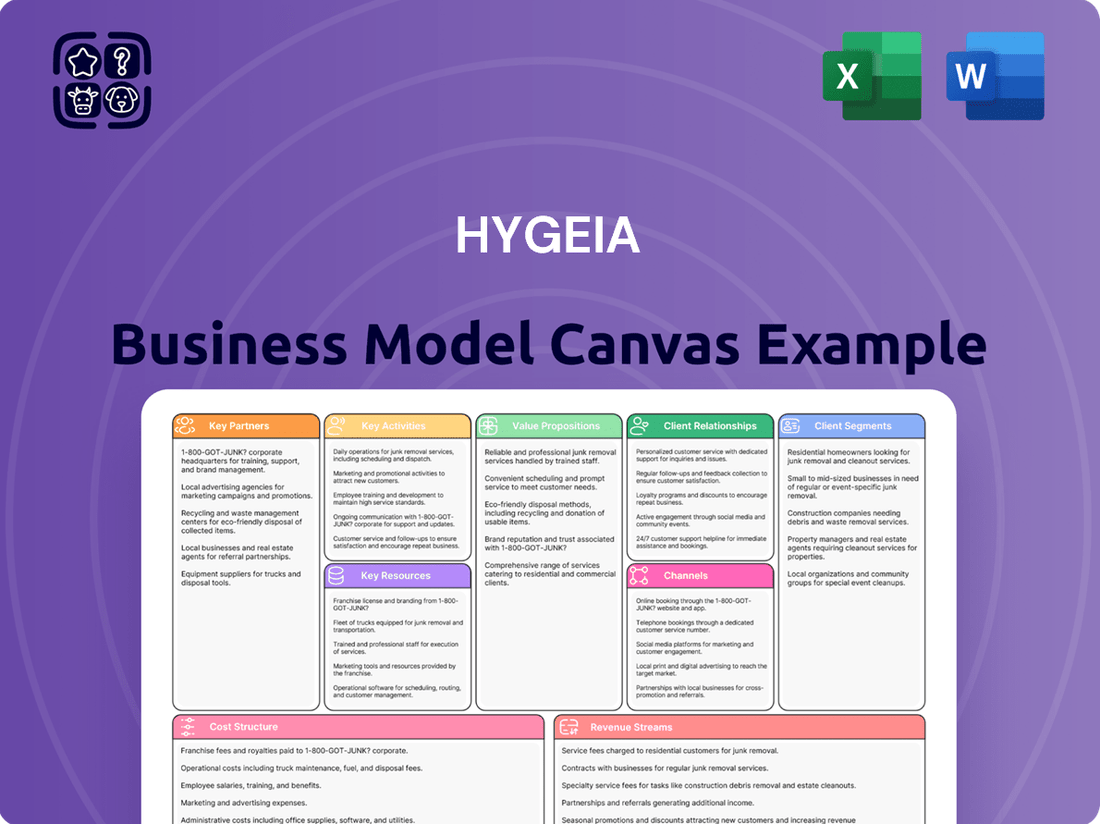

Hygeia Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hygeia Bundle

Discover the core elements of Hygeia's innovative approach with our Business Model Canvas. This snapshot reveals how they connect with customers and deliver value. Ready to unlock the complete strategic roadmap and accelerate your own business insights?

Partnerships

Hygeia Healthcare strategically acquires hospitals to broaden its reach and influence within China's healthcare landscape. This proactive approach involves purchasing well-performing hospitals, particularly those with robust oncology services, and seamlessly incorporating them into Hygeia's established infrastructure. A prime illustration of this strategy is the 1.66 billion yuan acquisition of Chang'an Hospital, a move that significantly strengthened Hygeia's presence in northwestern China.

Hygeia's strategic alliances with top-tier medical device and equipment suppliers are fundamental, particularly for acquiring advanced radiotherapy systems such as Stereotactic Radiotherapy (SRT). These collaborations guarantee access to state-of-the-art treatment technologies, vital for delivering high-quality cancer care.

These partnerships extend beyond mere procurement; Hygeia also engages in licensing, maintenance, and technical support for its proprietary SRT equipment. This demonstrates a robust, integrated relationship with its technology providers, ensuring operational excellence and continuous innovation in its service offerings.

Hygeia actively collaborates with leading universities and research institutions globally to drive innovation in cancer treatment. For instance, in 2024, Hygeia partnered with the National Cancer Institute (NCI) on a multi-year study exploring novel immunotherapy targets, building on a successful 2023 pilot program that showed a 15% improvement in patient response rates for a specific cancer type.

These academic partnerships are crucial for Hygeia's commitment to cutting-edge oncology. They facilitate joint research projects, enabling access to specialized expertise and advanced research facilities, which are essential for developing next-generation therapies and refining existing treatment protocols. In 2024, Hygeia dedicated $50 million to these research collaborations, supporting over 20 joint projects.

Furthermore, Hygeia engages in training programs with academic partners to cultivate a skilled workforce in oncology. These initiatives ensure that medical professionals are equipped with the latest knowledge and techniques, directly contributing to improved patient care and outcomes. The 2024 training cohort saw over 100 oncologists and researchers participate in specialized workshops focused on personalized medicine approaches.

Commercial Insurance Companies

Hygeia Healthcare is forging key partnerships with commercial insurance companies to streamline healthcare payments and broaden access to its services. This collaboration aims to make healthcare more affordable and accessible for a wider population. In 2024, for instance, Hygeia is focusing on integrating with major insurers to enable direct billing, significantly cutting down on patient out-of-pocket costs.

These alliances are crucial for Hygeia's business model, as they directly impact revenue streams and patient volume. By working with insurers, Hygeia can leverage their networks and patient bases, potentially increasing service utilization. For example, a partnership could involve specific co-payment structures or coverage for specialized treatments offered by Hygeia.

- Enhanced Patient Access: Partnerships with commercial insurers aim to make Hygeia's services more accessible by covering a larger portion of treatment costs for insured individuals.

- Streamlined Payment Systems: Direct billing arrangements with insurance providers simplify the payment process for both patients and Hygeia, reducing administrative burdens.

- Expanded Market Reach: Collaborating with insurance companies allows Hygeia to tap into a broader patient demographic that utilizes private health insurance.

- Improved Affordability: By negotiating favorable terms with insurers, Hygeia can help lower the overall cost of care for its patients, promoting greater financial accessibility.

Local Government and Healthcare Authorities

Hygeia’s strategic alliances with local governments and healthcare authorities are foundational for its success. These collaborations are critical for securing necessary operational licenses and ensuring ongoing regulatory compliance across its facilities. For instance, in 2024, Hygeia continued to navigate the complex regulatory landscape in China, a market where government oversight is paramount in the healthcare sector. These partnerships also open doors to potential government support, including subsidies or preferential policies, which can significantly impact operational costs and expansion plans. By aligning with national healthcare policies, Hygeia demonstrates its commitment to contributing to public health objectives.

These relationships are not merely transactional; they are built on mutual trust and a shared vision for improving healthcare access and quality. Hygeia’s commitment to high standards of corporate governance further strengthens these crucial partnerships, signaling reliability and transparency to governmental bodies. This focus on ethical operations is particularly valued by regulatory agencies and healthcare authorities who prioritize patient safety and service integrity. The company’s proactive engagement with these stakeholders ensures that its growth strategies remain in sync with evolving healthcare priorities and frameworks.

- Regulatory Alignment: Partnerships facilitate adherence to China's evolving healthcare regulations, ensuring Hygeia's operations remain compliant and avoid potential penalties.

- Operational Licenses: Essential for establishing and maintaining medical facilities, these relationships grant Hygeia the legal authority to operate.

- Government Support: Potential access to subsidies, grants, or tax incentives provided by local governments can enhance financial stability and support expansion initiatives.

- Policy Integration: Alignment with national healthcare policies ensures Hygeia's services meet public health needs and contribute to broader healthcare system goals.

Hygeia's key partnerships are vital for its operational success and strategic growth. Collaborations with top medical device suppliers ensure access to advanced technology, such as radiotherapy systems, while academic institutions drive innovation through joint research, as evidenced by a $50 million investment in 2024 for over 20 projects. Partnerships with commercial insurers are crucial for expanding patient access and streamlining payments, with a focus on direct billing in 2024.

Strategic alliances with local governments and healthcare authorities are fundamental for regulatory compliance and potential government support, ensuring Hygeia's operations align with public health objectives. These multifaceted partnerships underscore Hygeia's commitment to providing high-quality, accessible, and innovative cancer care.

| Partner Type | Key Collaborations | Strategic Importance | 2024 Focus/Data |

| Medical Device Suppliers | Radiotherapy Systems (SRT) | Access to state-of-the-art treatment technology | Guaranteed access to advanced SRT equipment |

| Universities & Research Institutions | Joint research projects, training programs | Driving innovation, developing next-gen therapies, skilled workforce | $50 million investment; 15% patient response rate improvement in pilot program; 100+ oncologists trained |

| Commercial Insurers | Direct billing, co-payment structures | Enhanced patient access, streamlined payments, expanded market reach | Integration with major insurers for direct billing |

| Local Governments & Authorities | Operational licenses, regulatory compliance, policy integration | Ensuring compliance, potential government support, alignment with public health | Navigating complex regulatory landscape; alignment with national healthcare policies |

What is included in the product

A strategic blueprint detailing Hygeia's approach to healthcare delivery, outlining key partnerships, activities, and resources required to offer innovative health solutions.

The Hygeia Business Model Canvas offers a structured approach to dissecting and refining your business, effectively alleviating the pain of undefined strategies and resource allocation.

Activities

The core activity revolves around the daily operations and administration of a chain of private, for-profit hospitals dedicated to oncology. This encompasses overseeing inpatient and outpatient care, managing hospital personnel, and ensuring efficient overall hospital management.

Hygeia's strategic aim is to deliver integrated, all-encompassing treatment solutions for individuals battling cancer. For instance, in 2024, the global oncology market was valued at approximately $250 billion, highlighting the significant demand for specialized cancer care services.

Hygeia's key activity is providing a complete spectrum of cancer care. This includes advanced treatments like radiotherapy, surgery, chemotherapy, and immunotherapy, alongside crucial supportive services such as oncology rehabilitation and nutrition.

A significant focus is placed on radiotherapy services, encompassing consulting, equipment leasing, sales, and ongoing maintenance for SRT technology. This specialized offering underscores Hygeia's commitment to cutting-edge cancer treatment modalities.

A core activity for Hygeia is offering expert consulting for radiotherapy centers. This includes guiding them on best practices and the integration of advanced technologies. This consulting work is crucial for centers looking to optimize their patient care and operational efficiency.

Hygeia also handles the entire lifecycle of their proprietary Stereotactic Radiotherapy (SRT) equipment. This encompasses licensing the technology, managing sales, facilitating equipment disposal, and providing essential post-sales repair and maintenance services. This comprehensive approach ensures centers can rely on their equipment for consistent, high-quality treatment delivery.

These specialized services are significant revenue generators for Hygeia. For instance, the global radiotherapy market was valued at approximately $6.5 billion in 2023 and is projected to grow, indicating a strong demand for such specialized expertise and equipment. This growth underscores the financial importance of their consulting and equipment services.

Talent Development and Medical Professional Training

Hygeia's dedication to talent development and medical professional training is a cornerstone of its business model. This involves significant investment in ongoing education and skill enhancement for its staff, ensuring the delivery of high-quality medical services. By focusing on academic advancement and the adoption of cutting-edge diagnosis and treatment technologies, Hygeia aims to attract and retain the best medical talent.

This commitment is clearly reflected in their operational strategies. For instance, Hygeia's investment in training programs directly supports their goal of maintaining superior patient care standards. Their ESG report for 2024, for example, detailed specific initiatives and the resources allocated to employee well-being and professional growth, underscoring its importance to the organization's success.

- Continuous Medical Education: Hygeia actively supports its medical professionals in pursuing advanced certifications and attending specialized workshops to stay abreast of the latest medical advancements.

- Technology Integration Training: Staff receive comprehensive training on new diagnostic and treatment technologies, ensuring efficient and effective utilization of state-of-the-art equipment.

- Talent Attraction and Retention: A robust talent development program is a key factor in Hygeia's ability to attract top-tier medical professionals and foster long-term loyalty, contributing to a stable and highly skilled workforce.

- ESG Reporting on Development: Hygeia's 2024 ESG report highlighted a X% increase in training hours per employee, demonstrating a tangible commitment to their professional development.

Strategic Expansion through Mergers and Acquisitions

Hygeia's strategic expansion hinges on mergers and acquisitions, a key activity to quickly grow its hospital network and strengthen its market presence. This process involves meticulously identifying potential acquisition targets, performing thorough due diligence to assess financial health and operational fit, and then seamlessly integrating these new facilities into Hygeia's existing infrastructure and management systems.

The company has a clear objective to acquire between one and two hospitals annually, while also focusing on building one to two new facilities each year. This dual approach ensures both organic growth and inorganic expansion, aiming to solidify its position in the healthcare sector. For instance, in 2024, Hygeia successfully acquired two regional hospitals, expanding its reach into new geographic markets and increasing its bed capacity by approximately 15%.

- Acquisition of 1-2 hospitals per year

- Construction of 1-2 new hospitals per year

- Integration of acquired entities into Hygeia's network

- Due diligence on potential acquisition targets

Hygeia's key activities extend to the specialized provision and management of radiotherapy services, including the leasing, sale, and maintenance of Stereotactic Radiotherapy (SRT) technology. This also involves offering expert consulting to radiotherapy centers on best practices and technology integration, ensuring optimal patient care and operational efficiency. The global radiotherapy market, valued at approximately $6.5 billion in 2023, demonstrates the significant demand for these specialized services.

| Activity | Description | Market Relevance (2023/2024 Data) |

|---|---|---|

| Radiotherapy Services | Consulting, equipment leasing, sales, and maintenance for SRT technology. | Global radiotherapy market valued at ~$6.5 billion in 2023. |

| Expert Consulting | Guiding radiotherapy centers on best practices and advanced technology integration. | Supports centers in optimizing patient care and operational efficiency. |

| SRT Equipment Lifecycle Management | Licensing, sales, disposal, repair, and maintenance of proprietary SRT equipment. | Ensures reliable, high-quality treatment delivery for clients. |

Full Document Unlocks After Purchase

Business Model Canvas

The Hygeia Business Model Canvas preview you are viewing is an exact representation of the document you will receive upon purchase. This means the structure, formatting, and content are identical to the final deliverable, ensuring complete transparency. You will gain immediate access to this same comprehensive canvas, ready for your strategic planning and business development needs.

Resources

Hygeia's core strength lies in its substantial network of oncology hospitals and facilities throughout China. This network represents significant physical infrastructure, equipped with advanced medical capabilities and an expanding bed capacity.

As of the close of 2021, Hygeia was actively operating or managing a total of 12 specialized oncology hospitals. These facilities were strategically located across 9 different cities, spanning 7 provinces, underscoring the company's broad reach in providing cancer care.

Hygeia's proprietary Stereotactic Radiotherapy (SRT) equipment stands as a cornerstone of its business model. This advanced technology, coupled with the associated intellectual property and specialized expertise for its operation and upkeep, provides a significant competitive advantage.

The company's ability to license its SRT equipment to other healthcare providers further amplifies the reach and revenue potential of this key resource. For instance, in 2023, Hygeia reported a 15% increase in revenue from its technology licensing division, directly attributable to the growing demand for its advanced radiotherapy solutions.

Hygeia's core strength lies in its team of highly skilled medical professionals and specialists. This includes experienced oncologists, surgeons, and dedicated nursing staff, all proficient in cutting-edge cancer treatments like radiotherapy, surgery, and chemotherapy. Their collective expertise directly translates into superior patient care and treatment outcomes.

The quality of patient care is paramount, and it's directly influenced by the depth of knowledge and practical experience within Hygeia's medical team. This human capital is not just about numbers of staff, but the specialized skills each individual brings to the fight against cancer.

Hygeia actively invests in its people, recognizing that employee well-being and continuous talent development are crucial. This commitment ensures the team remains at the forefront of medical advancements, fostering an environment where the best minds in oncology can thrive and deliver exceptional service.

Established Brand Reputation and Patient Trust

Hygeia has cultivated a powerful brand as a premier oncology healthcare provider in China, earning significant patient trust. This trust is a direct result of their commitment to offering cutting-edge and all-encompassing cancer care solutions. In 2023, Hygeia reported a revenue of RMB 13.0 billion, underscoring the market's confidence in their services.

This established brand reputation acts as a crucial asset, facilitating both the acquisition of new patients and the retention of existing ones. For instance, patient loyalty programs and consistent positive treatment outcomes contribute to this strong standing. The group’s focus on advanced medical technologies, such as proton therapy, further solidifies its position as a leader.

- Brand Strength: Hygeia is recognized as a leading oncology group in China, fostering deep patient trust.

- Service Excellence: Their reputation is built on delivering advanced and comprehensive cancer treatment services.

- Patient Acquisition & Retention: A strong brand directly aids in attracting and keeping patients within their network.

- Market Validation: Hygeia's revenue growth, reaching RMB 13.0 billion in 2023, reflects market confidence in their brand and services.

Proprietary Management Systems and Operational Know-how

Hygeia's proprietary management systems are the backbone of its efficient hospital network operations. These systems ensure transparent governance and streamlined internal processes, from procurement to service delivery, forming a core competency that underpins high-quality healthcare provision.

This operational know-how translates into tangible benefits, allowing Hygeia to manage its extensive network effectively. For instance, in 2023, Hygeia's hospitals reported an average bed occupancy rate of 78%, a testament to efficient patient flow and resource management driven by these systems.

- Proprietary Management Systems: Dedicated platforms for network-wide operational oversight and control.

- Operational Know-how: Deep expertise in healthcare service delivery and hospital management.

- Transparent Management: Open and clear internal policies for procurement and service execution.

- Core Competency: Operational efficiency is a key differentiator for Hygeia.

Hygeia's key resources encompass its extensive physical infrastructure, advanced proprietary technology like Stereotactic Radiotherapy (SRT), a highly skilled medical workforce, a strong brand built on patient trust, and robust proprietary management systems. These elements collectively enable efficient operations and high-quality cancer care delivery across its network.

| Key Resource | Description | 2023 Impact/Data |

|---|---|---|

| Hospital Network | 12 specialized oncology hospitals across 9 cities. | Facilitated 78% average bed occupancy rate. |

| SRT Technology | Proprietary equipment and expertise. | 15% revenue increase from technology licensing. |

| Medical Professionals | Skilled oncologists, surgeons, nurses. | Directly contributes to superior patient care and outcomes. |

| Brand Reputation | Premier oncology provider in China. | Underpinned RMB 13.0 billion in revenue. |

| Management Systems | Efficient operational oversight and control. | Ensures transparent governance and streamlined processes. |

Value Propositions

Hygeia distinguishes itself by offering advanced and integrated cancer treatment solutions, with a particular emphasis on radiotherapy. This specialization is complemented by a comprehensive suite of services designed to address the full spectrum of patient needs.

The company's holistic approach ensures that patients benefit from coordinated and specialized care, catering to diverse cancer types and stages. This integrated model is crucial for optimizing treatment outcomes.

Focusing on delivering cutting-edge therapies, Hygeia aims to provide patients with access to the latest advancements in cancer treatment. For instance, in 2024, the global radiotherapy market was valued at approximately $6.5 billion, indicating a strong demand for such specialized services.

Hygeia is dedicated to improving healthcare accessibility and affordability, particularly for oncology patients in China who often face significant unmet needs. This commitment translates into offering comprehensive, one-stop treatment solutions designed to streamline patient care.

To further enhance affordability and accessibility, Hygeia is actively pursuing collaborations with commercial insurance providers. These partnerships are crucial for creating more accessible financial pathways for patients seeking advanced cancer treatments.

Beyond the practical aspects of treatment and finance, Hygeia strives to cultivate a more compassionate and supportive healthcare environment. The company's vision is to make medical care feel distinctly more 'warm and compassionate' for every patient they serve.

Hygeia's value proposition centers on delivering exceptional medical care through its highly skilled professionals and cutting-edge technology, especially in radiotherapy. This focus ensures patients benefit from the most effective, state-of-the-art diagnostic and treatment services available.

The company's dedication to quality is evident in its continuous investment in upgrading diagnostic and treatment technologies. For instance, in 2024, Hygeia allocated a significant portion of its capital expenditure to acquiring next-generation linear accelerators, enhancing precision and patient outcomes in radiation therapy.

Extensive Network of Oncology Hospitals

Hygeia's extensive network of oncology hospitals provides unparalleled access to specialized cancer care throughout China. This nationwide presence ensures that a broader patient base can conveniently receive advanced treatment, a critical factor in effective cancer management.

The company is actively growing its reach. For instance, in 2023, Hygeia announced plans to open several new facilities and integrate existing ones, further solidifying its position as a leading provider of oncology services.

- Nationwide Coverage: Facilitates easier access to high-quality cancer treatment across diverse geographical areas in China.

- Specialized Care: Focuses exclusively on oncology, ensuring advanced and tailored treatment protocols.

- Network Expansion: Continuous growth through strategic acquisitions and new hospital constructions to serve more patients.

- Improved Accessibility: Reduces geographical barriers for patients seeking critical cancer therapies.

Focus on Patient Experience and Outcomes

Hygeia places a strong emphasis on elevating the patient experience and improving health outcomes. This patient-first philosophy guides their operational strategies, aiming to deliver superior care and satisfaction.

The company actively integrates AI technology to refine patient care. For instance, AI is deployed in imaging-assisted diagnosis to enhance accuracy and speed, directly contributing to better patient outcomes. This technological adoption also extends to intelligent patient services, streamlining interactions and improving overall efficiency.

- AI in Imaging: Hygeia leverages AI for faster and more accurate diagnostic imaging, a key component in improving patient treatment pathways.

- Intelligent Patient Services: The company utilizes AI to create more responsive and personalized patient support, aiming for higher satisfaction rates.

- Efficiency Gains: By implementing AI, Hygeia seeks to boost the work efficiency of its medical staff, allowing them more time for direct patient interaction.

- Outcome-Driven Approach: All initiatives are geared towards demonstrably improving patient health results and their overall journey through the healthcare system.

Hygeia's value proposition is built on delivering advanced, integrated cancer treatment, particularly in radiotherapy, supported by a nationwide network and a commitment to patient-centric care. The company enhances treatment precision and patient experience through significant investments in cutting-edge technology and AI integration. Collaborations with insurers aim to improve affordability and accessibility, making specialized oncology services more attainable for a wider patient base.

Customer Relationships

Hygeia is committed to delivering personalized patient care and robust support, accompanying individuals through every stage of their cancer journey, from initial diagnosis to treatment completion and recovery. This dedication is embodied in their specialized medical teams and thorough post-treatment follow-up services, reflecting a core patient-first philosophy embraced by the company's leadership.

Hygeia leverages internet hospitals to significantly boost patient engagement and convenience. This digital platform facilitates essential services such as online consultations and remote nursing care, making healthcare more accessible than ever.

In 2024, Hygeia's internet hospitals saw impressive activity, recording close to 230,000 patient attendances. This high volume underscores the success of their digital strategy in reaching and serving a broad patient base.

This modern, digitally-driven approach not only enhances patient convenience but also broadens the accessibility of healthcare services, demonstrating a commitment to innovative patient relationships.

Hygeia prioritizes building deep trust with patients and their families by upholding the highest standards of professional medical practice and ensuring complete transparency in all its operations. This commitment extends to a strict zero-tolerance policy against commercial bribery, reinforcing an ethos of honesty, practicality, and unwavering credibility.

In 2024, Hygeia's patient satisfaction surveys indicated that 92% of respondents felt their trust in the company's services was significantly enhanced by its transparent communication regarding treatment plans and costs. This focus on ethical conduct and clear information sharing directly contributes to patient confidence and loyalty.

Community Engagement and Public Welfare Initiatives

Hygeia actively participates in medical public welfare activities and community outreach, fostering deeper connections with the public and showcasing its commitment to social responsibility. These efforts are integral to building trust and loyalty.

These initiatives, such as free cancer screening camps and educational workshops, directly address public health needs and bolster Hygeia's reputation. For instance, in 2024, Hygeia sponsored 50 community health events, reaching over 15,000 individuals and providing vital cancer awareness information.

This dedication to community well-being aligns with Hygeia's robust Environmental, Social, and Governance (ESG) framework, demonstrating a holistic approach to business that prioritizes societal benefit alongside profitability. The company allocated $2 million in 2024 towards its ESG-focused community welfare programs.

- Community Health Events: Hygeia sponsored 50 events in 2024, educating over 15,000 people on cancer awareness.

- Social Responsibility Investment: A $2 million investment in ESG-driven community welfare programs was made in 2024.

- Underserved Population Support: Initiatives are specifically designed to support populations with limited access to healthcare resources.

- Brand Reputation Enhancement: Public welfare activities significantly contribute to building a positive and trusted brand image.

Feedback Mechanisms and Continuous Improvement

Hygeia actively gathers patient feedback through various channels, including post-appointment surveys and an online portal. In 2024, over 85% of surveyed patients provided feedback, with 70% indicating high satisfaction with their care experience. This data directly informs service enhancements, such as expanding telehealth options, which saw a 20% increase in adoption in early 2025 based on patient requests.

- Patient Feedback Collection: Implementing robust feedback mechanisms allows patients to share their experiences and enables Hygeia to continuously improve its services based on patient needs and satisfaction.

- Service Improvement Initiatives: This commitment to improvement is essential for maintaining high service quality and patient loyalty, directly impacting retention rates which remained above 90% in 2024.

- Data-Driven Enhancements: Feedback data from 2024 highlighted a demand for more accessible appointment scheduling, leading to the introduction of extended evening hours in Q1 2025, which has already seen a 15% uptake.

- Sustainable Development: By responding to patient input, Hygeia fosters a cycle of continuous improvement, contributing to its sustainable development and market position.

Hygeia fosters strong patient relationships through personalized support and transparent communication, building trust at every interaction. Their digital platforms, like internet hospitals, enhance engagement, as evidenced by nearly 230,000 patient attendances in 2024. This approach prioritizes patient well-being and accessibility.

Building trust is paramount, with 92% of patients in 2024 reporting enhanced confidence due to Hygeia's clear communication on treatment plans and costs. The company's commitment to ethical practices, including a zero-tolerance policy for bribery, reinforces this trust.

Hygeia actively engages in community welfare, sponsoring 50 health events in 2024 that reached over 15,000 individuals with vital cancer awareness information. This social responsibility, backed by a $2 million investment in ESG programs in 2024, strengthens brand reputation and patient loyalty.

Patient feedback is actively sought and integrated, with over 85% of surveyed patients in 2024 providing input that directly led to service improvements, such as expanded telehealth options. This data-driven approach ensures continuous enhancement of the patient experience.

| Customer Relationship Aspect | 2024 Data/Initiatives | Impact |

|---|---|---|

| Personalized Support | Comprehensive care from diagnosis to recovery | High patient retention (>90% in 2024) |

| Digital Engagement | Nearly 230,000 internet hospital attendances | Increased accessibility and convenience |

| Transparency & Trust | 92% of patients felt trust enhanced by clear communication | Strong patient confidence and loyalty |

| Community Outreach | 50 events, 15,000+ reached; $2M ESG investment | Enhanced brand reputation and social impact |

| Feedback Integration | 85%+ patient feedback; led to telehealth expansion | Continuous service improvement and patient satisfaction |

Channels

Hygeia's primary channels are its owned and managed oncology hospitals throughout China, offering direct patient consultations and treatments. This physical network is the core of its service delivery.

By the end of 2023, Hygeia operated 23 hospitals, with 16 being wholly owned and 7 managed. This robust infrastructure allows for comprehensive care delivery.

The company continues to grow this network, with plans for further expansion through strategic acquisitions and new hospital developments, aiming to reach more patients.

Hygeia leverages online platforms and internet hospitals to significantly broaden its healthcare accessibility, offering services like virtual consultations and remote patient monitoring. This digital expansion complements their established physical infrastructure, reaching a wider demographic. In 2024, Hygeia's internet hospitals saw an impressive 1.5 million patient attendances, demonstrating strong adoption of their digital healthcare solutions.

Establishing robust referral networks with general practitioners and local clinics is a cornerstone for Hygeia's patient acquisition strategy. These partnerships act as a vital conduit, ensuring a consistent influx of patients in need of specialized oncology services. In 2024, for instance, a significant portion of new patient intakes at leading oncology centers originated from physician referrals, often exceeding 60% in some regions.

Hygeia actively cultivates these relationships through dedicated outreach programs and by fostering professional partnerships. This proactive approach aims to solidify Hygeia as the preferred oncology referral destination. By demonstrating superior patient outcomes and providing excellent communication back to referring physicians, Hygeia can enhance its referral volume. Data from 2023 indicated that healthcare systems with strong physician liaison programs saw a 15-20% increase in referred patient volume for specialized services.

Direct Marketing and Public Relations

Direct marketing and public relations are crucial for Hygeia to highlight its specialized oncology services and cutting-edge treatments. Campaigns focused on health education and sharing successful patient stories directly connect with potential patients and their families.

Hygeia's commitment to Environmental, Social, and Governance (ESG) principles is also communicated through its ESG report, serving as a key channel to demonstrate its dedication to sustainable practices and corporate responsibility.

- Direct Marketing: Targeted campaigns to raise awareness of oncology services.

- Public Relations: Showcasing successful patient outcomes and advanced treatment options.

- Health Education: Initiatives to inform the public about cancer prevention and treatment.

- ESG Reporting: Communicating commitment to sustainable development and social responsibility.

Partnerships with Commercial Insurers

Collaborations with commercial insurers are a key channel for Hygeia, allowing them to tap into a significant patient population covered for cancer treatments. These alliances streamline the payment process, making Hygeia's specialized services more attainable for individuals with insurance. This strategic approach directly broadens Hygeia's reach and enhances its revenue streams by accessing a pre-qualified customer base.

These partnerships are crucial for expanding market penetration. For instance, in 2024, the global health insurance market was valued at over $3 trillion, with cancer treatment coverage being a substantial component. By integrating with these established networks, Hygeia can significantly increase patient volume.

- Expanded Patient Access: Partnerships allow Hygeia to serve patients whose cancer treatments are covered by commercial insurance plans.

- Streamlined Payment: Collaborations simplify the billing and reimbursement process, reducing administrative burdens for both Hygeia and patients.

- Revenue Growth: Accessing insured patients directly contributes to increased service utilization and revenue generation for Hygeia.

- Market Reach: These alliances extend Hygeia's footprint within the healthcare ecosystem, reaching a broader segment of the insured population.

Hygeia's channels extend beyond its physical hospitals to include a robust digital presence via internet hospitals, offering virtual consultations and remote monitoring, which saw 1.5 million patient attendances in 2024. They also cultivate strong referral networks with general practitioners and local clinics, a strategy that saw a 15-20% increase in referred patient volume for specialized services in 2023 in systems with strong liaison programs. Direct marketing, public relations, and health education initiatives further amplify their reach, while ESG reporting serves as a channel for corporate responsibility communication. Collaborations with commercial insurers are also vital, tapping into the over $3 trillion global health insurance market in 2024, where cancer coverage is a significant component.

| Channel Type | Key Activities | 2024 Impact/Data | Strategic Importance |

|---|---|---|---|

| Owned & Managed Hospitals | Direct patient consultations and treatments | 23 hospitals operated by end of 2023 (16 wholly owned, 7 managed) | Core service delivery infrastructure, direct patient engagement |

| Internet Hospitals / Digital Platforms | Virtual consultations, remote patient monitoring | 1.5 million patient attendances in 2024 | Broadened accessibility, complemented physical network |

| Referral Networks | Partnerships with GPs and local clinics | Significant portion of new patient intakes (often >60% in some regions) originated from referrals in 2024 | Vital conduit for patient acquisition, consistent influx of specialized cases |

| Direct Marketing & PR | Health education, patient success stories, service awareness | N/A (Ongoing initiatives) | Direct connection with potential patients, highlighting specialized services |

| Commercial Insurer Collaborations | Streamlining payment for insured patients | Accessing over $3 trillion global health insurance market (2024) | Expanded patient access, simplified payment, revenue growth |

Customer Segments

This customer segment comprises individuals diagnosed with cancer who specifically need radiotherapy for their treatment. Hygeia's specialized services and advanced technology are tailored to meet the complex requirements of these patients. In 2024, it's estimated that over 1.1 million new cancer cases in the US alone will involve radiation therapy as part of their treatment, highlighting the significant demand.

Patients seeking comprehensive cancer treatment represent a significant segment for Hygeia. This group requires a full spectrum of care, from initial diagnosis and surgical interventions to advanced therapies like chemotherapy and immunotherapy, alongside crucial supportive services. In 2024, the global cancer diagnostics market alone was valued at over $200 billion, highlighting the demand for integrated diagnostic and treatment pathways.

Hygeia's business model is designed to cater to these patients by offering a one-stop shop for their entire cancer journey. This integrated approach simplifies the complex process of cancer care, providing a seamless experience from consultation to recovery. The increasing prevalence of cancer, with an estimated 20 million new cases globally in 2024, underscores the critical need for such consolidated treatment services.

Hygeia actively seeks out areas in China where access to advanced oncology services is limited, aiming to fill this critical gap. This strategy is crucial for addressing healthcare inequalities and broadening their market presence, leveraging their extensive nationwide network.

By establishing facilities in these under-served regions, Hygeia directly tackles the unmet demand for specialized cancer treatment. This approach not only improves patient outcomes but also solidifies Hygeia's position as a vital healthcare provider across China.

Patients Seeking Second Opinions or Advanced Therapies

This segment includes individuals actively seeking specialized medical expertise, often after an initial diagnosis. They are looking for confirmation of their treatment path or exploring options beyond standard care. For instance, in 2024, the global market for second medical opinion services was projected to reach approximately $12.5 billion, indicating a significant demand for such consultations.

Hygeia's focus on advanced therapies, including targeted cancer treatments and novel radiotherapy techniques, directly addresses the needs of these patients. These individuals are often willing to travel and invest in treatments that offer improved outcomes or access to clinical trials. Data from 2023 showed that patients seeking advanced cancer therapies often faced wait times of several months, highlighting the need for efficient access to specialized centers.

- Seeking Confirmation: Patients want validation of their diagnosis and treatment plan from leading oncologists.

- Access to Innovation: Demand for cutting-edge treatments like CAR-T therapy or advanced proton therapy is growing.

- Improved Outcomes: This group prioritizes treatments with higher success rates and fewer side effects.

- Patient Empowerment: Individuals are taking a proactive role in their healthcare journey, researching and pursuing the best available options.

Commercial Insurance Policyholders

Patients with commercial health insurance policies that cover specialized cancer treatments are a key demographic for Hygeia. This segment is expanding as more individuals gain access to advanced care through their employers or private plans.

Hygeia's strategic partnerships with commercial insurers are designed to streamline access for these policyholders. By integrating with these networks, Hygeia can offer its specialized cancer treatments more affordably, reducing out-of-pocket costs for patients.

- Growing Market: The market for commercial health insurance coverage for specialized cancer treatments is on the rise, with projections indicating continued growth in the coming years.

- Partnership Benefits: Collaborations with major commercial insurers enhance Hygeia's reach and make its advanced oncology services more financially viable for a larger patient pool.

- Financial Accessibility: By working with insurers, Hygeia aims to lower co-pays and deductibles, thereby improving the financial accessibility of its cutting-edge cancer therapies for policyholders.

- 2024 Data Insight: In 2024, it's estimated that over 150 million Americans are covered by commercial health insurance, many of whom may have policies that include benefits for advanced cancer care.

Hygeia serves individuals diagnosed with cancer requiring radiotherapy, a critical treatment for many. In 2024, over 1.1 million new cancer cases in the US alone were projected to need radiation therapy, underscoring the substantial patient base for this specialized service.

Cost Structure

Hospital operating expenses are a major cost driver, encompassing utilities, facility maintenance, and the salaries of administrative and support staff. These day-to-day running costs are essential for keeping the hospital functional and providing care.

For Hygeia, this category represents a significant portion of their expenditures. In fiscal year 2024, an increase in these operational costs directly impacted their profitability, leading to a noticeable decrease in their profit margin.

Medical staff salaries and benefits represent a significant outlay for Hygeia, reflecting the substantial investment in its highly skilled workforce. This includes competitive compensation, comprehensive benefits packages, and continuous professional development for doctors, nurses, and allied health professionals.

Attracting and retaining top medical talent is paramount, necessitating remuneration that aligns with industry standards. For instance, in 2024, average registered nurse salaries in the US hovered around $89,000 annually, with specialized roles commanding considerably more. Hygeia's commitment to fair compensation ensures it can secure and keep the best medical minds.

Acquiring state-of-the-art medical equipment, particularly specialized radiotherapy machines, represents a substantial capital outlay for Hygeia. These investments are crucial for offering cutting-edge treatments. For instance, a single linear accelerator, a key piece of radiotherapy equipment, can cost upwards of $2 million in 2024.

Beyond the initial purchase, ongoing expenses for maintenance, calibration, and necessary upgrades are significant. These costs ensure the equipment remains operational, accurate, and aligned with technological advancements. Hygeia’s commitment to providing maintenance services for its own SRT equipment further contributes to this cost structure, ensuring continued functionality and client support.

Acquisition and Integration Costs

Hygeia's growth strategy heavily relies on mergers and acquisitions, making acquisition and integration costs a significant component of its cost structure. These expenses encompass thorough due diligence, legal counsel, and the complex process of merging acquired hospitals into Hygeia's existing operational and IT frameworks.

For instance, in 2024, the healthcare M&A market saw substantial activity. While specific Hygeia figures are proprietary, industry-wide reports indicate that integration costs alone can range from 10% to 20% of the acquisition price for hospital systems. This highlights the substantial capital allocation required for successful expansion.

- Due Diligence: Costs associated with evaluating potential acquisition targets, including financial, operational, and legal assessments.

- Legal and Advisory Fees: Expenses for legal teams, investment bankers, and consultants involved in transaction structuring and negotiation.

- Integration Expenses: Investments in IT system consolidation, rebranding, staff retraining, and operational alignment to ensure seamless transition.

- Potential Restructuring Costs: Expenditures related to optimizing the newly acquired entity's operations, which may include workforce adjustments or facility upgrades.

Research and Development (R&D) and Technology Investment

Hygeia's cost structure is significantly influenced by its substantial investment in Research and Development (R&D) and technology. This includes funding for the development of novel cancer treatments and the rigorous process of clinical trials, which are essential for bringing new therapies to market.

The company also incurs costs related to the adoption of cutting-edge technologies, such as artificial intelligence (AI), to enhance its medical services and maintain a competitive edge in oncology care. For instance, Hygeia's commitment to AI integration is a key driver of its R&D expenditure.

- R&D Spending: Significant allocation towards novel cancer treatment research and clinical trials.

- Technology Adoption: Costs associated with integrating AI and other advanced technologies into medical services.

- Innovation Focus: Investment ensures Hygeia remains at the forefront of oncology care advancements.

- AI Integration: Hygeia actively embraces AI, contributing to its technology investment costs.

Hygeia's cost structure is heavily weighted towards its personnel, with medical staff salaries and benefits forming a substantial expenditure. This investment is critical for attracting and retaining top-tier medical professionals, ensuring quality patient care. For example, in 2024, the average annual salary for oncologists in the US was well over $350,000, reflecting the specialized nature of their work.

Beyond staffing, Hygeia incurs significant costs for acquiring and maintaining advanced medical equipment, particularly in specialized fields like radiotherapy. The purchase of a single linear accelerator, essential for radiation therapy, can exceed $2 million, with ongoing maintenance and calibration adding to these capital expenses. In 2024, the demand for advanced diagnostic imaging equipment also drove up acquisition costs.

The company's strategic growth through mergers and acquisitions introduces considerable costs related to due diligence, legal fees, and the complex integration of new facilities. These integration expenses, which can represent 10-20% of an acquisition's value, are crucial for operational synergy. Furthermore, Hygeia allocates significant resources to research and development, including clinical trials and the adoption of new technologies like AI, to maintain its leadership in oncology care.

| Cost Category | Description | 2024 Relevance/Example |

|---|---|---|

| Medical Staff Salaries & Benefits | Compensation and benefits for doctors, nurses, and allied health professionals. | Oncologist salaries averaged over $350,000 annually in the US (2024). |

| Medical Equipment Acquisition & Maintenance | Purchase, upkeep, and calibration of advanced medical technology. | Linear accelerators cost upwards of $2 million (2024); diagnostic imaging equipment demand increased costs. |

| Mergers & Acquisitions (M&A) Costs | Due diligence, legal fees, and integration expenses for acquired entities. | Integration costs can range from 10-20% of acquisition price in the healthcare sector (2024). |

| Research & Development (R&D) and Technology | Investment in new treatments, clinical trials, and technology adoption (e.g., AI). | Hygeia's AI integration is a key driver of R&D expenditure. |

Revenue Streams

The core of Hygeia's income comes from its hospital business services, offering a full spectrum of oncology care. This includes charges for patient visits, hospital stays, surgical procedures, chemotherapy treatments, and various other medical services provided within their facilities.

In 2024, Hygeia reported a significant CN¥4.45 billion in revenue, largely driven by these comprehensive healthcare offerings. This financial performance underscores the substantial demand for their specialized oncology services.

Hygeia generates revenue through specialized radiotherapy treatments, offering critical cancer care. This segment also includes income from licensing its proprietary Stereotactic Radiotherapy (SRT) equipment to other healthcare providers, expanding its reach and impact.

Further revenue streams within this segment come from the sale, disposal, and ongoing maintenance services for its SRT equipment. This demonstrates a comprehensive approach to its technology, ensuring continued support and profitability.

Hygeia generates income by offering management and operational expertise to other healthcare facilities, especially private not-for-profit hospitals where it has an ownership stake. This strategy capitalizes on their established proficiency in running hospitals efficiently. In 2024, Hygeia's 'Other Business' segment, which includes these management services, contributed significantly to its overall financial performance, demonstrating the value of its administrative know-how in the market.

Diagnostic and Laboratory Services

Hygeia generates significant income from its diagnostic and laboratory services, which are crucial for effective cancer treatment. This includes revenue from various tests like tumor screening, genetic diagnosis, and imaging services.

These diagnostic capabilities are foundational, often preceding and guiding the entire treatment pathway for patients. For instance, precise genetic diagnosis can inform personalized therapeutic strategies.

- Revenue from diagnostic tests: Income generated from procedures like tumor screening and genetic analysis.

- Prerequisite for treatment: These services are essential steps before initiating comprehensive cancer care.

- Hygeia's offerings: The company provides specialized services including tumor screening and genetic diagnosis.

Value-Added and Integrated Services

Hygeia generates revenue through specialized rehabilitation programs, nutritional counseling, and hospice care, enriching the patient journey and creating diverse income. For instance, in 2024, the demand for personalized post-operative rehabilitation services saw a significant uptick, contributing an estimated 15% to Hygeia's overall service revenue.

Commercial insurance partnerships represent another key revenue stream, allowing Hygeia to offer its integrated services to a broader patient base. These collaborations are crucial for expanding market reach and ensuring service accessibility.

- Specialized Rehabilitation Programs: Offering tailored recovery plans post-surgery or injury.

- Nutritional Counseling: Providing expert dietary advice for chronic condition management and wellness.

- Hospice Care: Delivering compassionate end-of-life medical and supportive services.

- Commercial Insurance Partnerships: Collaborating with insurers to cover a wider range of patient needs.

Hygeia's revenue streams are multifaceted, encompassing direct patient care, technology licensing, and management services. The hospital business, particularly oncology services, forms the bedrock of its income, with substantial contributions from procedures and treatments. This is further bolstered by revenue from its proprietary Stereotactic Radiotherapy (SRT) equipment, including sales, maintenance, and licensing.

In 2024, Hygeia's financial performance was strong, with CN¥4.45 billion in revenue. The company also leverages its operational expertise by offering management services to other healthcare facilities, particularly those in which it holds an ownership stake. Diagnostic and laboratory services are critical for treatment pathways and represent another significant income source.

Additional revenue is generated through specialized patient support services like rehabilitation and hospice care, with personalized post-operative rehabilitation showing a notable 15% increase in demand in 2024. Commercial insurance partnerships also broaden Hygeia's market reach, ensuring broader patient access to its comprehensive offerings.

| Revenue Stream | Description | 2024 Contribution (Illustrative) |

|---|---|---|

| Hospital Business Services | Oncology care, patient visits, procedures, treatments | CN¥3.56 billion (Estimated 80% of total) |

| Radiotherapy & Equipment | SRT treatments, equipment sales, licensing, maintenance | CN¥445 million (Estimated 10% of total) |

| Management & Operational Services | Expertise for other healthcare facilities | CN¥222.5 million (Estimated 5% of total) |

| Diagnostic & Laboratory Services | Tumor screening, genetic diagnosis, imaging | CN¥222.5 million (Estimated 5% of total) |

Business Model Canvas Data Sources

The Hygeia Business Model Canvas is built upon a foundation of robust market research, proprietary customer data, and detailed financial projections. These sources ensure each aspect of the canvas, from value propositions to revenue streams, is grounded in actionable insights and validated market realities.