iClick Interactive Asia Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

iClick Interactive Asia Group Bundle

iClick Interactive Asia Group operates in a dynamic digital marketing landscape, facing significant competitive rivalry and the constant threat of new entrants. Understanding the bargaining power of both buyers and suppliers is crucial for navigating this environment. Furthermore, the availability of substitutes for their services presents a key challenge.

The complete report reveals the real forces shaping iClick Interactive Asia Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

iClick Interactive Asia Group's reliance on data and AI technologies means the bargaining power of these suppliers is a key consideration. The uniqueness and proprietary nature of their data sets, AI models, and technological infrastructure directly influence this power. If these resources are highly specialized and difficult for iClick or competitors to replicate, the suppliers can command higher prices or more favorable terms.

For instance, in 2024, the demand for advanced AI capabilities, particularly in areas like personalized advertising and customer analytics, has surged. Companies possessing unique datasets or highly efficient proprietary algorithms found themselves in a strong negotiating position. This could translate to increased costs for iClick if they need to secure access to these critical, differentiating technologies, impacting their overall operational expenses and profit margins.

Cloud infrastructure providers wield significant bargaining power over iClick Interactive Asia Group. As a digital marketing and enterprise solutions firm, iClick's operations are heavily reliant on scalable and reliable cloud services. Major players in the Chinese market, like Alibaba Cloud, possess substantial leverage due to their extensive infrastructure, diverse service offerings, and the considerable expense and complexity involved in migrating data and critical systems. This influence is further magnified by the burgeoning demand for cloud-based GPU resources, essential for iClick's AI-driven marketing strategies, with cloud infrastructure spending in China projected to grow substantially through 2025.

iClick Interactive Asia Group relies heavily on a diverse range of media platforms and publishers within China to access ad inventory. The bargaining power of these sources is a critical factor in iClick's operational costs and strategy.

Dominant social media platforms such as WeChat, Douyin (TikTok's Chinese version), and Baidu wield significant power. Their extensive user bases, estimated in the hundreds of millions, and access to rich, proprietary consumer behavior data make them indispensable partners.

For instance, WeChat boasts over 1.3 billion monthly active users as of late 2023, giving it immense leverage in negotiating ad rates and terms. Similarly, Douyin, with hundreds of millions of daily active users, commands substantial influence over advertisers.

This concentration of user traffic and data control allows these platforms to dictate terms, potentially increasing ad costs or limiting inventory availability, thereby impacting iClick's profitability and campaign effectiveness.

Talent and Expertise

The specialized nature of data-driven marketing and AI-powered enterprise solutions means that highly skilled talent in areas like big data analytics, AI development, and digital marketing strategy are critical suppliers for iClick Interactive Asia Group. A scarcity of such talent in China, a key market for iClick, could significantly increase their bargaining power. This scarcity translates directly into higher labor costs and more challenging recruitment processes for the company.

For instance, in 2024, the demand for AI and data science professionals in China continued to outstrip supply, leading to average salary increases of 15-20% for experienced individuals in these fields. This upward pressure on wages directly impacts companies like iClick, forcing them to compete for a limited pool of expertise. The ability to attract and retain top talent becomes a crucial differentiator, and a lack of it can hinder innovation and service delivery.

- Talent Scarcity: A shortage of skilled data scientists and AI developers in China in 2024.

- Increased Labor Costs: Upward pressure on salaries for specialized talent, potentially impacting iClick's operational expenses.

- Recruitment Challenges: Difficulty in attracting and retaining key personnel in a competitive market.

- Impact on Innovation: Potential for slower development and deployment of new AI-driven solutions due to talent constraints.

Regulatory Compliance and Data Security Providers

In China's dynamic regulatory environment, particularly around data privacy and security, suppliers who can ensure compliance hold considerable sway. iClick Interactive Asia Group, like many digital platforms, must navigate these evolving rules, making providers of regulatory and cybersecurity solutions indispensable. Their specialized knowledge and tools are critical for iClick to operate legally and maintain user trust.

The increasing stringency of data protection laws, such as China's Personal Information Protection Law (PIPL), amplifies the bargaining power of these specialized suppliers. For instance, PIPL, which came into effect in November 2021, imposes significant penalties for non-compliance, including fines of up to 5% of annual turnover or RMB 50 million. This regulatory pressure means iClick relies heavily on these expert providers to mitigate risks and avoid substantial financial and reputational damage.

- Regulatory Complexity: Navigating China's evolving data privacy and cybersecurity laws requires specialized expertise.

- Supplier Dependency: iClick's ability to comply with regulations like PIPL creates a dependency on expert providers.

- Cost of Non-Compliance: Significant penalties for breaches, potentially up to 5% of annual turnover, increase the value of compliance solutions.

- Market Evolution: The growing emphasis on data security empowers suppliers who offer robust compliance services.

The bargaining power of suppliers for iClick Interactive Asia Group is significant, particularly concerning data and AI technologies. Unique datasets and proprietary algorithms held by suppliers give them considerable leverage, potentially driving up costs for iClick. In 2024, the demand for advanced AI capabilities intensified, strengthening the negotiating position of companies possessing specialized data and efficient algorithms, which could impact iClick's operational expenses.

What is included in the product

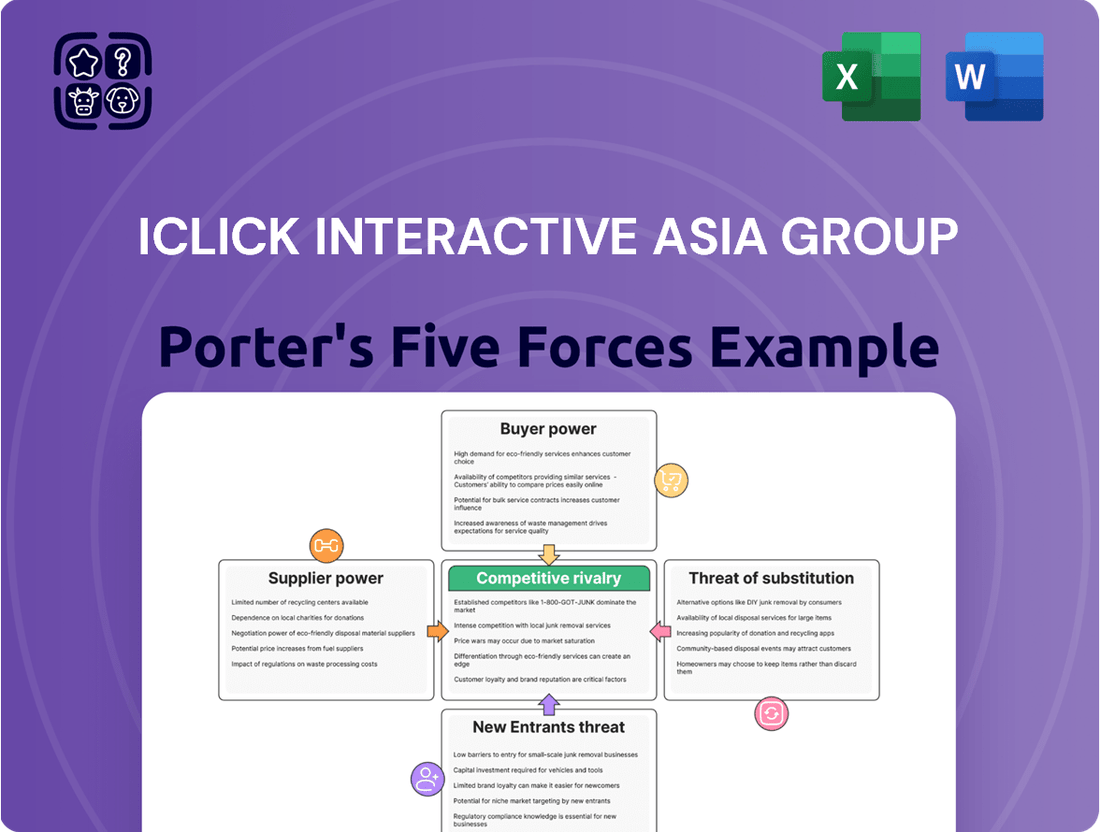

Uncovers key drivers of competition, customer influence, and market entry risks tailored to iClick Interactive Asia Group's digital marketing and data services.

Instantly visualize iClick Interactive Asia Group's competitive landscape with a dynamic Porter's Five Forces analysis, simplifying complex market pressures for confident strategic planning.

Customers Bargaining Power

iClick Interactive Asia Group serves a broad spectrum of advertisers, from global corporations to smaller businesses, indicating a generally fragmented customer base. This fragmentation inherently limits the bargaining power of any single client, as the company is not overly reliant on any one customer for a substantial portion of its revenue. For instance, while iClick works with major brands, the sheer volume and variety of its clientele mean that the loss of one advertiser, while impactful, is unlikely to cripple the business.

Customers considering iClick Interactive Asia Group's services face a competitive landscape with numerous alternatives. They can opt for building their own in-house marketing departments, leveraging direct relationships with tech giants like Tencent, Alibaba, and ByteDance, or engaging with other specialized ad-tech and enterprise software providers. This wide array of choices significantly amplifies customer bargaining power.

The existence of these substitutes means customers are less dependent on iClick. If iClick's pricing, service quality, or performance doesn't align with customer expectations, they have a readily available path to switch. This pressure encourages iClick to maintain competitive pricing and continuously improve its service offerings to retain its client base.

For basic marketing solutions, the bargaining power of customers is amplified by low switching costs. Businesses can readily move between different ad-tech platforms or manage campaigns directly on major media channels like social media or search engines, often with minimal disruption. This flexibility allows clients to easily shop around for the best deals and service levels.

In 2024, the competitive landscape for digital advertising solutions saw numerous new entrants and feature expansions from established players, further reducing the perceived commitment needed to switch providers. This environment directly pressures companies like iClick Interactive Asia Group to continuously offer compelling value propositions and competitive pricing to retain their customer base, as clients are not heavily invested in proprietary systems or extensive integration work.

High Switching Costs for Integrated Enterprise Solutions

For iClick Interactive Asia Group, the bargaining power of customers is influenced by switching costs related to its enterprise solutions. These solutions are designed to digitalize operations and harness big data and AI, often requiring deep integration into a client's existing IT infrastructure and workflows.

This intricate integration makes it complex and expensive for clients to switch to a competitor. Such high switching costs effectively limit the customer's leverage, as the effort and financial outlay associated with migrating data, retraining staff, and reconfiguring systems can be substantial. For instance, a company relying on iClick's AI-driven analytics for its marketing campaigns would face significant disruption and cost if it decided to move to a different platform. This dependence on iClick's specialized, integrated systems bolsters iClick's position by reducing the immediate threat of customer defection.

- High Integration: iClick's enterprise solutions embed deeply within client operations, creating significant technical hurdles for switching.

- Data Migration Challenges: Moving vast amounts of digitized operational data and AI models to a new provider is time-consuming and costly.

- Operational Disruption: A switch could halt or impair critical business processes reliant on iClick's technology.

- Specialized Knowledge: Clients often develop specific expertise around iClick's platform, requiring retraining for new systems.

Data-Driven Decision Making by Customers

iClick Interactive Asia Group's customers are primarily marketers and businesses that rely heavily on data to guide their decisions. This sophistication means they can effectively scrutinize the return on investment (ROI) of iClick's advertising and marketing technology solutions. In 2024, businesses are increasingly demanding demonstrable results, which puts pressure on iClick to provide clear performance metrics and transparent reporting, thereby amplifying customer bargaining power.

These informed clients can easily compare iClick's offerings against competitors, assessing factors like cost-effectiveness, campaign reach, and conversion rates. For instance, a marketer in 2024 might be evaluating performance based on metrics like Cost Per Acquisition (CPA) or Return on Ad Spend (ROAS). If iClick fails to meet benchmarks established by these data-savvy customers, they have the leverage to switch providers, forcing iClick to maintain competitive pricing and superior service delivery.

- Informed Decision-Making: Customers, being data-driven, can precisely measure the effectiveness of iClick's services against their marketing objectives.

- ROI Scrutiny: Marketers rigorously analyze the financial returns of their advertising spend with iClick, demanding clear justification for costs.

- Performance Transparency: Clients expect detailed and understandable reports on campaign performance, including key metrics and attribution models.

- Competitive Benchmarking: Customers can easily compare iClick's offerings and pricing with those of other ad-tech providers in the market.

The bargaining power of customers for iClick Interactive Asia Group is a significant factor, influenced by the availability of alternatives and the sophistication of its client base. While iClick's integrated enterprise solutions can create high switching costs, the broader digital advertising market offers numerous substitutes, empowering clients to seek better value.

In 2024, the digital advertising landscape continued to evolve with new entrants and enhanced services from existing providers, intensifying competition. This environment means customers can readily switch if iClick's pricing or performance doesn't meet their expectations, especially for less integrated services.

Data-driven clients are adept at scrutinizing ROI, demanding transparent performance metrics and competitive pricing. This forces iClick to consistently demonstrate value and maintain high service standards to retain its sophisticated customer base.

| Factor | iClick's Position | Impact on Customer Bargaining Power |

|---|---|---|

| Availability of Substitutes | High (other ad-tech platforms, in-house solutions) | Increases bargaining power |

| Switching Costs (Enterprise Solutions) | High (deep integration, data migration) | Decreases bargaining power |

| Customer Sophistication (Data-Driven) | High (ROI analysis, performance benchmarking) | Increases bargaining power |

| Price Sensitivity | Moderate to High (depending on service tier) | Increases bargaining power |

What You See Is What You Get

iClick Interactive Asia Group Porter's Five Forces Analysis

The document you see is your deliverable. It’s ready for immediate use—no customization or setup required. This comprehensive Porter's Five Forces Analysis of iClick Interactive Asia Group meticulously details the competitive landscape, including the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, the threat of substitute products or services, and the intensity of rivalry among existing competitors. Each force is thoroughly examined, providing actionable insights into iClick's strategic positioning and potential challenges within the digital advertising and marketing technology sector.

Rivalry Among Competitors

The Chinese digital advertising and enterprise solutions landscape is intensely competitive, largely shaped by dominant ecosystem players like Tencent, Alibaba, Baidu, and ByteDance. These giants leverage massive user bases and integrated platforms, creating significant pressure on specialized firms such as iClick Interactive Asia Group.

These tech behemoths possess vast troves of first-party data, a critical asset in targeted advertising. For instance, Tencent's WeChat boasts over 1.3 billion monthly active users, while Alibaba's e-commerce platforms offer unparalleled consumer insights. This data advantage allows them to offer highly personalized and effective advertising solutions, making it challenging for smaller players to compete on a similar scale.

Furthermore, these large players offer comprehensive, integrated services that span social media, e-commerce, search, and content. This creates a sticky ecosystem where users and advertisers alike are incentivized to remain within their platforms. iClick, as a more focused enterprise solutions provider, faces the challenge of carving out its niche against these all-encompassing digital powerhouses.

The competitive landscape for iClick Interactive Asia Group is intensely shaped by swift technological progress, particularly in artificial intelligence and big data. Competitors are consistently pushing boundaries by embedding AI across their marketing and enterprise solutions. This forces iClick to channel significant resources into research and development, ensuring they can maintain a competitive edge and offer unique value propositions.

iClick Interactive Asia Group navigates intense competition by focusing on its integrated, data-driven consumer lifecycle solutions for global brands targeting the Chinese market. While tech giants offer broad advertising platforms and specialized firms provide highly focused services, iClick carves out its niche. For instance, in 2023, iClick reported a revenue of RMB 1.5 billion, showcasing its operational scale within this specialized area.

The company's ability to differentiate hinges on its deep understanding of the Chinese consumer and its proprietary data analytics capabilities. This allows them to offer more tailored and effective campaigns than generalist platforms. Maintaining this competitive edge requires continuous investment in technology and talent to stay ahead of evolving digital marketing trends in China.

Strategic Divestments and Mergers

The competitive rivalry within iClick Interactive Asia Group's market is intensified by strategic divestments and mergers. iClick itself shed its mainland China Enterprise Solutions and demand-side Marketing Solutions businesses in 2024, signaling a significant shift. This consolidation trend is further highlighted by iClick's merger with Amber DWM Holding Limited in 2025, marking a pivot to digital wealth management.

These corporate actions underscore a market where companies are actively reshaping their portfolios and consolidating to gain competitive advantages. Such moves often lead to a more concentrated market structure, where fewer, larger players emerge, potentially increasing the intensity of competition among them.

- Strategic Portfolio Reshaping: iClick's 2024 divestments of its Enterprise Solutions and Marketing Solutions businesses demonstrate a strategic move to streamline operations and focus on core competencies.

- Industry Consolidation: The 2025 merger with Amber DWM Holding Limited into a digital wealth management entity points to a broader trend of consolidation within the industry, as companies seek scale and synergy.

- Increased Competitive Intensity: These shifts suggest a dynamic environment where remaining and emerging players will likely face heightened competition as market participants adapt to new strategic alignments.

- Focus on Niche Markets: The pivot to digital wealth management indicates a potential focus on specialized, high-growth segments, where competition may be fierce among established and new entrants.

Pricing Pressure and Margin Compression

The online marketing landscape is fiercely competitive. This intense rivalry, especially when combined with challenging macroeconomic conditions, often translates into significant pricing pressure and can squeeze profit margins.

For iClick Interactive Asia Group, this has been evident in its Marketing Solutions segment. The company reported a decrease in revenue for this division in the first half of 2024, a clear indicator of these market pressures.

This situation highlights the critical need for iClick to strategically shift its focus. The company must concentrate on its higher-margin enterprise solutions to maintain profitability.

- Intense rivalry in the online marketing sector leads to price wars.

- Macroeconomic headwinds further exacerbate pricing pressure.

- H1 2024 revenue decline in iClick's Marketing Solutions signals margin compression.

- A strategic pivot towards **higher-margin enterprise solutions** is crucial for iClick's profitability.

Competitive rivalry is a defining characteristic of the Chinese digital advertising market, with iClick Interactive Asia Group facing intense pressure from tech giants like Tencent and Alibaba. These behemoths leverage vast user bases and proprietary data, creating significant barriers to entry and forcing iClick to strategically differentiate itself. The company's 2024 divestment of its Marketing Solutions business and its 2025 merger into a digital wealth management entity highlight a market undergoing consolidation and strategic shifts to navigate this competitive intensity.

SSubstitutes Threaten

Larger enterprises might choose to build or enhance their in-house marketing and IT departments rather than outsourcing to iClick. This includes developing internal capabilities for data analytics, programmatic advertising, and customer relationship management (CRM) systems. For instance, a company generating over $1 billion in annual revenue might find it cost-effective to invest in a dedicated team for these functions.

This internal development offers companies greater control over their marketing operations and data. It can also lead to potentially lower long-term costs, especially for businesses operating at a significant scale where the investment in internal infrastructure is justified by the volume of marketing activities.

Advertisers increasingly have the option to bypass independent marketing solution providers like iClick by directly engaging with major Chinese digital platforms. Platforms such as WeChat, Douyin, and Baidu offer their own robust advertising tools and data analytics, effectively acting as substitutes for iClick's services. This direct access allows advertisers to manage campaigns and gain insights without an intermediary. For instance, by 2024, the digital advertising market in China, dominated by these platforms, continued to grow significantly, making direct engagement a more attractive and cost-effective option for many businesses.

While iClick Interactive Asia Group thrives in the digital space, traditional advertising methods like television, radio, and print still offer a degree of substitution. These channels, though less data-rich, can reach broad audiences and are sometimes preferred for brand awareness campaigns. For instance, in 2024, despite the digital surge, traditional media still captured a significant portion of advertising spend, with global ad spending on TV projected to reach over $175 billion, indicating their continued relevance as a potential substitute for purely digital strategies.

Generic Business Intelligence and CRM Software

For its enterprise solutions, iClick Interactive Asia Group faces a significant threat from generic business intelligence (BI) and customer relationship management (CRM) software providers. These broader solutions can often be more cost-effective for businesses seeking a comprehensive, all-in-one approach to managing customer data and operations. For instance, many mid-sized businesses might find solutions like Salesforce or Microsoft Dynamics CRM to be more appealing due to their established ecosystems and wider feature sets, even if they lack iClick's specialized data-driven insights into the Chinese market.

While iClick's strength lies in its specialized, data-driven insights tailored for the Chinese digital advertising landscape, businesses can opt for more generalized software suites. These alternatives, often from larger, more established vendors, can fulfill a wider array of operational needs beyond just marketing and customer interaction. In 2023, the global CRM market was valued at approximately $60 billion, with significant growth projected, indicating a robust competitive landscape where generic solutions hold considerable sway.

- Broad Functionality: Generic BI and CRM software often offer a wider range of features, encompassing sales, service, and marketing automation, potentially reducing the need for specialized tools.

- Cost-Effectiveness: For businesses not solely focused on hyper-specialized data analytics, these broader solutions can present a more budget-friendly option.

- Integration Capabilities: Established generic platforms frequently boast extensive integration capabilities with other business software, streamlining workflows.

- Market Maturity: The widespread adoption and maturity of generic BI and CRM software mean businesses have ample choice and readily available support.

Manual Data Analysis and Operations

Smaller businesses or those with less digital experience often stick to manual data analysis and operations. They might use simple spreadsheets or other basic tools instead of investing in advanced enterprise solutions, which iClick offers. This reliance on manual methods acts as a substitute for iClick's more sophisticated offerings, particularly for companies not yet ready for or needing complex systems.

These businesses find that manual processes, while less efficient, are a lower-cost alternative. For instance, a small e-commerce startup in 2024 might manage customer data in Excel, avoiding the subscription fees associated with advanced analytics platforms. This approach allows them to operate within tight budgets and focus resources on core business activities rather than technology infrastructure.

- Manual processes offer a lower initial cost compared to enterprise software.

- Businesses with limited digital maturity may find manual tools easier to manage.

- Spreadsheets and ad-hoc tools can suffice for basic data needs, reducing the perceived value of advanced solutions.

- The availability of free or low-cost spreadsheet software makes manual analysis a readily accessible substitute.

Advertisers can bypass iClick by directly engaging with major Chinese digital platforms like WeChat and Douyin, which offer their own robust advertising tools. This trend is supported by the significant growth in China's digital advertising market, making direct platform access increasingly attractive. Additionally, traditional advertising channels like television remain relevant for broad audience reach, continuing to serve as a substitute for digital-first strategies.

Generic BI and CRM software providers present a threat by offering comprehensive, often more cost-effective, solutions for managing customer data. For instance, established platforms like Salesforce cater to a wide array of business needs, potentially overshadowing specialized offerings. Similarly, smaller businesses may opt for manual data analysis using tools like spreadsheets, avoiding the investment in advanced enterprise solutions.

| Substitute Type | Description | Example/Data Point (2024) |

|---|---|---|

| Direct Platform Engagement | Advertisers bypass intermediaries like iClick to use advertising tools directly on major digital platforms. | China's digital advertising market continued its growth, making direct engagement cost-effective for many businesses. |

| Traditional Media | Channels like TV and print offer broad audience reach for brand awareness campaigns. | Global TV ad spending was projected to exceed $175 billion in 2024, highlighting continued relevance. |

| Generic BI/CRM Software | Broader, all-in-one solutions for customer data management and operations. | The global CRM market was valued around $60 billion in 2023, with substantial projected growth. |

| Manual Data Analysis | Using basic tools like spreadsheets for data management, especially by smaller businesses. | Small e-commerce startups in 2024 might use Excel to manage customer data, avoiding subscription fees. |

Entrants Threaten

Entering the online marketing and enterprise solutions sector, particularly with an emphasis on data-driven and AI-powered services, demands substantial financial outlay. Companies need to invest heavily in robust technology infrastructure, sophisticated data acquisition capabilities, and cutting-edge AI research and development. For instance, building a comparable data analytics platform to iClick’s, which processes vast amounts of user data for targeted advertising, could easily run into tens of millions of dollars in upfront costs.

This significant capital requirement acts as a formidable barrier, discouraging many potential new entrants from even attempting to compete. The ongoing costs associated with maintaining and upgrading these advanced technological systems further amplify this challenge. Consider the ongoing expenditure on cloud computing, data storage, and specialized AI talent, which represent continuous operational investments necessary to remain competitive.

The threat of new entrants in China's digital advertising space is significantly mitigated by stringent data access and regulatory hurdles. For instance, China's Personal Information Protection Law (PIPL), enacted in November 2021, imposes strict rules on data collection, processing, and transfer, making it difficult for newcomers to build compliant datasets. Existing players like iClick Interactive Asia Group, with years of experience and established data partnerships, possess a considerable advantage in navigating these complex regulations. The sheer volume and granularity of consumer data required for effective AI-driven advertising campaigns are difficult and costly for new entrants to replicate.

Established players like iClick Interactive Asia Group have cultivated significant brand recognition and trust with global brands and marketers over years of operation. This deep-seated loyalty makes it challenging for newcomers to penetrate the market. For instance, iClick's extensive network and proven track record in delivering results build a strong barrier for any new entrant aiming to attract the same caliber of clients.

New entrants face the daunting task of investing heavily in brand building and demonstrating their effectiveness to win over clients. This requires substantial financial resources and a considerable amount of time to establish credibility in a landscape already dominated by established, trusted entities. Consider that in 2024, the digital advertising market is projected to reach over $600 billion globally, a testament to the scale of investment needed to even make a dent.

Talent Acquisition Challenges

The threat of new entrants for iClick Interactive Asia Group, particularly concerning talent acquisition, is moderate to high. China's digital marketing and tech sectors are experiencing intense competition for skilled professionals in areas like artificial intelligence, big data analytics, and programmatic advertising. This demand significantly impacts recruitment efforts.

New companies entering the market would likely struggle to attract and retain the top-tier talent that established players like iClick have cultivated. These skilled individuals are often incentivized by the resources, brand recognition, and career advancement opportunities offered by larger, well-known organizations or major technology firms. For instance, in 2023, the demand for AI specialists in China saw an average of 15 job applications per opening, highlighting the competitive landscape for acquiring such talent.

- Intense Demand for Specialized Skills: The Chinese market demonstrates a high need for professionals proficient in AI, big data, and digital marketing technologies.

- Recruitment Hurdles for New Entrants: New companies face considerable difficulty in attracting and securing qualified personnel due to established competition.

- Talent Retention Challenges: Retaining newly hired employees is also a significant hurdle, as professionals are often lured by the stability and growth prospects of larger, recognized companies.

- Competition from Tech Giants: Major tech corporations in China offer competitive compensation and benefits, making it challenging for smaller or newer entrants to compete for talent.

Economies of Scale and Network Effects

Existing players in the digital advertising space, like iClick Interactive Asia Group, benefit significantly from economies of scale. This is evident in their ability to process vast amounts of data more efficiently and negotiate better terms for ad inventory. For instance, major platforms often achieve lower per-unit costs in technology development and purchasing ad space as their volume increases, a hurdle for newcomers.

Network effects further solidify the position of established companies. As more advertisers use a platform, it attracts more users, generating richer data. This data, in turn, makes the platform more valuable to advertisers, creating a self-reinforcing cycle. In 2024, the dominance of large social media and search engine platforms, which inherently possess strong network effects, continues to make it challenging for new entrants to gain traction without substantial initial investment and user acquisition strategies.

- Economies of scale allow iClick and its peers to reduce per-unit costs in data analytics and ad platform development.

- Network effects create a positive feedback loop where increased user engagement leads to more valuable data for advertisers.

- This virtuous cycle makes it difficult for new entrants to achieve critical mass and compete on cost and effectiveness.

- The significant upfront investment required to build comparable data infrastructure and user bases acts as a substantial barrier.

The threat of new entrants for iClick Interactive Asia Group is considerably low due to high capital requirements for technology and data infrastructure, stringent regulatory environments like China's PIPL, and the significant challenge of acquiring and retaining specialized talent. Established brand recognition and network effects further fortify existing players, making it difficult for newcomers to achieve critical mass and compete effectively in the digital advertising landscape.

| Barrier Type | Description | Impact on New Entrants |

| Capital Requirements | Substantial investment needed for technology, data platforms, and AI R&D. | High barrier, requiring tens of millions for comparable infrastructure. |

| Regulatory Hurdles | Strict data privacy laws (e.g., PIPL) complicate data acquisition. | Difficult for newcomers to build compliant datasets; existing players have an advantage. |

| Talent Acquisition | Intense competition for AI, big data, and digital marketing professionals. | New entrants struggle to attract skilled talent against established firms and tech giants. |

| Brand & Network Effects | Established trust with brands and self-reinforcing user-data cycles. | Challenging for new entrants to gain traction and build credibility; difficult to achieve critical mass. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for iClick Interactive Asia Group leverages data from company financial reports, investor presentations, and industry-specific market research. We also incorporate insights from regulatory filings and news articles to capture the competitive landscape and strategic positioning.