IBC Bank Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IBC Bank Bundle

IBC Bank navigates a complex financial landscape, where understanding the intensity of buyer power and the threat of new entrants is crucial for sustained success. Analyzing the bargaining power of suppliers and the intensity of rivalry among existing banks reveals key strategic vulnerabilities and opportunities.

The complete report reveals the real forces shaping IBC Bank’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Suppliers for a bank like IBC Bank are primarily depositors, interbank lenders, and various capital markets. The bargaining power of these suppliers is directly tied to how readily available and how costly funds are in the financial system. For instance, in 2024, as interest rates remained elevated, depositors often found themselves with greater leverage, as banks actively competed to attract and retain their savings.

As financial services become more reliant on technology, the influence of software and IT infrastructure providers is on the rise. Banks are increasingly investing in digital transformation and artificial intelligence, with global spending on financial technology expected to reach over $300 billion by 2024, according to some industry projections. This growing dependence means that providers of specialized or proprietary systems can wield significant bargaining power.

Skilled employees, particularly in high-demand fields such as digital banking, cybersecurity, and advanced financial analysis, wield significant bargaining power. A scarcity of talent in these critical areas directly translates to increased leverage for these professionals, potentially driving up compensation and benefit packages for IBC Bank.

For instance, in 2024, the demand for cybersecurity professionals in the financial sector continued to outstrip supply, with average salaries for experienced professionals often exceeding $120,000 annually, according to industry reports. This talent shortage empowers employees to negotiate for more favorable terms, impacting the bank's operational costs and strategic agility.

Regulatory and Compliance Services

The banking sector's stringent regulatory environment significantly bolsters the bargaining power of suppliers offering specialized compliance and legal services. Banks must navigate a complex web of rules, including those related to data security, anti-money laundering, and international standards like ISO 20022, which came into full effect for many payment systems in November 2024.

The increasing complexity and constant evolution of these regulations mean banks often lack in-house expertise, making them reliant on external legal counsel, compliance consultants, and auditors. This dependency allows these service providers to command premium fees, as failure to comply can result in substantial fines and reputational damage. For instance, in 2023, fines for regulatory breaches in the financial sector globally exceeded billions of dollars, underscoring the critical need for effective compliance.

- High Demand for Expertise: Banks require specialized knowledge to interpret and implement evolving regulations, such as those impacting digital asset management and cybersecurity.

- Cost of Non-Compliance: Significant financial penalties and reputational damage associated with regulatory breaches empower compliance service providers.

- Industry-Wide Mandates: The push for standardization, like the adoption of ISO 20022 messaging for payments, creates a concentrated demand for specific compliance solutions.

- Limited Supplier Pool: The niche nature of these services often means a limited number of highly qualified providers, further enhancing their bargaining leverage.

Data and Information Providers

Data and information providers wield significant bargaining power, particularly when their offerings are unique or indispensable for critical functions like risk assessment and strategic planning. Access to accurate, timely financial data, credit reporting, and market intelligence is foundational for banks like IBC Bank.

The concentration of specialized data providers can amplify their influence. For instance, a limited number of firms offering comprehensive global credit scores or proprietary market sentiment analysis can command higher prices and dictate terms. Banks are increasingly reliant on these insights, making it difficult to switch providers without incurring substantial costs and operational disruptions.

- Data providers offering unique or proprietary market intelligence hold strong leverage.

- The high cost and complexity of switching data vendors limit banks' ability to negotiate.

- Banks' growing reliance on data analytics and AI for competitive advantage increases their dependence on these providers.

- In 2024, the global data analytics market was valued at over $200 billion, highlighting the economic significance of data providers.

Suppliers of critical technology and data, especially those offering specialized or proprietary solutions, possess significant bargaining power. As financial institutions like IBC Bank increasingly depend on advanced analytics, AI, and unique market intelligence, the leverage of these providers grows. The global data analytics market, valued at over $200 billion in 2024, underscores the economic importance and influence of these data suppliers.

| Supplier Type | Bargaining Power Factors | Impact on IBC Bank |

| Technology Providers (AI, Cloud, Cybersecurity) | Proprietary systems, high switching costs, specialized expertise | Increased costs for essential digital transformation, potential dependence on single vendors. |

| Data & Market Intelligence Firms | Unique data sets, indispensable for risk and strategy, high integration costs | Higher subscription fees, limited negotiation flexibility due to reliance on critical insights. |

| Skilled Employees (Digital, Cybersecurity) | Talent scarcity, high demand, specialized skills | Upward pressure on salaries and benefits, impacting operational costs and talent retention strategies. |

What is included in the product

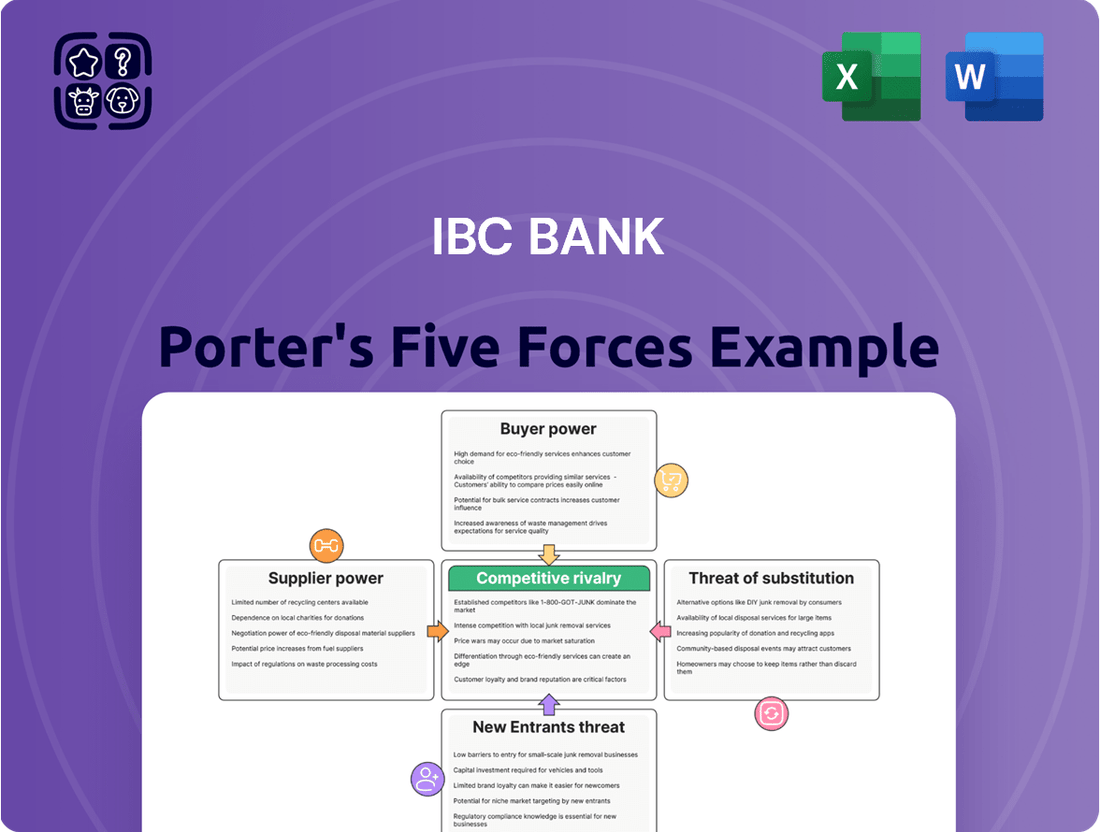

This analysis dissects the competitive forces impacting IBC Bank, examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the banking sector.

Instantly gauge competitive threats with a clear, visual representation of each force, simplifying complex market dynamics for informed strategic planning.

Customers Bargaining Power

Customers of IBC Bank, whether individuals or businesses, wield considerable power in the banking sector. This strength stems from the sheer number of options available, ranging from large national institutions and smaller regional banks to member-owned credit unions, all competing for their business.

In 2024, the U.S. banking industry featured over 4,500 commercial banks and over 5,000 credit unions, illustrating the breadth of customer choice. This intense competition means banks must offer attractive rates, fees, and services to retain and attract clients, directly impacting IBC Bank's ability to dictate terms.

Switching costs for customers can significantly influence a bank's bargaining power. For businesses, particularly those with intricate treasury management or international trade operations, transitioning their primary banking relationship can incur moderate switching costs. These can include the administrative burden of updating payment systems, retraining staff, and the potential for operational disruption during the transition period.

For individual consumers, however, the costs associated with switching basic banking services are generally low. This ease of switching for retail customers means banks must continually compete on service and pricing to retain them. In 2024, the average customer tenure in the retail banking sector remained a key metric, with many institutions focusing on digital onboarding to reduce initial friction and thereby lowering perceived switching costs.

Customers now have unprecedented access to information about interest rates, fees, and service quality across numerous financial institutions. This readily available data, often presented through online comparison tools and increasingly transparent pricing, significantly boosts their ability to make well-informed choices.

In 2024, the proliferation of financial comparison websites and fintech apps means that a consumer can easily compare savings account APYs or loan terms from dozens of banks in minutes. For instance, a customer looking for a mortgage can readily see rates from major banks and credit unions, with some platforms even offering real-time updates on market fluctuations.

This heightened transparency directly translates to increased bargaining power for customers. They can leverage competitive offers to negotiate better terms or switch to providers that offer superior value, forcing banks like IBC Bank to remain competitive on pricing and service to retain their business.

Digital Sophistication and Expectations

The digital revolution has significantly amplified the bargaining power of IBC Bank's customers. The proliferation of digital banking and fintech innovations means customers now expect highly convenient, personalized, and seamless experiences. This heightened expectation translates into a demand for advanced digital platforms, robust mobile banking capabilities, and instant, real-time transactions, compelling banks like IBC to continuously invest in cutting-edge technology to stay competitive.

This digital sophistication directly impacts IBC Bank by increasing customer leverage. Customers can easily compare offerings across numerous digital-first competitors, often with lower overheads. For instance, by mid-2024, the global digital banking market was projected to reach over $30 trillion, a testament to the widespread adoption and customer preference for digital channels. This trend forces traditional banks to offer competitive digital features and pricing to retain their customer base, thereby strengthening the customers' bargaining position.

- Increased Demand for Digital Features: Customers now prioritize mobile banking apps, online account management, and digital payment solutions.

- Comparison Shopping is Easier: The digital landscape allows customers to quickly compare interest rates, fees, and service quality across multiple financial institutions.

- Expectation of Personalization: Advanced analytics enable customers to expect tailored product recommendations and customized financial advice.

- Fintech Competition: The rise of agile fintech companies offering specialized digital services puts pressure on traditional banks to match or exceed their offerings.

Large Commercial and International Clients

Large commercial and international clients, especially those operating along the U.S.-Mexico border, often wield significant bargaining power. Their substantial transaction volumes and demand for tailored financial solutions, such as cross-border financing and foreign exchange services, give them leverage. IBC Bank's strategic focus on these regions amplifies the influence of these key clients.

For instance, a large corporation conducting extensive trade between the U.S. and Mexico might negotiate more favorable terms on international wire transfers or currency hedging due to the sheer volume of business they bring. This can include seeking lower fees or better exchange rates. Such clients may also have the capacity to switch to alternative financial institutions if their needs are not met, further strengthening their negotiating position.

- Client Volume: Large clients can represent a significant portion of a bank's revenue, making them less replaceable.

- Service Specialization: Clients requiring complex international services may have fewer alternative providers, but their need for these specific services still grants them leverage.

- Switching Costs: While switching banks can be costly, the potential savings or improved service for large clients can justify the effort.

- Market Concentration: In regions with a concentrated number of large businesses, competition among banks to serve them can increase client bargaining power.

The bargaining power of IBC Bank's customers is substantial due to the highly competitive banking landscape and the ease with which they can switch providers. In 2024, the U.S. banking sector's vast number of institutions, exceeding 4,500 commercial banks and 5,000 credit unions, ensures customers have numerous alternatives.

Digitalization has further empowered customers, with fintech innovations and comparison tools making it simple to find better rates and services, as evidenced by the projected over $30 trillion global digital banking market by mid-2024. This forces banks like IBC to continuously offer competitive pricing and advanced digital features to retain clients.

Large corporate clients, particularly those engaged in cross-border trade, possess significant leverage due to their transaction volumes and specialized financial needs, allowing them to negotiate favorable terms. For example, a major importer might secure lower fees on international transfers by demonstrating substantial business volume.

| Customer Segment | Bargaining Power Factors | Impact on IBC Bank |

|---|---|---|

| Retail Customers | Low switching costs, easy access to rate comparisons, high digital expectations | Pressure on pricing and service quality, need for robust digital offerings |

| Small & Medium Businesses (SMBs) | Moderate switching costs for basic services, increasing demand for digital tools | Need for competitive pricing on loans and transaction services, user-friendly digital platforms |

| Large Commercial Clients | High transaction volumes, demand for specialized services (e.g., international trade finance), potential for significant revenue loss if switched | Ability to negotiate fees and rates, demand for tailored solutions, strategic importance in specific regions |

Same Document Delivered

IBC Bank Porter's Five Forces Analysis

This preview shows the exact, comprehensive IBC Bank Porter's Five Forces Analysis you'll receive immediately after purchase, detailing the competitive landscape and strategic implications for the bank. You're looking at the actual document that meticulously breaks down the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, the threat of substitute products or services, and the intensity of rivalry within the banking industry. Once you complete your purchase, you’ll get instant access to this exact, professionally formatted file, ready for your strategic planning needs.

Rivalry Among Competitors

IBC Bank operates within a fiercely competitive U.S. banking landscape. The regional banking sector, in particular, is characterized by a substantial number of traditional banks and credit unions vying for market share.

Adding to this intensity, fintech companies are increasingly disrupting the traditional banking model, offering innovative digital solutions that attract customers. This diverse and growing competitive set means IBC Bank faces rivalry from multiple fronts.

As of early 2024, there were over 4,000 commercial banks and nearly 5,000 credit unions operating in the United States, highlighting the sheer density of established players.

While the U.S. banking sector overall is quite mature, with many segments experiencing saturation, the competitive landscape for IBC Bank, particularly in its U.S.-Mexico border region focus, is exceptionally fierce. This intense rivalry stems from established national banks, other regional players, and increasingly, fintech companies vying for the same customer base.

In 2024, the U.S. banking industry continues to grapple with slow deposit growth and the ongoing need to differentiate services. For instance, data from the Federal Reserve in early 2024 indicated a slight contraction in overall commercial bank deposits compared to the previous year, forcing banks like IBC to compete more aggressively for funding and customer relationships.

Competitive rivalry in the banking sector is intense, extending beyond mere price competition on interest rates. Banks are increasingly differentiating themselves through the quality of their services, the innovation of their product offerings, and the sophistication of their digital platforms. For instance, in 2024, major banks are investing heavily in AI-powered customer service chatbots and personalized financial planning tools to attract and retain customers.

IBC Bank aims to stand out by focusing on superior customer service and efficient operational management. This strategy seeks to create a distinct value proposition for its clients, moving beyond transactional banking to foster stronger, more personalized relationships. Such differentiation is crucial in a market where customers have numerous choices and often base their decisions on factors beyond interest rates.

Regulatory Environment and M&A Activity

Regulatory shifts can significantly alter the competitive dynamics within the banking sector. For instance, changes in capital requirements or lending regulations might create opportunities for new players or, conversely, push smaller institutions to seek mergers for scale and compliance efficiency.

Recent data highlights a notable uptick in mergers and acquisitions among regional banks. In 2024, the banking industry saw a continuation of this trend, with several significant deals announced, signaling a potential consolidation that could intensify competition among the remaining larger entities.

- Regulatory Impact: Evolving regulations can either lower barriers for new entrants or drive consolidation, directly influencing competitive intensity.

- M&A Acceleration: 2024 witnessed a surge in regional bank M&A, with deal volumes indicating a reshaping of the competitive landscape.

- Competitive Reshaping: Increased M&A activity may lead to fewer, but larger, competitors, potentially altering pricing power and service offerings.

- Strategic Implications: Banks must adapt to regulatory changes and consider M&A as a strategic tool to maintain or improve their competitive position.

Geographic Focus and Local Presence

IBC Bank's strategic focus on communities along the U.S.-Mexico border intensifies competitive rivalry. It directly contends with numerous regional and local banks that possess deep-rooted presences and established customer relationships within these specific geographic areas. This local embeddedness makes community ties and personalized service critical differentiators.

The competitive landscape is characterized by a strong emphasis on local market knowledge and the ability to cater to the unique financial needs of border communities. For instance, as of early 2024, the Texas banking sector, where IBC Bank has a significant presence, saw continued consolidation, but many smaller, community-focused banks maintained strong local market share by leveraging personal relationships.

- Intense Local Competition: IBC Bank faces robust competition from other banks with a strong foothold in U.S.-Mexico border regions.

- Importance of Community Ties: Local relationships and deep community engagement are key factors in winning and retaining customers.

- Regional Banking Dynamics: In 2024, the Texas banking market, a key area for IBC, continued to show the resilience of community banks that prioritize local client needs.

IBC Bank operates in a highly competitive U.S. banking market, intensified by a vast number of traditional banks, credit unions, and disruptive fintech companies. This intense rivalry forces IBC Bank to differentiate through service quality and digital innovation, a trend seen in 2024 with major banks investing in AI for customer engagement.

The U.S. banking sector, with over 4,000 commercial banks and nearly 5,000 credit unions as of early 2024, presents a crowded field. Furthermore, a surge in regional bank mergers and acquisitions throughout 2024 is reshaping the competitive landscape, potentially leading to larger, more formidable competitors.

IBC Bank's specific focus on U.S.-Mexico border regions means it directly competes with numerous local banks that have deep community ties and established customer relationships. In 2024, community banks in Texas, a key area for IBC, continued to demonstrate resilience by prioritizing local client needs, highlighting the importance of personalized service.

| Metric | Value (Early 2024) | Source |

|---|---|---|

| U.S. Commercial Banks | Over 4,000 | Federal Reserve |

| U.S. Credit Unions | Nearly 5,000 | NCUA |

| Deposit Growth (YoY) | Slight Contraction | Federal Reserve |

| M&A Activity | Accelerated in 2024 | Industry Reports |

SSubstitutes Threaten

Fintech companies and digital payment platforms present a significant threat of substitution for traditional banking services. Platforms like PayPal and Venmo are increasingly handling everyday transactions, bypassing traditional bank infrastructure. In 2023, global digital payment transaction volume was projected to exceed $10 trillion, highlighting the scale of this shift.

These fintech alternatives often provide a more streamlined user experience and competitive pricing, directly challenging IBC Bank's established customer base. The convenience of instant money transfers and integrated budgeting tools offered by many fintech apps can be highly appealing to consumers seeking modern financial solutions.

The threat of substitutes for traditional banking services is growing as non-bank lenders and alternative financing options become more prevalent. Businesses and individuals can now secure capital from private equity firms, venture capital, peer-to-peer lending platforms, and even direct lending from corporations. This diversification of funding sources reduces the exclusive reliance on banks.

In 2024, the alternative lending market continued its robust expansion. For instance, private credit funds, a significant component of alternative financing, saw substantial inflows, with estimates suggesting the global private debt market could reach upwards of $2.5 trillion by 2025, indicating a strong and growing substitute for bank loans.

The emergence of cryptocurrencies and the development of Central Bank Digital Currencies (CBDCs) pose a growing, albeit still developing, threat of substitution to traditional banking services. These digital assets offer alternative methods for value storage and transfer, potentially bypassing conventional financial intermediaries.

By 2024, the cryptocurrency market capitalization fluctuated significantly, demonstrating investor interest in digital alternatives, while several major central banks, including China and the European Union, advanced their CBDC pilot programs. This indicates a tangible shift towards exploring digital currencies as viable substitutes for existing payment and banking systems.

Embedded Finance and Banking-as-a-Service (BaaS)

Embedded finance, where non-financial companies integrate financial services into their customer journeys, presents a substantial threat. Think of ride-sharing apps offering instant payouts or e-commerce platforms providing point-of-sale financing. This trend is accelerating, with the global embedded finance market projected to reach $7.2 trillion by 2030, up from $4.8 trillion in 2022, according to Statista.

Banking-as-a-Service (BaaS) is the engine powering this shift. It allows companies to access banking functionalities through APIs, essentially white-labeling financial products. This disintermediation bypasses traditional banks, offering a more seamless and often cheaper alternative for consumers and businesses alike.

- Disintermediation: Embedded finance directly competes with traditional banking services by offering financial solutions within non-financial platforms.

- Customer Experience: Seamless integration of financial services enhances user experience, drawing customers away from standalone banking channels.

- Market Growth: The embedded finance market is experiencing rapid expansion, indicating a significant shift in how financial services are consumed.

Credit Unions and Community Development Financial Institutions (CDFIs)

Credit unions and Community Development Financial Institutions (CDFIs) present a significant threat of substitutes for traditional banks like IBC Bank. These organizations often cater to specific community needs and offer competitive financial products, drawing customers who prioritize local impact or member benefits over conventional banking. For instance, credit unions, being member-owned, can sometimes offer more favorable rates on loans and savings accounts, directly competing for IBC Bank's deposit and lending business. By mid-2024, the credit union sector in the US held over $2.2 trillion in assets, demonstrating their substantial market presence and competitive capacity.

CDFIs, while often smaller, play a crucial role in underserved markets, providing essential financial services where traditional banks may have less presence. Their mission-driven approach can resonate strongly with individuals and businesses seeking socially responsible financial partners. This focus allows them to attract a segment of the market that values more than just transactional banking. In 2023, the CDFI Fund certified over 1,500 CDFIs, which collectively deployed billions of dollars in capital, highlighting their growing influence as alternative financial providers.

The threat is amplified by their ability to offer a comparable suite of services, including checking accounts, savings accounts, loans, and even business financing, albeit sometimes with different eligibility criteria or service models. This broad overlap in service offerings means customers can often switch their primary banking relationships without sacrificing essential financial functions. The increasing digital capabilities of many credit unions and CDFIs further reduce the friction for customers considering a switch.

- Competitive Rates: Credit unions often provide lower interest rates on loans and higher rates on savings accounts compared to traditional banks.

- Community Focus: CDFIs and credit unions emphasize local economic development and member well-being, attracting socially conscious consumers.

- Asset Growth: The US credit union sector's asset base exceeding $2.2 trillion by mid-2024 signifies their significant market share and competitive strength.

- Mission-Driven Appeal: Their organizational missions can attract customers seeking ethical and community-oriented financial services.

The threat of substitutes for IBC Bank is multifaceted, encompassing digital payment platforms, alternative lenders, cryptocurrencies, embedded finance, and community-focused institutions. These substitutes often offer enhanced convenience, competitive pricing, or a mission-driven appeal that can draw customers away from traditional banking models.

Fintech and digital payment solutions are rapidly gaining traction, with global digital payment transaction volume projected to exceed $10 trillion in 2023. Alternative lending markets, particularly private credit, are also expanding, with the global private debt market potentially reaching $2.5 trillion by 2025. Embedded finance is another significant disruptor, with its market expected to grow to $7.2 trillion by 2030.

Furthermore, cryptocurrencies and the development of CBDCs offer new avenues for value storage and transfer, bypassing traditional intermediaries. By 2024, major economies were advancing CBDC pilot programs, signaling a shift towards digital currencies. Credit unions, with over $2.2 trillion in assets in the US by mid-2024, and CDFIs, which deployed billions in capital in 2023, also represent substantial competitive forces.

| Substitute Category | Key Characteristics | 2023/2024 Data Point | Projected Growth/Impact |

|---|---|---|---|

| Fintech & Digital Payments | Convenience, competitive pricing, streamlined experience | Global digital payment volume > $10 trillion (2023 est.) | Increasingly handling everyday transactions |

| Alternative Lending | Diversified funding sources, capital access | Global private debt market potentially $2.5 trillion by 2025 | Reduced reliance on traditional bank loans |

| Cryptocurrencies & CBDCs | Alternative value storage/transfer, disintermediation | Advancing CBDC pilots by major central banks (2024) | Potential to bypass traditional financial intermediaries |

| Embedded Finance | Integrated financial services in non-financial platforms | Market projected to reach $7.2 trillion by 2030 | Seamless user experience, disintermediation |

| Credit Unions & CDFIs | Community focus, competitive rates, member benefits | US credit union assets > $2.2 trillion (mid-2024) | Attracting customers prioritizing local impact/benefits |

Entrants Threaten

Establishing a new bank necessitates immense capital, acting as a formidable barrier for potential entrants. Regulatory bodies, such as the Federal Reserve in the U.S., mandate strict capital adequacy ratios, requiring new institutions to hold significant reserves to absorb potential losses and maintain financial stability. For instance, in early 2024, the average Tier 1 capital ratio for large U.S. banks remained robust, underscoring the substantial financial foundation required to operate within the sector.

The banking sector presents significant barriers to entry due to stringent regulatory requirements. New players must navigate a labyrinth of licensing procedures, capital adequacy rules, and ongoing compliance mandates such as Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations, which demand substantial investment in systems and personnel. For instance, in 2024, the average cost for a new fintech company to achieve full regulatory compliance in a major market could easily run into millions of dollars, deterring many potential entrants.

Established banks like IBC Bank benefit from decades of brand recognition and customer trust, which are incredibly difficult and time-consuming for new entrants to replicate. In 2024, consumer surveys consistently show that trust remains a primary factor in choosing a financial institution, with legacy banks often holding a significant advantage. New entrants must invest heavily in marketing and transparent operations to even begin to erode this deeply ingrained customer loyalty.

Economies of Scale and Network Effects

Existing banks, like IBC Bank, often leverage significant economies of scale. This allows them to spread the high costs of technology, compliance, and marketing across a larger customer base, leading to lower per-unit operational expenses. For instance, in 2024, major global banks reported operating expenses in the billions, a cost structure difficult for a new entrant to match initially.

Furthermore, established banks benefit from powerful network effects. A large existing customer base and extensive branch networks create a virtuous cycle, making it more convenient and attractive for customers to stay with them. This deep-rooted infrastructure and customer loyalty present a substantial barrier for new players aiming to gain market share and build comparable reach.

- Economies of Scale: Major banks in 2024 incurred substantial operational and technological investments, making it challenging for new entrants to achieve comparable cost efficiencies.

- Network Effects: Established customer relationships and widespread physical or digital presence create significant advantages for incumbent institutions like IBC Bank.

- Customer Loyalty: Existing customer bases are often entrenched due to convenience and trust, requiring new entrants to offer compelling incentives to switch.

- Brand Recognition: Long-standing banks benefit from established brand awareness and reputation, which new entrants must build from the ground up.

Talent Acquisition and Retention

New banks entering the market face a significant hurdle in attracting and keeping skilled banking professionals. This is especially true for those needing expertise in specialized areas or specific regions, such as the U.S.-Mexico border, where IBC Bank operates.

The financial sector broadly experiences a scarcity of high-caliber talent, making it difficult for newcomers to build a competitive team. For instance, in 2024, many financial institutions reported increased hiring challenges, with some specialized roles seeing applicant pools shrink by as much as 20% compared to previous years.

- Talent Shortage: A general lack of experienced banking professionals impacts all institutions, but new entrants are particularly vulnerable.

- Niche Expertise: Attracting individuals with specific knowledge, like cross-border financial regulations or specialized lending, is a key challenge.

- Competitive Landscape: Established banks often offer more attractive compensation and benefits packages, making it harder for new entrants to compete for top talent.

The threat of new entrants for IBC Bank is significantly mitigated by the substantial capital requirements and stringent regulatory landscape. In 2024, the average capital requirement for a new bank charter in the US remained in the tens of millions of dollars, a figure that deters many aspiring institutions. Furthermore, the ongoing need for compliance with evolving financial regulations, such as those related to cybersecurity and data privacy, adds considerable operational costs for any new player.

Established brand loyalty and network effects also serve as strong deterrents against new entrants. Customers often prefer the familiarity and convenience of existing banking relationships, making it difficult for newcomers to gain traction. For instance, in 2024, customer retention rates for established banks often exceeded 90%, highlighting the challenge of customer acquisition for new entities.

| Barrier | Description | 2024 Relevance |

|---|---|---|

| Capital Requirements | High initial investment needed for licensing and operations. | Tens of millions of dollars for new bank charters. |

| Regulatory Compliance | Costs associated with meeting stringent banking laws. | Millions for fintechs to achieve full compliance; ongoing costs for data security and AML/KYC. |

| Brand Recognition & Trust | Customer loyalty to established institutions. | Trust remains a primary factor; legacy banks hold significant advantage. |

| Economies of Scale | Lower per-unit costs due to large operational volume. | Major banks' billions in operating expenses difficult for new entrants to match. |

| Network Effects | Advantages from existing customer base and infrastructure. | Deep-rooted infrastructure and customer loyalty create substantial barriers. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for IBC Bank leverages data from financial statements, regulatory filings, and industry-specific market research reports. This blend of sources provides a comprehensive view of competitive intensity, supplier and buyer power, and the threat of new entrants and substitutes within the banking sector.