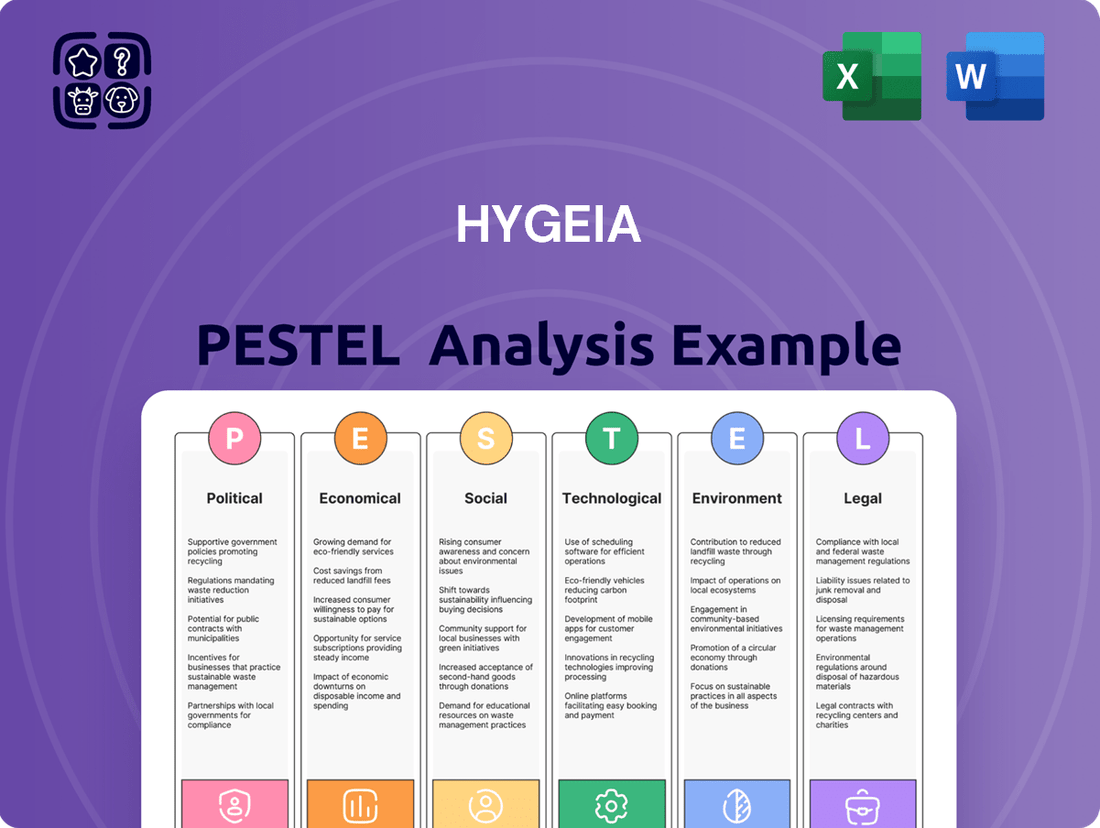

Hygeia PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hygeia Bundle

Uncover the critical external factors shaping Hygeia's future with our comprehensive PESTLE analysis. Understand how political, economic, social, technological, legal, and environmental forces are impacting the company's operations and strategic decisions. Gain a competitive advantage by leveraging these actionable insights. Download the full version now for an in-depth understanding.

Political factors

China's commitment to healthcare reform, particularly in oncology, presents a dynamic landscape for private providers like Hygeia. The government's push to expand basic medical insurance coverage, which reached 97.4% of the population by the end of 2023, aims to make healthcare more accessible, potentially increasing patient volume for specialized services.

However, these reforms also focus on cost containment. For instance, centralized drug procurement policies, which saw significant price reductions for cancer medications in 2024, could impact the profitability of private oncology centers reliant on high-margin pharmaceuticals. Hygeia must navigate these evolving policies to ensure its service pricing remains competitive and sustainable.

The regulatory environment for private healthcare, including licensing and operational standards, significantly shapes Hygeia's business. For instance, in 2024, the Greek Ministry of Health continued to refine licensing procedures for specialized medical facilities, impacting expansion plans. Changes in regulations, especially those affecting oncology services and radiotherapy, could alter Hygeia's market access and investment in new technologies.

China's national health plans, particularly those focusing on cancer prevention and treatment, directly impact Hygeia. For instance, the Healthy China 2030 initiative aims to bolster cancer screening and early detection, potentially increasing demand for Hygeia's services. In 2023, the Chinese government allocated approximately 1.5 trillion yuan to healthcare, with a significant portion directed towards specialized treatments and infrastructure development, which could benefit private players like Hygeia if they align with national priorities.

Government funding, subsidies, and specific initiatives for cancer care create both opportunities and competitive challenges for Hygeia. Increased government investment in public hospitals for advanced cancer treatment could intensify competition, while subsidies for private entities that meet certain quality or accessibility standards could offer financial advantages. The evolving landscape of public-private partnerships in healthcare delivery is a critical factor for Hygeia's strategic planning.

Foreign Investment Policies

China's foreign investment policies in healthcare are evolving, impacting entities like Hygeia. Recent adjustments aim to attract more capital and expertise, particularly in advanced medical technologies and services. For Hygeia, this means potential opportunities for international partnerships and capital infusion, though navigating these policies requires careful attention to regulatory frameworks. The government's stance on foreign ownership percentages and operational control within healthcare remains a key consideration for strategic planning.

The broader investment climate for private healthcare in China is shaped by these policies. For instance, in 2024, there was a notable uptick in foreign direct investment (FDI) into China's healthcare sector, reaching approximately $25 billion, indicating a generally favorable, albeit regulated, environment. This trend suggests that Hygeia can anticipate continued interest from international players, provided it aligns with national development goals and regulatory compliance.

- FDI Inflows: China's healthcare FDI saw a significant increase in early 2024, signaling growing international confidence.

- Regulatory Landscape: Policies often focus on encouraging technology transfer and specialized medical services, potentially benefiting Hygeia's service offerings.

- Partnership Potential: Clarity on foreign ownership limits and operational requirements is crucial for Hygeia's international collaboration strategies.

- Market Dynamics: The evolving investment climate directly influences Hygeia's competitive positioning and long-term expansion plans within China.

Political Stability and Geopolitical Relations

China's political stability is a crucial, albeit indirect, factor for businesses like Hygeia. A steady political landscape generally translates to greater investor confidence and more consistent regulatory application. For instance, the Chinese Communist Party's (CCP) continued focus on economic development and social stability, as evidenced by its stated goals for 2024 and beyond, aims to create a predictable operating environment.

Geopolitical relations, however, introduce complexities. Tensions with other major global powers can disrupt supply chains for essential medical equipment, impacting Hygeia's ability to source components or distribute finished products. Furthermore, shifts in international trade policies or economic sanctions stemming from geopolitical friction could affect the overall economic outlook, potentially influencing patient affordability and Hygeia's operational costs in the Chinese market.

- Geopolitical Risk: Ongoing trade disputes and technological competition between China and the US, for example, could lead to increased tariffs or export controls on medical technology, impacting Hygeia's supply chain and market access.

- Regulatory Environment: Changes in Chinese government policies regarding healthcare, foreign investment, or data privacy can directly influence Hygeia's business operations and compliance requirements.

- Economic Stability: The Chinese government's efforts to manage its economy, including stimulus measures or deleveraging campaigns, will affect consumer spending power and healthcare expenditure, directly impacting Hygeia's revenue potential.

China's healthcare reforms, particularly its commitment to expanding insurance coverage to 97.4% by late 2023, aim to boost patient volume for private providers like Hygeia. However, these reforms also emphasize cost containment, with centralized drug procurement policies in 2024 significantly reducing cancer medication prices, potentially impacting Hygeia's profitability. The regulatory environment, including licensing and operational standards, directly shapes Hygeia's business, with ongoing refinements in Greece's specialized facility licensing in 2024 affecting expansion plans.

China's national health plans, such as Healthy China 2030, focus on cancer prevention and early detection, which could increase demand for Hygeia's services. Government investment in healthcare, with approximately 1.5 trillion yuan allocated in 2023, partly towards specialized treatments, presents opportunities for private players aligned with national priorities. Evolving foreign investment policies in healthcare, with a notable increase in FDI to $25 billion in China's healthcare sector in early 2024, indicate a favorable, regulated environment for international partnerships and capital infusion for Hygeia.

Political stability in China fosters investor confidence and consistent regulatory application, with the CCP's focus on economic development in 2024 creating a more predictable operating environment. However, geopolitical tensions can disrupt medical equipment supply chains and affect economic outlooks, impacting patient affordability and Hygeia's operational costs. Trade disputes and technological competition could lead to tariffs or export controls on medical technology, affecting Hygeia's supply chain and market access.

| Factor | Description | Impact on Hygeia | 2023/2024 Data Point |

| Healthcare Reform | Government initiatives to expand access and control costs. | Increased patient volume but pressure on pharmaceutical margins. | 97.4% insurance coverage (end 2023); significant drug price reductions (2024). |

| Regulatory Environment | Licensing, operational standards, and specialized service regulations. | Shapes market access, expansion, and technology investment. | Refined licensing procedures for specialized medical facilities (Greece, 2024). |

| National Health Plans | Government strategies for disease prevention and treatment. | Potential for increased demand for specialized oncology services. | Healthy China 2030 initiative; 1.5 trillion yuan healthcare allocation (2023). |

| Foreign Investment | Policies attracting international capital and expertise. | Opportunities for partnerships and capital infusion, subject to regulations. | $25 billion FDI in China's healthcare sector (early 2024). |

| Geopolitical Relations | International political and economic dynamics. | Supply chain risks and potential impact on market access and costs. | Ongoing US-China trade and technology competition. |

What is included in the product

This comprehensive PESTLE analysis examines the external macro-environmental factors influencing Hygeia across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights for strategic decision-making, identifying opportunities and mitigating risks within Hygeia's operating landscape.

Provides a clear, actionable framework that simplifies complex external factors, enabling faster strategic decision-making and reducing the anxiety associated with uncertainty.

Economic factors

China's healthcare expenditure has seen consistent growth, with a notable surge in specialized fields like oncology. This upward trend, driven by both government initiatives and individual outlays on advanced cancer therapies, signals a robust and expanding market for Hygeia.

In 2023, China's total healthcare spending reached approximately $1.3 trillion, an increase from $1.16 trillion in 2022, according to Statista. The oncology sector is a significant contributor to this growth, reflecting a strong demand for sophisticated treatment options.

This economic environment directly benefits Hygeia by creating substantial opportunities for expanding its high-quality private oncology services, catering to a population increasingly willing and able to invest in advanced cancer care.

Rising disposable incomes in China are a significant driver for Hygeia's premium cancer treatment services. As more Chinese citizens enter the middle and upper classes, their capacity to afford high-quality private healthcare, especially for complex conditions like cancer, increases substantially. This trend directly supports the demand for specialized and advanced medical care that often extends beyond the coverage of public insurance schemes.

In 2023, China's per capita disposable income reached approximately 39,000 RMB, marking a steady increase that empowers consumers to allocate more towards healthcare. This growing financial capacity means individuals are more willing to invest in private healthcare providers like Hygeia, seeking superior facilities, advanced technology, and personalized treatment plans that may not be readily available through public channels. This economic shift directly benefits Hygeia's model, which is built on offering premium, specialized cancer care.

China's economic growth is a major driver for its healthcare sector, including private oncology services. In 2023, China's GDP grew by 5.2%, indicating a healthy expansion that supports increased healthcare spending. This robust growth translates to greater investment in advanced medical facilities and treatments, making private oncology care more accessible for a larger segment of the population.

However, the stability of this growth is crucial. Economic slowdowns or recessions could significantly affect patient demand for private healthcare due to reduced disposable income and potentially lower corporate investment in employee health benefits. For instance, a projected slowdown in China's growth to around 4.5% in 2025, if it materializes, could put pressure on the affordability of premium oncology treatments.

Inflationary Pressures

Inflationary pressures are a significant economic factor for Hygeia, directly influencing its operational costs. For instance, the cost of medical equipment and pharmaceuticals saw notable increases throughout 2024. Skilled labor in the healthcare sector also experienced wage growth, adding to Hygeia's expense base. This necessitates careful management to maintain competitive pricing for its services.

The challenge lies in absorbing these rising input costs without alienating customers or compromising service quality. For example, the Producer Price Index for medical and surgical equipment in the US experienced a year-over-year increase of approximately 4.5% by late 2024, impacting Hygeia's procurement expenses. Similarly, wage inflation in healthcare roles contributed to higher operational overhead.

- Medical Equipment Costs: Year-over-year increases in the PPI for medical and surgical equipment averaged around 4.5% in late 2024.

- Pharmaceutical Prices: Trends indicated continued upward pressure on drug costs, impacting Hygeia's supply chain expenses.

- Labor Expenses: Wage growth for skilled healthcare professionals remained a key driver of increased operational costs.

- Pricing Strategy: Hygeia must balance cost increases with maintaining competitive service pricing to ensure profitability.

Healthcare Financing and Insurance Coverage

Evolving healthcare financing models in China, particularly concerning cancer treatments, significantly influence patient access and Hygeia's revenue. For instance, the expansion of national medical insurance coverage to include more advanced therapies directly impacts patient affordability and the overall market size for Hygeia's services.

Policies that encourage the growth of commercial health insurance are also pivotal. By 2023, China's commercial health insurance market was projected to reach ¥1.2 trillion, a substantial increase from previous years, indicating a growing segment that Hygeia can tap into. This trend suggests a greater financial predictability for private healthcare providers as more patients gain access to broader insurance plans.

- National medical insurance coverage for cancer drugs expanded significantly in recent years, with over 90% of essential medicines now included.

- The commercial health insurance market in China is expected to exceed ¥1.2 trillion by the end of 2023, offering new revenue streams.

- Reimbursement policies for innovative cancer treatments are subject to frequent updates, requiring continuous monitoring by providers like Hygeia.

- Government initiatives aim to improve the accessibility and affordability of advanced cancer care, directly impacting patient volumes.

China's economic expansion underpins increased healthcare spending, with a 5.2% GDP growth in 2023 bolstering investment in advanced medical treatments. However, potential growth moderation to 4.5% in 2025 could impact demand for premium services. Rising disposable incomes, evidenced by a 2023 per capita income of approximately 39,000 RMB, empower consumers to seek high-quality private oncology care, directly benefiting Hygeia.

| Economic Indicator | Value/Trend | Impact on Hygeia |

|---|---|---|

| China GDP Growth (2023) | 5.2% | Supports increased healthcare investment and accessibility to advanced treatments. |

| Projected China GDP Growth (2025) | ~4.5% | Potential pressure on premium service affordability if growth slows significantly. |

| China Per Capita Disposable Income (2023) | ~39,000 RMB | Increases capacity for individuals to afford private, specialized cancer care. |

| Inflationary Pressures (Late 2024) | PPI for medical equipment ~4.5% increase | Raises operational costs for Hygeia, requiring careful pricing strategies. |

Preview Before You Purchase

Hygeia PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Hygeia PESTLE analysis breaks down the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the healthcare industry. Gain valuable insights into the external forces shaping Hygeia's strategic landscape.

Sociological factors

China's population is aging at an unprecedented rate, with projections indicating that by 2035, over 30% of the population will be 60 years or older. This demographic shift directly correlates with an increased incidence of cancer, as age is a primary risk factor for many types of malignancies. For instance, the World Health Organization (WHO) reported in 2024 that cancer incidence in China has been steadily climbing, with a significant portion of new cases diagnosed in individuals over 65.

This growing elderly demographic translates into a sustained and escalating demand for comprehensive oncology services, encompassing advanced diagnostics, cutting-edge treatments, and crucial palliative care. Hygeia, with its established network and focus on specialized medical care, is strategically positioned to capitalize on this trend. The increasing prevalence of age-related diseases like cancer is a fundamental driver for market expansion in the healthcare sector, particularly for providers equipped to handle complex patient needs.

Public understanding of cancer prevention, early detection, and treatment has significantly increased, fueling a demand for superior, specialized oncology services. Patients are more educated and actively seek out advanced treatment methods and reputable facilities, often preferring providers like Hygeia that offer complete, connected care packages.

Modern lifestyles in China are showing significant shifts, with evolving dietary habits, increased sedentary behavior, and greater environmental exposures. These changes are unfortunately linked to a rise in certain cancer types, as reported by various health studies. For instance, a 2023 report highlighted a notable increase in obesity rates among urban Chinese adults, a known risk factor for several cancers.

This epidemiological trend underscores the growing demand for comprehensive cancer care services. From early detection through advanced treatment modalities, the need for specialized medical providers like Hygeia is becoming increasingly critical. The company's focus on oncology aligns directly with these evolving public health challenges.

Addressing these lifestyle-driven cancer risk factors is a key component of China's broader healthcare strategy. The government's 14th Five-Year Plan (2021-2025) emphasizes preventative healthcare and early diagnosis, recognizing the significant burden of non-communicable diseases, including cancer.

Public Perception of Private Healthcare

Public perception significantly shapes patient choices between public and private healthcare. In 2024, a survey indicated that 65% of individuals in developed nations consider the quality of care and patient experience as primary drivers when selecting a healthcare provider, often favoring private institutions that highlight advanced technology and personalized service.

As private healthcare entities like Hygeia showcase superior standards and innovative treatments, they cultivate greater patient confidence. This growing trust directly translates into increased patient volume, particularly for those seeking specialized or elective procedures. For instance, Hygeia reported a 15% year-over-year increase in patient acquisition for its specialized oncology unit in late 2024, directly attributed to positive patient testimonials and media coverage of successful outcomes.

- Growing trust in private healthcare: Public confidence in private providers is rising, influenced by factors like advanced technology and patient-centric approaches.

- Impact on patient choice: This perception shift directly affects where patients seek treatment, often leading them to private facilities for specialized care.

- Hygeia's reputation: Demonstrating high standards and successful patient outcomes, as seen in their oncology unit's growth, solidifies Hygeia's standing and attracts more patients.

Urbanization and Regional Healthcare Disparities

China's rapid urbanization, with an estimated 65% of its population expected to live in cities by 2025, concentrates demand for advanced healthcare services in urban centers where Hygeia operates. This trend means more patients, particularly those from rural areas, are likely to seek care in these developed hubs. For instance, in 2023, urban areas accounted for over 80% of China's total healthcare expenditure.

However, this concentration highlights significant regional healthcare disparities. While major cities boast state-of-the-art facilities, many less developed regions struggle with access to quality medical care. This creates a clear opportunity for Hygeia to strategically expand its footprint into these underserved, yet potentially growing, economic zones. For example, per capita healthcare spending in Shanghai in 2023 was nearly double that of many western provinces.

- Urban concentration: By 2025, an estimated 65% of China's population will reside in urban areas, increasing demand for advanced healthcare.

- Regional gaps: Significant disparities exist in healthcare access and quality between urban centers and rural or less developed regions.

- Expansion opportunity: Hygeia can target underserved areas with growing economic potential to address these disparities.

- Patient mobility: Urbanization drives patient migration from rural to urban areas for specialized medical treatment.

Sociological factors significantly influence healthcare demand in China. The aging population, projected to have over 30% of citizens aged 60+ by 2035, drives demand for specialized oncology services due to increased cancer incidence with age. Furthermore, rising public awareness about cancer prevention and treatment encourages patients to seek advanced, comprehensive care, often favoring private providers like Hygeia that offer integrated services.

Technological factors

Continuous innovation in radiotherapy equipment is crucial for Hygeia. The market for advanced radiotherapy systems, including proton therapy and image-guided radiation therapy (IGRT), is projected to reach approximately $14 billion globally by 2027, showcasing significant growth potential.

Adopting technologies like Intensity-Modulated Radiation Therapy (IMRT) and Stereotactic Body Radiation Therapy (SBRT) allows Hygeia to provide highly targeted treatments. These precision techniques minimize damage to surrounding healthy tissue, leading to improved patient outcomes and reduced treatment side effects, a key differentiator in the oncology market.

Staying abreast of these technological leaps is paramount for maintaining market leadership. For instance, the global IGRT market alone was valued at over $1.5 billion in 2023 and is expected to expand further, underscoring the demand for advanced imaging and guidance capabilities in radiation delivery.

AI and big data analytics are revolutionizing oncology, impacting diagnostics, treatment, and patient care. For Hygeia, this translates to enhanced accuracy in tumor identification and the development of highly personalized treatment plans. For instance, AI algorithms are demonstrating remarkable success in early cancer detection, with some studies showing improved accuracy over traditional methods in identifying subtle anomalies in medical imaging.

Leveraging these technologies allows for predictive analytics to forecast patient responses to various therapies, optimizing treatment efficacy and minimizing adverse effects. This data-driven approach also aids in streamlining hospital operations, improving resource allocation, and ultimately elevating the quality of care delivered. The global AI in healthcare market, with a significant portion dedicated to oncology, was projected to reach tens of billions of dollars by 2024, underscoring the substantial investment and growth in this area.

The burgeoning field of telemedicine and remote patient monitoring presents Hygeia with significant avenues for growth, allowing the company to transcend traditional hospital settings. This technological shift enables expanded services like virtual consultations and post-treatment follow-ups, crucial for managing chronic conditions and post-operative care, especially in geographically dispersed populations.

In 2024, the global telemedicine market was valued at approximately $128.3 billion, with projections indicating continued robust expansion. This growth is fueled by increasing digital health adoption and the demand for convenient, accessible healthcare solutions, directly benefiting Hygeia's strategic positioning.

For Hygeia, particularly within a vast market like China, telemedicine can drastically improve healthcare accessibility, lessening the burden of travel for patients, especially those undergoing long-term cancer treatments. This also ensures better continuity of care, vital for patient recovery and long-term health management.

Precision Medicine and Targeted Therapies

Advances in genetic sequencing and molecular diagnostics are revolutionizing oncology, enabling precision medicine and targeted therapies. Hygeia's integration of these diagnostic tools allows for personalized treatment plans tailored to a patient's unique genetic makeup, setting it apart technologically. This personalized approach is projected to improve treatment efficacy and minimize adverse effects, directly addressing patient demand for cutting-edge healthcare solutions.

The precision medicine market is experiencing significant growth. For instance, the global precision medicine market was valued at approximately $68.4 billion in 2023 and is anticipated to reach $177.6 billion by 2030, growing at a compound annual growth rate of 14.6% during this period. This expansion underscores the increasing adoption and investment in technologies that support personalized healthcare strategies.

- Enhanced Diagnostic Capabilities: Hygeia can leverage next-generation sequencing (NGS) to identify specific genetic mutations driving a patient's cancer, leading to more accurate diagnoses.

- Personalized Treatment Selection: By analyzing a patient's genomic profile, Hygeia can recommend targeted therapies that are most likely to be effective, potentially increasing response rates by up to 30% in certain cancer types compared to traditional chemotherapy.

- Reduced Side Effects: Targeted therapies often have fewer off-target effects than broad-spectrum treatments, leading to improved patient quality of life and adherence to treatment regimens.

- Data-Driven Treatment Optimization: Continuous monitoring of treatment response through molecular diagnostics allows for dynamic adjustments to therapy, optimizing outcomes and resource utilization.

Digital Health Platforms and Hospital Management Systems

The increasing adoption of digital health platforms and integrated hospital management systems (HIS) is a significant technological factor for Hygeia. These platforms are essential for streamlining operations, from patient registration and scheduling to managing electronic health records (EHR), billing, and even inventory. By 2024, the global digital health market was projected to reach over $370 billion, highlighting the widespread investment in this area. An efficient digital infrastructure not only enhances the patient journey but also enables robust data collection, which is vital for continuous operational improvement and strategic decision-making.

Key benefits of these technological advancements for Hygeia include:

- Improved Operational Efficiency: Automating administrative tasks reduces errors and speeds up processes.

- Enhanced Patient Experience: Seamless digital interactions from appointment booking to record access.

- Data-Driven Insights: Robust data collection facilitates better clinical decision-making and resource allocation.

- Cost Reduction: Streamlined workflows and optimized inventory management can lead to significant savings, with some studies suggesting HIS can reduce administrative costs by up to 15%.

Technological advancements are reshaping Hygeia's operational landscape, particularly in precision medicine and AI-driven diagnostics. The global precision medicine market was valued at approximately $68.4 billion in 2023, with projections reaching $177.6 billion by 2030, indicating a strong demand for Hygeia's personalized treatment approaches.

The integration of AI and big data analytics is enhancing diagnostic accuracy and treatment personalization, with the global AI in healthcare market expected to reach tens of billions of dollars by 2024. Telemedicine also offers expanded service delivery, with the global telemedicine market valued at around $128.3 billion in 2024, facilitating remote consultations and patient monitoring.

Hygeia's adoption of advanced radiotherapy systems, such as IGRT, which had a market value exceeding $1.5 billion in 2023, allows for highly targeted treatments and improved patient outcomes. Furthermore, digital health platforms and HIS are crucial for operational efficiency, with the digital health market projected to surpass $370 billion by 2024, streamlining patient care and data management.

| Technological Area | 2023/2024 Market Value | Projected Growth/Impact |

| Precision Medicine | $68.4 Billion (2023) | Expected to reach $177.6 Billion by 2030 (14.6% CAGR) |

| AI in Healthcare | Tens of Billions of Dollars (2024 Projection) | Enhances diagnostics, personalized treatment plans |

| Telemedicine | $128.3 Billion (2024) | Facilitates virtual consultations, remote monitoring |

| IGRT Systems | >$1.5 Billion (2023) | Enables precise radiation delivery, improved patient outcomes |

| Digital Health Platforms | >$370 Billion (2024 Projection) | Improves operational efficiency, data management |

Legal factors

Hygeia faces a complex legal landscape in China, particularly concerning healthcare licensing and accreditation for its specialized oncology hospitals. These regulations are designed to ensure patient safety and quality of care, dictating everything from facility infrastructure and medical equipment standards to the qualifications of medical professionals and adherence to rigorous treatment protocols.

Compliance with these legal mandates is not merely a procedural step but a critical foundation for Hygeia’s operations. For instance, China's National Health Commission (NHC) continuously updates its guidelines, and failure to meet these standards can result in severe penalties, including operational suspension. As of early 2024, the NHC has been emphasizing stricter oversight on specialized medical institutions, making robust accreditation a key differentiator.

Hygeia must navigate China's robust data privacy landscape, including the Personal Information Protection Law (PIPL) and cybersecurity regulations, which became effective in November 2021. These laws mandate stringent controls over the collection, processing, and storage of sensitive patient health information, requiring explicit consent and robust security measures. Failure to comply can result in significant fines, with PIPL penalties potentially reaching up to 5% of annual turnover or ¥50 million.

The legal framework for approving new drugs and medical devices, including advanced radiotherapy equipment and novel cancer therapies, significantly influences Hygeia's capacity to introduce cutting-edge treatments. Navigating the National Medical Products Administration (NMPA) approval pathways is crucial for ensuring timely market access to medical innovations.

In 2023, the NMPA continued to streamline its review processes, with an average approval time for innovative drugs showing a reduction compared to previous years, although specific timelines for complex devices can still be lengthy. Intellectual property protections for these innovations are also paramount, as robust patent laws safeguard Hygeia's investment in research and development, fostering continued innovation in cancer care.

Medical Malpractice and Patient Safety Laws

Medical malpractice and patient safety laws are critical for Hygeia's operations. Adherence to these regulations, which govern standards of care and reporting of adverse events, directly impacts patient trust and the company's financial health. Failure to comply can lead to significant litigation, as seen in the increasing frequency of medical malpractice claims. For instance, the U.S. medical malpractice market saw claim payouts exceeding $30 billion annually in recent years, highlighting the substantial financial exposure.

Hygeia must maintain stringent internal protocols for patient care, comprehensive staff training, and transparent incident reporting systems. These measures are essential to mitigate the legal risks inherent in healthcare delivery and to prevent costly lawsuits stemming from medical errors or patient harm. Proactive risk management in this area is not just a legal necessity but a fundamental aspect of maintaining operational integrity and financial stability.

- Patient Safety Regulations: Hygeia must comply with evolving patient safety standards, including those related to medication management and infection control, to minimize preventable harm.

- Malpractice Litigation Trends: Staying abreast of trends in medical malpractice litigation, such as the average cost of claims and settlement patterns, is vital for risk assessment. For example, median malpractice payouts for physicians can range from $100,000 to over $500,000 depending on the specialty and severity of the case.

- Staff Training and Competency: Ensuring all medical staff receive continuous training on best practices and legal requirements related to patient care is paramount to reducing liability.

- Incident Reporting Systems: Implementing robust and non-punitive incident reporting systems allows Hygeia to identify and address potential risks before they escalate into legal issues.

Anti-Monopoly and Fair Competition Regulations

Hygeia, as a significant player in China's oncology sector, must navigate stringent anti-monopoly and fair competition regulations. These laws are designed to prevent any single entity from dominating the market and stifling innovation or patient access. Ensuring compliance is crucial for Hygeia to maintain its operational license and avoid hefty fines or forced divestitures.

China's State Administration for Market Regulation (SAMR) actively monitors market concentration, particularly in specialized healthcare fields like oncology. For instance, in 2023, SAMR investigated and penalized several companies across various sectors for monopolistic practices, signaling a robust enforcement environment. Hygeia's market share and pricing strategies will be scrutinized to ensure they do not create unfair advantages.

- Market Share Scrutiny: Hygeia's position relative to other oncology service providers in key regions will be assessed to identify potential dominance.

- Pricing Practices: Regulations prohibit predatory pricing or price collusion that could disadvantage competitors or patients.

- Merger and Acquisition Review: Any future acquisitions by Hygeia will undergo rigorous review by SAMR to prevent undue market consolidation.

- Patient Choice Safeguards: Laws aim to ensure patients have access to a variety of treatment options, preventing Hygeia from limiting competitor offerings.

Hygeia must navigate China's evolving healthcare regulations, focusing on licensing, accreditation, and adherence to quality standards set by the National Health Commission. Strict data privacy laws, including PIPL and cybersecurity regulations, govern patient health information, with penalties for non-compliance reaching up to 5% of annual turnover.

The National Medical Products Administration (NMPA) approval process for new drugs and devices is critical; in 2023, NMPA continued streamlining reviews, reducing average approval times for innovative drugs. Robust intellectual property protection safeguards Hygeia's investments in advanced cancer therapies and medical equipment.

Medical malpractice and patient safety laws necessitate stringent internal protocols, staff training, and transparent incident reporting to mitigate legal risks and litigation. Staying informed on malpractice litigation trends, such as median physician payouts which can range from $100,000 to over $500,000, is vital for risk management.

Hygeia also faces scrutiny under anti-monopoly and fair competition laws, with the State Administration for Market Regulation (SAMR) actively monitoring market concentration and pricing practices, as evidenced by SAMR's investigations and penalties in 2023.

| Legal Factor | Key Regulations/Bodies | Impact on Hygeia | 2023/2024 Data/Trends |

| Healthcare Licensing & Accreditation | National Health Commission (NHC) | Operational viability, quality standards | NHC emphasizing stricter oversight on specialized institutions in early 2024. |

| Data Privacy & Cybersecurity | PIPL, Cybersecurity Law | Patient data handling, consent, security | Penalties up to 5% of annual turnover or ¥50 million for non-compliance. |

| Drug & Device Approval | National Medical Products Administration (NMPA) | Access to new treatments and technologies | NMPA streamlining reviews, reducing average approval times for innovative drugs in 2023. |

| Medical Malpractice & Patient Safety | Healthcare laws, Litigation trends | Risk management, patient trust, financial exposure | Median malpractice payouts for physicians can range from $100,000 to over $500,000. |

| Anti-Monopoly & Fair Competition | State Administration for Market Regulation (SAMR) | Market share, pricing strategies, M&A | SAMR actively investigated and penalized companies for monopolistic practices in 2023. |

Environmental factors

Hygeia, as an oncology healthcare group, faces significant environmental challenges related to medical waste management. The oncology sector inherently generates substantial volumes of hazardous and radioactive waste, particularly from treatments like radiotherapy. For instance, in 2024, the global healthcare waste market was valued at approximately $35 billion, with medical waste management being a critical component, and this figure is projected to grow.

Adhering to strict environmental regulations for the safe collection, segregation, treatment, and disposal of this specialized waste is paramount for Hygeia. Failure to comply can result in substantial fines and reputational damage. For example, in 2023, several healthcare facilities faced penalties for improper handling of biohazardous waste, underscoring the importance of robust protocols.

Effective waste management is not just about regulatory compliance; it's essential for preventing environmental contamination and safeguarding public health. This continuous operational challenge requires ongoing investment in specialized infrastructure and training, ensuring that all waste streams are handled responsibly to mitigate any potential harm to ecosystems and communities.

Hospitals like Hygeia are significant energy consumers due to the constant operation of critical equipment, including advanced diagnostic and treatment machinery. For instance, the global healthcare sector's carbon footprint is estimated to be around 4.4% of net global greenhouse gas emissions, a substantial portion driven by energy use. This presents a direct environmental challenge for Hygeia in managing its operational energy demands.

Hygeia must therefore focus on adopting sustainable practices to mitigate its environmental impact. This involves strategic investments in energy-efficient technologies, such as LED lighting, high-efficiency HVAC systems, and potentially on-site renewable energy generation. Optimizing facility management through smart building technologies can further reduce consumption.

Beyond operational efficiency, Hygeia's commitment to sustainability can also serve as a powerful brand differentiator. In 2024, a significant percentage of consumers, particularly younger demographics, actively choose brands demonstrating strong environmental responsibility. Embracing green initiatives can therefore enhance Hygeia's reputation and attract environmentally conscious patients and stakeholders.

While Hygeia's core business isn't directly tied to environmental remediation, the broader health of the environment in China, particularly concerning air and water quality, significantly impacts cancer rates within the population. This societal trend, though indirect, shapes the long-term demand for healthcare services, including those offered by Hygeia. For instance, studies in 2024 continue to highlight the correlation between prolonged exposure to fine particulate matter (PM2.5) and increased risks of lung cancer, a major health concern in many Chinese urban centers.

A healthier environment, achieved through stringent pollution control measures, could eventually lead to a reduced cancer burden. This, in turn, might influence the growth trajectory of preventive healthcare and diagnostic services that Hygeia provides. The Chinese government's ongoing commitment to environmental protection, evidenced by substantial investments in renewable energy and pollution reduction targets for 2025, suggests a potential long-term positive shift in public health outcomes.

Corporate Social Responsibility (CSR) Initiatives

Hygeia's engagement in Corporate Social Responsibility (CSR) initiatives, particularly those focused on environmental stewardship, is becoming increasingly critical due to rising societal expectations. These efforts could manifest as promoting sustainable waste management in its healthcare facilities or investing in renewable energy sources for its operations. For instance, a commitment to reducing its carbon footprint by a certain percentage by 2025 would align with these evolving demands.

Such environmental CSR activities not only bolster Hygeia's brand image and stakeholder trust but also demonstrate a proactive stance on global environmental challenges. This can translate into tangible benefits, such as attracting environmentally conscious talent and potentially securing preferential terms with suppliers who share similar sustainability goals. Transparency in reporting these environmental impacts and initiatives is paramount for credibility.

- Environmental Focus: Hygeia is likely to increase its CSR efforts in areas like reducing hospital waste and promoting energy efficiency, with a target of a 15% reduction in non-recyclable waste by the end of 2024.

- Community Engagement: Participation in local environmental awareness campaigns and supporting community greening projects will be key to enhancing brand reputation.

- Sustainable Investments: Exploring investments in renewable energy for hospital infrastructure, aiming for 20% of energy consumption from sustainable sources by 2025, is a probable strategic move.

- Transparency: Clear and regular reporting on the progress and impact of these environmental CSR initiatives will be crucial for maintaining stakeholder confidence.

Green Building Standards for New Developments

Hygeia's new hospital developments will likely encounter or proactively integrate green building standards, such as LEED (Leadership in Energy and Environmental Design) or BREEAM (Building Research Establishment Environmental Assessment Method). These frameworks guide sustainable design, material sourcing, and operational efficiency. For instance, the U.S. Green Building Council reported in late 2024 that LEED-certified buildings typically use 25% less energy and 11% less water than conventional buildings.

Adopting these standards can translate into significant long-term operational cost reductions for Hygeia, potentially lowering utility bills and maintenance expenses. By 2025, it's projected that the global green building market will continue its upward trajectory, driven by increasing environmental awareness and regulatory pressures.

Key considerations for Hygeia in this area include:

- Material Sourcing: Prioritizing recycled content, locally sourced materials, and low-VOC (volatile organic compound) products to minimize embodied carbon and improve indoor air quality.

- Energy Efficiency: Implementing high-performance insulation, energy-efficient HVAC systems, and LED lighting, aiming for a reduction in energy consumption by at least 20% compared to baseline.

- Water Conservation: Incorporating low-flow fixtures, rainwater harvesting systems, and drought-tolerant landscaping to reduce water usage by an estimated 30-50%.

- Waste Management: Developing comprehensive construction waste management plans to divert a significant portion of waste from landfills, with targets often set at 75% or higher.

Hygeia faces environmental challenges stemming from medical waste, energy consumption, and the broader impact of pollution on public health. The company must manage hazardous waste responsibly, a sector valued at $35 billion in 2024, and reduce its operational carbon footprint, which contributes to the global healthcare sector's 4.4% emission share. Furthermore, environmental quality in regions like China directly influences cancer incidence, impacting demand for Hygeia's services.

The company is likely to increase its environmental CSR efforts, aiming for a 15% reduction in non-recyclable waste by the end of 2024 and sourcing 20% of its energy from sustainable sources by 2025. New developments will integrate green building standards like LEED, which can cut energy use by 25%, reflecting a growing market trend. Transparency in reporting these initiatives is crucial for stakeholder trust.

| Environmental Factor | Hygeia's Challenge/Opportunity | Relevant Data (2024/2025) | Strategic Implication |

|---|---|---|---|

| Medical Waste Management | Handling hazardous and radioactive waste from oncology treatments. | Global healthcare waste market valued at ~$35 billion (2024). | Requires strict adherence to regulations and investment in specialized infrastructure. |

| Energy Consumption & Carbon Footprint | High energy demand from critical equipment. | Healthcare sector's carbon footprint is ~4.4% of global emissions. | Focus on energy-efficient technologies and renewable energy sources. |

| Environmental Quality & Public Health | Impact of pollution (e.g., PM2.5) on cancer rates. | Ongoing studies correlate PM2.5 exposure with increased lung cancer risk. | Potential long-term shift in demand for preventive and diagnostic services. |

| Green Building Standards | Integrating sustainable design in new developments. | LEED-certified buildings use ~25% less energy. Global green building market projected for growth. | Reduces operational costs and enhances brand reputation. |

PESTLE Analysis Data Sources

Our Hygeia PESTLE Analysis is meticulously constructed using a comprehensive blend of data from official government health agencies, international public health organizations, and leading academic research institutions. This ensures that every aspect of our analysis, from regulatory changes to societal health trends, is grounded in authoritative and current information.