HPB Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HPB Bundle

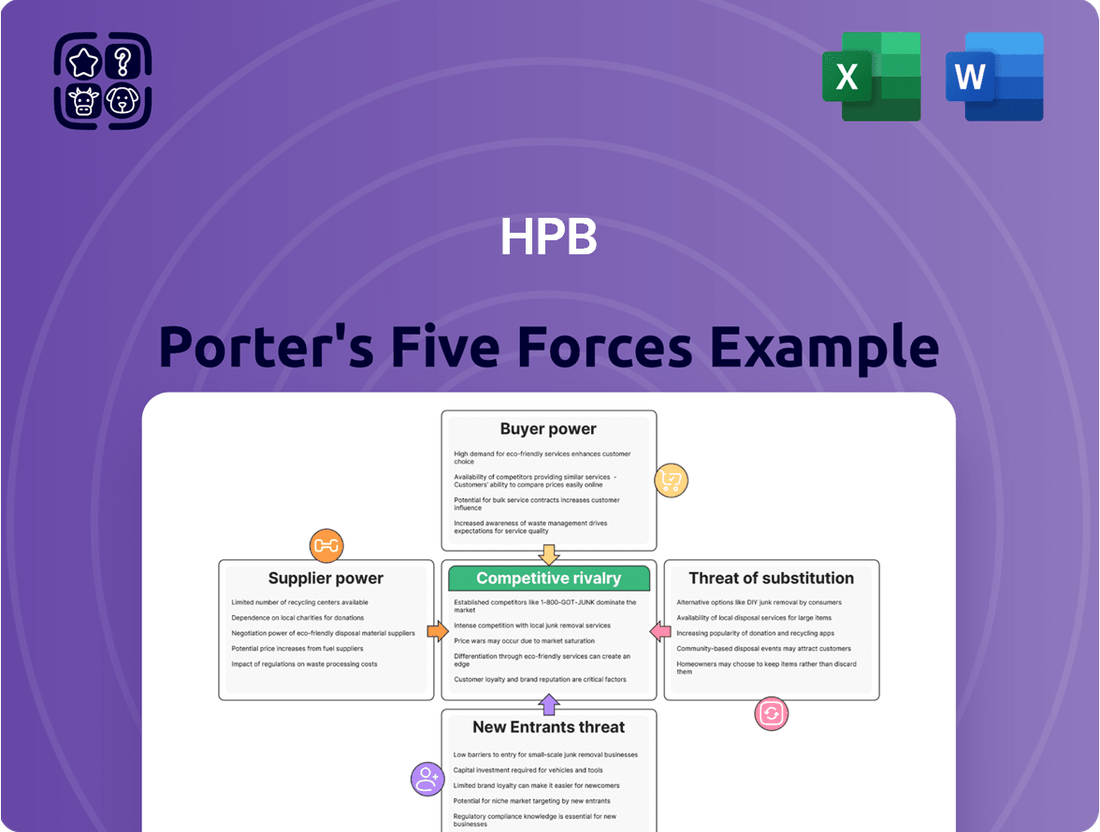

Understanding the competitive landscape for HPB is crucial for any strategic decision. Our Porter's Five Forces analysis delves into the intense rivalry among existing competitors, the bargaining power of buyers, and the significant threat posed by new market entrants. We also assess the influence of suppliers and the constant pressure from substitute products.

The complete report reveals the real forces shaping HPB’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Technology and software providers wield considerable influence over the banking sector. The industry's deep reliance on digital channels, core banking systems, and robust cybersecurity means that suppliers of specialized software, IT infrastructure, and digital solutions are key players. Their power is amplified when their offerings are proprietary or necessitate complex integration, making switching costs high for banks. For instance, in 2024, the global banking IT market was valued at approximately $120 billion, with a significant portion dedicated to core banking and digital transformation initiatives, underscoring the critical role of these technology vendors.

The availability of skilled professionals, especially in IT, cybersecurity, and financial technology, is paramount for banks. Croatia's banking sector, for instance, grappled with a shortage of top IT talent in 2024, leading to increased recruitment costs and longer hiring times.

This scarcity can significantly amplify the bargaining power of employees and specialized recruitment firms. When demand for specific skills outstrips supply, as seen with cybersecurity experts in the EU banking landscape, these professionals can command higher salaries and better benefits, directly impacting a bank's operational expenses and its ability to attract and retain crucial talent.

Regulatory bodies like the Croatian National Bank (HNB) wield considerable indirect power over banks. They set stringent capital requirements, compliance standards, and operational resilience frameworks, such as the Digital Operational Resilience Act (DORA). These regulations directly influence a bank's operating costs and strategic choices, effectively acting as powerful suppliers of operational mandates.

Financial Market Infrastructure Providers

Financial Market Infrastructure Providers (FMIPs) wield significant bargaining power over companies like HPB. These providers, such as payment processors and settlement systems, are critical for day-to-day operations. Their established networks and the high cost of switching to alternatives mean HPB has limited options, often leading to less favorable fee structures and service agreements. For instance, in 2024, transaction fees for major payment networks can represent a substantial operational cost for businesses processing high volumes.

New regulations, such as the EU's Instant Payments Regulation (IPR), are reshaping the landscape for FMIPs. While IPR aims to increase competition and reduce costs for end-users, it also imposes new compliance burdens on the infrastructure providers themselves. This can lead to increased investment in technology and security by FMIPs, which they may pass on through service fees. The ongoing development and adoption of real-time payment systems across various regions in 2024 highlight the evolving nature of this sector.

- High Switching Costs: Businesses face substantial costs and operational disruptions when changing payment processing or settlement providers.

- Limited Alternatives: The concentrated nature of critical financial infrastructure often leaves companies with few viable alternatives.

- Regulatory Impact: New regulations can either increase or decrease the bargaining power of FMIPs depending on compliance requirements and market dynamics.

- Essential Services: The indispensable nature of FMIPs for financial transactions grants them inherent leverage.

Data and Information Service Providers

Data and information service providers hold significant bargaining power, especially for companies like HPB that rely heavily on accurate financial data, market insights, and credit ratings. This information is crucial for effective risk management, strategic decision-making, and meeting regulatory compliance. Without reliable data, HPB's operations could be severely hampered.

Specialized data providers, particularly those offering real-time analytics or unique, proprietary datasets, can leverage their position. Their pricing power stems from the indispensable nature of their services; if HPB cannot easily substitute this data, these suppliers can command higher fees. For instance, Bloomberg Terminal, a leading financial data provider, charges substantial subscription fees, reflecting the critical role its comprehensive data plays in financial markets.

- Essential Data Reliance: HPB's strategic planning and risk management are directly tied to the quality and availability of financial data and market insights.

- Specialized Information Value: Providers offering real-time analytics or unique datasets have increased leverage due to the difficulty in finding comparable alternatives.

- Pricing Power: The indispensability of specialized data allows providers to set higher prices, impacting HPB's operational costs.

- Market Dynamics: The concentration of key data providers in the market can further amplify their bargaining power.

Suppliers of critical financial infrastructure, like payment processors, hold considerable sway over HPB due to high switching costs and limited alternatives. These essential services, vital for daily transactions, mean HPB often faces less favorable terms. For example, in 2024, transaction fees from major payment networks represented a significant operational expense for businesses with high transaction volumes.

Technology and software providers are also powerful suppliers, especially for specialized core banking systems and cybersecurity solutions. Banks' reliance on proprietary software with complex integration requirements elevates these vendors' influence, as switching costs can be very high. The global banking IT market, valued around $120 billion in 2024, highlights the substantial investment in these critical digital components.

Data and information service providers, such as Bloomberg, wield significant power by supplying indispensable financial data and market insights. HPB's reliance on accurate, real-time analytics for risk management and strategic decisions means these specialized providers can command higher fees due to the difficulty in finding comparable substitutes.

| Supplier Type | Key Services | Impact on HPB | Example Data (2024) |

| Financial Market Infrastructure Providers (FMIPs) | Payment processing, settlement systems | High switching costs, limited alternatives, potential for less favorable fee structures | Transaction fees can be a substantial operational cost for high-volume businesses. |

| Technology & Software Providers | Core banking systems, cybersecurity, digital solutions | Proprietary offerings, high integration costs, significant reliance | Global banking IT market valued at ~$120 billion, with major spending on digital transformation. |

| Data & Information Service Providers | Real-time analytics, market insights, credit ratings | Indispensable for risk management and strategy, pricing power due to lack of substitutes | Leading providers like Bloomberg charge substantial subscription fees for critical market data. |

What is included in the product

This analysis unpacks the competitive forces shaping HPB's market, detailing threats from rivals, buyer and supplier power, new entrants, and substitutes to inform strategic decisions.

Instantly identify and mitigate competitive threats with a dynamic, interactive framework for understanding industry power dynamics.

Customers Bargaining Power

The Croatian banking sector is quite competitive, with approximately 20 commercial banks vying for customers. This abundance of choices means individuals and businesses can readily compare offerings and switch providers if they find more attractive terms, superior service, or a better digital platform. For instance, in 2023, the total assets of Croatian banks reached over €100 billion, indicating a substantial market where customer loyalty can be influenced by competitive pricing and innovation.

The increasing digital adoption in Croatia, with a significant portion of the population now using online and mobile banking, has dramatically shifted power towards customers. For instance, in 2024, over 70% of Croatian bank customers were actively using digital channels for their banking needs, a figure that continues to climb.

This heightened digital engagement allows customers to easily compare offerings from various financial institutions, including HPB, and manage their accounts with unprecedented independence. They are no longer solely reliant on traditional branch interactions.

Consequently, customer expectations have evolved; they now demand personalized digital experiences that are both simple and efficient. This forces banks like HPB to invest heavily in improving their digital platforms and services to meet these growing demands and retain their customer base.

New legislation in Croatia, like the introduction of free basic banking services for vulnerable groups and flexible free service packages for the general public, has a significant impact on fees. This directly enhances customer bargaining power by making essential services more accessible, potentially at no cost, thereby limiting banks' revenue from these offerings.

Price Sensitivity and Lack of Differentiation

In the current financial landscape, many banking products exhibit minimal differentiation, leading to significant customer price sensitivity. This means customers are more inclined to switch providers based on the best available rates for loans and deposits, or the lowest fees. For instance, data from early 2024 indicates that the average savings account yield across major US banks remained relatively low, pushing consumers to actively seek out higher returns elsewhere.

This lack of unique product features means that loyalty is often driven by cost rather than intrinsic value. Banks that fail to offer competitive pricing risk losing customers to rivals who do.

- Price Sensitivity Dominates: Customers prioritize interest rates and fees over minor product variations.

- Low Switching Costs: For many standard banking services, moving accounts is a straightforward process, further enabling price-driven decisions.

- Impact of Digitalization: Online comparison tools and fintech disruptors make it easier than ever for consumers to find and switch to better-priced alternatives.

Access to Information and Financial Literacy

Customers are increasingly empowered by readily available information and growing financial literacy. Online resources, comparison websites, and financial news outlets provide unprecedented access to data on pricing, features, and customer reviews for financial products and services. This transparency significantly reduces information asymmetry, a traditional advantage for financial institutions.

This heightened awareness allows customers to make more informed choices, compare offerings from various providers, and negotiate for better terms. For instance, in 2024, the proliferation of fintech apps offering investment comparisons and personalized financial advice has further amplified customer bargaining power. Reports indicate that a significant percentage of consumers actively research financial products online before making a decision, often leveraging this knowledge to seek out the most competitive rates or favorable contract conditions.

- Informed Decision-Making: Consumers can easily access product details, fees, and performance metrics from multiple financial institutions.

- Price Sensitivity: Increased transparency allows customers to identify and switch to providers offering more attractive pricing or benefits.

- Demand for Value: Customers are more likely to seek out products and services that offer superior value, pushing financial firms to innovate and improve their offerings.

- Reduced Switching Costs: Digital platforms and improved customer service have lowered the perceived cost and effort associated with changing financial providers.

The bargaining power of customers in the Croatian banking sector is significant, driven by intense competition and increasing digitalization. With around 20 banks operating, customers have ample choice, readily comparing services and switching for better terms. This is amplified by over 70% of Croatian bank customers actively using digital channels in 2024, enabling easy comparison of offerings and fostering demand for personalized, efficient digital experiences.

| Factor | Impact on Customer Bargaining Power | Supporting Data (2024 unless specified) |

|---|---|---|

| Market Competition | High | ~20 commercial banks in Croatia |

| Digital Adoption | Increased | >70% of customers using digital channels |

| Product Differentiation | Low | Customers highly sensitive to rates/fees |

| Information Availability | High | Proliferation of fintech comparison apps |

Same Document Delivered

HPB Porter's Five Forces Analysis

This preview showcases the exact HPB Porter's Five Forces Analysis you will receive immediately after purchase, ensuring complete transparency and no hidden surprises. You're looking at the actual, professionally compiled document, offering a comprehensive breakdown of competitive forces impacting HPB. Once your purchase is complete, you’ll gain instant access to this identical, ready-to-use analysis.

Rivalry Among Competitors

Croatia's banking landscape features approximately 19 commercial banks, fostering a highly competitive environment. HPB's recent ascent into the top five by assets highlights this dynamic.

However, the market isn't uniformly fragmented; several large, often foreign-owned, institutions hold significant market share. This concentration among key players alongside a broader base of smaller banks intensifies the rivalry for customers and market influence.

In the traditional banking sector, many competitors offer very similar products, making it hard for customers to see a real difference. This lack of unique features means banks often end up competing mainly on price, like offering lower interest rates or fewer fees. For example, in 2023, the average interest rate on a new car loan from a major bank hovered around 6-8%, a clear sign of price-based competition.

This intense price competition directly impacts profitability, as margins get squeezed when banks have to constantly adjust rates to attract or retain customers. It also pushes them to innovate in how they deliver services, moving beyond just basic transactions to offer more personalized experiences or digital convenience to stand out.

The banking sector is experiencing intense competition fueled by digital transformation and the integration of fintech. Banks are pouring significant resources into enhancing their digital platforms, mobile banking capabilities, and developing novel customer solutions. This technological arms race is a direct consequence of the need to attract and retain customers in an increasingly digital-first financial landscape.

In 2024, major banks globally continued to allocate substantial capital towards digital initiatives. For instance, many large financial institutions reported digital transformation budgets in the billions of dollars, aiming to improve user experience and operational efficiency. This investment is critical as customer expectations shift towards seamless, on-demand digital services, intensifying the rivalry among established players and emerging fintech challengers.

Aggressive Growth Strategies

HPB's own commitment to aggressive growth, exemplified by its ambition to solidify its position among the top five banks, directly fuels intense rivalry. This proactive stance means HPB is not just reacting to competition but actively shaping it.

Leading banks, including HPB, are increasingly employing mergers and acquisitions as a key growth lever. For instance, HPB's integration of Nova hrvatska banka in 2023, a significant strategic move, demonstrates this trend. Such consolidation activities inherently intensify the competitive landscape as market share is consolidated and operational efficiencies are sought, putting pressure on other players to respond in kind.

- HPB's 2023 acquisition of Nova hrvatska banka significantly boosted its market presence.

- Aggressive growth strategies by major banks often involve inorganic expansion through M&A.

- This consolidation trend increases the pressure on smaller or less aggressive competitors.

Regulatory Changes and Compliance Costs

Ongoing regulatory reforms, such as the Digital Operational Resilience Act (DORA) and new payment rules, are reshaping the financial landscape. These changes necessitate significant investments in compliance, potentially creating a barrier for smaller institutions while offering a competitive edge to those that can effectively adapt and enhance their security offerings.

For instance, the implementation of DORA, which came into effect in January 2024, requires financial entities to bolster their IT security and risk management frameworks. This increased compliance burden can lead to higher operational costs, impacting profitability, especially for firms with limited resources. However, companies that successfully navigate these new regulations can differentiate themselves by offering greater security and reliability to their customers.

- DORA's Impact: Increased operational costs and IT security investments for financial institutions.

- Barrier to Entry: Higher compliance demands can disadvantage smaller or less capitalized players.

- Competitive Differentiator: Effective compliance can enhance customer trust and market position.

- New Payment Rules: Evolving payment regulations also require adaptation and investment.

The competitive rivalry within Croatia's banking sector is intense, driven by a mix of large, established institutions and a growing number of smaller players. HPB's strategic moves, like its 2023 acquisition of Nova hrvatska banka, exemplify the consolidation trend that heightens competition as market share shifts.

Banks are heavily investing in digital transformation, with global digital transformation budgets in the billions for 2024, to meet evolving customer expectations for seamless services. This technological race intensifies rivalry, pushing firms to differentiate beyond traditional product offerings.

Price-based competition, evident in areas like car loan interest rates averaging 6-8% in 2023, squeezes margins and forces continuous innovation in service delivery to attract and retain customers.

Regulatory changes, such as the January 2024 DORA implementation, add to the competitive pressure by requiring significant IT security investments, potentially creating a divide between well-resourced and smaller institutions.

| Metric | 2023 Data | 2024 Outlook/Trend |

|---|---|---|

| Average Car Loan Interest Rate | 6-8% | Continued pressure on rates due to competition |

| Digital Transformation Budgets (Global) | Billions of USD | Ongoing significant investment |

| Number of Commercial Banks in Croatia | Approx. 19 | Stable, with consolidation impacting market share |

SSubstitutes Threaten

The burgeoning fintech sector, particularly in regions like Croatia where fintech companies are experiencing rapid expansion, poses a significant threat of substitution for traditional banking services. These agile competitors are introducing innovative financial solutions that directly challenge HPB's established offerings. For instance, the proliferation of mobile payment platforms and digital wallets provides consumers with convenient alternatives to traditional card or cash transactions, impacting HPB's payment processing revenue streams.

Furthermore, specialized lending services offered by fintech firms, often characterized by faster approval times and tailored products, directly substitute for HPB's loan portfolios. In 2024, the digital payments market, a key area of competition, saw substantial growth globally, with projections indicating continued upward trends. This increasing adoption of digital alternatives by consumers and businesses alike means that HPB must actively innovate to retain its market share in these critical financial product categories.

The increasing adoption of mobile and internet banking presents a significant threat of substitutes for traditional banking models. As consumers and businesses embrace digital channels for transactions, deposits, and loan applications, the necessity for physical branches diminishes. This shift directly impacts HPB's core asset, its branch network, as purely digital alternatives offer comparable convenience and often lower costs.

In 2024, data indicates a continued surge in digital banking usage. For instance, a significant percentage of retail banking transactions globally are now conducted through mobile apps, with some reports suggesting over 70% in developed markets. This trend directly substitutes the need for in-person interactions at bank branches, eroding the traditional value proposition of institutions like HPB that rely heavily on physical presence.

The rise of peer-to-peer (P2P) lending and crowdfunding platforms presents a growing threat of substitutes for traditional banking services, including loans. While these alternative financing models are still gaining traction in markets like Croatia, they offer compelling alternatives, especially for small businesses and individuals seeking capital. These platforms can provide more adaptable terms and quicker access to funds compared to conventional bank lending processes.

Cryptocurrencies and Blockchain-based Solutions

The increasing adoption of cryptocurrencies and blockchain offers a potential alternative to traditional financial services. While still subject to significant volatility, these digital assets are carving out a niche, particularly in payment processing and as a store of value for some investors. For instance, by the end of 2023, the global cryptocurrency market capitalization reached approximately $1.6 trillion, indicating substantial investor interest.

As regulatory clarity improves globally, the threat of these substitutes is likely to grow. For example, in 2024, several countries have been actively developing or refining their digital asset regulations, which could pave the way for broader institutional and retail acceptance. This evolving landscape means that traditional payment providers and investment platforms may face increasing competition from decentralized alternatives.

- Growing Market Cap: The global cryptocurrency market cap surpassed $1.6 trillion by the end of 2023.

- Regulatory Evolution: Increased regulatory clarity in 2024 is expected to boost cryptocurrency adoption.

- Alternative Payment Rails: Blockchain technology offers potential for faster and cheaper cross-border transactions.

- Investment Diversification: Cryptocurrencies are increasingly viewed as an alternative asset class for portfolio diversification.

Non-Bank Financial Institutions and Retailers Offering Financial Services

Large retailers and telecommunication companies are increasingly stepping into financial services, presenting a significant threat of substitution for traditional banks. These non-bank entities can leverage their vast customer bases and established digital platforms to offer services like payment processing, credit, and even basic investment accounts. For instance, in 2024, major retailers continued to expand their in-house credit card programs and digital wallets, offering seamless integration with their core retail operations.

This trend blurs the lines between sectors, as consumers may opt for the convenience of financial products bundled with their everyday purchases. Companies like Amazon, with its Amazon Pay service, and major mobile carriers offering installment plans for devices, exemplify this shift. This competitive pressure forces traditional banks to innovate and adapt their offerings to remain relevant.

The accessibility and often lower fees associated with these non-traditional financial providers make them attractive alternatives. For example, a significant portion of online transactions in 2024 were facilitated through non-bank payment gateways, demonstrating a clear preference for these convenient solutions.

- Retailers offering private-label credit cards and buy-now-pay-later (BNPL) options directly compete with bank-issued credit products.

- Telecommunication companies are expanding into mobile payments and digital banking services, targeting underserved segments.

- The digital infrastructure of these non-financial institutions allows for rapid deployment of new financial products, often with a focus on user experience.

- Partnerships between retailers and fintech companies are accelerating the development of integrated financial solutions.

The increasing adoption of digital payment platforms and mobile banking presents a significant threat of substitutes for traditional banking services. These agile fintech competitors offer convenient alternatives, directly challenging HPB's established offerings and impacting revenue streams from payment processing and traditional loan portfolios.

The global digital payments market saw substantial growth in 2024, with projections indicating continued upward trends. This increasing adoption of digital alternatives by consumers and businesses means HPB must innovate to retain market share.

The rise of peer-to-peer lending and crowdfunding platforms also offers compelling alternatives for capital seeking, particularly for small businesses and individuals. These platforms can provide more adaptable terms and quicker access to funds compared to conventional bank lending processes.

| Substitute Type | Impact on HPB | 2024 Market Trend/Data |

|---|---|---|

| Fintech Payment Platforms | Reduced payment processing revenue | Global digital payments market experienced significant growth. |

| P2P Lending/Crowdfunding | Competition for loan portfolios | Growing adoption for small business and individual financing. |

| Mobile & Internet Banking | Diminished need for physical branches | Over 70% of retail banking transactions in developed markets conducted via mobile apps. |

| Cryptocurrencies/Blockchain | Potential alternative for payments and investments | Global crypto market cap ~$1.6 trillion by end of 2023; regulatory clarity improving. |

| Non-Bank Financial Services (Retailers/Telcos) | Competition through integrated offerings | Major retailers expanded credit card programs and digital wallets. |

Entrants Threaten

The banking sector in Croatia, much like in other developed economies, presents a formidable barrier to entry due to exceptionally high capital requirements. Establishing a new bank necessitates a significant upfront investment, often running into tens or even hundreds of millions of Euros, to meet solvency ratios and operational needs.

Furthermore, regulatory hurdles imposed by the Croatian National Bank (HNB) and adherence to European Union directives, such as the Digital Operational Resilience Act (DORA) and the Investment Firm Regulation (IFR), create substantial compliance costs and complexities. These stringent licensing procedures and ongoing regulatory obligations mean that new entrants must possess not only substantial financial backing but also robust operational and compliance frameworks.

Established banks like HPB benefit from decades of brand recognition, fostering deep customer trust and long-standing relationships. This makes it incredibly difficult for new entrants to gain traction.

Building comparable trust and loyalty in a sector as sensitive as finance is a protracted and expensive undertaking for any newcomer. For instance, in 2024, customer acquisition costs for traditional banks remained significantly higher than for digital-only challengers, reflecting the ingrained loyalty to established brands.

HPB's significant investment in both a widespread physical branch network and robust digital infrastructure presents a formidable barrier to new entrants. Establishing a comparable physical footprint would necessitate massive capital expenditure, akin to the billions of dollars traditional banks have historically poured into their networks. Similarly, replicating HPB's advanced digital capabilities, which likely include seamless online banking, mobile applications, and sophisticated customer service portals, demands considerable technological investment and expertise.

Economies of Scale and Cost Advantages

Established banks leverage significant economies of scale. This allows them to spread operational, risk management, and technology infrastructure costs across a vast customer base. For example, in 2024, major banks continued to invest billions in digital transformation, a cost that is more manageable for incumbents than for a startup aiming to replicate similar capabilities from scratch.

These scale advantages translate into cost benefits. Banks with larger asset bases can negotiate better terms with suppliers, optimize processing costs, and absorb the substantial expenses associated with regulatory compliance more effectively. This creates a considerable barrier for new entrants who must either accept higher per-unit costs or make massive upfront investments to compete on price.

New entrants face a steep uphill battle to achieve comparable efficiency. Without the existing infrastructure and customer volume, they often operate at a higher cost per transaction. This cost disadvantage makes it difficult for them to offer competitive interest rates or fees, a crucial factor for attracting customers in the banking sector.

- Economies of Scale: Large banks benefit from lower per-unit costs in operations and technology due to their size.

- Cost Advantages: Incumbents can absorb higher compliance costs and offer more competitive pricing.

- New Entrant Challenges: Startups struggle to match the operational efficiencies and cost structures of established players.

- 2024 Data Point: Continued heavy investment by major banks in technology infrastructure underscores the scale barrier.

Talent Acquisition and Market Understanding

New banks entering the Croatian market face significant hurdles in attracting seasoned banking professionals. The existing talent pool is often concentrated within established institutions, making it difficult for newcomers to recruit experienced staff. This scarcity of specialized banking talent can slow down operations and hinder the development of competitive products and services.

Furthermore, gaining a deep understanding of the local Croatian market, including intricate customer preferences and regulatory landscapes, requires substantial time and investment. For instance, in 2024, the Croatian banking sector saw a modest growth of 3.5% in total assets, indicating a mature market where established players already hold significant market share and customer loyalty. New entrants must invest heavily in market research and localized strategies to effectively compete.

- Talent Scarcity: Limited availability of experienced banking professionals in Croatia.

- Market Nuances: Difficulty in understanding local customer preferences and regulatory complexities.

- Investment Needs: Significant capital required for market research and localized strategies.

- Competitive Landscape: Established banks possess strong market share and customer loyalty, posing a barrier to entry.

The threat of new entrants into the Croatian banking sector, particularly for HPB, is significantly mitigated by substantial barriers. These include high capital requirements, stringent regulatory compliance, and the established brand loyalty of incumbents. Newcomers must overcome these challenges by investing heavily in infrastructure, talent, and market penetration strategies.

The existing market structure, characterized by strong customer relationships and economies of scale enjoyed by established players like HPB, further deters new entrants. For instance, in 2024, customer acquisition costs remained elevated for new banking ventures, reflecting the difficulty in unseating incumbents. Replicating the extensive branch networks and advanced digital capabilities of established banks demands immense financial and technological resources, making the threat of new entrants relatively low.

| Barrier Type | Description | Impact on New Entrants | HPB's Advantage |

|---|---|---|---|

| Capital Requirements | Substantial upfront investment needed to meet solvency ratios and operational needs. | High financial barrier; requires significant funding. | Established financial strength and access to capital markets. |

| Regulatory Hurdles | Complex licensing, compliance with HNB and EU directives (e.g., DORA). | Increases operational costs and time-to-market. | Existing robust compliance frameworks and expertise. |

| Brand Loyalty & Trust | Decades of customer relationships and established reputation. | Difficult to attract customers away from trusted incumbents. | Strong brand recognition and deep customer loyalty. |

| Economies of Scale | Lower per-unit costs in operations, technology, and risk management. | Higher cost per transaction for new entrants, impacting pricing. | Efficient operations and ability to absorb high infrastructure costs. |

| Infrastructure Investment | Widespread physical branches and advanced digital platforms. | Massive capital expenditure required to match. | Extensive physical footprint and sophisticated digital capabilities. |

Porter's Five Forces Analysis Data Sources

Our HPB Porter's Five Forces analysis is built upon a foundation of comprehensive data, including publicly available financial statements, industry-specific market research reports, and regulatory filings from key players in the healthcare sector.