Hornbeck Offshore Services Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hornbeck Offshore Services Bundle

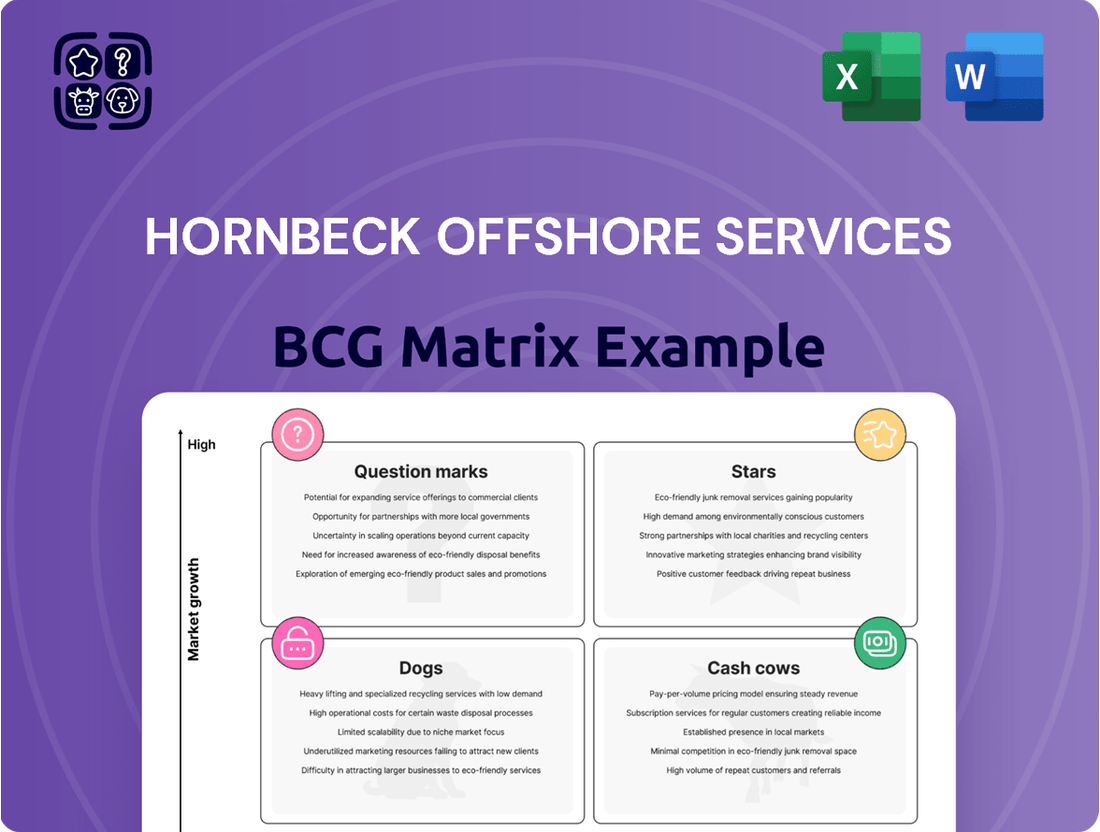

Hornbeck Offshore Services' BCG Matrix offers a crucial lens into its diverse fleet, highlighting which vessels are driving growth and which may require strategic reallocation. Understanding these dynamics is key to navigating the competitive offshore market.

This preview offers a glimpse into the strategic positioning of Hornbeck Offshore's assets. For a comprehensive analysis of their Stars, Cash Cows, Dogs, and Question Marks, along with actionable insights to optimize your investment and operational strategies, unlock the full BCG Matrix report today.

Stars

Hornbeck Offshore's high-specification deepwater OSVs are a dominant force in the demanding U.S. Gulf of Mexico deepwater exploration and production sector. These specialized vessels, equipped with advanced dynamic positioning and designed for efficiency, are crucial for complex deep-well projects. Their strong market position and the growing need for deepwater services translate into significant revenue generation for the company.

Hornbeck Offshore Services' Multi-Purpose Support Vessels (MPSVs), including the upcoming HOS Warhorse and HOS Wild Horse slated for 2025, are key growth drivers. These advanced vessels boast features like active heave-compensation cranes and remotely operated vehicles (ROVs), enabling them to tackle complex subsea construction, inspection, and maintenance tasks. Their dual capability to serve both traditional oil and gas operations and the burgeoning offshore wind sector, coupled with their Jones Act compliance, positions them for substantial market expansion and demand.

Hornbeck Offshore Services' U.S. Jones Act-qualified fleet is a clear star in its BCG matrix. A significant portion of its vessels meet these stringent U.S. maritime requirements, giving them a major edge in the protected domestic market. This qualification allows them to exclusively serve U.S. offshore projects, from traditional oil and gas exploration to the rapidly growing offshore wind sector, effectively shielding them from foreign flag competition.

Offshore Wind Support Vessels (SOV Conversion)

Hornbeck Offshore Services is strategically positioning itself in the burgeoning offshore wind sector through initiatives like the conversion of an Offshore Support Vessel (OSV) into a Service Operation Vessel (SOV). This move, exemplified by the HOS Rocinante, is a clear indication of their intent to capture a significant share of this high-growth market.

The HOS Rocinante, slated for delivery in spring 2025, is designed with advanced capabilities specifically tailored for the demands of offshore wind farm construction and maintenance. This specialized vessel will be equipped to support technicians and provide essential services directly at wind turbine sites.

- Market Entry: Hornbeck's conversion of an OSV to an SOV, the HOS Rocinante, marks a significant strategic entry into the U.S. offshore wind market.

- Growth Potential: This initiative aligns with the projected expansion of the offshore wind sector, which is expected to see substantial investment and development in the coming years.

- Vessel Specialization: The HOS Rocinante's design focuses on providing critical support services for offshore wind farms, including accommodation and logistics for technicians.

- Delivery Timeline: The vessel is anticipated to be delivered in spring 2025, positioning Hornbeck to capitalize on upcoming projects.

Technology-Advanced Fleet

Hornbeck Offshore Services' investment in a technology-advanced fleet, featuring enhanced dynamic positioning and superior fuel efficiency, clearly positions them as a potential star in the BCG matrix. This commitment to modern, capable vessels is vital for tackling complex offshore projects safely and effectively.

Their fleet modernization is not just about having new ships; it's about having the right tools for the job. For instance, in 2024, Hornbeck continued to focus on operating its younger, more technologically advanced vessels, which are better suited for the demanding conditions of deepwater exploration and production. This strategic focus on advanced technology allows them to command premium day rates and secure contracts in high-value segments of the market.

- Fleet Modernization: Hornbeck's fleet includes a significant proportion of new-generation vessels, designed for optimal performance and efficiency.

- Technological Edge: Features like advanced dynamic positioning systems (DP3) and improved fuel economy translate to operational advantages and cost savings.

- Market Capture: These advanced vessels are essential for high-demand offshore activities, enabling Hornbeck to capture a larger share of the evolving offshore energy market.

- Competitive Advantage: The integration of cutting-edge technology in their fleet provides a distinct competitive advantage in a challenging and dynamic industry.

Hornbeck Offshore's advanced deepwater vessels, particularly those built to U.S. Jones Act standards, are strong contenders for Star status. Their high-specification deepwater OSVs are dominant in the U.S. Gulf of Mexico, a sector requiring specialized, efficient vessels for complex projects. The company's strategic push into the offshore wind market with vessels like the HOS Rocinante, slated for spring 2025 delivery, further solidifies their Star potential by tapping into a high-growth industry.

Hornbeck's commitment to a technologically advanced and modern fleet, including vessels with advanced dynamic positioning and superior fuel efficiency, positions them as Stars. In 2024, the company continued to prioritize operating its newer, more capable vessels, which are crucial for demanding deepwater operations and command premium rates. This focus on cutting-edge technology provides a significant competitive edge in the offshore energy sector.

| Vessel Type | Key Features | Market Position | Growth Potential |

|---|---|---|---|

| Deepwater OSVs | High-specification, advanced dynamic positioning | Dominant in U.S. Gulf of Mexico deepwater | Strong, driven by complex well projects |

| Multi-Purpose Support Vessels (MPSVs) | Active heave-compensation cranes, ROVs | Key growth drivers, dual-use for oil/gas and wind | Substantial expansion expected |

| Service Operation Vessel (SOV) - HOS Rocinante | Specialized for offshore wind construction/maintenance | Strategic entry into high-growth sector | High, aligned with offshore wind expansion |

What is included in the product

Hornbeck Offshore's BCG Matrix analysis reveals strategic positioning of its vessel fleet, guiding investment decisions.

A clear BCG Matrix visually identifies Hornbeck Offshore's Stars and Cash Cows, relieving the pain of resource allocation uncertainty.

Cash Cows

Hornbeck Offshore Services' established U.S. Gulf of Mexico operations represent a classic cash cow within their business portfolio. These operations have been a consistent revenue generator for years, benefiting from a strong market presence and a loyal customer base in the offshore oil and gas sector.

Despite potentially slower market growth compared to newer ventures, the ongoing demand for essential services like supply and personnel transportation to offshore platforms provides a stable and predictable cash flow. For instance, in the first quarter of 2024, Hornbeck reported that its Gulf of Mexico vessel utilization rates remained robust, underscoring the consistent demand for their services in this mature market.

Hornbeck Offshore Services' long-term contracts for core offshore supply vessel services are a significant driver of its Cash Cow status. These agreements offer a predictable revenue stream, insulating the company from the volatility often seen in the spot market. For instance, in 2024, a substantial portion of their fleet operated under multi-year charters, ensuring consistent utilization rates.

Hornbeck Offshore Services' maintenance and logistics support services function as a classic Cash Cow within the BCG Matrix. These operations, including general logistics, standby safety, and routine platform upkeep, generate a reliable and steady income stream. This stability is crucial as these services are fundamental to keeping existing offshore operations running smoothly, irrespective of new exploration ventures.

The recurring nature of these essential support activities ensures consistent profitability for Hornbeck. For instance, in 2024, the company continued to leverage its fleet of vessels for these vital services, contributing significantly to its operational revenue. This segment benefits from the ongoing need for offshore infrastructure maintenance, providing a predictable revenue base.

Leveraging Existing Infrastructure and Expertise

Hornbeck Offshore Services' established shore-base and operational expertise, especially in the U.S. Gulf of Mexico, are key to their Cash Cow status. This allows for highly efficient and cost-effective service delivery, as evidenced by their strong market position in this region.

Their extensive experience in marine transportation and offshore support services significantly reduces operational risks. This deep knowledge base translates directly into maximized profit margins for their core offerings.

The company's existing infrastructure serves as a robust foundation, enabling them to generate consistent cash flow from their established operations. This infrastructure is a significant competitive advantage.

- Established U.S. Gulf of Mexico Presence: Hornbeck Offshore has a dominant footprint in a mature but stable market.

- Operational Efficiency: Leveraging existing infrastructure minimizes overhead and optimizes service delivery costs.

- Reduced Risk Profile: Deep expertise in offshore support services leads to fewer operational disruptions and higher profitability.

- Consistent Cash Flow Generation: The stability of their core services allows for predictable and reliable cash generation.

Government Contracts (e.g., U.S. Navy)

Hornbeck Offshore Services' contracts with the U.S. Navy represent a significant Cash Cow. These agreements, which involve operating and maintaining specialized vessels, generate a consistent and substantial revenue stream. For instance, a key contract is anticipated to extend through the 2025-2026 period, underscoring its long-term stability.

This diversification away from the more volatile commercial oil and gas sector provides Hornbeck with enhanced cash flow consistency. The military support services segment acts as a stable anchor, contributing reliably to the company's overall financial health.

- Consistent Revenue: U.S. Navy contracts offer predictable income, unlike fluctuating commercial markets.

- Long-Term Stability: Contracts extending into 2025-2026 provide a secure revenue base.

- Reduced Cyclicality: Military support services insulate cash flow from oil and gas market volatility.

- Enhanced Cash Flow: This segment bolsters the overall consistency of Hornbeck's financial performance.

Hornbeck Offshore Services' established U.S. Gulf of Mexico operations, along with its U.S. Navy contracts, function as prime examples of Cash Cows within the BCG Matrix. These segments benefit from stable demand and long-term agreements, ensuring consistent revenue generation. For instance, in Q1 2024, Hornbeck reported robust vessel utilization rates in the Gulf of Mexico, a testament to the enduring demand in this mature market.

| Segment | Market Growth | Relative Market Share | Cash Flow Generation | Strategic Implication |

|---|---|---|---|---|

| U.S. Gulf of Mexico Operations | Low | High | High & Stable | Maintain and harvest profits. |

| U.S. Navy Contracts | Low | High | High & Stable | Maintain and harvest profits. |

Full Transparency, Always

Hornbeck Offshore Services BCG Matrix

The Hornbeck Offshore Services BCG Matrix you are previewing is the definitive document you will receive upon purchase, offering a complete, unwatermarked analysis ready for immediate strategic application. This comprehensive report, meticulously crafted with industry-specific data, will be delivered directly to you without any demo content or alterations. You are seeing the exact, fully formatted BCG Matrix that will empower your decision-making, providing actionable insights into Hornbeck Offshore's business units. Once purchased, this professional-grade analysis is instantly downloadable, allowing you to seamlessly integrate it into your planning and presentations.

Dogs

While Hornbeck Offshore Services (HOS) focuses on its modern fleet, some older or less specialized offshore supply vessels (OSVs) could be considered Dogs in a BCG matrix analysis. These vessels might experience low utilization rates, making it difficult to compete with newer, more technologically advanced ships.

These older assets often come with higher maintenance expenses and command lower daily charter rates, thus contributing little to the company's overall profitability. For instance, if a significant portion of HOS's older OSVs are consistently underutilized, their contribution to revenue could be marginal.

Given their limited market share and dim growth prospects, strategies like divestment or strategic stacking might be appropriate for these underperforming vessels. This approach allows HOS to reallocate resources to more promising segments of its fleet.

Vessels within Hornbeck Offshore Services' fleet that demand substantial and expensive upkeep, resulting in extended periods of inactivity, would likely fall into the 'Dogs' category of the BCG Matrix. These assets often carry high operational expenses without the benefit of robust market demand or competitive day rates, which can significantly diminish profitability. For instance, if a particular offshore support vessel (OSV) class experienced a fleet-wide average downtime of 20% in 2024 due to recurring mechanical issues, and its average daily charter rate was only $15,000 compared to the industry average of $25,000 for similar vessels, it would represent a classic 'Dog'.

Hornbeck Offshore Services might classify certain vessels as dogs if they operate in highly specialized, niche markets where competition is fierce and their own market share is negligible. The significant investment in resources and personnel to maintain a competitive edge in these low-return segments may not be strategically sound, especially if these areas don't fit the company's broader focus on high-specification, growth-oriented assets.

Non-Core, Low-Demand Geographic Areas

Hornbeck Offshore Services might classify operations in non-core, low-demand geographic areas as dogs within its BCG matrix. These are regions where the company's market share is minimal and growth prospects are dim, making them less strategic than areas like the U.S. Gulf of Mexico or Latin America. Continued investment in these dog segments may not yield significant returns.

A strategic assessment of Hornbeck's geographical footprint is crucial to identify these underperforming areas. For instance, if Hornbeck has a very small presence in a particular European market with limited offshore activity, it could be categorized as a dog. Such segments might require divestment or a significant restructuring to become viable.

- Low Market Share: Operations in geographic areas where Hornbeck holds a negligible market share.

- Limited Growth Potential: Regions exhibiting minimal or no expected future demand for offshore support vessels.

- Strategic Review Needed: A formal evaluation of these areas to determine their future role in Hornbeck's portfolio.

Legacy Assets from Acquisitions Not Meeting Current Standards

Legacy assets from acquisitions that don't align with Hornbeck Offshore Services' current high-spec or new generation fleet standards, especially those with limited upgrade potential, would likely be classified as Dogs in a BCG Matrix analysis. These vessels may face challenges in securing contracts as the market increasingly prioritizes advanced capabilities and efficiency.

The continued operation of these underperforming assets could potentially dilute the overall fleet's efficiency and profitability, impacting the company's financial performance. For instance, older vessels might command lower day rates compared to newer, more technologically advanced ones, affecting revenue generation. In 2023, the offshore vessel market saw varied performance, with demand for high-spec vessels generally outstripping supply, putting pressure on older, less capable units.

- Limited Contract Viability: Vessels not meeting current industry specifications struggle to secure lucrative, long-term contracts.

- Lower Day Rates: Legacy assets typically command significantly lower day rates than their modern counterparts.

- Operational Inefficiencies: Older vessels may have higher maintenance costs and lower fuel efficiency, impacting profitability.

- Fleet Dilution: Their presence can reduce the average performance metrics of the entire Hornbeck fleet.

Vessels within Hornbeck Offshore Services' fleet that are older, less specialized, or operate in niche markets with low demand and high competition are likely classified as Dogs. These assets often have low utilization, high maintenance costs, and command lower charter rates, negatively impacting overall profitability.

For example, if a specific class of older offshore supply vessels (OSVs) in HOS's fleet had an average utilization rate of only 40% in 2024, compared to the company's average fleet utilization of 75%, and generated less than 5% of total revenue, they would fit the Dog profile.

Strategies such as divestment or strategic stacking are often considered for these underperforming assets to free up capital and resources for more profitable segments of the fleet.

Hornbeck Offshore Services' older, less efficient vessels, particularly those not meeting the industry's increasing demand for high-specification tonnage, would fall into the Dog category. These assets struggle to secure competitive charter rates and often incur higher operating expenses, diminishing their contribution to profitability.

| Vessel Type | Estimated 2024 Utilization | Estimated 2024 Daily Rate | Fleet Segment |

|---|---|---|---|

| Older OSV (e.g., 10+ years) | 40% | $12,000 | Dog |

| Mid-Spec OSV (e.g., 5-10 years) | 70% | $18,000 | Cash Cow/Question Mark |

| High-Spec OSV (e.g., <5 years) | 85% | $25,000 | Star |

Question Marks

Hornbeck Offshore Services' strategic consideration of expansion into new international markets places it in the question mark category of the BCG matrix. These ventures are characterized by high growth potential but also by a currently low market share for Hornbeck.

Significant capital investment will be necessary to build brand recognition and operational capacity in these nascent markets, making the return on investment uncertain. For instance, as of the first quarter of 2024, Hornbeck reported a total fleet of 46 vessels, with a substantial portion dedicated to its core U.S. operations, indicating a need for careful resource allocation for international expansion.

Hornbeck Offshore Services exploring new specialized vessel types beyond their established OSV and MPSV lines represents a classic question mark. These ventures target high-growth, emerging markets, but demand significant R&D investment and initial market penetration, likely starting with a low market share.

For instance, if Hornbeck were to develop advanced subsea construction vessels or highly specialized pipeline support vessels, they would need to contend with established players and demonstrate clear technological advantages. The success of such a move hinges on rapid market adoption and effective differentiation, as seen in the offshore wind installation vessel market, which saw significant investment and rapid technological evolution in the early 2020s, with companies like Cadeler securing major contracts.

Hornbeck Offshore Services' early-stage involvement in broader offshore wind construction support, especially in emerging U.S. markets, presents a question mark within its BCG portfolio. While the offshore wind sector promises substantial growth, Hornbeck's current market penetration in these nascent construction niches may be limited, necessitating considerable capital outlay to establish a stronger foothold.

This segment's high growth potential is tempered by the inherent uncertainties of long offshore wind project development cycles. For instance, the U.S. offshore wind pipeline, while expanding, faces regulatory hurdles and supply chain challenges that can impact project timelines and the demand for support vessels.

Diversification into Non-Energy Maritime Services

Hornbeck Offshore Services' diversification into non-energy maritime services, such as humanitarian aid, disaster relief, aerospace, or telecommunications support, represents a strategic question mark. These emerging sectors offer significant growth potential for specialized marine capabilities, but Hornbeck's current market penetration and established presence within these specific niches are likely nascent. This necessitates considerable investment in marketing and operational development to build market share and achieve meaningful returns.

These new ventures require substantial upfront capital for fleet adaptation, specialized equipment, and personnel training. For instance, entering the humanitarian aid sector might involve retrofitting vessels for cargo and passenger transport in challenging environments, a process that could cost millions per vessel. The company's ability to secure contracts in these competitive, often government- or NGO-driven markets remains a key uncertainty, impacting future revenue streams.

- Market Entry Costs: Significant investment is needed to adapt existing vessels or acquire new ones suitable for non-energy maritime roles.

- Competitive Landscape: These sectors often feature established players and require building new relationships and trust.

- Revenue Uncertainty: Contract awards in humanitarian aid or disaster relief can be sporadic and depend on global events.

Investments in Decarbonization Technologies for Existing Fleet

Investments in decarbonization technologies for Hornbeck Offshore's existing fleet present a classic question mark scenario. While the long-term imperative for environmental sustainability is clear, the substantial upfront capital required for retrofitting vessels with alternative fuels or hybrid systems, especially without immediate regulatory mandates or widespread market demand for 'green' vessel premiums, introduces considerable uncertainty.

This high-growth trend in maritime decarbonization, projected to see significant expansion in the coming years, faces challenges in the near term regarding return on investment. For instance, the International Maritime Organization's (IMO) 2023 strategy aims to achieve net-zero greenhouse gas emissions by or around 2050, signaling a future shift that necessitates such investments. However, the immediate market acceptance and pricing power for vessels equipped with these technologies remain subjects of speculation, leading to potentially high capital demands with initially low returns.

- High Upfront Costs: Retrofitting existing vessels with technologies like methanol or ammonia fuel systems can involve millions of dollars per vessel, impacting immediate profitability.

- Uncertain ROI: The premium customers are willing to pay for greener operations is still developing, making the payback period for these investments unclear.

- Technological Maturity: While alternative fuel technologies are advancing rapidly, their widespread adoption and long-term reliability in offshore operations are still being proven.

- Market Adoption Pace: The speed at which the offshore industry embraces and mandates greener vessel specifications will directly influence the success of these investments.

Hornbeck Offshore Services' exploration into new geographic markets, such as potential expansion into the Asia-Pacific region, represents a classic question mark. These markets offer high growth potential, but Hornbeck's current market share is likely minimal, requiring substantial investment to build brand awareness and operational infrastructure.

The company's continued investment in advanced technologies for its existing fleet, aiming to enhance efficiency and environmental performance, also falls into the question mark category. While these upgrades could secure future contracts in an evolving industry, the immediate return on investment is uncertain, especially if market demand for these specific technological enhancements is not yet widespread. For example, the company's 2024 first quarter report indicated ongoing capital expenditures, a portion of which would be allocated to fleet modernization and efficiency improvements.

| Strategic Initiative | Market Growth Potential | Hornbeck's Current Market Share | Capital Investment Needs | Return Uncertainty |

|---|---|---|---|---|

| Asia-Pacific Market Entry | High | Low (Assumed) | High | High |

| Fleet Technology Upgrades | Moderate to High (for efficiency/environment) | N/A (Internal) | Moderate | Moderate |

BCG Matrix Data Sources

Our Hornbeck Offshore Services BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable insights.