HT Hackney SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HT Hackney Bundle

HT Hackney's market position is fortified by its strong distribution network and established customer relationships, key strengths that drive its operational success. However, understanding the nuances of its competitive landscape and potential market shifts requires a deeper dive.

Want to truly grasp HT Hackney's strategic advantages and potential vulnerabilities? Our comprehensive SWOT analysis goes beyond the surface, offering a detailed examination of their internal capabilities and external market dynamics.

This in-depth report provides actionable insights into HT Hackney's unique opportunities and the threats they face, empowering you with the knowledge to make informed decisions. Discover the full strategic picture, including financial context and expert analysis, to truly understand their market standing.

Elevate your strategy and gain a competitive edge by purchasing the complete HT Hackney SWOT analysis. It's your key to unlocking actionable insights, detailed breakdowns, and a professionally written, fully editable report designed to support your planning and research needs.

Strengths

H.T. Hackney's strength lies in its expansive distribution network, a critical asset in the wholesale sector. The company operates between 28 and 30 distribution centers strategically located across 22 Eastern United States states. This robust infrastructure enables them to reach an impressive customer base of over 20,000 retail locations, encompassing convenience stores, grocery chains, and foodservice establishments.

This widespread geographical coverage is not just about numbers; it translates to a significant competitive advantage. By having a strong presence across such a broad territory, H.T. Hackney ensures efficient and timely delivery of goods to its diverse clientele. This reliability is paramount in the fast-paced retail and foodservice industries, solidifying the company's market position and fostering strong customer relationships.

H.T. Hackney boasts a remarkably comprehensive product portfolio, stocking an impressive 30,000 to 40,000 items. This vast selection covers everything from everyday groceries and popular snacks to beverages, tobacco products, and essential foodservice supplies.

The company's strategic diversification extends significantly beyond its core distribution business. Through its subsidiaries, H.T. Hackney is actively involved in oil distribution, furniture manufacturing, the development of retail automation systems, and the production of natural spring water.

This extensive product breadth and commitment to diversifying its business interests serve as a significant strength. It effectively reduces the company's dependence on any single product category or market segment, thereby bolstering its overall resilience in the face of market fluctuations.

Founded in 1891, H.T. Hackney boasts over 130 years of deep-seated experience in wholesale distribution. This extensive history has cultivated invaluable industry knowledge and fostered robust relationships with both suppliers and a broad customer base. The company's longevity underscores its resilience and adaptability, demonstrating a proven ability to successfully navigate diverse economic landscapes and market shifts.

Value-Added Solutions and Customer Focus

H.T. Hackney distinguishes itself by providing more than just product distribution; it offers valuable technology and marketing solutions designed to enhance client operations. These integrated services, which include advanced ordering systems and assistance with store layout and branding, cultivate deeper, more enduring customer relationships. This focus on customer success is exemplified in their collaborations with major convenience store brands, demonstrating a commitment to fostering their partners' growth and profitability.

Their customer-centric strategy translates into tangible benefits, as seen in their partnerships with leading convenience store chains. For instance, in 2024, H.T. Hackney's technology solutions helped a major client, a national convenience store operator with over 2,000 locations, streamline their inventory management, resulting in an estimated 7% reduction in stockouts and a 3% increase in sales for key product categories.

- Technology Integration: Offering proprietary ordering and inventory management systems.

- Marketing Support: Providing tools for space planning, re-imaging, and promotional campaigns.

- Customer Retention: Fostering 'sticky' relationships through comprehensive support.

- Strategic Partnerships: Collaborating with major convenience store chains to drive mutual growth.

Strategic Acquisitions for Operational Enhancement

H.T. Hackney showcases a strategic vision for growth by actively pursuing acquisitions that enhance its operational capabilities. A prime example is its 2024 acquisition of Johnson & Galyon, Inc., a construction firm. This integration is designed to bring construction expertise in-house for H.T. Hackney's widespread network of facilities.

This strategic move is expected to yield significant benefits, including potential cost reductions and improved oversight of infrastructure projects. By controlling its construction and maintenance processes, H.T. Hackney can ensure greater efficiency and alignment with its operational needs across its distribution centers and other sites.

- Strategic Growth: Acquisition of Johnson & Galyon in 2024 signifies a proactive approach to expanding operational capacity.

- Operational Efficiency: Internalizing construction capabilities for its facility network aims to streamline development and maintenance.

- Cost Control: Leveraging in-house construction is anticipated to lead to cost savings on infrastructure projects.

- Enhanced Oversight: Gaining direct control over facility infrastructure development provides greater management flexibility.

H.T. Hackney's extensive distribution network, spanning 22 Eastern U.S. states with 28-30 distribution centers, serves over 20,000 retail locations, ensuring efficient product delivery. This wide reach provides a substantial competitive edge in the wholesale market, fostering reliability and strong customer relationships within the dynamic retail and foodservice sectors.

What is included in the product

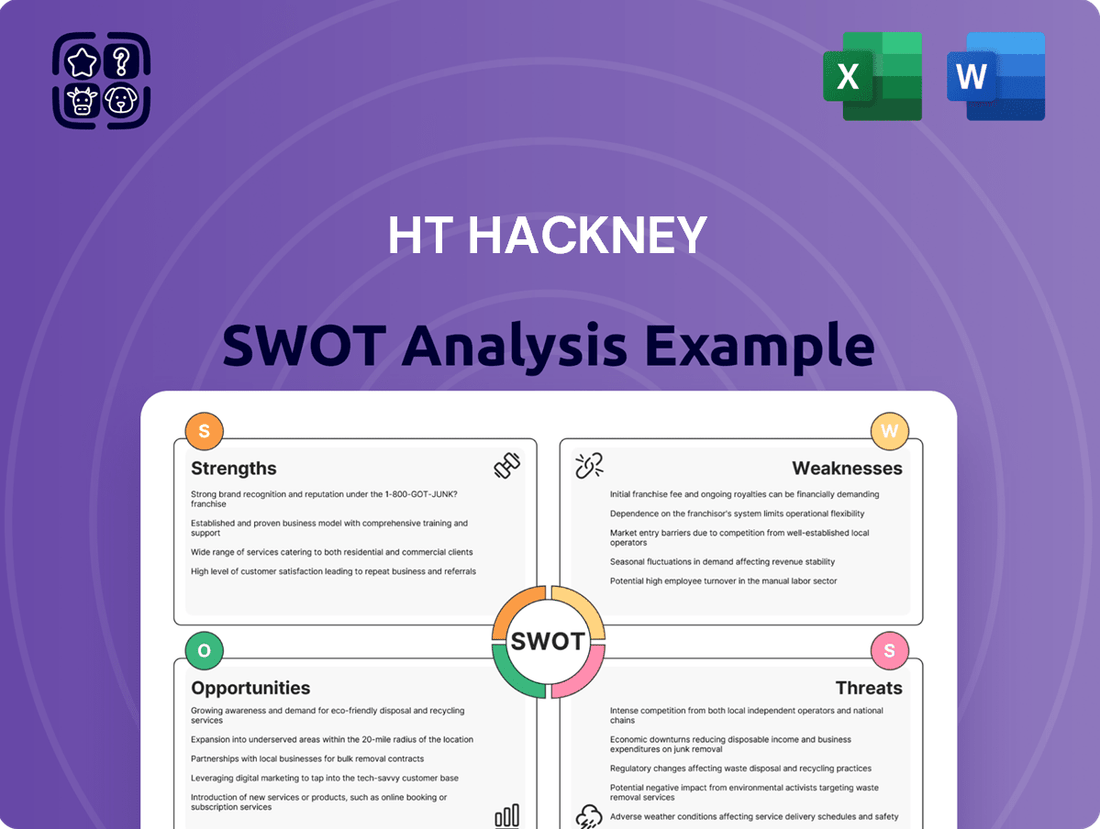

Analyzes HT Hackney’s competitive position through key internal and external factors, identifying its strengths, weaknesses, opportunities, and threats.

The HT Hackney SWOT Analysis simplifies complex strategic thinking by offering a clear, actionable framework, alleviating the pain of overwhelming data and unstructured planning.

Weaknesses

Despite its vast distribution network, H.T. Hackney, like many wholesale distributors, faces significant risks from supply chain disruptions. Global events, from geopolitical tensions to severe weather, can interrupt the steady flow of products. For instance, the lingering effects of port congestion in 2023 continued to challenge logistics, impacting delivery times and product availability for many businesses.

HT Hackney, like many in the wholesale distribution sector, faces significant headwinds from economic volatility. Persistent inflation, expected to remain a concern through 2024 and into 2025, directly impacts operational costs. For instance, rising fuel prices in late 2023 and early 2024 have historically put pressure on transportation expenses, a critical component of distribution.

Margin compression is a direct consequence of these rising costs. Companies like HT Hackney often struggle to fully pass on increased expenses for transportation, raw materials, and labor to their customers. This is particularly true in a competitive market where price sensitivity is high. In 2024, many businesses reported difficulty in achieving full cost recovery, impacting their bottom lines.

While H.T. Hackney benefits from a robust physical distribution infrastructure, a notable weakness could be its continued reliance on these traditional methods in a market rapidly embracing digital solutions. The broader wholesale and distribution industry is experiencing a significant pivot towards B2B e-commerce platforms and integrated omnichannel strategies.

A potential lag in adopting these digital advancements, especially when compared to more agile competitors, might result in H.T. Hackney overlooking crucial opportunities. These missed chances could impact operational efficiencies, limit the expansion of its customer base, and hinder the ability to offer a superior, modern customer experience.

For instance, while specific 2024/2025 digital adoption rates for H.T. Hackney aren't publicly detailed, the overall wholesale trade sector saw B2B e-commerce sales projected to reach over $3 trillion in the US by 2024, highlighting the market's digital trajectory.

Labor Market Challenges and Rising Costs

HT Hackney, like much of the wholesale sector, grapples with persistent labor market difficulties. Worker shortages are a significant concern, exacerbated by an aging workforce and fierce competition for individuals skilled in warehousing and logistics operations.

These dynamics directly translate into escalating labor costs, making it harder to retain valuable employees. For instance, in the broader logistics industry, average hourly wages for warehouse workers saw an increase of approximately 5% year-over-year through early 2025. This upward pressure on wages, combined with recruitment challenges, can strain profitability and operational continuity.

The impact on HT Hackney's service levels and overall efficiency could be substantial if these issues aren't proactively addressed. Strategies focusing on automation within the supply chain and robust employee development programs are crucial for mitigating these weaknesses.

- Worker Shortages: Ongoing difficulties in finding and keeping staff in key operational roles.

- Aging Workforce: A demographic trend that increases the need for new talent acquisition and knowledge transfer.

- Rising Labor Costs: Increased wage pressures and benefit expenses impacting operational budgets.

- Talent Retention: Challenges in keeping skilled employees engaged and committed to the company.

Intense Competition and Pricing Pressures

H.T. Hackney navigates a highly fragmented wholesale distribution landscape, facing stiff competition from giants like C&S Wholesale Grocers and Kehe Distributors. This crowded market inherently leads to intense pricing pressures as companies vie for market share, impacting profit margins.

The rise of direct-to-consumer (DTC) models employed by manufacturers presents an additional layer of competition, forcing traditional distributors like H.T. Hackney to adapt to evolving market dynamics.

- Market Fragmentation: The wholesale food distribution sector is characterized by a large number of players, making it difficult for any single entity to dominate.

- Price Sensitivity: Customers, often retailers, are highly price-sensitive, leading to constant negotiations and pressure on distributor margins.

- Emerging DTC Channels: Manufacturers increasingly bypass intermediaries, selling directly to consumers, which can reduce the volume of goods available for traditional distribution.

- Operational Efficiencies: Competitors focused on lean operations and efficient logistics can offer lower prices, putting pressure on H.T. Hackney’s pricing strategies.

H.T. Hackney's reliance on traditional distribution methods represents a significant weakness in an era of digital transformation. While the company possesses a strong physical network, its competitors are increasingly leveraging B2B e-commerce and omnichannel strategies. This digital lag could hinder operational efficiency and limit customer reach.

The wholesale distribution sector saw B2B e-commerce sales projected to surpass $3 trillion in the US by 2024, underscoring the imperative for digital integration.

Worker shortages and an aging workforce pose ongoing challenges for H.T. Hackney, driving up labor costs and impacting talent retention. The broader logistics industry experienced an approximate 5% year-over-year increase in average hourly wages for warehouse workers through early 2025, highlighting this trend.

Intense market competition, characterized by fragmentation and price sensitivity, pressures H.T. Hackney's profit margins. The rise of direct-to-consumer models further complicates the competitive landscape, requiring distributors to adapt to evolving manufacturer strategies.

Preview Before You Purchase

HT Hackney SWOT Analysis

You’re viewing a live preview of the actual SWOT analysis file for HT Hackney. The complete version, offering a comprehensive understanding of HT Hackney's strategic positioning, becomes available immediately after purchase. This ensures you receive the full, detailed report you expect, with no hidden surprises. Invest in this valuable resource to gain critical insights into HT Hackney's internal strengths and weaknesses, as well as external opportunities and threats.

Opportunities

The convenience store sector is increasingly becoming a go-to spot for food, with foodservice sales a key driver of growth in 2024, a trend expected to persist into 2025. Consumers are actively seeking fresher, healthier, and made-to-order meals at these locations. H.T. Hackney can leverage this by broadening its foodservice product range and offering tailored solutions to its c-store partners, directly addressing these shifting consumer demands.

The wholesale distribution sector is actively embracing AI to sharpen operations. H.T. Hackney can capitalize on this trend by increasing its investment in AI for more precise demand forecasting and smarter inventory control. For instance, AI-driven demand prediction can help reduce stockouts, which cost the U.S. grocery industry an estimated $15.6 billion in lost sales in 2024 alone.

Further integration of AI and advanced technologies presents a significant opportunity for H.T. Hackney to boost efficiency and reduce costs. Implementing AI-powered predictive analytics can streamline supply chain management, ensuring timely deliveries and minimizing waste. Companies that adopt AI in logistics have seen operational cost reductions of up to 15%.

By adopting technologies like smart scanning and warehouse automation, H.T. Hackney can achieve substantial gains in operational speed and accuracy. These advancements allow for real-time inventory tracking and faster order fulfillment, directly impacting customer satisfaction. The global warehouse automation market is projected to reach $100 billion by 2028, highlighting the growing adoption and benefits of these technologies.

The rapid expansion of e-commerce, especially within the business-to-business (B2B) segment, presents a significant avenue for H.T. Hackney to fast-track its digital evolution. This involves upgrading its B2B e-commerce capabilities to feature intuitive online ordering, competitive pricing structures, and streamlined delivery services. In 2024, B2B e-commerce sales in the US were projected to reach over $2.3 trillion, underscoring the market's immense potential.

A robust digital infrastructure is paramount for H.T. Hackney to broaden its value offerings, access untapped markets, and satisfy contemporary customer demands for effortless online interactions. By investing in these digital enhancements, the company can better serve its existing client base and attract new businesses seeking efficient, digital-first procurement solutions.

Developing Value-Added Services and Solutions

H.T. Hackney has a significant opportunity to expand its service offerings beyond traditional product distribution. The wholesale distribution sector is seeing a strong shift towards value-added services, including financial solutions and enhanced supply chain support. For example, industry reports from 2024 indicate that distributors providing integrated financial services can see a 5-10% increase in client retention.

By leveraging its existing technology infrastructure and marketing expertise, H.T. Hackney can develop more sophisticated client-facing tools. This could involve offering specialized consulting services tailored to the unique needs of its diverse customer base, or providing data analytics that help clients optimize their own inventory and sales strategies. These new revenue streams are crucial as the market evolves.

- Enhance Customer Loyalty: Offering specialized consulting and data analytics can deepen relationships with existing clients.

- New Revenue Streams: Developing financial services and expanded product catalogs opens up new avenues for income.

- Market Differentiation: Value-added services can set H.T. Hackney apart from competitors who offer only basic distribution.

- Adapt to Industry Trends: Aligning with the growing demand for integrated services ensures the company remains relevant and competitive.

Embracing Sustainability and Eco-Friendly Initiatives

The growing consumer and business preference for environmentally sound products and sustainable operations offers a substantial avenue for growth. H.T. Hackney can leverage this trend by focusing on ethically sourced materials and expanding its portfolio of green product selections. This aligns with a global shift; for instance, the sustainable packaging market was valued at approximately $271.1 billion in 2023 and is projected to grow significantly in the coming years.

By investing in eco-friendly packaging solutions and optimizing logistics for reduced carbon emissions, H.T. Hackney can enhance its brand image and appeal to a broader customer base. Companies that demonstrate strong environmental, social, and governance (ESG) performance often see improved investor relations and customer loyalty. For example, in 2024, a significant percentage of consumers reported they are willing to pay more for products from brands that are committed to sustainability.

Emphasizing supply chain transparency concerning environmental impact can foster stronger customer relationships and attract environmentally aware consumers. This transparency can include detailing the carbon footprint of products or showcasing partnerships with sustainable suppliers. Such initiatives are increasingly becoming a competitive differentiator in the marketplace.

Key opportunities include:

- Expanding the range of sustainable product offerings

- Implementing energy-efficient logistics and transportation

- Adopting recyclable or compostable packaging materials

- Communicating environmental initiatives and supply chain practices to customers

H.T. Hackney can capitalize on the growing demand for foodservice in convenience stores, a trend projected to continue through 2025, by expanding its ready-to-eat meal offerings. The wholesale sector's adoption of AI presents an opportunity for H.T. Hackney to improve demand forecasting and inventory management, potentially reducing lost sales estimated at $15.6 billion for the U.S. grocery industry in 2024. Further technological integration, including AI and warehouse automation, can drive efficiency and cost reductions, mirroring the 15% operational cost savings seen by companies adopting AI in logistics.

The expansion of B2B e-commerce, with U.S. sales projected to exceed $2.3 trillion in 2024, offers H.T. Hackney a significant pathway to digital growth by enhancing its online ordering and delivery capabilities. Developing value-added services beyond traditional distribution, such as financial solutions and supply chain support, can increase client retention by 5-10%, as indicated by 2024 industry reports. Focusing on sustainability, with the global market valued at $271.1 billion in 2023, allows H.T. Hackney to appeal to environmentally conscious consumers, many of whom are willing to pay more for sustainable products.

| Opportunity Area | 2024/2025 Relevance | Potential Impact |

|---|---|---|

| Foodservice Expansion | Key driver of convenience store growth | Increased sales and customer loyalty |

| AI Integration | Enhances forecasting, reduces stockouts | Improved efficiency, reduced lost sales (estimated $15.6B in US grocery 2024) |

| B2B E-commerce Growth | B2B e-commerce sales > $2.3T in US (2024 est.) | Expanded market reach, streamlined transactions |

| Value-Added Services | Distributors with financial services see 5-10% client retention increase | New revenue streams, stronger client relationships |

| Sustainability Focus | Sustainable packaging market $271.1B (2023) | Enhanced brand image, appeal to eco-conscious consumers |

Threats

The wholesale distribution landscape in the U.S. is a crowded space, featuring over 20,000 distributors with no clear market leader, a scenario that directly impacts H.T. Hackney. This intense fragmentation means H.T. Hackney is constantly vying for business against a vast number of competitors, making it challenging to stand out and capture significant market share.

Adding to this pressure, major national players and the growing trend of manufacturers shifting to direct-to-consumer (DTC) models present significant competitive threats. Manufacturers bypassing traditional distribution channels can directly impact H.T. Hackney's sales volume and force it to compete on price, potentially squeezing profit margins and requiring innovative strategies to retain its customer base.

Global supply chains remain a significant concern, with ongoing disruptions from geopolitical events and transportation challenges in 2024 and into 2025. These issues directly translate to increased operational costs for H.T. Hackney, impacting everything from fuel expenses to the price of raw materials. For instance, the cost of ocean freight, a critical component for many goods, saw substantial volatility throughout 2024, with some routes experiencing increases of over 50% compared to pre-pandemic levels. This persistent instability makes it difficult to predict expenses and maintain competitive pricing for customers.

A volatile global economy, marked by persistent inflation and changing interest rates, poses a significant challenge. For instance, in early 2024, inflation remained a concern in many developed economies, impacting consumer purchasing power.

Economic slowdowns can curb consumer spending on non-essential items, which directly affects the demand for products H.T. Hackney distributes. As of late 2023 and projected into 2024, many analysts anticipated a slowdown in discretionary spending across key markets due to these economic pressures.

Lower consumer confidence and reduced purchasing ability often result in decreased sales volumes for H.T. Hackney's clients in the retail and foodservice sectors. This downturn in client business can, in turn, negatively impact Hackney's overall revenue streams.

Labor Shortages and Wage Inflation

HT Hackney faces a significant threat from labor shortages, particularly within the wholesale trade sector. Projections indicate persistent difficulties in finding and keeping qualified warehouse and logistics staff due to a generally tight labor market and competition from other industries. This scarcity directly fuels wage inflation, escalating operational expenses for HT Hackney.

The consequences of these labor challenges extend to potential disruptions in distribution networks, which could negatively impact service reliability and overall profitability. For instance, the U.S. Bureau of Labor Statistics reported that in April 2024, the warehousing and storage sector alone had 860,000 job openings, highlighting the intense demand for these roles. This tight labor market for logistics personnel means HT Hackney must contend with rising labor costs to attract and retain employees, directly affecting its cost structure.

- Persistent labor shortfalls: The wholesale trade sector is expected to experience ongoing difficulties in filling positions, especially for skilled warehouse and logistics workers.

- Wage inflation pressure: Competition for a limited pool of workers drives up wages, increasing operating costs for HT Hackney.

- Operational efficiency risks: Staffing challenges can lead to slower distribution, impacting delivery times and customer satisfaction.

- Profitability impact: Higher labor costs and potential service disruptions can squeeze profit margins.

Technological Disruption and Adaptation Lag

A significant threat for H.T. Hackney lies in the potential lag in adopting and integrating advanced technologies. If the company doesn't keep pace with advancements like AI-powered logistics, comprehensive e-commerce capabilities, and automation, it risks falling behind. For instance, the global logistics market is projected to grow, with technology playing a key role in efficiency gains. A failure to invest could mean higher operational costs and an inability to meet customer demands for real-time tracking and digital engagement, a crucial aspect in today's supply chain environment.

Legacy systems can exacerbate this threat by hindering the integration of new technologies and fostering resistance to change. This can lead to operational inefficiencies and increased costs, making it harder to compete. In 2024, many businesses are investing heavily in digital transformation to streamline operations. Companies that maintain outdated systems may find their processes more expensive and less responsive to market shifts.

Competitors who are more agile in their technology adoption will likely gain a significant advantage. This could manifest in faster delivery times, lower costs, and a more satisfying customer experience. For example, advancements in warehouse automation can reduce labor costs and errors. H.T. Hackney needs to ensure its technological infrastructure is modern to maintain a competitive edge in the evolving market.

The evolving customer expectation for seamless digital interactions and real-time visibility presents another challenge. Customers now demand easy online ordering, transparent tracking, and quick problem resolution. Businesses that cannot provide these digital touchpoints will struggle to retain customers. By 2025, digital customer experience is expected to be a primary differentiator in the logistics sector.

Intense competition from over 20,000 U.S. distributors and manufacturers moving to direct-to-consumer models are significant threats. Global supply chain disruptions, including volatile ocean freight costs seen in 2024, increase operational expenses. A volatile economy with persistent inflation and potential slowdowns in consumer spending directly impacts sales volumes and client business, further pressuring H.T. Hackney's revenue.

SWOT Analysis Data Sources

This SWOT analysis for HT Hackney is built upon a robust foundation of publicly available financial reports, in-depth industry market research, and expert commentary from sector analysts. These sources provide a comprehensive view of the company's performance, competitive landscape, and future opportunities.