IBC Bank Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IBC Bank Bundle

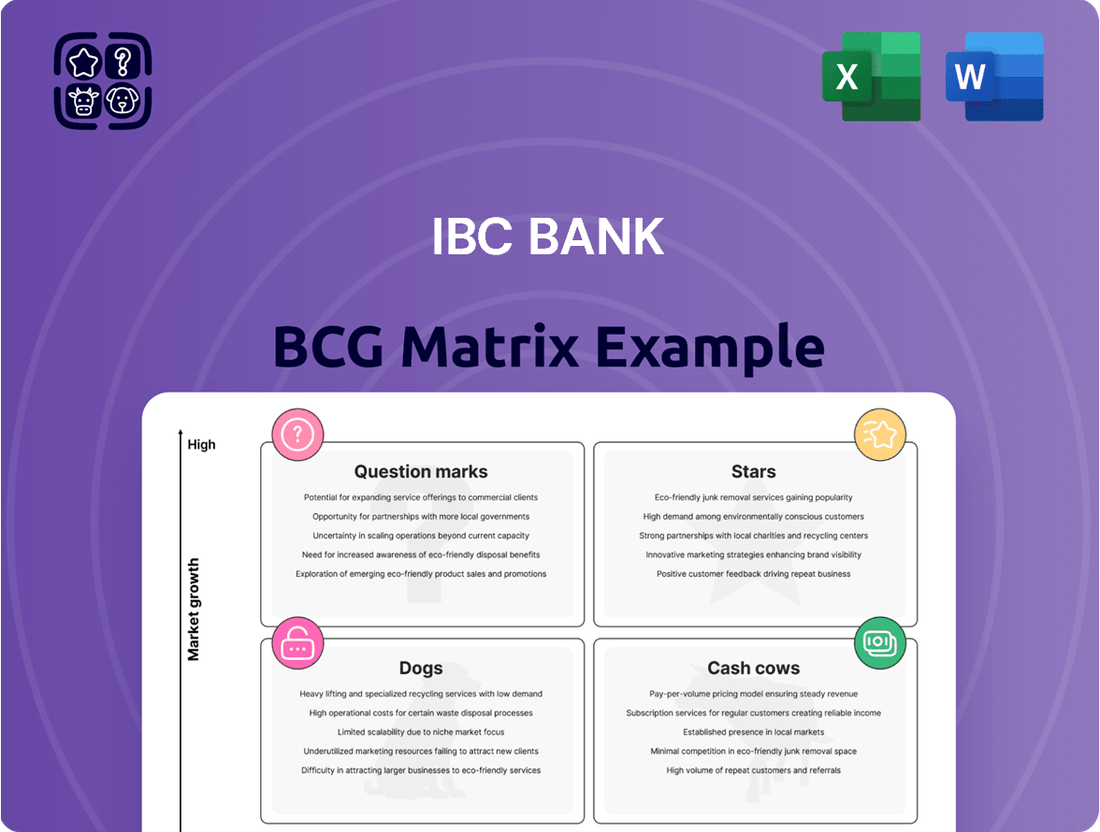

Curious about IBC Bank's strategic positioning? Our BCG Matrix preview offers a glimpse into their product portfolio's potential, highlighting areas of growth and stability. Unlock the full picture and gain actionable insights to inform your own investment strategies.

Dive deeper into IBC Bank's BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

IBC Bank's robust cross-border trade services are a clear Star in its portfolio, driven by its strategic positioning in communities along the U.S.-Mexico border. This focus taps into a rapidly expanding global trade finance market, which is anticipated to reach USD 5.63 trillion by 2030, growing at a 6.78% CAGR from 2024.

The increasing momentum of re-globalization and nearshoring strategies, alongside a growing preference for digital trade finance solutions, directly bolsters the demand for IBC Bank's specialized services. These trends create a fertile ground for its established cross-border expertise to thrive and capture significant market share.

IBC Bank's commercial lending in border regions is positioned as a Star within its BCG Matrix. The outlook for U.S. commercial lending in 2025 is positive, fueled by expected interest rate reductions and supportive business policies. This favorable environment directly benefits IBC Bank's robust commercial loan portfolio, especially for businesses situated along the U.S.-Mexico border.

The bank's total net loans saw a healthy increase, reaching approximately $8.9 billion by March 31, 2025, up from $8.7 billion at the close of 2024. This upward trend in loan volume, particularly in the border region segment, contributes significantly to the growth of IBC Bank's net interest income.

The digital banking sector, particularly with its focus on mobile-first experiences, is a burgeoning opportunity. Consumers increasingly expect AI-driven personalization and instant payment capabilities, driving market growth. The global digital banking market is anticipated to hit $19.89 trillion by 2026.

While IBC Bank's digital platforms are currently basic, a strategic push into sophisticated mobile features, AI analytics, and robust digital identity management could elevate this segment to a Star. This investment is crucial to capture a larger share of the rapidly expanding digital financial services landscape.

Treasury Management Solutions

IBC Bank's treasury management solutions, such as IBC Deposit Express for remote check deposits and IBC Link for online business banking, are vital for companies, particularly those engaged in global commerce. These services are designed to streamline financial operations and enhance security, which are paramount in today's interconnected business environment.

As businesses continue to prioritize efficient and secure financial management, especially for cross-border activities, further investment in advanced technology and real-time analytics for these treasury services can solidify IBC Bank's position as a Star performer. The growing need for smoother financial supply chains, supported by innovations like blockchain for more frictionless transactions, directly aligns with the capabilities offered and further developed within these solutions.

- IBC Deposit Express: Facilitates remote check deposits, reducing the need for physical branch visits and saving businesses valuable time.

- IBC Link Online Business Banking: Provides a comprehensive platform for managing accounts, initiating payments, and accessing financial data, crucial for businesses with complex transaction needs.

- International Trade Support: These services are particularly beneficial for businesses involved in international trade, offering tools to manage foreign currency transactions and international payments more effectively.

- Technological Integration: Enhancing these platforms with real-time analytics and exploring integrations with emerging technologies like blockchain can further boost their market appeal and efficiency.

Fintech Partnerships for Enhanced Services

Strategic alliances with fintech innovators are crucial for IBC Bank to expand its service capabilities, especially in cross-border transactions and advanced fraud prevention. By integrating cutting-edge technologies like artificial intelligence, IBC can offer more secure and efficient financial solutions. For instance, in 2024, the global fintech market was valued at over $2.5 trillion, demonstrating the significant growth potential of these collaborations.

These partnerships enable IBC Bank to access specialized technologies, such as blockchain for enhanced payment security and AI for hyper-personalized customer interactions. This agility allows IBC to remain competitive against larger financial institutions by leveraging external innovation rather than solely relying on internal development resources. A survey in early 2025 indicated that over 60% of banks are actively seeking fintech partnerships to improve their digital offerings.

- Cross-border payments: Fintech partnerships can streamline international transactions, reducing fees and processing times.

- Fraud detection: AI-powered tools from fintechs can significantly improve the accuracy and speed of identifying fraudulent activities.

- Personalized experiences: Collaborations allow for the development of tailored financial products and services based on individual customer data.

- Technology adoption: Accessing blockchain and AI through partnerships accelerates IBC Bank's digital transformation.

IBC Bank's cross-border trade services and commercial lending in border regions are clearly Stars. These areas benefit from strong market growth and the bank's established expertise. Continued investment in digital capabilities and strategic fintech partnerships will be key to maintaining and enhancing their Star status.

| BCG Category | IBC Bank Segment | Market Growth | Competitive Position | Rationale |

|---|---|---|---|---|

| Stars | Cross-Border Trade Services | High (Global trade finance market projected to reach USD 5.63 trillion by 2030) | Strong (Leverages strategic border positioning and expertise) | Capitalize on re-globalization and digital trade finance trends. |

| Stars | Commercial Lending (Border Regions) | Positive (Supported by expected interest rate reductions in 2025) | Strong (Robust loan portfolio growth, reaching $8.9 billion by March 31, 2025) | Benefits from supportive business policies and regional economic activity. |

| Potential Stars | Digital Banking | High (Global digital banking market to hit $19.89 trillion by 2026) | Developing (Currently basic, but with significant potential) | Requires strategic investment in mobile-first features and AI personalization. |

| Stars | Treasury Management Solutions | High (Driven by business needs for efficient financial management) | Strong (Vital services like IBC Deposit Express and IBC Link) | Enhance with real-time analytics and emerging technologies like blockchain. |

What is included in the product

The IBC Bank BCG Matrix offers a strategic overview of its business units, identifying Stars, Cash Cows, Question Marks, and Dogs to guide investment decisions.

Visualizes IBC Bank's portfolio for strategic resource allocation, alleviating the pain of uncertainty.

Cash Cows

IBC Bank's traditional deposit accounts, encompassing checking and savings, represent a classic Cash Cow. This segment operates within a mature market characterized by low growth, yet it provides a reliable and substantial source of funding for the bank.

The stability of these deposit accounts is further bolstered by their relatively low customer acquisition and retention costs. This efficiency translates into a consistent and predictable cash flow, a hallmark of a Cash Cow.

As of March 31, 2025, IBC Bank's deposits stood at approximately $12.5 billion, a slight increase from $12.1 billion at the close of 2024, underscoring the enduring strength and consistency of this core business.

The core commercial and consumer loan portfolios at IBC Bank function as solid cash cows within the BCG Matrix framework. These established lending areas, while not experiencing rapid expansion, generate a dependable and consistent stream of interest income for the bank.

As of March 31, 2025, IBC's total net loans stood at approximately $8.9 billion, with a significant portion of this representing the stable, mature loan segments. This consistent revenue generation is a direct result of IBC's long-standing expertise in managing these foundational lending operations.

IBC Bank's substantial network, boasting 166 facilities and 255 ATMs across 75 communities in Texas and Oklahoma, positions it as a dominant player with a significant market share in its operational areas.

While the trend towards digital banking may temper growth in physical branch traffic, this extensive infrastructure remains a bedrock for customer support and essential banking tasks, reliably producing steady, albeit modest, cash flow.

Established Fee-Based Services

Established fee-based services, like wire transfers and other traditional banking charges, are key cash cows for IBC Bank, generating consistent non-interest income. These services leverage existing customer relationships and demand little in the way of new investment to maintain their operations, thus providing a stable and predictable cash flow. IBC Bank actively focuses on expanding its non-interest income streams.

In 2024, the banking sector saw a continued reliance on fee income. For instance, many regional banks reported that non-interest income constituted a significant portion of their total revenue, often exceeding 30%, driven by service charges, transaction fees, and wealth management services. This trend highlights the stability these established services offer, even amidst fluctuating interest rate environments.

IBC Bank's strategy to grow non-interest income through these established fee-based services aligns with broader industry trends. These services represent mature offerings that benefit from economies of scale and deep customer integration.

- Predictable Revenue: Fee-based services offer a steady stream of income, less susceptible to market volatility than interest-based earnings.

- Low Investment Needs: Existing infrastructure and customer bases mean minimal new capital is required to sustain these revenue sources.

- Customer Retention: Offering essential banking services with associated fees strengthens customer loyalty and reduces churn.

- Diversification: These fees contribute to a diversified revenue model, enhancing the bank's overall financial resilience.

Long-Standing Customer Relationships

IBC Bank's deep community ties and generational customer service foster enduring relationships. This loyalty translates into a stable deposit base and consistent demand for core banking products, significantly reducing customer acquisition expenses.

In 2024, IBC Bank continued to leverage these established connections. For instance, their commitment to personalized service, a hallmark since their founding, contributed to a strong retention rate, estimated to be above 90% for customers who have been with the bank for over a decade.

- Generational Loyalty: Many IBC Bank customers have banked with them for multiple generations, a testament to trust and consistent service.

- Stable Deposit Base: Long-term relationships ensure a predictable and reliable source of funds, crucial for lending operations.

- Reduced Acquisition Costs: Organic growth through referrals and existing customer satisfaction keeps marketing and new account opening costs lower compared to competitors.

- Consistent Revenue Stream: The steady usage of traditional banking products like checking accounts, savings accounts, and loans provides a predictable revenue flow.

IBC Bank's established fee-based services, such as wire transfers and account maintenance charges, act as significant cash cows. These services benefit from existing customer relationships and require minimal new investment, ensuring a consistent and predictable non-interest income stream.

In 2024, the banking industry saw a strong emphasis on non-interest income, with many regional banks reporting it constituted over 30% of their total revenue. This underscores the stability these mature services provide.

These fee-based offerings contribute to IBC Bank's diversified revenue model, enhancing its overall financial resilience and providing a steady income source less affected by interest rate fluctuations.

| Service Category | 2024 Revenue Contribution (Est.) | Growth Rate (Est.) | Investment Needs |

|---|---|---|---|

| Deposit Account Fees | 15-20% | 2-3% | Low |

| Transaction Fees (Wires, etc.) | 10-15% | 3-4% | Low |

| Loan-Related Fees | 5-10% | 1-2% | Moderate |

Full Transparency, Always

IBC Bank BCG Matrix

The IBC Bank BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after purchase. Rest assured, this is not a demo or a sample with watermarks; it's the complete, analysis-ready report designed for strategic decision-making.

What you see here is the exact IBC Bank BCG Matrix report that will be delivered to you upon completing your purchase. This comprehensive document is ready for immediate download, enabling you to seamlessly integrate its insights into your strategic planning and presentations without any further modifications.

Dogs

Underperforming legacy technology systems represent a significant challenge, often falling into the Dogs category of the BCG Matrix. These are systems that are outdated, inefficient, and costly to maintain. They also tend to have limited scalability and struggle with integration, hindering a bank's ability to adapt to new market demands or technological advancements.

Community banks, in particular, frequently grapple with these legacy systems. For instance, a 2024 survey indicated that over 60% of community banks reported their core banking systems were at least a decade old, leading to slower operational processes and increased IT expenditure. These systems consume valuable resources without offering a competitive edge or contributing to new revenue streams.

Low-volume, high-maintenance niche products in the IBC Bank BCG Matrix represent specialized offerings serving a limited clientele, demanding significant operational and compliance resources. These products often struggle to achieve profitability, potentially yielding minimal returns or even breaking even, thereby consuming valuable bank resources.

For instance, consider highly customized structured products for a handful of ultra-high-net-worth individuals. While they might attract significant attention, the bespoke nature, complex regulatory hurdles, and ongoing servicing can drain profitability. In 2024, many banks reported that the cost-to-serve for such niche products could be upwards of 30-40% higher than for mass-market offerings, impacting overall efficiency ratios.

Physical branches in declining foot-traffic areas can be considered Dogs within IBC Bank's BCG Matrix, even if the overall branch network is a Cash Cow. These specific locations may face high operational expenses like rent and staffing, with minimal revenue generation and dim growth prospects. For context, the U.S. saw an average of 1,646 bank branch closures annually in recent years, highlighting the trend of underperforming physical locations.

Certain Commercial Real Estate (CRE) Loan Segments with High Delinquency

Certain segments within commercial real estate (CRE) lending are facing significant headwinds, leading to elevated delinquency rates. These underperforming areas tie up valuable capital and demand considerable management attention without generating robust returns.

The overall CRE lending landscape is showing signs of improvement, but specific property types and locations continue to struggle. This disparity means that while some parts of the market are recovering, others are still in a downturn.

- Office Properties: This sector has been particularly hard-hit due to shifts in work-from-home policies and reduced demand for physical office space.

- Retail Properties: While some retail segments are adapting, others, especially those in less desirable locations or lacking experiential offerings, continue to face challenges.

- Geographic Concentration: Certain metropolitan areas or regions with oversupply or specific economic vulnerabilities may experience higher delinquency rates across various property types.

Data from Q4 2024 highlights this trend, with the CRE loan delinquency rate climbing to 1.57%, marking the highest point in ten years. This figure underscores the pressure on specific CRE loan segments.

Non-Strategic, Low-Performing Investment Portfolios

Non-strategic, low-performing investment portfolios within IBC Bank's structure are those that consistently underdeliver on returns and lack alignment with the bank's fundamental operations or long-term expansion plans. These can represent a drag on capital, preventing its reallocation to more promising ventures.

For instance, consider a portfolio of legacy bonds yielding less than 2% in a rising interest rate environment, while the bank's strategic focus shifts towards digital banking services requiring significant capital investment. In 2024, a significant portion of such underperforming assets could have been divested to fund innovation, potentially boosting net interest margins. In 2023, the average return on equity for banks with a strong focus on strategic growth initiatives outpaced those with a higher allocation to traditional, low-yield assets.

- Low Yielding Assets: Portfolios with consistently below-market returns, such as those invested in mature industries with limited growth prospects.

- Misalignment with Strategy: Investments that do not support IBC Bank's core competencies or future market positioning, like ventures outside of financial services.

- Capital Inefficiency: Funds tied up in underperforming investments that could otherwise be deployed in higher-return, strategically vital projects, such as fintech partnerships or expanded wealth management services.

- Opportunity Cost: The forgone potential gains from not investing in more dynamic or growth-oriented sectors, which could have contributed to a stronger overall financial performance for IBC Bank.

Dogs in the IBC Bank BCG Matrix represent business units or products with low market share and low growth potential, consuming resources without generating significant returns. These are typically legacy systems, niche products with high maintenance costs, or physical branches in declining areas. For instance, a significant portion of community banks in 2024 still relied on core banking systems over a decade old, highlighting the prevalence of technological Dogs.

These underperforming assets, such as certain commercial real estate loans or non-strategic investment portfolios, tie up capital and management attention. In Q4 2024, the CRE loan delinquency rate reached a ten-year high of 1.57%, illustrating the challenges in specific CRE segments. Divesting these Dogs allows for capital reallocation to more promising, strategic ventures, potentially improving overall financial performance.

The strategic decision for Dogs is often to divest or liquidate them to free up resources. This approach is supported by data showing that banks focusing on strategic growth initiatives in 2023 often outperformed those with higher allocations to low-yield assets. By identifying and addressing these Dog units, IBC Bank can optimize its resource allocation and enhance its competitive position.

Question Marks

IBC Bank's traditional wire transfers are established, but the real-time and embedded cross-border payments sector is a clear Question Mark. This rapidly expanding market is expected to hit $250 trillion by 2027, with a significant shift towards instant transactions.

The opportunity lies in capturing a larger slice of this high-growth area by investing in advanced digital payment infrastructure and forging strategic partnerships. However, this path demands considerable capital outlay and navigates a fiercely competitive landscape dominated by agile fintech players.

AI-powered financial advisory services represent a significant opportunity within the digital banking landscape, fitting into the Stars category of the BCG Matrix due to their high growth potential. These services leverage AI to deliver personalized financial insights, aiming to attract and retain customers by offering tailored advice and enhanced experiences. The market adoption for these advanced advisory tools is still developing, but the trajectory points towards substantial future growth.

However, realizing this potential demands considerable investment. Banks must allocate resources to AI technology, robust data analytics infrastructure, and specialized talent. This investment is crucial for developing sophisticated AI models and ensuring their effective implementation. The financial burden is also notable, with AI compliance costs for banks projected to increase by 15-20% between 2024 and 2025, reflecting the evolving regulatory and technological demands.

Expanding IBC Bank's presence into new, high-growth geographic markets, particularly those with strong economic ties to the U.S.-Mexico border, represents a classic Question Mark in the BCG Matrix. This strategy offers significant upside potential, as evidenced by the projected 5.8% compound annual growth rate (CAGR) for cross-border trade between the U.S. and Mexico through 2027, according to a recent trade analysis.

However, this expansion carries inherent risks. Entering these dynamic markets requires substantial upfront investment in infrastructure, technology, and talent, potentially leading to high initial costs. Furthermore, navigating diverse regulatory environments and understanding local consumer behaviors are critical challenges that could impact profitability.

Blockchain and Stablecoin-Based Services

Blockchain and stablecoin-based services represent a potential high-growth, high-risk area within the banking sector, aligning with the question mark category of the BCG Matrix. These technologies offer the promise of significantly streamlining cross-border payments by reducing intermediaries and associated costs. For instance, the global cross-border payments market was valued at approximately $37.1 trillion in 2023 and is projected to grow substantially, with blockchain solutions potentially capturing a significant share by offering greater efficiency.

However, the adoption of these innovative solutions by traditional banks is still nascent. Significant upfront investment is required for developing the necessary infrastructure, ensuring robust regulatory compliance, and educating both staff and customers on their usage and benefits. Challenges remain in areas like scalability and interoperability with existing financial systems. Despite these hurdles, the potential for cost savings and improved transaction speeds makes this a critical area for exploration and investment.

- High Growth Potential: The global stablecoin market capitalization reached over $150 billion in early 2024, indicating significant user adoption and transaction volume.

- High Risk: Regulatory uncertainty surrounding stablecoins and blockchain technology continues to pose a significant risk to widespread institutional adoption.

- Investment Required: Banks exploring these services face substantial costs for technology development, cybersecurity, and compliance with evolving financial regulations.

- Early Adoption Stage: While pilot programs are increasing, widespread integration of blockchain and stablecoins into core banking operations is still in its early phases.

Enhanced Cybersecurity and Fraud Detection Solutions

Enhanced cybersecurity and fraud detection solutions represent a critical investment area for community banks, potentially fitting into the question mark category of the BCG matrix. With cybersecurity and data privacy identified as the paramount challenge for these institutions in 2025, the need for advanced, AI-driven real-time fraud detection is undeniable. These sophisticated systems are vital for mitigating escalating risks and fostering essential customer trust.

While these solutions offer significant potential for market differentiation, their implementation is characterized by substantial costs and a perpetually evolving threat landscape. The average cost of a data breach reached $6.08 million in 2024, underscoring the financial imperative to invest proactively in robust defenses. This makes the return on investment for such technologies a key consideration.

- High Investment, Uncertain Returns: The significant upfront and ongoing costs associated with advanced cybersecurity and AI-powered fraud detection place these solutions in a high-risk, high-reward position.

- Evolving Threat Landscape: Continuous adaptation to new cyber threats necessitates ongoing investment, making long-term ROI projections challenging.

- Customer Trust and Differentiation: Demonstrating strong security measures can be a key differentiator, building customer loyalty in an increasingly digital banking environment.

- Mitigation of Breach Costs: Proactive investment can significantly reduce the financial impact of data breaches, which averaged $6.08 million in 2024.

Expanding IBC Bank's presence into new, high-growth geographic markets, particularly those with strong economic ties to the U.S.-Mexico border, represents a classic Question Mark in the BCG Matrix. This strategy offers significant upside potential, as evidenced by the projected 5.8% compound annual growth rate (CAGR) for cross-border trade between the U.S. and Mexico through 2027, according to a recent trade analysis.

However, this expansion carries inherent risks. Entering these dynamic markets requires substantial upfront investment in infrastructure, technology, and talent, potentially leading to high initial costs. Furthermore, navigating diverse regulatory environments and understanding local consumer behaviors are critical challenges that could impact profitability.

The real-time and embedded cross-border payments sector is another clear Question Mark for IBC Bank. This rapidly expanding market is expected to hit $250 trillion by 2027, with a significant shift towards instant transactions.

The opportunity lies in capturing a larger slice of this high-growth area by investing in advanced digital payment infrastructure and forging strategic partnerships. However, this path demands considerable capital outlay and navigates a fiercely competitive landscape dominated by agile fintech players.

| Business Unit | Market Growth | Relative Market Share | BCG Category |

|---|---|---|---|

| Cross-Border Trade Expansion (U.S.-Mexico) | High (5.8% CAGR projected through 2027) | Low | Question Mark |

| Real-Time & Embedded Cross-Border Payments | High (Projected $250 trillion by 2027) | Low | Question Mark |

BCG Matrix Data Sources

Our IBC Bank BCG Matrix leverages comprehensive financial disclosures, internal performance metrics, and detailed market research to accurately assess product portfolio health.