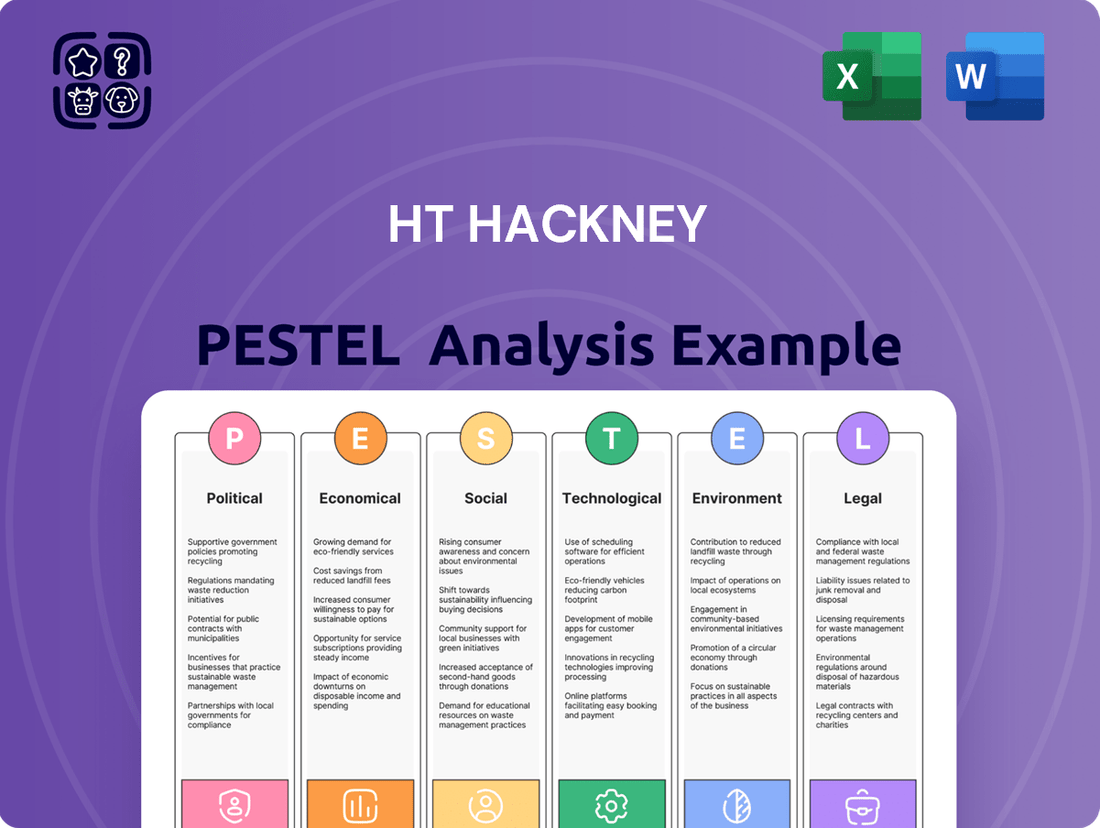

HT Hackney PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HT Hackney Bundle

Uncover the intricate web of external forces shaping HT Hackney's trajectory. Our PESTLE analysis delves deep into the political, economic, social, technological, legal, and environmental factors impacting the company. Arm yourself with actionable intelligence to anticipate challenges and seize opportunities. Download the full, professionally researched report now to gain a decisive market advantage.

Political factors

Government regulations significantly shape H.T. Hackney's operational landscape, particularly concerning product categories like tobacco and food. Changes in federal and state laws regarding product safety, ingredient disclosure, and marketing can directly influence H.T. Hackney's product mix and necessitate adjustments to compliance procedures. For example, evolving food safety standards, such as those implemented by the FDA, require distributors to maintain rigorous tracking and handling protocols for perishable goods, impacting logistics and storage costs.

Shifts in global trade policies, including potential new tariffs or adjustments to existing free trade agreements, directly impact H.T. Hackney's distribution model. For instance, if the U.S. were to impose tariffs on certain food products or packaging materials from countries like Mexico or Canada, the cost of imported goods H.T. Hackney handles would likely increase. This could lead to higher operational expenses for the company, forcing them to re-evaluate their pricing strategies and explore alternative sourcing options to mitigate these impacts. The U.S. imported approximately $2.7 trillion in goods in 2023, highlighting the significant exposure to trade policy changes.

Government initiatives and legislation designed to bolster supply chain resilience, such as the Promoting Resilient Supply Chains Act, directly impact distributor operations. These policies often mandate or incentivize the mapping of critical supply chains, the identification of potential weak points, and assessments of domestic manufacturing capacities. For instance, the US Department of Commerce's supply chain resilience initiative, launched in 2021, aims to address vulnerabilities, and its ongoing efforts could introduce new compliance burdens or opportunities for distributors.

Labor Laws and Minimum Wage

New labor laws and adjustments to minimum wage regulations present significant financial and operational challenges for H.T. Hackney. For instance, the continued trend of states and cities raising their minimum wages, with many scheduled to implement increases in 2025, will directly impact the company's labor expenses across its distribution network.

Furthermore, evolving regulations regarding the classification of independent contractors could necessitate changes to H.T. Hackney's current staffing models, potentially leading to increased costs associated with benefits and payroll taxes if drivers are reclassified as employees. Recent legislative actions, such as new warehouse worker protection acts being introduced in various states, also add layers of compliance and operational adjustments necessary for managing distribution center labor effectively.

- Minimum Wage Increases: As of early 2025, numerous states and municipalities have enacted or are planning minimum wage hikes, with some reaching $15-$20 per hour.

- Independent Contractor Rules: Evolving legal interpretations and potential legislative changes around gig economy workers could affect H.T. Hackney's use of contracted drivers.

- Worker Protection Laws: New state-level legislation focusing on warehouse worker safety and working conditions are being implemented, requiring updated HR and operational protocols.

Political Stability and Elections

Political stability is a cornerstone for businesses like HT Hackney. For instance, the 2024 US Presidential election, with its potential for shifts in economic policy, could influence everything from corporate tax rates to international trade agreements impacting the wholesale distribution sector. A change in administration might signal evolving priorities in regulatory oversight, which could affect compliance costs or operational flexibility for distributors.

Changes in government leadership can directly translate to altered economic landscapes for wholesale distributors. For example, if a new administration prioritizes domestic manufacturing or imposes new tariffs, it could reshape supply chains and input costs for companies like HT Hackney. Similarly, shifts in labor law or environmental regulations, often a byproduct of election outcomes, can necessitate significant adjustments to business operations and capital expenditures.

- Election Uncertainty: Upcoming elections in major markets can introduce volatility as businesses await clarity on future economic and regulatory frameworks.

- Policy Shifts: New administrations may re-evaluate trade policies, potentially impacting import/export costs for wholesale distributors.

- Regulatory Changes: Potential revisions to environmental standards or labor laws could affect operational expenses and compliance requirements.

Government policy directly impacts H.T. Hackney's operational costs and strategic direction, especially concerning labor and trade. For instance, the ongoing trend of minimum wage increases, with many states aiming for $15-$20 per hour by 2025, will significantly raise H.T. Hackney's payroll expenses across its distribution network.

Evolving regulations around independent contractor classification and new worker protection laws in states like California and New York also require careful navigation and potential adjustments to staffing models, impacting labor costs and compliance procedures for H.T. Hackney.

Trade policy shifts, such as potential tariffs on imported goods or packaging materials, could increase H.T. Hackney's cost of goods sold, mirroring the U.S.'s $2.7 trillion in imports in 2023, necessitating a review of sourcing and pricing strategies.

| Regulation Area | Potential Impact on H.T. Hackney | Example/Data Point (2024-2025) |

|---|---|---|

| Minimum Wage | Increased labor costs, potential price adjustments | Many states have minimum wages projected to reach $15+ by 2025. |

| Labor Classification | Higher payroll taxes and benefit costs if drivers reclassified | Ongoing legislative debates on gig worker status across multiple states. |

| Trade Tariffs | Higher cost of goods, supply chain adjustments | U.S. imports totaled $2.7 trillion in 2023, showing significant exposure. |

What is included in the product

The HT Hackney PESTLE Analysis delves into how external macro-environmental factors—Political, Economic, Social, Technological, Environmental, and Legal—shape the company's strategic landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors into actionable insights.

Economic factors

Persistent inflation, especially in transportation and raw materials, significantly impacts H.T. Hackney's expenses. For instance, the Producer Price Index for transportation and warehousing services saw a notable increase in early 2024, directly affecting fuel and logistics costs. This pressure on operating expenses can squeeze profit margins.

As a wholesale distributor, H.T. Hackney is particularly susceptible to these rising costs. If the cost of goods and delivery escalates, the company faces a challenge in maintaining its own profitability without passing those increases on. This can strain relationships with their retail and foodservice customers who then face higher wholesale prices.

For example, the average price of diesel fuel, a critical component for H.T. Hackney's fleet, remained elevated throughout 2023 and into early 2024, impacting delivery costs. Similarly, the cost of many food and beverage ingredients saw year-over-year increases, adding to the overall cost of inventory for the distributor.

Consumer spending habits are undergoing significant shifts, directly impacting demand for the diverse products H.T. Hackney distributes. Economic pressures, including persistent inflation, have made consumers more price-sensitive, leading many to scrutinize purchases and seek greater value. For instance, data from early 2024 indicated that while overall consumer spending showed some resilience, a notable portion of this growth was driven by essential goods, with discretionary spending facing more headwinds.

This increased price consciousness often translates into a preference for private label brands or promotional items, a trend that can influence the product mix and sales volumes for distributors like H.T. Hackney. As consumers actively look for more affordable alternatives, the traditional brand loyalty may weaken, forcing distributors to adapt their offerings and potentially adjust inventory strategies to cater to this evolving demand. Reports in late 2023 and early 2024 highlighted a rise in private label sales across various retail categories, a clear indicator of this consumer behavior shift.

Interest rates significantly influence H.T. Hackney's access to capital and its associated costs. For instance, a rise in the Federal Reserve's benchmark interest rate, which was held steady around 5.25%-5.50% through early 2025, directly increases the cost of borrowing for operational needs, inventory management, and future expansion plans.

Higher borrowing costs can constrain H.T. Hackney's ability to invest in critical areas like technology upgrades or infrastructure improvements, potentially impacting efficiency and long-term competitiveness. For example, if the prime lending rate increases by 1%, a company needing $100 million in new debt could face an additional $1 million in annual interest expenses.

Conversely, a stable or declining interest rate environment would reduce H.T. Hackney's debt servicing obligations, freeing up capital for reinvestment and strategic initiatives. The Federal Reserve's projections for 2025 indicated a potential for rate cuts, which could improve capital access and lower financing expenses for businesses like H.T. Hackney.

Supply Chain Disruptions

Ongoing global and domestic supply chain disruptions, fueled by geopolitical tensions like the ongoing conflict in Eastern Europe and labor disputes in key sectors, continue to impede the flow of goods for distributors. These issues directly translate into longer lead times and elevated costs, impacting inventory management and profitability. For instance, shipping costs saw significant fluctuations throughout 2024, with the average cost of shipping a 40-foot container from Asia to North America experiencing volatility driven by port congestion and vessel availability.

To counter these challenges, companies like HT Hackney must focus on building more resilient and diversified supply chains. This involves exploring alternative sourcing options, increasing inventory levels for critical components where feasible, and investing in technology to improve visibility and responsiveness. The focus shifts from pure cost optimization to a balance of cost, reliability, and agility.

Key impacts include:

- Increased operational costs: Fluctuations in fuel prices and labor shortages in transportation sectors added an estimated 10-15% to logistics expenses for many distributors in 2024.

- Extended lead times: Delays at major ports and manufacturing hubs, some extending by several weeks, impacted the timely availability of essential products.

- Need for strategic partnerships: Collaborations with multiple logistics providers and suppliers become crucial to mitigate risks associated with single-source dependencies.

- Inventory management adjustments: Companies are re-evaluating just-in-time strategies in favor of holding slightly higher safety stocks for critical items to buffer against unexpected shortages.

Market Competition and Margins

The wholesale distribution sector, including companies like H.T. Hackney, is experiencing intensified competition, which is consequently squeezing profit margins. This pressure stems from traditional rivals and increasingly from manufacturers adopting direct-to-consumer (DTC) strategies, bypassing distributors. For instance, in 2024, the U.S. wholesale trade sector saw a modest revenue growth of approximately 3.5%, but this growth was often accompanied by a decline in net profit margins for many players as they absorbed rising operational costs and competitive pricing pressures.

To navigate this challenging landscape and maintain profitability, distributors are compelled to differentiate themselves beyond mere product delivery. This involves developing and offering a suite of value-added services. These could include enhanced data analytics for customers, customized inventory management solutions, or specialized logistics and merchandising support. Such services allow distributors to command better pricing and foster deeper customer loyalty.

Leveraging technology is no longer optional but a critical imperative for staying competitive. Investments in advanced supply chain management software, automation in warehousing, and digital platforms for sales and customer interaction are key. For example, reports from late 2024 indicate that distributors who have successfully integrated AI-powered demand forecasting have seen a reduction in inventory holding costs by up to 10% and an improvement in on-time delivery rates, directly impacting their operational efficiency and margins.

- Increased Competition: Manufacturers increasingly selling directly to consumers erode traditional distributor roles.

- Margin Pressure: A competitive market and rising operational costs are forcing distributors to accept narrower profit margins.

- Value-Added Services: Offering services like data analytics and customized logistics is crucial for differentiation and profitability.

- Technology Adoption: Investments in AI, automation, and digital platforms are essential for operational efficiency and competitive advantage.

Economic factors significantly shape the operating environment for H.T. Hackney. Persistent inflation, particularly in transportation and raw materials, directly increases operational costs. For instance, the Producer Price Index for transportation and warehousing saw a notable uptick in early 2024, impacting fuel and logistics expenses. This cost pressure can compress profit margins for a wholesale distributor like H.T. Hackney, especially when coupled with shifts in consumer spending towards more price-sensitive choices and private label brands, as evidenced by increased private label sales in late 2023 and early 2024.

Interest rates also play a crucial role, influencing capital costs. With the Federal Reserve maintaining rates between 5.25%-5.50% through early 2025, borrowing for operations or expansion becomes more expensive. This can limit investments in technology or infrastructure. Conversely, potential rate cuts in 2025 could ease financing burdens.

Supply chain disruptions, driven by geopolitical issues and labor disputes, continue to affect product availability and increase lead times. For example, shipping costs from Asia to North America remained volatile in 2024. Distributors must build resilient supply chains, diversify sourcing, and potentially hold higher inventory levels to mitigate these risks.

Intensified competition, including manufacturers adopting direct-to-consumer models, squeezes margins in the wholesale sector. In 2024, the U.S. wholesale trade sector experienced modest revenue growth but often saw declining net profit margins. To stay competitive, companies like H.T. Hackney must offer value-added services and invest in technology such as AI-powered demand forecasting, which can reduce inventory costs by up to 10%.

| Economic Factor | Impact on H.T. Hackney | Supporting Data/Trend (2023-2025) |

|---|---|---|

| Inflation | Increased operating costs (fuel, raw materials), potential margin squeeze. | PPI for transportation up in early 2024; elevated diesel prices throughout 2023-2024. |

| Consumer Spending Habits | Shift towards price sensitivity and private labels, affecting product mix. | Increased private label sales noted in late 2023/early 2024; focus on essential goods in spending. |

| Interest Rates | Higher cost of capital, potentially limiting investment. | Fed rates stable at 5.25%-5.50% through early 2025; potential for cuts in 2025. |

| Supply Chain Disruptions | Extended lead times, increased logistics costs, need for resilience. | Volatile shipping costs in 2024; extended port delays impacting product flow. |

| Competition | Margin pressure, need for value-added services and technology adoption. | Wholesale trade revenue growth of ~3.5% in 2024 accompanied by margin pressure; AI forecasting can cut inventory costs by up to 10%. |

Same Document Delivered

HT Hackney PESTLE Analysis

The preview you see here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive HT Hackney PESTLE analysis breaks down the political, economic, social, technological, legal, and environmental factors impacting the company.

You can confidently anticipate receiving this detailed report, offering valuable insights into HT Hackney's strategic landscape.

No surprises, just a complete and professionally structured analysis of HT Hackney's PESTLE factors.

Sociological factors

Consumers are increasingly prioritizing health and wellness, driving demand for fresher, more functional food and beverages. This shift directly influences the product selections H.T. Hackney's clients require, pushing for options like protein-boosted drinks and plant-based alternatives. For instance, the global plant-based food market was valued at approximately $29.7 billion in 2022 and is projected to reach $162 billion by 2030, highlighting the substantial impact of this trend.

This growing preference for healthier choices fuels innovation within the industry, encouraging the development of clean-label products with fewer artificial ingredients. The market for functional foods, which offer health benefits beyond basic nutrition, is also expanding rapidly. In 2024, it's estimated that the functional food market will surpass $200 billion globally, demonstrating a clear consumer appetite for products that contribute to overall well-being.

Busy lifestyles are fueling a significant demand for convenience across the retail and foodservice industries. This trend directly impacts H.T. Hackney by increasing the need for ready-to-eat meals, quick snacks, and efficient digital ordering systems. For instance, the global ready-to-eat meal market was valued at approximately $185 billion in 2023 and is projected to reach over $250 billion by 2028, highlighting a clear shift in consumer purchasing habits.

Consumer shopping habits are definitely changing. We're seeing more people paying close attention to prices and looking for the best value. It's interesting that many are now willing to wait a bit longer for deliveries if it means saving money. This trend directly affects how convenience and grocery stores operate, forcing distributors like H.T. Hackney to be flexible and support various retail strategies. For instance, a 2024 survey by NielsenIQ indicated that 65% of consumers are actively seeking out deals and promotions, a significant jump from previous years.

This shift means H.T. Hackney needs to adapt its distribution models. Supporting a wider range of retail formats, from traditional brick-and-mortar to online-only operations, is becoming crucial. The company might also need to rethink its delivery logistics to accommodate customer preferences for cost savings over speed, perhaps offering tiered delivery options. The growth of the quick commerce sector, while still developing, shows a segment of the market prioritizing immediate delivery, creating a dynamic H.T. Hackney must navigate.

Demographic Shifts and Urbanization

Demographic shifts, including an aging population and increasing ethnic diversity, are reshaping consumer preferences and the types of businesses H.T. Hackney supports. For instance, the U.S. population is projected to reach over 335 million by 2025, with a growing segment of older adults who may favor different dining experiences and product selections.

Continued urbanization means more people are concentrated in cities, driving demand for convenience and quick-service options. By 2025, it's estimated that 60% of the global population will live in urban areas, a trend that directly impacts H.T. Hackney's logistics and the types of products in demand, such as ready-to-eat meals and delivery-friendly packaging.

- Urban Demand: Cities are hotspots for quick-service restaurants and demand for digital ordering, a key area for H.T. Hackney's distribution.

- Aging Population: Shifts towards an older demographic may alter demand for certain food types and service styles.

- Diversity Impact: Growing ethnic diversity fuels demand for a wider range of international cuisines and specialty food items.

- Convenience Focus: Urban living necessitates convenient food solutions, increasing the need for efficient supply chains for grab-and-go options.

Ethical Consumption and Sustainability Awareness

Consumers increasingly prioritize ethical sourcing and environmental impact, with a notable shift towards sustainable packaging and transparent business practices. This growing awareness directly influences purchasing decisions across various sectors.

This societal trend puts significant pressure on distributors like H.T. Hackney and their supply chain partners to embrace more eco-friendly operations and actively offer responsibly sourced products. For instance, by 2024, over 60% of consumers surveyed indicated they are willing to pay more for products from sustainable brands, a figure projected to rise.

- Consumer Demand: A significant portion of the market now actively seeks out products with minimal environmental footprint.

- Supply Chain Scrutiny: Ethical sourcing and labor practices within the supply chain are under greater public and regulatory examination.

- Brand Reputation: Companies demonstrating commitment to sustainability often experience enhanced brand loyalty and a stronger market position.

- Regulatory Impact: Evolving environmental regulations worldwide are compelling businesses to adopt greener operational standards.

Societal values are shifting, with a growing emphasis on health and wellness. This translates to increased demand for healthier food options and transparency in ingredients, impacting product offerings. Simultaneously, busy lifestyles are driving a need for convenience, boosting the market for ready-to-eat meals and efficient delivery services.

Demographic changes, such as an aging population and increased ethnic diversity, are also reshaping consumer preferences. Urbanization continues to concentrate populations, further fueling the demand for convenient food solutions and efficient distribution networks. For instance, by 2025, approximately 60% of the global population is expected to reside in urban areas.

Consumers are increasingly prioritizing ethical sourcing and sustainability, willing to pay more for eco-friendly products. By 2024, over 60% of consumers indicated a willingness to pay a premium for sustainable brands, a trend that pressures distributors like H.T. Hackney to adopt greener practices.

| Sociological Factor | Impact on H.T. Hackney | Relevant Data (2024/2025) |

|---|---|---|

| Health & Wellness Focus | Increased demand for healthier, functional, and plant-based products. | Global plant-based food market projected to reach $162 billion by 2030. Functional food market to exceed $200 billion in 2024. |

| Convenience Demand | Growth in ready-to-eat meals, quick snacks, and efficient delivery. | Global ready-to-eat meal market valued at ~$185 billion in 2023. |

| Demographic Shifts | Adapting to needs of an aging population and diverse ethnic groups. | U.S. population projected over 335 million by 2025, with a growing older demographic. |

| Urbanization | Increased need for urban-centric logistics and convenience foods. | ~60% of global population expected to live in urban areas by 2025. |

| Sustainability & Ethics | Pressure to adopt eco-friendly practices and offer responsibly sourced goods. | Over 60% of consumers willing to pay more for sustainable brands (2024). |

Technological factors

The burgeoning growth of e-commerce and B2B digital platforms is fundamentally altering the wholesale distribution landscape. H.T. Hackney must prioritize investments in intuitive online ordering systems to keep pace. For instance, a significant portion of B2B buyers now actively prefer digital channels for their procurement needs, underscoring the critical importance of a strong online presence.

This digital shift necessitates H.T. Hackney developing a user-friendly interface for its B2B clientele, aiming to simplify the purchasing process and elevate the overall customer experience. Reports indicate that B2B e-commerce sales are projected to reach $3.6 trillion by 2027, highlighting the immense opportunity and competitive pressure within this evolving market.

Advances in warehouse automation and robotics present substantial opportunities for H.T. Hackney. These technologies can significantly boost operational efficiency and cut down on labor expenses. For instance, the global warehouse automation market was valued at approximately USD 20 billion in 2023 and is projected to reach over USD 40 billion by 2030, indicating robust growth and widespread adoption.

Implementing solutions like digital picking systems, bin location mapping, and task automation can streamline warehouse workflows. Such systems have been shown to reduce picking errors by up to 80% and increase throughput by as much as 30% in various logistics operations, directly impacting H.T. Hackney's ability to manage inventory and fulfill orders more effectively.

The integration of Artificial Intelligence (AI) and predictive analytics is becoming crucial for optimizing inventory levels, forecasting demand, and enhancing customer relationship management for companies like H.T. Hackney. These technologies allow for more informed decisions regarding stock, pricing, and promotional activities, directly impacting operational efficiency.

AI-powered demand forecasting tools can significantly reduce overstocking and stockouts. For instance, in 2024, many retail and logistics operations are leveraging AI to achieve forecast accuracy improvements of 10-15%, leading to substantial cost savings in inventory management.

Furthermore, AI in customer relationship management (CRM) enables personalized marketing campaigns and improved customer service. By analyzing vast datasets, H.T. Hackney can better understand customer preferences and purchasing patterns, fostering loyalty and driving sales growth.

Supply Chain Visibility and IoT

H.T. Hackney is significantly benefiting from the integration of the Internet of Things (IoT) in its supply chain operations. Real-time visibility, powered by IoT devices and technologies like RFID and advanced barcode scanning, is enhancing accuracy and traceability across its distribution network. This allows for precise tracking of goods from origin to destination, a crucial element in managing perishable inventory and adhering to stringent food safety regulations.

The adoption of these technologies directly impacts H.T. Hackney's inventory management, reducing discrepancies and minimizing waste. For instance, enhanced traceability supports compliance with regulations such as the Food Safety Modernization Act (FSMA) in the United States, which mandates robust record-keeping for food product movements. This technological advancement is not just about tracking; it's about building a more resilient and efficient supply chain.

Key benefits for H.T. Hackney include:

- Improved Inventory Accuracy: IoT sensors and smart scanning reduce manual errors, leading to more precise stock counts.

- Enhanced Traceability: Real-time data allows for quick identification and isolation of products in case of recalls or quality issues.

- Regulatory Compliance: Facilitates adherence to food traceability mandates, ensuring consumer safety and brand trust.

- Operational Efficiency: Streamlined tracking and inventory management contribute to faster order fulfillment and reduced operational costs.

Cybersecurity Risks

H.T. Hackney's increasing reliance on digital systems and interconnected supply chains significantly elevates its exposure to cybersecurity risks. Threats such as data breaches and ransomware attacks can disrupt operations and compromise sensitive customer and company information. For instance, the global cost of cybercrime is projected to reach $10.5 trillion annually by 2025, highlighting the substantial financial and operational impact these risks can have.

Maintaining robust cybersecurity measures is therefore not just a technical necessity but a strategic imperative for H.T. Hackney. Protecting intellectual property, customer data, and ensuring the integrity of its digital infrastructure are critical for maintaining business continuity and safeguarding its reputation. The company's ability to prevent and respond to cyber incidents directly impacts stakeholder trust and long-term viability.

- Data Breach Impact: A single data breach can cost an average of $4.45 million globally in 2024, according to IBM's Cost of a Data Breach Report.

- Ransomware Prevalence: Ransomware attacks continue to be a significant threat, with many businesses experiencing prolonged downtime and substantial recovery costs.

- Supply Chain Vulnerabilities: The interconnected nature of modern supply chains means that a cybersecurity failure in one partner can cascade and affect H.T. Hackney.

- Regulatory Scrutiny: Increasing data privacy regulations worldwide, such as GDPR and CCPA, impose significant penalties for non-compliance related to data security.

The ongoing digital transformation within the wholesale sector, marked by the rise of e-commerce and B2B digital platforms, demands H.T. Hackney's focus on enhancing its online presence and user experience. With B2B e-commerce sales projected to reach $3.6 trillion by 2027, a seamless digital ordering system is crucial for competitive advantage and customer engagement.

Advancements in warehouse automation, including robotics and digital picking systems, offer H.T. Hackney significant opportunities to boost efficiency and reduce labor costs. The global warehouse automation market, valued at approximately $20 billion in 2023 and expected to exceed $40 billion by 2030, underscores the widespread adoption and potential for throughput increases of up to 30%.

The integration of AI and IoT technologies is vital for H.T. Hackney to optimize inventory, forecast demand accurately, and enhance customer relationships. AI-powered forecasting can improve accuracy by 10-15% in 2024, reducing stockouts, while IoT ensures enhanced traceability, supporting compliance with regulations like FSMA.

However, H.T. Hackney's increased reliance on digital systems exposes it to growing cybersecurity risks, with global cybercrime costs anticipated to reach $10.5 trillion annually by 2025. Data breaches alone can cost an average of $4.45 million globally in 2024, making robust cybersecurity a strategic imperative.

| Technology Area | Opportunity/Impact | Key Data/Projection |

|---|---|---|

| E-commerce & Digital Platforms | Enhanced B2B sales channels, improved customer experience | B2B e-commerce sales projected to reach $3.6 trillion by 2027 |

| Warehouse Automation & Robotics | Increased operational efficiency, reduced labor costs, improved accuracy | Global warehouse automation market valued at ~$20 billion (2023), projected to exceed $40 billion by 2030 |

| Artificial Intelligence (AI) | Optimized inventory, demand forecasting, personalized customer service | AI forecast accuracy improvements of 10-15% achieved in 2024 |

| Internet of Things (IoT) | Real-time supply chain visibility, enhanced traceability, regulatory compliance | Supports compliance with regulations like FSMA for food product movements |

| Cybersecurity | Mitigation of data breaches, ransomware, operational disruptions | Global cybercrime costs projected to reach $10.5 trillion annually by 2025; average data breach cost ~$4.45 million (2024) |

Legal factors

Strict food safety regulations are a significant legal factor for H.T. Hackney. For example, the U.S. Food and Drug Administration's Food Traceability Final Rule mandates detailed recordkeeping for specific food categories. This means H.T. Hackney needs robust systems to track products throughout its supply chain. In 2024, compliance with these evolving traceability standards is paramount to avoid penalties and ensure consumer trust.

Compliance with these food safety mandates is critical for swift product recalls. H.T. Hackney must be able to quickly identify and remove any potentially contaminated items from circulation. Failure to do so can lead to significant financial losses and reputational damage, especially in a market where consumer confidence is easily shaken.

Ongoing and proposed regulations concerning tobacco products significantly influence H.T. Hackney's distribution business. The U.S. Food and Drug Administration (FDA) is actively shaping the landscape with rules on menthol bans and potential nicotine level reductions. These regulatory shifts necessitate continuous adaptation within H.T. Hackney's supply chain to ensure compliance.

The FDA's evolving guidance impacts how tobacco products are marketed and sold, directly affecting H.T. Hackney's operational strategies. For instance, restrictions on flavored tobacco, which constituted a substantial portion of the market, could alter sales volumes and product mix. As of early 2024, discussions around further nicotine reduction continue, presenting a dynamic regulatory environment.

Changes in labor laws significantly impact H.T. Hackney's operational costs and human resource strategies. For instance, minimum wage increases, such as the federal minimum wage potentially rising, directly affect payroll expenses. Evolving overtime exemption criteria and shifts in worker classification rules, like the ongoing debate around independent contractor status, necessitate careful compliance to avoid penalties.

Emerging state-level requirements for warehouse employees, particularly concerning quotas, add another layer of complexity. Companies like H.T. Hackney must adapt their policies and potentially invest in new systems to monitor and manage these performance metrics, ensuring both compliance and efficiency.

Antitrust and Competition Laws

H.T. Hackney, as a significant player in the distribution industry, must carefully adhere to antitrust and competition laws. These regulations are designed to prevent monopolistic practices and ensure a fair marketplace for all participants. Failure to comply can result in substantial fines and legal challenges.

Regulatory bodies actively monitor the distribution sector for potential anti-competitive behavior. This scrutiny directly impacts H.T. Hackney's strategies concerning market share expansion, as well as any planned mergers or acquisitions. For instance, in 2023, the Federal Trade Commission (FTC) continued its focus on investigating mergers that could lessen competition, a trend expected to persist into 2024 and 2025.

- Compliance is paramount: H.T. Hackney must ensure its operations do not stifle competition, particularly in its core markets.

- Merger & acquisition reviews: Any proposed deals will undergo rigorous antitrust review to assess their impact on market dynamics.

- Market share strategies: Growth initiatives must be balanced against legal boundaries to avoid accusations of predatory pricing or exclusionary tactics.

- Regulatory landscape: Ongoing vigilance regarding evolving antitrust enforcement, including potential new guidelines from agencies like the FTC and the Department of Justice, is crucial.

Packaging and Labeling Regulations

Navigating the complex web of packaging and labeling regulations is crucial for H.T. Hackney, particularly within the food and beverage sectors. The Food and Drug Administration (FDA) continuously updates its guidelines, impacting how products must be presented to consumers. For instance, the Nutrition Facts label underwent a significant redesign, with updated serving sizes and calorie information becoming mandatory for most manufacturers by January 1, 2020, and for smaller manufacturers by January 1, 2021. This means H.T. Hackney must ensure all distributed products comply with these current disclosure requirements.

Adherence extends to critical areas like allergen declarations and environmental claims. The Food Allergen Labeling and Consumer Protection Act of 2004 (FALCPA) requires clear identification of the eight major food allergens. Furthermore, as consumer demand for sustainable practices grows, regulations around environmental marketing claims, such as "recyclable" or "biodegradable," are becoming more stringent, requiring substantiation and clear definitions to prevent misleading consumers.

- Allergen Labeling: Strict compliance with FALCPA, identifying milk, eggs, fish, crustacean shellfish, tree nuts, peanuts, wheat, and soybeans.

- Nutritional Information: Updated FDA standards for the Nutrition Facts label, including calorie counts and serving sizes.

- Environmental Claims: Verification and clear communication for sustainability marketing, aligning with FTC Green Guides.

- Ingredient Transparency: Growing pressure for more detailed ingredient disclosures beyond regulatory minimums.

Legal frameworks governing food safety, such as the FDA's Food Traceability Final Rule, mandate detailed recordkeeping for H.T. Hackney, impacting supply chain management. Continued regulatory scrutiny of tobacco products by the FDA, including potential menthol bans and nicotine reductions, necessitates ongoing adaptation in distribution strategies. Labor law changes, particularly minimum wage adjustments and evolving worker classification rules, directly influence operational costs and HR policies for the company.

Environmental factors

H.T. Hackney faces increasing demands to implement sustainable practices throughout its supply chain, with a significant focus on reducing food waste and embracing environmentally friendly packaging solutions. For instance, the U.S. EPA reported in 2023 that food waste accounts for roughly 24% of all landfilled municipal solid waste, a staggering figure that drives regulatory and consumer pressure for improvement.

Governments are actively encouraging waste reduction through various programs. As of late 2024, numerous cities are expanding their infrastructure for waste separation, community composting initiatives, and food recovery programs, creating both operational challenges and opportunities for companies like H.T. Hackney to partner in these efforts.

Climate change presents significant challenges for HT Hackney, with an increasing frequency of extreme weather events like hurricanes, floods, and droughts directly impacting its distribution operations. These events can cause severe disruptions to transportation routes, damage storage facilities, and ultimately affect product availability for customers.

For instance, the intensification of hurricane seasons, as observed in recent years with record-breaking activity in the Atlantic, poses a direct threat to coastal and inland logistics hubs. This necessitates a proactive approach to contingency planning and the development of more resilient supply chain and logistics networks to mitigate these risks.

The financial implications are substantial; severe weather can lead to increased operational costs due to repair, rerouting, and potential product spoilage. In 2023, weather-related disasters in the U.S. alone caused billions of dollars in economic losses, a trend expected to continue and potentially worsen.

HT Hackney must therefore invest in advanced weather forecasting and implement flexible logistics strategies. Building redundant infrastructure and diversifying transportation options are crucial steps to ensure business continuity and maintain product flow even during adverse environmental conditions.

The push to reduce carbon footprints throughout the food supply chain, from farm to fork, is intensifying. This focus often translates into new regulations and evolving industry standards for emissions reduction. For H.T. Hackney, this means a growing imperative to optimize logistics for lower emissions and meticulously track its environmental impact across operations.

In 2024, global efforts to curb greenhouse gas emissions are a significant driver. Companies like H.T. Hackney are increasingly scrutinized for their contribution to these emissions, particularly within the transportation and distribution sectors. For instance, the International Transport Forum reported that freight transport emissions could rise by 70% by 2050 if current trends continue, highlighting the urgency for companies to adapt.

Resource Scarcity and Sourcing

Concerns about resource scarcity, especially water and agricultural land, are increasingly impacting the availability and cost of goods for distributors like H.T. Hackney. For instance, projections indicate that by 2040, over 40% of the world's population could face water scarcity, directly affecting agricultural yields and thus the supply chain for many food and beverage products.

This necessitates a keen awareness of sustainable sourcing practices. H.T. Hackney must consider how environmental stresses affect their suppliers' operations, which can directly influence their supplier selection and the composition of their product portfolio.

The company's ability to adapt to these challenges will hinge on its proactive approach to managing supply chain risks associated with resource constraints.

- Water Scarcity Impact: Global water stress is projected to affect billions, increasing operational costs for agriculture-dependent suppliers.

- Land Availability: Degradation and limited availability of arable land can reduce crop yields, impacting product variety and pricing.

- Sustainable Sourcing Strategy: Companies are increasingly prioritizing suppliers with demonstrable commitments to water conservation and responsible land management.

- Portfolio Diversification: Distributors may need to diversify their product offerings to mitigate reliance on resources facing significant scarcity.

Consumer Demand for Eco-Friendly Products

Consumer demand for eco-friendly products is a significant environmental factor influencing businesses like H.T. Hackney. Younger demographics, particularly Millennials and Gen Z, are increasingly prioritizing sustainability. For instance, a 2024 Nielsen report indicated that over 70% of consumers are willing to pay more for products from sustainable brands. This shift directly impacts H.T. Hackney's role as a distributor, encouraging partnerships with manufacturers who demonstrate strong environmental commitments.

This growing preference for eco-conscious goods pushes H.T. Hackney to adapt its distribution strategies. The company is likely to see increased demand for products that are ethically sourced, have reduced packaging waste, or utilize renewable energy in their production. Companies that fail to align with these values risk losing market share, as consumers actively seek out greener alternatives.

H.T. Hackney's ability to facilitate the distribution of products from environmentally responsible manufacturers is crucial for its future growth and relevance. This includes ensuring transparency in the supply chain and promoting brands that actively reduce their carbon footprint. The market is evolving, and companies that embrace sustainability will likely find themselves better positioned for success in the coming years.

Key aspects of this trend include:

- Increasing consumer awareness: Consumers are more informed about environmental issues than ever before.

- Generational shift in preferences: Younger consumers are key drivers of demand for sustainable products.

- Brand reputation and loyalty: Companies with strong environmental credentials often build greater customer loyalty.

- Regulatory pressures: Growing environmental regulations also influence manufacturing and distribution practices.

Environmental factors significantly shape H.T. Hackney's operations. Growing concerns over climate change lead to increased frequency of extreme weather events, disrupting logistics and supply chains. For instance, the U.S. experienced over $150 billion in weather and climate disasters in 2023, a trend impacting transportation and storage. Furthermore, resource scarcity, particularly water, is becoming a critical issue. Projections indicate that by 2040, over 40% of the world's population could face water scarcity, directly affecting agricultural yields and product availability for distributors.

| Environmental Factor | Impact on H.T. Hackney | Supporting Data/Trend (2023-2025) |

|---|---|---|

| Climate Change & Extreme Weather | Disruptions to transportation routes, damage to storage facilities, product availability issues. | 2023 U.S. weather/climate disasters exceeded $150 billion in economic losses. Increased hurricane activity observed in recent years. |

| Resource Scarcity (Water) | Reduced agricultural yields, impacting product variety and pricing. Increased operational costs for suppliers. | By 2040, over 40% of the global population may face water scarcity, affecting crop production. |

| Waste Reduction & Packaging | Pressure to reduce food waste and adopt eco-friendly packaging. | Food waste constitutes ~24% of U.S. landfilled municipal solid waste (2023). |

| Carbon Footprint Reduction | Imperative to optimize logistics for lower emissions and track environmental impact. | Freight transport emissions could rise 70% by 2050 without intervention (International Transport Forum). |

| Consumer Demand for Sustainability | Increased demand for ethically sourced, low-waste, and sustainably produced goods. | Over 70% of consumers willing to pay more for sustainable brands (2024 Nielsen report). |

PESTLE Analysis Data Sources

Our PESTLE Analysis is meticulously crafted using data from reputable sources including government publications, international economic bodies, and leading market research firms. We incorporate insights from regulatory updates, technological advancements, and socio-economic trends to provide a comprehensive overview.