Huron Consulting Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Huron Consulting Group Bundle

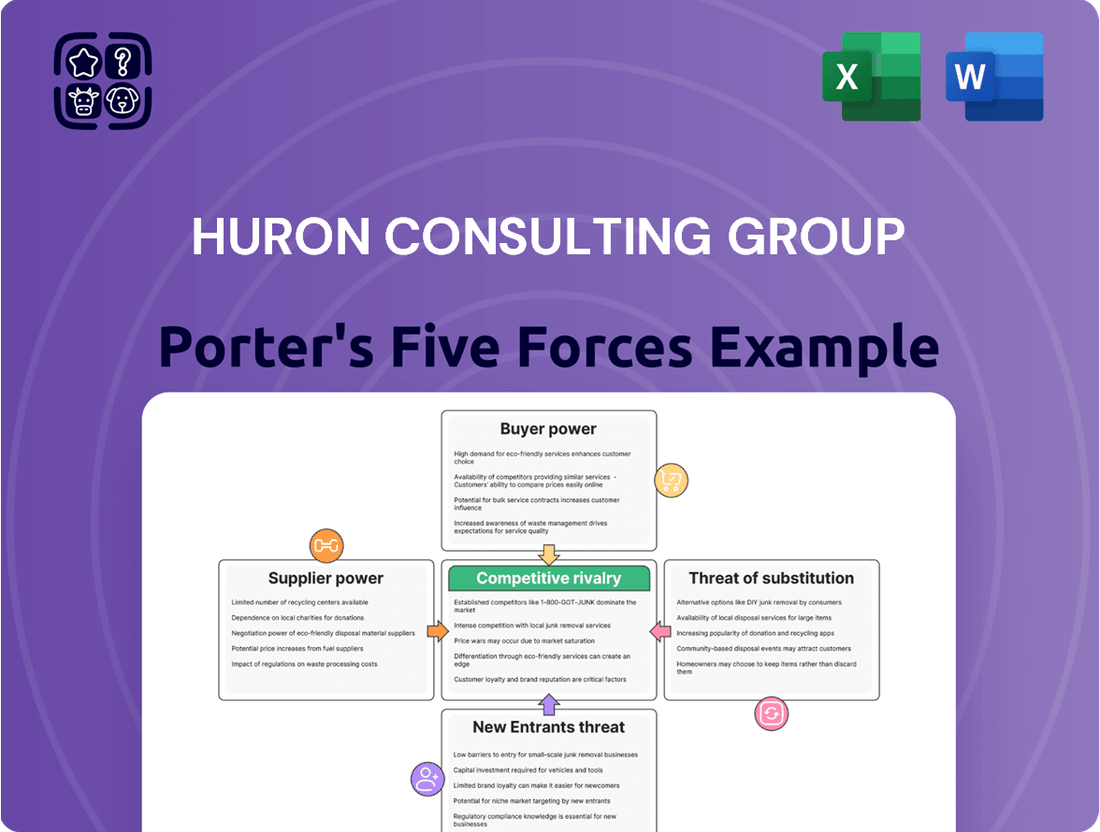

Huron Consulting Group operates within a dynamic landscape shaped by five key competitive forces. Understanding the intensity of these forces—rivalry among existing competitors, the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, and the threat of substitute products or services—is crucial for strategic planning.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Huron Consulting Group’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The consulting sector's dependence on specialized expertise means that highly skilled professionals act as key suppliers. When talent with niche skills, such as in emerging areas like AI implementation or sustainability reporting, is in short supply, these individuals or the firms that source them wield considerable influence over consulting groups like Huron. For instance, a report from Burning Glass Technologies in 2023 indicated a significant demand for cybersecurity talent, with job postings for these roles increasing by 95% over a five-year period, highlighting the scarcity and power of such specialized skills.

Suppliers possessing unique, proprietary knowledge, like specialized data analytics platforms or intricate regulatory compliance frameworks, can leverage this distinctiveness to demand premium pricing. Huron Consulting Group's dependence on such specialized expertise directly influences its operational expenses and its standing in the competitive consulting landscape.

If Huron Consulting Group deeply integrates specific software platforms, data subscriptions, or external research services into its core operations, the cost and disruption associated with switching to alternatives can be substantial. For instance, a significant investment in a proprietary analytics platform, which requires extensive employee training and data migration, would make moving to a competitor a complex undertaking. This reliance on deeply embedded systems empowers incumbent technology and data providers, thereby increasing their bargaining power over Huron.

Supplier Concentration in Niche Areas

In niche consulting areas, a few specialized providers can dictate terms. If Huron relies on a small number of these suppliers for critical technology or expertise, their bargaining power increases significantly. This concentration can lead to higher costs for Huron, impacting its profitability.

- Limited Supplier Options: In specialized fields like advanced analytics or specific regulatory compliance, the pool of expert providers is often small.

- Huron's Dependence: If Huron’s service delivery model heavily incorporates these niche offerings, its reliance on these few suppliers grows.

- Pricing and Terms Influence: Concentrated suppliers can leverage this dependence to command higher prices or impose less favorable contract terms on Huron.

Reputation and Brand of Key Personnel

The reputation and brand of key personnel significantly influence Huron Consulting Group's bargaining power with its talent pool. Individual consultants or small teams possessing strong personal brands and established reputations in niche areas, such as healthcare strategy or digital transformation within the education sector, can command higher fees or more advantageous contractual terms. This dynamic empowers these individuals as suppliers, as Huron must actively recruit and retain such high-caliber talent to maintain its competitive edge.

- Talent Dependency: Huron's reliance on specialized expertise means that highly sought-after individuals can leverage their reputations to negotiate better compensation and working conditions.

- Brand Equity Transfer: The personal brand of a key consultant can attract clients, effectively transferring some of the client relationship's value to the individual, thereby increasing their bargaining leverage.

- Retention Challenges: The ability of individual consultants to secure lucrative opportunities elsewhere based on their reputation presents a constant challenge for Huron in retaining top performers.

The bargaining power of suppliers for Huron Consulting Group is significant, particularly concerning specialized talent and proprietary technology. When fewer suppliers can provide essential expertise or platforms, their ability to dictate terms, including pricing and contract conditions, increases substantially. This is evident in the demand for niche skills, where a limited supply of qualified professionals allows them to command higher compensation, impacting Huron's operational costs and competitive positioning.

| Supplier Type | Key Characteristics Driving Power | Impact on Huron |

|---|---|---|

| Specialized Talent (e.g., AI, Cybersecurity) | High demand, low supply, unique skill sets | Increased recruitment costs, retention challenges |

| Proprietary Technology/Data Platforms | Unique features, high switching costs, deep integration | Potential for premium pricing, dependence on vendor roadmaps |

| Niche Expertise Providers | Limited number of providers, critical service component | Higher fees, less favorable contract terms |

What is included in the product

Huron Consulting Group's Porter's Five Forces analysis details the intensity of rivalry, buyer and supplier power, threat of new entrants, and threat of substitutes within the consulting industry.

Instantly identify competitive threats and opportunities with a dynamic, interactive model that visualizes each force.

Customers Bargaining Power

Huron Consulting Group's concentration in sectors like healthcare, education, and life sciences means that a few significant clients can wield considerable influence. For instance, if a handful of large hospital systems or major universities represent a substantial percentage of Huron's revenue, these clients can leverage their size to negotiate better pricing or more favorable service agreements.

The professional services landscape is highly competitive, with a multitude of global and specialized boutique firms vying for client business. This abundance of choice directly empowers customers, allowing them to readily compare offerings and pricing across various consulting entities.

Customers can effectively "shop around" for the best value, seeking firms that offer specialized expertise or more favorable pricing structures. This ability to easily switch or select from a broad pool of consultants significantly enhances their leverage when negotiating terms with firms like Huron Consulting Group.

For instance, the consulting market is estimated to be worth hundreds of billions globally, with many firms offering overlapping services in areas like management, technology, and strategy. In 2024, the global consulting market size was projected to reach over $300 billion, underscoring the vast number of alternatives available to potential clients.

For project-based consulting, clients often face minimal costs when switching between firms. This low switching cost allows them to leverage competition, pushing for more favorable pricing and terms. For instance, in 2023, the average project duration for management consulting engagements in North America was around 6-9 months, suggesting that clients can re-evaluate providers relatively frequently.

Client's Ability to Develop In-house Capabilities

Many large enterprises are increasingly building robust internal strategy, IT, and operational teams. This allows them to handle tasks previously outsourced to consulting firms like Huron. For instance, in 2024, a survey by Gartner found that 65% of large organizations reported an increase in their in-house digital transformation capabilities.

When clients believe they can develop or strengthen these internal skills more cost-effectively or with better oversight, their need for external consultants diminishes. This directly boosts their bargaining power.

- Increased In-house Expertise: Organizations are investing heavily in training and technology to build internal competencies.

- Cost Savings Perception: Clients often estimate lower long-term costs by developing internal teams versus ongoing consultant fees.

- Control and Customization: Internal teams offer greater control over project direction and tailored solutions.

- Reduced Reliance: As internal capabilities grow, the dependency on external providers like Huron decreases significantly.

Price Sensitivity and Budget Constraints

Clients, particularly in fields like healthcare and education, frequently face tight budget limitations, making them acutely aware of pricing. This financial pressure translates into a stronger ability for them to negotiate lower service fees and demand greater value from consulting firms like Huron.

For instance, many government and non-profit organizations, significant players in these sectors, operate with fixed budgets that are often scrutinized. In 2024, the average budget increase for many public sector organizations remained modest, intensifying their focus on cost-effectiveness and return on investment for consulting services.

- Price Sensitivity: Clients are actively seeking the best value for their money, pushing consultants to justify every dollar spent.

- Budget Constraints: Limited financial resources empower clients to dictate terms and seek cost reductions.

- Value-Driven Outcomes: The demand is shifting from simply delivering services to achieving measurable, tangible results that justify the expense.

- Negotiating Leverage: Clients with clear budget limitations and high price sensitivity gain significant power in fee discussions.

Huron Consulting Group's clients, especially large ones in healthcare and education, can exert significant bargaining power due to their substantial revenue contribution. This allows them to negotiate favorable pricing and terms, as seen in the competitive consulting market projected to exceed $300 billion in 2024, offering clients numerous alternatives.

Low switching costs for project-based work further empower clients, enabling them to frequently re-evaluate consulting partners. For example, average project durations of 6-9 months in North America in 2023 allow for regular vendor assessments, increasing client leverage.

The rise of in-house capabilities, with 65% of large organizations increasing their digital transformation expertise in 2024, reduces client reliance on external consultants. This shift enhances their bargaining power by offering a viable alternative to outsourcing.

| Factor | Impact on Huron's Customer Bargaining Power | Supporting Data/Insight (2024 unless otherwise noted) |

|---|---|---|

| Client Concentration | High power for large clients | Major clients can dictate terms due to significant revenue contribution. |

| Availability of Substitutes | High power for clients | Global consulting market over $300 billion, offering many alternatives. |

| Switching Costs | Low costs empower clients | Average project duration of 6-9 months (2023) allows frequent re-evaluation. |

| In-house Capabilities | Increasing client power | 65% of large organizations increased in-house digital transformation capabilities. |

Full Version Awaits

Huron Consulting Group Porter's Five Forces Analysis

This preview showcases the complete Huron Consulting Group Porter's Five Forces Analysis, meaning the document you see is precisely what you will receive upon purchase, offering a thorough examination of competitive forces within an industry.

The detailed insights into threat of new entrants, bargaining power of buyers, bargaining power of suppliers, threat of substitute products or services, and the intensity of rivalry among existing competitors are all present in this exact file.

You're looking at the actual document, ensuring that once you complete your purchase, you’ll get instant access to this same professionally formatted and ready-to-use Porter's Five Forces Analysis.

Rivalry Among Competitors

Huron Consulting Group operates within a highly fragmented consulting market, facing intense rivalry from a multitude of players. This includes global giants like Accenture, Deloitte, and PwC, alongside numerous specialized boutique firms, all competing for client engagements across various industries.

The sheer volume and diversity of competitors mean that Huron must constantly differentiate itself to capture market share. For instance, the global management consulting market was valued at approximately $300 billion in 2023, indicating a substantial arena where many firms are vying for a piece of the pie.

Consulting firms like Huron Consulting Group face intense rivalry due to substantial fixed costs, particularly the high salaries of their expert talent. This necessitates a constant drive to secure client projects to ensure consultants remain billable and profitable, even when market demand fluctuates.

The need to keep highly compensated professionals engaged often translates into aggressive bidding and a willingness to compete fiercely for engagements. For instance, the consulting industry's reliance on human capital means that even a temporary slowdown can significantly impact profitability if utilization rates drop. In 2024, firms are keenly aware that unutilized, expensive talent is a direct drain on resources.

Huron Consulting Group operates in a landscape where many consulting services, especially at a foundational level, can appear quite similar. This lack of distinctiveness makes it difficult for clients to perceive significant differences between providers, leading to a more intense focus on factors beyond unique offerings.

When consulting services become commoditized, the competitive battleground often shifts to price. This dynamic forces firms like Huron to compete more aggressively on cost, potentially squeezing profit margins and intensifying the rivalry among players in the market. For instance, the global management consulting market was valued at approximately $320 billion in 2023, with a significant portion driven by services where differentiation is less pronounced.

Slow Industry Growth in Mature Segments

When the consulting industry, or specific segments within it, matures or faces economic headwinds, the pace of overall market growth can decelerate. This slowdown intensifies competition as firms vie for a shrinking pool of available projects and clients.

This dynamic directly fuels competitive rivalry. Firms must work harder to win business, often leading to more aggressive pricing strategies or a greater emphasis on differentiation to secure market share. For instance, during periods of slower economic expansion, such as the projected moderate growth in global consulting services for 2024, this effect becomes more pronounced.

- Slowdown Impact: Mature segments of the consulting market experience reduced overall growth, intensifying competition.

- Client Acquisition Pressure: Firms must compete more fiercely for existing clients and projects when growth is sluggish.

- 2024 Outlook: Projections for global consulting market growth in 2024 indicate a need for increased competitive focus.

Mergers and Acquisitions Activity

Mergers and acquisitions are a constant in the consulting world. Firms often buy others to quickly add new services, grab more clients, or bring in experts they don't have in-house. This means Huron Consulting Group faces a landscape where competitors can suddenly become much larger and more powerful.

For instance, in 2024, the consulting sector continued to see significant M&A deals. A notable trend has been larger firms acquiring specialized boutique consultancies to bolster their offerings in areas like AI implementation and cybersecurity. This consolidation means Huron must contend with a more concentrated market, where fewer, but larger, players can exert greater influence.

- Increased Consolidation: M&A activity leads to fewer, larger competitors, intensifying rivalry.

- Capability Expansion: Acquiring firms gain immediate access to new services and talent.

- Market Share Gains: Mergers can quickly shift market share, putting pressure on existing players like Huron.

- Talent Acquisition: M&A is a key strategy for securing specialized expertise in a competitive talent market.

The consulting industry, particularly for firms like Huron Consulting Group, is characterized by intense competitive rivalry. This stems from a crowded marketplace populated by global powerhouses, specialized boutiques, and an increasing number of firms engaging in mergers and acquisitions. The need to maintain high utilization rates for expensive talent, coupled with the potential for service commoditization, further fuels this competition, often leading to aggressive pricing and a constant drive for differentiation.

| Competitor Type | Example | Impact on Huron |

|---|---|---|

| Global Consulting Giants | Accenture, Deloitte, PwC | Significant market share, broad service offerings, extensive client networks |

| Specialized Boutique Firms | Various niche players | Deep expertise in specific areas, agile service delivery |

| Consolidated Entities (Post-M&A) | Larger firms acquiring smaller ones | Increased scale, expanded capabilities, greater competitive leverage |

SSubstitutes Threaten

The rise of robust internal consulting capabilities presents a significant threat of substitutes for firms like Huron Consulting Group. Many organizations are investing heavily in building in-house expertise across strategy, operations, and technology. This trend means companies are less likely to outsource these functions, directly impacting demand for external consulting services.

For instance, a 2024 survey indicated that over 60% of Fortune 500 companies have expanded their internal strategy departments in the past five years. This growth in internal talent acts as a direct substitute, especially for routine or less complex projects that were previously outsourced to external consultants.

The rise of off-the-shelf software and automation solutions presents a significant threat of substitutes for consulting services. Many tasks previously handled by consultants, such as data analysis, process optimization, and even strategic planning, can now be accomplished with readily available technology. For instance, by mid-2024, the global market for business process automation software was projected to reach over $13.1 billion, demonstrating the widespread adoption of these alternatives.

These technological solutions offer a compelling value proposition, often providing a more scalable and cost-effective alternative to engaging human consultants. Companies are increasingly leveraging AI-powered platforms and specialized software to address complex business challenges, reducing their reliance on external expertise. The increasing sophistication and accessibility of these tools mean that businesses can achieve similar outcomes, sometimes with greater speed and efficiency, directly impacting the demand for traditional consulting interventions.

The burgeoning gig economy presents a significant threat of substitutes for traditional consulting firms like Huron Consulting Group. Platforms connecting clients directly with independent, highly skilled freelance consultants offer a flexible and often more cost-effective alternative. For instance, by mid-2024, the global freelance platform market was projected to reach over $3.7 trillion, demonstrating the scale of this shift.

Clients increasingly recognize they can bypass the overhead and longer engagement times associated with large consulting firms by sourcing specialized expertise through these platforms for specific project needs. This allows businesses to access talent on demand, potentially reducing project costs and accelerating delivery timelines, thereby posing a direct competitive challenge.

Industry Associations and Peer Networks

Clients can bypass traditional consulting by tapping into industry associations and peer networks for advice and best practices. These informal channels offer solutions to challenges, acting as a substitute for formal engagements. For instance, in 2024, the consulting industry saw continued growth, with many firms leveraging digital platforms for knowledge sharing, making these informal networks even more accessible.

These networks provide a readily available source of shared knowledge and solutions, potentially reducing the perceived need for external consulting services. The accessibility of information through these channels can empower clients to address many of their issues internally.

- Industry Associations: Offer forums for members to exchange insights and problem-solve collaboratively.

- Peer-to-Peer Learning: Enables direct knowledge transfer between individuals facing similar business challenges.

- Informal Networks: Facilitate quick access to advice and best practices without formal consulting fees.

- Digital Platforms: Increasingly host these networks, enhancing accessibility and the breadth of shared knowledge.

Decision to Do Nothing or Delay Action

The threat of substitutes for consulting services like those offered by Huron Consulting Group can manifest as a client's decision to do nothing or delay action. This passive substitute is particularly potent when budget constraints are tight or the perceived urgency of a problem is low. For instance, a company facing operational inefficiencies might choose to absorb those costs rather than invest in external expertise.

This 'do nothing' option is a real competitive force. Consider that in 2024, many businesses, especially mid-sized ones, reported tightening budgets due to persistent inflation and higher interest rates. This financial pressure makes the decision to forgo consulting fees, even for significant challenges, a more viable and attractive alternative for some.

- Status Quo Preference: Clients may opt to maintain existing processes, even if suboptimal, to avoid upfront consulting costs.

- Budgetary Constraints: Limited financial resources in 2024 have led many organizations to prioritize essential spending over discretionary services like consulting.

- Perceived Lack of Urgency: Some issues might be deemed manageable internally or not critical enough to warrant immediate external intervention, thus delaying or negating the need for consulting.

The threat of substitutes for consulting services is multifaceted, encompassing internal capabilities, technological solutions, the gig economy, informal networks, and even the decision to do nothing. These alternatives directly compete with traditional consulting firms by offering potentially more cost-effective, flexible, or readily available solutions to business challenges.

By mid-2024, the market for business process automation software was projected to exceed $13.1 billion, highlighting the significant adoption of technology as a substitute for human-led consulting tasks. Similarly, the global freelance platform market, estimated to reach over $3.7 trillion by mid-2024, underscores the growing appeal of independent consultants over established firms.

Furthermore, in 2024, many organizations, particularly mid-sized ones, faced tightened budgets due to inflation and interest rates, making the option of maintaining the status quo or leveraging informal networks a more attractive substitute than engaging external consultants.

| Substitute Category | Key Characteristics | Impact on Consulting Demand | Supporting Data (2024/Mid-2024 Estimates) |

|---|---|---|---|

| Internal Capabilities | Growing in-house expertise, reduced reliance on outsourcing | Decreased demand for external strategy and operations support | Over 60% of Fortune 500 companies expanded internal strategy departments |

| Technological Solutions | Automation software, AI platforms, specialized tools | Automation of tasks previously done by consultants, cost-effectiveness | Business Process Automation Software Market: >$13.1 billion |

| Gig Economy/Freelancers | Flexible, specialized expertise, cost-effective | Direct competition for project-based work, bypass of firm overhead | Global Freelance Platform Market: >$3.7 trillion |

| Informal Networks & Doing Nothing | Industry associations, peer learning, budget constraints, perceived low urgency | Reduced need for formal consulting, status quo preference | Budgetary pressures cited by many mid-sized businesses |

Entrants Threaten

The consulting industry, particularly for services like those offered by Huron Consulting Group, often presents relatively low capital requirements compared to sectors like manufacturing. This means that individuals or small teams can launch consulting firms with minimal investment in physical assets, primarily needing expertise and human capital.

This accessibility is a significant factor in the threat of new entrants. For instance, the rise of specialized boutique consulting firms, which focus on niche areas, is facilitated by these lower upfront costs. In 2024, the trend of remote work and digital platforms further reduces the need for extensive office space, lowering the financial barrier even more.

While the initial capital needed to start a consulting firm might not be prohibitively high, the real barrier for new entrants lies in building a strong reputation and a trusted brand. Established players like Huron Consulting Group have spent years cultivating client relationships and demonstrating expertise, creating a significant advantage.

It takes substantial time and investment to develop the credibility and market recognition that established firms possess. For instance, in 2024, the consulting industry continued to see a premium placed on proven track records, making it difficult for newcomers to quickly displace incumbents or attract major clients without a demonstrable history of success.

New consulting firms often struggle to attract the best talent. Top consultants are frequently drawn to the established reputations and perceived stability of larger, well-known firms. For instance, in 2024, major consulting players like McKinsey, Bain, and BCG continued to see record application numbers, making it harder for emerging companies to secure skilled professionals.

This difficulty in accessing a strong talent pool is particularly acute in specialized areas like AI implementation or advanced data analytics. Without specialized expertise, new entrants cannot offer the same depth of service as incumbents, hindering their ability to compete and build credibility in the market.

Client Relationships and Sales Channels

Huron Consulting Group benefits from deeply entrenched client relationships and well-established sales channels, making it difficult for newcomers to gain traction. These existing ties, cultivated over years, often translate into repeat business and a trusted advisor status that new entrants struggle to replicate. For instance, in 2024, consulting firms continued to see a significant portion of their revenue derived from existing clients, highlighting the power of these relationships.

New entrants face substantial barriers in building a comparable client base and sales infrastructure. They must invest considerable resources in business development, networking, and demonstrating value to win over clients from established players. This often involves a lengthy and costly process before any significant revenue can be generated.

- Established networks and long-standing client relationships provide a significant competitive advantage for firms like Huron.

- New entrants must overcome substantial hurdles in developing their own client base and sales channels.

- The cost and time required for business development represent a major deterrent for potential new competitors.

- Client loyalty and trust, built over time, are difficult for new firms to challenge in the consulting market.

Economies of Scale and Scope

Established consulting giants, like Accenture and Deloitte, leverage significant economies of scale. These firms benefit from centralized back-office operations, extensive global training programs, and shared research capabilities, which reduce per-project costs. For instance, a major firm might have a centralized IT department supporting thousands of consultants worldwide, a cost structure a new entrant cannot easily replicate.

Economies of scope also present a barrier. Larger firms can offer a comprehensive suite of services, from strategy and digital transformation to human capital and cybersecurity, across diverse industries. This broad service offering allows them to bundle solutions and capture more client spend. A startup, typically specializing in a niche, finds it challenging to match this breadth and depth of expertise, making it difficult to compete for larger, more complex engagements.

In 2024, the consulting market continued to see this dynamic. For example, the top five global consulting firms reported combined revenues well into the tens of billions of dollars, a scale that new, smaller firms simply cannot approach in their initial years. This financial muscle allows them to invest heavily in technology, talent development, and marketing, further solidifying their competitive advantage against potential new entrants.

- Economies of Scale: Lower per-unit costs through large-scale operations.

- Economies of Scope: Cost savings from offering a wider range of services.

- Competitive Disadvantage for New Entrants: Difficulty matching established firms' efficiency and breadth.

- Market Reality (2024): Top firms' multi-billion dollar revenues highlight the scale challenge.

While the consulting industry has relatively low initial capital requirements, the threat of new entrants is significantly mitigated by the need for established reputation and talent acquisition. New firms struggle to build credibility and attract top consultants, as seen in 2024 with record application numbers for major players.

Furthermore, entrenched client relationships and sales channels create a substantial barrier. In 2024, a significant portion of consulting revenue still came from existing clients, making it difficult for newcomers to secure business. The cost and time associated with developing these relationships are major deterrents.

Economies of scale and scope also play a crucial role. Large firms benefit from lower per-unit costs and can offer a broader range of services, a breadth that startups cannot easily match. The multi-billion dollar revenues of top firms in 2024 illustrate the immense scale challenge for new competitors.

| Barrier Type | Description | Impact on New Entrants | 2024 Context |

|---|---|---|---|

| Reputation & Brand | Building trust and credibility takes years. | Difficult to attract clients and talent without a proven track record. | Premium placed on demonstrated success. |

| Client Relationships | Deeply entrenched ties and repeat business. | Challenging to gain traction and secure initial engagements. | Existing clients still drive significant revenue. |

| Talent Acquisition | Attracting skilled professionals to new firms. | New entrants struggle to compete with established firms for top talent. | Record applications for major consulting players. |

| Economies of Scale/Scope | Cost efficiencies and broad service offerings. | New firms cannot match the operational efficiency or service breadth of incumbents. | Top firms' multi-billion dollar revenues highlight scale disparity. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, drawing from company annual reports, industry-specific market research, and publicly available financial statements. This ensures a comprehensive understanding of competitive dynamics.