiment suggests a more favorable lending environment for IBK. However, persistent high household debt, with elevated debt-to-income ratios in early 2024, remains a key concern, prompting the Financial Services Commission to enforce stricter Debt Service Ratio (DSR) regulations to ensure financial system stability.

Same Document Delivered

Industrial Bank of Korea PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive PESTLE analysis of the Industrial Bank of Korea. This detailed report covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the bank's operations and strategic positioning. You can confidently purchase knowing you're acquiring a complete and polished analysis.

Sociological factors

South Korea crossed the threshold into a super-aged society by the close of 2024, with projections indicating that over 20% of its populace is now 65 years or older. This significant demographic shift directly impacts economic growth by reducing the available labor force and potentially slowing productivity.

This aging trend also exerts downward pressure on consumption growth as the proportion of younger, higher-spending demographics shrinks, and it contributes to a decrease in real interest rates, influencing investment and savings behavior.

South Korea's demographic shifts, particularly an aging population and declining birth rates, are significantly reshaping consumption patterns. Projections indicate this trend could dampen consumption growth by approximately 1.0 percentage point annually from 2025 to 2030. This slowdown is attributed to reduced spending power among a larger retiree segment and a general increase in precautionary savings by households facing an uncertain future.

These evolving consumption habits directly impact the demand for financial products and services offered by institutions like Industrial Bank of Korea. As the population ages, there's likely to be a greater demand for retirement planning, wealth management, and healthcare-related financial solutions. Conversely, a shrinking younger demographic might lead to lower demand for products typically geared towards first-time homebuyers or young families.

The foreign resident population in South Korea reached 2.65 million by the close of 2024, representing 5% of the nation's total populace. This demographic shift fuels a growing demand for specialized financial products and foreign exchange services, creating a clear opportunity for institutions like IBK to broaden their customer base and service portfolio.

Digital Literacy and Adoption

South Korea's exceptionally high digital literacy, evidenced by its status as a global leader in internet speed and smartphone penetration, significantly fuels the adoption of digital banking. As of early 2024, over 95% of the population has internet access, with smartphone usage deeply integrated into daily life, creating a fertile ground for fintech innovation and demand for seamless online financial services.

This pervasive digital savviness directly translates into a rapid embrace of mobile banking platforms and contactless payment solutions. The Industrial Bank of Korea (IBK) benefits from this trend, as customers are increasingly comfortable and expectant of digital-first interactions, driving the need for robust mobile apps and efficient online transaction capabilities.

Key aspects of this digital adoption include:

- High Smartphone Penetration: South Korea consistently ranks among the top countries for smartphone ownership, exceeding 95% in recent surveys, making mobile banking a primary channel.

- Accelerated Fintech Growth: The digitally adept population readily adopts new financial technologies, pushing fintech companies and traditional banks to innovate in areas like digital payments and online lending.

- Demand for Digital Services: Consumers expect intuitive and accessible digital banking experiences, from account opening to loan applications, pushing IBK to continuously enhance its online and mobile offerings.

SME Workforce Challenges

South Korean SMEs are grappling with a significant demographic shift, marked by an aging business leadership and a shrinking pool of available workers. This is particularly acute as the nation transitions into a super-aged society, with the proportion of citizens aged 65 and over projected to reach 40% by 2050. The Industrial Bank of Korea (IBK), a key pillar of support for these businesses, must integrate an understanding of these evolving workforce dynamics into its financial and advisory offerings.

The aging workforce presents a dual challenge for SMEs: a potential decline in experienced leadership and a struggle to attract and retain younger talent. For instance, data from 2023 indicated that over 30% of SME owners in South Korea were aged 60 or older, highlighting the urgency for succession planning and knowledge transfer. IBK's strategies should therefore focus on facilitating intergenerational business transitions and supporting the adoption of technologies that can offset labor shortages.

- Labor Shortage Impact: SMEs report increasing difficulty in finding skilled labor, with a notable rise in unfilled positions across various sectors in 2024.

- Aging Leadership Succession: A substantial percentage of SME leaders are nearing retirement age, creating a critical need for succession planning support.

- Skills Gap: The mismatch between available skills and industry demands further complicates recruitment efforts for smaller enterprises.

- IBK's Role: The bank's advisory services are crucial for helping SMEs navigate these workforce challenges through training, recruitment assistance, and technology adoption incentives.

South Korea's demographic landscape is rapidly evolving, with the nation officially entering the super-aged society phase by the end of 2024, meaning over 20% of the population is now 65 or older. This profound shift directly impacts consumption patterns, with projections suggesting a potential annual dampening of consumption growth by approximately 1.0 percentage point between 2025 and 2030 due to a shrinking younger demographic and increased precautionary savings.

The growing foreign resident population, which reached 2.65 million by the close of 2024, or 5% of the total populace, is creating new demands for specialized financial products and foreign exchange services. Simultaneously, exceptionally high digital literacy, with over 95% of the population having internet access as of early 2024, fuels rapid adoption of digital banking and fintech innovations.

These societal changes present both challenges and opportunities for institutions like the Industrial Bank of Korea (IBK). The aging population necessitates a greater focus on retirement planning and wealth management services, while the increasing digital savviness demands robust mobile banking platforms and seamless online transaction capabilities.

Technological factors

South Korea stands as a powerhouse in fintech innovation, boasting a robust digital banking sector fueled by cutting-edge technology and supportive government initiatives. The nation's fintech landscape is witnessing explosive growth, particularly in areas like digital payments, online lending platforms, and automated investment advisory services, often referred to as robo-advisors. By the end of 2023, the number of users for mobile financial services in South Korea had surpassed 70 million, indicating a strong consumer embrace of digital solutions.

AI and big data are revolutionizing financial services, offering enhanced personalization and efficiency. For instance, advanced credit scoring models powered by AI can analyze vast datasets to provide more accurate risk assessments. This allows institutions like IBK to tailor offerings, from loan products to investment advice, to individual customer needs, improving both customer satisfaction and operational effectiveness. The global AI in finance market was valued at approximately $10.6 billion in 2023 and is projected to grow significantly in the coming years.

Blockchain and cryptocurrency adoption is accelerating in South Korea, with the Financial Services Commission providing clearer regulations. This regulatory environment is encouraging institutional investment and fostering new financial service opportunities and collaborations.

Digital Payment and Mobile Banking Expansion

Digital payment solutions, including mobile payments and e-wallets, continue their rapid expansion in South Korea, with major financial institutions like the Industrial Bank of Korea (IBK) actively participating. These platforms leverage technologies such as Near Field Communication (NFC) to facilitate seamless transactions.

The mobile payments market in South Korea is projected for substantial growth, signaling a definitive and ongoing shift away from traditional cash-based transactions and even card usage. This trend presents both opportunities and challenges for established banks.

Key statistics highlight this digital transformation:

- The value of mobile payment transactions in South Korea reached an estimated 200 trillion KRW (approximately $150 billion USD) in 2023, with projections showing continued double-digit annual growth through 2025.

- A significant portion of the South Korean population, over 70% as of late 2024, actively uses mobile banking and payment applications for daily financial activities.

- IBK has reported a 25% year-over-year increase in mobile transaction volume through its banking app in the first half of 2024, demonstrating direct engagement with this trend.

- The increasing adoption of QR code payments and contactless terminals further solidifies the move towards digital-first financial interactions.

Robo-Advisory and Wealth Management Transformation

Robo-advisors and AI are revolutionizing wealth management in South Korea, making personalized investment advice and portfolio management accessible to a wider range of individuals. This technological shift presents significant opportunities for Industrial Bank of Korea (IBK) to expand its service offerings and reach a more diverse client base.

The adoption of these digital platforms is accelerating, with projections indicating continued growth in the fintech sector. For instance, the South Korean robo-advisory market has seen substantial investment, with firms leveraging AI to offer sophisticated yet user-friendly investment solutions.

- Increased Accessibility: Robo-advisors lower the barrier to entry for investment services, attracting younger demographics and those with smaller capital.

- Personalized Portfolios: AI algorithms can analyze vast amounts of data to create highly customized investment strategies, adapting to individual risk tolerance and financial goals.

- Efficiency Gains: Automation through robo-advisory platforms can streamline operations, potentially reducing costs for both financial institutions and clients.

- Competitive Landscape: The rise of fintech challengers necessitates traditional banks like IBK to innovate and integrate similar technologies to remain competitive.

Technological advancements are rapidly reshaping South Korea's financial sector, with IBK needing to adapt to these shifts. The nation's strong embrace of fintech, evidenced by over 70 million mobile financial service users by the end of 2023, highlights a clear demand for digital solutions.

AI and big data are crucial for enhancing customer experiences and operational efficiency, with the global AI in finance market valued at approximately $10.6 billion in 2023. IBK's reported 25% year-over-year increase in mobile transaction volume in the first half of 2024 underscores the impact of these technologies.

The acceleration of digital payments, with transaction values reaching an estimated 200 trillion KRW ($150 billion USD) in 2023, necessitates IBK's continued investment in seamless payment technologies.

Robo-advisors are democratizing wealth management, and IBK's engagement with these platforms is key to remaining competitive in a market where over 70% of the population actively uses mobile banking apps as of late 2024.

Legal factors

The Financial Services Commission (FSC) in South Korea is a key regulator, actively shaping the landscape for banks like the Industrial Bank of Korea (IBK). In 2024, the FSC continued to propose significant rule changes, particularly concerning emerging areas like fractional investment and refining existing practices such as short selling. These proactive regulatory adjustments directly influence how IBK and other financial institutions operate and manage risk.

Furthermore, the FSC's focus on preventing the mis-selling of complex financial products is paramount. By implementing stricter guidelines and oversight in 2024 and looking ahead into 2025, the commission aims to bolster consumer protection and maintain market integrity. This regulatory environment necessitates that IBK remains agile, adapting its product offerings and sales practices to comply with evolving FSC directives.

Government initiatives and legislation directly shape the Industrial Bank of Korea's (IBK) operational focus, particularly its mandate to support small and medium-sized enterprises (SMEs). These policies create both opportunities and obligations for IBK in its lending and advisory services.

The Ministry of SMEs and Startups (MSS) has a significant influence, with its 2025 budget allocating increased funds for policy loans and various support programs specifically targeting SMEs. For instance, the MSS's 2025 budget proposal includes a substantial increase in policy fund loans, aiming to bolster capital access for these businesses.

South Korea's MyData initiative, evolving into MyData 2.0 in 2025, is significantly reshaping how financial institutions handle personal information. This upgrade broadens access to sensitive financial data via mobile applications, compelling banks like Industrial Bank of Korea to prioritize stringent data security measures and adhere to evolving privacy legislation.

Compliance with these regulations is paramount, especially as MyData 2.0 aims to facilitate more seamless data sharing. Banks must invest in advanced cybersecurity infrastructure and transparent data management practices to maintain customer trust and avoid penalties, ensuring they can securely provide the expanded access envisioned by the initiative.

Corporate Governance Reporting Requirements

The Financial Services Commission (FSC) is enhancing corporate governance transparency by extending mandatory disclosure of governance reports to all KOSPI-listed firms starting in 2026. This move aims to foster more accountable corporate management across the board.

While Industrial Bank of Korea (IBK) is state-owned, these evolving governance standards will likely shape its internal operations and reporting, aligning with broader market expectations for robust governance practices.

- Increased Transparency: The mandatory disclosure for all KOSPI firms from 2026 will create a more standardized and transparent environment for corporate governance.

- Influence on State-Owned Enterprises: Even though IBK is state-owned, the FSC's push for enhanced governance reporting can indirectly influence its internal policies and reporting frameworks.

- Investor Confidence: Greater transparency in corporate governance, driven by these new requirements, is expected to boost investor confidence in the Korean market.

ESG Disclosure Roadmap Adjustments

South Korea's Financial Services Commission (FSC) has adjusted its ESG disclosure roadmap, pushing back mandatory requirements for KOSPI-listed companies with assets exceeding 2 trillion won to after 2026. This strategic delay acknowledges the dynamic nature of global ESG regulations and aims for greater alignment with international standards. For Industrial Bank of Korea (IBK), this means a revised timeline for formalizing its ESG reporting practices, allowing more time to integrate evolving global expectations into its disclosure framework.

The postponement directly influences IBK's strategic planning for ESG integration and reporting. While the immediate pressure for comprehensive, standardized ESG disclosures has eased, the underlying trend towards greater transparency remains strong. IBK will need to continue developing its capabilities to meet these future requirements, potentially leveraging the extended period to refine its data collection and reporting methodologies.

- Delayed Mandate: Mandatory ESG disclosures for large KOSPI firms, including IBK, are now expected post-2026, a shift from earlier timelines.

- Global Harmonization: The delay reflects South Korea's effort to align its ESG disclosure requirements with evolving international regulatory landscapes.

- Strategic Impact on IBK: IBK has more time to prepare for formal ESG reporting, focusing on refining data and methodologies.

- Continued Trend: Despite the delay, the global push for ESG transparency means IBK must still prioritize building robust ESG reporting capabilities.

The legal framework in South Korea significantly impacts the Industrial Bank of Korea (IBK), particularly through regulations set by the Financial Services Commission (FSC). The FSC's ongoing efforts to refine rules for areas like fractional investment and short selling in 2024 and 2025 directly shape IBK's operational strategies and risk management practices.

Moreover, government policies aimed at supporting small and medium-sized enterprises (SMEs) are central to IBK's mandate. The Ministry of SMEs and Startups' increased allocation of funds for policy loans in its 2025 budget, for example, underscores the legal and financial backing for IBK's SME-focused activities.

The evolving MyData 2.0 initiative, set to enhance personal financial data access in 2025, necessitates robust data security and privacy compliance from IBK, impacting how customer information is managed and shared.

Furthermore, the FSC's push for increased corporate governance transparency, with mandatory disclosures for all KOSPI-listed firms from 2026, will likely influence IBK's internal reporting and operational standards, even as a state-owned entity.

Environmental factors

Environmental factors are increasingly shaping the banking sector, and the Industrial Bank of Korea (IBK) is actively responding. IBK's commitment to sustainable finance is evident through initiatives like the first ESG loan in Korea, demonstrating a proactive approach to environmental responsibility within its operations. This focus extends to supporting small and medium-sized enterprises (SMEs) in their own green transitions, a critical component of broader environmental stewardship.

The bank's 2024 Sustainability Report underscores its strategic integration of ESG principles, detailing performance metrics and future plans. This transparency highlights IBK's dedication to not only meeting but exceeding environmental expectations, aligning its business model with a more sustainable future for the Korean economy.

The Korean government is actively promoting green finance, with a strong focus on climate initiatives. The Financial Services Commission and Ministry of Environment are driving this, encouraging public financial institutions to commit substantial funds. By 2030, there's a significant push to increase green finance, creating a very favorable landscape for Industrial Bank of Korea's (IBK) green lending and investment endeavors.

Industrial Bank of Korea's (IBK) commitment to sustainability is clearly demonstrated in its 2024 Sustainability Report, which aligns with leading international frameworks. The bank adheres to the Global Reporting Initiative (GRI) Standards and the United Nations Principles for Responsible Banking (UN PRB), showcasing a dedication to transparent and comprehensive disclosure.

Furthermore, IBK actively references the International Sustainability Standards Board's (ISSB) IFRS Sustainability Disclosure Standards. This proactive adoption of evolving global benchmarks underscores IBK's focus on enhancing its accountability and building trust with stakeholders through robust, standardized sustainability reporting.

Support for SME Green Transition

The Industrial Bank of Korea (IBK) is a key player in facilitating South Korea's push towards a greener economy, particularly for small and medium-sized enterprises (SMEs). IBK offers a range of financial products and advisory services designed to help these businesses adopt more sustainable practices and transition to low-carbon models. This initiative is directly in step with national strategies aimed at boosting private sector green investment and accelerating the country's overall low-carbon transition.

IBK's commitment is evident in its targeted financial support. For instance, in 2023, IBK provided significant lending for green projects, with a substantial portion directed towards SMEs. The bank's green loan portfolio saw a notable increase, reflecting the growing demand for sustainable financing solutions among smaller businesses seeking to comply with evolving environmental regulations and capture emerging green market opportunities.

Key aspects of IBK's support for the SME green transition include:

- Green Financing Products: Offering loans and credit lines with preferential terms for eco-friendly investments, such as energy efficiency upgrades and renewable energy adoption.

- Consulting Services: Providing expert advice on environmental management, carbon footprint reduction, and sustainability reporting to help SMEs navigate the complexities of the green transition.

- Partnerships: Collaborating with government agencies and industry associations to create a more robust ecosystem for SME green initiatives.

- Digitalization of Green Services: Leveraging technology to streamline the application and management of green finance products for SMEs.

Environmental Risk Management in Lending

As an Equator Principles Financial Institution (EPFI), Industrial Bank of Korea (IBK) actively manages environmental risks in its lending by categorizing financed projects based on their potential environmental and social impacts. This structured approach allows IBK to systematically assess and mitigate the environmental footprint of its loan portfolio, aligning with global sustainability standards. For instance, in 2024, IBK continued to integrate environmental risk assessments into its due diligence processes for all new project finance deals exceeding specified thresholds.

This framework is crucial for identifying and addressing potential environmental liabilities that could affect project viability and, consequently, IBK's financial exposure. IBK's commitment to the Equator Principles underscores its proactive stance on responsible financing, aiming to prevent adverse environmental outcomes and promote sustainable development through its lending activities.

- IBK's EPFI Status: IBK adheres to the Equator Principles, a benchmark for assessing and managing environmental and social risk in projects.

- Project Categorization: Projects are classified into categories (A, B, C) based on their potential environmental and social risks, guiding the level of due diligence required.

- Risk Mitigation: The framework mandates the development and implementation of environmental and social action plans for projects with significant risks.

- Portfolio Management: IBK utilizes this system to manage environmental risks across its entire lending portfolio, ensuring compliance and promoting sustainable finance practices.

Environmental regulations are becoming more stringent in South Korea, pushing financial institutions like IBK to integrate sustainability into their core strategies. The bank's proactive stance is demonstrated by its commitment to green finance, aiming to significantly increase its green loan portfolio by 2030. This aligns with national targets for carbon neutrality and sustainable economic growth.

IBK's 2024 Sustainability Report highlights a 15% year-on-year increase in its green finance portfolio, reaching KRW 25 trillion by the end of 2023. This growth is driven by increased demand from SMEs seeking to invest in energy-efficient technologies and renewable energy sources, supported by government incentives.

| Key Environmental Metrics (2023) | Value | Target (2025) |

| Green Loan Portfolio Growth | 15% YoY | 20% YoY |

| Total Green Finance Assets | KRW 25 Trillion | KRW 30 Trillion |

| SME Green Financing Allocation | 60% of New Green Loans | 70% of New Green Loans |

PESTLE Analysis Data Sources

Our PESTLE Analysis for the Industrial Bank of Korea is grounded in data from official government publications, financial regulatory bodies, and reputable economic forecasting agencies. We incorporate insights from industry-specific reports and international financial institutions to ensure a comprehensive understanding of the macro-environment.