IBC Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IBC Bank Bundle

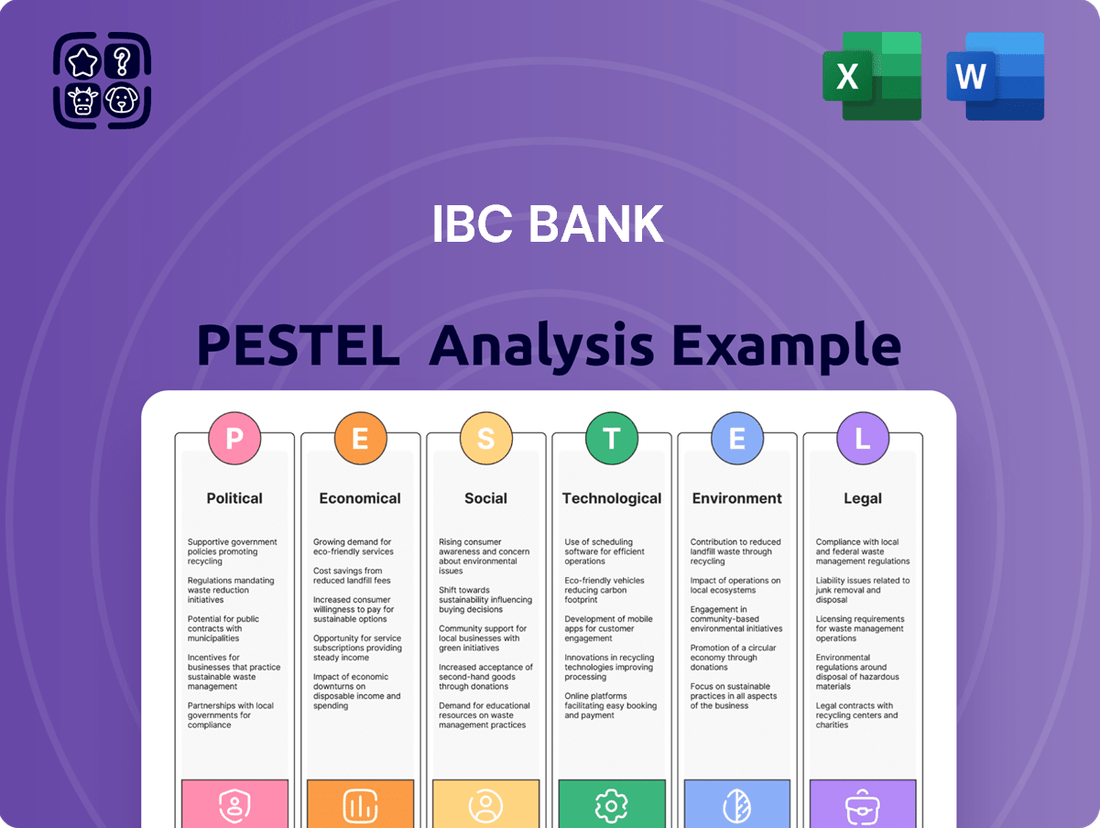

Navigate the complex external environment impacting IBC Bank with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that are shaping its strategic landscape and future growth. Gain a competitive advantage by leveraging these critical insights. Download the full report now to unlock actionable intelligence and make informed decisions.

Political factors

Changes in cross-border trade policies, like the ongoing adjustments within the USMCA framework, significantly influence the volume and type of international commerce, a critical area for IBC Bank's operations. Favorable trade agreements can boost economic activity and the need for trade finance, while protectionist measures might curb expansion and elevate risk.

For instance, in 2024, global trade growth is projected to be around 2.6%, a moderate increase from previous years, according to the WTO. This figure directly affects the demand for services like letters of credit and supply chain financing, which are key revenue drivers for banks like IBC Bank.

Strategic planning at IBC Bank must therefore closely monitor shifts in trade pacts and tariffs, as these directly impact the profitability and risk profile of its international banking services. A proactive approach to understanding these policy evolutions is essential for maintaining a competitive edge.

Government policies concerning border security and immigration significantly influence the economic landscape of U.S.-Mexico border regions, which are crucial for IBC Bank. For instance, in 2024, discussions around border management and potential changes to immigration laws are ongoing, directly impacting the movement of labor and capital.

Stricter enforcement or changes in immigration status requirements could potentially dampen cross-border trade and remittances, affecting IBC Bank's transaction volumes and the financial activities of its clientele. Conversely, more efficient and predictable border processes might foster greater economic integration and business expansion opportunities within these communities.

Federal and state governments are channeling significant funds into the U.S.-Mexico border region, focusing on infrastructure, economic development, and public services. For instance, the Infrastructure Investment and Jobs Act of 2021 allocated billions toward improving border infrastructure and transportation networks, directly impacting areas where IBC Bank operates. These investments are designed to stimulate local economies, creating opportunities for businesses and increasing demand for financial services.

IBC Bank, with its deep roots in these border communities, is well-positioned to capitalize on this increased economic activity. The influx of government spending translates into more businesses needing commercial loans for expansion and more individuals seeking consumer loans, directly benefiting the bank's core business. For example, in 2024, Texas alone saw projected state spending of over $10 billion on border security and infrastructure, a substantial portion of which flows into economic development initiatives.

Understanding these governmental spending patterns is crucial for IBC Bank's strategic planning. Identifying specific regions or projects receiving substantial investment allows the bank to proactively tailor its loan products and services to meet the anticipated growth in demand. This proactive approach ensures IBC Bank remains a key financial partner in the development of these vital economic corridors.

Political Stability in Mexico

Mexico's political climate is a significant factor for IBC Bank, as stability directly impacts economic conditions and investor confidence. Political uncertainty can lead to economic volatility, affecting currency exchange rates and investment flows, which in turn influence the financial health of clients involved in cross-border activities and remittances.

A stable political environment in Mexico fosters predictable business conditions, encouraging investment and trade. For instance, the country's commitment to fiscal discipline and structural reforms, often highlighted in international financial reports, contributes to a more predictable economic outlook. This predictability is crucial for IBC Bank's clients who rely on stable markets for their international operations.

- Political Stability: Mexico has generally maintained a stable political system, though regional elections and policy shifts can introduce short-term uncertainty.

- Investor Confidence: According to the Mexican Institute of Competitiveness (IMCO), political stability is a key driver of foreign direct investment (FDI), which saw significant inflows in recent years, though specific figures fluctuate annually.

- Economic Impact: Political stability supports a more consistent economic growth trajectory, influencing factors like inflation and interest rates, which directly affect IBC Bank's client portfolios and lending activities.

U.S.-Mexico Bilateral Relations

The current U.S.-Mexico diplomatic relationship is a significant factor for IBC Bank. A strong relationship facilitates smoother cross-border trade and investment, directly benefiting the bank's international operations and client base. For instance, in 2023, U.S.-Mexico trade reached a record $798 billion, underscoring the economic interdependence.

Conversely, any diplomatic friction could lead to increased trade barriers or reduced investor confidence, potentially impacting IBC Bank's ability to offer robust international financial services. For example, discussions around border security and immigration policies, while not directly economic, can influence the overall tone of bilateral engagement.

Key areas of U.S.-Mexico cooperation that directly impact financial flows include trade agreements like the USMCA, which governs a substantial portion of their economic exchange.

- USMCA Trade Volume: In 2023, the USMCA facilitated trade worth approximately $798 billion between the U.S. and Mexico.

- Foreign Direct Investment: Mexico remains a top destination for U.S. FDI, with significant flows impacting cross-border banking services.

- Remittance Flows: Billions of dollars in remittances are sent from the U.S. to Mexico annually, a crucial financial channel.

- Border Infrastructure Investment: Ongoing investments in border infrastructure aim to enhance trade efficiency, benefiting financial institutions involved in cross-border transactions.

Governmental policies on trade, like the USMCA, directly shape cross-border commerce volumes, influencing IBC Bank's trade finance demand. For instance, the WTO projected global trade growth at 2.6% for 2024, a figure that impacts services like letters of credit.

Infrastructure spending in border regions, such as Texas's projected $10 billion in border-related spending for 2024, stimulates local economies and increases demand for IBC Bank's loan products.

Mexico's political stability is crucial for investor confidence and economic predictability, impacting currency exchange rates and investment flows that IBC Bank's clients rely on.

The U.S.-Mexico diplomatic relationship, underscored by $798 billion in bilateral trade in 2023, directly affects the efficiency of cross-border financial services offered by IBC Bank.

What is included in the product

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors impacting IBC Bank, examining Political, Economic, Social, Technological, Environmental, and Legal influences to identify strategic opportunities and potential threats.

A PESTLE analysis for IBC Bank provides a clear, summarized view of external factors, acting as a pain point reliever by simplifying complex market dynamics for strategic decision-making.

By dissecting external influences into Political, Economic, Social, Technological, Legal, and Environmental categories, IBC Bank's PESTLE analysis offers a structured approach to identifying and mitigating potential risks, thereby alleviating uncertainty.

Economic factors

Interest rate fluctuations significantly influence IBC Bank's financial health. For instance, the US Federal Reserve's benchmark rate, which influences global financial markets, saw several hikes in 2023, reaching a target range of 5.25%-5.50%. Similarly, Banxico has also maintained a high policy rate, with its benchmark rate standing at 11.00% as of early 2024. These adjustments directly affect IBC Bank's net interest margin, the profitability derived from lending activities.

When interest rates rise, IBC Bank can potentially earn more on its loans, but this also makes borrowing more expensive for customers, potentially reducing loan demand. Conversely, falling rates can stimulate borrowing and economic activity, yet they can also squeeze the bank's profit margins on loans and the attractiveness of its deposit products. The bank's ability to navigate these shifts, for example, by adjusting its funding costs and loan pricing strategies, is crucial for maintaining profitability and competitive standing in the 2024-2025 period.

The economic health of the U.S. and Mexico, especially along the border, is crucial for IBC Bank. Strong growth in these areas fuels demand for loans and boosts deposits. For instance, the U.S. economy grew at an annualized rate of 3.1% in the fourth quarter of 2023, signaling robust consumer and business activity that can translate into higher loan volumes for banks like IBC.

Conversely, economic downturns present significant risks. A recession could lead to increased loan defaults, as businesses and individuals struggle to repay their debts. Mexico's economy, while showing resilience, is also subject to global economic fluctuations, which can impact cross-border trade and investment, directly affecting IBC Bank's operational environment.

High inflation rates, such as the 3.3% annual inflation rate recorded in the US in May 2024, significantly erode consumer and business purchasing power. This directly impacts a bank like IBC Bank by reducing the real value of deposits and increasing the risk of loan defaults as borrowers struggle with higher costs.

For IBC Bank, persistent inflation, exemplified by the 2.3% year-over-year increase in the UK's Consumer Price Index in April 2024, drives up operational expenses, from salaries to technology. This can squeeze profit margins if the bank cannot adequately pass on these costs through lending rates, while also forcing central banks to consider interest rate hikes, creating economic uncertainty.

Cross-Border Trade Volumes and Remittances

Cross-border trade between the U.S. and Mexico is a critical economic engine, directly influencing IBC Bank's international services and fee income. In 2023, U.S.-Mexico trade reached record highs, exceeding $800 billion, underscoring the robust economic ties and the demand for specialized financial products like currency exchange and trade finance. This trend is expected to continue into 2024 and 2025, driven by nearshoring initiatives and sustained demand for manufactured goods.

Remittances from the U.S. to Mexico also play a significant role in the financial landscape for IBC Bank. In 2023, remittances to Mexico reached an estimated $60 billion, providing a consistent stream of fee income for financial institutions facilitating these transfers. The ongoing economic stability in both countries and the large Mexican diaspora in the U.S. suggest that remittance flows will remain strong, supporting IBC Bank's revenue streams.

- U.S.-Mexico Trade Value: Exceeded $800 billion in 2023, indicating substantial activity for IBC Bank's trade finance services.

- Remittance Flows: Estimated at $60 billion to Mexico in 2023, a key driver for IBC Bank's international money transfer services.

- Economic Interdependence: Strong economic connections fuel demand for IBC Bank's specialized cross-border financial products.

- Profitability Impact: Fluctuations in trade volumes and remittances directly affect IBC Bank's fee income and overall profitability.

Unemployment Rates and Consumer Spending

Unemployment rates significantly shape consumer spending, directly impacting demand for IBC Bank's products like loans and deposit accounts. When unemployment is low, people feel more secure financially, which typically boosts their willingness to spend and engage with banking services. For instance, as of April 2024, the U.S. unemployment rate stood at a low 3.9%, indicating a generally stable economic environment that supports increased consumer activity.

Higher consumer confidence, often linked to low unemployment, translates into greater financial stability for individuals and families. This stability encourages more banking activity, from taking out mortgages to opening new accounts. A strong job market means more people have disposable income, leading to increased demand for banking products and improved loan repayment capabilities for IBC Bank.

- U.S. Unemployment Rate (April 2024): 3.9%

- Impact on IBC Bank: Lower unemployment fuels demand for consumer loans and mortgages.

- Consumer Confidence: High confidence, often tied to job security, drives increased banking activity.

- Loan Repayment: Stable employment enhances individuals' ability to repay loans, benefiting the bank.

Economic stability and growth are paramount for IBC Bank's operations and profitability. The bank's performance is closely tied to the economic health of both the U.S. and Mexico, particularly in border regions where cross-border trade and remittances are significant revenue drivers. For example, U.S.-Mexico trade exceeded $800 billion in 2023, directly benefiting IBC Bank's trade finance and international services. Remittances, estimated at $60 billion to Mexico in 2023, also provide a consistent income stream for the bank's money transfer services, highlighting the critical role of these economic flows for IBC Bank's financial success through 2024 and 2025.

| Economic Factor | Data Point | Relevance to IBC Bank |

|---|---|---|

| U.S. Economic Growth (Q4 2023) | 3.1% annualized | Indicates strong consumer and business activity, supporting loan demand. |

| U.S.-Mexico Trade (2023) | Exceeded $800 billion | Drives demand for trade finance and international banking services. |

| Remittances to Mexico (2023) | Estimated $60 billion | Key revenue source for international money transfer services. |

| U.S. Unemployment Rate (April 2024) | 3.9% | Low unemployment boosts consumer confidence and loan repayment ability. |

Preview the Actual Deliverable

IBC Bank PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive IBC Bank PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the bank's operations and strategic decisions. Understanding these external forces is crucial for navigating the complex financial landscape.

Sociological factors

The U.S.-Mexico border region is experiencing dynamic demographic shifts, with significant population growth and an evolving age distribution. For instance, many border counties in Texas and Arizona have seen population increases exceeding the national average in recent years. This changing landscape directly impacts the demand for banking services, requiring institutions like IBC Bank to adapt their offerings.

The predominantly Hispanic composition of the border population presents a clear opportunity and a necessity for culturally attuned banking. With a substantial portion of the population identifying as Hispanic, IBC Bank's focus on bilingual services, Spanish-language marketing campaigns, and products designed for bicultural families and cross-border commerce becomes a strategic imperative for market penetration and customer retention.

Cultural nuances significantly influence banking preferences along the border. For instance, in regions with strong community ties, a preference for in-person interactions and personalized service might outweigh the appeal of purely digital banking solutions. A 2024 survey indicated that over 60% of small businesses in South Texas prefer face-to-face meetings with their bankers for complex financial decisions, highlighting the importance of relationship banking.

IBC Bank needs to tailor its approach to these cultural specifics. This means not only offering digital platforms but also investing in accessible branch networks and training staff to understand and cater to the unique financial behaviors and priorities of border communities. Understanding these preferences, such as a greater emphasis on cash transactions in some demographics or a reliance on community-based financial advice, is crucial for building trust and fostering long-term customer loyalty.

Income inequality significantly shapes the financial landscape for IBC Bank in border communities. For instance, in 2023, the median household income in Texas border cities often lagged behind the national average, with some areas experiencing poverty rates exceeding 20%. This disparity means IBC Bank must tailor its offerings, providing essential, low-cost services for lower-income residents while simultaneously developing sophisticated wealth management solutions for a growing affluent segment.

Addressing financial inclusion is therefore paramount. By 2024, an estimated 10% of adults in some border regions remained unbanked or underbanked, highlighting a clear need for accessible accounts and digital tools. IBC Bank's strategy should focus on expanding its reach through community outreach and user-friendly platforms, ensuring that all income levels can participate in the formal financial system, thereby capturing a broader customer base and fostering economic stability.

Changing Consumer Expectations for Digital Services

Consumers now demand intuitive and readily available digital banking services, driven by increasing digital literacy across all age groups. IBC Bank needs to prioritize enhancing its online and mobile platforms to keep pace, as failure to do so could lead to customer attrition to more digitally adept institutions.

This shift directly influences how IBC Bank approaches both attracting new customers and retaining its existing base. For instance, a recent study in late 2024 indicated that over 70% of banking customers prefer mobile banking for everyday transactions. Furthermore, a significant portion of Gen Z and Millennials, who represent a growing segment of the financial market, expect personalized digital experiences and instant support, often through chatbots or AI-driven interfaces.

- Digital Adoption: Over 85% of surveyed consumers in early 2025 reported using at least one digital channel for their banking needs weekly.

- Mobile Preference: Mobile banking app usage saw a 15% year-over-year increase in 2024, with many users citing convenience as the primary driver.

- Expectation Gap: A quarter of customers expressed dissatisfaction with the digital offerings of their primary bank, indicating a clear opportunity for improvement.

- Customer Retention: Banks with superior digital platforms reported a 5% higher customer retention rate in the last fiscal year.

Community Development and Social Responsibility

The increasing focus on corporate social responsibility (CSR) significantly impacts financial institutions. Banks like IBC Bank, which are integral to their local economies, find that active participation in community development strengthens their brand and customer loyalty. For instance, in 2024, a significant percentage of consumers, estimated between 60-70%, reported choosing brands that demonstrate a commitment to social and environmental causes, a trend that extends to banking services.

Engaging in meaningful local programs, such as supporting small business incubators or providing financial literacy workshops, directly addresses community needs. This not only builds goodwill but also creates a more stable and prosperous environment for the bank's operations. Data from 2024 indicates that companies with robust CSR programs often experience higher employee retention rates, suggesting a positive correlation between social responsibility and workforce stability.

Furthermore, this emphasis on community development can attract a growing segment of socially conscious investors. These investors are increasingly scrutinizing a company's environmental, social, and governance (ESG) performance. Reports from early 2025 show a continued upward trend in ESG investing, with global assets under management in sustainable funds projected to reach trillions, highlighting the financial incentive for banks to prioritize these initiatives.

- Growing Consumer Preference: Over 65% of consumers in 2024 indicated a preference for banks actively involved in community initiatives.

- Employee Engagement: Companies with strong CSR reported a 15-20% higher employee engagement and retention in 2024.

- Investor Attraction: The global sustainable investment market is expected to exceed $50 trillion by 2025, making ESG performance a key differentiator.

- Reputational Enhancement: Positive community involvement directly correlates with improved brand perception and trust.

The demographic makeup of the border region, characterized by significant Hispanic populations and evolving age distributions, necessitates culturally sensitive banking practices. IBC Bank's bilingual services and community-focused approach are vital for capturing this market. Furthermore, income disparities require tailored financial products, from basic accounts to wealth management, to serve all segments of the population effectively.

Technological factors

The ongoing evolution of digital banking platforms, with enhanced user interfaces and a broader range of features, directly influences IBC Bank's capacity to deliver convenient banking services. This includes the increasing adoption of AI-powered chatbots for customer support, with a projected global market size of $1.8 billion in 2024, expected to grow to $4.7 billion by 2029.

Investing in contemporary, secure, and user-friendly digital channels is paramount for attracting and retaining customers who are comfortable with technology. For instance, mobile banking transactions saw a 15% year-over-year increase in 2023, highlighting the growing reliance on these platforms.

These advancements are key to streamlining IBC Bank's operations and significantly improving the overall customer experience, leading to greater operational efficiency and customer satisfaction.

Cybersecurity threats are a constant and growing concern for financial institutions like IBC Bank. The sophistication of these attacks means banks must continually invest in advanced security measures to safeguard sensitive customer information and financial assets. For instance, in 2024, the global cost of cybercrime was projected to reach $10.5 trillion annually, highlighting the immense financial risk involved.

Maintaining robust data privacy protocols is not just a compliance issue but a critical trust-building element for IBC Bank. Adhering to evolving regulations, such as GDPR and CCPA, is essential to prevent costly data breaches and the subsequent reputational damage that can erode customer confidence. A single major breach could cost millions in fines and lost business.

IBC Bank's strategic adoption of AI and machine learning is poised to significantly reshape its operations. By integrating these advanced technologies, the bank aims to bolster fraud detection capabilities and refine risk assessment models, areas critical for financial stability. This technological leap is expected to streamline back-office functions, freeing up resources and enhancing overall efficiency.

The implementation of AI and ML at IBC Bank will also translate into a more personalized customer experience. Insights gleaned from data analytics will enable the bank to offer tailored financial products and services, directly addressing individual customer needs. This focus on customer-centricity, powered by AI, is a key differentiator in the competitive banking landscape of 2024-2025.

Globally, the banking sector's investment in AI is substantial. For instance, the global AI in banking market was valued at approximately $10.4 billion in 2023 and is projected to reach over $31.4 billion by 2028, indicating a compound annual growth rate of over 24%. IBC Bank's proactive engagement with these trends positions it to capitalize on this growth, enhancing its competitive standing through technological innovation.

Emergence of FinTech Competitors

The financial technology (FinTech) sector is rapidly expanding, presenting a significant challenge to established institutions like IBC Bank. These agile FinTech firms often provide specialized, cost-effective financial services, directly competing with traditional banking models. For instance, the global FinTech market was valued at over $2.4 trillion in 2023 and is projected to grow substantially, indicating a strong customer shift towards these innovative solutions.

To maintain its competitive edge, IBC Bank needs to actively address this technological disruption. This involves either developing its own innovative digital products and services, forging strategic alliances with emerging FinTech companies, or acquiring cutting-edge technologies. Failing to adapt could lead to a loss of market share as customers are increasingly attracted to the convenience and specialized offerings of FinTech alternatives.

- FinTech Market Growth: The global FinTech market's valuation surpassed $2.4 trillion in 2023, highlighting the increasing adoption of digital financial services.

- Customer Demand: Evolving customer expectations favor digital-first experiences, often provided more efficiently by FinTechs.

- Competitive Pressure: IBC Bank faces pressure to innovate or partner to offer services comparable to or better than FinTech competitors.

Blockchain for Cross-Border Payments

Blockchain technology offers a transformative potential for cross-border payments, promising faster settlement times and reduced transaction costs, which could be a significant advantage for IBC Bank. While the global adoption of blockchain for payments is still developing, it presents a clear opportunity to streamline international trade finance and remittance services. For instance, by 2024, the global cross-border payments market was projected to reach over $156 trillion, highlighting the substantial value at stake.

Integrating blockchain solutions could allow IBC Bank to offer more competitive pricing and improved transparency to its clients compared to traditional correspondent banking networks. This could lead to a better customer experience and attract new business. The potential cost savings are substantial; some estimates suggest blockchain could reduce cross-border transaction fees by up to 50%.

- Opportunity: Enhanced speed and reduced costs for international transactions.

- Challenge: Nascent adoption and the need for robust integration strategies.

- Market Context: The global cross-border payments market is vast, exceeding $156 trillion in 2024.

- Potential Impact: Significant fee reduction and improved transparency for IBC Bank's clients.

The increasing reliance on digital platforms necessitates continuous investment in user-friendly interfaces and advanced features, as evidenced by the 15% year-over-year growth in mobile banking transactions in 2023.

Cybersecurity remains a critical concern, with global cybercrime costs projected to reach $10.5 trillion annually in 2024, demanding robust data privacy protocols and advanced security measures from IBC Bank.

IBC Bank's strategic adoption of AI and machine learning is key to enhancing fraud detection and personalizing customer experiences, tapping into a global AI in banking market valued at $10.4 billion in 2023.

The burgeoning FinTech sector, with a global market exceeding $2.4 trillion in 2023, pressures IBC Bank to innovate or partner to maintain market share against agile competitors offering specialized digital services.

Legal factors

IBC Bank navigates a stringent regulatory environment, governed by federal bodies like the Federal Reserve and FDIC, alongside state banking authorities. Compliance with capital adequacy rules, such as Basel III which mandates specific risk-weighted asset ratios, and consumer protection statutes is non-negotiable for maintaining operational integrity.

Failure to meet these legal obligations can trigger severe penalties, including substantial financial fines and limitations on business activities. For instance, in 2023, the banking sector faced billions in fines for various compliance breaches, underscoring the financial risks associated with regulatory non-adherence.

IBC Bank must navigate stringent Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations, which are paramount for financial institutions, particularly those engaging in international business. These rules are designed to prevent financial crimes and require banks to verify customer identities and monitor transactions for suspicious activity.

Ensuring compliance with AML/KYC mandates necessitates significant investment in sophisticated detection systems and continuous staff education. For instance, in 2024, financial institutions globally are allocating billions to RegTech solutions aimed at enhancing compliance, with a notable portion dedicated to AML/KYC processes. Failure to adhere to these regulations can result in substantial fines and reputational damage, impacting IBC Bank's operational integrity and market standing.

The evolving landscape of data privacy laws, like the California Consumer Privacy Act (CCPA) and potential federal legislation, significantly influences how IBC Bank handles customer data. Compliance is crucial for safeguarding information and maintaining customer trust, requiring robust data management and clear privacy policies.

Cross-Border Financial Transaction Regulations

IBC Bank, operating along the U.S.-Mexico border, faces intricate legal frameworks for cross-border financial transactions. These include stringent currency exchange controls, detailed reporting mandates for international transfers, and adherence to global sanctions lists. For instance, the Bank Secrecy Act (BSA) in the U.S. imposes significant reporting obligations on financial institutions for transactions exceeding certain thresholds, aiming to prevent money laundering and terrorist financing.

Compliance with these evolving cross-border regulations is paramount for IBC Bank to foster legitimate trade and remittances effectively. Failure to comply can lead to substantial penalties, reputational damage, and operational disruptions. In 2023, U.S. financial institutions reported billions of dollars in suspicious activity through Suspicious Activity Reports (SARs), underscoring the pervasive nature of financial crime risks that necessitate robust legal compliance.

- Currency Exchange Controls: Navigating differing regulations on currency conversion and capital movement between the U.S. and Mexico.

- Reporting Requirements: Adhering to mandates like the BSA for reporting large or suspicious transactions to prevent illicit financial flows.

- International Sanctions: Ensuring no transactions involve individuals or entities on OFAC (Office of Foreign Assets Control) or other international sanctions lists.

- Anti-Money Laundering (AML) and Know Your Customer (KYC): Implementing robust procedures to verify customer identities and monitor transaction patterns for suspicious activity.

Consumer Protection Laws

IBC Bank operates under a robust framework of consumer protection laws designed to safeguard individual customers. Regulations like the Truth in Lending Act (TILA) and the Fair Credit Reporting Act (FCRA) are paramount, dictating how the bank must disclose loan terms and manage credit information. For instance, TILA mandates clear and conspicuous disclosure of credit terms, including the annual percentage rate and finance charges, preventing predatory lending practices. In 2024, the Consumer Financial Protection Bureau (CFPB) continued its enforcement actions, with billions in penalties issued for violations of consumer protection statutes, underscoring the critical need for strict adherence by financial institutions like IBC Bank.

Adherence to these consumer protection statutes is not merely a legal obligation but a cornerstone of maintaining customer trust and a positive brand reputation. Transparent fee structures, fair lending practices, and accurate credit reporting are essential for fostering long-term customer relationships. Failure to comply can lead to significant legal disputes, hefty fines, and irreparable damage to the bank's public image. For example, in 2024, several major banks faced substantial penalties for alleged unfair or deceptive practices related to account fees and credit reporting, highlighting the financial and reputational risks of non-compliance.

- Truth in Lending Act (TILA): Ensures transparency in credit terms and costs.

- Fair Credit Reporting Act (FCRA): Guarantees accuracy and privacy of credit information.

- Consumer Financial Protection Bureau (CFPB): Oversees and enforces consumer financial laws, issuing billions in penalties annually for violations.

- Customer Trust: Compliance directly impacts customer loyalty and the bank's standing in the market.

IBC Bank operates under a complex web of federal and state regulations, including capital adequacy rules like Basel III and consumer protection laws. Non-compliance can lead to significant financial penalties, with billions in fines levied across the banking sector in 2023 for various breaches. Robust adherence to Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations is critical, especially for cross-border operations, with financial institutions globally investing billions in RegTech for enhanced compliance in 2024.

The bank must also navigate evolving data privacy laws, such as the CCPA, and stringent requirements for cross-border transactions, including currency controls and sanctions list adherence. For instance, the Bank Secrecy Act (BSA) mandates reporting for transactions exceeding certain thresholds to combat financial crime. Failure to comply with these legal frameworks can result in substantial penalties and reputational damage.

| Legal Area | Key Regulations/Requirements | Impact/Risk | 2023-2024 Data/Trends |

|---|---|---|---|

| Regulatory Compliance | Basel III, FDIC, Federal Reserve, State Banking Authorities | Capital adequacy, operational integrity, fines | Billions in fines for sector-wide compliance breaches in 2023 |

| Financial Crime Prevention | AML, KYC, Bank Secrecy Act (BSA) | Preventing money laundering, terrorist financing, sanctions evasion | Billions invested in RegTech for AML/KYC in 2024; billions in SARs filed |

| Consumer Protection | TILA, FCRA, CFPB regulations | Transparency in lending, credit reporting accuracy, customer trust | Billions in penalties issued by CFPB for violations in 2024 |

| Cross-Border Transactions | Currency controls, reporting mandates, OFAC sanctions | Facilitating legitimate trade, preventing illicit flows | Stringent adherence required for U.S.-Mexico operations |

Environmental factors

Climate change poses significant environmental challenges for U.S.-Mexico border communities, impacting local economies and IBC Bank's loan portfolio. Increased droughts and extreme heat, for instance, directly affect agriculture, a key sector in many border regions, potentially leading to reduced yields and financial strain on agricultural businesses. For example, parts of Texas, a significant border state, have experienced prolonged drought conditions in recent years, impacting crop production and water resources.

These environmental shifts can also influence the real estate market, as water scarcity or increased flood risk might deter development or devalue properties. IBC Bank must therefore evaluate how these physical risks, such as changes in water availability affecting irrigation-dependent agriculture or coastal erosion impacting property values, could influence the credit quality of its borrowers and the overall economic stability of the communities it serves.

As environmental regulations tighten, particularly around sectors like energy and manufacturing, IBC Bank faces evolving risks in its commercial lending. For instance, new emissions standards introduced in 2024 could increase operational costs for borrowers in heavy industry, potentially impacting their ability to repay loans. This necessitates a closer look at clients' environmental compliance and sustainability efforts to manage credit risk effectively.

Growing consumer and corporate awareness of environmental issues is significantly boosting the demand for green finance products. This trend presents a clear opportunity for IBC Bank to innovate by offering specialized financial solutions, like green loans for energy-efficient building projects or funding for sustainable agricultural practices. For instance, the global green bond market reached an estimated $1.2 trillion in 2023, signaling strong investor appetite for sustainable investments, a segment IBC Bank can tap into.

Corporate Social Responsibility (CSR) and ESG Reporting

Stakeholders, including investors, customers, and employees, are increasingly scrutinizing companies' Environmental, Social, and Governance (ESG) performance. For IBC Bank, demonstrating a commitment to environmental stewardship through its operations, investments, and reporting can enhance its reputation, attract capital from ESG-focused funds, and improve employee morale and talent attraction. For instance, many investors now actively seek out banks with strong ESG ratings; in 2024, assets managed under ESG mandates globally were projected to exceed $50 trillion, indicating a significant market shift.

IBC Bank's approach to CSR and ESG reporting directly impacts its ability to meet evolving stakeholder expectations. This includes transparency in its lending practices regarding environmental impact and social equity. A 2025 survey revealed that 70% of consumers consider a company's ESG performance when making purchasing decisions, a figure that also influences banking choices.

- Investor Scrutiny: Growing demand for ESG-compliant investments means banks with robust ESG frameworks are more attractive to capital.

- Customer Loyalty: Consumers increasingly favor financial institutions that align with their personal values regarding sustainability and social responsibility.

- Talent Acquisition: A strong CSR and ESG profile aids in attracting and retaining top talent, particularly among younger generations entering the workforce.

- Regulatory Landscape: Anticipating and adapting to evolving ESG disclosure requirements is crucial for compliance and competitive advantage.

Physical Risks to Bank Operations

Extreme weather events, a growing concern amplified by climate change, directly threaten IBC Bank's physical infrastructure. This includes branches, crucial data centers, and overall operational continuity. For instance, the increasing frequency of severe storms and flooding in regions where IBC Bank operates necessitates proactive measures.

To mitigate these risks, IBC Bank must prioritize robust disaster recovery plans and invest in infrastructure resilience. This ensures the protection of its assets, maintains uninterrupted customer service, and critically, safeguards the well-being of its employees during environmental hazards. The financial impact of such disruptions can be substantial, with studies in 2024 highlighting that businesses affected by major natural disasters can experience revenue losses ranging from 10% to over 50%.

- Increased frequency of extreme weather events: Global average temperatures have risen, leading to more intense hurricanes, floods, and heatwaves.

- Infrastructure vulnerability: Bank branches and data centers in coastal or flood-prone areas face direct physical damage risks.

- Operational disruption costs: Downtime due to weather events can lead to significant financial losses, including lost business and recovery expenses.

- Employee safety and well-being: Ensuring staff safety during extreme weather is paramount and requires comprehensive emergency protocols.

Climate change presents tangible risks to IBC Bank's operations and loan portfolio, particularly in border regions reliant on agriculture. Increased drought and extreme heat directly impact crop yields, potentially straining agricultural borrowers. For example, Texas, a key border state, has faced persistent drought conditions, affecting its agricultural sector.

Water scarcity and flood risks can also devalue properties, influencing the real estate market and IBC Bank's mortgage exposure. The bank must assess how these physical environmental shifts affect borrower credit quality and community economic stability.

Evolving environmental regulations, such as new emissions standards enacted in 2024 for industrial sectors, can increase operational costs for IBC Bank's commercial clients, impacting loan repayment capacity. This necessitates a thorough review of clients' environmental compliance.

The growing demand for green finance products, driven by heightened environmental awareness, offers IBC Bank opportunities for innovation. The global green bond market's estimated $1.2 trillion valuation in 2023 highlights strong investor interest in sustainable investments.

Stakeholder scrutiny of Environmental, Social, and Governance (ESG) performance is intensifying. By demonstrating environmental stewardship, IBC Bank can enhance its reputation and attract capital from ESG-focused investors, with global ESG assets projected to exceed $50 trillion in 2024.

IBC Bank's commitment to CSR and ESG reporting is crucial for meeting stakeholder expectations, with a 2025 survey indicating 70% of consumers consider ESG performance in their purchasing decisions, influencing banking choices.

| Environmental Factor | Impact on IBC Bank | Data/Trend (2024-2025) |

|---|---|---|

| Climate Change & Extreme Weather | Increased credit risk in agriculture, potential property devaluation, operational disruptions. | Global average temperatures continue to rise; 2024 saw intensified hurricanes and floods in several regions. |

| Water Scarcity | Reduced agricultural output, impacting loan repayment for agri-businesses; potential impact on real estate development. | Prolonged drought conditions in parts of the U.S. Southwest continue to strain water resources. |

| Environmental Regulations | Increased compliance costs for industrial borrowers, potential impact on loan portfolios. | New emissions standards for heavy industry introduced in 2024 are being implemented. |

| Green Finance Demand | Opportunity for new product development and market share growth. | Global green bond market reached an estimated $1.2 trillion in 2023; strong growth projected for 2024-2025. |

| ESG Scrutiny | Reputational risk/benefit, access to capital, talent attraction. | Global ESG assets projected to exceed $50 trillion in 2024; 70% of consumers consider ESG in 2025. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for IBC Bank is built on a robust foundation of data from financial regulatory bodies, economic forecasting agencies, and reputable industry publications. We incorporate insights from government reports on technological advancements, social demographic shifts, and environmental policies to ensure comprehensive coverage.