Huron Consulting Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Huron Consulting Group Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Huron Consulting Group's trajectory. Our meticulously crafted PESTLE analysis provides a strategic roadmap, highlighting opportunities and potential challenges. Equip yourself with actionable intelligence to navigate the complex external landscape. Download the full PESTLE analysis now and gain a decisive competitive advantage.

Political factors

Government healthcare policy reforms significantly shape the environment for Huron Consulting Group's clients. For instance, ongoing discussions around Medicare reimbursement rates and potential adjustments to the Affordable Care Act (ACA) directly impact hospital and health system revenue streams. These policy shifts create an immediate demand for expert guidance on compliance and financial strategy.

In 2024, the Centers for Medicare & Medicaid Services (CMS) proposed changes to the Inpatient Prospective Payment System (IPPS) that could affect hospital operating margins. Huron's ability to interpret and advise on such regulatory adjustments, including new telehealth mandates or data privacy regulations, is crucial for clients navigating these complexities.

Furthermore, legislative proposals aimed at controlling drug costs or expanding access to certain treatments can alter the operational models of pharmaceutical and life sciences companies. Huron's healthcare advisory services are essential for clients to adapt to these evolving policy landscapes and capitalize on emerging opportunities.

Public funding for higher education is a critical political factor. For instance, in the 2024-2025 academic year, many state governments are facing budget pressures, potentially leading to shifts in institutional appropriations. Huron's clients in this sector must be prepared for these fluctuations.

Accreditation bodies and evolving government regulations also shape the education landscape. New compliance requirements or changes in student aid policies, such as federal Pell Grant adjustments, can directly affect university operations and student enrollment, demanding strategic adaptation.

Government initiatives promoting research and development, including grant programs and tax incentives, offer opportunities but also require institutions to align their strategic goals with political priorities. Huron's ability to guide clients through these politically driven funding streams is paramount for their growth.

The regulatory landscape for life sciences is a significant political factor impacting Huron Consulting Group's clients. Agencies like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) set the standards for drug and device approval. For instance, in 2024, the FDA continued to emphasize real-world evidence in its review processes, a shift that requires companies to adapt their data collection strategies, directly influencing the consulting needs Huron addresses.

Changes in these approval pathways, such as evolving clinical trial protocols or new data submission mandates, can force substantial strategic and operational overhauls for life sciences firms. Huron's expertise is crucial in helping clients adapt to these shifts, aiming to speed up market entry while rigorously maintaining regulatory compliance, a vital service in a sector where delays can cost millions.

Geopolitical Stability and Trade Policies

Global geopolitical events and evolving trade policies significantly impact Huron Consulting Group's clients, particularly those in the commercial and life sciences sectors. Fluctuations in international relations can disrupt supply chains, alter market access, and influence crucial investment decisions for multinational corporations. For instance, the ongoing trade tensions between major economic blocs, which intensified in late 2023 and early 2024, have led many companies to re-evaluate their global sourcing strategies and market diversification plans. Huron's expertise in navigating these complex political landscapes becomes vital as clients seek guidance on risk management and supply chain resilience.

The ability of Huron to provide timely insights into global political dynamics is a key differentiator. As of early 2024, the World Trade Organization (WTO) reported a slowdown in global trade growth, partly attributed to geopolitical uncertainties and protectionist measures. This environment necessitates robust consulting services focused on market entry strategies, regulatory compliance, and adapting to shifting international trade agreements. Huron's advisory services help clients mitigate these risks and capitalize on emerging opportunities in a volatile global marketplace.

- Geopolitical Instability: Ongoing conflicts and political realignments in various regions create uncertainty for global businesses, impacting investment flows and operational continuity.

- Trade Policy Shifts: Changes in tariffs, trade agreements, and non-tariff barriers, such as those seen in bilateral trade discussions throughout 2024, directly affect market access and cost structures for Huron's clients.

- Supply Chain Vulnerabilities: Geopolitical risks have exposed fragilities in global supply chains, prompting increased demand for consulting on diversification and resilience strategies.

- Market Access Challenges: New trade barriers or sanctions can restrict market access, requiring clients to seek expert advice on alternative market entry strategies and compliance.

Government Spending and Economic Stimulus

Government fiscal policies significantly influence the consulting market. For instance, the US federal budget for fiscal year 2024 proposed around $6.9 trillion in spending, with a focus on areas like national defense and social programs. Such allocations can directly translate into demand for consulting services in areas like defense modernization, public health initiatives, or digital transformation within government agencies.

Conversely, austerity measures or budget constraints can dampen demand. If governments tighten their belts, organizations may postpone or scale back investments in strategic advice or operational improvements. For Huron Consulting Group, this means monitoring announcements regarding government spending priorities and potential budget adjustments, as these directly impact the landscape for advisory services.

- Increased Infrastructure Spending: Initiatives like the US Bipartisan Infrastructure Law, allocating over $1 trillion, create opportunities for consultants in project management, engineering advisory, and environmental impact assessments.

- Technology Modernization Funds: Government investments in upgrading IT systems and cybersecurity, such as the proposed $11.5 billion for the General Services Administration's IT modernization in FY2025, drive demand for digital transformation consulting.

- Healthcare Sector Investments: As governments continue to prioritize healthcare, consulting firms can find work in areas like public health program evaluation, hospital operational efficiency, and healthcare technology implementation.

- Impact of Fiscal Deficits: High national debt levels can lead to future austerity, potentially reducing government contract opportunities and overall economic stimulus, thereby affecting consulting demand.

Governmental focus on economic stimulus and infrastructure development presents significant opportunities for consulting firms like Huron. For instance, the US government's commitment to infrastructure projects, as highlighted by the over $1 trillion allocated through the Bipartisan Infrastructure Law, directly translates into demand for advisory services in project management and strategic planning.

Political stability and government effectiveness also play a crucial role. In 2024, countries with stable political environments and efficient regulatory frameworks tend to attract more foreign investment, benefiting sectors that Huron serves. Conversely, political instability can deter investment and create uncertainty, impacting client spending on consulting services.

The political landscape's influence on regulatory environments, particularly in healthcare and life sciences, remains paramount. As of mid-2024, regulatory bodies continue to adapt to advancements in technology and patient care, necessitating expert guidance for compliance and strategic adaptation. For example, evolving data privacy regulations require companies to invest in robust compliance strategies, a service Huron provides.

Governmental fiscal policies, including tax reforms and spending priorities, directly impact the demand for consulting services. In 2024, many nations are navigating post-pandemic economic recovery, leading to varied fiscal approaches that create both opportunities and challenges for businesses and, consequently, for consulting engagements.

| Political Factor | Impact on Huron Consulting Group | Example/Data (2024/2025) |

|---|---|---|

| Infrastructure Spending | Increased demand for project management and strategic advisory. | US Bipartisan Infrastructure Law: Over $1 trillion allocated. |

| Regulatory Environment (Healthcare) | Need for compliance and strategic adaptation consulting. | FDA emphasis on real-world evidence in drug approvals. |

| Fiscal Policies | Demand for services related to tax and spending adjustments. | Global focus on post-pandemic economic recovery strategies. |

| Political Stability | Influences investment and client spending on consulting. | Stable nations attract more foreign investment, boosting consulting needs. |

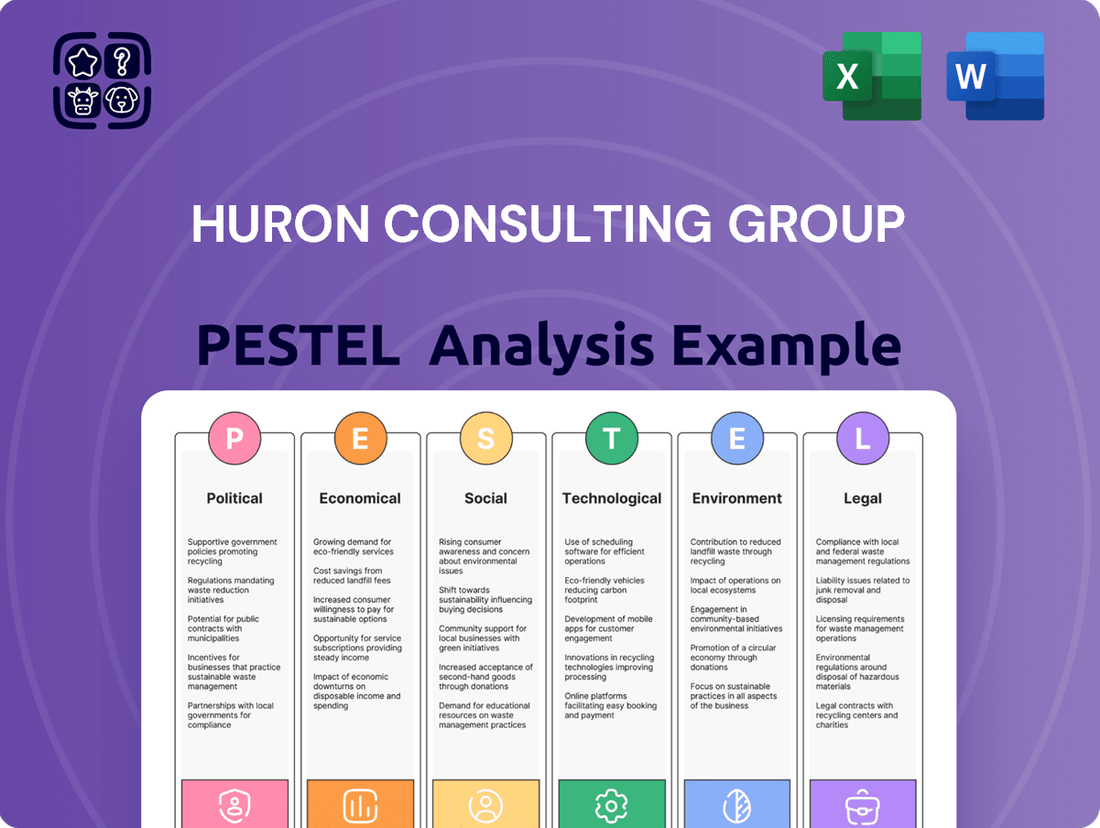

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental forces impacting Huron Consulting Group, covering Political, Economic, Social, Technological, Environmental, and Legal factors.

It offers actionable insights for strategic decision-making by identifying potential threats and opportunities within Huron's operating landscape.

Huron Consulting Group's PESTLE analysis provides a clear and concise framework that simplifies complex external factors, acting as a pain point reliever by enabling quick understanding and strategic decision-making for busy executives.

Economic factors

Rising inflation, a persistent economic challenge in 2024 and projected into 2025, directly impacts Huron Consulting Group's operational expenses, particularly for talent and technology investments. For instance, the U.S. Consumer Price Index (CPI) saw significant increases throughout 2023 and early 2024, impacting wage demands and software licensing costs.

This inflationary environment also affects Huron's client base by eroding their purchasing power and potentially squeezing profit margins. Consequently, businesses are increasingly turning to consulting firms like Huron for solutions in cost optimization, supply chain resilience, and robust financial strategy to navigate these economic headwinds.

The demand for Huron's performance improvement and financial advisory services is therefore amplified in this economic climate. As companies grapple with the effects of inflation, such as the projected 3.5% to 4.5% inflation rate for the US in 2024 according to various economic forecasts, their need for expert guidance on efficiency and financial health becomes paramount.

Changes in interest rates significantly impact the cost of capital for Huron's clients, directly influencing their capacity and inclination to fund major capital projects or technology upgrades. For instance, if the Federal Reserve maintains its target range for the federal funds rate at 5.25%-5.50% in 2024, as it did through much of late 2023 and early 2024, borrowing becomes more expensive, potentially causing clients to postpone investments that require consulting expertise.

Conversely, periods of lower interest rates, such as the near-zero rates seen in prior years, tend to spur greater investment and consequently boost demand for Huron's strategic planning and implementation services. Understanding these capital market shifts is crucial for Huron to effectively tailor its service portfolio to match the ebb and flow of client investment cycles and economic conditions.

The global economy's trajectory significantly influences demand for consulting services. In 2024, while growth is projected to moderate, the International Monetary Fund (IMF) forecasts a 3.2% expansion for the global economy, a slight uptick from 3.1% in 2023. This generally positive outlook supports investment in strategic initiatives by clients.

However, recessionary risks remain a concern, particularly in developed economies. For Huron Consulting Group, a slowdown could mean clients prioritizing cost optimization over growth-oriented projects. For instance, if a recessionary environment takes hold, companies might reduce discretionary spending on large-scale transformation projects, impacting Huron's revenue streams.

The consulting industry, including firms like Huron, is inherently cyclical. During economic upturns, demand for services like digital transformation and M&A advisory typically rises. Conversely, during downturns, there's a shift towards operational efficiency and restructuring services. Huron's ability to adapt its service offerings to prevailing economic conditions is crucial for sustained performance.

Labor Market Dynamics and Talent Costs

The availability and cost of skilled labor are crucial economic considerations for Huron Consulting Group. In 2024, the US experienced a persistent tight labor market, with the unemployment rate hovering around 3.9% for much of the year, indicating a high demand for workers. This scarcity directly impacts Huron's ability to attract and retain top consulting talent, potentially increasing recruitment and compensation expenses.

Conversely, labor shortages faced by Huron's clients, particularly in sectors like healthcare and technology, are a significant driver for demand for their services. For instance, the healthcare industry in 2024 continued to grapple with critical shortages of nurses and specialized medical professionals. This client-side pressure fuels demand for Huron's expertise in workforce planning, talent strategy, and operational efficiency solutions designed to mitigate these labor challenges.

These labor market dynamics directly influence both Huron's internal operational costs and the strategic value of its service offerings. The increasing cost of talent acquisition and retention for Huron, coupled with client needs stemming from labor scarcity, shapes the consulting landscape and strategic priorities for the firm and its clientele.

- US Unemployment Rate (2024 Average): Approximately 3.9%

- Impact on Huron: Increased costs for talent acquisition and retention.

- Client Demand Driver: Labor shortages in healthcare and technology sectors.

- Huron's Service Relevance: Workforce planning, talent management, operational efficiency.

Industry-Specific Economic Trends

Huron Consulting Group operates across diverse sectors, each with its own economic currents. In healthcare, for instance, the push towards value-based care models, as evidenced by CMS's continued emphasis on programs like the Medicare Shared Savings Program, creates demand for efficiency and cost-optimization consulting. This contrasts with the education sector, which in 2024 and 2025 is grappling with demographic shifts leading to enrollment challenges at many institutions, requiring strategic financial planning and operational adjustments.

The life sciences industry, a key area for Huron, is experiencing robust growth driven by innovation and increased R&D spending, with global pharmaceutical R&D expenditure projected to reach over $250 billion in 2024. Conversely, the commercial sector's economic trajectory is more varied, influenced by inflation rates and consumer spending patterns, which directly impact demand for Huron's advisory services related to performance improvement and digital transformation.

- Healthcare: Rising operational costs and the transition to value-based reimbursement models continue to shape demand for Huron's services in 2024-2025.

- Education: Declining enrollment trends in certain regions and evolving funding structures necessitate specialized financial and strategic advisory.

- Life Sciences: Strong R&D investment and innovation pipeline growth present significant opportunities for consulting in areas like market access and operational efficiency.

- Commercial: Economic volatility, including inflation and shifts in consumer behavior, drives demand for performance improvement and digital strategy consulting.

Persistent inflation in 2024 and projected into 2025 directly affects Huron's operational costs, particularly for talent and technology, with U.S. CPI showing significant increases. This economic factor also impacts clients' purchasing power, increasing demand for Huron's cost optimization and financial strategy services, as companies navigate headwinds like the projected 3.5%-4.5% U.S. inflation rate for 2024.

Interest rate changes, such as the Federal Reserve's potential maintenance of the 5.25%-5.50% federal funds rate in 2024, influence clients' capital expenditure and their willingness to invest in projects requiring consulting. This economic shift necessitates Huron's adaptation of its service portfolio to align with client investment cycles, contrasting with periods of lower rates that historically spurred greater investment.

The global economic outlook for 2024, with the IMF forecasting 3.2% growth, generally supports client investment, though recessionary risks could lead clients to prioritize cost optimization over growth projects. Huron's performance is inherently cyclical, requiring flexibility in service offerings to meet shifting client needs during economic upturns and downturns.

Labor market dynamics, including the tight U.S. labor market with a 3.9% unemployment rate in 2024, increase Huron's talent acquisition costs. Simultaneously, client-side labor shortages, especially in healthcare and technology, drive demand for Huron's workforce planning and operational efficiency solutions.

| Economic Factor | 2024/2025 Data Point | Impact on Huron Consulting Group | Client Demand Driver |

| Inflation | U.S. CPI significant increases; Projected 3.5%-4.5% U.S. inflation 2024 | Increased operational costs (talent, technology) | Demand for cost optimization, financial strategy |

| Interest Rates | Fed Funds Rate target 5.25%-5.50% (late 2023-early 2024) | Affects client capital investment capacity | Demand for strategic planning, implementation |

| Global Economic Growth | IMF forecast 3.2% global growth 2024 | Generally supports client investment | Demand for growth-oriented projects; Recession risk shifts focus to efficiency |

| Labor Market | U.S. Unemployment Rate ~3.9% (2024) | Higher talent acquisition/retention costs | Client labor shortages drive demand for workforce solutions |

Same Document Delivered

Huron Consulting Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, detailing Huron Consulting Group's PESTLE analysis.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, offering a comprehensive look at the political, economic, social, technological, legal, and environmental factors impacting Huron.

The content and structure shown in the preview is the same document you’ll download after payment, providing actionable insights into Huron Consulting Group's strategic environment.

Sociological factors

Shifting workforce demographics, including an aging population and the rise of a more diverse, multi-generational workforce, are significantly influencing how businesses operate and manage talent. For instance, as of 2024, the U.S. Bureau of Labor Statistics projects that workers aged 55 and over will continue to be a growing segment of the labor force. This demographic shift presents both opportunities and challenges for organizations seeking to attract, retain, and effectively integrate talent.

Organizations are increasingly turning to consulting firms like Huron for assistance in navigating these complex workforce dynamics. This includes addressing persistent labor shortages in key sectors, such as healthcare and technology, and developing strategies to improve talent acquisition and retention in a competitive market. The demand for expertise in fostering inclusive work environments and managing generational differences is also on the rise, as companies strive to create equitable and productive workplaces.

Huron's established expertise in human capital management, organizational design, and change management positions it to provide critical support to clients adapting to these evolving workforce landscapes. By offering insights into talent strategy, workforce planning, and employee engagement, Huron helps organizations build resilient and adaptable workforces capable of meeting future demands and capitalizing on demographic trends.

In healthcare, patients are increasingly seeking personalized, convenient, and digitally integrated care. For instance, a 2024 survey indicated that 70% of patients prefer online appointment scheduling and digital communication with providers. This shift fuels demand for Huron's expertise in patient engagement strategies and the implementation of telehealth solutions.

Similarly, in education, students are looking for flexible learning options and programs directly linked to career outcomes. By 2025, it's projected that over 60% of university students will utilize digital learning platforms extensively. This trend highlights the need for Huron's services in developing digital learning environments and enhancing student success initiatives.

A significant societal shift towards prioritizing health equity, preventative care, and mental well-being is reshaping the healthcare landscape and influencing employer strategies. This growing consciousness is fueling demand for services focused on population health management, community health programs, and comprehensive employee wellness initiatives.

For instance, the U.S. Department of Health and Human Services has set ambitious goals for improving health equity, aiming to increase access to care and reduce health disparities by 2030. This aligns directly with the increasing demand for services that address social determinants of health.

Huron's consulting expertise is well-positioned to guide healthcare providers and employers in developing and executing strategies that not only meet these evolving public health priorities but also demonstrably enhance patient and employee outcomes, potentially impacting a significant portion of the U.S. population, which saw healthcare spending reach $4.5 trillion in 2023, according to CMS data.

Demand for Digital Accessibility and Inclusion

Societal expectations are rapidly evolving towards greater digital accessibility and inclusion across all sectors. As more of life moves online, consumers and clients demand that digital services, from healthcare portals to e-commerce platforms, are usable by everyone, including individuals with disabilities and those facing socioeconomic barriers. This trend is particularly pronounced in 2024 and 2025, with regulatory bodies and advocacy groups pushing for stricter adherence to accessibility standards. For instance, the U.S. Department of Justice has been actively enforcing the Americans with Disabilities Act (ADA) in the digital space, leading to increased litigation and a greater focus on compliance.

This growing demand directly influences client investment in digital transformation. Businesses are realizing that failing to provide accessible and inclusive digital experiences not only alienates segments of their customer base but also exposes them to legal and reputational risks. Companies are therefore prioritizing projects that enhance user interfaces, ensure compatibility with assistive technologies, and offer content in multiple formats. For example, a significant portion of digital transformation budgets in 2024 were allocated to improving website accessibility, with projections indicating this will continue into 2025.

Huron Consulting Group is well-positioned to assist clients in navigating these evolving demands. The firm can offer expert guidance on developing and implementing digital strategies that embed accessibility and inclusion from the outset. This includes advising on the design of user-friendly interfaces, selecting appropriate technologies, and ensuring compliance with global accessibility guidelines such as the Web Content Accessibility Guidelines (WCAG). Huron's expertise can help clients build digital solutions that are not only compliant but also foster broader market reach and enhanced customer loyalty.

Key areas where Huron can support clients include:

- Digital Accessibility Audits: Assessing current digital platforms against WCAG 2.2 standards, which became a key benchmark in late 2023 and continues to gain traction.

- Inclusive Design Strategy: Developing user-centered design principles that cater to a diverse range of abilities and backgrounds.

- Assistive Technology Integration: Advising on the seamless incorporation of screen readers, keyboard navigation, and other assistive tools into client systems.

- Accessibility Training and Awareness: Educating client teams on best practices for creating and maintaining accessible digital content and services, a growing need as awareness intensifies through 2025.

Public Trust and Ethical Considerations

Societal expectations for ethical conduct, data privacy, and corporate social responsibility are significantly rising, impacting all sectors. Clients, especially in sensitive areas like healthcare and life sciences, face mounting pressure to showcase transparency and integrity. For instance, a 2024 survey indicated that 78% of consumers consider a company's ethical practices when making purchasing decisions.

Huron Consulting Group is well-positioned to address these evolving demands by offering expertise in governance, risk, and compliance (GRC) frameworks. By helping clients implement robust ethical business practices and responsible data handling protocols, Huron can assist them in building and sustaining crucial public trust. This includes advising on compliance with regulations like GDPR, which saw a 15% increase in reported data breaches in 2024, highlighting the ongoing need for strong data protection measures.

- Growing Consumer Demand for Ethics: 78% of consumers in 2024 prioritize ethical business practices.

- Regulatory Scrutiny: Increased focus on data privacy, with GDPR breaches up 15% in 2024.

- Huron's Role: Advising on GRC frameworks to enhance client transparency and integrity.

- Sectoral Sensitivity: Healthcare and life sciences clients face particular pressure for ethical operations.

Societal expectations for ethical conduct and data privacy are increasingly shaping business strategies, particularly in sectors like healthcare. For example, a 2024 survey revealed that 78% of consumers consider a company's ethical practices when making purchasing decisions, underscoring the importance of transparency and integrity.

Huron Consulting Group leverages its expertise in governance, risk, and compliance (GRC) to help clients navigate these evolving demands. By implementing robust ethical frameworks and responsible data handling, Huron assists organizations in building and maintaining public trust, especially as data breaches, like the 15% increase in GDPR incidents reported in 2024, highlight the critical need for strong data protection.

This societal shift necessitates a proactive approach to corporate social responsibility, influencing everything from supply chain management to employee relations. Companies that prioritize ethical operations and data security are better positioned to attract talent, retain customers, and mitigate reputational risks in the current landscape.

Technological factors

Artificial intelligence and machine learning are fundamentally reshaping how businesses operate, analyze data, and make critical decisions across all industries that Huron Consulting Group serves. This technological wave is a major driver of demand for consulting services focused on digital transformation and advanced analytics.

Clients are actively seeking Huron's expertise to embed AI into their core processes. Examples include leveraging predictive analytics for improved patient outcomes in healthcare or developing adaptive, personalized learning systems in education. This surge in client interest highlights a significant opportunity for Huron's technology strategy and implementation services, as organizations look to harness AI's potential.

The global AI market is projected to reach over $1.5 trillion by 2030, with a compound annual growth rate of around 37%, underscoring the immense growth potential. For Huron, staying at the forefront of these advancements necessitates continuous investment in developing and refining its AI and machine learning capabilities and service offerings to meet evolving client needs.

The growing complexity of cyber threats, impacting sectors like healthcare and education, demands advanced data protection measures. Huron's clients increasingly rely on the firm for risk assessments, ensuring compliance with regulations such as HIPAA, and deploying cutting-edge security solutions to safeguard sensitive information.

The financial and reputational damage from data breaches is substantial, making cybersecurity a paramount concern for businesses. For instance, the average cost of a data breach in the healthcare sector reached $10.10 million in 2023, highlighting the critical need for expert guidance.

The relentless migration to cloud computing and broad digital transformation efforts are significantly fueling demand for consulting services. Organizations are increasingly adopting cloud solutions to boost their ability to scale, improve operational efficiency, and drive innovation. For instance, the global public cloud market was projected to reach over $600 billion in 2023, with continued strong growth anticipated through 2025, underscoring the widespread client investment in these technologies.

Huron Consulting Group is strategically positioned to capitalize on this trend by offering specialized advisory and implementation services. They assist clients in navigating complex cloud migrations, optimizing their existing digital infrastructures, and ultimately achieving key business objectives through the adoption of advanced technologies. This focus directly addresses the critical need for expertise in managing and leveraging these transformative digital shifts.

Data Analytics and Business Intelligence

The increasing reliance on data analytics and business intelligence is a significant technological driver for consulting firms like Huron. Organizations are actively seeking to harness vast datasets for improved decision-making and operational efficiency. Huron's expertise in data strategy, governance, and analytics platform implementation directly addresses this demand, enabling clients to unlock the full potential of their data assets.

The market for data analytics services is experiencing robust growth. For instance, global big data and business analytics market revenue was projected to reach $312.5 billion in 2024, a substantial increase from previous years. This highlights the critical need for sophisticated analytical capabilities across industries.

Huron's strategic focus on these areas positions them well to capitalize on this trend. Their ability to provide end-to-end solutions, from data strategy development to the implementation of advanced analytics tools, is a key differentiator. This allows clients to gain actionable insights that drive tangible business outcomes.

- Growing Demand: The global big data and business analytics market is expected to continue its upward trajectory, with significant investment in data-driven decision-making tools.

- Huron's Value Proposition: Huron Consulting Group offers specialized services in data strategy, data governance, and analytics platform implementation, crucial for clients seeking to leverage their data effectively.

- Client Needs: Businesses are increasingly looking for ways to improve operational efficiency and identify emerging trends through advanced data analysis.

- Impact of Technology: The technological advancement in data processing and AI further amplifies the need for expert guidance in extracting value from complex data environments.

Emerging Technologies and Innovation

Beyond the well-established fields of AI and cloud computing, technologies like blockchain, virtual and augmented reality (VR/AR), and advanced automation are rapidly maturing, poised to reshape numerous sectors. For instance, the global AR/VR market is projected to reach $107.6 billion by 2027, indicating significant client interest in these disruptive forces. Huron Consulting Group must maintain a keen focus on these emerging innovations, cultivating expertise to guide clients through their strategic implementation and the identification of competitive advantages.

Staying ahead of the technological curve is paramount for Huron's continued relevance and value proposition. This proactive approach ensures the firm can effectively advise clients navigating the complexities of digital transformation.

- Blockchain: Continued development in decentralized ledger technology offers potential for enhanced security and transparency in supply chains and financial transactions.

- Virtual/Augmented Reality: The expanding adoption of VR/AR in training, design, and customer engagement presents new avenues for operational efficiency and client experience.

- Advanced Automation: Sophisticated robotics and intelligent process automation are transforming manufacturing, logistics, and service industries, demanding strategic integration.

Technological advancements, particularly in AI and cloud computing, are driving significant demand for Huron's consulting services. Organizations are actively seeking expertise to integrate these technologies for improved efficiency and decision-making. The global AI market's projected growth to over $1.5 trillion by 2030, coupled with the public cloud market's expected continued strong growth through 2025, underscores this trend.

Huron's strategic focus on data analytics and business intelligence is crucial, as the big data and business analytics market revenue was projected to reach $312.5 billion in 2024. Furthermore, emerging technologies like VR/AR, with a projected market of $107.6 billion by 2027, present new opportunities for clients and require Huron's advisory services.

Cybersecurity remains a critical concern, with the average cost of a data breach in healthcare reaching $10.10 million in 2023, necessitating Huron's risk assessment and security solutions. The firm's ability to navigate these complex technological landscapes and provide actionable insights is key to client success.

Legal factors

The healthcare industry operates under a stringent regulatory framework, with key legislation like the Health Insurance Portability and Accountability Act (HIPAA) dictating patient data privacy and security standards, and the Stark Law overseeing physician self-referral arrangements. Huron's healthcare clients depend on expert legal and compliance guidance to navigate these intricate rules, thereby avoiding significant penalties and upholding ethical practices.

In 2024, the healthcare sector continued to grapple with evolving compliance landscapes. For instance, HIPAA enforcement actions resulted in substantial fines, with settlements in the millions of dollars for data breaches, underscoring the critical need for robust data protection measures that Huron helps implement. The firm's expertise is vital for clients seeking to build and maintain compliant operations amidst these challenges.

Global data privacy laws like GDPR and CCPA are increasingly influencing how businesses, including Huron's commercial and life sciences clients, manage sensitive information. These regulations mandate stringent protocols for data collection, processing, and secure storage, directly impacting client operations and requiring expert navigation.

Huron Consulting Group offers essential advisory services to help clients achieve compliance with these complex data privacy frameworks. This includes implementing privacy-by-design strategies and robust data breach management plans, crucial for maintaining trust and avoiding significant penalties.

For instance, as of early 2025, companies face substantial fines for non-compliance; GDPR violations can reach up to €20 million or 4% of global annual turnover. This underscores the critical need for expert guidance in navigating these evolving legal landscapes.

Huron Consulting Group's advisory on mergers, acquisitions, and strategic partnerships, especially within commercial and life sciences, necessitates strict adherence to anti-trust and competition laws. These laws are designed to prevent market monopolization and foster equitable competition. For instance, the U.S. Department of Justice and the Federal Trade Commission actively review transactions to ensure they don't harm consumers, with significant merger filings in 2024 indicating ongoing regulatory scrutiny.

Huron's strategic guidance frequently incorporates these legal considerations, aiming to ensure client ventures are compliant and avoid potential regulatory roadblocks. Understanding the nuances of these regulations is crucial for successful deal execution and long-term business sustainability. Failure to comply can result in substantial fines and divestitures, impacting deal value and strategic objectives.

Education Accreditation and Compliance

Educational institutions operate under a stringent legal umbrella, encompassing accreditation standards, student privacy laws like FERPA, and federal funding regulations such as Title IX. Huron Consulting Group's expertise is critical for these clients to navigate these complex requirements, ensuring they maintain their operational licenses and eligibility for vital federal funding. For instance, in 2023, the U.S. Department of Education reported over $160 billion in federal student aid, underscoring the financial implications of compliance.

Huron assists its education sector clients in mitigating risks tied to student data management and campus safety, both areas heavily regulated by law. Ensuring adherence to these legal frameworks is not merely a procedural step but a fundamental requirement for the sustained operation and financial health of educational organizations.

- Accreditation: Institutions must meet rigorous standards set by accrediting bodies to offer degrees and receive federal aid.

- Student Rights: Laws like Title IX prohibit sex discrimination, impacting campus policies and procedures.

- Data Privacy: FERPA protects student educational records, demanding secure data handling practices.

- Funding Eligibility: Compliance with federal regulations is paramount for accessing significant financial resources.

Labor and Employment Laws

Huron Consulting Group, like all employers, must navigate a complex web of labor and employment laws. This includes regulations covering everything from minimum wage and overtime pay to workplace safety and anti-discrimination statutes. For instance, in the US, the Fair Labor Standards Act (FLSA) sets federal minimum wage and overtime pay requirements, while Title VII of the Civil Rights Act of 1964 prohibits employment discrimination based on race, color, religion, sex, or national origin. These laws directly affect how Huron manages its own workforce and how it advises clients on their employment practices.

Changes in these legal frameworks can significantly alter business operations. For example, an increase in the federal minimum wage, which has been a recurring topic of discussion and potential legislation in 2024 and projected for 2025, would necessitate adjustments to compensation strategies for many companies. Similarly, new rulings on independent contractor classification or remote work policies could require substantial revisions to HR policies and client service delivery models.

Huron's advisory services are crucial in helping clients adapt to these evolving legal landscapes. By offering expertise on compliance, risk management, and best practices in workforce management, Huron assists businesses in ensuring fair treatment of employees and avoiding costly legal challenges. This is particularly relevant as the gig economy continues to grow, raising questions about worker classification and protections. In 2023, the US Department of Labor continued to emphasize enforcement of wage and hour laws, with significant penalties for violations.

Key areas of labor and employment law impacting businesses include:

- Wage and Hour Laws: Compliance with minimum wage, overtime, and record-keeping requirements. For example, in 2024, many states saw increases in their state minimum wages, impacting businesses operating across multiple jurisdictions.

- Anti-Discrimination and Harassment: Adherence to laws prohibiting discrimination and ensuring a harassment-free workplace. The Equal Employment Opportunity Commission (EEOC) reported a significant number of discrimination charges filed annually, highlighting the ongoing importance of these regulations.

- Workplace Safety: Meeting standards set by agencies like the Occupational Safety and Health Administration (OSHA) to ensure a safe working environment.

- Union Relations: Understanding and complying with laws governing collective bargaining and employee representation. The National Labor Relations Board (NLRB) has seen increased activity in unionization efforts across various sectors in recent years.

Huron's clients must navigate a complex legal environment, particularly concerning data privacy and cybersecurity. Regulations like GDPR and CCPA impose strict requirements on data handling, with potential fines reaching millions for non-compliance, as seen in ongoing enforcement actions throughout 2024 and projected into 2025.

In the healthcare sector, adherence to HIPAA remains paramount, with significant penalties for breaches. Huron's advisory ensures clients meet these stringent data protection standards, crucial for avoiding financial repercussions and maintaining patient trust.

Mergers and acquisitions are subject to rigorous antitrust reviews by bodies like the FTC and DOJ. Huron's strategic guidance helps clients ensure compliance with competition laws, vital for successful deal execution amidst heightened regulatory scrutiny in 2024.

Educational institutions face legal mandates regarding student privacy (FERPA) and non-discrimination (Title IX). Huron's expertise assists these clients in maintaining compliance, which is essential for accreditation and access to federal funding, a sector that saw over $160 billion in federal student aid in 2023.

Environmental factors

Companies are increasingly expected to report on their Environmental, Social, and Governance (ESG) performance, driven by investors, regulators, and consumers. For instance, by the end of 2024, the SEC's proposed climate disclosure rules, though facing legal challenges, signal a trend toward greater environmental reporting. This growing demand for transparency creates a substantial opportunity for advisory firms like Huron to offer expertise in data collection, reporting frameworks, and developing sustainability strategies.

Climate change presents both physical and transitional risks that directly affect Huron's clients. Extreme weather events, for instance, can disrupt infrastructure and supply chains, impacting operational continuity. As of early 2024, the increasing frequency and intensity of such events, like severe floods and heatwaves, are compelling businesses to reassess their vulnerability.

Consequently, there's a growing demand for consulting services focused on climate risk assessment and adaptation strategy development. Many organizations are actively seeking expertise to build resilience into their operations, recognizing that proactive measures are crucial for long-term viability. This trend is underscored by the projected global costs of climate inaction, which are expected to far outweigh the investments in adaptation.

Huron Consulting Group is well-positioned to advise on climate risk management and sustainable operational planning. By helping clients understand their exposure to physical and transitional risks, such as potential carbon pricing mechanisms, Huron can guide them in developing robust strategies to navigate these challenges and ensure business continuity.

Growing global concerns over resource depletion and escalating waste generation are significantly pushing industries towards adopting circular economy principles. This shift focuses on minimizing resource consumption, maximizing reuse, and enhancing recycling processes to create more sustainable business models. For instance, the Ellen MacArthur Foundation estimates that a global shift to a circular economy for plastics could generate $200 billion annually by 2040.

Clients are increasingly seeking expert guidance to optimize their resource utilization, effectively reduce their environmental impact, and build more resilient, sustainable operations. Huron Consulting Group is well-positioned to support these evolving client needs by offering specialized services in supply chain optimization, developing impactful waste reduction strategies, and aiding in the creation of sustainable product designs.

Regulatory Pressure for Decarbonization

Governments globally are intensifying efforts to combat climate change through robust decarbonization mandates. For instance, the European Union's Fit for 55 package aims to cut emissions by at least 55% by 2030 compared to 1990 levels, impacting sectors like manufacturing and transportation. This regulatory push compels businesses, including Huron's clients in healthcare and manufacturing, to actively transition towards renewable energy sources and enhance their energy efficiency.

Huron Consulting Group is well-positioned to assist clients in navigating this evolving landscape. The firm can offer strategic advisory services focused on energy transition planning, comprehensive carbon footprint analysis and reduction strategies, and ensuring compliance with a growing array of climate-related policies and reporting standards. This includes advising on the implementation of technologies and operational changes necessary to meet ambitious emissions targets.

The financial implications of these regulations are significant. For example, carbon pricing mechanisms, such as emissions trading schemes, are becoming more widespread. In 2024, the EU Emissions Trading System (ETS) saw allowance prices fluctuate, impacting operational costs for heavy industry. Companies must factor these costs into their long-term strategies, making expert guidance on decarbonization crucial for maintaining competitiveness and profitability.

- Regulatory Landscape: Increasing global regulations mandating emissions reductions, such as the EU's Fit for 55 package, are driving demand for decarbonization strategies.

- Industry Impact: Sectors like manufacturing and healthcare face direct pressure to adopt cleaner energy and improve energy efficiency to comply with new climate policies.

- Huron's Role: The firm provides strategic guidance on energy transition, carbon footprint reduction, and adherence to emerging climate regulations.

- Financial Considerations: The rise of carbon pricing mechanisms, like the EU ETS, necessitates strategic planning to manage operational costs and ensure long-term financial viability.

Stakeholder Expectations for Corporate Responsibility

Customers, employees, and communities are increasingly looking beyond basic legal compliance, expecting businesses to actively manage their environmental impact. This growing demand for corporate responsibility directly affects how companies are perceived, their ability to attract top talent, and their access to various markets. For instance, a 2024 survey indicated that over 60% of consumers consider a company's environmental policies when making purchasing decisions.

Huron Consulting Group assists clients in navigating these heightened expectations. They help in crafting and communicating effective environmental policies, implementing sustainable operational practices, and ultimately bolstering their overall corporate responsibility image. This proactive approach is crucial for businesses aiming to align with evolving societal values and maintain a competitive edge.

Meeting these stakeholder demands can translate into tangible business benefits. Companies demonstrating strong environmental stewardship often experience improved brand loyalty and a more engaged workforce. In 2025, businesses with robust ESG (Environmental, Social, and Governance) frameworks are projected to see a 15% higher valuation compared to their peers with weaker commitments.

- Consumer Demand: Over 60% of consumers in 2024 factored environmental policies into their buying choices.

- Talent Attraction: A strong environmental record is becoming a key differentiator in attracting and retaining employees.

- Market Access: Many B2B contracts and investment opportunities now prioritize partners with demonstrated sustainability commitments.

- Financial Performance: Companies with strong ESG frameworks are expected to achieve 15% higher valuations by 2025.

The increasing focus on environmental sustainability, driven by consumer and investor demand, compels businesses to adopt greener practices. By 2025, companies with strong ESG commitments are anticipated to see valuations 15% higher than those with weaker ones, highlighting the financial imperative of environmental stewardship.

Huron Consulting Group is equipped to guide clients in developing and implementing robust sustainability strategies, addressing everything from resource efficiency to circular economy principles, thereby enhancing their market appeal and long-term viability.

The imperative to decarbonize, spurred by regulations like the EU's Fit for 55 package, is reshaping industries. This necessitates strategic planning for energy transitions and carbon footprint reduction, areas where Huron offers crucial advisory services to ensure compliance and competitiveness.

Climate change itself presents significant risks, from extreme weather disrupting supply chains to the financial implications of carbon pricing. Huron's expertise in climate risk assessment and adaptation planning helps clients build resilience and navigate these evolving challenges effectively.

PESTLE Analysis Data Sources

Our PESTLE analysis is informed by a comprehensive blend of data, including official government publications, reports from international organizations like the World Bank and IMF, and leading industry-specific market research. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental landscapes impacting your business.