iClick Interactive Asia Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

iClick Interactive Asia Group Bundle

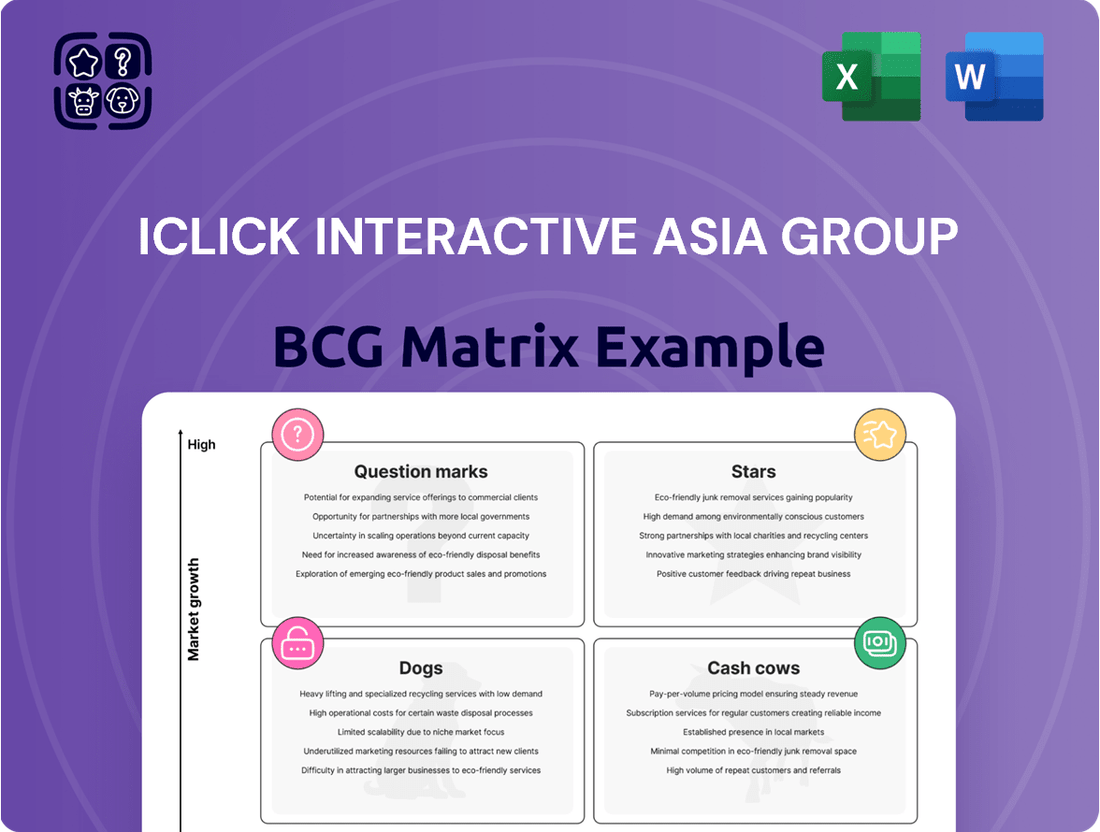

Curious about iClick Interactive Asia Group's market performance? Our BCG Matrix preview highlights key product categories, offering a glimpse into their growth potential and market share. See which of their offerings might be Stars, Cash Cows, Dogs, or Question Marks.

This snapshot is designed to pique your interest and demonstrate the value of a comprehensive analysis. To truly understand iClick's strategic positioning and make informed decisions, you need the full picture.

Purchase the complete BCG Matrix report to unlock detailed quadrant placements, data-driven recommendations, and a clear roadmap for optimizing your investments in iClick's diverse portfolio.

Don't miss out on the strategic clarity that comes with a full understanding of iClick's product landscape. Get the full report and start strategizing for success today!

Stars

Amber International Holding Limited, formerly iClick Interactive Asia Group, is aggressively expanding into Web3 financial solutions. This strategic shift targets a burgeoning market with substantial growth potential, aiming to capture significant market share.

The company's recent capital infusion and investments in crypto reserves highlight a strong commitment to this innovative sector. These moves signal a clear intention to establish leadership in the evolving Web3 financial landscape.

Following the merger with Amber DWM Holding Limited, Amber Premium Products have been a major driver of iClick Interactive Asia Group's financial performance. In Q1 2025, these offerings contributed significantly to a dramatic revenue increase. This surge highlights their position as a key player in the burgeoning digital wealth management sector.

Amber Premium Products are currently in a high-growth phase, reflecting the broader fintech landscape's expansion. Their rapid adoption by consumers indicates a strong potential for iClick to capture substantial market share within this specific segment. This growth trajectory is a positive sign for the company's diversification efforts.

Amber International, formerly iClick, is aggressively employing its advanced AI and data analytics in the dynamic Chinese digital advertising sector. This market is expected to see robust growth, with a projected compound annual growth rate of 18% between 2025 and 2030, underscoring the significant potential for AI-driven marketing solutions.

The company’s proprietary AI technologies are crucial for refining audience targeting and personalizing customer experiences, thereby securing a distinct competitive advantage. This focus on AI-powered marketing is a cornerstone of their strategy, as detailed in their 2024 whitepaper, signaling their intent to be at the forefront of innovation in the digital advertising space.

Cross-Border E-commerce Solutions

iClick Interactive Asia Group's cross-border e-commerce solutions are a significant growth driver, capitalizing on China's expanding online market. These offerings connect global marketers with Chinese consumers, a segment poised for substantial growth.

The Chinese e-commerce market is forecast to grow at a compound annual growth rate of 21.327% between 2025 and 2035, highlighting the immense potential for iClick's expertise in this area. Leveraging their deep knowledge of China's digital landscape, iClick is well-positioned to capture a considerable portion of this expanding market.

- High Growth Potential: The projected 21.327% CAGR for China's e-commerce market from 2025 to 2035 underscores the significant opportunity for cross-border solutions.

- Expertise in Chinese Market: iClick's established understanding of the Chinese digital ecosystem is a key differentiator for its cross-border e-commerce services.

- Market Expansion: These solutions enable global brands to access and engage with the burgeoning Chinese consumer base effectively.

- Strategic Positioning: iClick's capabilities are aligned to capitalize on the increasing demand for international products within China's e-commerce sphere.

Hong Kong Enterprise Solutions

Hong Kong Enterprise Solutions, despite the divestiture of its mainland China counterpart, demonstrates robust growth. In the first half of 2024, continuing operations saw a 13% year-over-year increase in enterprise solutions revenue, signaling a positive trajectory.

This segment is strategically positioned to capitalize on the booming enterprise AI and big data market in China. Projections indicate this sector will expand at a substantial 38.5% compound annual growth rate from 2025 to 2030. This forecast highlights significant opportunities for iClick Interactive Asia Group's Hong Kong enterprise solutions to capture increasing market share.

- Segment Focus Hong Kong-based enterprise solutions are targeting the high-growth enterprise AI and big data market.

- Revenue Growth Reported a 13% year-over-year increase in revenue for continuing operations in H1 2024.

- Market Potential The enterprise AI and big data market in China is forecast to grow at a 38.5% CAGR between 2025 and 2030.

Stars represent iClick Interactive Asia Group's most promising ventures, characterized by high market share in high-growth industries. These are the segments poised for significant future expansion and profitability.

The company's Web3 financial solutions and cross-border e-commerce offerings are prime examples, both operating in markets with substantial projected growth rates. Their AI-driven advertising solutions in China also fit this profile, benefiting from a rapidly expanding digital landscape.

These "Star" segments are critical for iClick's long-term strategy, demanding continued investment to maintain and grow their dominant positions. Their success is foundational to the company's overall growth trajectory.

| Business Segment | Market Growth Rate (Projected) | iClick's Position |

|---|---|---|

| Web3 Financial Solutions | High (Emerging Market) | Aggressively Expanding |

| Cross-Border E-commerce (China) | 21.327% CAGR (2025-2035) | Strong Market Capture Potential |

| AI-Driven Digital Advertising (China) | 18% CAGR (2025-2030) | Leveraging Proprietary AI |

What is included in the product

The iClick Interactive Asia Group BCG Matrix offers a tailored analysis of its product portfolio, categorizing offerings into Stars, Cash Cows, Question Marks, and Dogs.

The iClick Interactive Asia Group BCG Matrix alleviates the pain of strategic uncertainty by providing a clear, visual roadmap for resource allocation across its business units.

This matrix offers a simplified, actionable framework to address the pain of complex portfolio management, enabling focused decision-making.

Cash Cows

Established Marketing Solutions in Hong Kong and other overseas markets, excluding mainland China, represent iClick Interactive Asia Group's cash cows. These segments are likely to have a solid market share within their respective niches, benefiting from mature but consistent demand.

While not experiencing rapid expansion, these established operations are expected to continue generating significant positive cash flow for the company. For instance, in the first quarter of 2024, iClick reported that its overseas marketing solutions segment continued to be a stable contributor to revenue, demonstrating the resilience of these mature businesses.

iClick's proprietary data and audience insights platform is a core strength, providing a stable revenue stream. This platform leverages extensive data assets and advanced analytics, offering a distinct advantage in the digital advertising landscape. The unique value proposition translates to high profit margins, making it a reliable generator of consistent insights and revenue for the company.

iClick Interactive Asia Group's long-standing strategic partnerships, notably with Tencent, are a cornerstone of its business, acting as significant cash cows. These collaborations provide a remarkably stable and recurring revenue stream, leveraging Tencent's extensive reach in the Chinese market. This established relationship ensures a consistent flow of business, allowing iClick to tap into well-developed market channels and maintain a strong position in specific ventures.

Retained Enterprise Solutions in Hong Kong

Even after divesting its mainland China enterprise solutions, iClick Interactive Asia Group maintains its Hong Kong enterprise solutions segment. This division, though not a hyper-growth area, likely benefits from consistent demand for digital transformation services in a mature and stable market. Its continued operation suggests a solid market standing, contributing reliable cash flow to the company's overall financial health.

The improvement in the gross profit margin for this segment, reaching 47.4% in 2023, underscores its positive impact on iClick's profitability. This indicates efficient operations and strong pricing power within its Hong Kong market niche. The segment is a testament to the company's ability to generate consistent revenue streams from established services.

- Stable Cash Flow Generation: The Hong Kong enterprise solutions business continues to provide a predictable revenue stream, acting as a stable cash generator for iClick Interactive Asia Group.

- Improved Profitability: A notable increase in gross profit margin to 47.4% in 2023 demonstrates the segment's enhanced efficiency and contribution to the company's bottom line.

- Strategic Focus: While divesting other operations, maintaining this segment highlights its value as a reliable and profitable unit within iClick's portfolio.

Client Base for Full Consumer Lifecycle Solutions

iClick Interactive Asia Group's full suite of data-driven solutions, designed to support brands across the entire consumer lifecycle, has attracted a substantial and varied client base. This established roster of clients ensures predictable revenue and consistent repeat business, making them a reliable cash generator in a mature market.

The company's emphasis on nurturing client relationships bolsters stable profitability. For instance, in 2024, iClick reported that a significant portion of its revenue was derived from existing clients, highlighting the effectiveness of its client retention strategies.

- Diverse Clientele: iClick serves a wide range of industries, from e-commerce and automotive to finance and travel.

- Repeat Business: The loyalty of its client base translates into recurring revenue, a hallmark of cash cow businesses.

- Stable Profitability: Strong client retention directly contributes to consistent and predictable earnings for the company.

- Market Position: In 2024, iClick's ability to maintain a high percentage of repeat business underscored its competitive strength in the digital advertising space.

iClick's established marketing solutions in Hong Kong and overseas markets, excluding mainland China, function as its cash cows. These operations benefit from mature but consistent demand, securing a solid market share in their respective niches. The company's proprietary data and audience insights platform, coupled with long-standing strategic partnerships like the one with Tencent, further solidify these revenue streams.

These segments are characterized by their ability to generate significant positive cash flow without requiring substantial investment for growth. For instance, iClick's overseas marketing solutions continued to be a stable revenue contributor in Q1 2024. The Hong Kong enterprise solutions segment, even after divestments, demonstrates resilience, with a gross profit margin of 47.4% in 2023 highlighting its profitability.

The company's robust client relationships also contribute to its cash cow status, with a significant portion of revenue in 2024 derived from existing clients. This strong client retention, evident across diverse industries like e-commerce and finance, ensures recurring revenue and stable profitability, reinforcing the cash cow nature of these business units.

| Business Segment | BCG Matrix Classification | Key Characteristics | Financial Highlight |

| Established Marketing Solutions (HK & Overseas) | Cash Cow | Mature market, consistent demand, solid market share | Stable revenue contributor (Q1 2024) |

| Proprietary Data & Audience Insights Platform | Cash Cow | Leverages extensive data, advanced analytics, high profit margins | Reliable generator of insights and revenue |

| Strategic Partnerships (e.g., Tencent) | Cash Cow | Recurring revenue, leverages extensive market reach | Ensures consistent business flow |

| Hong Kong Enterprise Solutions | Cash Cow | Consistent demand for digital services, stable market | Gross Profit Margin: 47.4% (2023) |

| Established Client Base & Repeat Business | Cash Cow | Predictable revenue, consistent repeat business | Significant revenue from existing clients (2024) |

Delivered as Shown

iClick Interactive Asia Group BCG Matrix

The iClick Interactive Asia Group BCG Matrix preview you are currently viewing is the identical, fully realized document you will receive immediately after completing your purchase. This means no watermarks, no placeholder text, and no altered content; you'll get the complete, professionally formatted analysis ready for immediate strategic application. The detailed breakdown of iClick's product portfolio within the matrix, as displayed here, will be precisely what you download, enabling you to make informed decisions about resource allocation and future investment. Rest assured, the insights and visual representation of iClick's market position are accurate and ready for your business planning needs.

Dogs

iClick Interactive Asia Group strategically exited its mainland China demand-side marketing solutions business in late 2024. This move was driven by the segment's inherent characteristics: lower profit margins and elevated risk profiles.

The decision was further influenced by a broader economic climate marked by client reductions in advertising expenditure due to prevailing macroeconomic uncertainties. This segment was a classic example of a 'Dog' in the BCG matrix, consuming capital without generating commensurate returns.

By divesting this business, iClick aimed to streamline operations and reallocate resources towards more promising growth areas. The disposal reflects a proactive approach to managing its portfolio and enhancing overall profitability.

iClick Interactive Asia Group made a significant strategic move in July 2024 by divesting its mainland China enterprise solutions business. This decision stemmed from a challenging operating environment characterized by uncertain macroeconomic conditions and fierce competition within the Software-as-a-Service (SaaS) sector in China.

The intense market pressure led to a noticeable decline in segment margins and a negative impact on operating cash flows for this particular business. Consequently, iClick classified its mainland China enterprise solutions business as a ‘Dog’ in its BCG Matrix analysis, highlighting its limited growth prospects and its role as a financial drain on the company’s resources.

Legacy advertising formats within iClick Interactive Asia Group's portfolio likely represent question marks or even dogs in a BCG matrix analysis. These segments, often characterized by reliance on older, less efficient methods, struggled to keep pace with China's rapidly evolving digital advertising ecosystem. For instance, traditional display advertising, while still present, saw its effectiveness diluted by ad blockers and user fatigue, contributing to a lower market share.

These underperforming areas would exhibit low growth and low market share, making them prime candidates for strategic contraction. In 2024, as the industry increasingly favored AI-driven targeting and mobile-first programmatic solutions, these legacy formats became even more marginalized. The strategic decision to streamline operations and focus on higher-margin, growth-oriented services directly reflects the challenges faced by these older advertising channels, which saw diminishing returns compared to more innovative approaches.

Highly Competitive, Undifferentiated Offerings

Highly Competitive, Undifferentiated Offerings represent business units within iClick Interactive Asia Group that operate in saturated markets with little to distinguish their products or services from rivals. In the dynamic Chinese digital marketing and enterprise software sectors, this lack of unique selling propositions makes it challenging to capture and retain customers. Companies in this category often face intense price wars and struggle to achieve premium margins.

These segments are characterized by low barriers to entry and a multitude of players, including dominant tech behemoths like Tencent and Alibaba, which further squeezes smaller competitors. Without a clear competitive advantage, iClick's offerings in these areas would find it difficult to gain significant market share or achieve sustainable profitability. For instance, in 2024, the digital advertising market in China continued to be dominated by platforms offering broad reach, making it harder for niche or undifferentiated players to stand out.

- Market Saturation: The Chinese digital marketing landscape is crowded, with numerous agencies and platforms vying for attention.

- Lack of Proprietary Technology: Offerings that rely on standard digital marketing tools without unique technological innovation struggle to differentiate.

- Price Sensitivity: In competitive environments, clients often prioritize cost over unique features, pressuring margins for undifferentiated services.

- Dominant Competitors: Giants like ByteDance and Tencent control significant portions of the digital advertising spend, leaving less room for smaller, undifferentiated players.

Operations with Poor Cost Efficiency

Businesses or operational units that consistently demonstrated poor cost efficiency and failed to contribute positively to overall profitability, despite market trends, would fall into the Dogs category. iClick Interactive Asia Group's focus on improving financial performance and cash flows through cost optimization indicates that some areas were previously inefficient and underperforming.

In 2024, iClick Interactive Asia Group has been actively addressing operational inefficiencies. For instance, by streamlining marketing spend and optimizing content creation processes, they aim to reduce the cost per acquisition for their clients. This strategic shift is crucial for units that historically struggled with profitability due to high operating expenses relative to revenue generated.

- Dogs: These are business units or operations with low market share and low growth prospects, often characterized by poor cost efficiency.

- Cost Inefficiency: Units in this category may have struggled to control operating expenses, leading to negative or minimal profit margins.

- Profitability Concerns: Despite potential market opportunities, these operations fail to generate positive returns, requiring significant investment or divestment.

- Strategic Review: iClick's management is likely reviewing these "dog" units to determine whether to divest, restructure, or discontinue them to improve overall company performance.

The divestment of iClick's mainland China demand-side marketing solutions in late 2024, due to low margins and high risk, exemplifies a 'Dog' in the BCG matrix. Similarly, the enterprise solutions business, divested in July 2024 because of intense competition and declining margins, also fits this classification. Legacy advertising formats and undifferentiated offerings, struggling against dominant players and price sensitivity, represent further 'Dog' segments within iClick's portfolio.

| Segment | BCG Classification | Reasoning | 2024 Impact |

| Demand-Side Marketing Solutions (China) | Dog | Low margins, high risk, client ad spend reduction | Divested late 2024 |

| Enterprise Solutions (China) | Dog | Intense competition, declining margins, negative cash flow | Divested July 2024 |

| Legacy Advertising Formats | Dog/Question Mark | Low growth, low market share, declining effectiveness | Marginalized by AI/mobile solutions |

| Undifferentiated Offerings | Dog | Market saturation, lack of proprietary tech, price sensitivity | Struggles against tech giants |

Question Marks

iClick Interactive Asia Group's strategic pivot into Web3 financial solutions, under the Amber International Holding Limited brand, firmly places these emerging products in the Question Mark category of the BCG Matrix. This sector is experiencing rapid growth, with the global decentralized finance (DeFi) market projected to reach over $2 trillion by 2030, indicating substantial potential. However, iClick's current market share within this nascent and highly innovative space is still building, requiring significant investment to establish a strong foothold.

Success for these Web3 financial products hinges on achieving rapid market adoption and carving out distinct competitive advantages. The company must navigate a landscape characterized by evolving regulations and technological advancements. For instance, the total value locked (TVL) in DeFi protocols, a key metric of market adoption, saw significant fluctuations throughout 2023 and early 2024, highlighting the volatility and early stage of this market.

The merger with Amber DWM Holding Limited marks iClick Interactive Asia Group's strategic entry into the dynamic digital wealth management sector, a key area of fintech growth. This move positions the company to tap into a market projected to reach $1.4 trillion in assets under management globally by 2027, according to recent industry analyses.

These new ventures, while holding significant promise, are currently in their nascent stages of development and market penetration. Their specific service offerings and customer adoption rates are still being established, placing them in a position of high uncertainty within the BCG matrix.

Significant capital investment is being channeled into developing these digital wealth management capabilities and building market presence. While the returns are not yet guaranteed, the potential for high future returns in this expanding fintech landscape makes these ventures a calculated risk for iClick.

iClick Interactive Asia Group aims to help brands harness the power of smart retail, a field where AI and big data are becoming essential. This segment is expanding rapidly, with global smart retail market expected to reach $27.7 billion by 2025, growing at a CAGR of 12.5%.

However, iClick's current position within this niche application of enterprise solutions might be nascent, meaning its market share could be relatively small as it carves out its space.

To transition from a Question Mark to a Star, these AI-driven smart retail solutions necessitate ongoing, substantial investment in research and development and continuous innovation to achieve significant market penetration and leadership.

Unproven International Marketing Expansion

Unproven international marketing expansion for iClick Interactive Asia Group would fall into the Question Marks category of the BCG Matrix. These are markets with high growth potential in digital advertising but where iClick currently has a low market share.

Successfully penetrating these markets demands significant investment in marketing and the development of highly localized strategies. Without this focused effort, iClick risks not capturing the burgeoning regional digital advertising opportunities.

- Market Entry Strategy: iClick must tailor its marketing solutions to the specific cultural nuances and consumer behaviors of each new international territory.

- Investment Needs: Significant capital allocation will be required for brand building, local partnerships, and adapting product offerings to meet regional demands.

- Competitive Landscape: Understanding and effectively navigating existing local and international competitors is crucial for gaining traction.

- Potential Return: While risky, successful expansion into high-growth international markets could yield substantial long-term revenue and market share gains, potentially turning these Question Marks into Stars.

Niche AI/Big Data Applications in Specific Verticals

iClick Interactive Asia Group could be carving out a niche in enterprise AI and big data by focusing on highly specialized applications within specific verticals. These solutions might target rapidly expanding sub-sectors of the broader AI market, where their current market penetration is still nascent. Significant investment would be needed to amplify the reach of these tailored offerings.

The global enterprise AI market experienced substantial growth, projected to reach $370 billion by 2025, according to IDC. This expansion creates fertile ground for specialized AI and big data applications that address unique industry challenges. For instance, iClick might develop AI-driven customer analytics for the booming e-commerce sector in Southeast Asia, or predictive maintenance solutions for the manufacturing industry in China.

- Targeted AI solutions for specific industries

- Focus on high-growth, potentially underserved market segments

- Requirement for strategic investment to scale niche applications

- Leveraging the exponential growth of the overall enterprise AI market

iClick's Web3 financial ventures and digital wealth management initiatives, under Amber International Holding, are positioned as Question Marks due to their nascent market presence despite high growth potential. The DeFi market alone is anticipated to surpass $2 trillion by 2030, underscoring the opportunity. However, iClick’s current market share in these innovative sectors is still developing, necessitating substantial investment for competitive positioning and growth.

The company's strategic focus on AI and big data for smart retail solutions also falls into the Question Mark category. While the smart retail market is projected to reach $27.7 billion by 2025, iClick’s market share in this specialized application is likely small, requiring significant R&D and innovation to capture market leadership.

Unproven international marketing expansion represents another Question Mark for iClick. These markets offer high growth in digital advertising, but iClick’s current penetration is low. Success hinges on localized strategies and substantial investment in brand building to compete effectively and potentially transform these ventures into Stars.

iClick's specialized enterprise AI and big data applications, targeting specific verticals, are also Question Marks. With the global enterprise AI market set to reach $370 billion by 2025, these niche offerings have significant potential but require strategic investment to scale and achieve broader market penetration.

BCG Matrix Data Sources

Our iClick Interactive Asia Group BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.