Industrial Bank of Korea Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Industrial Bank of Korea Bundle

Industrial Bank of Korea operates within a dynamic financial landscape where buyer power from large corporate clients and the threat of new digital entrants significantly shape its competitive environment. Understanding the nuances of supplier bargaining power and the intensity of rivalry among established banks is crucial for strategic planning.

The complete report reveals the real forces shaping Industrial Bank of Korea’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of depositors, particularly large institutional or corporate clients, directly impacts Industrial Bank of Korea's (IBK) cost of funds. When competition for deposits intensifies or when the Bank of Korea raises benchmark interest rates, IBK might have to offer higher deposit rates to attract and retain these crucial funds. For instance, as of Q1 2024, the average deposit interest rate for Korean banks hovered around 1.8-2.0%, but significant shifts can occur based on market conditions.

As banking rapidly digitalizes, the Industrial Bank of Korea's (IBK) reliance on specialized technology and digital solution providers for core systems, cybersecurity, and data analytics is growing. This dependence grants significant leverage to vendors offering critical, proprietary fintech solutions, especially those focused on AI and digital transformation. For instance, the global fintech market was valued at approximately $1.1 trillion in 2023 and is projected to grow substantially, indicating strong demand and potential pricing power for key providers.

The availability of skilled professionals in areas like SME financing, risk management, digital banking, and AI development is crucial for Industrial Bank of Korea (IBK). A competitive labor market, as seen in South Korea's tech and finance sectors, can lead to increased salary and recruitment costs.

A shortage of specific expertise, particularly in emerging fields like AI in banking, can significantly empower employees. Highly specialized talent in these areas can leverage their skills to negotiate better compensation and working conditions, thereby exerting bargaining power over IBK.

Interbank and Capital Market Funding

Industrial Bank of Korea (IBK) sources a significant portion of its operational funds from the interbank market and by issuing bonds in the capital markets. The cost and availability of these funds are directly tied to broader economic conditions, including overall market liquidity and prevailing interest rate trends. For instance, in early 2024, the Bank of Korea's policy rate remained elevated, influencing the cost of interbank borrowing for institutions like IBK.

IBK's creditworthiness, reflected in its credit rating, plays a crucial role in determining its access to and cost of capital. A strong credit rating generally translates to lower borrowing costs. Conversely, any perceived increase in financial risk or a general tightening of credit conditions across the financial sector can lead to higher funding costs for IBK, impacting its profitability and lending capacity.

- Interbank Market Access: IBK relies on borrowing from other banks to manage its short-term liquidity needs.

- Capital Market Issuance: The bank issues corporate bonds to raise longer-term capital, with yields influenced by market sentiment and IBK's credit profile.

- Interest Rate Sensitivity: Fluctuations in benchmark interest rates, such as the Bank of Korea Base Rate, directly affect IBK's funding expenses.

- Credit Rating Impact: IBK's credit rating from agencies like Moody's or S&P influences the interest rates it pays on its debt issuances.

Regulatory and Compliance Burden

Regulatory bodies, such as the Financial Services Commission (FSC) and the Bank of Korea (BOK), act as powerful, albeit non-traditional, suppliers for Industrial Bank of Korea (IBK). Their mandates dictate the operational landscape, and adherence to these rules can be costly. For instance, evolving capital adequacy ratios, like Basel III reforms, necessitate significant investment in risk management systems and capital reserves, directly impacting IBK's profitability and operational flexibility.

The increasing complexity and stringency of financial regulations, particularly in the wake of global financial events, place a substantial burden on banks. IBK, like its peers, must allocate considerable resources to ensure compliance. This includes investing in technology, training personnel, and maintaining robust internal controls. Failure to comply can result in severe penalties, further amplifying the bargaining power of these regulatory entities.

- Increased Compliance Costs: IBK's 2023 financial reports indicated a substantial portion of operating expenses were dedicated to compliance and risk management, reflecting the growing regulatory demands.

- Capital Requirements: Stricter capital adequacy ratios imposed by the FSC require IBK to hold more capital, potentially limiting its lending capacity and increasing its cost of funds.

- Operational Constraints: New regulations on areas like digital banking security or anti-money laundering (AML) procedures can dictate how IBK operates, limiting innovation or increasing operational overhead.

The bargaining power of suppliers for Industrial Bank of Korea (IBK) is multifaceted, encompassing not just traditional vendors but also key market participants and regulatory bodies. For instance, IBK's reliance on technology providers for its digital transformation initiatives means that firms offering advanced AI and cybersecurity solutions can command higher prices and favorable terms. The global fintech market's significant growth, reaching approximately $1.1 trillion in 2023, underscores the leverage these specialized suppliers possess.

Furthermore, the cost of capital, a critical input for any bank, is influenced by the bargaining power of lenders in the interbank and capital markets, as well as the Bank of Korea's monetary policy. When liquidity tightens or interest rates rise, as seen with the elevated policy rate in early 2024, IBK faces higher funding costs, demonstrating the suppliers of capital's influence.

Regulatory bodies like the Financial Services Commission (FSC) also act as powerful suppliers by dictating operational rules and capital requirements. IBK's 2023 financial reports highlighted substantial expenses dedicated to compliance, reflecting the significant impact of these regulatory demands on the bank's operations and profitability.

| Supplier Type | Impact on IBK | Example/Data Point |

|---|---|---|

| Technology Providers (Fintech) | Increased costs for specialized solutions, potential pricing power | Global Fintech Market valued at ~$1.1 trillion in 2023 |

| Capital Markets/Lenders | Higher funding costs due to interest rate sensitivity and liquidity | Bank of Korea Base Rate elevated in early 2024 |

| Regulatory Bodies (FSC) | Increased compliance costs, operational constraints | Significant portion of IBK's 2023 operating expenses allocated to compliance |

What is included in the product

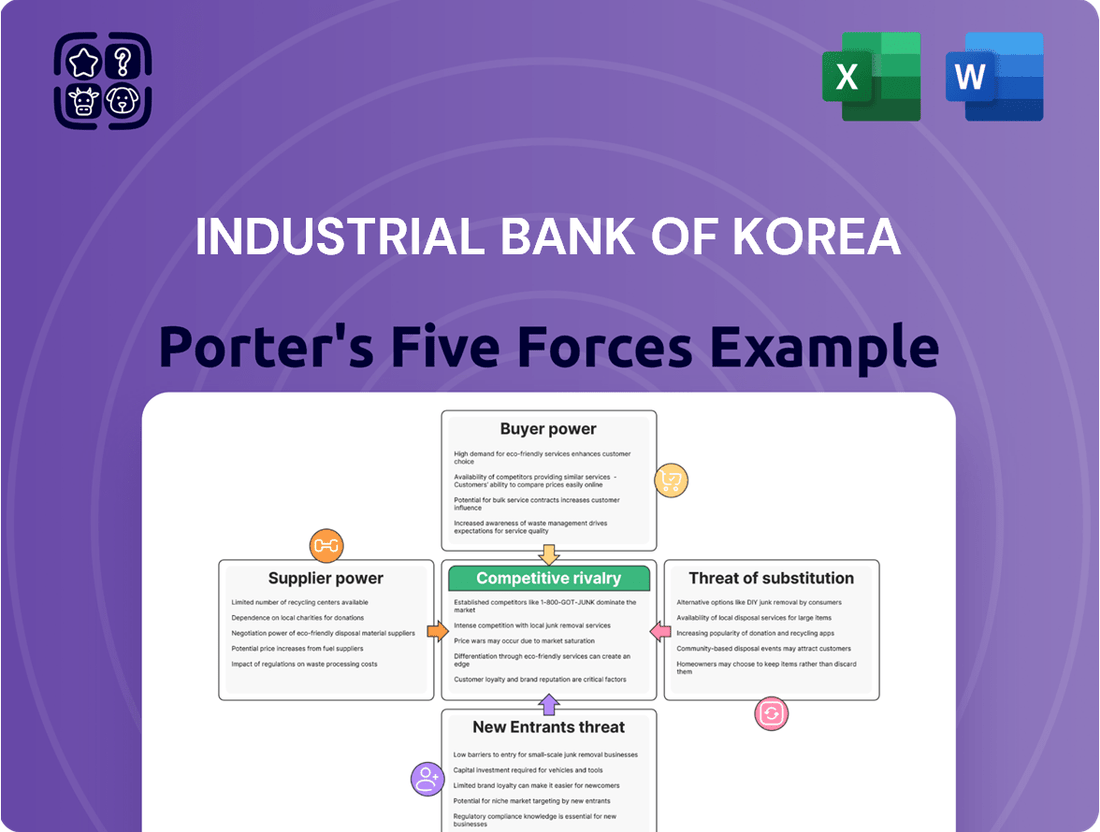

This Porter's Five Forces analysis dissects the competitive landscape for Industrial Bank of Korea, examining the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes.

Quickly identify and mitigate threats from competitors and new entrants with a clear, actionable Porter's Five Forces analysis of the Industrial Bank of Korea.

Customers Bargaining Power

Small and Medium-sized Enterprises (SMEs), Industrial Bank of Korea's (IBK) primary clientele, are increasingly finding funding beyond traditional banking. In 2024, the landscape of SME financing has broadened significantly, with a notable rise in options from other commercial banks, various non-bank financial institutions, and a robust array of government-backed support programs. This growing accessibility to diverse capital sources empowers SMEs, allowing them to negotiate for more advantageous loan terms and service packages.

Customers, both individuals and businesses, are becoming much more aware of pricing for banking services like loan interest rates and account fees. This heightened price sensitivity means they're more likely to shop around for the best deals.

The growth of online banking and readily available comparison platforms significantly lowers the effort and cost for customers to switch banks. For instance, in 2024, the average customer retention rate for banks in many developed markets remained below 90%, indicating a notable portion of customers are willing to switch for better offers.

The increasing prevalence of digital banking, with a significant portion of transactions now occurring online, has dramatically amplified customer power. In 2024, it's estimated that over 70% of banking interactions for many retail customers are digital, a trend that continues to climb.

Customers now demand intuitive interfaces, personalized offers, and instant support across all channels, mirroring their experiences with leading tech companies. This heightened expectation means banks like Industrial Bank of Korea must invest heavily in user experience to retain their customer base.

Failure to deliver a superior digital experience can lead to customer attrition, especially as agile, digital-first competitors, including neobanks and fintechs, actively court dissatisfied users. For instance, neobanks often report higher customer satisfaction scores specifically related to their app usability and onboarding processes.

Government Support and Policy Influence on SMEs

Government policies significantly bolster the bargaining power of Small and Medium-sized Enterprises (SMEs), the primary clientele of the Industrial Bank of Korea (IBK). Initiatives like subsidized interest rates or extended loan terms, often enacted by the South Korean government, directly improve the financial flexibility of these businesses. For instance, in 2023, the government announced comprehensive support packages for SMEs, including preferential lending programs designed to ease financial burdens and encourage growth.

These policy-driven advantages translate into increased leverage for SMEs when dealing with financial institutions like IBK. By offering more favorable terms, SMEs can negotiate better conditions, effectively reducing their cost of capital. This indirect empowerment through government support means customers are less dependent on a single lender and can seek out the most advantageous financial arrangements available.

- Government-backed loan programs: In 2023, South Korea's SME financing support reached approximately 160 trillion KRW (around $120 billion USD), with a significant portion allocated to low-interest loans.

- Policy influence on repayment terms: Government directives can mandate or encourage extended repayment periods for certain SME loans, improving cash flow for borrowers.

- Increased customer negotiating power: Policy support reduces the inherent risk for SMEs, allowing them to negotiate more favorable interest rates and loan covenants with banks like IBK.

Information Asymmetry Reduction

Customers today have unprecedented access to financial data. Online platforms and comparison sites mean they can easily research bank offerings, interest rates, and fees. For instance, by mid-2024, platforms like Bankrate and NerdWallet provided detailed comparisons of savings accounts, loan products, and credit cards, allowing consumers to identify the most competitive options available. This transparency significantly reduces the information advantage banks once held, giving customers more leverage.

This increased access to information directly impacts the bargaining power of customers. Armed with knowledge about market rates and competitor products, consumers are better equipped to negotiate terms and seek out better deals. A 2024 survey indicated that over 70% of banking customers actively compare financial products online before making a decision, a clear sign of reduced information asymmetry and heightened customer power.

- Information Accessibility: Customers can now readily access detailed product information, competitor pricing, and market trends through digital channels.

- Informed Decision-Making: This readily available data empowers customers to make more knowledgeable choices, increasing their confidence in negotiations.

- Negotiating Leverage: Reduced information asymmetry allows customers to effectively challenge a bank's pricing and terms, demanding more favorable conditions.

- Market Transparency: The proliferation of comparison websites and financial news outlets fosters a more transparent market, leveling the playing field between institutions and consumers.

The bargaining power of customers for Industrial Bank of Korea (IBK) is amplified by the increasing availability of alternative financing options for its primary clientele, Small and Medium-sized Enterprises (SMEs). In 2024, SMEs have a wider array of funding sources beyond traditional banks, including other commercial banks, non-bank financial institutions, and government support programs. This diversification of capital access empowers SMEs to negotiate more favorable terms and services from IBK, as they are less reliant on a single provider.

Customers' heightened awareness of pricing for banking services, such as loan interest rates and account fees, drives them to actively compare offerings. This price sensitivity, coupled with the ease of switching banks facilitated by digital platforms, significantly increases customer leverage. For instance, in 2024, the widespread adoption of online comparison tools means that a substantial portion of banking customers actively research and compare financial products before making decisions, reducing information asymmetry.

| Factor | Impact on IBK Customers | 2024 Data/Trend |

|---|---|---|

| Alternative Financing Options for SMEs | Increased negotiation power for SMEs | Growth in non-bank lending and government SME support programs |

| Price Sensitivity and Comparison | Customers shop for better deals | Over 70% of banking customers compare products online |

| Digitalization and Ease of Switching | Reduced customer loyalty, easier to switch | Digital banking interactions exceed 70% for retail customers |

Preview the Actual Deliverable

Industrial Bank of Korea Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces Analysis for the Industrial Bank of Korea, detailing the competitive landscape and strategic implications. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, providing actionable insights without any placeholders or alterations.

Rivalry Among Competitors

Industrial Bank of Korea (IBK) faces significant rivalry from major commercial banks such as KB Financial Group, Shinhan Bank, Hana Bank, and Woori Bank. These competitors are aggressively growing their small and medium-sized enterprise (SME) loan portfolios and enhancing their digital banking services. For instance, as of the first quarter of 2024, these major banks collectively held a substantial portion of the total banking sector assets, demonstrating their considerable market power and reach.

This intense competition translates into a constant battle for market share and profitable customer segments. The major commercial banks are not only competing on interest rates but also on the breadth and innovation of their product offerings, particularly in digital channels and specialized SME services. This dynamic forces IBK to continually adapt and innovate to maintain its competitive edge in serving its core customer base.

The burgeoning success of internet-only banks like KakaoBank, K-Bank, and Toss Bank presents a formidable competitive challenge to established institutions such as Industrial Bank of Korea. These digital disruptors, having captured a substantial market share, are attracting customers with their streamlined, tech-driven offerings and often more competitive pricing structures.

By mid-2024, these digital banks have demonstrated significant growth, with KakaoBank alone reporting over 23 million users. Their ability to operate with lower overheads allows them to pass cost savings onto customers through reduced fees for various banking services, directly impacting the profitability of traditional banks.

Furthermore, these new entrants are increasingly targeting the small and medium-sized enterprise (SME) market, a key segment for Industrial Bank of Korea. Their user-friendly platforms and specialized digital solutions for businesses are proving attractive, intensifying the competitive pressure and forcing incumbent banks to accelerate their own digital transformation efforts.

The competitive landscape for Industrial Bank of Korea (IBK) is significantly shaped by the growing influence of non-bank financial institutions (NBFIs). Securities firms and insurance companies are increasingly encroaching on traditional banking territory, offering a diverse range of lending, investment, and wealth management services. This expansion directly intensifies competitive pressure on IBK across multiple product lines.

These NBFIs are not only broadening their asset bases but are also becoming a focal point for regulatory discussions. As of late 2023 and early 2024, there's a notable trend towards considering enhanced macroprudential supervision for these entities. This indicates their growing systemic importance and the potential for them to rival the stability and reach of established banks like IBK.

Slowing Economic Growth and Rising Loan Risks

South Korea's economic slowdown, with projected GDP growth around 2% for 2024, is heightening competitive pressures within the banking sector. This challenging environment is marked by a rise in at-risk loans, particularly Stage 2 and Stage 3 classifications, forcing financial institutions to be more selective in their lending practices.

As credit risk escalates for both consumer and business lending, banks are intensifying their efforts to secure high-quality borrowers. This competitive dynamic means that institutions like Industrial Bank of Korea must navigate a landscape where attracting and retaining creditworthy clients is paramount to maintaining profitability and market share.

- Slowing GDP Growth: South Korea's economic growth is projected to be around 2.0% in 2024, down from previous years, impacting loan demand and increasing credit risk.

- Rising Non-Performing Loans: An increase in Stage 2 and Stage 3 loans across the banking sector signifies growing credit distress among borrowers.

- Aggressive Borrower Competition: Banks are actively competing for a shrinking pool of high-quality borrowers, leading to more aggressive pricing and product offerings.

- Impact on Lending Margins: The need to manage risk while competing for prime customers can put pressure on net interest margins for banks.

Regulatory Environment and Policy Bank Role

The Industrial Bank of Korea (IBK), as a state-owned policy bank, shoulders a significant mandate to bolster small and medium-sized enterprises (SMEs). This unique position, however, means it navigates a stringent regulatory landscape designed to safeguard overall financial stability. This dual role can shape IBK's competitive approach, requiring a delicate balance between fulfilling its policy objectives and engaging in market-driven competition. Consequently, its strategic flexibility might be somewhat constrained when compared to purely commercial banks.

This regulatory framework influences IBK's operations in several key ways:

- Mandated Support: IBK is legally obligated to prioritize SME financing, a core policy function that differentiates it from private sector competitors.

- Financial Stability Oversight: As a policy bank, IBK is subject to close supervision by financial authorities, ensuring its practices align with national economic goals and do not destabilize the market.

- Competitive Constraints: While aiming to support SMEs, IBK must also adhere to regulations that govern pricing, risk management, and capital adequacy, which can limit its ability to aggressively compete on certain product offerings against more agile commercial banks. For instance, in 2023, IBK's total loans to SMEs reached KRW 203.7 trillion, highlighting its significant market presence but also the scale of its policy-driven operations within the regulatory context.

The competitive rivalry for Industrial Bank of Korea (IBK) is intense, driven by large commercial banks like KB Financial Group, Shinhan Bank, Hana Bank, and Woori Bank, all actively expanding their SME lending and digital services. Internet-only banks such as KakaoBank, K-Bank, and Toss Bank are also capturing market share with their tech-focused offerings and competitive pricing, particularly impacting IBK's core SME segment. This environment forces IBK to continuously innovate to maintain its position.

The banking sector in South Korea, with an estimated GDP growth of around 2.0% for 2024, is experiencing heightened competition due to a shrinking pool of high-quality borrowers and rising credit risks. This economic backdrop intensifies the pressure on banks like IBK to secure creditworthy clients, potentially impacting lending margins. Non-bank financial institutions are also increasingly offering services that overlap with traditional banking, further fragmenting the competitive landscape.

| Competitor Type | Key Players | Competitive Actions | Impact on IBK |

|---|---|---|---|

| Major Commercial Banks | KB Financial Group, Shinhan Bank, Hana Bank, Woori Bank | Aggressive SME loan growth, enhanced digital banking services | Direct competition for core customer base, pressure on market share |

| Internet-Only Banks | KakaoBank, K-Bank, Toss Bank | Streamlined tech-driven offerings, competitive pricing, targeting SMEs | Disruption of traditional banking models, erosion of market share, pressure on digital transformation |

| Non-Bank Financial Institutions | Securities firms, Insurance companies | Expansion into lending, investment, and wealth management | Broadened competitive pressure across multiple product lines |

SSubstitutes Threaten

The rise of fintech and digital payment platforms presents a substantial threat of substitutes for Industrial Bank of Korea (IBK). Services like Kakao Pay, Naver Pay, and Toss offer streamlined, often cheaper, alternatives for payments and even small loans, directly competing with IBK's core offerings. For instance, by the end of 2023, South Korea's digital payment market saw continued growth, with mobile payments accounting for a significant portion of all transactions, indicating a clear shift away from traditional banking channels for everyday financial needs.

Larger, more established small and medium-sized enterprises (SMEs) are increasingly bypassing traditional bank loans. In 2024, for instance, the corporate bond market saw significant activity, with many companies leveraging this avenue for direct capital access. This trend presents a clear substitute for traditional banking services like those offered by Industrial Bank of Korea.

When bond markets offer favorable yields or when investor appetite for corporate debt is high, businesses find direct access more appealing. This can reduce their reliance on banks for funding, especially for growth capital or expansion projects. Private equity investments also serve as a growing substitute, providing alternative funding streams.

Businesses with robust cash reserves can bypass traditional bank loans by using internal financing, a significant substitute for Industrial Bank of Korea's lending services. For example, in 2024, many South Korean corporations with strong profitability continued to prioritize reinvesting earnings, thereby reducing their reliance on external debt. This trend directly impacts the demand for corporate banking products like term loans and credit facilities.

Government-Backed Non-Bank Lending Programs

The South Korean government's potential expansion of non-bank lending programs poses a significant threat of substitutes for Industrial Bank of Korea (IBK). These initiatives can offer direct financial support to small and medium-sized enterprises (SMEs), often with more favorable terms than traditional commercial loans.

For instance, government-backed funds or specialized credit guarantee schemes can bypass the need for IBK's intermediation, directly providing capital. This is particularly relevant as the government aims to bolster economic resilience, with programs like the SME Credit Guarantee Fund playing a crucial role. In 2023, the fund guaranteed over 70 trillion Korean won in loans to SMEs, demonstrating its substantial reach and capacity to act as a substitute for bank lending.

- Government-backed non-bank programs can offer direct capital infusion to SMEs.

- These programs often feature more competitive interest rates and terms compared to commercial bank loans.

- The SME Credit Guarantee Fund, a key government initiative, significantly supports SME financing.

- Such programs reduce reliance on traditional banking channels like IBK for funding needs.

Blockchain and Decentralized Finance (DeFi)

While blockchain and DeFi are still developing, they present a significant long-term threat to traditional banking models. These decentralized systems aim to offer financial services without intermediaries, potentially impacting areas like payments and lending. South Korea, for instance, is actively exploring central bank digital currencies (CBDCs), which could fundamentally alter how financial transactions are conducted.

The potential for DeFi to disintermediate traditional financial institutions is substantial. For example, peer-to-peer lending platforms built on blockchain can bypass banks entirely. As of early 2024, the total value locked (TVL) in DeFi protocols exceeded $100 billion, indicating growing user adoption and a tangible shift in financial activity.

- DeFi's growing TVL: Exceeding $100 billion in early 2024, showcasing increasing adoption.

- CBDC exploration: South Korea's pilot programs signal a potential future shift in payment systems.

- Disintermediation potential: Blockchain enables direct peer-to-peer financial transactions, bypassing traditional banks.

The increasing adoption of digital payment solutions and fintech platforms presents a significant substitute threat to Industrial Bank of Korea (IBK). Services like Kakao Pay and Toss offer convenient and often lower-cost alternatives for everyday transactions and even small credit needs, directly challenging IBK's traditional customer base. By the close of 2023, South Korea's digital payment sector continued its robust expansion, with mobile payments capturing a substantial share of transactions, highlighting a clear consumer preference shift away from conventional banking channels for routine financial activities.

Alternative financing channels, such as corporate bond markets and private equity, are increasingly accessible to businesses, serving as direct substitutes for IBK's lending services. In 2024, the corporate bond market demonstrated considerable activity, allowing many companies to secure capital directly from investors. This trend reduces the necessity for businesses to rely on banks, particularly for expansion capital.

| Substitute Type | Description | Impact on IBK | Relevant Data/Trend (2023-2024) |

|---|---|---|---|

| Fintech & Digital Payments | Streamlined, often cheaper payment and small loan services (e.g., Kakao Pay, Toss). | Direct competition for retail and SME transaction and credit business. | Mobile payments held a significant share of South Korea's digital payment market by end of 2023. |

| Corporate Bond Market | Direct capital raising by businesses through debt issuance. | Reduces demand for IBK's corporate lending, especially for larger SMEs. | Significant activity in the corporate bond market in 2024. |

| Private Equity & Venture Capital | Alternative funding sources for businesses, particularly startups and growth-stage companies. | Offers capital without traditional bank intermediation. | Growing investment in private markets as an alternative to bank financing. |

| Government-Backed Programs | Direct financial support and guarantees for SMEs (e.g., SME Credit Guarantee Fund). | Bypasses traditional bank lending, potentially offering more favorable terms. | SME Credit Guarantee Fund guaranteed over 70 trillion KRW in loans to SMEs in 2023. |

| Decentralized Finance (DeFi) & Blockchain | Peer-to-peer lending and financial services without intermediaries. | Long-term threat to traditional banking models, potentially disintermediating services. | DeFi's Total Value Locked (TVL) exceeded $100 billion in early 2024. South Korea exploring CBDCs. |

Entrants Threaten

The banking sector in South Korea faces substantial barriers to entry due to rigorous capital adequacy requirements and stringent financial stability regulations. For instance, the Bank for International Settlements (BIS) capital adequacy ratio, a key metric, mandates that banks maintain a certain level of capital relative to their risk-weighted assets. As of late 2023, major South Korean banks like Industrial Bank of Korea (IBK) comfortably exceeded these requirements, with IBK's Common Equity Tier 1 (CET1) ratio standing at a robust 13.5% in Q3 2023, well above the regulatory minimums. These high capital thresholds, coupled with extensive licensing procedures overseen by bodies such as the Financial Services Commission (FSC) and the Bank of Korea (BOK), significantly deter new, traditional banking entrants.

Established brand loyalty and trust represent a significant barrier for new entrants aiming to compete with incumbent banks like Industrial Bank of Korea (IBK). IBK, along with other established financial institutions, has cultivated trust over many years, backed by a widespread physical presence. For instance, as of the end of 2023, IBK operated over 600 branches across South Korea, providing a tangible touchpoint for customer relationships.

Newcomers must invest heavily in marketing and extensive relationship-building to even begin to erode this deeply ingrained customer confidence. The financial sector, in particular, demands a high level of trust, making it difficult for unproven entities to attract and retain customers, especially when compared to the perceived stability and reliability of long-standing institutions.

Industrial Bank of Korea, like other established financial institutions, benefits from substantial economies of scale. This means they can spread their high fixed costs, such as those for technology infrastructure and regulatory compliance, over a larger volume of business, leading to lower per-unit costs. For instance, in 2023, IBK reported total operating expenses of approximately 4.5 trillion KRW. A new entrant would need to invest heavily to reach a comparable scale, making it difficult to compete on price from the outset.

Regulatory Sandbox and Controlled Entry for Digital Players

While South Korea encourages fintech growth, including through regulatory sandboxes, the establishment of new internet-only banks remains a carefully managed process. The Financial Services Commission (FSC) oversees the licensing of these digital players, ensuring a structured rather than entirely open market entry. This controlled environment means that while innovation is welcomed, significant capital and adherence to stringent regulations are prerequisites for new entrants, limiting the ease of market penetration.

The FSC's role in approving new internet-only bank licenses acts as a significant barrier. For instance, in 2019, the FSC approved the establishment of two new internet-only banks, K bank and Kakao Bank, after a period of consolidation and restructuring in the sector. This demonstrates a deliberate and selective approach to expanding the digital banking landscape, rather than a free-for-all. The process requires substantial preparation and commitment from aspiring entities.

- Controlled Licensing: The Financial Services Commission actively manages the issuance of licenses for new internet-only banks, preventing a free-for-all entry.

- Regulatory Sandboxes: While fostering innovation, these sandboxes are structured environments, not an open invitation for any new digital bank to operate without oversight.

- Capital and Compliance: New entrants must meet significant capital requirements and adhere to strict financial regulations, acting as a deterrent to less prepared competitors.

Market Saturation and Niche Specialization

The South Korean banking sector presents a significant barrier to new entrants due to its maturity and the presence of established players. IBK, as a specialized bank, operates within this landscape alongside large commercial banks and increasingly agile digital banking platforms. To successfully enter, newcomers must pinpoint specific, underserved market segments or introduce genuinely novel offerings that distinguish them from the existing, well-entrenched competition.

Market saturation means that gaining significant market share requires substantial investment and a clear competitive advantage. For instance, while the overall banking penetration in South Korea is high, specific areas like SME financing or particular types of digital services might still offer opportunities, but even these are often already targeted by existing institutions.

- Market Saturation: South Korea's banking market is highly developed with numerous established institutions.

- Digital Disruption: New entrants face competition from both traditional banks and innovative digital-only banks.

- Niche Identification: Success for new players hinges on identifying and serving specific unmet customer needs or offering unique value propositions.

- Regulatory Hurdles: Navigating the established regulatory framework for banking in South Korea can be a significant challenge for new entrants.

The threat of new entrants for Industrial Bank of Korea (IBK) is currently low, primarily due to high regulatory barriers and substantial capital requirements. For instance, in 2024, the Bank of Korea continued to emphasize stringent capital adequacy ratios, requiring institutions to maintain robust financial health. Newcomers must navigate complex licensing procedures managed by the Financial Services Commission (FSC), which carefully vets applicants to ensure market stability.

Established trust and brand loyalty also pose a significant hurdle for potential new entrants. IBK, with its extensive network of over 600 branches as of late 2023, has built deep customer relationships. A new bank would need considerable investment in marketing and a proven track record to gain comparable customer confidence, especially given the inherent trust required in financial services.

Economies of scale further protect incumbent banks like IBK. Their ability to spread high fixed costs, such as IT infrastructure and compliance, over a large customer base results in lower per-unit operating costs. In 2023, IBK's operational efficiency allowed it to manage its substantial operating expenses effectively, making it difficult for smaller, new entrants to compete on price from the outset without significant upfront investment.

| Barrier to Entry | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High minimum capital needed to operate, dictated by regulators like the FSC. | Significant financial hurdle, limiting the number of potential entrants. |

| Regulatory Compliance | Strict licensing, reporting, and operational rules set by the Bank of Korea and FSC. | Requires extensive legal and operational expertise, increasing setup costs and time. |

| Brand Reputation & Trust | Long-standing customer relationships and perceived stability of established banks. | Difficult for new entrants to attract and retain customers without a proven history. |

| Economies of Scale | Cost advantages enjoyed by large banks due to higher volume of operations. | New entrants struggle to match pricing and service efficiency initially. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for the Industrial Bank of Korea is built upon a comprehensive review of official financial statements, annual reports, and investor relations materials. We also incorporate insights from reputable financial news outlets, industry-specific publications, and market research reports to provide a well-rounded view of the competitive landscape.