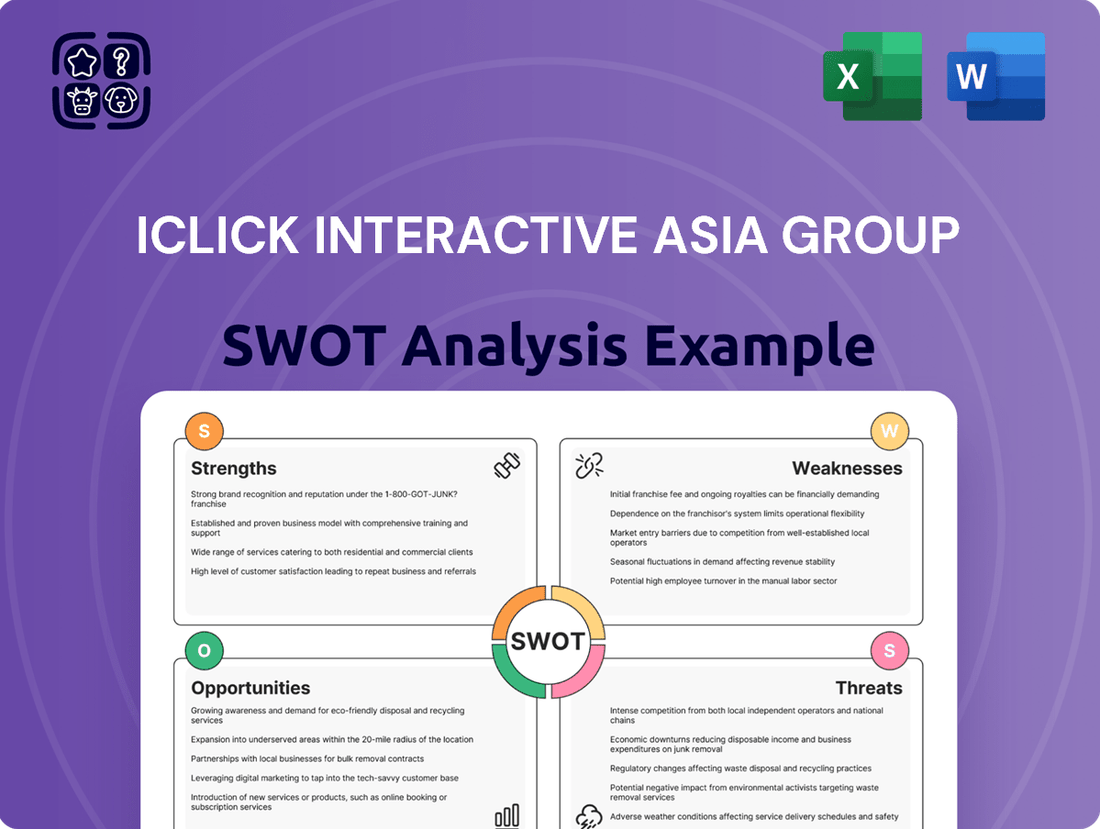

iClick Interactive Asia Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

iClick Interactive Asia Group Bundle

iClick Interactive Asia Group's SWOT analysis reveals a compelling picture of its market position. While it boasts strong brand recognition and a robust data platform, potential investors and strategists should be aware of its reliance on key partners and the dynamic nature of the digital advertising landscape. Understanding these internal capabilities and external pressures is crucial for informed decision-making.

Want the full story behind iClick Interactive Asia Group's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

iClick Interactive Asia Group has initiated a significant strategic pivot, moving away from lower-margin ventures to concentrate on more profitable areas. This shift is clearly demonstrated by the company's divestment from its mainland China Enterprise Solutions business in July 2024 and its demand-side Marketing Solutions business in September 2024.

The core of this new strategy involves a strong focus on higher-margin services and innovative Web3 financial solutions. This deliberate realignment is designed to boost overall profitability and streamline operations.

Early indications suggest this strategic repositioning is yielding positive results, with the company reporting improved gross margins as a direct consequence of shedding less lucrative business segments.

iClick Interactive Asia Group's core strength lies in its robust data-driven and AI capabilities. The company utilizes proprietary data platforms coupled with advanced technologies like artificial intelligence and big data analytics. This empowers them to achieve highly precise audience targeting and optimize marketing campaigns effectively.

This technological advantage translates into integrated cross-channel insights and the delivery of tailored solutions for clients. As of the first quarter of 2024, iClick reported a 22.5% year-over-year increase in revenue from its intelligent marketing segment, underscoring the effectiveness of its data and AI investments.

By continuously enhancing these capabilities, iClick solidifies its position as a leading independent marketing technology stack provider. Their commitment to innovation in data analytics and AI ensures they remain at the forefront of delivering measurable results in the digital advertising landscape.

iClick Interactive Asia Group, founded in Hong Kong in 2009, boasts a formidable presence and strong brand recognition across Asia, with a particular stronghold in China. This deep-rooted establishment is a significant asset, built over years of dedicated operation and strategic growth.

The company's history is marked by crucial partnerships with major internet platforms, including Tencent, which have significantly amplified its reach and influence within the Chinese market. These collaborations have cemented iClick's position as a key player in the region's digital advertising landscape.

With a substantial internet user reach in China, iClick effectively connects businesses with a vast and engaged audience. This extensive network is a testament to its deep understanding of local consumer behavior and digital consumption patterns.

As of the first quarter of 2024, iClick reported a gross profit of $11.5 million, reflecting its continued ability to generate revenue and maintain profitability within its core markets, underscoring the strength of its established brand and operational capabilities.

Improved Financial Performance in Continuing Operations

iClick Interactive Asia Group demonstrated improved financial performance in its continuing operations during the first half of 2024. Despite a dip in total revenue from these segments, the company managed to significantly narrow its net loss. This suggests a more efficient operational structure and a strategic shift towards higher-margin business activities.

Key to this improvement was a notable increase in the gross margin, which reached 56.9% in H1 2024. This uptick in gross margin is a strong indicator of effective cost management and successful focus on more profitable areas of the business. The company's ability to enhance profitability at the gross level, even with lower overall revenue, highlights its operational resilience and strategic financial planning.

- Narrowed Net Loss: iClick substantially reduced its net loss from continuing operations in H1 2024, signaling enhanced profitability.

- Increased Gross Margin: The gross margin climbed to 56.9% in the first half of 2024, reflecting improved cost control and focus on lucrative segments.

- Cost Optimization: The financial results point to successful cost optimization strategies being implemented across continuing operations.

- Strategic Focus: A positive impact is evident from the company's strategic decision to concentrate on more profitable business segments.

Synergistic Dual Offerings (Pre-Merger Focus)

Before its recent strategic realignments, iClick Interactive Asia Group excelled with its synergistic dual offerings. The integration of Marketing Solutions and Enterprise Solutions created a powerful full-stack consumer lifecycle management system for brands.

This unified framework was a significant competitive advantage, enabling clients to seamlessly manage the entire customer journey, from initial acquisition through to long-term retention.

This integrated approach allowed for more efficient marketing spend and deeper customer engagement. For instance, in 2023, iClick reported that its integrated solutions contributed significantly to client success in acquiring and nurturing customer relationships.

The company's ability to offer a comprehensive suite of services under one umbrella was a key strength, differentiating it in a crowded market.

iClick's core strengths are its advanced data-driven capabilities and established market presence. The company leverages proprietary data platforms and AI for precise audience targeting and campaign optimization, as evidenced by a 22.5% year-over-year revenue increase in its intelligent marketing segment in Q1 2024. Its strong brand recognition across Asia, particularly in China, built over years and reinforced by key partnerships like the one with Tencent, allows for significant internet user reach and deep understanding of local consumer behavior.

| Metric | Q1 2024 | Significance |

|---|---|---|

| Intelligent Marketing Revenue Growth (YoY) | 22.5% | Demonstrates effectiveness of data and AI investments. |

| Gross Profit | $11.5 million | Indicates continued revenue generation and profitability in core markets. |

What is included in the product

Delivers a strategic overview of iClick Interactive Asia Group’s internal and external business factors, highlighting its strengths in data analytics and market position, while also identifying weaknesses in reliance on third-party platforms and opportunities in emerging markets and threats from evolving regulations.

Uncovers critical market vulnerabilities and competitive advantages for targeted strategic adjustments.

Highlights actionable insights from iClick's internal capabilities and external market dynamics.

Weaknesses

The Marketing Solutions segment, a key part of iClick Interactive Asia Group's business, faced a notable downturn. In the first half of 2024, this segment saw its revenue drop by 26%. This contraction significantly impacted the company's overall financial performance.

This decline in marketing solutions revenue directly contributed to a 16% decrease in iClick's total revenue from its continuing operations during the same period. Such a substantial drop highlights existing difficulties within this core business area, even as the company pursues strategic divestitures to reshape its portfolio.

iClick Interactive Asia Group faces intense competition in China's digital marketing sector, a landscape heavily influenced by giants like Alibaba, Tencent, and ByteDance. These behemoths possess vast user bases and integrated ecosystems, making it challenging for smaller players to compete on scale alone. For instance, in 2024, the Chinese digital advertising market is projected to reach over $150 billion, a significant portion of which is captured by these dominant platforms, limiting iClick's market share potential without substantial differentiation.

The company’s relatively smaller size necessitates a strategic focus on continuous innovation to carve out and maintain its market presence. Adapting quickly to evolving consumer behaviors and technological advancements is crucial to avoid being overshadowed by the resource-rich competitors. This ongoing need for innovation requires significant investment in research and development, which can strain resources for a company of iClick's scale compared to its much larger rivals.

iClick Interactive Asia Group's deep reliance on the Chinese market presents a significant vulnerability. While its strong presence there has been a driver of growth, it also exposes the company to the unpredictable nature of Chinese government regulations. Recent years have seen a tightening of rules around data privacy and internet platforms, directly impacting how companies like iClick can operate and monetize user data. For instance, China's Personal Information Protection Law (PIPL), implemented in November 2021, mandates stricter consent requirements and data handling practices, potentially increasing compliance burdens and limiting certain data-driven strategies.

Impact of Macroeconomic Conditions

Uncertainty in China's macroeconomic landscape significantly affected iClick's performance, particularly its advertising revenue streams. This instability led to reduced advertising spending by clients, directly impacting the company's top line.

The volatile economic environment also squeezed profit margins. Specifically, the mainland China Enterprise Solutions segment experienced diminished segment margins, reflecting the broader challenges in the market before its disposal.

Operating cash flows were not immune to these macroeconomic headwinds. The reduced advertising spending and margin pressures contributed to a contraction in the cash generated from operations, creating financial strain.

For instance, in the first quarter of 2024, iClick reported a revenue of $34.6 million, a decrease from $44.6 million in the same period of 2023, showcasing the ongoing impact of macroeconomic challenges on its core business.

- Reduced Advertising Spending: Macroeconomic uncertainty in China directly led to a pullback in client advertising budgets.

- Diminished Segment Margins: The company faced lower profitability in key segments due to the economic downturn.

- Impact on Operating Cash Flows: Cash generation was negatively affected by decreased revenues and tighter margins.

- Q1 2024 Revenue Decline: Revenue fell to $34.6 million from $44.6 million year-over-year, highlighting the persistent economic pressures.

Transition Challenges Post-Merger and Divestitures

iClick Interactive Asia Group is navigating a complex period marked by a merger with Amber DWM Holding and the divestiture of its mainland China operations. This significant strategic shift, while designed to foster future growth, inevitably creates hurdles in integrating new operations and managing ongoing business transitions during the 2024-2025 timeframe.

These changes introduce short-to-medium term integration and operational challenges. Effectively merging systems, cultures, and business processes from Amber DWM Holding while simultaneously unwinding mainland China activities requires substantial management focus and resource allocation. The company must carefully manage the disruption to maintain operational efficiency and stakeholder confidence.

The financial implications of these transitions are also a key consideration. For instance, the divestiture of mainland China businesses might impact revenue streams and profitability in the immediate aftermath. Successfully integrating the acquired entity will be crucial for offsetting these potential shortfalls and realizing the intended synergies.

- Integration Complexity: Merging Amber DWM Holding's operations with iClick's existing infrastructure presents significant technical and cultural integration challenges.

- Divestiture Impact: The sale of mainland China businesses, a significant revenue contributor, will necessitate a strategic realignment of the company's financial performance metrics.

- Operational Disruption: Managing the parallel processes of integration and divestiture can lead to temporary disruptions in customer service, supply chains, and internal workflows during 2024 and early 2025.

- Resource Strain: The transformation demands considerable financial and human capital, potentially straining existing resources as the company adapts to its new structure.

iClick Interactive Asia Group's marketing solutions segment experienced a significant revenue decline, dropping by 26% in the first half of 2024. This contraction directly led to a 16% decrease in the company's total revenue from continuing operations during the same period, highlighting ongoing challenges in its core business area.

The company faces fierce competition from major players like Alibaba, Tencent, and ByteDance in China's digital marketing sector, which is projected to exceed $150 billion in 2024. This intense rivalry makes it difficult for iClick to gain substantial market share without significant differentiation, requiring continuous investment in innovation which can strain its resources.

iClick's heavy dependence on the Chinese market exposes it to regulatory risks, such as China's Personal Information Protection Law (PIPL), which mandates stricter data handling practices. Macroeconomic uncertainties in China also negatively impacted advertising spending and squeezed profit margins, contributing to a contraction in operating cash flows, as evidenced by a revenue drop to $34.6 million in Q1 2024 from $44.6 million year-over-year.

The ongoing merger with Amber DWM Holding and the divestiture of its mainland China operations create integration and operational challenges during 2024-2025. These transitions may cause short-to-medium term disruptions and require substantial resource allocation to manage effectively, potentially straining existing capital.

Same Document Delivered

iClick Interactive Asia Group SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of iClick Interactive Asia Group's Strengths, Weaknesses, Opportunities, and Threats. Understand the market position and strategic outlook for iClick Interactive Asia Group. This detailed analysis is ready for your strategic planning.

Opportunities

China's digital transformation and AI market is booming. Projections show continued strong growth in enterprise technology adoption and AI integration across various sectors. This trend is expected to create substantial opportunities for companies like iClick Interactive Asia Group.

iClick's established expertise in big data analytics and artificial intelligence directly aligns with this surging demand. The company is particularly well-positioned to benefit from the increasing need for sophisticated AI solutions in the Chinese enterprise landscape.

The company's focus on higher-margin enterprise services, powered by its data and AI capabilities, presents a significant growth avenue. For instance, the Chinese AI market was valued at over $100 billion in 2023, with projections indicating a compound annual growth rate exceeding 20% through 2027, according to various industry reports.

iClick Interactive Asia Group's merger with Amber DWM Holding positions them firmly within the burgeoning Web3 and digital wealth management space. This strategic diversification is a significant opportunity, tapping into an emerging sector with substantial growth potential. By integrating Amber DWM's expertise, iClick is poised to offer innovative financial solutions leveraging blockchain technology and decentralized finance.

The digital advertising market in China is poised for significant expansion, with projections indicating a compound annual growth rate (CAGR) of 18% between 2025 and 2030. This robust growth trajectory offers a substantial opportunity for iClick Interactive Asia Group.

iClick can capitalize on this expanding market by leveraging its advanced data-driven marketing solutions. The company is well-positioned to assist businesses with cross-border marketing initiatives, helping them navigate the complexities of reaching Chinese consumers.

Furthermore, iClick's expertise is particularly valuable for targeting affluent Chinese consumers, a demographic that represents a growing segment of the market. By utilizing iClick's sophisticated targeting capabilities, brands can more effectively engage this high-value audience.

Strategic Partnerships and International Expansion

iClick Interactive Asia Group (iClick) has a proven track record of forming strategic alliances, notably its partnership with Tencent. This foundation allows iClick to continue pursuing opportunities that bridge international brands with the vast Chinese consumer market. In 2024, such collaborations are crucial for navigating evolving digital landscapes and accessing new customer segments.

The company's position as the exclusive overseas agency for platforms like MaiMai presents significant avenues for international expansion. This role is particularly advantageous for growth in markets like Hong Kong, where iClick can leverage its expertise to facilitate cross-border digital marketing efforts. As of early 2025, iClick's strategic focus includes deepening these international relationships to drive revenue growth.

Key opportunities stemming from these strategic initiatives include:

- Expanding market reach: Collaborating with major tech players like Tencent allows iClick to access a wider audience for its clients.

- New revenue streams: Exclusive agency agreements, such as with MaiMai, open up dedicated monetization channels.

- Geographic diversification: Focusing on markets like Hong Kong mitigates risk and taps into emerging growth areas.

- Enhanced service offerings: Partnerships can lead to integrated solutions that provide greater value to global brands targeting China.

Leveraging Data for Enhanced Consumer Insights

iClick Interactive Asia Group's strength in data collection and analysis presents a significant opportunity to deepen consumer understanding. By leveraging its extensive datasets, the company can achieve more granular audience segmentation, leading to highly personalized marketing strategies that resonate with consumers. This enhanced targeting is crucial for brands seeking to connect with specific demographics and psychographics in the increasingly competitive digital landscape.

This data-driven approach allows iClick to anticipate and respond to evolving consumer demands more effectively. For instance, by analyzing past campaign performance and user behavior patterns, iClick can predict future trends and tailor its offerings accordingly. This proactive stance ensures that the marketing campaigns developed are not only personalized but also highly relevant and impactful, driving better results for clients.

- Refined Audience Segmentation: iClick can move beyond broad demographic targeting to hyper-segmentation based on detailed behavioral and interest data, potentially increasing ad relevance by over 30% based on industry benchmarks.

- Personalized Campaign Development: The ability to analyze vast datasets allows for the creation of unique customer journeys and tailored ad creatives, leading to improved engagement rates and conversion metrics.

- Anticipating Evolving Demands: By continuously analyzing consumer data, iClick can identify emerging trends and preferences, enabling clients to stay ahead of market shifts and consumer expectations.

- Enhanced ROI for Brands: More precise targeting and personalized messaging directly translate to more efficient ad spend and a higher return on investment for the brands that iClick serves.

The integration with Amber DWM positions iClick to capitalize on the growing digital wealth management sector, a market projected to see significant expansion in Asia. This diversification into Web3 and blockchain-enabled financial solutions offers new revenue streams and aligns with the increasing global interest in decentralized finance.

iClick's established expertise in data analytics and AI is a key opportunity, especially given China's continued digital transformation and AI adoption. The company is well-placed to offer sophisticated enterprise solutions in a market that was valued at over $100 billion in 2023 and is expected to grow at a CAGR exceeding 20% through 2027.

The robust growth of China's digital advertising market, with an estimated CAGR of 18% between 2025 and 2030, provides a substantial platform for iClick. Leveraging advanced data-driven marketing and targeting affluent Chinese consumers offers a significant advantage.

Strategic partnerships, such as the one with Tencent, and exclusive agency roles like that for MaiMai, create opportunities for expanded market reach and new revenue channels. These alliances are crucial for navigating evolving digital landscapes and facilitating cross-border marketing, particularly in markets like Hong Kong.

Threats

iClick Interactive Asia Group faces significant competitive pressures. Major Chinese tech players like Alibaba, Tencent, and ByteDance possess extensive user bases and proprietary data, giving them a substantial advantage in the digital advertising landscape. These giants can leverage their integrated ecosystems to offer comprehensive marketing solutions that are difficult for iClick to match directly.

Beyond these behemoths, iClick also contends with a multitude of specialized marketing technology and Software-as-a-Service (SaaS) firms. These niche players often excel in specific areas of the marketing funnel, such as customer data platforms (CDPs) or advanced analytics, presenting iClick with a fragmented competitive environment. This makes achieving and sustaining market share growth a constant challenge.

The rapid evolution of the digital marketing space means that new competitors and disruptive technologies can emerge quickly. For instance, the increasing sophistication of AI-driven advertising platforms developed by tech leaders could further consolidate market power. iClick’s ability to innovate and differentiate its offerings will be crucial to navigate this intensified competitive threat.

China's rapidly evolving regulatory landscape, particularly concerning data privacy, presents a significant threat to iClick Interactive Asia Group. The implementation of the Personal Information Protection Law (PIPL) and other evolving regulations requires substantial investment in compliance. For instance, PIPL, effective November 1, 2021, imposes stringent rules on how companies collect, process, and store personal data, which could directly impact iClick's core business of targeted advertising and data analytics.

Meeting these new compliance demands can be expensive and may force iClick to fundamentally alter its data handling strategies. These changes could reduce the effectiveness of its advertising solutions or necessitate costly overhauls of its technological infrastructure. The potential for hefty fines or operational disruptions due to non-compliance adds another layer of risk.

Economic slowdowns, particularly in China, pose a significant threat to iClick Interactive Asia Group. Should economic growth falter, businesses are likely to scale back their marketing expenditures, directly impacting iClick's primary revenue stream: Marketing Solutions. This reduction in advertising budgets can lead to decreased client spending and, consequently, lower overall financial performance for the company.

For instance, during periods of economic uncertainty, companies often prioritize cost-cutting measures, and advertising is frequently among the first budgets to be trimmed. This has been observed in past macroeconomic downturns, where companies tightened their belts, leading to a noticeable dip in advertising demand. iClick's reliance on these advertising dollars makes it particularly vulnerable to such shifts in client spending patterns, directly affecting its top-line growth and profitability.

Technological Disruption and Rapid Market Shifts

Technological disruption is a significant threat for iClick Interactive Asia Group, given the fast-paced evolution of the digital marketing and enterprise solutions landscape. Emerging technologies like artificial intelligence (AI), Web3, and the metaverse are rapidly reshaping consumer engagement and advertising strategies. For instance, AI's growing role in personalized advertising and data analytics could quickly render less sophisticated approaches obsolete.

Failure to keep pace with these technological shifts and evolving consumer behaviors presents a substantial risk of iClick losing its competitive edge. Companies that don't invest in and integrate new platforms and tools may find their offerings outdated. The digital advertising market in Asia, a key region for iClick, saw significant growth, with mobile advertising spend projected to reach over $260 billion in 2024, highlighting the need for continuous adaptation to remain relevant in this dynamic environment.

- AI Integration: Competitors are increasingly leveraging AI for ad targeting and campaign optimization, potentially offering superior ROI.

- Emerging Platforms: The rise of new digital spaces like the metaverse requires new strategies and technologies for effective marketing.

- Data Privacy Regulations: Evolving data privacy laws, such as those in China, necessitate constant updates to data handling and targeting methodologies.

- Shifting Consumer Habits: Rapid changes in how consumers interact with digital content demand agile marketing solutions.

Integration Risks of New Merger and Business Model Shift

The integration of Amber DWM into iClick Interactive Asia Group presents considerable challenges. Merging disparate operational systems, aligning distinct corporate cultures, and harmonizing technological infrastructures require meticulous planning and execution. Failure to manage these complexities effectively could lead to significant disruptions in iClick's core business activities.

Furthermore, the strategic pivot towards Web3 financial solutions introduces inherent risks associated with navigating a nascent and rapidly evolving market. iClick's ability to adapt its established business model and technology stack to the demands of Web3 is crucial for its future success. A misstep in this transition could jeopardize its current revenue streams and overall financial stability.

Specific integration risks include:

- Operational Inefficiencies: Delays or failures in integrating Amber DWM's systems could hinder iClick's ability to serve existing clients effectively.

- Cultural Clashes: Differences in corporate culture between the two entities might impede collaboration and slow down decision-making processes.

- Technological Compatibility: Ensuring seamless integration of different technology platforms is vital to avoid service interruptions or data security breaches.

- Market Adoption Uncertainty: The success of the Web3 pivot hinges on market acceptance of iClick's new offerings, which remains a significant variable.

For instance, a poorly executed merger could result in a decline in revenue from established advertising services, impacting iClick's financial performance. In 2023, iClick reported revenue of $101.1 million, and any significant disruption to its core business lines due to integration issues could have a material impact on this figure.

iClick faces intense competition from tech giants and specialized firms, making market share growth a constant battle. The company must also navigate China's evolving data privacy laws, such as the PIPL, which require costly compliance measures and could impact its core business. Furthermore, economic downturns can significantly reduce advertising budgets, directly affecting iClick's revenue streams.

The rapid advancement of technologies like AI and Web3 presents a threat if iClick fails to adapt its offerings, potentially leading to a loss of competitive edge. The integration of Amber DWM also introduces risks of operational inefficiencies and cultural clashes. For example, iClick reported revenue of $101.1 million in 2023, and disruptions from integration or market adoption uncertainty for its Web3 pivot could materially impact this figure.

| Threat Category | Specific Threat | Impact on iClick | Example/Data Point (2024/2025 Focus) |

|---|---|---|---|

| Competition | Dominance of Tech Giants | Reduced market share, difficulty matching integrated solutions | Alibaba, Tencent, ByteDance leverage vast user data and ecosystems. |

| Regulatory | Data Privacy Laws (PIPL) | Increased compliance costs, potential alteration of data strategies | PIPL (effective Nov 2021) mandates stringent data handling rules. |

| Economic | Economic Slowdowns | Reduced advertising expenditure, lower revenue | Businesses often cut marketing budgets during economic uncertainty. |

| Technological | Rapid Tech Evolution (AI, Web3) | Risk of obsolescence, loss of competitive edge | AI-driven advertising platforms can quickly surpass less sophisticated approaches. Mobile advertising spend in Asia projected over $260 billion in 2024. |

| Integration | Amber DWM Merger | Operational inefficiencies, cultural clashes, tech compatibility issues | Poor execution could impact 2023 revenue of $101.1 million. |

SWOT Analysis Data Sources

This analysis is built upon a foundation of reliable data, including iClick Interactive Asia Group's official financial filings, comprehensive market research reports, and expert commentary from industry analysts to ensure a robust and accurate assessment.