Hornbeck Offshore Services Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hornbeck Offshore Services Bundle

Hornbeck Offshore Services faces significant pressure from intense rivalry within the offshore support vessel sector, where differentiation is challenging and pricing power is limited.

The bargaining power of buyers, primarily large oil and gas companies, is substantial, influencing contract terms and vessel rates. Furthermore, the threat of substitutes, though currently low, could emerge with shifts in energy production technologies.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Hornbeck Offshore Services’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The market for highly specialized components and services essential for offshore support vessels (OSVs) and multi-purpose support vessels (MPSVs), like advanced dynamic positioning systems and unique engine parts, is often controlled by a small number of manufacturers. This scarcity of specialized suppliers means they hold considerable leverage over companies like Hornbeck Offshore Services, particularly when it comes to acquiring equipment for new vessels or enhancing existing fleets.

High switching costs significantly bolster the bargaining power of suppliers for Hornbeck Offshore Services. When it's expensive and time-consuming for Hornbeck to change to a different provider for essential vessel parts or upkeep, those suppliers gain leverage. For instance, in 2024, the maritime industry saw continued supply chain complexities, meaning specialized components for offshore vessels often have limited suppliers, making any transition costly.

Suppliers who possess unique technologies or highly specialized skills in building and maintaining offshore vessels can negotiate for higher prices. Hornbeck Offshore Services, in its drive for cutting-edge vessels, likely depends on these specialized suppliers, thus increasing their bargaining power.

Impact of Raw Material Price Volatility

The bargaining power of suppliers for Hornbeck Offshore Services is significantly influenced by the volatility of raw material prices. Suppliers of essential inputs like steel and specialized electronic components are exposed to global commodity market fluctuations. For instance, steel prices saw considerable upward pressure in early 2024 due to increased demand from infrastructure projects and ongoing supply chain disruptions, directly impacting the cost of building and maintaining offshore vessels.

These price swings can be directly passed on to Hornbeck Offshore, leading to higher operational expenditures. This ability of suppliers to dictate terms and prices effectively strengthens their position in negotiations. As of mid-2024, the cost of high-grade steel suitable for offshore construction had risen by approximately 8-12% compared to the previous year, a factor that directly impacts Hornbeck's capital expenditure budgets and project profitability.

- Global commodity markets directly affect the cost of key inputs like steel.

- Suppliers can pass on price increases, raising Hornbeck Offshore's operational costs.

- Steel prices in early 2024 experienced an estimated 8-12% increase year-over-year, impacting vessel construction costs.

Labor and Skilled Workforce Shortages

The specialized nature of offshore vessel operations and maintenance demands a highly skilled workforce, including marine engineers and experienced crew. Shortages in this labor pool can lead to increased wages and associated costs, thereby amplifying the bargaining power of labor suppliers for companies like Hornbeck Offshore Services.

- Skilled Workforce Demand: The offshore energy sector, particularly for complex vessel operations, requires specialized expertise that is not readily available.

- Wage Inflation: In 2024, reports indicated persistent wage pressures in maritime and offshore industries due to these skill gaps, directly impacting operational expenses.

- Impact on Costs: Higher labor costs translate to increased operating expenses for Hornbeck Offshore Services, potentially squeezing profit margins if not managed effectively.

The bargaining power of suppliers for Hornbeck Offshore Services is considerable due to the specialized nature of offshore vessel components and services. Limited suppliers for advanced systems and high switching costs for Hornbeck mean suppliers can dictate terms. For instance, in 2024, continued supply chain issues in the maritime sector meant sourcing specialized parts for offshore vessels remained challenging, reinforcing supplier leverage.

Suppliers with proprietary technology or unique expertise in offshore vessel manufacturing and maintenance command higher prices, impacting Hornbeck's acquisition and upgrade costs. Furthermore, volatility in raw material markets, such as the 8-12% increase in high-grade steel prices observed in early 2024, directly translates to higher input costs for suppliers, which are often passed on to Hornbeck Offshore, affecting project profitability and operational expenditures.

| Factor | Impact on Hornbeck Offshore | 2024 Data/Trend |

|---|---|---|

| Specialized Components | Limited supplier options increase leverage | Continued supply chain complexities in maritime |

| High Switching Costs | Difficult and expensive to change providers | N/A (inherent to specialized equipment) |

| Unique Technology/Skills | Suppliers can command premium pricing | Essential for cutting-edge vessel capabilities |

| Raw Material Volatility (Steel) | Increased input costs for suppliers, passed to Hornbeck | 8-12% price increase for high-grade steel YoY |

What is included in the product

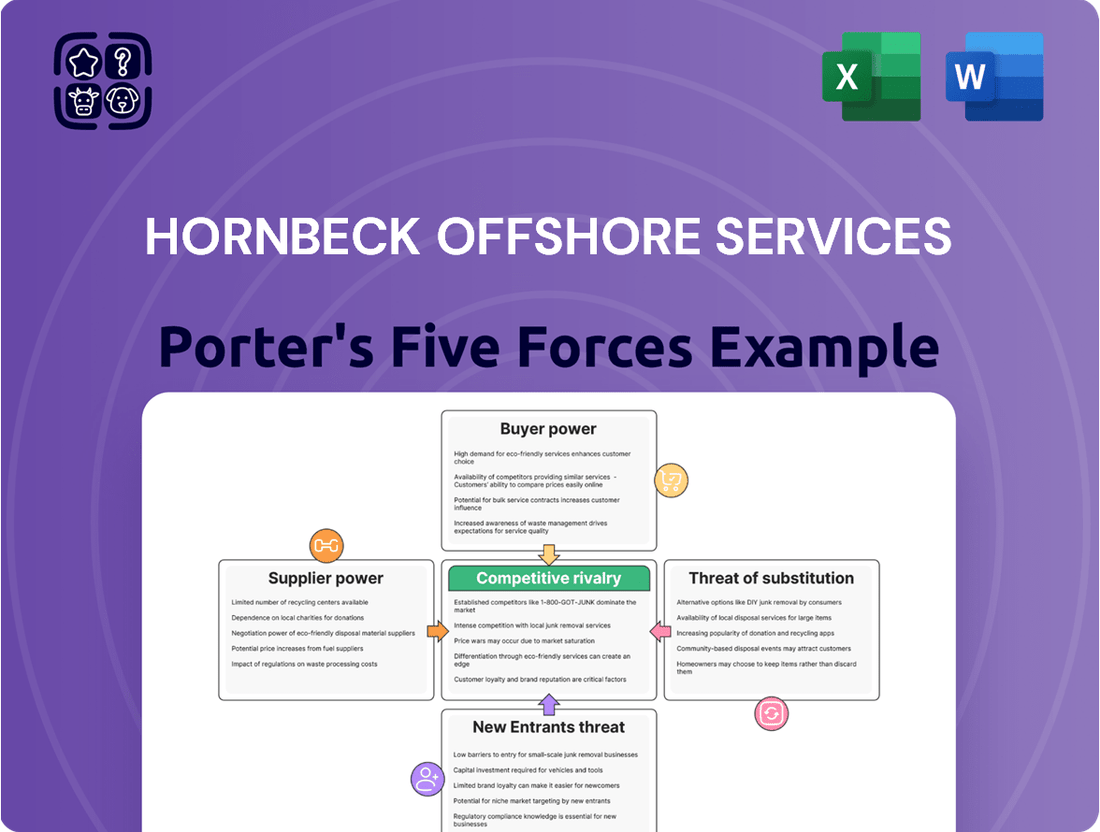

This Porter's Five Forces analysis for Hornbeck Offshore Services meticulously examines the competitive intensity within the offshore service vessel industry, detailing the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the rivalry among existing players.

Instantly assess competitive intensity with a clear, visual breakdown of Hornbeck Offshore's Porter's Five Forces, simplifying complex market dynamics.

Customers Bargaining Power

Hornbeck Offshore Services' customer base is largely concentrated within the energy sector, featuring major integrated oil and gas companies and burgeoning offshore wind developers. These significant clients, undertaking massive projects and securing lengthy contracts, possess substantial leverage. Their consolidated demand allows them to negotiate aggressively on pricing and contract conditions, directly impacting Hornbeck's profit margins.

The profitability of offshore oil and gas exploration, and increasingly offshore wind projects, is directly tied to energy prices. When oil and gas markets experience downturns, or when financing for renewable projects becomes more constrained, the customers' focus sharpens on cost efficiency.

This heightened price sensitivity significantly amplifies the bargaining power of customers. They are more inclined to negotiate for lower vessel charter rates, directly impacting the pricing power of companies like Hornbeck Offshore Services.

For instance, in early 2024, fluctuating oil prices, hovering around the $80-$90 per barrel range for Brent crude, created a dynamic where charter rates for offshore support vessels were under pressure from exploration and production companies seeking to optimize their project economics.

While Hornbeck Offshore Services (HOS) specializes in high-specification vessels, customers can still find alternatives from other offshore support vessel (OSV) and multipurpose supply vessel (MPSV) providers, particularly for less demanding operations. This availability of choice, even for niche services, can give customers leverage in price and service negotiations.

Market conditions significantly impact this bargaining power. For instance, during periods of high fleet utilization and limited vessel availability, customers may find their options constrained, reducing their negotiating strength. Conversely, an oversupplied market with low utilization rates empowers customers by offering more choices and competitive pricing.

Long-term Contracts and Strategic Partnerships

Hornbeck Offshore Services frequently secures long-term contracts, a strategy that offers predictable revenue streams but simultaneously empowers its larger clients. These extended agreements allow major customers to leverage their commitment for more favorable pricing and service conditions over the contract's duration, effectively enhancing their bargaining power.

Furthermore, the formation of strategic partnerships can amplify customer influence. By aligning interests with key clients, Hornbeck may find its operational flexibility somewhat constrained, as these partnerships can necessitate adherence to mutually agreed-upon terms that might not always align with the company's broader strategic objectives or market opportunities.

- Revenue Stability vs. Negotiating Leverage: Long-term contracts provide a predictable revenue base for Hornbeck Offshore, but also grant significant negotiating leverage to its major clients over extended periods.

- Customer Entrenchment through Partnerships: Strategic alliances can further solidify customer power by creating intertwined interests and potentially limiting Hornbeck's ability to pivot or adjust terms independently.

- Impact on Flexibility: The commitment inherent in long-term deals and partnerships can reduce Hornbeck's agility in responding to changing market dynamics or pursuing alternative business avenues.

Customer Demand for Specialized Services

Customers are increasingly seeking specialized offshore services beyond simple vessel chartering. This includes demand for complex operations like subsea construction support, detailed inspection, ongoing maintenance, and critical infrastructure development for the offshore wind sector. For instance, the offshore wind market, projected to see significant growth, requires highly specialized vessels and services.

Hornbeck Offshore Services' strategic shift to offer these advanced capabilities, such as their investment in Service Operation Vessels (SOVs) for offshore wind projects, directly addresses this evolving customer need. By providing these niche, high-value services, Hornbeck can differentiate itself, thereby diminishing the bargaining power of customers who might otherwise switch to competitors offering less specialized solutions.

- Specialized Service Demand: Offshore clients now require advanced support for subsea construction, inspection, maintenance, and offshore wind projects.

- Hornbeck's SOV Strategy: The company's investment in SOVs for offshore wind demonstrates a commitment to meeting these specialized demands.

- Reducing Customer Power: By offering unique, high-value services, Hornbeck can lessen customer leverage and secure more favorable terms.

Hornbeck Offshore Services' customers, primarily major energy companies and offshore wind developers, wield significant bargaining power due to their concentrated demand and ability to negotiate favorable terms. This leverage is amplified during periods of market downturns or when financing for renewable projects is tight, pushing customers to prioritize cost efficiency and seek lower charter rates.

While Hornbeck offers specialized vessels, the availability of alternative providers, especially for less demanding operations, gives customers options to negotiate on price and service. Market conditions, such as fleet utilization rates, also play a crucial role; an oversupplied market empowers customers with more choices and better pricing.

Long-term contracts, while providing revenue stability for Hornbeck, also grant substantial negotiating leverage to its large clients over the contract's life. Strategic partnerships can further entrench customer influence, potentially limiting Hornbeck's operational flexibility.

The increasing demand for specialized services, like subsea construction support and offshore wind infrastructure development, presents an opportunity for Hornbeck to reduce customer bargaining power by offering unique, high-value solutions, such as its investment in Service Operation Vessels (SOVs).

| Customer Segment | Key Bargaining Factors | Impact on Hornbeck |

|---|---|---|

| Major Oil & Gas Companies | Project economics, oil price sensitivity, alternative vessel providers | Pressure on charter rates, contract terms |

| Offshore Wind Developers | Project financing, specialized vessel needs, long-term commitments | Negotiating leverage for specialized services, potential for partnership constraints |

| General Market Conditions | Fleet utilization, vessel availability, supply/demand balance | Empowers customers in oversupplied markets, reduces leverage when fleet is highly utilized |

What You See Is What You Get

Hornbeck Offshore Services Porter's Five Forces Analysis

This preview showcases the complete Hornbeck Offshore Services Porter's Five Forces Analysis, providing a detailed examination of the competitive landscape within the offshore support vessel industry. You're looking at the actual document, which will be available for immediate download upon purchase, ensuring you receive a professionally formatted and ready-to-use analysis. This comprehensive document will equip you with a thorough understanding of the forces shaping Hornbeck Offshore's strategic environment.

Rivalry Among Competitors

The offshore support vessel market, especially in the U.S. Gulf of Mexico and Latin America, is quite crowded with strong competitors. Companies like SEACOR Marine, Tidewater, and Harvey Gulf are major players, each vying for contracts and a bigger slice of the market. This means Hornbeck Offshore Services faces significant pressure from these established rivals.

The offshore vessel services industry, including companies like Hornbeck Offshore Services, is inherently capital-intensive. The significant upfront investment in acquiring and maintaining specialized vessels, coupled with ongoing crewing expenses, creates substantial fixed costs. For instance, a modern offshore support vessel (OSV) can cost tens of millions of dollars to build.

These high fixed costs necessitate high fleet utilization rates to achieve profitability. Companies are driven to keep their vessels operating as much as possible to spread these costs over more revenue-generating days. This pressure to maximize utilization often leads to aggressive pricing strategies and intense competition, particularly when the market experiences an oversupply of vessels.

In 2024, the OSV market continued to grapple with the balance between demand and supply. While activity in offshore exploration and production picked up, the existing fleet size meant that achieving optimal utilization remained a challenge for many operators. This dynamic fuels price competition as companies vie for contracts to ensure their assets remain productive and cover their considerable fixed overheads.

Hornbeck Offshore Services (HOS) actively competes by showcasing its advanced fleet, featuring new-generation Offshore Support Vessels (OSVs) and Multi-Purpose Support Vessels (MPSVs). These vessels are equipped with sophisticated dynamic positioning systems and enhanced operational capabilities, setting them apart from older, less specialized tonnage.

This emphasis on technological superiority and specialized services allows HOS to sidestep intense price wars common in the market for basic offshore support. However, it concentrates competition among operators offering similar high-spec, modern solutions, creating a more demanding environment for innovation and service quality within this premium segment.

Geographic Focus and Regional Competition

Hornbeck Offshore Services primarily operates within the U.S. Gulf of Mexico and Latin America. However, its competitors may possess stronger footholds or different strategic advantages in these or other geographic areas, intensifying rivalry. For instance, while Hornbeck is a significant player in the U.S. Gulf, international operators might be more dominant in Latin American markets.

The intensity of competition is further shaped by regional market dynamics. Local demand for offshore support vessels and the specific regulatory landscapes, such as the Jones Act which mandates U.S. flag, U.S. built, U.S. crewed vessels for certain domestic trade, significantly impact how companies compete. These regional factors create varied competitive pressures across Hornbeck's operating areas.

- Regional Strengths of Competitors: Competitors may have concentrated strengths in specific regions, leading to more intense localized rivalry.

- Influence of Local Demand: Varying levels of demand for offshore services in different geographic areas directly affect competitive pressures.

- Regulatory Impact (Jones Act): The Jones Act provides a competitive advantage for U.S.-flagged vessels in U.S. waters, influencing the competitive landscape for Hornbeck and its domestic rivals.

- Latin American Market Dynamics: Competition in Latin America can differ due to distinct economic conditions, regulatory frameworks, and the presence of local or international service providers.

Industry Consolidation and Acquisitions

The offshore support vessel (OSV) market has experienced significant consolidation. For instance, in 2023, Hornbeck Offshore Services (HOS) continued its strategy of acquiring vessels, including purchasing a fleet from a competitor, which bolstered its market share and operational capacity.

These strategic acquisitions reshape the competitive dynamics by reducing the number of independent OSV providers. This trend can lead to a more concentrated market, potentially increasing the bargaining power of larger, consolidated entities.

- Market Concentration: Consolidation reduces the number of OSV operators, potentially leading to fewer, larger players.

- Acquisition Activity: Companies like Hornbeck Offshore have actively acquired vessels, demonstrating a trend towards market consolidation.

- Competitive Landscape Shift: Acquisitions can alter market share distribution and influence pricing power among remaining competitors.

The offshore support vessel market is characterized by intense rivalry among established players like SEACOR Marine and Tidewater, particularly in key regions such as the U.S. Gulf of Mexico. Hornbeck Offshore Services (HOS) faces constant pressure from these competitors who also operate significant fleets and compete for the same contracts. This competitive environment is further shaped by the capital-intensive nature of the industry, where high fixed costs drive utilization and can lead to aggressive pricing, especially when vessel supply outstrips demand.

In 2024, the market continued to see a dynamic interplay between demand recovery and fleet capacity, with companies like HOS leveraging their modern, high-specification vessels to differentiate themselves. However, even with specialized fleets, competition remains fierce, particularly among those offering similar advanced solutions. Market consolidation, exemplified by HOS's own acquisition activities, is also reshaping the competitive landscape, leading to fewer, larger operators and potentially altering market power dynamics.

| Competitor | Key Regions | Fleet Size (Approx. 2024) | Notes |

|---|---|---|---|

| SEACOR Marine | U.S. Gulf of Mexico, International | ~100+ vessels | Diversified fleet, strong presence in offshore and marine support. |

| Tidewater | Global (significant in U.S. Gulf, West Africa) | ~60+ vessels | One of the largest OSV operators globally, focusing on efficiency. |

| Harvey Gulf International Marine | U.S. Gulf of Mexico | ~40+ vessels | Known for its focus on new builds and specialized vessels, including LNG-powered options. |

SSubstitutes Threaten

While alternative transportation methods like helicopters for personnel or pipelines for certain supplies exist, their ability to substitute for offshore supply vessels (OSVs) is limited. For instance, in 2024, the global offshore oil and gas support vessel market, which includes OSVs, was valued at approximately $28 billion, highlighting the significant demand for these specialized vessels.

The growing trend of shifting energy production from deepwater offshore fields to onshore shale or nearshore conventional fields poses a significant threat of substitution for Hornbeck Offshore Services (HOS). This transition directly impacts the demand for offshore support vessels (OSVs) and multipurpose platform supply vessels (MPSVs) that HOS specializes in. For instance, the U.S. Energy Information Administration (EIA) reported that crude oil production from onshore shale plays, particularly in the Permian Basin, continued to surge through 2024, often outpacing deepwater output growth.

This strategic pivot by energy companies, driven by factors like reduced exploration costs and quicker return on investment in onshore operations, effectively diminishes the need for the specialized, high-cost services HOS provides in deepwater environments. As more capital is allocated to these accessible reserves, the market for large, sophisticated offshore vessels could contract, presenting a clear substitute for the services HOS offers, potentially leading to lower utilization rates and pricing pressure.

Technological advancements in remote operations present a significant threat of substitution for Hornbeck Offshore Services. As autonomous underwater vehicles (AUVs) and remotely operated vehicles (ROVs) become more sophisticated, they can increasingly perform tasks traditionally requiring manned support vessels, such as subsea inspection, maintenance, and construction. This shift directly impacts the demand for Hornbeck's offshore support vessels.

Focus on Renewable Energy Sources

The accelerating global shift towards renewable energy presents a significant threat of substitution for Hornbeck Offshore Services. While the company is strategically positioning itself within the offshore wind sector, a swift and comprehensive move away from fossil fuels, especially towards onshore renewable solutions, could fundamentally diminish the demand for traditional offshore support vessels (OSVs) that service the oil and gas industry.

This transition is not a distant possibility but a current trend. For instance, in 2024, global investment in renewable energy sources is projected to reach record highs, with offshore wind alone expected to see substantial growth. This increasing reliance on alternatives directly substitutes the need for the services Hornbeck has historically provided.

- Threat of Substitutes: Renewable Energy Sources

- Impact on Traditional OSV Demand: A rapid global transition to renewables, particularly onshore solar and wind, directly reduces the need for OSVs servicing offshore oil and gas exploration and production.

- Market Shift: As of 2024, investments in renewable energy are surging, with offshore wind projects expanding, creating a substitute market that diverts capital and operational focus away from traditional offshore energy sectors.

- Hornbeck's Adaptation: While Hornbeck is diversifying into offshore wind support, the pace of this transition and the continued dominance of onshore renewables pose a substantial risk to its legacy business model.

In-house Vessel Ownership by Energy Companies

Large energy companies, particularly those with significant offshore operations, may consider owning their own fleets of vessels. This strategic choice directly substitutes for the chartering services provided by companies like Hornbeck Offshore. For instance, in 2024, major integrated oil and gas companies continued to evaluate the cost-effectiveness of in-house fleet management versus outsourcing.

The decision hinges on factors such as the scale of operations, anticipated vessel utilization rates, and the desire for greater control over logistics and asset deployment. Companies like ExxonMobil and Shell, with substantial deepwater projects, possess the capital and expertise to manage their own vessel fleets, thereby reducing reliance on third-party charterers.

- Capital Investment: Acquiring and maintaining a fleet requires significant upfront capital, a barrier for smaller players but manageable for majors.

- Operational Control: In-house ownership offers direct control over vessel scheduling, maintenance, and crew, potentially improving efficiency.

- Cost Analysis: Energy companies conduct detailed cost-benefit analyses, comparing the total cost of ownership and operation against charter rates.

- Strategic Alignment: For some, owning vessels aligns with a broader strategy of vertical integration and asset control.

The threat of substitutes for Hornbeck Offshore Services (HOS) is multifaceted, encompassing shifts in energy production, technological advancements, and the rise of renewable energy. The increasing focus on onshore shale production, as highlighted by the U.S. Energy Information Administration's 2024 data showing surging Permian Basin output, directly reduces demand for HOS's specialized deepwater vessels. Furthermore, advancements in autonomous underwater vehicles (AUVs) and remotely operated vehicles (ROVs) can perform tasks traditionally requiring manned OSVs, impacting service needs. The global pivot towards renewable energy, with substantial investments in offshore wind in 2024, creates an alternative market that diverts capital and focus from traditional oil and gas offshore activities.

| Substitute Category | Description | 2024 Relevance/Data Point |

|---|---|---|

| Onshore Energy Production | Shift from deepwater to accessible shale and nearshore fields | U.S. EIA data shows continued surge in Permian Basin (onshore) crude oil production through 2024. |

| Advanced Robotics (AUVs/ROVs) | Performing subsea inspection, maintenance, and construction tasks | Increasing sophistication allows for greater automation, reducing need for manned support vessels. |

| Renewable Energy Sector | Growth in offshore wind and onshore renewables | Global investment in renewables projected to reach record highs in 2024; offshore wind expansion is significant. |

| In-house Vessel Ownership | Large energy companies managing their own fleets | Major integrated oil and gas companies (e.g., ExxonMobil, Shell) continue to evaluate cost-effectiveness of in-house fleet management in 2024. |

Entrants Threaten

Entering the offshore support vessel (OSV) market demands immense capital, with new, high-specification vessels costing tens of millions of dollars each. For instance, a modern, advanced PSV (Platform Supply Vessel) can easily exceed $50 million. This substantial upfront investment in acquiring or constructing these specialized, costly assets presents a formidable barrier, deterring many potential new players from entering Hornbeck Offshore Services' competitive landscape.

The offshore services industry is a minefield of regulations, especially concerning safety and environmental protection. For instance, operating in the U.S. Gulf of Mexico often requires adherence to the Jones Act, a complex piece of legislation. New companies must navigate these intricate rules, which demand significant investment in compliance and can be a major barrier to entry.

Hornbeck Offshore Services benefits significantly from its deep-rooted customer relationships, particularly with major energy players involved in deepwater and complex projects. These established connections, built over years of reliable service, create a formidable barrier for any potential new entrants aiming to break into the market.

The trust and reputation Hornbeck has cultivated are not easily replicated. New companies would face a considerable challenge in convincing these sophisticated clients to shift from a proven, long-term partner to an unproven entity, especially given the high stakes and capital intensity of offshore operations.

Access to Skilled Labor and Expertise

The offshore services industry, including companies like Hornbeck Offshore Services, relies heavily on a specialized and experienced workforce. Operating and maintaining advanced offshore vessels requires highly skilled crews, engineers, and technical personnel. New entrants would find it difficult to attract and keep this crucial talent, especially given the competitive nature of the industry.

For instance, in 2024, the demand for experienced maritime professionals remained robust, with many specialized roles experiencing shortages. This scarcity directly impacts the ability of new companies to quickly build a competent operational team, a significant barrier to entry.

- High Demand for Specialized Maritime Skills: The offshore sector requires certified and experienced personnel for vessel operation, maintenance, and specialized services.

- Recruitment and Retention Challenges: New entrants face significant hurdles in attracting and retaining skilled crews and technical experts due to established players and the global nature of talent acquisition.

- Training and Certification Costs: The extensive training and certification required for offshore personnel represent a substantial upfront investment for any new market participant.

Economies of Scale and Fleet Size

Existing players in the offshore vessel market, such as Hornbeck Offshore Services, leverage significant economies of scale derived from their substantial fleet sizes. This scale allows for greater operational efficiencies, more favorable terms on maintenance contracts, and optimized utilization of resources, all of which contribute to lower per-unit costs.

For new entrants, achieving a comparable scale to effectively compete on cost presents a formidable barrier. Without a similarly large fleet, new companies would struggle to match the cost advantages enjoyed by established operators like Hornbeck, making it difficult to undercut pricing and gain market share.

- Economies of Scale: Hornbeck Offshore, with its extensive fleet, benefits from reduced per-unit operating costs due to bulk purchasing of supplies and more efficient crew deployment.

- Fleet Size Advantage: As of early 2024, Hornbeck Offshore operates a diverse fleet of over 60 vessels, providing a significant competitive edge in terms of capacity and service breadth.

- Cost Competition Barrier: New entrants would need substantial capital investment to build or acquire a fleet of comparable size, a prerequisite for achieving cost competitiveness against established players.

- Operational Efficiency: Larger fleets enable better scheduling, reduced downtime through in-house maintenance capabilities, and optimized logistics, all contributing to a lower cost structure.

The threat of new entrants for Hornbeck Offshore Services is relatively low due to several significant barriers. The sheer capital required to build or acquire modern offshore support vessels, often exceeding $50 million per vessel, is a major deterrent. Navigating complex regulatory environments and securing necessary certifications also demands substantial investment and expertise.

Established customer relationships and a strong reputation for reliability, which Hornbeck possesses, are difficult for newcomers to replicate. Furthermore, the industry's reliance on a specialized and experienced workforce, facing shortages in 2024, makes it challenging for new companies to assemble competent teams quickly. Finally, the economies of scale enjoyed by large operators like Hornbeck, which boasts a fleet of over 60 vessels as of early 2024, create a significant cost advantage that new entrants would struggle to match.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High cost of new, specialized vessels (e.g., >$50M for advanced PSVs) | Significant financial hurdle, limiting the number of potential entrants. |

| Regulatory Hurdles | Complex safety, environmental, and operational regulations (e.g., Jones Act) | Requires substantial investment in compliance and legal expertise. |

| Customer Relationships & Reputation | Established trust with major energy players | New entrants face difficulty displacing proven, long-term partners. |

| Skilled Workforce Availability | Shortage of experienced maritime professionals (noted in 2024) | Challenges in recruiting and retaining essential operational talent. |

| Economies of Scale | Large fleet size (Hornbeck operates >60 vessels) leads to lower per-unit costs | New entrants struggle to compete on price without comparable scale. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Hornbeck Offshore Services is built upon a foundation of publicly available financial data, including SEC filings and annual reports. This is supplemented by industry-specific market research from reputable firms and insights from trade publications.