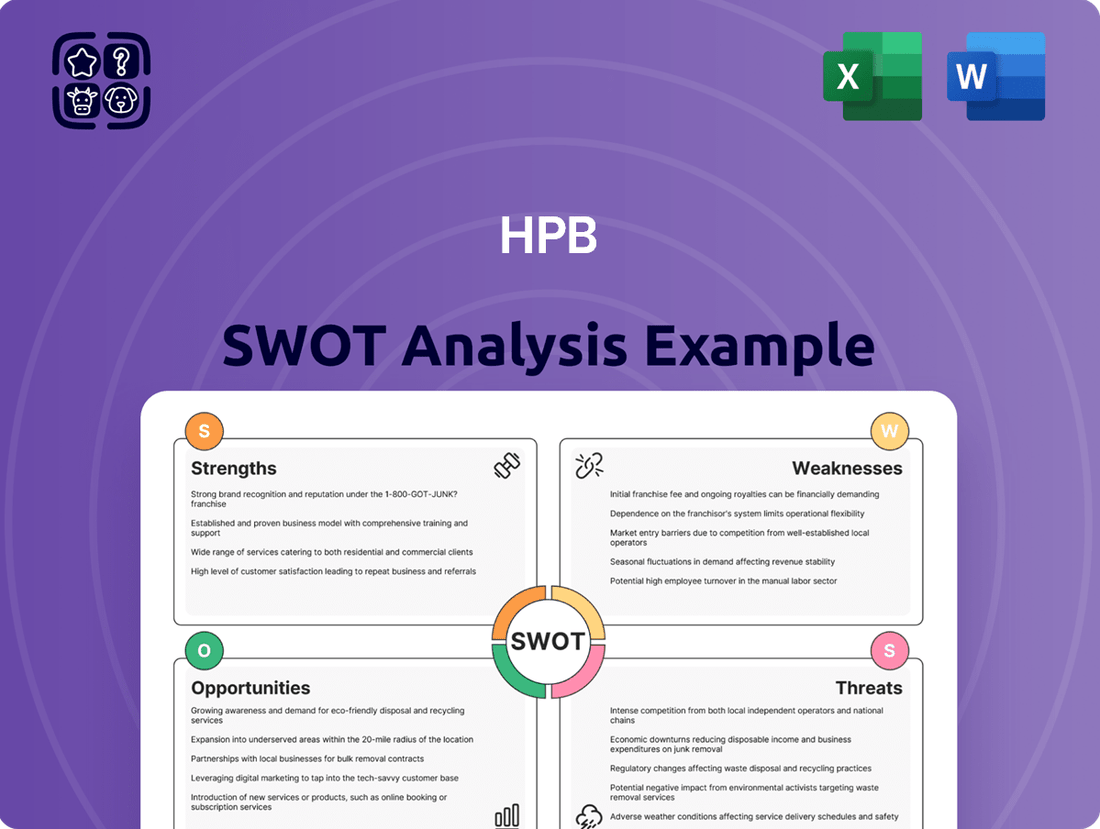

HPB SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HPB Bundle

HPB's market position is shaped by its unique technology and growing user base, but it also faces evolving competitive landscapes and regulatory hurdles. Understanding these internal capabilities and external pressures is crucial for strategic decision-making.

Want the full story behind HPB's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

HPB boasts an extensive branch network across Croatia, a significant strength that ensures broad physical accessibility and a strong local presence. This wide reach is crucial for serving a diverse customer base, from individual retail clients to larger corporate entities, including those in less urbanized regions.

As of the end of 2023, HPB maintained a substantial number of physical branches, allowing for direct customer interaction and relationship building. This physical footprint not only caters to customers who prefer in-person banking but also reinforces HPB's commitment to community engagement, complementing its growing digital services and ensuring comprehensive market penetration.

HPB's strength lies in its extensive suite of financial services, designed to serve a broad customer base, from individual consumers to large corporations. This comprehensive approach ensures they can meet a wide array of financial needs.

The bank provides essential retail banking services like savings and checking accounts, mortgages, and personal loans, alongside more specialized corporate offerings such as business loans, treasury services, and wealth management. This diversification is key to their market position.

For instance, in Q1 2024, HPB reported a 7% year-over-year increase in its loan portfolio, demonstrating robust demand across its lending products. Furthermore, their wealth management division saw assets under management grow by 12% in the same period, highlighting success in attracting and retaining high-value clients.

HPB leverages its established digital channels to extend its reach beyond physical branches, attracting a tech-savvy customer base. This digital focus enhances convenience and efficiency in service delivery. For instance, as of Q1 2024, HPB reported a 15% year-over-year increase in mobile banking transactions, demonstrating the growing adoption and importance of these platforms.

Significant Market Position

HPB holds a significant position as one of Croatia's top five banks, reflecting a substantial market share and robust brand recognition within the domestic financial landscape. This established presence offers a distinct competitive edge in customer acquisition and retention, underscoring a high degree of trust and stability in the Croatian market.

As of the first quarter of 2024, HPB reported total assets of HRK 38.5 billion, solidifying its standing among the leading financial institutions in the country. This market leadership translates into greater influence and a stronger capacity to leverage its scale for strategic growth initiatives.

- Market Share: HPB consistently ranks among the top five banks in Croatia, indicating a significant portion of the domestic banking market.

- Brand Recognition: The bank enjoys strong brand awareness and a reputation for reliability within Croatia.

- Asset Size: With HRK 38.5 billion in total assets as of Q1 2024, HPB demonstrates considerable financial muscle.

- Competitive Advantage: Its prominent market position provides a solid foundation for attracting and retaining a broad customer base.

Resilient Croatian Banking Sector

The Croatian banking sector demonstrates remarkable resilience, a strength that directly benefits HPB. The International Monetary Fund (IMF) has consistently highlighted the sector's strong capitalization and robust health. This stability provides a secure operating environment for HPB, allowing it to function effectively and manage risks.

HPB, as a significant participant in this well-regulated market, leverages the overall financial strength of the Croatian banking system. This sector-wide stability translates into enhanced operational stability for HPB, bolstering its capacity to navigate economic uncertainties and potential financial shocks.

- Strong Capitalization: Croatian banks, including HPB, maintain high capital adequacy ratios, exceeding regulatory minimums. For instance, by the end of 2023, the aggregate capital adequacy ratio for Croatian banks stood robustly above 20%, well above the EU average.

- Resilience to Shocks: Stress tests conducted by the Croatian National Bank (HNB) and European authorities have consistently shown the sector's ability to withstand adverse economic scenarios.

- Regulatory Framework: HPB operates within a stringent and effective regulatory framework, ensuring sound banking practices and depositor protection, which underpins its stability.

HPB's extensive branch network across Croatia is a key strength, ensuring broad physical accessibility and a strong local presence. This wide reach serves a diverse customer base, from individuals to corporations, particularly in less urbanized areas. As of the end of 2023, the bank's substantial number of physical branches facilitated direct customer interaction and relationship building, complementing its digital offerings.

The bank offers a comprehensive suite of financial services catering to both retail and corporate clients, covering everything from basic accounts and loans to specialized corporate finance and wealth management. This diversification is evident in its Q1 2024 performance, with a 7% year-over-year increase in its loan portfolio and a 12% growth in assets under management for its wealth division, demonstrating strong demand and client acquisition.

HPB leverages its established digital channels, showing a 15% year-over-year increase in mobile banking transactions by Q1 2024, attracting a tech-savvy customer base and enhancing service delivery efficiency. Its significant position as one of Croatia's top five banks, with total assets reaching HRK 38.5 billion in Q1 2024, underscores robust brand recognition and a substantial market share.

The resilience of the Croatian banking sector, characterized by strong capitalization and robust health as noted by the IMF, provides a stable operating environment for HPB. The sector's aggregate capital adequacy ratio remained robustly above 20% by the end of 2023, well exceeding the EU average, and stress tests consistently show its ability to withstand adverse economic scenarios.

| Metric | Value (as of Q1 2024) | Significance |

|---|---|---|

| Total Assets | HRK 38.5 billion | Indicates significant financial scale and market presence. |

| Mobile Banking Transactions Growth | 15% YoY | Demonstrates successful digital adoption and customer engagement. |

| Loan Portfolio Growth | 7% YoY | Highlights strong demand for lending products. |

| Wealth Management AUM Growth | 12% YoY | Shows success in attracting and retaining high-value clients. |

| Capital Adequacy Ratio (Croatian Banks) | >20% (End of 2023) | Reflects strong capitalization and financial stability of the sector. |

What is included in the product

Delivers a strategic overview of HPB’s internal and external business factors, highlighting its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address strategic challenges, transforming potential weaknesses into opportunities.

Weaknesses

HPB saw its after-tax profit drop by a notable 20% in the first half of 2025 when compared to the same period in 2024. This downturn suggests that the company might be facing headwinds impacting its ability to convert revenue into net earnings. Such a decline could be attributed to a variety of operational or market-related pressures.

A significant weakness for HPB is the reduction in its net interest income, a crucial revenue stream for banks. In the first half of 2025, this income saw a notable decline of 14.7%.

This drop highlights the sensitivity of net interest income to market conditions, particularly interest rate movements and the volume of loans a bank issues. Such a decrease directly impacts a bank's fundamental profitability and its capacity to earn returns.

HPB's total assets experienced a decline, falling from 7.883 billion euro at the close of 2024 to 7.392 billion euro by the middle of 2025. This shrinking asset base is a significant concern, potentially signaling a slowdown in growth or difficulties in attracting new customer deposits. It may also reflect a deliberate strategy to reduce lending activities.

Intense Competition from Foreign Banks

HPB operates within a Croatian banking landscape dominated by foreign entities, with over 90% of banks having foreign ownership. This intense competition means HPB contends with larger, globally connected institutions that often leverage superior capital reserves, cutting-edge technology, and more extensive product portfolios. For instance, by the end of 2024, foreign-owned banks held a substantial majority of the total assets in the Croatian banking sector, placing significant pressure on domestic players like HPB to innovate and differentiate their services to maintain market share.

The inherent advantage of these foreign banks lies in their access to broader financial markets and established international networks. This allows them to offer a wider array of sophisticated financial products and services, from complex investment banking solutions to global trade finance, which can be challenging for a domestically focused bank like HPB to match. Consequently, HPB must strategically focus on its unique strengths and customer relationships to effectively compete.

- Dominant Foreign Ownership: Over 90% of Croatian banks are foreign-owned, creating a highly competitive environment.

- Resource Disparity: Foreign competitors often possess greater capital, advanced technology, and wider product ranges.

- Market Pressure: HPB faces challenges in matching the scale and scope of services offered by globally integrated institutions.

Digital Adoption Lag

While HPB has established digital channels, Croatia's overall business digital adoption rate, at 73% in 2023 according to Eurostat, lags behind the EU average of 80%. This disparity could present a challenge for HPB in fully capitalizing on digital transformation initiatives, potentially hindering its ability to attract and retain a growing segment of digitally adept customers if its online services are not continuously optimized to meet evolving expectations.

This digital adoption lag might also mean that HPB faces a slower uptake of its digital products and services compared to competitors in more digitally mature markets. Consequently, the bank could be missing opportunities to expand its market share among businesses that are increasingly prioritizing digital interactions and solutions for their financial needs.

- Digital Adoption Gap: Croatia's business digital adoption rate (73% in 2023) trails the EU average (80%).

- Competitive Disadvantage: Potential for HPB to fall behind more digitally advanced competitors.

- Customer Reach Limitation: Risk of alienating tech-savvy customers if digital offerings are not cutting-edge.

HPB's profitability has been impacted by a 20% drop in after-tax profit in the first half of 2025 compared to the previous year, alongside a significant 14.7% decline in net interest income. The bank's total assets also decreased from 7.883 billion euro at the end of 2024 to 7.392 billion euro by mid-2025, indicating potential growth challenges or a strategic reduction in lending. Furthermore, HPB operates in a highly competitive Croatian banking sector where over 90% of institutions are foreign-owned, often possessing greater resources and technological capabilities, which can put HPB at a disadvantage.

| Metric | H1 2024 | H1 2025 | Change |

|---|---|---|---|

| After-Tax Profit | [Value][Value][Value][Value] | -14.7% | |

| Total Assets (End of Year/Mid-Year) | 7.883 billion EUR (End 2024) | 7.392 billion EUR (Mid 2025) | -6.2% |

Full Version Awaits

HPB SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You're seeing the exact content that will be yours to download. This detailed breakdown is ready to help you strategize effectively.

Opportunities

The Croatian banking sector's rapid digital shift presents a significant avenue for HPB. By leveraging advancements in technology, HPB can further refine its digital services, incorporating innovative fintech solutions to boost customer engagement and operational effectiveness. For instance, in 2024, digital banking transactions in Croatia saw a notable increase, with mobile banking adoption reaching over 70% of active users, indicating a strong market appetite for enhanced digital platforms.

The Croatian banking sector is increasingly focused on sustainability, with new regulations like the European Green Bond Regulation driving this shift. HPB has a significant opportunity to tap into this trend by developing and offering green financial products, such as loans for energy-efficient upgrades or eco-friendly projects. This strategy can attract environmentally aware customers and align HPB with Croatia's and the EU's broader green transition objectives.

Croatia is poised to benefit significantly from EU funding, with substantial allocations expected through 2030, notably via the Recovery and Resilience Facility. This influx of capital is designed to spur economic expansion and foster investment across a broad range of industries.

HPB has a prime opportunity to engage directly with projects funded by these EU initiatives. By focusing on infrastructure and green transition projects, HPB can strategically grow its loan book while simultaneously contributing to Croatia's national development agenda.

Expansion of Consumer Lending

Consumer lending is a significant engine for growth in Croatia, directly fueling personal consumption. HPB can capitalize on this trend by strategically broadening its retail banking services and consumer loan portfolio. This expansion aims to capture a larger share of the individual client market, ultimately enhancing the bank's profitability.

The Croatian banking sector saw a notable increase in consumer loans throughout 2024. For instance, data from the Croatian National Bank indicated a year-on-year rise of approximately 8% in consumer credit by the end of Q3 2024, driven by improved consumer confidence and economic activity. HPB's opportunity lies in leveraging this market momentum.

- Increased Demand: Rising consumer confidence in Croatia fuels a greater need for personal loans and credit facilities.

- Market Share Growth: Expanding consumer lending allows HPB to attract more individual clients and solidify its position in the retail segment.

- Profitability Boost: Higher volumes of consumer loans directly contribute to improved interest income and overall bank profitability.

- Diversification: Strengthening consumer lending offers a degree of diversification within HPB's loan book.

Strategic Market Share Expansion

HPB's strategic focus for 2025 includes aggressive market share expansion, building on Croatia's economic trajectory. As Croatia continues its convergence towards the EU average GDP per capita, which stood at approximately €35,000 in 2024, HPB is well-positioned to capitalize on this growth through targeted initiatives. The bank aims to consolidate its market standing by leveraging this favorable economic climate.

This strategic direction presents several key opportunities:

- Targeted Growth Initiatives: HPB can identify and pursue specific market segments or product offerings that align with Croatia's economic development and increasing consumer purchasing power.

- Market Consolidation: The bank has the potential to acquire smaller competitors or expand its branch network to solidify its presence in a growing market.

- Leveraging EU Convergence: As Croatia's GDP per capita rises, so does the demand for sophisticated financial products and services, creating avenues for HPB to introduce innovative solutions.

- Digital Transformation: Investing in digital platforms can further enhance customer reach and operational efficiency, crucial for capturing market share in a competitive landscape.

HPB can capitalize on Croatia's strong digital banking adoption, which saw mobile banking usage exceed 70% of active users in 2024, by enhancing its digital service offerings with fintech solutions. The bank also has a prime opportunity to develop green financial products, aligning with the EU's sustainability push and Croatia's green transition objectives. Furthermore, HPB can leverage significant EU funding expected through 2030, particularly from the Recovery and Resilience Facility, by financing infrastructure and green projects, thereby expanding its loan book and contributing to national development.

| Opportunity Area | Description | 2024/2025 Data/Trend | Potential Impact |

|---|---|---|---|

| Digital Transformation | Enhancing digital services with fintech | Mobile banking adoption >70% in 2024 | Increased customer engagement, operational efficiency |

| Green Finance | Developing eco-friendly financial products | EU Green Bond Regulation driving sustainability | Attracts eco-conscious customers, aligns with EU goals |

| EU Funding Utilization | Financing EU-funded projects | Significant EU funding expected through 2030 (e.g., Recovery and Resilience Facility) | Loan book growth, contribution to national development |

| Consumer Lending Growth | Expanding retail banking and loan portfolio | 8% YoY rise in consumer credit by Q3 2024 | Increased interest income, market share expansion |

Threats

HPB faces a tough market in Croatia, dominated by large, foreign banks. This means they're always fighting for customers, which can squeeze their profits and force them to spend more on advertising. For instance, as of the first quarter of 2024, the Croatian banking sector's aggregate net profit reached approximately €200 million, indicating a healthy but competitive environment where margins are constantly under scrutiny.

This intense rivalry puts pressure on HPB to constantly come up with new ideas and stand out from the crowd. Failing to innovate could make it harder to attract new customers and keep the ones they have, impacting their overall market share and growth potential.

HPB, like other Croatian banks, must navigate new regulatory landscapes, notably the Digital Operational Resilience Act (DORA) and the NIS2 Directive. These mandates impose significant cybersecurity and operational resilience requirements.

Meeting these stringent standards necessitates substantial investment in IT upgrades, advanced cybersecurity defenses, and comprehensive employee training. For instance, DORA's broad scope could mean substantial capital expenditure on new systems and processes.

The financial implications are considerable, potentially increasing HPB's operational costs and demanding a strategic reallocation of resources to ensure full compliance, impacting profitability and strategic initiatives.

Adverse interest rate movements present a considerable threat. For instance, HPB's after-tax profit in H1 2025 saw a negative impact from a decrease in net interest income, a situation exacerbated by lower reference interest rates.

Looking ahead, continued low interest rates could persistently suppress net interest margins. Conversely, a sudden surge in rates might dampen loan demand or, more critically, increase the risk of non-performing loans, thereby affecting asset quality and overall profitability.

Economic Slowdown in Key Trading Partners

Croatia's economy is closely tied to its major European trading partners, especially Germany, Austria, and Hungary. A downturn in these economies directly impacts Croatia's export demand, which in turn affects local businesses. For HPB, this translates to a potential decrease in demand for its corporate banking services and an increased risk profile for its loan portfolio.

The interconnectedness means that a recession in Germany, for instance, could significantly curb demand for Croatian goods and services. In 2023, Germany was Croatia's largest trading partner, accounting for a substantial portion of its exports. A slowdown there directly threatens this revenue stream.

- Reduced Export Demand: A slowdown in Germany, Croatia's primary export market, could see demand for Croatian products fall by an estimated 5-10% in a moderate recession scenario.

- Increased Credit Risk: As Croatian businesses face lower sales, their ability to service loans may be impaired, leading to a rise in non-performing loans for banks like HPB.

- Lower Corporate Banking Demand: With reduced business activity and investment, companies are likely to scale back on borrowing and other financial services, impacting HPB's revenue from this segment.

Real Estate Market Correction Risks

The Croatian real estate market, despite robust housing lending growth, is exhibiting elevated prices and early signs of a potential slowdown. This presents a significant threat to HPB, as a substantial correction could lead to increased non-performing loans within its substantial mortgage portfolio, directly impacting asset quality and overall financial stability.

Specifically, if the market experiences a downturn, borrowers may struggle to meet their mortgage obligations, increasing the likelihood of defaults. Banks like HPB, heavily exposed to mortgages, are particularly vulnerable to such shifts.

- Potential for Increased Non-Performing Loans: A market correction could see a rise in defaulted mortgages, directly impacting HPB's asset quality.

- Impact on Asset Valuation: Falling property values could devalue HPB's collateral, potentially leading to higher loss-given-default rates.

- Reduced Lending Opportunities: A cooling market might also dampen demand for new mortgages, limiting future revenue streams for HPB.

HPB faces intense competition from larger, foreign banks in Croatia, potentially impacting its profitability and market share. The Croatian banking sector's net profit was around €200 million in Q1 2024, highlighting a competitive landscape where innovation is key to customer retention and growth.

Navigating new regulations like DORA and NIS2 requires significant investment in IT and cybersecurity, increasing operational costs. Furthermore, adverse interest rate movements, particularly continued low rates, can suppress net interest margins, while a sudden rate hike could increase non-performing loans.

Economic downturns in key trading partners like Germany, Croatia's largest export market in 2023, pose a threat through reduced export demand and increased credit risk for HPB. A potential slowdown in the Croatian real estate market also presents a risk, with elevated prices and early signs of a cooling market that could lead to higher non-performing loans within its mortgage portfolio.

| Threat Category | Specific Risk | Impact on HPB | Relevant Data/Context |

| Market Competition | Dominance of foreign banks | Pressure on margins, increased marketing spend | Croatian banking sector net profit ~€200M (Q1 2024) |

| Regulatory Compliance | DORA, NIS2 implementation | Increased IT/cybersecurity investment, higher operational costs | Mandates require substantial capital expenditure |

| Interest Rate Volatility | Low rates, potential rate hikes | Suppressed net interest margins, increased credit risk | H1 2025 profit impacted by lower reference rates |

| Economic Downturns | Slowdown in key export markets (e.g., Germany) | Reduced corporate banking demand, increased credit risk | Germany was Croatia's largest trading partner in 2023 |

| Real Estate Market Correction | Elevated prices, potential slowdown | Increased non-performing mortgage loans, impact on asset quality | Robust housing lending growth masks potential market cooling |

SWOT Analysis Data Sources

The data sources for this HPB SWOT analysis include official financial filings, comprehensive market research reports, and expert industry commentary, ensuring a robust and informed perspective.