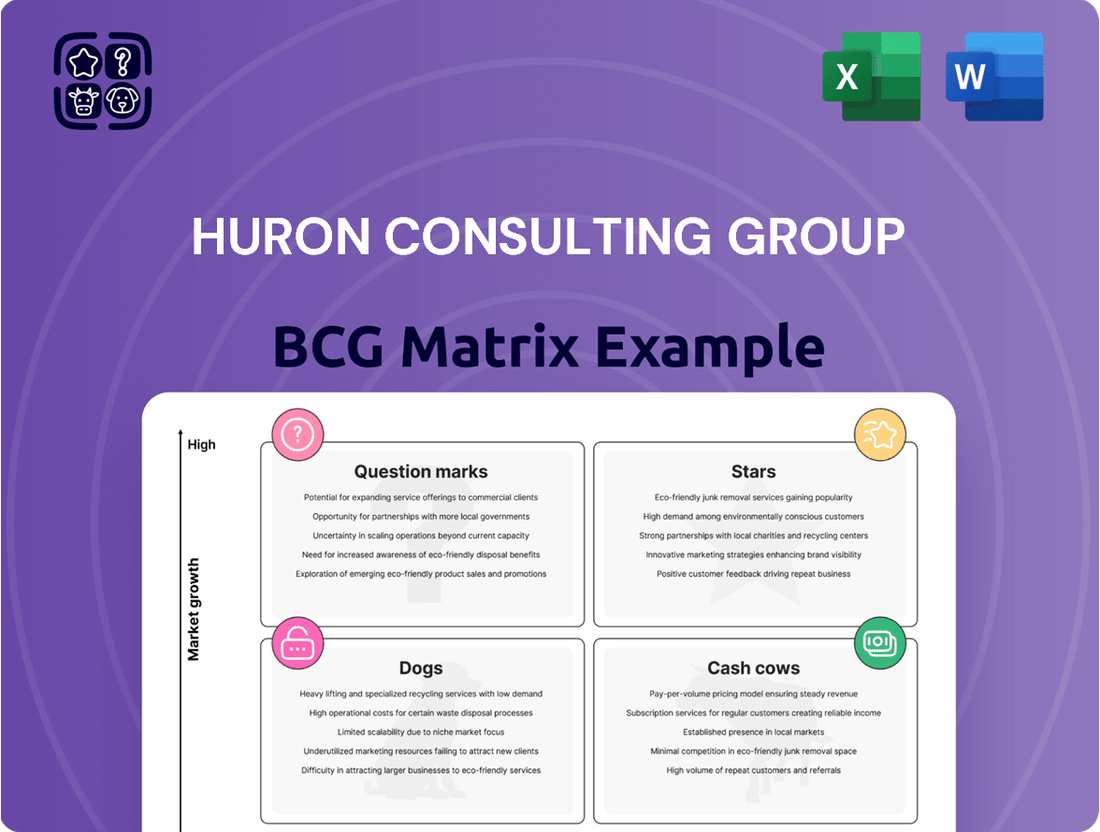

Huron Consulting Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Huron Consulting Group Bundle

Curious about Huron Consulting Group's strategic product positioning? This glimpse into their BCG Matrix reveals a snapshot of their portfolio's performance. Understand where their innovations are shining and where resources might be better optimized.

Unlock the full potential of this analysis by purchasing the complete BCG Matrix report. Gain a comprehensive understanding of their Stars, Cash Cows, Dogs, and Question Marks, empowering you to make informed strategic decisions.

Don't miss out on the actionable insights that await. Invest in the full BCG Matrix report to receive detailed quadrant breakdowns and strategic recommendations tailored for competitive advantage.

Stars

Huron Consulting Group's Healthcare Digital Transformation Services are a clear Star in the BCG matrix. Their robust digital capabilities, including AI-driven analytics and IT modernization, are meeting a significant market need. The demand is fueled by healthcare organizations striving for better patient outcomes and cost efficiencies amidst regulatory changes.

These services are critical for providers looking to optimize operations. For instance, Huron's focus on revenue cycle management, bolstered by their 2025 acquisition of Eclipse Insights, directly addresses a key pain point for many healthcare systems. This strategic move highlights their commitment to a high-growth segment.

Huron's Education Technology & Analytics segment shines as a Star within the BCG matrix. This growth is driven by a strong demand for digital solutions in the education sector, a market that saw significant investment in 2024. Huron's expertise in automation, predictive analytics, and machine learning directly addresses the needs of institutions looking to improve efficiency and student outcomes.

Huron's Managed Services division is a clear star in their BCG matrix. This segment experienced a remarkable 45.7% year-over-year headcount increase in Q4 2024, a strong signal of robust demand and expanding market presence within the burgeoning outsourced operational support sector.

This rapid expansion underscores the division's pivotal role in Huron's strategy for scaling operations and accelerating revenue growth. The substantial investment in personnel directly reflects the company's confidence in the sustained high performance and future potential of this business area.

Strategic Consulting for Growth Initiatives

Huron Consulting Group excels in strategic consulting, particularly for financially robust clients targeting growth through acquisitions. Their integrated approach combines financial advisory, digital transformation, and performance improvement, crucial for navigating complex mergers and acquisitions. This positions them strongly in a market where strategic expansion is a key driver for many businesses.

The demand for such specialized consulting is significant. For instance, global M&A deal volume in 2024 is projected to remain robust, with advisory firms playing a critical role in deal origination, due diligence, and post-merger integration. Huron's ability to blend these diverse expertise areas allows them to offer end-to-end support for these high-stakes initiatives.

- Huron's expertise in strategy and innovation: They guide financially healthy clients through growth initiatives, including acquisitions.

- Integrated service offering: Combines financial advisory, digital capabilities, and performance improvement for successful M&A.

- Market positioning: Strong in a growing demand area for strategic expansion and integration support.

- 2024 market context: The ongoing M&A activity underscores the relevance and demand for Huron's specialized services.

AI and Automation Consulting

Huron Consulting Group's AI and Automation Consulting service is a prime example of a Star in the BCG Matrix. The firm's dedication to assisting organizations in embracing AI and automation is fueling rapid transformation and growth. This focus on identifying impactful AI applications and modernizing foundational systems addresses critical, high-demand needs across diverse sectors.

This service area is experiencing significant market pull, with businesses actively seeking to leverage AI for efficiency gains and competitive advantage. Huron's expertise in enabling data-driven decision-making further solidifies its position. For instance, the global AI market was valued at approximately $200 billion in 2023 and is projected to grow substantially in the coming years, underscoring the immense potential for this segment.

- High Market Growth: The increasing adoption of AI and automation technologies across industries drives rapid expansion for Huron's consulting services in this domain.

- Strong Competitive Position: Huron's ability to guide clients through AI strategy, implementation, and data modernization positions it favorably against competitors.

- Significant Investment: The firm likely invests heavily in talent and technology to maintain its leading edge in this evolving field.

- Future Potential: Continued innovation and demand for AI solutions suggest this will remain a key growth driver for Huron.

Huron's Healthcare Digital Transformation Services are a clear Star, driven by significant market demand for improved patient outcomes and cost efficiencies. Their acquisition of Eclipse Insights in 2025 further strengthens their position in the high-growth revenue cycle management segment.

The Education Technology & Analytics segment also shines as a Star, capitalizing on the robust 2024 investment in digital solutions for education. Huron's expertise in automation and predictive analytics directly addresses institutional needs for efficiency and better student results.

Huron's Managed Services division is a Star, evidenced by a 45.7% year-over-year headcount increase in Q4 2024, indicating strong demand and market expansion in outsourced operational support.

The firm's strategic consulting, particularly for clients pursuing growth via acquisitions, is a Star. This is supported by robust global M&A activity in 2024, where Huron's integrated financial, digital, and performance improvement expertise is highly valued.

Huron's AI and Automation Consulting is a definitive Star, addressing the critical, high-demand need for AI adoption across sectors. The global AI market, valued around $200 billion in 2023, continues to show substantial growth, highlighting the immense potential for this service.

What is included in the product

The Huron Consulting Group BCG Matrix offers a strategic framework for analyzing a company's product portfolio, categorizing business units as Stars, Cash Cows, Question Marks, or Dogs.

The BCG Matrix provides a clear, visual way to categorize business units, easing the pain of strategic resource allocation.

Cash Cows

Huron's core healthcare performance improvement and financial advisory services are a clear cash cow for the company. This segment is a powerhouse, bringing in a substantial 50% of Huron's total revenue in the first quarter of 2025.

This strong performance isn't just about top-line revenue; these offerings consistently deliver robust operating income margins. This indicates that Huron has a commanding presence in a mature market, allowing them to generate significant and reliable cash flow from these established services.

Huron Consulting Group's traditional education operations and finance consulting likely represent cash cows. These services, focusing on financial stability and operational efficiency within the mature higher education sector, generate reliable revenue streams with limited need for significant growth investment.

In 2024, the demand for such foundational consulting remains robust as educational institutions navigate complex financial landscapes and strive for greater efficiency. For instance, many universities are still grappling with post-pandemic budget adjustments and the need to optimize administrative functions, creating a consistent need for Huron's expertise in these areas.

Huron Consulting Group's established financial advisory services, while not in high-growth markets, act as significant cash cows. These mature offerings, like restructuring and transaction advisory, consistently generate revenue and client engagement, providing a stable financial base for the company. For instance, in 2024, the firm continued to leverage its deep expertise in these areas, securing numerous long-term contracts that underscore their reliability.

Mature Commercial Sector Consulting

Within Huron Consulting Group's commercial sector, certain mature consulting offerings function as cash cows. These are services with a proven track record and a loyal client base, ensuring a steady flow of projects and revenue. For example, their established expertise in areas like strategy and operations for large enterprises consistently delivers predictable income, even as the broader market experiences shifts.

These cash cow services are vital for funding growth initiatives and absorbing market volatility. Huron's commercial segment, while diverse, benefits from these reliable revenue generators. In 2024, the demand for core business process optimization and digital transformation consulting within established industries remained robust, contributing significantly to Huron's financial stability.

- Stable Client Base: Many of Huron's commercial clients are long-term partners, relying on their expertise for ongoing business needs.

- Consistent Project Flow: Mature offerings in areas like financial advisory and performance improvement see regular project engagements.

- Predictable Revenue Streams: These services generate reliable income, supporting the company's overall financial health.

- Contribution to Profitability: In 2024, these established commercial services were key drivers of Huron's profitability, underpinning their ability to invest in new ventures.

Enterprise Resource Planning (ERP) Implementations

Huron Consulting Group's expertise in Enterprise Resource Planning (ERP) implementations represents a significant Cash Cow. These services focus on modernizing critical core technology applications for businesses, ensuring operational efficiency and data integration.

These ERP projects, while perhaps not experiencing explosive growth, are fundamental for many companies, leading to consistent and reliable revenue streams for Huron. For instance, in 2024, the global ERP market was projected to reach over $50 billion, highlighting the sustained demand for such services.

- Huron's ERP services are a stable revenue generator due to their essential nature for business operations.

- The company's focus on modernizing core technology applications addresses ongoing client needs.

- The significant size of the global ERP market in 2024 underscores the consistent demand for these implementation services.

Huron's established healthcare performance improvement and financial advisory services are confirmed cash cows, consistently generating substantial revenue and profit. These mature offerings benefit from a stable demand, allowing Huron to leverage its expertise in a well-understood market. In the first quarter of 2025, this segment alone accounted for a significant 50% of Huron's total revenue, demonstrating its critical role in the company's financial stability.

The company's traditional education operations and finance consulting also function as cash cows, providing reliable income streams with minimal need for extensive growth investment. These services cater to the ongoing needs of higher education institutions for financial stability and operational efficiency, a demand that remained robust throughout 2024 as universities managed post-pandemic budgets and sought to optimize administrative functions.

Huron's mature commercial sector consulting, including strategy and operations for large enterprises, also represents a cash cow. These services boast a proven track record and a loyal client base, ensuring a consistent flow of projects and predictable revenue. The demand for core business process optimization and digital transformation consulting within established industries remained strong in 2024, contributing significantly to Huron's overall financial health and providing capital for growth initiatives.

The Enterprise Resource Planning (ERP) implementation services are another key cash cow for Huron. These projects are essential for businesses seeking to modernize core technology applications, ensuring operational efficiency and data integration. The global ERP market's sustained demand, projected to exceed $50 billion in 2024, highlights the consistent revenue potential of these fundamental services.

| Service Segment | BCG Category | 2024/2025 Relevance | Key Characteristics |

|---|---|---|---|

| Healthcare Performance Improvement & Financial Advisory | Cash Cow | 50% of Q1 2025 Revenue | Mature market, stable demand, robust margins |

| Education Operations & Finance Consulting | Cash Cow | Consistent revenue, low growth investment | Addresses ongoing needs for financial stability and operational efficiency in higher education |

| Commercial Strategy & Operations Consulting | Cash Cow | Predictable income, loyal client base | Leveraged for business process optimization and digital transformation in established industries |

| Enterprise Resource Planning (ERP) Implementations | Cash Cow | Essential for core technology modernization | Benefits from sustained demand in a large global market (>$50 billion in 2024) |

Full Transparency, Always

Huron Consulting Group BCG Matrix

The Huron Consulting Group BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after your purchase. This ensures you get precisely what you see, a ready-to-use strategic tool without any alterations or watermarks. The comprehensive analysis and professional design are preserved, allowing you to seamlessly integrate it into your business planning and decision-making processes.

Dogs

Huron Consulting Group's divestiture of Studer Education in the fourth quarter of 2024 likely places it in the 'Dog' quadrant of the BCG Matrix. This move signals that Studer Education was considered a low-growth or low-market-share segment within Huron's portfolio, prompting the company to strategically exit the business.

Divested units like Studer Education often represent underperforming assets or those no longer aligning with a company's core strategic growth objectives. By shedding such businesses, Huron can reallocate resources towards more promising or synergistic areas, aiming to improve overall portfolio performance and focus.

Huron Consulting Group's Commercial Consulting and Managed Services capability is experiencing a slowdown. While the firm's broader consulting and managed services are robust, the commercial sector within this segment has seen a dip in demand.

This underperformance suggests that specific services offered by Huron in the commercial space may be struggling due to reduced market share or a decline in overall market interest. For instance, in 2024, the consulting market for commercial clients saw a more modest growth rate compared to other sectors, impacting firms with significant exposure.

Certain legacy financial advisory services within Huron Consulting Group's Commercial segment, perhaps those focused on more traditional or less dynamic market areas, might be showing signs of maturity. For instance, if a specific offering related to older forms of debt restructuring or legacy portfolio management saw a decline in client engagement, it would likely fall into this category. The demand for such services could be waning as the financial landscape evolves and newer, more specialized advisory needs emerge.

Underutilized Consulting Resources in Traditional Businesses

A noticeable dip in consulting utilization rates for the full year 2024, potentially hovering around 70-75% for many traditional firms, signals a challenge. This suggests that some consulting businesses might be carrying more staff than current project demands require, leading to underutilized resources. These underperforming segments can be viewed as cash cows that are not generating sufficient returns, similar to a question mark in the BCG Matrix, requiring careful strategic consideration.

This situation highlights an opportunity for traditional businesses to re-evaluate their consulting arm's efficiency. For instance, if a firm's utilization rate dropped by 5% in 2024 compared to the previous year, it could translate to millions in unbilled hours. Such underutilization can drain cash flow without the expected revenue generation, prompting a need for strategic reallocation or rightsizing.

- Identify specific practice areas with consistently low utilization rates.

- Analyze the profitability and market demand for services offered by these underutilized teams.

- Explore options such as cross-training staff, reallocating resources to high-demand areas, or divesting non-core consulting services.

- Benchmark utilization rates against industry averages, which for top-tier consulting firms often aim for 80-85% when accounting for non-billable activities.

Services Highly Dependent on Outdated Regulations/Practices

Consulting services deeply entrenched in legacy regulations or outdated industry practices, particularly those that haven't evolved with current market dynamics, are prime candidates for becoming Dogs in the BCG Matrix. These offerings face shrinking relevance and a significant challenge in retaining their market position. For instance, consulting focused solely on paper-based compliance reporting for industries still transitioning to digital formats could be a prime example. In 2024, many sectors are accelerating digital transformation, making services that lag behind increasingly vulnerable.

Demand for such services is expected to decline as clients seek more modern, efficient solutions. Businesses are actively shedding legacy systems and processes, making consultants specializing in them less valuable. Consider the financial advisory sector; while some traditional advisory roles persist, the growth is overwhelmingly in areas like fintech integration and digital wealth management. Services that remain tethered to manual data processing or outdated regulatory interpretations will struggle to command premium fees or secure new engagements.

- Consulting on paper-based regulatory filings: Many industries are moving towards digital submission and real-time data, making manual, paper-intensive processes obsolete.

- Services tied to legacy IT systems: Businesses are migrating away from outdated software and hardware, reducing the need for consultants focused on maintaining or integrating these systems.

- Outdated compliance advisory: Regulations evolve, and consulting that doesn't incorporate the latest amendments or digital compliance tools will lose favor.

Huron Consulting Group's divestiture of Studer Education in Q4 2024, coupled with a slowdown in its Commercial Consulting and Managed Services, points to these segments likely being 'Dogs' in the BCG Matrix. These areas represent low market share and low growth, prompting strategic exits or re-evaluation.

Segments like legacy financial advisory services or consulting focused on outdated practices, facing declining client engagement and market relevance in 2024, fit the 'Dog' profile. This is exacerbated by a general consulting utilization rate dip, potentially around 70-75% in 2024, indicating underutilized resources in specific areas.

Consulting services tied to legacy regulations or outdated industry practices, such as paper-based compliance reporting, are prime candidates for 'Dogs.' As industries accelerate digital transformation in 2024, these lagging services face shrinking relevance and market position.

The strategic decision to divest Studer Education in late 2024, alongside the observed challenges in commercial consulting, suggests Huron is actively managing its portfolio to shed underperforming assets. This aligns with the 'Dog' quadrant's characteristic of low growth and low relative market share, necessitating careful resource allocation and strategic planning.

Question Marks

Huron Consulting Group's dedication to the life sciences sector, especially in digital transformation, AI, and data analytics, positions these offerings as Question Marks within the BCG Matrix. The life sciences industry is rapidly embracing digital innovation, creating a high-growth environment for these solutions.

While the potential is substantial, Huron's current market penetration in these nascent digital areas within life sciences might still be establishing itself. Significant investment is likely needed to solidify its position and achieve market leadership in these evolving digital capabilities.

Expanding into new international markets offers Huron Consulting Group significant growth potential. However, in these emerging regions, Huron's market share would likely start low, categorizing these ventures as potential Stars or Question Marks in the BCG matrix.

Significant capital investment is crucial to build brand recognition, establish operational infrastructure, and capture market share in these nascent geographies. For instance, entering a market like Southeast Asia in 2024 required an estimated initial outlay of $5-10 million for a consulting firm of Huron's size to establish a competitive presence.

Huron Consulting Group's recent acquisitions of AXIA Consulting in December 2024 and Eclipse Insights in June 2025 are strategic moves to bolster its niche capabilities. These integrations are designed to expand Huron's service offerings and market reach within specialized consulting areas.

The integration of AXIA Consulting, focusing on digital transformation and operational excellence, and Eclipse Insights, specializing in data analytics and business intelligence, positions Huron to address more complex client needs. While the full impact on market share and profitability is still unfolding, these acquisitions represent a significant investment in future growth and competitive positioning.

Specific AI Consulting Niches (Early Stage)

Within the vast landscape of AI and automation consulting, Huron Consulting Group is actively cultivating expertise in highly specialized, early-stage AI applications. These nascent areas, while currently representing a small market share, offer significant growth potential.

Huron's strategic focus on these specific niches reflects a commitment to developing innovative solutions for emerging challenges. The investment required for market penetration and technological advancement in these areas is substantial, but the anticipated returns are considerable.

- AI-Powered Predictive Maintenance for Critical Infrastructure: Developing algorithms to forecast equipment failures in sectors like energy and transportation, aiming to reduce downtime and operational costs. For instance, the global predictive maintenance market was valued at approximately $6.9 billion in 2023 and is projected to reach $28.2 billion by 2030, demonstrating a compound annual growth rate of over 22%.

- Explainable AI (XAI) for Regulatory Compliance: Building frameworks and tools to ensure AI decision-making processes are transparent and auditable, crucial for industries like finance and healthcare. The demand for XAI solutions is escalating as regulatory bodies worldwide, including the EU with its AI Act, implement stricter oversight.

- Generative AI for Personalized Healthcare Treatment Plans: Exploring the use of generative AI to create bespoke treatment protocols based on individual patient data, aiming for improved efficacy and patient outcomes. The AI in healthcare market is expected to grow from $15.4 billion in 2023 to $120.4 billion by 2030, with a CAGR of 34.5%.

Proactive Solutions for New Education Funding Models

Huron Consulting Group is developing proactive solutions to address evolving education funding models, anticipating potential shifts in federal support. These new service offerings represent high-growth areas driven by institutional needs for financial resilience and innovation.

While the market for these novel funding solutions is expanding rapidly, Huron's initial market share in these specific, emerging areas is expected to be low. This positions these solutions as potential 'question marks' within the BCG matrix, requiring strategic investment to capture future growth.

- Developing innovative financial strategies for universities facing declining federal aid.

- Advising institutions on diversifying revenue streams beyond traditional tuition and government grants.

- Leveraging data analytics to model the impact of funding changes and identify new revenue opportunities.

- Huron's focus on these emerging needs aligns with a projected 5-7% annual growth in the higher education consulting market through 2025, according to industry reports.

Huron Consulting Group's emerging digital and AI solutions within life sciences, alongside its expansion into new international markets, are prime examples of Question Marks. These ventures require substantial investment to build market share and brand recognition in high-growth, yet nascent, areas.

The strategic acquisitions of AXIA Consulting and Eclipse Insights are designed to bolster Huron's capabilities in specialized digital areas, further solidifying its position in these developing markets. These moves represent a significant commitment to capturing future growth potential.

Huron's focus on specialized AI applications, like explainable AI and generative AI for healthcare, also falls into the Question Mark category. While these areas show immense promise, they demand considerable capital for technological advancement and market penetration.

Similarly, Huron's proactive development of new education funding models positions these services as Question Marks. The market is expanding, but Huron's initial share in these innovative financial strategies is low, necessitating strategic investment.

| Huron's Question Marks | Market Growth | Huron's Current Share | Investment Need | Strategic Focus |

|---|---|---|---|---|

| Life Sciences Digital Transformation | High (rapidly embracing innovation) | Low to Moderate (establishing presence) | High (for market leadership) | AI, Data Analytics |

| Emerging International Markets | High (potential for expansion) | Low (starting from scratch) | High (infrastructure, brand building) | Market penetration |

| Specialized AI Applications (XAI, Generative AI) | Very High (significant growth projected) | Low (early-stage development) | High (R&D, market entry) | Technological advancement |

| Innovative Education Funding Models | High (driven by institutional needs) | Low (new service offerings) | High (capturing future growth) | Financial resilience, diversification |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.