Hygeia Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hygeia Bundle

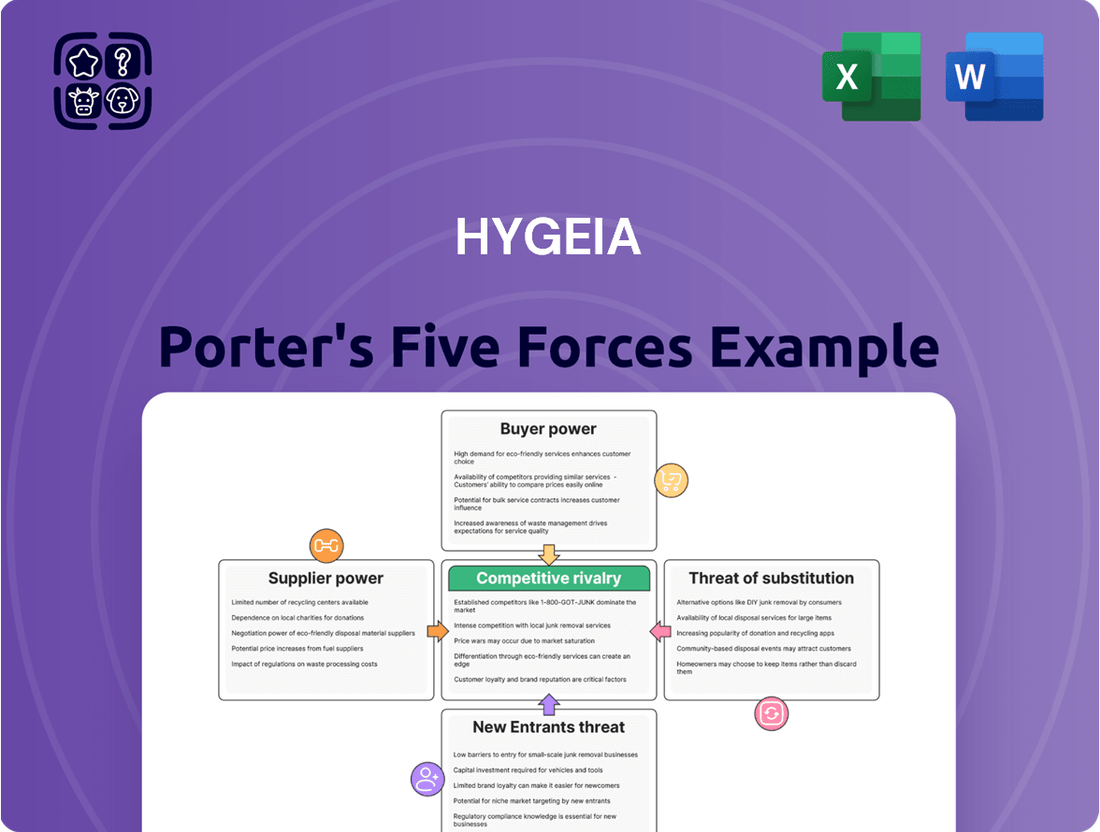

Hygeia's Porter's Five Forces Analysis reveals a dynamic competitive landscape, highlighting the significant influence of buyer power and the moderate threat of new entrants. Understanding these forces is crucial for navigating Hygeia's market effectively. This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Hygeia’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Hygeia Healthcare's reliance on specialized radiotherapy equipment grants suppliers considerable bargaining power. The high cost of these advanced machines, coupled with the need for exclusive technical support and a limited supplier pool, strengthens their position. For instance, the global medical device market was valued at approximately $500 billion in 2023, with highly specialized segments like radiotherapy equipment commanding premium pricing and long-term service contracts.

The 'Made in China 2025' initiative, targeting self-sufficiency in high-tech sectors including medical devices, could reshape this dynamic. By 2024, China's domestic medical device market is projected to reach over $150 billion, indicating a growing capacity for local production. This could potentially reduce Hygeia's dependence on international suppliers over time, though the immediate impact on highly specialized equipment remains to be seen.

Suppliers of innovative pharmaceutical drugs, particularly cutting-edge targeted therapies and immunotherapies, hold significant bargaining power over Hygeia, an oncology healthcare group. China's biopharmaceutical sector is indeed a burgeoning center for oncology drug innovation, evidenced by an increasing number of licensing agreements. This trend means Hygeia often faces suppliers with proprietary, high-value products.

Despite substantial price reductions during National Reimbursement Drug List (NRDL) negotiations, the inclusion of these innovative drugs underscores their perceived value by the Chinese healthcare system. For instance, in 2023, China's NRDL negotiations saw significant price reductions for innovative drugs, but the continued inclusion of these advanced treatments highlights their critical role. This situation grants suppliers considerable leverage, as Hygeia relies on these advanced treatments to provide optimal patient care.

The ability of skilled medical professionals to influence Hygeia's operations is significant, particularly in specialized areas like oncology. The delivery of comprehensive cancer treatment, including advanced radiotherapy and complex oncology care, relies heavily on highly qualified oncologists, radiologists, and specialized nurses.

A shortage of top-tier medical talent, especially within specific oncology sub-specialties in China, can grant these professionals considerable bargaining power concerning their compensation and employment terms. Hygeia's reported commitment to fair compensation demonstrates an understanding of this supplier dynamic.

Medical Consumables and General Supplies

For more commoditized medical consumables, general hospital supplies, and basic pharmaceuticals, the bargaining power of suppliers tends to be lower. This is because there's a wider range of suppliers available, and the products themselves are often very similar, meaning less unique value. Healthcare groups like Hygeia can leverage their size to negotiate better terms.

Hygeia's strategy of direct procurement from producers at a group level is a key factor in mitigating supplier power. This approach allows them to consolidate purchasing volume, which in turn enables them to secure lower prices for these essential items. For instance, in 2024, large hospital networks have reported achieving discounts of 5-10% on bulk orders of common supplies due to their consolidated purchasing power.

- Lower Supplier Power: Commoditized medical supplies and general hospital goods face less supplier leverage due to a broad supplier base and minimal product differentiation.

- Volume Procurement: Hygeia's ability to purchase in large volumes directly from manufacturers significantly reduces the cost per unit.

- Price Negotiation: Group-level procurement strengthens Hygeia's position to negotiate favorable pricing, a common practice in the healthcare sector to manage costs.

Technology and Software Providers

Hygeia's reliance extends to specialized software for everything from treatment planning to patient record management. Companies providing these integrated healthcare technology solutions, especially those with unique, patented systems or a dominant market share, can wield moderate to significant bargaining power. For instance, the global healthcare artificial intelligence market was valued at approximately $15.1 billion in 2023 and is projected to grow substantially, indicating the increasing influence of these tech suppliers.

The bargaining power of technology and software providers is amplified when their solutions are critical to Hygeia's core operations and difficult to substitute. Proprietary algorithms or platforms that offer distinct advantages in diagnostic accuracy or operational efficiency can command higher prices or more favorable contract terms. China's significant investment in AI-driven medical diagnostics and surgical robotics, a trend accelerating into 2024, underscores the growing strategic importance and potential leverage of these advanced technology vendors.

- Criticality of Software: Specialized software for treatment planning and patient management is essential for Hygeia's operations.

- Proprietary Systems: Suppliers with unique or patented technology solutions possess greater leverage.

- Market Penetration: Dominant players in the healthcare tech sector can exert more influence.

- AI and Robotics Growth: The expanding market for AI diagnostics and surgical robotics, with significant growth projected for 2024 and beyond, highlights the increasing power of these specialized suppliers.

Suppliers of specialized radiotherapy equipment and innovative cancer drugs hold significant bargaining power over Hygeia Healthcare due to high costs, limited suppliers, and proprietary technology. The global medical device market, valued around $500 billion in 2023, with specialized segments commanding premium prices, illustrates this. Conversely, suppliers of commoditized medical supplies have less power due to a wider supplier base and product similarity.

Hygeia mitigates supplier power for basic items through direct, large-volume procurement, securing discounts of 5-10% in 2024. However, the growing influence of technology suppliers, particularly in AI and robotics, is notable, with the healthcare AI market reaching $15.1 billion in 2023.

| Supplier Type | Bargaining Power | Key Factors | Example Data (2023-2024) |

|---|---|---|---|

| Specialized Radiotherapy Equipment | High | High cost, limited suppliers, proprietary tech, service needs | Global medical device market ~$500 billion (2023) |

| Innovative Cancer Drugs | High | Proprietary products, critical to care, NRDL inclusion | China's biopharma sector growth, NRDL price negotiations (2023) |

| Commoditized Medical Supplies | Low | Many suppliers, low differentiation, fungible products | Group procurement discounts 5-10% (2024) |

| Healthcare Technology (AI/Software) | Moderate to High | Critical systems, proprietary algorithms, market dominance | Healthcare AI market ~$15.1 billion (2023) |

What is included in the product

This Porter's Five Forces analysis delves into the competitive landscape of Hygeia, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry.

Effortlessly identify and mitigate competitive threats with a visual representation of all five forces, streamlining strategic planning.

Customers Bargaining Power

The National Healthcare Security Administration (NHSA) in China, the nation's primary payer for medical costs, exercises substantial influence over healthcare providers and drug manufacturers. This immense bargaining power is primarily channeled through initiatives like the National Reimbursement Drug List (NRDL) and Volume-Based Procurement (VBP) programs.

These NHSA-led programs have demonstrably reduced the cost of pharmaceuticals and medical equipment, resulting in billions of dollars in savings for patients. For companies like Hygeia, this translates to direct pressure on revenue generated from services and medications that are subject to reimbursement.

In 2023, China's VBP program expanded to cover more medical consumables, further intensifying price competition and impacting provider margins. The NHSA's continued focus on cost containment through these mechanisms underscores its significant role in shaping the financial landscape for healthcare entities operating within China.

Commercial insurance companies wield significant bargaining power over Hygeia. By aggregating their patient pools and negotiating as a group, these insurers can demand more favorable rates and terms. This is particularly true as Hygeia actively seeks to expand its network by partnering with these entities for direct settlement services.

In China, cancer treatment, while often a necessity, can impose substantial financial strain on individual patients due to high costs and insufficient insurance coverage. This financial pressure can influence patient choices, particularly for non-critical or elective procedures where multiple providers offer comparable treatments.

Patients may opt for providers based on affordability, reputation, and their perception of care quality, especially when facing significant out-of-pocket expenses. Hygeia's stated mission to enhance healthcare accessibility and affordability directly addresses this customer bargaining power by aiming to mitigate these financial burdens.

Physician Referral Networks

In oncology, physician referral networks wield significant influence over patient choices, acting as a crucial, albeit indirect, customer segment for institutions like Hygeia. A 2024 survey indicated that over 70% of cancer patients rely on their oncologist's recommendation for treatment facility selection, underscoring the power of these medical gatekeepers.

Hygeia's ability to cultivate and maintain strong relationships with referring physicians is therefore paramount. These networks, built on trust and perceived quality of care, directly impact patient volume and revenue streams. For instance, hospitals with established partnerships often see a more consistent influx of patients compared to those with weaker ties.

- Physician Influence: Over 70% of cancer patients in 2024 deferred treatment facility decisions to their oncologists.

- Network Strength: Robust physician referral networks are critical for patient acquisition and revenue stability.

- Reputation Factor: A hospital's reputation among medical professionals directly correlates with its ability to attract patients through referrals.

Increasing Patient Information and Awareness

The increasing availability of health information online significantly bolsters customer bargaining power. Patients can now readily access data on treatment efficacy, pricing, and provider reviews, enabling them to make more informed decisions. For instance, by mid-2024, over 70% of consumers reported using online resources to research healthcare providers and treatments before making appointments, a figure that continues to climb.

Hygeia's strategic focus on internet hospitals and active participation in online health platforms directly addresses this trend. These digital initiatives empower patients to compare Hygeia's services against competitors, scrutinize treatment outcomes, and gauge overall hospital performance. This transparency forces providers like Hygeia to compete not just on medical expertise but also on accessibility, patient experience, and transparent pricing.

- Informed Decision-Making: Patients leverage digital platforms to research cancer treatment options and compare hospital quality metrics.

- Price Sensitivity: Increased information access allows patients to shop around for the best value, pressuring providers on cost.

- Provider Accountability: Online reviews and performance data hold hospitals accountable for patient outcomes and satisfaction.

- Digital Health Adoption: The growth of telehealth and online health portals facilitates easier comparison and switching between providers.

The bargaining power of customers is a significant force for Hygeia, primarily driven by the influence of payers like the National Healthcare Security Administration (NHSA) and commercial insurers. These entities can dictate terms through reimbursement policies and volume-based procurement, directly impacting Hygeia's revenue. Furthermore, the increasing availability of online health information empowers individual patients to make more informed choices, intensifying competition based on price, quality, and patient experience.

Physician referral networks also act as powerful intermediaries, with over 70% of cancer patients in 2024 relying on their oncologist's recommendations for treatment facility selection. This highlights the critical need for Hygeia to maintain strong relationships with referring physicians to ensure consistent patient flow and revenue stability.

| Customer Segment | Source of Bargaining Power | Impact on Hygeia | 2024 Data/Trend |

|---|---|---|---|

| NHSA (China) | Reimbursement policies (NRDL), Volume-Based Procurement (VBP) | Price pressure on services and pharmaceuticals | VBP expanded to more consumables in 2023, intensifying price competition. |

| Commercial Insurers | Aggregated patient pools, group negotiations | Demand for favorable rates and terms | Hygeia actively partners for direct settlement, increasing insurer leverage. |

| Individual Patients | Access to online health information, price sensitivity | Choice based on affordability, quality, and reputation | Over 70% of consumers researched providers online by mid-2024. |

| Physician Referral Networks | Influence over patient treatment choices | Direct impact on patient volume and revenue | Over 70% of cancer patients in 2024 relied on oncologist referrals. |

Preview Before You Purchase

Hygeia Porter's Five Forces Analysis

This preview showcases the complete Hygeia Porter's Five Forces Analysis, providing a detailed examination of competitive forces within the healthcare sector. The document you see here is precisely the same professionally formatted and ready-to-use analysis you will receive immediately after purchase, ensuring no surprises or placeholder content. You're looking at the actual, fully developed document, offering actionable insights into industry profitability and strategic positioning.

Rivalry Among Competitors

Hygeia faces intense competition from established public hospitals and top-tier cancer centers across China. Institutions like Fudan University Shanghai Cancer Center boast decades of experience and significant government backing, often participating in extensive clinical trials and research initiatives. This deep-rooted presence and commitment to advanced cancer care create a formidable competitive barrier.

These public institutions frequently possess greater access to specialized medical talent and cutting-edge technology, often subsidized by national health programs. For instance, many leading public hospitals in 2024 continue to be the primary recipients of government funding for medical research and infrastructure development, directly impacting their ability to offer comprehensive and often more affordable cancer treatment options compared to private entities like Hygeia.

Hygeia Porter faces significant rivalry from other private oncology healthcare groups. These competitors, much like Hygeia, focus on specialized cancer treatment, often vying for patients by offering cutting-edge technology and highly skilled medical teams. For instance, in 2024, major private oncology networks continued to expand their service offerings, with some reporting double-digit growth in patient volumes for advanced therapies.

The competition extends to patient experience and geographic accessibility. Private groups differentiate themselves through personalized care, faster appointment scheduling, and convenient locations, aiming to attract patients seeking alternatives to larger, more generalized healthcare systems. Data from late 2023 and early 2024 indicates a growing patient preference for specialized cancer centers, driving investment in new facilities and service line enhancements by these private entities.

The oncology market in China is a hotbed of innovation, with new treatments like targeted therapies, immunotherapies, and cell and gene therapies emerging at a breakneck pace. Hospitals and healthcare groups that can swiftly adopt and integrate these cutting-edge solutions are positioning themselves for a significant competitive advantage. This relentless pursuit of the latest and most effective treatments fuels a fierce rivalry among providers.

Geographic Expansion and Market Penetration

Hygeia's deliberate strategy of organic growth, coupled with targeted acquisitions, aims to establish a comprehensive nationwide network of oncology-focused hospitals. This expansion directly fuels competitive rivalry, particularly as Hygeia enters new geographic markets or solidifies its existing presence, inevitably intensifying competition with established players.

This aggressive market penetration means Hygeia is actively challenging competitors for market share, potentially leading to price wars or increased marketing spend across the industry. For instance, in 2024, the healthcare sector saw significant M&A activity, with hospital systems frequently engaging in expansion to gain economies of scale and market dominance.

- Hygeia's nationwide hospital footprint expansion directly intensifies competitive rivalry in newly entered or strengthened markets.

- This strategy can lead to increased competition for patients, talent, and resources among healthcare providers.

- The healthcare industry in 2024 has been characterized by consolidation and expansion efforts, highlighting the pressure on companies to grow market share.

Price Competition Driven by Government Policies

Government policies, such as the National Reimbursement Drug List (NRDL) negotiations and Volume-Based Procurement (VBP) in China, directly impact pricing in the healthcare sector. These initiatives aim to lower the cost of drugs and medical devices, thereby increasing price competition among healthcare providers like Hygeia. While Hygeia can leverage these policies for reduced procurement expenses, it also means competitors can potentially offer more affordable treatment packages, intensifying the rivalry.

The impact of these policies is substantial. For instance, VBP programs have historically led to significant price reductions for selected medical consumables. In 2023, VBP for orthopedic implants saw average price cuts exceeding 50% for many products, a trend expected to continue and broaden in scope through 2024 and beyond.

- NRDL Negotiations: These government-led discussions with pharmaceutical companies result in lower prices for drugs included in the national health insurance list.

- Volume-Based Procurement (VBP): This policy consolidates purchasing power to negotiate lower prices for drugs and medical devices based on guaranteed purchase volumes.

- Price Erosion: Both NRDL and VBP contribute to significant price erosion, forcing companies to compete more aggressively on cost.

- Competitive Pressure: Hygeia faces increased pressure as competitors can also benefit from these lower input costs, potentially leading to more competitive pricing for services and treatments.

Hygeia faces intense competition from both public hospitals and other private oncology providers in China. Public institutions often benefit from government funding and established reputations, while private competitors are actively expanding and innovating in specialized cancer care.

The market is dynamic, with rapid adoption of new therapies like immunotherapy fueling rivalry. Hygeia's expansion strategy directly confronts existing players, potentially triggering price competition and increased marketing efforts across the sector.

Government policies, such as volume-based procurement, are driving down costs for medical supplies, further intensifying price competition among providers. This creates a challenging environment where efficiency and cost management are paramount for maintaining market share.

| Competitor Type | Key Strengths | Competitive Impact |

|---|---|---|

| Public Hospitals | Government backing, extensive research, established talent | Formidable barrier due to resources and scale |

| Top-Tier Cancer Centers | Specialized expertise, advanced technology, clinical trials | High bar for specialized treatment and patient attraction |

| Other Private Oncology Groups | Agility, patient experience focus, rapid adoption of new tech | Direct competition for market share and patient loyalty |

SSubstitutes Threaten

Traditional Chinese Medicine (TCM) presents a significant threat of substitution for Western oncology treatments, particularly in China where it's deeply ingrained in the healthcare landscape. For many cancer patients, TCM is not just an alternative but often a primary or complementary approach, sometimes integrated alongside conventional Western medicine.

In 2024, the global TCM market was valued at approximately $130 billion, with China being a dominant player. This widespread acceptance and integration means that for certain patient segments, TCM therapies can directly substitute for or reduce reliance on Western pharmaceutical or surgical interventions, impacting the demand for traditional cancer care services.

While Hygeia focuses on radiotherapy, other Western cancer treatments like surgery, chemotherapy, and systemic therapies, including targeted therapies and immunotherapies, act as substitutes. If patients choose these alternative primary treatment paths, it can reduce demand for Hygeia's core services.

The swift evolution and integration of novel drug classes, such as antibody-drug conjugates (ADCs) and bispecific antibodies, are actively reshaping cancer treatment protocols. For instance, the global oncology drug market was valued at approximately $200 billion in 2023 and is projected to grow significantly, driven by these innovative therapies, potentially diverting patients from traditional radiation treatments.

For cancer care aspects not needing hospitalization, like follow-ups, medication, or palliative care, home-based services and digital health platforms are emerging substitutes. Telemedicine and online pharmacies offer convenient alternatives to traditional hospital visits. Hygeia's investment in its own internet hospitals underscores the recognition of this significant shift towards decentralized healthcare delivery.

Prevention and Early Detection Programs

Long-term investments in cancer prevention and early detection programs, often driven by government health initiatives like 'Healthy China 2030,' aim to reduce the incidence and severity of cancer. These programs, while not direct treatment substitutes, can significantly lower the demand for extensive, late-stage hospital-based oncology interventions.

For instance, the increasing focus on lifestyle modifications and regular screenings can shift patient needs away from complex treatments. In 2024, global spending on cancer prevention and screening is projected to rise, indicating a growing awareness of their impact on healthcare demand.

- Reduced Incidence: Successful prevention strategies can decrease the overall number of cancer cases diagnosed.

- Early Diagnosis Impact: Early detection often leads to less aggressive and more treatable forms of cancer, potentially reducing the need for costly, prolonged treatments.

- Government Initiatives: Programs like 'Healthy China 2030' are actively promoting public health, which includes cancer prevention and early detection efforts, influencing future healthcare utilization.

- Shifting Demand: As prevention and early detection become more effective, the demand for advanced, late-stage cancer treatments may see a relative decline.

Lifestyle Changes and Holistic Wellness Approaches

Patients increasingly explore lifestyle changes and holistic wellness as alternatives or complements to traditional cancer treatments. These approaches, while not always direct replacements for medical intervention, can significantly impact patient decisions, potentially lessening the demand for intensive hospital-based care.

The growing interest in self-care and preventative health is a notable trend. For instance, by 2024, the global wellness market was projected to reach over $5.6 trillion, reflecting a strong consumer inclination towards holistic health solutions.

- Growing Wellness Market: The global wellness market's expansion signifies a broader consumer interest in health approaches beyond conventional medicine.

- Dietary and Lifestyle Impact: Significant shifts in diet and lifestyle are being adopted by individuals seeking to manage chronic conditions, including cancer.

- Complementary, Not Always Substitute: While these methods often complement medical treatments, they can reduce the perceived need for certain intensive hospital services for some patients.

Other cancer treatment modalities, such as surgery, chemotherapy, and advanced drug therapies, represent direct substitutes for radiotherapy. The increasing efficacy and accessibility of these alternatives can divert patients, impacting Hygeia's market share. For example, the global oncology drug market, valued at approximately $200 billion in 2023, continues to expand with novel therapies.

Digital health solutions and home-based care services are emerging as substitutes for certain aspects of cancer treatment, like follow-ups and palliative care. Telemedicine and online pharmacies offer convenience, reducing the need for hospital visits. Hygeia's own investment in internet hospitals acknowledges this trend towards decentralized healthcare delivery.

Preventative health measures and early detection programs, supported by government initiatives, also act as indirect substitutes by reducing the overall demand for extensive, late-stage cancer treatments. Global spending on cancer prevention and screening is projected to rise in 2024, indicating a shift towards managing cancer at earlier, less intensive stages.

| Substitute Category | Description | 2023/2024 Data Point | Impact on Hygeia |

|---|---|---|---|

| Alternative Medical Treatments | Surgery, chemotherapy, targeted therapies, immunotherapies | Global oncology drug market ~$200 billion (2023) | Potential diversion of patients from radiotherapy |

| Digital Health & Home Care | Telemedicine, online pharmacies, remote monitoring | Growing market for digital health solutions | Reduced demand for in-person hospital services |

| Prevention & Early Detection | Screenings, lifestyle changes, public health campaigns | Increasing global spending on cancer prevention (2024 projection) | Lower incidence and severity of cancer cases requiring intensive treatment |

Entrants Threaten

Establishing a comprehensive oncology healthcare group, particularly one with a network of hospitals offering advanced services like radiotherapy, demands substantial capital. For instance, a single linear accelerator for radiotherapy can cost upwards of $2 million, and building out a comprehensive cancer center can easily run into hundreds of millions of dollars. This significant financial outlay acts as a considerable deterrent for new entrants looking to compete in this specialized sector.

China's healthcare sector presents formidable barriers to entry due to its intricate regulatory landscape. New entrants face demanding licensing and approval procedures for hospitals, medical devices, and pharmaceuticals, demanding significant investment in time, capital, and specialized knowledge.

For instance, the National Medical Products Administration (NMPA) oversees a rigorous approval process for new drugs, which can take years and cost millions, deterring many potential market entrants. In 2023, the NMPA approved a limited number of novel drugs, underscoring the high bar for market access.

The threat of new entrants in the specialized oncology sector, particularly for advanced treatments, is significantly low due to the immense need for specialized expertise and a well-established brand reputation. Building this level of trust and accumulating the necessary clinical knowledge, especially in rapidly evolving fields like targeted therapies and immunotherapy, requires many years of dedicated practice and successful patient outcomes.

New players would find it exceptionally difficult to quickly attract leading oncologists and researchers, who are often loyal to established institutions with proven track records and resources for cutting-edge research. Furthermore, gaining the confidence of patients and referring physicians, crucial for patient flow and revenue generation, is a long and arduous process that established leaders like Hygeia have cultivated over decades.

Government Support for Domestic Innovation

Government support for domestic innovation, particularly in China, presents a significant threat of new entrants for Hygeia. Policies like the Made in China 2025 initiative actively promote the development and growth of local medical device and pharmaceutical companies. This can lead to a surge in new domestic players entering the market, potentially challenging established foreign firms.

These government initiatives often translate into direct financial backing, research grants, and preferential regulatory treatment for domestic companies. For example, China's National Medical Products Administration (NMPA) has been streamlining approval processes for innovative domestic drugs and devices. This creates a less equitable environment for international companies seeking to penetrate the market, as they may not benefit from the same level of support or face fewer hurdles.

- Government Funding: Chinese governmental bodies allocated substantial funds to R&D in the life sciences sector, with projections indicating continued growth through 2025.

- Regulatory Advantages: The NMPA has prioritized the review and approval of innovative domestic medical products, potentially shortening time-to-market for local entrants.

- Market Access: Policies aimed at fostering domestic champions can sometimes create indirect barriers for foreign competitors, influencing procurement decisions and market share.

Consolidation by Existing Players

The threat of new entrants in the healthcare sector, particularly concerning Hygeia, is significantly influenced by consolidation among existing players. For instance, the Chinese healthcare market has seen substantial consolidation, with major entities like Hygeia strategically acquiring and integrating smaller hospital networks. This trend creates formidable barriers for newcomers aiming for organic growth.

New entrants often face an uphill battle trying to compete with these larger, more established groups that benefit from economies of scale and a deeply entrenched market presence. To gain a foothold, potential new entrants might need to consider acquiring existing facilities rather than building from scratch, a strategy that demands significant capital and market insight.

Consider the implications of Hygeia's own growth trajectory. As of late 2024, Hygeia Healthcare Holdings Co., Ltd. continued to expand its network, demonstrating a clear strategy of inorganic growth through acquisitions and partnerships. This ongoing consolidation means that any new entrant must not only contend with Hygeia’s existing scale but also anticipate further market concentration, making direct competition increasingly difficult.

The consolidation landscape presents a clear challenge:

- Increased Capital Requirements: New entrants must possess substantial capital to either acquire established players or build a competitive infrastructure against scaled incumbents.

- Economies of Scale Advantage: Consolidated entities like Hygeia leverage greater purchasing power and operational efficiencies, offering lower costs and potentially better service integration.

- Brand Recognition and Trust: Established players often command greater brand recognition and patient trust, which are difficult for new entrants to replicate quickly.

- Regulatory Hurdles: Navigating complex healthcare regulations can be more burdensome for new, smaller entities compared to established players with existing compliance frameworks.

The threat of new entrants into Hygeia's specialized oncology market is significantly mitigated by the immense capital requirements for advanced facilities, such as radiotherapy centers, which can cost hundreds of millions. Furthermore, the complex regulatory environment in China, exemplified by the NMPA's stringent drug approval process, demands extensive time and financial investment, acting as a substantial barrier.

The need for specialized expertise and a strong brand reputation, cultivated over years of successful patient care and research, makes it difficult for newcomers to attract top talent and gain patient trust. Established players like Hygeia benefit from economies of scale and market presence, further consolidating their position and increasing the hurdles for new entrants.

| Barrier Type | Description | Impact on New Entrants |

| Capital Intensity | High cost of advanced medical equipment (e.g., linear accelerators > $2 million) and comprehensive cancer center development. | Substantially deters new entrants due to upfront investment needs. |

| Regulatory Hurdles | Complex licensing, approval processes for hospitals, devices, and drugs (e.g., NMPA drug approvals taking years and millions). | Creates significant time and financial investment challenges for market entry. |

| Expertise & Reputation | Requirement for specialized clinical knowledge, leading oncologists, and established patient/physician trust. | Makes rapid market penetration difficult for new players lacking a proven track record. |

| Market Consolidation | Acquisition strategies by established players like Hygeia increase market concentration. | Forces new entrants to either acquire existing facilities or face intense competition against scaled incumbents. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Hygeia is built upon a robust foundation of data, including publicly available financial reports, industry-specific market research from firms like IBISWorld, and insights from healthcare trade publications. We also leverage data from regulatory bodies and economic databases to provide a comprehensive view of the competitive landscape.