HT Hackney Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HT Hackney Bundle

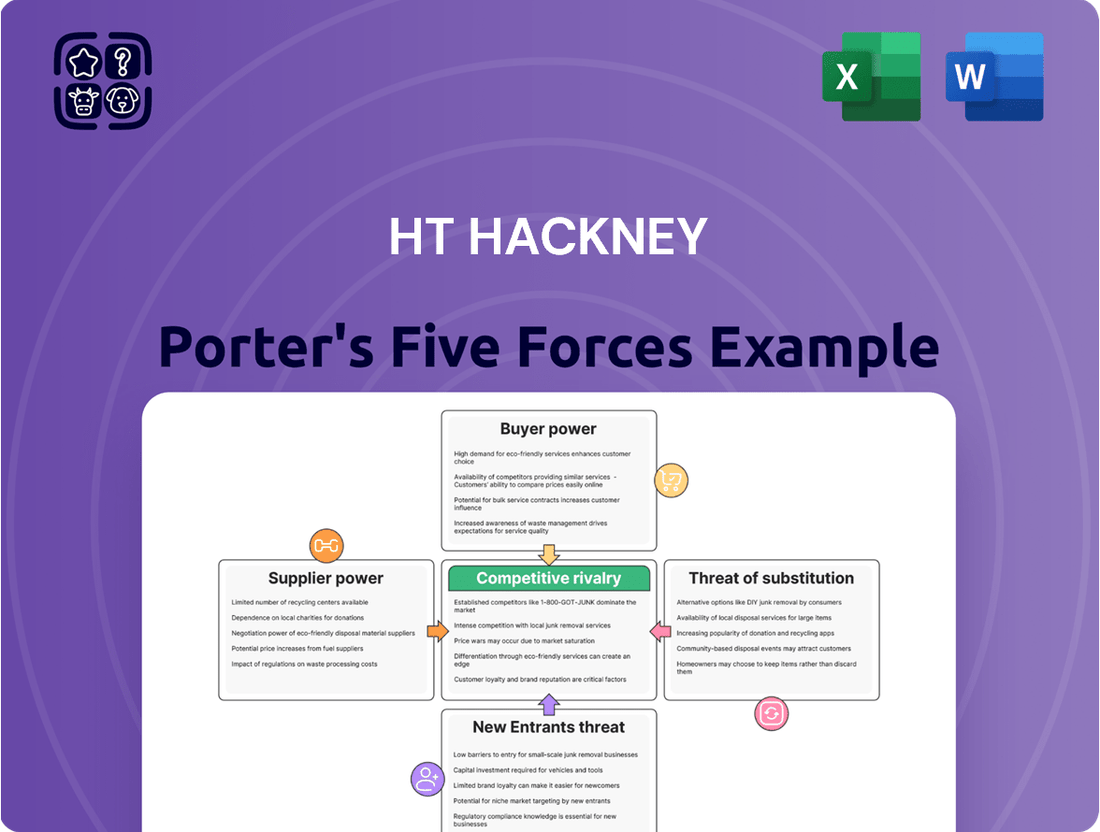

HT Hackney's competitive landscape is shaped by five powerful forces: the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry among existing competitors. Understanding these dynamics is crucial for navigating the industry effectively. This brief overview only scratches the surface of these complex interactions.

The complete report reveals the real forces shaping HT Hackney’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

H.T. Hackney's suppliers' reliance on the distributor for market access is a key factor in their bargaining power. If a supplier has few alternative distribution channels, or if H.T. Hackney represents a substantial portion of their business, the supplier's leverage is reduced. For instance, if a specialized food ingredient supplier primarily serves the convenience store sector and H.T. Hackney is their largest client, that supplier has less power to dictate terms.

The uniqueness of the products H.T. Hackney sources significantly impacts supplier bargaining power. When H.T. Hackney deals with suppliers offering highly branded, proprietary, or patented items, such as specific popular beverage brands or specialized tobacco products, those suppliers naturally command greater negotiation leverage. This is because alternatives are limited, making it difficult for H.T. Hackney to switch suppliers without incurring substantial costs or losing access to key revenue drivers.

The bargaining power of suppliers for H.T. Hackney is significantly influenced by switching costs. If H.T. Hackney were to change its primary suppliers, it would likely incur substantial expenses and operational disruptions. These could include the cost of re-negotiating new supply agreements, retooling equipment to accommodate different product specifications, and the potential loss of established relationships that ensure reliable delivery of popular or proprietary product lines. For instance, if a key supplier for a high-demand beverage brand were to be replaced, H.T. Hackney might face a temporary but impactful reduction in sales due to stockouts of that particular item.

Supplier Industry Concentration

The concentration within H.T. Hackney's supplier industries significantly impacts their bargaining power. When a few dominant suppliers control a critical component or raw material, they can dictate terms more effectively. Conversely, a fragmented supplier landscape, featuring numerous smaller providers, usually grants H.T. Hackney greater leverage in negotiations. For instance, in 2024, industries supplying specialized food ingredients often exhibit higher concentration compared to those providing general packaging materials, creating differing negotiation dynamics.

This concentration directly influences pricing and availability. High supplier concentration can lead to increased costs for H.T. Hackney if these few suppliers face limited competition and can charge premium prices.

- Supplier Concentration: The number and market share of companies supplying H.T. Hackney.

- Impact on Bargaining Power: Fewer, larger suppliers generally hold more power.

- Fragmented Markets: Many small suppliers typically reduce supplier bargaining power.

- 2024 Data Insight: Industries like specialized beverage flavoring often have fewer, more concentrated suppliers than those for common truck parts.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers is a significant factor impacting H.T. Hackney. This occurs when suppliers decide to bypass H.T. Hackney's distribution channels and sell their products directly to retailers or foodservice operators. If suppliers possess the capability and incentive to establish their own distribution networks, it directly enhances their bargaining power.

For instance, a major beverage supplier with established relationships and a strong brand could potentially leverage its resources to manage its own last-mile delivery. This capability would allow them to capture more of the value chain, thereby increasing their leverage over H.T. Hackney in price negotiations or service level agreements. The feasibility of such a move is crucial; if it's easily achievable, the threat is more potent.

H.T. Hackney's robust distribution infrastructure, including its extensive fleet and established routes, serves as a critical defense against this threat. By providing efficient, reliable, and cost-effective distribution services, H.T. Hackney offers substantial value to its suppliers, making direct distribution less attractive. Furthermore, the company's value-added services, such as merchandising support and inventory management, further solidify supplier relationships and reduce the incentive for forward integration.

In 2024, the logistics industry saw continued pressure on operational costs, potentially making forward integration a more attractive, albeit complex, proposition for some suppliers. However, the capital investment required for a dedicated distribution network remains a significant barrier for many. H.T. Hackney's ability to absorb these costs and provide economies of scale through its existing operations remains a key competitive advantage.

- Supplier Capability: Suppliers' ability to establish and manage their own distribution networks directly impacts their bargaining power.

- Cost-Benefit Analysis: Suppliers weigh the costs of forward integration against the potential benefits of increased control and margin capture.

- H.T. Hackney's Mitigation: H.T. Hackney's extensive distribution network and value-added services reduce the attractiveness of forward integration for its suppliers.

- Market Dynamics in 2024: Rising operational costs in logistics may have increased the theoretical appeal of forward integration for some suppliers, though significant capital investment remains a hurdle.

The bargaining power of suppliers for H.T. Hackney hinges on factors like supplier concentration and the threat of forward integration. When a few dominant suppliers control essential products, they gain leverage. Conversely, a broad supplier base often gives H.T. Hackney more negotiating power. In 2024, the specialized beverage ingredients sector, for example, often features more concentrated suppliers compared to the more fragmented market for general packaging materials, leading to differing price dynamics.

The potential for suppliers to bypass H.T. Hackney and distribute directly to customers also amplifies their bargaining strength. However, H.T. Hackney's extensive and efficient distribution network, coupled with value-added services, significantly mitigates this threat. While rising logistics costs in 2024 might have made direct distribution seem more appealing to some suppliers, the substantial capital investment required remains a considerable barrier.

| Factor | Impact on Supplier Bargaining Power | Example Scenario (2024 Context) |

|---|---|---|

| Supplier Concentration | High concentration increases power | A few dominant brands of energy drinks may have higher leverage than numerous small snack producers. |

| Threat of Forward Integration | Higher threat increases power | A large beverage manufacturer could leverage its brand recognition and capital to build its own distribution, increasing its negotiation power with H.T. Hackney. |

| Switching Costs | High switching costs increase power | If H.T. Hackney relies on a unique, proprietary packaging supplier, the cost and disruption to change would empower that supplier. |

What is included in the product

Analyzes the five competitive forces impacting HT Hackney, including the threat of new entrants, bargaining power of buyers and suppliers, threat of substitutes, and industry rivalry.

Easily identify and prioritize competitive threats with a visual representation of all five forces, simplifying strategic planning and mitigating potential market disruptions.

Customers Bargaining Power

H.T. Hackney's customer concentration and volume significantly influence its bargaining power. Large, high-volume customers, such as major grocery chains and foodservice distributors, wield considerable influence. These entities can negotiate for lower prices and more favorable terms due to the substantial revenue they represent. For instance, in 2024, the top 10 customers of food distributors often account for over 50% of revenue, giving them significant leverage.

Conversely, a fragmented customer base, composed of numerous small, independent retail outlets, dilutes individual customer bargaining power. While collectively these smaller customers represent a significant portion of sales, their lack of individual scale limits their ability to demand concessions. H.T. Hackney benefits from this dispersion as it reduces the impact of any single customer's demands.

Customer switching costs for H.T. Hackney are a critical factor in assessing their bargaining power. If it's easy for convenience stores and other clients to switch to a different wholesale distributor, H.T. Hackney's ability to command prices or dictate terms diminishes.

The convenience of H.T. Hackney's ordering platforms, the extensive range of products offered, and the dependability of their delivery services directly influence these costs. For instance, a customer heavily reliant on H.T. Hackney's integrated technology solutions for inventory management would face higher costs to transition to a competitor.

Reports from 2024 indicate that the wholesale distribution sector continues to see consolidation, with larger players offering integrated digital solutions. This trend suggests that customers who can easily access comparable technology and a broad product selection elsewhere will have greater leverage.

If H.T. Hackney's value proposition, including their technology and marketing support, is not significantly differentiated, customers may find it relatively straightforward to switch, thereby increasing their bargaining power.

The availability of alternative distributors significantly impacts the bargaining power of H.T. Hackney's customers. If convenience stores, grocery stores, and foodservice operators have numerous other wholesale distributors to choose from within their operating regions, they can easily switch suppliers if pricing or service levels are not competitive. For instance, in 2024, the wholesale distribution sector for convenience stores saw a notable increase in regional players and specialized suppliers, offering more choices than in previous years.

Customer Price Sensitivity

Customer price sensitivity is a significant factor for H.T. Hackney. In the convenience store and gas station sector, margins are typically tight, making customers highly attuned to price fluctuations. This means that distributors like H.T. Hackney face constant pressure from their retail clients to secure the lowest possible wholesale prices for products.

The ability to offer competitive pricing is therefore paramount. H.T. Hackney's success hinges on its capacity to negotiate favorable terms with suppliers and maintain efficient operations to pass those savings on. For instance, if the average gross margin for convenience stores hovers around 25-30%, even small price increases on high-volume items can significantly impact a retailer's profitability, amplifying their demand for lower wholesale costs.

Beyond just the base price, value-added services play a crucial role in mitigating customer price sensitivity. H.T. Hackney can differentiate itself by offering services like reliable delivery, merchandising support, or flexible payment terms. These services can justify slightly higher prices by providing convenience and operational efficiencies for their customers.

Consider the impact of fuel costs on H.T. Hackney's operational expenses, a major component of their overall cost structure. Fluctuations in fuel prices, which can directly impact delivery costs, can either necessitate price adjustments or require H.T. Hackney to absorb these increases to maintain competitiveness, directly affecting their ability to meet customer price demands.

- Price Sensitivity Impact: Retailers in H.T. Hackney's customer base often operate on thin margins, making them highly responsive to wholesale price changes.

- Competitive Pricing Necessity: To retain and attract business, H.T. Hackney must consistently offer competitive wholesale prices, a challenge in a low-margin industry.

- Value-Added Services: Offering services beyond just product delivery, such as merchandising or tailored inventory management, can help offset direct price comparisons.

- Operational Efficiency Link: H.T. Hackney's ability to manage its own operational costs, including logistics and fuel, directly influences its capacity to offer attractive pricing to customers.

Threat of Backward Integration by Customers

The threat of backward integration by customers poses a significant consideration for H.T. Hackney. This means that H.T. Hackney's clients, particularly large retail chains, could potentially develop their own in-house distribution networks or join forces to create purchasing cooperatives. For instance, a major grocery chain might evaluate if managing its own fleet and warehousing offers a cost advantage over outsourcing to H.T. Hackney.

If customers perceive that establishing their own capabilities would lead to substantial cost savings or grant them enhanced control over their supply chains, they might pursue this route. For example, a report from 2024 indicated that some large retailers were exploring vertical integration to gain more leverage over logistics costs. This move could directly impact H.T. Hackney's market share and revenue streams.

- Customer Integration Risk: Large customers may consider developing their own distribution or forming buying groups.

- Cost Savings Incentive: The primary driver for backward integration is the potential for reduced operational expenses.

- Control Factor: Customers might seek greater oversight of their supply chain operations.

- H.T. Hackney's Counter-Strategy: H.T. Hackney's focus on efficiency and a broad service portfolio aims to deter such moves.

The bargaining power of customers for H.T. Hackney is significantly shaped by their concentration, price sensitivity, and the ease with which they can switch suppliers. Large customers, often representing a substantial portion of revenue, wield more influence, demanding lower prices and better terms. Conversely, a fragmented customer base dilutes individual power. In 2024, the wholesale distribution sector continued to see consolidation, with integrated digital solutions becoming more prevalent, increasing customer options.

| Factor | Impact on H.T. Hackney | 2024 Data/Trend |

|---|---|---|

| Customer Concentration | High concentration = High bargaining power | Top 10 customers often >50% of revenue for distributors |

| Switching Costs | Low switching costs = High bargaining power | Increased availability of comparable tech solutions |

| Price Sensitivity | High sensitivity = High bargaining power | Convenience stores average 25-30% gross margins |

| Backward Integration Threat | Potential for customers to self-distribute | Retailers exploring vertical integration for logistics control |

Full Version Awaits

HT Hackney Porter's Five Forces Analysis

This preview showcases the complete HT Hackney Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the industry. What you see here is precisely the document you will receive immediately after purchase, fully formatted and ready for your strategic planning. This comprehensive analysis includes insights into threat of new entrants, bargaining power of buyers, bargaining power of suppliers, threat of substitute products or services, and the intensity of rivalry among existing competitors. You can confidently proceed with your purchase, knowing you'll get the exact, professionally prepared analysis displayed.

Rivalry Among Competitors

The wholesale distribution sector, where H.T. Hackney operates, is characterized by a crowded competitive landscape. This includes large, national distributors like McLane Company and Core-Mark, alongside a substantial number of smaller regional and local players. For instance, in 2024, the convenience store distribution market alone sees dozens of significant regional operators in addition to the national giants, creating a highly fragmented environment. This sheer volume and diversity of competitors means intense pressure on pricing and service levels across the board.

The pace of growth within the wholesale distribution sector directly influences the intensity of competition. In markets experiencing sluggish or no growth, companies are more likely to engage in aggressive pricing strategies and heightened marketing efforts to secure market share.

Conversely, a robustly expanding market can temper competitive pressures, as the availability of new business opportunities provides more room for all players. For instance, the wholesale trade sector in the US saw a growth of 2.5% in 2023, indicating a moderately expanding environment that might still foster some rivalry but less intensely than a stagnant market.

Competitive rivalry for H.T. Hackney is heightened by the relatively low product differentiation in the food distribution sector. While H.T. Hackney offers a broad range of products, many core grocery and convenience store items are commodities, making it challenging to stand out solely on product variety. This low differentiation intensifies competition, often forcing players like H.T. Hackney to compete more aggressively on price and delivery efficiency.

However, H.T. Hackney can achieve differentiation through operational excellence. For instance, investing in advanced logistics technology, as seen in the broader industry's push for real-time tracking and optimized routing, can provide a competitive edge. Companies that can offer superior supply chain visibility and reliability, coupled with tailored marketing support for their clients, carve out a distinct position. This focus on service and technology becomes crucial when the products themselves are largely undifferentiated.

Exit Barriers

Exit barriers in the wholesale distribution industry, like HT Hackney, are substantial due to significant investments in fixed assets. These include extensive warehouse networks, specialized transportation fleets, and deeply entrenched supply chain relationships that are costly and time-consuming to dismantle or sell off. For instance, the logistics sector, which is crucial for wholesale distribution, saw capital expenditures by major players exceeding billions in 2024, reflecting the scale of these assets.

These high costs of exiting create a situation where companies may continue to operate even when facing profitability challenges, leading to intensified competition. This reluctance to leave the market can prolong periods of oversupply or price pressure. Consequently, businesses often absorb losses rather than incur the substantial costs associated with ceasing operations, such as severance packages, contract termination fees, and asset depreciation.

- High Capital Investment: Companies in wholesale distribution often possess millions invested in specialized infrastructure, making liquidation difficult and financially damaging.

- Supply Chain Integration: Established relationships with suppliers and customers are complex to unwind, involving contractual obligations and reputational damage if severed abruptly.

- Asset Specificity: Warehouses and transportation fleets are often tailored for specific operational needs, reducing their marketability to other industries.

- Employee Related Costs: Severance packages and potential legal liabilities for contract terminations add to the financial burden of exiting.

Fixed Costs and Capacity Utilization

The wholesale distribution industry, including segments like automotive parts distribution, is marked by substantial fixed costs. These include investments in extensive warehouse networks, large fleets of delivery vehicles, and a significant workforce. For instance, a major automotive parts distributor might have millions invested in its physical infrastructure and logistics capabilities alone.

Operating efficiently hinges on maximizing capacity utilization. When demand falters, distributors face a strong incentive to lower prices to keep their warehouses full and fleets in motion, even if it means accepting lower profit margins. This dynamic directly fuels competitive rivalry.

In 2024, economic headwinds and fluctuating consumer demand in sectors like automotive repair, for example, can put particular pressure on distributors. If a distributor’s capacity utilization drops significantly, say from 85% to 70%, the per-unit cost of handling inventory and transportation rises, compelling them to compete more aggressively on price to avoid losses.

- High Fixed Costs: Investments in warehouses, transportation, and personnel create significant operating leverage.

- Capacity Utilization: Efficiency is directly tied to how fully these assets are utilized.

- Price Competition: Soft demand can lead to price wars as companies try to fill excess capacity.

- Margin Pressure: The need to cover fixed costs can erode profit margins during downturns.

The competitive rivalry for H.T. Hackney is intense due to the fragmented nature of the wholesale distribution market. Numerous players, from national giants to smaller regional firms, vie for market share, creating pressure on pricing and service. This is particularly evident in sectors like convenience store distribution, where dozens of significant regional operators compete alongside national distributors in 2024.

Product differentiation is low for many core items distributed, forcing companies to compete heavily on price and delivery efficiency. However, operational excellence, such as advanced logistics and superior supply chain visibility, offers a path to differentiation. High exit barriers, stemming from significant investments in warehouses, fleets, and relationships, mean that companies may persist even when unprofitable, further intensifying competition.

High fixed costs in warehousing and transportation also drive competitive rivalry. When demand weakens, distributors are incentivized to lower prices to maintain capacity utilization, as seen in sectors facing economic headwinds in 2024. This need to cover overhead can lead to price wars and margin erosion.

SSubstitutes Threaten

The threat of direct sourcing by retailers poses a significant challenge for H.T. Hackney. Larger convenience store chains and grocery operators, with substantial order volumes and established logistics, can potentially bypass distributors like H.T. Hackney to secure goods directly from manufacturers. For instance, a major national convenience store chain with thousands of locations might find it more cost-effective to negotiate directly with beverage or snack producers, reducing their reliance on intermediary distributors.

This direct sourcing capability is amplified by the increasing sophistication of retail supply chains. As retailers invest in their own warehousing and transportation networks, the cost and complexity of managing direct procurement from manufacturers decrease. A 2024 industry report indicated that over 30% of large retail chains have expanded their direct sourcing initiatives in the past two years, driven by a desire for better margin control and supply chain visibility.

The feasibility of direct sourcing for H.T. Hackney's customers is directly tied to their scale and operational efficiency. While smaller independent stores may lack the resources to pursue direct sourcing, larger organizations can leverage their purchasing power and logistical infrastructure. This creates a tiered threat, where the most significant customers are also the most likely to explore and implement direct procurement strategies, potentially eroding H.T. Hackney's market share among these key accounts.

The rise of buying cooperatives presents a significant threat to traditional distributors like HT Hackney Porter. These groups, formed by retailers or foodservice operators, pool their purchasing power to negotiate directly with manufacturers. This collective action allows them to secure more favorable pricing, effectively bypassing the distributor model.

For instance, in 2024, many independent grocery chains have explored or implemented cooperative buying strategies to combat the pricing leverage of larger competitors. These cooperatives can achieve economies of scale comparable to major players, offering competitive pricing that directly substitutes for the services traditional distributors provide.

This trend puts pressure on distributors to demonstrate their value beyond just price, focusing on services like logistics, inventory management, and market insights. If cooperatives gain substantial traction, they could significantly erode the market share and profitability of established distributors.

The threat of substitutes, particularly in the form of alternative logistics providers, poses a significant challenge for H.T. Hackney. Customers are increasingly exploring the option of engaging third-party logistics (3PL) companies for warehousing and transportation, while taking on the management of their supplier relationships internally. This shift allows businesses to unbundle H.T. Hackney's integrated services.

While 3PLs might not offer a complete replacement for H.T. Hackney's comprehensive, end-to-end distribution model, they can certainly fragment the value chain. By outsourcing specific functions like warehousing or transportation, clients can reduce the overall scope of services H.T. Hackney traditionally provides. This fragmentation means H.T. Hackney must continually demonstrate the unique value proposition of its full-service offering.

For instance, many businesses are leveraging technology platforms in 2024 that connect them directly with carriers and warehousing facilities, bypassing traditional distributors for certain needs. The global 3PL market was valued at approximately $1.15 trillion in 2023 and is projected to grow, indicating a strong and expanding market for these alternative solutions. This growth underscores the pressure on companies like H.T. Hackney to innovate and adapt.

Changes in Consumer Purchasing Habits

Changes in how end-consumers buy products can indirectly affect the demand for traditional wholesale distribution, even for companies like H.T. Hackney that serve businesses. For instance, manufacturers increasingly adopting direct-to-consumer (DTC) sales models or the surge in online grocery purchases can reshape the retail environment and the necessity of intermediaries like distributors. This shift means that the traditional wholesale model might face pressure as supply chains evolve to meet changing consumer preferences.

The growing popularity of DTC strategies by manufacturers, bypassing traditional retail channels, presents a significant substitute. This approach allows manufacturers to control their brand experience and capture more of the consumer’s dollar. In 2024, it's estimated that DTC e-commerce sales are projected to reach over $200 billion in the U.S. alone, highlighting a substantial shift away from traditional wholesale reliance.

Furthermore, the expansion of online grocery platforms and quick-commerce services directly competes with the traditional retail outlets that H.T. Hackney serves. Consumers valuing convenience and speed are increasingly opting for these digital channels. By 2025, the global online grocery market is expected to surpass $1.5 trillion, indicating a powerful consumer preference for accessible, digitally-driven purchasing options that can reduce the volume of goods moving through traditional wholesale networks.

- Direct-to-Consumer (DTC) Growth: Manufacturers increasingly selling directly to consumers, reducing reliance on intermediaries.

- Online Grocery Dominance: The rise of e-commerce platforms for grocery shopping bypasses traditional retail distribution.

- Changing Retail Landscape: Shifts in consumer behavior towards online and convenience-focused purchasing impact wholesale volumes.

- Supply Chain Innovation: New distribution models emerging to cater to direct consumer demand.

In-house Distribution Development by Customers

The threat of substitutes, specifically in-house distribution development by customers, poses a significant challenge for H.T. Hackney. Larger customers, especially those with substantial scale and capital, may find it economically viable to establish their own distribution networks. This direct control over logistics can lead to cost reductions and enhanced supply chain management, effectively replacing the need for H.T. Hackney's services.

For example, a major grocery chain with a large fleet of trucks and numerous distribution centers could internalize the last-mile delivery operations currently handled by H.T. Hackney. This move is driven by a desire for greater efficiency and cost savings. In 2024, the logistics industry saw continued investment in automation and optimization, making in-house solutions increasingly feasible for large enterprises.

- Customer Scale: Large customers with significant volume can amortize the fixed costs of building their own distribution infrastructure over a larger base.

- Cost Savings Potential: By eliminating third-party markups and optimizing routes, customers can achieve direct cost reductions in their supply chain.

- Control and Flexibility: In-house operations offer greater control over delivery schedules, inventory management, and responsiveness to market changes.

- Industry Trends: The ongoing push for supply chain resilience and efficiency among major retailers makes vertical integration, including distribution, an attractive strategic option.

The threat of substitutes for H.T. Hackney stems from various evolving market dynamics. Retailers increasingly bypass distributors by sourcing directly from manufacturers, especially larger chains that can leverage their volume and sophisticated supply chains. This trend is fueled by a desire for better margins and supply chain visibility, with industry reports from 2024 indicating over 30% of large retail chains expanding direct sourcing initiatives.

Additionally, the rise of buying cooperatives allows retailers to pool purchasing power, securing better pricing and effectively substituting the distributor role. The growth of third-party logistics (3PL) providers also fragments the value chain, as customers can outsource specific functions like warehousing or transportation, reducing reliance on H.T. Hackney's integrated model. The global 3PL market, valued at approximately $1.15 trillion in 2023, highlights the significant demand for these alternative solutions.

Changes in consumer behavior, such as the growth of direct-to-consumer (DTC) sales by manufacturers and the surge in online grocery purchases, indirectly impact traditional wholesale distribution. DTC e-commerce sales in the U.S. are projected to exceed $200 billion in 2024. Furthermore, customers with substantial scale are exploring in-house distribution development to gain greater control, reduce costs, and enhance efficiency, making vertical integration an increasingly attractive option.

| Threat Type | Key Drivers | Impact on H.T. Hackney | Supporting Data (2024/2023) |

| Direct Sourcing by Retailers | Retailer scale, supply chain sophistication | Erosion of customer base, reduced order volumes | 30%+ of large retail chains expanding direct sourcing |

| Buying Cooperatives | Pooled purchasing power | Price pressure, loss of market share | Increased exploration by independent grocery chains |

| Third-Party Logistics (3PL) | Outsourcing of specific logistics functions | Fragmentation of services, reduced value proposition | Global 3PL market ~$1.15 trillion (2023) |

| Direct-to-Consumer (DTC) / Online Grocery | Changing consumer preferences, digital channels | Reduced demand for traditional wholesale | U.S. DTC e-commerce sales >$200 billion (2024 projection) |

| In-house Distribution | Customer scale, cost savings, control | Loss of key accounts, reduced service scope | Continued investment in logistics automation by large enterprises |

Entrants Threaten

Entering the wholesale distribution sector, like the one HT Hackney Porter operates in, requires substantial capital. Think about the sheer cost of acquiring and maintaining a large fleet of trucks for deliveries, plus the necessity of vast warehouse spaces to store goods. These aren't small investments; they represent significant upfront financial commitments.

For example, the cost of a new, fully equipped semi-trailer truck can easily range from $150,000 to $200,000 or more, and a distributor needs many of these. Add to that the expense of building or leasing and equipping large distribution centers, which can run into millions of dollars depending on size and location.

This high barrier to entry means that only well-funded companies or those with strong access to capital can realistically consider competing. It effectively limits the number of new players that can emerge, thereby reducing the threat of new entrants.

Existing players in the beverage distribution industry, such as H.T. Hackney, leverage significant economies of scale. This advantage translates to lower per-unit costs in crucial areas like purchasing inventory, managing warehouse operations, and optimizing transportation logistics. For instance, H.T. Hackney's extensive network allows for bulk purchasing discounts, reducing the cost of goods sold.

New entrants face a substantial hurdle in matching these established efficiencies. Without the substantial volume that incumbents enjoy, new companies find it challenging to achieve comparable per-unit cost savings. This makes it difficult for them to compete effectively on price against established players who can absorb lower margins due to their scale.

In 2024, the beverage distribution landscape continues to be shaped by these scale advantages. Companies with larger distribution networks can negotiate more favorable terms with suppliers and can spread fixed costs, like warehouse maintenance and fleet management, over a greater volume of goods. This directly impacts their ability to offer competitive pricing and service levels, acting as a significant barrier to entry.

New entrants into the food service distribution industry face a formidable hurdle in replicating H.T. Hackney's deeply entrenched distribution networks and established supplier relationships. Building the necessary infrastructure and trust to serve a wide array of customers, from small independent restaurants to large chains, requires substantial time and capital investment. For instance, a new player would need to secure numerous warehousing facilities and a complex logistics system to match H.T. Hackney's existing reach, which currently serves thousands of customer locations across multiple states. These established connections are not easily bypassed, as they are built on years of reliable service and mutual understanding.

Regulatory Hurdles and Licensing

The distribution of specific goods, like tobacco and alcohol, faces a maze of federal and state regulations, demanding licenses and strict compliance. For instance, obtaining a liquor license can involve extensive background checks and fees that vary significantly by state, potentially costing thousands of dollars and many months. New entrants must invest heavily in legal counsel and compliance personnel to navigate these requirements, creating a substantial barrier to entry.

These regulatory complexities translate into significant upfront costs and operational challenges for newcomers. Consider the Alcohol and Tobacco Tax and Trade Bureau (TTB) in the United States, which oversees permits and excise taxes, adding another layer of complexity. The sheer volume of paperwork and the need for ongoing adherence to evolving laws can deter smaller or less capitalized businesses from entering the market.

- Licensing Fees: State-specific liquor license fees can range from a few hundred to over ten thousand dollars annually.

- Compliance Costs: Businesses must budget for legal reviews, compliance officers, and potential fines for non-adherence.

- Time Investment: The application and approval process for necessary permits can extend for several months, delaying market entry.

- Navigational Complexity: Understanding and adhering to varying state and federal laws requires specialized expertise.

Access to Technology and Data Analytics

Modern wholesale distribution is deeply intertwined with advanced technology, from intricate inventory management systems and optimized delivery routes to seamless order processing and robust customer relationship management tools. New players entering this space need substantial capital to acquire or build these sophisticated IT infrastructures and data analytics capabilities. For instance, companies like Manhattan Associates offer comprehensive warehouse management systems that are critical for efficient operations.

The barrier to entry related to technology and data analytics is significant. Without access to cutting-edge software and the expertise to leverage data for insights, new entrants struggle to achieve the operational efficiencies and customer service levels expected in today's market. In 2024, the investment required for a fully integrated, data-driven distribution platform can easily run into millions of dollars.

- High upfront investment in IT infrastructure.

- Need for specialized data analytics talent.

- Requirement for advanced software for inventory, logistics, and CRM.

- Difficulty in achieving economies of scale without technological parity.

The threat of new entrants into the wholesale beverage distribution sector is generally low due to significant capital requirements for fleet, warehousing, and technology. Regulatory hurdles, especially for alcohol and tobacco, further complicate market entry. Established players like HT Hackney benefit from strong brand loyalty and existing distribution networks, making it difficult for newcomers to compete on price and service.

In 2024, the average startup cost for a small to medium-sized beverage distributor can range from $500,000 to over $2 million, encompassing fleet acquisition, warehouse leasing or purchase, initial inventory, and technology investments. For example, a fleet of 10 delivery trucks alone can cost upwards of $1.5 million. Additionally, obtaining the necessary federal and state licenses for distributing alcoholic beverages can incur fees ranging from a few hundred to over ten thousand dollars annually per state, alongside significant legal and compliance costs.

| Factor | Estimated Cost Range (USD) | Notes |

| Fleet Acquisition (10 trucks) | $1,500,000 - $2,000,000 | New, fully equipped semi-trailer trucks |

| Warehouse Facilities | $500,000 - $5,000,000+ | Leasehold improvements, construction, or purchase |

| Initial Inventory | $200,000 - $1,000,000+ | Depends on product mix and volume |

| Technology & Software | $100,000 - $500,000+ | WMS, TMS, CRM, ERP systems |

| Licensing & Compliance (Alcohol) | $5,000 - $50,000+ per state | Annual fees, legal consultation, background checks |

Porter's Five Forces Analysis Data Sources

Our HT Hackney Porter's Five Forces analysis leverages a robust combination of industry-specific market research reports, company financial statements, and trade association data to provide a comprehensive view of the competitive landscape.