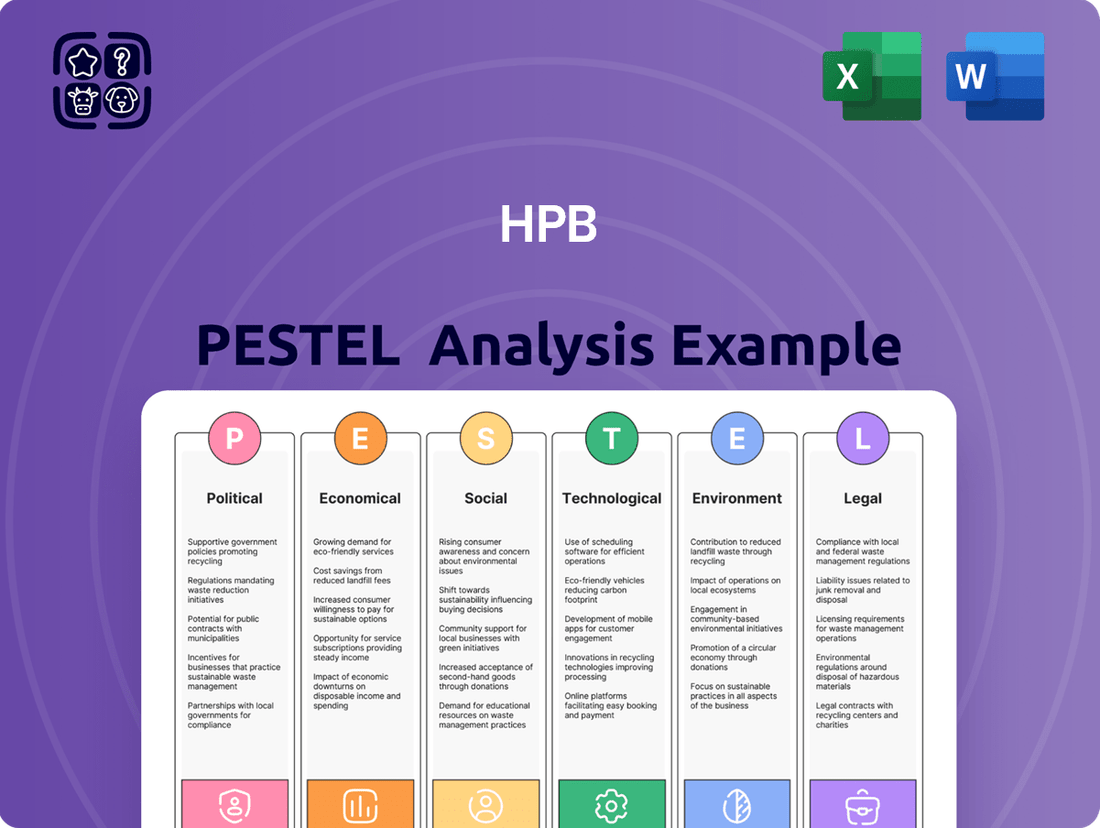

HPB PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HPB Bundle

Unlock the strategic advantages of HPB by understanding the external forces shaping its path. Our PESTLE analysis delves into the political, economic, social, technological, legal, and environmental factors critical to HPB's success. Gain a competitive edge by leveraging these insights for smarter planning and investment decisions. Download the full PESTLE analysis now for a comprehensive understanding.

Political factors

The stability of the Croatian government is a key political factor for HPB. A stable government generally leads to more predictable economic policies, which is beneficial for the banking sector. For instance, the Croatian government's commitment to EU accession and subsequent integration has historically shaped its financial regulatory framework, impacting banks like HPB.

Government policy direction, particularly concerning the banking and financial services sector, directly affects HPB's operational landscape. Decisions on capital requirements, consumer protection, and digital banking initiatives create the environment in which HPB operates. Furthermore, policies focused on the absorption of EU funds, such as those from the NextGenerationEU program, can stimulate economic activity and potentially increase demand for banking services.

Political decisions on public sector wages and social benefits have an indirect but significant impact on HPB. Increases in these areas can boost consumer spending power, leading to higher demand for credit and other banking products, thus influencing HPB's loan portfolio and overall profitability. For example, in 2024, Croatia's budget planning included provisions for public sector wage increases, aiming to support domestic demand.

As a member of the European Union since 2013, Croatia, and by extension HPB, is bound by EU directives and regulations. This means HPB must align its operations with various banking packages, anti-money laundering (AML) frameworks, and digital operational resilience acts. For instance, the Digital Operational Resilience Act (DORA), fully applicable from January 2025, mandates stringent cybersecurity and ICT risk management practices for financial entities like HPB.

This harmonization significantly influences HPB's operational procedures, potentially increasing compliance costs as it adapts to new EU-wide standards. However, it also levels the playing field, enhancing HPB's competitive positioning within the broader European financial market and facilitating cross-border business opportunities.

The Croatian National Bank (HNB) is pivotal in shaping HPB's operational landscape through monetary policy and prudential supervision. Recent HNB directives, such as adjustments to capital adequacy ratios or loan loss provisioning requirements, directly impact HPB's ability to lend and manage risk. For instance, the HNB's monetary policy rate, which stood at 3.75% in early 2024, influences the cost of funding for HPB and the pricing of its loans.

Anti-Money Laundering and Sanctions Compliance

HPB must navigate an increasingly complex landscape of anti-money laundering (AML) and sanctions compliance. The Croatian Act on Restrictive Measures, fully implemented in May 2024, significantly elevates due diligence and reporting requirements for financial institutions. This legislation is crucial for aligning with EU and UN sanctions, with non-compliance carrying the risk of substantial financial penalties and severe reputational harm.

Failure to adhere to these stringent regulations can lead to significant financial repercussions. For instance, under the EU's AML Directive (AMLD6), which influences national legislation like Croatia's, penalties for non-compliance can reach up to €5 million or 10% of the total annual turnover of the undertaking. HPB's proactive engagement with these evolving legal frameworks is therefore paramount for maintaining operational integrity and market trust.

- Enhanced Due Diligence: Financial institutions must implement more rigorous customer identification and verification processes.

- Transaction Monitoring: Stricter oversight of financial transactions is required to detect and report suspicious activities.

- Regulatory Reporting: Timely and accurate reporting of compliance data to relevant authorities is essential.

- Sanctions Screening: Robust systems for screening customers and transactions against sanctions lists are critical.

Government Initiatives for Financial Inclusion

The Croatian government's push for financial inclusion, particularly through initiatives like the proposed Law on Fee Comparability, Account Switching, and Access to a Basic Payment Account, directly influences HPB's approach to its retail banking services. This legislation aims to make basic banking services more accessible and affordable, potentially impacting revenue generated from certain account fees.

These government efforts, focusing on reducing financial burdens for vulnerable populations, present both opportunities and challenges for HPB. While fostering broader market participation, the reduced fee structures could necessitate strategic adjustments to maintain profitability within the retail segment.

- Government Focus: The Croatian government is actively promoting financial inclusion, with initiatives like the proposed Law on Fee Comparability aiming to ensure access to basic payment accounts.

- Impact on HPB: This legislation could affect HPB's revenue streams from retail banking fees, particularly for basic account services.

- Strategic Consideration: HPB may need to adapt its retail banking strategy to align with government objectives while managing the potential impact on its fee-based income.

Political stability in Croatia is crucial for HPB, as it influences economic policy predictability and the financial regulatory environment. Government decisions on banking regulations, consumer protection, and digital initiatives directly shape HPB's operational framework.

Croatia's adherence to EU directives, such as the Digital Operational Resilience Act (DORA) effective January 2025, mandates stringent cybersecurity for financial institutions like HPB. This harmonization impacts operational procedures and compliance costs but also enhances competitive positioning within the EU market.

Government initiatives promoting financial inclusion, like the proposed Law on Fee Comparability, aim to make basic banking services more accessible. This could affect HPB's retail banking fee structures, necessitating strategic adjustments to maintain profitability.

The Croatian National Bank's monetary policy, with its policy rate at 3.75% in early 2024, directly influences HPB's funding costs and lending rates. Furthermore, evolving AML and sanctions compliance, driven by legislation like the Croatian Act on Restrictive Measures (May 2024), increases due diligence and reporting requirements.

What is included in the product

This HPB PESTLE analysis systematically examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting the organization, offering a comprehensive view of its external operating landscape.

Provides a clear, actionable framework that simplifies complex external factors, enabling businesses to proactively address potential threats and capitalize on opportunities.

Economic factors

Croatia's economy is showing strong momentum, with GDP growth projected to exceed 3% in both 2024 and 2025. This expansion is largely fueled by healthy household spending and the significant influx of EU funds, creating a favorable landscape for HPB. This sustained economic growth typically translates into higher demand for a range of banking services, from personal loans to investment opportunities.

Inflation in Croatia, while projected to slow down, continues to be a significant economic consideration. For instance, annual inflation in Croatia stood at 4.9% in May 2024, a noticeable decrease from previous months but still a factor influencing the economic landscape. This persistent inflation directly impacts HPB's financial performance by affecting its net interest income, the cost of borrowing funds, and the rates it can charge for loans.

The Croatian National Bank's monetary policy, particularly its adjustments to interest rates in response to inflation, plays a crucial role. If inflation remains elevated, the central bank might maintain or increase interest rates, which could increase HPB's cost of funds. Conversely, lower inflation might allow for interest rate reductions, potentially boosting loan demand but also compressing net interest margins.

Furthermore, the prevailing inflation and interest rate environment directly influences the purchasing power of consumers and the ability of businesses and individuals to repay their loans. Higher inflation erodes real incomes, potentially leading to increased defaults or a slowdown in new lending, thereby impacting HPB's asset quality and profitability.

Consumer credit in Croatia reached a record high of €30.5 billion in May 2025, indicating robust household confidence and borrowing capacity. This surge, alongside a projected 4.2% increase in real household disposable income for 2025, directly benefits HPB by driving demand for its core retail banking offerings like personal loans and credit cards.

The sustained growth in consumer credit, particularly for durable goods and services, suggests a healthy appetite for spending that translates into higher transaction volumes for payment services. HPB's strategic focus on these areas positions it well to capitalize on this expanding market, with credit portfolio growth expected to exceed 5% in the coming fiscal year.

Investment Trends and EU Funds Absorption

Investment growth, significantly bolstered by the absorption of EU funds, is a pivotal force propelling the Croatian economy forward. This trend presents a prime opportunity for HPB within its corporate banking segment, enabling the bank to provide essential financing and sophisticated cash management services to businesses actively engaged in these EU-funded investment initiatives.

Croatia’s commitment to leveraging EU funds for development is substantial. For instance, in 2023, the country was projected to absorb a significant portion of its allocated EU funds, with a particular focus on infrastructure and green transition projects. This influx of capital directly translates into increased business activity and demand for financial services.

- EU Fund Absorption: Croatia aimed to maximize its absorption rate of EU funds in 2024, targeting key sectors like transport, energy, and digitalization.

- Corporate Banking Opportunities: HPB is well-positioned to support companies undertaking projects financed by these EU grants, offering tailored loan products and working capital solutions.

- Economic Impact: The successful absorption of EU funds is expected to contribute several percentage points to Croatia's GDP growth in 2024 and 2025, creating a favorable environment for business expansion and investment.

- Financing Needs: Businesses involved in these large-scale projects often require robust financial backing for co-financing, operational expenses, and managing cash flow, which HPB can readily provide.

Unemployment and Wage Growth

The current economic climate, as of mid-2024, is characterized by a remarkably tight labor market. Unemployment rates remain at historically low levels, fostering strong consumer confidence and contributing to financial stability. This positive employment scenario generally lowers credit risk for financial institutions and enhances individuals' ability to engage with financial services.

Wage growth has also been robust, further bolstering consumer spending power. For instance, average hourly earnings in the US saw a notable increase year-over-year in early 2024, outpacing inflation in many sectors. This trend directly supports the capacity of individuals and households to manage debt and invest.

- Low Unemployment Rates: As of April 2024, the US unemployment rate stood at 3.9%, a figure indicative of a very tight labor market.

- Strong Wage Growth: Average hourly earnings in the US increased by 3.9% over the 12 months ending April 2024, demonstrating sustained wage momentum.

- Impact on Financial Services: A stable and growing wage base supports increased demand for banking products, loans, and investment services.

- Reduced Credit Risk: High employment and rising wages generally translate to lower default rates on loans, benefiting the financial sector.

Croatia's economic outlook for 2024 and 2025 is robust, with GDP growth anticipated to surpass 3%, driven by strong consumer spending and substantial EU fund inflows. This economic expansion directly benefits HPB by increasing demand for its diverse banking services. The country’s successful absorption of EU funds, particularly in infrastructure and green projects, is a key growth driver, creating significant opportunities for HPB's corporate banking division to offer financing and cash management solutions.

Inflation, while moderating, remains a key factor. Croatia's annual inflation was 4.9% in May 2024, impacting HPB's net interest income and lending rates. The Croatian National Bank’s monetary policy, influencing interest rates, will continue to shape borrowing costs and loan demand. Consumer credit reached a record €30.5 billion in May 2025, reflecting strong household confidence and boosting HPB’s retail banking offerings, with credit portfolios projected to grow over 5%.

| Economic Indicator | Value | Period | Impact on HPB |

|---|---|---|---|

| Projected GDP Growth | >3% | 2024-2025 | Increased demand for banking services |

| Annual Inflation | 4.9% | May 2024 | Affects net interest income and lending rates |

| Consumer Credit | €30.5 billion | May 2025 | Boosts retail banking offerings |

| EU Fund Absorption | High | 2024-2025 | Drives corporate banking opportunities |

Preview the Actual Deliverable

HPB PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive HPB PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the business. You'll gain valuable insights to inform strategic decisions.

Sociological factors

Croatia's demographic landscape is characterized by an aging population, a trend mirrored across much of Europe. This shift significantly impacts the financial sector, particularly banking. We're seeing a growing demand for services catering to retirees, such as pension planning and wealth management solutions. For instance, by the end of 2023, the proportion of individuals aged 65 and over in Croatia was estimated to be around 22.5%, a figure projected to rise.

This demographic evolution also presents challenges for future economic growth. A shrinking active workforce can lead to reduced consumer spending and, consequently, a potential dampening effect on the demand for certain banking products, like long-term mortgages or business loans. The Croatian Bureau of Statistics reported a slight decrease in the working-age population in recent years, underscoring this concern for the banking sector's long-term loan portfolio growth.

Consumer behavior is increasingly shifting towards digital channels, with a significant portion of banking transactions now conducted online. This trend, coupled with rising financial literacy, means HPB must prioritize user-friendly digital platforms and transparent product offerings to meet evolving customer expectations. For instance, a recent report indicated that over 70% of banking customers in developed economies prefer digital interactions for routine transactions, highlighting the imperative for HPB to enhance its digital capabilities and communication strategies.

Public trust in financial institutions is a bedrock for customer loyalty and growth, directly impacting HPB's ability to attract and retain clients. Surveys in 2024 indicated that while trust levels in major banks have seen some recovery since the 2008 crisis, specific incidents like data breaches or perceived ethical lapses can quickly undermine this confidence.

For HPB, maintaining unwavering transparency in its operations and demonstrating consistent ethical conduct are paramount. A strong focus on robust data security, as highlighted by the increasing prevalence of cyber threats targeting financial data in 2024-2025, is non-negotiable to prevent erosion of customer faith.

Urbanization and Rural Access to Banking

Croatia's population distribution, with a significant portion residing in urban centers and a smaller, more dispersed rural population, directly influences HPB's strategic approach to its branch network. While digital banking solutions are increasingly vital for reaching all segments, maintaining a physical presence or alternative access points in less urbanized areas is crucial for HPB's market penetration and fostering financial inclusion.

As of 2023, roughly 57% of Croatia's population lived in urban areas, a figure that continues to grow. This trend means that while urban centers offer concentrated customer bases, the remaining 43% in rural and semi-urban regions require tailored service strategies. Ensuring these areas have accessible banking options, whether through branches, ATMs, or digital support, is key to HPB's goal of comprehensive service delivery.

- Urban concentration: Over half of Croatia's population resides in cities, presenting a core market for HPB's services.

- Rural access challenges: Approximately 43% of the population lives outside major urban centers, necessitating strategies for rural banking access.

- Digital vs. Physical: HPB must balance the expansion of digital channels with the need for physical or alternative banking access points in less populated regions to ensure financial inclusion.

Cultural Attitudes Towards Debt and Saving

Cultural attitudes towards debt and saving significantly shape financial product demand in Croatia, directly impacting HPB's strategic approach. Historically, Croatian culture has often favored a more conservative approach to borrowing, with a strong emphasis placed on personal savings and financial prudence. This can translate into a preference for lower-risk savings accounts and a more cautious uptake of credit facilities, especially for long-term investments.

Recent trends, however, suggest a gradual shift, particularly among younger generations who may be more open to leveraging debt for education or property acquisition. For instance, data from the Croatian National Bank (HNB) in early 2024 indicated a slight increase in consumer lending, although mortgage lending remained the dominant form of credit. Understanding these evolving cultural nuances is crucial for HPB to effectively tailor its offerings.

- Preference for Savings: A deep-seated cultural value in Croatia often prioritizes building personal savings over accumulating debt, influencing demand for savings products.

- Cautious Borrowing: Traditional attitudes lean towards careful consideration of loans, especially for non-essential items, impacting the uptake of certain credit products.

- Generational Shifts: Younger Croatians may exhibit more openness to debt for specific life goals like education or homeownership, presenting an opportunity for targeted financial products.

- Impact on Product Development: HPB must align its loan structures and savings incentives with these prevailing and evolving cultural preferences to maximize market penetration.

Croatia's aging demographic, with an estimated 22.5% of its population over 65 in late 2023, necessitates a focus on retirement planning and wealth management services for HPB. This trend, common across Europe, also means a shrinking workforce could dampen demand for long-term loans. The Croatian Bureau of Statistics noted a recent dip in the working-age population, a factor HPB must consider for future loan growth.

Technological factors

HPB must navigate Croatia's swift digital transformation, with mobile banking adoption accelerating. By the end of 2023, over 70% of Croatian bank customers used digital channels, a figure projected to rise significantly in 2024 and 2025. This trend necessitates continuous investment in HPB's online and mobile platforms to retain and attract customers.

Enhancing digital capabilities is crucial for operational efficiency and meeting evolving customer demands for seamless banking experiences. HPB's strategic focus on digital channels, including user-friendly mobile apps and secure online portals, will be a key differentiator in the competitive Croatian market throughout 2024 and into 2025.

Croatia's fintech landscape is rapidly evolving, presenting a dynamic environment for HPB. In 2024, the Croatian fintech market saw significant growth, with transaction volumes in digital payments projected to increase by 15% year-over-year. This expansion offers HPB opportunities to integrate innovative fintech solutions, potentially enhancing its digital banking services and customer experience.

However, this growth also intensifies competition. Specialized fintech firms are carving out niches in areas like cross-border payments and peer-to-peer lending, directly challenging traditional banking services. For instance, by the end of 2024, it's estimated that over 20 new fintech startups had launched in Croatia, many focusing on streamlining payment processes, which could impact HPB's market share in this segment.

The increasing reliance on digital platforms for financial transactions, as seen with HPB's operations, amplifies cybersecurity threats. For instance, the global cost of cybercrime is projected to reach $10.5 trillion annually by 2025, a significant increase from previous years, highlighting the critical need for advanced protection.

HPB must prioritize continuous investment in robust cybersecurity infrastructure to safeguard sensitive customer data. Adherence to evolving regulations, such as the EU's Digital Operational Resilience Act (DORA), which came into effect in January 2025, is paramount. DORA mandates stringent requirements for ICT risk management, incident reporting, and third-party risk, directly impacting financial entities like HPB.

Artificial Intelligence and Data Analytics

Artificial intelligence and data analytics are poised to revolutionize HPB's operational efficiency and customer engagement. By applying AI to personalize customer service and optimize marketing campaigns, HPB can achieve a more targeted and effective outreach. For instance, advanced analytics can identify customer preferences and predict future behavior, leading to tailored product offerings and improved loyalty.

The impact of these technologies extends to critical areas like fraud detection and risk management. HPB can leverage AI-powered systems to analyze vast datasets in real-time, identifying suspicious patterns and mitigating potential financial losses more effectively. This proactive approach not only safeguards assets but also enhances the overall security and trustworthiness of HPB's services.

Looking at the broader industry trends, the global market for AI in financial services was projected to reach over $25 billion by 2024, with significant growth expected to continue through 2025. This underscores the strategic imperative for HPB to integrate these advanced capabilities.

Key applications for HPB include:

- Enhanced Customer Experience: AI-driven chatbots and personalized recommendation engines can improve customer satisfaction and retention.

- Optimized Marketing: Data analytics enables hyper-targeted marketing campaigns, increasing conversion rates and ROI.

- Improved Risk Management: Real-time fraud detection and predictive analytics can minimize financial risks.

- Operational Efficiency: Automation of routine tasks and data-driven insights can streamline internal processes.

Blockchain and Distributed Ledger Technology

While blockchain and distributed ledger technology (DLT) are still finding their footing in traditional banking, their potential to reshape financial operations is significant. For HPB, keeping a close eye on these advancements is crucial for identifying future opportunities in payment systems and cross-border transactions.

These technologies could streamline processes, reduce costs, and enhance transparency. For instance, by 2025, the global blockchain in banking market is projected to reach $3.1 billion, highlighting rapid adoption and innovation.

- Payment Systems: DLT can enable faster, cheaper, and more secure peer-to-peer transactions, potentially disrupting existing interbank payment networks.

- Cross-Border Transactions: Blockchain offers a more efficient alternative to the current correspondent banking system, reducing settlement times and fees.

- Collateral Management: Smart contracts on a blockchain could automate collateral management, improving liquidity and reducing counterparty risk.

HPB's technological landscape is defined by rapid digital adoption and the growing influence of fintech. By 2024, over 70% of Croatian bank customers utilized digital channels, a trend expected to accelerate through 2025, demanding continuous investment in HPB's online and mobile platforms. The Croatian fintech market saw significant growth in 2024, with digital payment transaction volumes projected to rise by 15% year-over-year, presenting both opportunities and intensified competition from new startups.

Cybersecurity is a paramount concern, especially as the global cost of cybercrime is projected to reach $10.5 trillion annually by 2025. HPB must bolster its defenses and comply with regulations like DORA, effective January 2025, which mandates stringent ICT risk management. Furthermore, the integration of AI and data analytics offers substantial benefits, with the global AI in financial services market expected to exceed $25 billion by 2024, enabling personalized customer experiences, optimized marketing, and improved risk management for HPB.

Emerging technologies like blockchain and DLT hold potential for payment systems and cross-border transactions, with the global blockchain in banking market projected to reach $3.1 billion by 2025. HPB should monitor these advancements for future strategic integration, particularly in streamlining processes and enhancing transparency.

Legal factors

HPB, or Hrvatska poštanska banka, navigates a complex web of banking and financial sector regulations, primarily driven by Croatian national laws and the overarching directives of the European Union. Key legislation like the Credit Institutions Act and the Capital Requirements Regulation (CRR) dictate operational standards, capital adequacy, and risk management practices.

Compliance is rigorously monitored by the Croatian National Bank (HNB), ensuring HPB adheres to prudential requirements and consumer protection laws. For instance, as of the end of 2023, the HNB reported that the Croatian banking sector maintained a solid capital position, with the average capital adequacy ratio standing at a healthy 22.5%, well above the regulatory minimums, indicating a stable operating environment for banks like HPB.

New legislation in Croatia, like the proposed Law on Fee Comparability, Account Switching, and Access to a Basic Payment Account, is set to bolster consumer protection in banking. This means HPB needs to adjust its operations to guarantee fair dealings with all customers, paying special attention to those who might be more vulnerable.

For instance, the European Union's Payment Services Directive 2 (PSD2), which Croatia has implemented, mandates stronger consumer rights regarding payment transactions, including fraud protection and transparency in fees. HPB's adherence to these directives is crucial for maintaining trust and avoiding penalties.

HPB faces substantial compliance obligations due to stringent Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) legislation, such as the Croatian Act on Restrictive Measures. These regulations mandate rigorous internal controls, comprehensive customer due diligence, and the reporting of any suspicious transactions to prevent financial crime and avoid severe penalties. Failure to comply can result in significant fines, reputational damage, and operational disruptions, underscoring the critical importance of robust AML/CTF frameworks for the bank's stability and trustworthiness.

Data Privacy and GDPR Compliance

As a financial institution, HPB must navigate a complex web of data privacy laws, with the EU's General Data Protection Regulation (GDPR) being a prime example. Failure to comply with GDPR's strict rules on data collection, storage, and processing can result in substantial fines, potentially impacting financial performance and reputation.

HPB's commitment to GDPR compliance is not just about avoiding penalties; it's fundamental to maintaining customer trust. In 2023, the European Data Protection Board reported over 160,000 data breach notifications under GDPR, highlighting the ongoing challenges and the critical need for robust data protection measures.

Key aspects of HPB's legal obligations regarding data privacy include:

- Consent Management: Ensuring clear and informed consent is obtained for all personal data processing activities, aligning with GDPR's stringent requirements.

- Data Minimization: Collecting only the data that is absolutely necessary for specified purposes, reducing the scope of potential breaches.

- Security Measures: Implementing appropriate technical and organizational measures to protect personal data against unauthorized access or disclosure.

- Data Subject Rights: Facilitating individuals' rights, such as the right to access, rectify, or erase their personal data.

EU Directives and National Transposition

HPB's operations are significantly shaped by the ongoing transposition of EU directives into Croatian law. For instance, the Consumer Credit Directive 2 aims to harmonize credit agreements across the EU, influencing HPB's lending products and disclosure requirements. Similarly, the Instant Payments Regulation (IPR), which became fully applicable in July 2024, mandates that payment service providers like HPB offer instant credit transfers in euro. This requires substantial investment in technological infrastructure and process adjustments to meet the 24/7 availability and near-immediate settlement stipulated by the regulation.

The bank must diligently monitor and implement these legal changes to maintain compliance and competitive product offerings. Failure to transpose directives or adhere to regulations like the IPR can lead to significant penalties and reputational damage. As of early 2025, the Croatian National Bank continues to oversee the implementation of these directives, with ongoing guidance and potential enforcement actions for non-compliance.

- Consumer Credit Directive 2: Enhances consumer protection in credit agreements, impacting HPB's loan product design and marketing.

- Instant Payments Regulation (IPR): Mandates 24/7 instant euro payments, requiring technological upgrades and operational readiness by July 2024.

- National Transposition Timelines: HPB must adhere to specific deadlines set by Croatian authorities for implementing these EU legal frameworks.

- Regulatory Oversight: The Croatian National Bank actively monitors compliance, with potential fines for deviations from EU and national banking laws.

HPB operates under strict Croatian and EU financial regulations, impacting everything from capital requirements to consumer protection. The Croatian National Bank (HNB) actively supervises compliance, ensuring banks like HPB maintain robust financial health. For instance, the banking sector's average capital adequacy ratio remained strong at 22.5% by the end of 2023, reflecting a stable regulatory environment.

New EU directives, such as the Instant Payments Regulation (IPR) fully applicable from July 2024, mandate 24/7 instant euro transfers, pushing HPB towards significant technological investment. Compliance with data privacy laws like GDPR is also paramount, with over 160,000 data breach notifications reported under GDPR in 2023 across the EU, underscoring the critical need for secure data handling.

The legal landscape also includes stringent Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) laws, requiring rigorous due diligence and transaction monitoring. Failure to comply can lead to substantial fines and reputational damage, making robust legal adherence a cornerstone of HPB's operations.

HPB must also adapt to evolving consumer credit directives, like the Consumer Credit Directive 2, which harmonizes credit agreements and enhances borrower protections across the EU. This necessitates careful review and potential modification of HPB's lending products and disclosure practices.

| Regulatory Area | Key Legislation/Directive | Applicability/Impact on HPB | Recent Data/Trend |

|---|---|---|---|

| Capital Adequacy | Capital Requirements Regulation (CRR) | Ensures sufficient capital reserves for operations and risk mitigation. | Croatian banking sector average capital adequacy: 22.5% (End 2023) |

| Consumer Protection | Consumer Credit Directive 2 | Harmonizes credit agreements, impacting loan product design and transparency. | Ongoing transposition into national law. |

| Payment Services | Instant Payments Regulation (IPR) | Mandates 24/7 instant euro transfers, requiring technological upgrades. | Fully applicable from July 2024. |

| Data Privacy | General Data Protection Regulation (GDPR) | Governs data collection, storage, and processing; non-compliance incurs significant fines. | Over 160,000 GDPR data breach notifications in EU (2023). |

| Financial Crime Prevention | Act on Restrictive Measures (AML/CTF) | Requires robust internal controls and suspicious transaction reporting. | Critical for avoiding penalties and maintaining trust. |

Environmental factors

The increasing global and EU emphasis on climate change and Environmental, Social, and Governance (ESG) factors is significantly reshaping the banking landscape. HPB can expect mounting pressure to embed ESG principles into its core operations, from lending and investment strategies to transparent corporate reporting.

This trend is likely to drive the development and offering of green financial products, aligning with the EU's sustainable finance agenda, which aims to channel investments towards environmentally sound activities. For instance, the EU Taxonomy Regulation, fully applicable from January 1, 2023, provides a framework for identifying sustainable economic activities, influencing financial institutions' disclosures and product development.

HPB's engagement with sustainable finance initiatives, such as those spurred by the European Green Bond Regulation, is becoming increasingly important. Croatia's push for these regulations is driving banks to expand their green financial product offerings, directly supporting environmentally sound projects.

By actively participating in these sustainability efforts, HPB can significantly bolster its public image and attract a growing segment of clients who prioritize environmental responsibility. This strategic alignment with green finance trends is crucial for long-term growth and market positioning.

Resource scarcity, particularly concerning water and energy, can indirectly impact HPB's operational costs and its public perception. For instance, rising energy prices in 2024, driven by geopolitical factors and increased demand, could lead to higher utility expenses for HPB's physical branches and data centers.

Adopting energy-efficient technologies and practices across its extensive branch network and digital infrastructure is crucial for HPB's long-term operational sustainability. By investing in greener energy solutions, HPB can mitigate the financial impact of fluctuating energy costs and enhance its corporate social responsibility profile.

Natural Disaster Risk

Croatia, including regions where HPB operates, faces risks from natural disasters such as earthquakes and floods. While these events may not immediately disrupt daily banking, their broader economic consequences can be significant. For instance, a severe earthquake in a key tourist region could impact local economies, potentially affecting the repayment capacity of borrowers and thus HPB's loan portfolios.

HPB must maintain robust business continuity and disaster recovery plans to mitigate these risks. This includes strategies for data backup, alternative operational sites, and communication protocols to ensure continued service delivery even during or after a major event.

Recent data highlights the ongoing vulnerability. For example, the Petrinja earthquake in late 2020 caused widespread damage, underscoring the need for preparedness.

- Earthquake Risk: Croatia is located in a seismically active zone, with the potential for significant seismic events impacting infrastructure and economic activity.

- Flood Risk: Coastal and riverine areas are susceptible to flooding, which can disrupt local businesses and affect property values, indirectly influencing banking sector stability.

- Preparedness Measures: Financial institutions like HPB need to integrate natural disaster risk into their overall risk management frameworks, ensuring resilience and continuity of operations.

Regulatory Pressure for Environmental Reporting

Financial institutions are increasingly expected to report on their environmental footprint and sustainability initiatives. This trend is likely to translate into more stringent regulatory demands for comprehensive environmental disclosures from companies like HPB.

HPB should anticipate future regulatory requirements that will likely mandate more detailed reporting on its environmental, social, and governance (ESG) performance. This will require robust data collection mechanisms and clear, transparent communication strategies regarding its sustainability efforts.

For instance, the Task Force on Climate-related Financial Disclosures (TCFD) recommendations, adopted by many jurisdictions, are driving greater transparency. As of 2024, a significant number of major global companies have begun aligning their reporting with TCFD, indicating a growing global standard. HPB's proactive approach to data collection for ESG reporting will be crucial in meeting these evolving expectations.

Key areas of focus for HPB's environmental reporting will likely include:

- Greenhouse Gas Emissions: Quantifying and reporting Scope 1, 2, and potentially Scope 3 emissions.

- Resource Management: Disclosing water usage, waste generation, and recycling rates.

- Supply Chain Sustainability: Assessing and reporting on the environmental impact of its suppliers.

- Climate Risk Assessment: Evaluating and disclosing the physical and transitional risks associated with climate change.

The growing emphasis on sustainability means HPB must integrate environmental considerations into its operations and product offerings. This includes developing green financial products and adhering to evolving EU regulations like the Taxonomy Regulation, which guides sustainable investments.

Resource scarcity, particularly energy, presents both operational cost challenges and opportunities for efficiency gains. Rising energy prices in 2024 underscore the need for HPB to invest in energy-efficient technologies across its infrastructure.

Croatia's susceptibility to natural disasters like earthquakes requires HPB to maintain robust business continuity plans. The economic fallout from such events can impact loan portfolios, necessitating proactive risk management.

HPB faces increasing demands for transparent environmental reporting, aligning with global trends like the TCFD recommendations. Proactive data collection for ESG performance will be crucial for meeting these evolving regulatory expectations.

PESTLE Analysis Data Sources

Our HPB PESTLE analysis is built on a robust foundation of data from reputable sources including government publications, international organizations, and leading market research firms. We ensure comprehensive coverage by incorporating economic indicators, regulatory updates, technological advancements, and socio-cultural trends.