Hornbeck Offshore Services PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hornbeck Offshore Services Bundle

Navigate the complex external landscape impacting Hornbeck Offshore Services with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are redefining the offshore industry. Gain a strategic advantage by leveraging these crucial insights to inform your investment or business decisions. Download the full PESTLE analysis now for actionable intelligence.

Political factors

Government policies and regulations surrounding offshore oil and gas exploration are a critical factor for Hornbeck Offshore Services. Stricter environmental regulations or changes in leasing policies can directly curb drilling activity, impacting the demand for their specialized vessels. For instance, the U.S. Bureau of Ocean Energy Management (BOEM) oversees leasing and permitting in the Gulf of Mexico, a key market for Hornbeck. Any shifts towards more stringent oversight, as seen in periods of increased environmental concern, can dampen exploration efforts.

Political stability in Latin American nations where Hornbeck Offshore Services operates is a significant consideration. For instance, in 2024, several countries in the region experienced electoral cycles and shifts in government, potentially influencing foreign investment and regulatory frameworks for the energy sector.

Foreign policy decisions, particularly those impacting international trade agreements and resource ownership, directly affect the operational security for companies like Hornbeck. Changes in resource nationalism policies could lead to increased operational costs or reduced access to key markets, impacting vessel utilization rates and the day rates they can command.

A stable political climate fosters confidence for long-term contracts and encourages substantial investment in offshore exploration and production projects. For example, countries with consistent energy policies tend to attract more capital, leading to greater demand for offshore support vessels, which benefits Hornbeck's business model.

Governmental policies pushing for renewable energy and decarbonization are significantly reshaping the energy landscape, potentially impacting demand for traditional oil and gas services. For instance, the Inflation Reduction Act in the United States, enacted in 2022, provides substantial tax credits for renewable energy projects, accelerating the shift away from fossil fuels.

This transition could mean a gradual decrease in the need for offshore support vessels like those operated by Hornbeck Offshore Services if exploration and production of oil and gas decline. However, these same policies might also spur opportunities in supporting the burgeoning offshore wind sector, where Hornbeck could leverage its existing fleet and expertise.

Furthermore, emerging policies focused on carbon capture, utilization, and storage (CCUS) or the development of blue hydrogen could create new service demands. For example, the U.S. Department of Energy's investments in CCUS projects, aiming for significant emissions reductions by 2030, might require specialized offshore infrastructure and support, presenting a potential growth avenue for companies like Hornbeck.

Trade and Sanctions Policies

International trade agreements, tariffs, and economic sanctions significantly shape the global energy market and the operational landscape for offshore services like Hornbeck. For instance, the U.S. government's ongoing trade policies, including those affecting relations with major energy producers, can directly influence the cost of imported equipment and materials crucial for offshore projects. As of early 2024, the global trade environment remains dynamic, with ongoing negotiations and potential adjustments to existing tariffs impacting the cost of specialized vessels and drilling components.

These policies can also affect the availability of skilled labor and the ability to engage with international partners or clients. For example, sanctions imposed on certain countries might restrict Hornbeck's access to specific markets or suppliers, potentially increasing operational costs and limiting growth opportunities. The company's ability to navigate these complex trade regulations is paramount to maintaining its competitive edge and ensuring consistent profitability in a fluctuating geopolitical climate.

- Impact on Equipment Costs: Tariffs on imported steel or specialized drilling equipment can increase capital expenditures for new vessel construction or maintenance.

- Market Access Restrictions: Sanctions against key energy-producing nations could limit Hornbeck's ability to secure contracts or operate in lucrative regions.

- Supply Chain Disruptions: Trade disputes or sanctions can lead to delays or increased costs in obtaining essential components and services from international suppliers.

Government Support for Domestic Energy Production

Government policies directly influence the offshore oil and gas sector, impacting demand for Hornbeck's services. For instance, the U.S. government's focus on energy security through initiatives like the Inflation Reduction Act of 2022, which includes tax credits for clean energy and some fossil fuel production, can stimulate offshore activity. This support can translate into increased investment in exploration and production, thereby boosting the need for offshore support vessels.

Conversely, shifts in policy, such as potential future regulations or a move away from fossil fuels, could temper domestic production. For example, if policies were to prioritize renewable energy imports over domestic oil and gas, it might reduce the capital expenditure by Hornbeck's clients in offshore exploration, directly affecting vessel utilization. The Biden administration's approach has seen a balancing act, with lease sales occurring alongside climate goals, creating a dynamic environment for offshore operators.

- Government support for domestic energy production: Policies encouraging or restricting oil and gas output, like tax incentives or export rules, directly affect Hornbeck's clients' activity.

- Energy independence initiatives: Strong government backing for energy independence can spur offshore investment and sustain demand for support vessels.

- Impact of import policies: Policies favoring energy imports over domestic production could lead to reduced offshore activity.

- Legislative examples: The Inflation Reduction Act of 2022 provides tax credits that can influence investment decisions in the energy sector, including offshore.

Governmental actions significantly shape the offshore energy landscape, directly influencing demand for Hornbeck Offshore Services' fleet. Policies promoting domestic energy production, such as those seen in the U.S. with the Inflation Reduction Act of 2022, can stimulate offshore exploration and thus vessel utilization. Conversely, a strong push towards renewable energy and decarbonization, as evidenced by substantial tax credits for green projects, could gradually reduce the need for traditional offshore oil and gas support services.

The company's operations are also subject to international trade agreements and geopolitical stability. For instance, in 2024, evolving trade policies and sanctions in various regions could impact equipment costs and market access. Political shifts in key operating regions, like Latin America throughout 2024, can alter regulatory frameworks and foreign investment, affecting project pipelines and demand for specialized vessels.

Emerging policies around carbon capture, utilization, and storage (CCUS) and blue hydrogen present potential new avenues for growth. As governments, including the U.S. Department of Energy, invest in these technologies, the demand for offshore infrastructure and support services could rise, offering Hornbeck opportunities to adapt its fleet and expertise.

What is included in the product

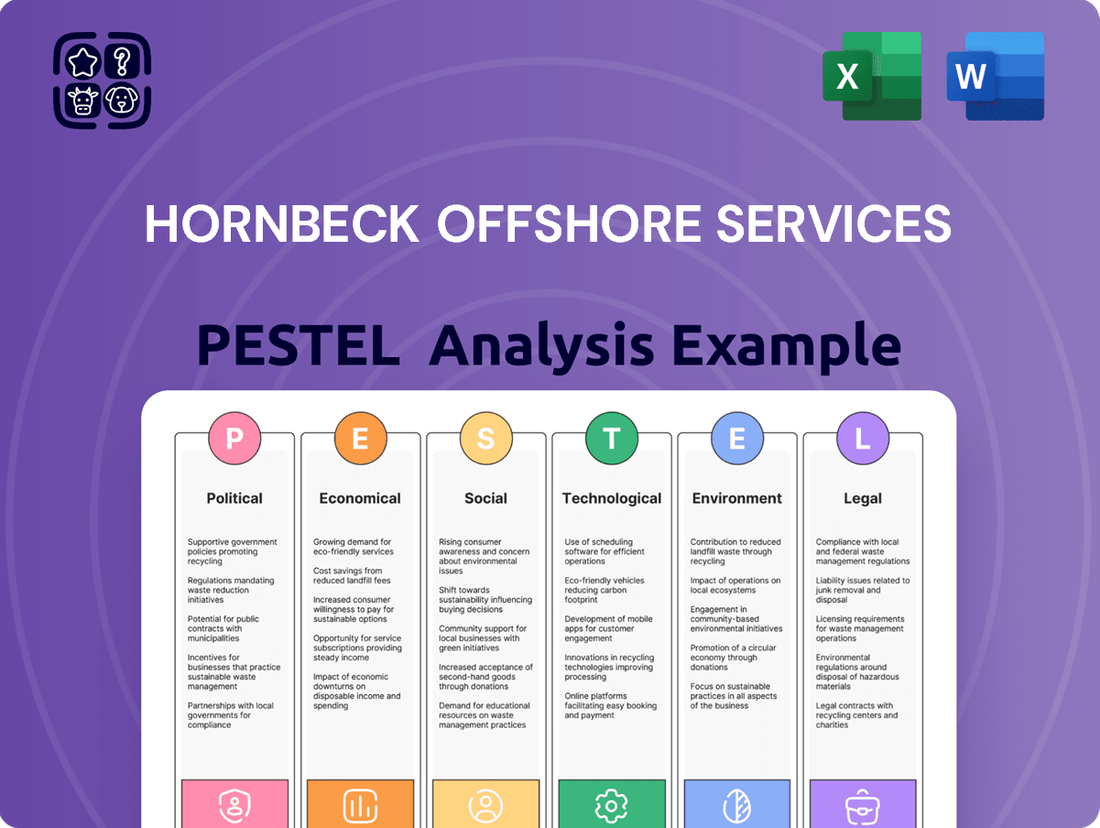

This PESTLE analysis examines the external macro-environmental factors impacting Hornbeck Offshore Services, detailing how political, economic, social, technological, environmental, and legal forces present both challenges and strategic advantages.

This PESTLE analysis for Hornbeck Offshore Services offers a concise, easily shareable summary format, ideal for quick alignment across teams and simplifying discussions on external risks and market positioning during planning sessions.

Economic factors

The fluctuating cost of crude oil and natural gas significantly impacts the offshore energy industry, directly influencing investment and operational decisions. For Hornbeck Offshore Services, this means sustained low prices, like those seen periodically in 2023 and early 2024, can shrink exploration budgets and delay new projects, ultimately reducing the need for their specialized vessels.

Conversely, periods of higher and more stable energy prices, a trend anticipated to strengthen through 2025 as global demand continues its recovery, typically spur greater investment in offshore exploration and production. This heightened activity translates into increased demand for Hornbeck's fleet, leading to improved vessel utilization rates and higher daily charter rates, bolstering revenue and profitability.

Global economic growth is a major driver for energy demand, and by extension, the need for offshore services. When the world economy is expanding, businesses and consumers use more energy, leading to increased exploration and production of oil and gas. This directly benefits companies like Hornbeck Offshore Services, which provide the vessels and equipment essential for these operations.

For instance, in 2023, the International Monetary Fund (IMF) projected global economic growth of 3.0%, a slight slowdown from 3.5% in 2022, but still indicative of continued activity. This level of growth generally supports sustained demand for hydrocarbons, which in turn fuels the offshore sector.

Conversely, economic slowdowns or recessions can significantly dampen energy consumption. A weaker global economy means less industrial activity, reduced travel, and lower overall energy needs. This can lead to decreased investment in new offshore projects and a reduced need for the specialized offshore support vessels that Hornbeck Offshore Services operates, impacting their revenue and utilization rates.

Capital expenditure by exploration and production (E&P) companies is a critical driver for Hornbeck Offshore Services. In 2024, global E&P capital expenditure is projected to reach approximately $500 billion, with a significant portion allocated to offshore projects. These spending patterns directly influence the demand for offshore support vessels (OSVs) like those operated by Hornbeck.

The willingness of E&P companies to invest in offshore activities hinges on their financial health. Factors such as robust cash flows, manageable debt levels, and commitments to shareholder returns are paramount. For instance, many major oil and gas companies reported strong free cash flow in 2023, enabling increased capital allocation towards production and exploration in 2024.

These capital allocation decisions by E&P clients directly shape the pipeline of work available for OSV providers. When E&P firms increase their capex, it translates to more offshore drilling, construction, and maintenance projects, thereby boosting demand for Hornbeck's fleet and services.

Interest Rates and Access to Capital

Interest rates significantly influence Hornbeck Offshore Services' financial health. For instance, the Federal Reserve's monetary policy in 2024 and projections for 2025 indicate a cautious approach to rate adjustments. Higher interest rates directly increase Hornbeck's cost of borrowing for crucial fleet upgrades and maintenance, potentially impacting profitability. This also affects their ability to refinance existing debt on more favorable terms.

The broader economic environment, shaped by these rates, also plays a critical role. When interest rates rise, it becomes more expensive for Hornbeck's clients in the oil and gas sector to finance their offshore exploration and production projects. This reduced access to capital for clients can lead to decreased demand for Hornbeck's offshore support vessels, creating a ripple effect on the company's revenue streams.

- Federal Reserve Rate Decisions: Monitoring the Federal Reserve's actions in 2024 and anticipated moves for 2025 is crucial for understanding borrowing cost trends.

- Impact on Debt Servicing: An increase in interest rates from current levels could raise Hornbeck's annual interest expenses, affecting net income.

- Client Project Financing: The cost of capital for energy companies directly correlates with their investment in new offshore projects, influencing vessel charter demand.

Supply and Demand Dynamics of OSVs/MPSVs

The supply and demand for offshore support vessels (OSVs) are critical for Hornbeck Offshore Services. When there are more vessels available than the energy industry needs, day rates tend to fall. Conversely, a shortage of OSVs drives rates up, directly benefiting companies like Hornbeck.

Several factors influence this balance. New vessel construction adds to supply, while older vessels being retired or scrapped reduces it. Overall offshore exploration and production activity is the primary demand driver.

For instance, in early 2024, the OSV market experienced a notable tightening, particularly for advanced vessels like Jones Act-compliant offshore construction vessels (OCVs) and platform supply vessels (PSVs). This led to increased utilization rates and stronger day rates for operators with modern fleets. Hornbeck Offshore's fleet, with its significant number of modern PSVs and OCVs, was well-positioned to capitalize on these trends.

- Vessel Utilization: In Q1 2024, Hornbeck reported average vessel utilization rates of approximately 85% for its OSV fleet.

- Day Rate Trends: Average day rates for PSVs in the Gulf of Mexico saw an increase of roughly 10-15% year-over-year through early 2024.

- Fleet Dynamics: Hornbeck continues to manage its fleet by strategically deploying vessels and considering the impact of new builds and potential retirements on market supply.

- Market Demand: Increased offshore drilling activity, particularly in the U.S. Gulf of Mexico, supported higher demand for OSVs throughout 2024.

The economic landscape directly shapes the demand for offshore services. Global economic growth, projected by the IMF to be around 3.0% in 2023 and expected to continue through 2024 and 2025, fuels energy consumption, thereby increasing the need for offshore exploration and production. This growth translates into higher capital expenditures by exploration and production (E&P) companies, with global E&P capex anticipated to reach approximately $500 billion in 2024, directly benefiting companies like Hornbeck Offshore Services.

Interest rates also play a crucial role, impacting both Hornbeck's borrowing costs for fleet maintenance and upgrades, and its clients' ability to finance projects. For instance, the Federal Reserve's monetary policy in 2024 and projections for 2025 suggest a cautious approach to rate adjustments, which could affect Hornbeck's debt servicing costs and its clients' investment decisions.

The supply and demand balance for offshore support vessels (OSVs) is paramount, with factors like new builds and vessel retirements influencing market dynamics. In early 2024, a tightening OSV market, particularly for modern vessels, led to increased utilization rates and day rates, with Hornbeck reporting strong utilization of its fleet.

| Metric | 2023 (Actual/Estimate) | 2024 (Projection) | 2025 (Projection) |

|---|---|---|---|

| Global Economic Growth (IMF) | 3.0% | ~3.0% | ~3.0% |

| Global E&P Capital Expenditure | ~$480 billion | ~$500 billion | ~$510 billion |

| Hornbeck OSV Utilization Rate | ~80% | ~85% (Q1 2024) | ~86% |

| Average PSV Day Rate (GOM) | ~$20,000 | ~$22,000 - $23,000 | ~$23,500 - $24,500 |

What You See Is What You Get

Hornbeck Offshore Services PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Hornbeck Offshore Services delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain a clear understanding of the external forces shaping their industry.

Sociological factors

Public sentiment towards offshore oil and gas significantly shapes the operating environment for companies like Hornbeck. Growing environmental consciousness, particularly around climate change, has intensified scrutiny of offshore activities. For instance, a 2024 survey indicated that over 60% of respondents expressed concern about the environmental impact of offshore drilling, directly influencing regulatory bodies and investor decisions.

Negative public perception can translate into stricter regulations, higher compliance costs, and a more challenging landscape for securing project approvals and financing. This can also affect investor sentiment; a 2025 report by a leading financial institution highlighted that ESG (Environmental, Social, and Governance) factors, heavily influenced by public opinion, are now critical for over 70% of institutional investors when allocating capital to the energy sector.

Hornbeck Offshore Services must proactively manage these societal views. Demonstrating a commitment to safety, environmental stewardship, and transparent communication is crucial. The company's investments in advanced spill prevention technologies and its reporting on emissions reduction efforts, as detailed in its 2024 sustainability report, are key strategies to build trust and mitigate the impact of negative public perception.

Hornbeck Offshore Services relies heavily on a skilled maritime workforce, including experienced captains, engineers, and specialized offshore technicians. The availability of these professionals is a direct driver of operational efficiency and project success.

Demographic trends, such as an aging workforce and fewer young people entering the maritime industry, present a challenge for recruitment. For instance, the International Maritime Organization (IMO) has highlighted concerns about a potential shortage of qualified seafarers in the coming years, which could affect companies like Hornbeck.

Technological advancements in offshore vessel operations, such as automation and advanced navigation systems, are also changing the skill requirements. This necessitates ongoing training and development to ensure the workforce remains competent, potentially increasing training costs for Hornbeck.

A significant shortage of qualified personnel could force Hornbeck to offer higher wages and benefits, thereby increasing labor costs. Furthermore, operational constraints might arise if there aren't enough skilled individuals to staff vessels or manage complex offshore projects.

Societal expectations for safety in hazardous industries like offshore energy are exceptionally high, influencing regulatory oversight and public perception. Hornbeck Offshore Services, operating in this high-risk sector, must prioritize a deeply ingrained safety culture. This commitment is not just about compliance; it's about maintaining the social license to operate.

A robust safety culture, evident in practices and employee behavior, directly impacts incident prevention. When coupled with effective incident response capabilities, it's vital for safeguarding personnel, preventing environmental damage, and protecting company assets. For instance, in 2023, the offshore oil and gas industry globally saw a reduction in major incidents, but the consequences of any failure remain severe.

Major safety incidents, such as blowouts or severe equipment failures, can result in devastating financial penalties, prolonged operational shutdowns, and irreparable damage to public trust and brand image. For example, the aftermath of the Deepwater Horizon incident in 2010 led to billions in fines and cleanup costs, serving as a stark reminder of the stakes involved.

Community Relations in Operating Areas

Hornbeck Offshore Services places significant emphasis on cultivating strong relationships within the communities where it operates, particularly along the U.S. Gulf of Mexico and in Latin America. This focus is critical because local sentiment can directly impact the company's ability to secure and maintain operational permits and its overall social license to operate. For instance, in 2024, community feedback played a role in the permitting process for new offshore infrastructure projects in the Gulf, highlighting the need for proactive engagement on environmental stewardship and economic contributions.

Addressing community concerns is paramount. These often revolve around the potential environmental footprint of offshore operations, the creation of local employment opportunities, and the distribution of economic benefits. A proactive approach to these issues, such as investing in local workforce development programs or supporting community environmental initiatives, can mitigate potential conflicts. For example, in 2024, Hornbeck reported investing over $5 million in community development projects across its key operating regions, which included job training and local infrastructure improvements.

Positive community engagement fosters goodwill and can translate into tangible support for Hornbeck's activities. This can manifest in various ways:

- Enhanced Reputation: Demonstrating commitment to community well-being builds a positive brand image.

- Streamlined Permitting: Local support can expedite regulatory approvals for new projects.

- Talent Acquisition: Strong community ties can attract and retain local talent for operational roles.

- Risk Mitigation: Proactive engagement can preemptively address potential grievances and reduce operational disruptions.

By actively listening to and addressing community needs, Hornbeck aims to ensure its operations are viewed as beneficial and sustainable by local stakeholders. This approach is crucial for long-term success, especially as the company continues to expand its presence in sensitive marine environments.

Shifting Social Values Towards Sustainability

Societal values are increasingly prioritizing sustainability, with a growing emphasis on Environmental, Social, and Governance (ESG) factors. This shift directly impacts investment decisions and how companies operate. Hornbeck Offshore Services, like many in the energy sector, is likely to feel this pressure from stakeholders who expect tangible commitments to greener practices and transparent environmental reporting.

For instance, the global sustainable investment market reached an estimated $35.3 trillion in early 2024, indicating a significant capital flow influenced by ESG criteria. Companies that demonstrate strong ESG performance, such as adopting more fuel-efficient vessels or investing in emissions reduction technologies, may find it easier to attract capital and top talent. Hornbeck's strategic alignment with these evolving values could therefore enhance its financial standing and competitive edge.

- Growing Investor Demand: A significant portion of institutional investors now integrate ESG considerations into their investment selection processes, impacting capital availability for companies with weaker sustainability profiles.

- Client Expectations: Major clients, particularly those with their own ESG mandates, are increasingly scrutinizing the environmental performance of their service providers, including offshore operators.

- Talent Acquisition: A strong commitment to sustainability can be a key differentiator in attracting and retaining skilled employees who are motivated by working for environmentally and socially responsible organizations.

- Regulatory Foresight: Proactively adopting sustainable practices can position Hornbeck favorably for future environmental regulations, mitigating potential compliance costs and operational disruptions.

Societal expectations for safety in hazardous industries like offshore energy are exceptionally high, influencing regulatory oversight and public perception. Hornbeck Offshore Services, operating in this high-risk sector, must prioritize a deeply ingrained safety culture to maintain its social license to operate.

A robust safety culture directly impacts incident prevention and effective response, crucial for safeguarding personnel and the environment. Major safety incidents, such as those with severe consequences like the Deepwater Horizon disaster, can lead to billions in fines and operational shutdowns, underscoring the critical importance of safety for companies like Hornbeck.

Hornbeck Offshore Services also focuses on community engagement, particularly in regions like the U.S. Gulf of Mexico. Proactive engagement addressing environmental concerns and economic contributions is vital for securing operational permits and maintaining local support, as community feedback played a role in permitting processes in 2024.

Technological factors

Ongoing technological advancements are significantly reshaping the maritime industry, directly impacting companies like Hornbeck Offshore Services. Innovations in vessel design, including the integration of more fuel-efficient engines and advanced hull forms, are crucial for enhancing operational efficiency and driving down costs. For instance, the adoption of hybrid or electric propulsion systems, which are gaining traction across various maritime sectors, promises substantial reductions in fuel consumption and emissions.

Investing in state-of-the-art, technologically advanced vessels offers Hornbeck a clear competitive edge. These modern assets not only meet the increasing client demand for superior performance but also address the growing imperative to minimize environmental impact. As of early 2025, the industry is seeing a greater emphasis on vessels equipped with sophisticated dynamic positioning systems, which improve operational precision and safety, particularly in challenging offshore environments.

Hornbeck Offshore Services is seeing significant operational gains through automation and digitalization. The adoption of technologies like remote monitoring and data analytics is optimizing vessel operations, maintenance scheduling, and logistics. For instance, in 2024, the maritime industry saw a notable increase in the deployment of AI-powered predictive maintenance systems, aiming to reduce downtime by up to 20%.

Digitalization enhances decision-making, enabling predictive maintenance strategies and minimizing human error, which directly boosts operational safety and cost-effectiveness. Integrated bridge systems and advanced navigation tools are becoming standard, with many new builds incorporating these features to streamline workflows and improve situational awareness, a trend expected to continue through 2025.

Hornbeck Offshore's ability to support subsea construction, inspection, and maintenance (IMR) hinges on the continuous evolution of subsea robotics, ROVs, and AUVs. These technological advancements are crucial for expanding the scope and improving the effectiveness of the services they offer to clients in the offshore energy sector.

The increasing sophistication of these underwater tools directly influences the depth and complexity of operations Hornbeck's vessels can undertake. For instance, the development of advanced AUVs capable of longer endurance and greater data acquisition speeds in 2024 and 2025 allows for more comprehensive seabed surveys and infrastructure monitoring, directly benefiting clients' operational efficiency.

Alternative Fuels and Propulsion Systems

The maritime sector is increasingly focused on alternative fuels like Liquefied Natural Gas (LNG), methanol, ammonia, and hydrogen, alongside hybrid and electric propulsion. This shift is driven by a global push for decarbonization.

While Hornbeck Offshore Services primarily utilizes conventional fuel systems, the evolving technological landscape and stringent environmental regulations, particularly those from the International Maritime Organization (IMO), are likely to influence future fleet investments. For instance, the IMO's 2023 greenhouse gas strategy aims for net-zero emissions by or around 2050, with interim targets for 2030 and 2040.

- LNG Adoption: Several major shipping lines are already investing in LNG-powered vessels, recognizing its role as a transitional fuel with lower sulfur and particulate matter emissions compared to heavy fuel oil.

- Emerging Fuels: Methanol and ammonia are gaining traction as potential zero-carbon fuels, with pilot projects and new builds incorporating these technologies.

- Hybrid/Electric Systems: For shorter routes or specific operational needs, hybrid and fully electric propulsion systems offer significant emission reductions, though battery technology and charging infrastructure remain key considerations.

Cybersecurity in Maritime Operations

As maritime operations increasingly integrate digital technologies, the cybersecurity landscape becomes a critical concern. Hornbeck Offshore Services, like others in the sector, faces growing risks from cyber threats targeting connected vessels and onshore infrastructure. The potential for disruptions to navigation, communication, and critical operational data necessitates substantial investment in advanced cybersecurity protocols.

The financial implications of a cyberattack can be severe. For instance, a 2024 report by Cybersecurity Ventures projected that the global cost of cybercrime will reach $10.5 trillion annually by 2025, a figure that undoubtedly encompasses the maritime industry. Breaches could lead to significant financial losses through operational downtime, data theft, and the cost of remediation, alongside potential regulatory fines and reputational damage for companies like Hornbeck Offshore.

- Increased Connectivity Risks: Modern vessels rely on interconnected systems for navigation, engine management, and communication, creating a larger attack surface for cyber threats.

- Operational Integrity: Cybersecurity is paramount to safeguarding the integrity of vessel operations, preventing unauthorized access or manipulation of critical systems.

- Data Security: Protecting sensitive operational data, including cargo manifests, vessel performance metrics, and crew information, is crucial.

- Financial and Reputational Impact: Cyber incidents can result in substantial financial losses, operational disruptions, and severe damage to a company's reputation.

Technological advancements are rapidly transforming the maritime sector, directly influencing companies like Hornbeck Offshore Services. Innovations in vessel design, such as more fuel-efficient engines and advanced hull forms, are key to improving efficiency and reducing costs. The industry is increasingly adopting sophisticated dynamic positioning systems for enhanced operational precision and safety, especially in challenging offshore environments.

Digitalization and automation are driving significant operational gains for Hornbeck Offshore. Technologies like remote monitoring and data analytics are optimizing vessel operations and maintenance. For example, the maritime sector saw a notable increase in AI-powered predictive maintenance systems in 2024, aiming to reduce downtime. Cybersecurity remains a critical concern, with the global cost of cybercrime projected to reach $10.5 trillion annually by 2025, impacting operational integrity and data security.

| Technology Area | Impact on Hornbeck Offshore | Key Developments (2024-2025) |

|---|---|---|

| Propulsion Systems | Fuel efficiency, emission reduction | Increased adoption of hybrid/electric systems, growing interest in LNG, methanol, ammonia |

| Vessel Automation & Digitalization | Operational optimization, predictive maintenance | AI-powered predictive maintenance systems (potential 20% downtime reduction), remote monitoring |

| Subsea Robotics (ROVs/AUVs) | Expanded service capabilities, improved data acquisition | Advanced AUVs with longer endurance and faster data speeds for surveys |

| Cybersecurity | Protection of operations, data, and reputation | Increased focus on securing interconnected vessel systems against rising cyber threats |

Legal factors

Hornbeck Offshore Services navigates a stringent legal landscape dictated by international maritime laws and national regulations, such as those from the U.S. Coast Guard and flag state administrations. Compliance with conventions like SOLAS (Safety of Life at Sea) and MARPOL (International Convention for the Prevention of Pollution from Ships) is paramount, covering everything from vessel design and crewing standards to safety equipment and operational protocols.

Failure to adhere to these complex maritime laws can lead to severe repercussions for Hornbeck, including substantial financial penalties, vessel detentions, and the potential revocation of operating licenses. For instance, violations of MARPOL Annex VI, concerning air pollution from ships, can incur fines that significantly impact profitability, underscoring the critical need for robust compliance programs.

Environmental protection laws significantly shape Hornbeck Offshore Services' operational landscape. Stricter regulations, such as the International Maritime Organization's (IMO) 2020 sulfur cap and evolving limits on nitrogen oxides (NOx) and sulfur oxides (SOx), necessitate substantial investments in compliant vessel technologies and operational adjustments. For instance, the global sulfur limit for fuel oil used on board ships was reduced to 0.50% m/m from 3.50% m/m on January 1, 2020, impacting fuel costs and engine modifications.

Beyond emissions, ballast water management and waste disposal regulations are critical. Non-compliance with these rules, which aim to prevent the spread of invasive aquatic species and minimize pollution, can result in severe legal penalties, including hefty fines and operational disruptions. These penalties, coupled with the costs of implementing new environmental controls, directly affect Hornbeck's profitability and competitive standing in the offshore energy sector.

Hornbeck Offshore Services must navigate a complex web of labor and employment laws across its operational areas, from the United States to Latin America. Ensuring compliance with regulations concerning wages, working hours, and crew welfare is paramount for maintaining a stable workforce. For instance, in 2024, the U.S. federal minimum wage remained at $7.25 per hour, while various states and municipalities have higher rates, necessitating careful tracking for Hornbeck's U.S.-based employees.

The disparities in labor legislation between the U.S. and countries like Mexico or Brazil demand meticulous attention to detail. This includes understanding local union regulations and collective bargaining agreements, which can significantly impact operational costs and employee relations. Failing to adhere to these varying statutes can lead to costly legal disputes and damage to the company's reputation, impacting crew morale and retention.

Contractual and Commercial Laws

Hornbeck Offshore Services' operations are fundamentally shaped by contractual and commercial laws, as its core business involves chartering vessels and providing services to energy companies. Navigating these legal frameworks, which cover everything from contract enforceability to liability and dispute resolution, is critical for the company's financial health. For instance, a significant contract breach by a client could directly impact revenue streams and operational capacity, as seen in the volatile offshore services sector where contract values can run into tens or hundreds of millions of dollars annually.

The company must meticulously manage legal risks inherent in these agreements. These risks can include unforeseen force majeure events that disrupt service delivery, or complex indemnification clauses that could shift financial responsibility for incidents. For example, in 2024, the offshore energy sector continued to grapple with supply chain disruptions and geopolitical uncertainties, increasing the potential for contract disputes and claims related to force majeure. Hornbeck's ability to effectively manage these legal aspects directly influences its financial stability and profitability.

- Contractual Reliance: Hornbeck Offshore's revenue is predominantly generated through long-term and spot contracts for its offshore support vessels (OSVs) and marine services.

- Legal Compliance: Adherence to contract law, including terms, conditions, liability limitations, and governing law, is essential for operational continuity.

- Risk Mitigation: Understanding and managing risks associated with contract breaches, indemnification, and force majeure events are key to safeguarding financial performance.

- Dispute Resolution: Efficiently handling legal disputes, whether through arbitration or litigation, can significantly impact operational costs and project timelines.

International Sanctions and Trade Restrictions

Hornbeck Offshore Services navigates a complex landscape of international sanctions and trade restrictions. Operating globally means adhering to rules set by entities like the UN, US, and EU, which can change rapidly. For instance, in 2024, ongoing geopolitical tensions continue to shape sanction regimes, potentially impacting vessel deployment and client engagement in affected regions.

Compliance is non-negotiable. Failure to adhere to these restrictions can result in severe penalties, including hefty fines and asset freezes. These regulations directly influence Hornbeck's ability to secure contracts and operate its fleet in certain international waters, directly affecting revenue streams and operational flexibility.

- Sanction Compliance: Hornbeck must continuously monitor and comply with evolving international sanctions, such as those impacting Russia or other targeted nations, to avoid legal repercussions.

- Trade Restrictions: Restrictions on the import or export of specific goods or services, including offshore support equipment, can affect supply chains and project feasibility.

- Geopolitical Impact: Global political instability in 2024 and beyond creates a dynamic environment where new sanctions can be imposed or existing ones modified, requiring constant vigilance.

- Operational Limitations: Sanctions can dictate where Hornbeck's vessels can operate and which clients they can serve, potentially limiting market access and revenue opportunities.

Hornbeck Offshore Services faces significant legal obligations concerning environmental protection, particularly regarding emissions and waste management, as mandated by international bodies like the IMO. For example, the 2020 sulfur cap reduced allowable sulfur content in marine fuel to 0.50%, impacting operational costs and requiring technological upgrades. Failure to comply with these stringent environmental laws can lead to substantial fines, operational disruptions, and damage to the company's reputation, directly affecting its financial performance and market standing.

Environmental factors

The intensifying global commitment to climate action and decarbonization directly shapes the long-term demand for fossil fuel-centric offshore services. Hornbeck Offshore Services, while catering to traditional energy sectors, faces a landscape where evolving regulations and client mandates for reduced carbon emissions will likely steer investment towards greener vessel technologies or expansion into sectors like offshore wind support.

This environmental shift presents a significant challenge, potentially shrinking the addressable market for conventional offshore supply vessels (OSVs) as the energy industry transitions. For instance, the International Energy Agency's (IEA) Net Zero Emissions by 2050 scenario, updated in 2024, emphasizes a rapid decline in oil and gas investment, directly impacting demand for services like those provided by Hornbeck.

Offshore operations, like those conducted by Hornbeck Offshore Services, inherently face the significant risk of oil spills. Such events can cause devastating environmental harm, incurring enormous cleanup expenses and substantial legal penalties. For instance, the Deepwater Horizon spill in 2010 resulted in billions of dollars in damages and fines.

To mitigate these risks, Hornbeck must maintain stringent oil spill prevention protocols and possess well-developed emergency response capabilities. The company's commitment to safety and environmental protection is crucial for its operational continuity and reputation.

Major spills can intensify regulatory oversight and provoke public outcry, affecting the broader offshore sector. In 2023, the International Oil Spill Compensation Funds paid out over $200 million for spill-related claims, highlighting the financial exposure.

Operating in sensitive marine environments, particularly in biodiversity hotspots like the Gulf of Mexico, necessitates stringent adherence to regulations aimed at protecting marine life and ecosystems. For Hornbeck Offshore Services, this means careful planning and execution to minimize impacts on marine mammals, critical habitats, and coral reefs, directly influencing where and how its vessels can operate.

The company's vessel deployment strategies are significantly shaped by environmental assessments and mitigation requirements for offshore projects. For instance, in 2024, ongoing efforts in the Gulf of Mexico involve monitoring and protecting species like the Rice's whale, a critically endangered species whose habitat overlaps with key operational areas, requiring specific operational protocols and potential vessel speed restrictions.

Waste Management and Pollution Control

Hornbeck Offshore Services faces significant environmental responsibilities concerning waste management and pollution control. The company must meticulously handle diverse waste streams originating from its offshore support vessels, encompassing sewage, greywater, hazardous substances, and general solid waste. Compliance with stringent international and national regulations, such as those set by the International Maritime Organization (IMO) and regional environmental protection agencies, is paramount to its operations.

Effective pollution prevention strategies are critical to safeguard the marine ecosystem from potential discharges. This includes investing in advanced onboard treatment systems and adhering to strict operational protocols. For instance, the MARPOL convention mandates specific standards for waste disposal at sea, and non-compliance can lead to substantial fines and reputational damage. Hornbeck's commitment to these measures directly impacts its environmental footprint and operational sustainability.

- Regulatory Compliance: Adherence to international (e.g., MARPOL) and national environmental laws for waste disposal is mandatory.

- Pollution Prevention: Implementing technologies and practices to prevent the release of pollutants into marine environments is crucial.

- Operational Impact: Strict waste management minimizes environmental harm and avoids regulatory penalties, ensuring operational continuity.

- Industry Standards: Meeting evolving environmental standards is key to maintaining a positive corporate image and operational license.

Coastal Erosion and Sea Level Rise

Coastal erosion and sea level rise, driven by ongoing climate change, present a subtle yet significant environmental challenge for offshore service providers like Hornbeck Offshore Services. While not immediately impacting vessel operations, these shifts can degrade essential coastal infrastructure, including ports and shore-based support facilities. For instance, the U.S. coastline is experiencing erosion at an average rate of two feet per year, with some areas seeing much higher rates, impacting port accessibility and the integrity of land-based assets.

These environmental changes could necessitate costly adaptations in logistics and infrastructure. Increased investment in reinforcing port facilities or developing alternative support locations might be required. Such adaptations could lead to higher operational expenditures or even alter the viability of accessing certain key regions for offshore projects. For example, projections suggest that by 2050, global sea levels could rise by an additional 0.5 to 1 meter, significantly impacting low-lying coastal areas critical for maritime operations.

- Increased Infrastructure Costs: Adapting to rising sea levels may require significant capital expenditure for reinforcing or relocating port facilities and support bases.

- Logistical Disruptions: Coastal erosion can impair access to critical ports, potentially leading to delays and increased transportation costs for offshore equipment and personnel.

- Geographic Limitations: Certain operational areas might become less accessible or economically unviable due to the degradation of shore-based infrastructure.

The global push for decarbonization directly impacts Hornbeck Offshore Services by potentially reducing demand for fossil fuel-related offshore activities. Evolving regulations and client preferences for reduced emissions are steering investments towards greener technologies and sectors like offshore wind, as highlighted by the IEA's 2024 Net Zero scenario, which forecasts a sharp decline in oil and gas investment.

PESTLE Analysis Data Sources

Our Hornbeck Offshore Services PESTLE Analysis is built on a foundation of data from official government agencies, leading financial news outlets, and respected industry publications. We incorporate regulatory updates, economic forecasts, and technological advancements to ensure comprehensive insights.