Hormel Foods PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hormel Foods Bundle

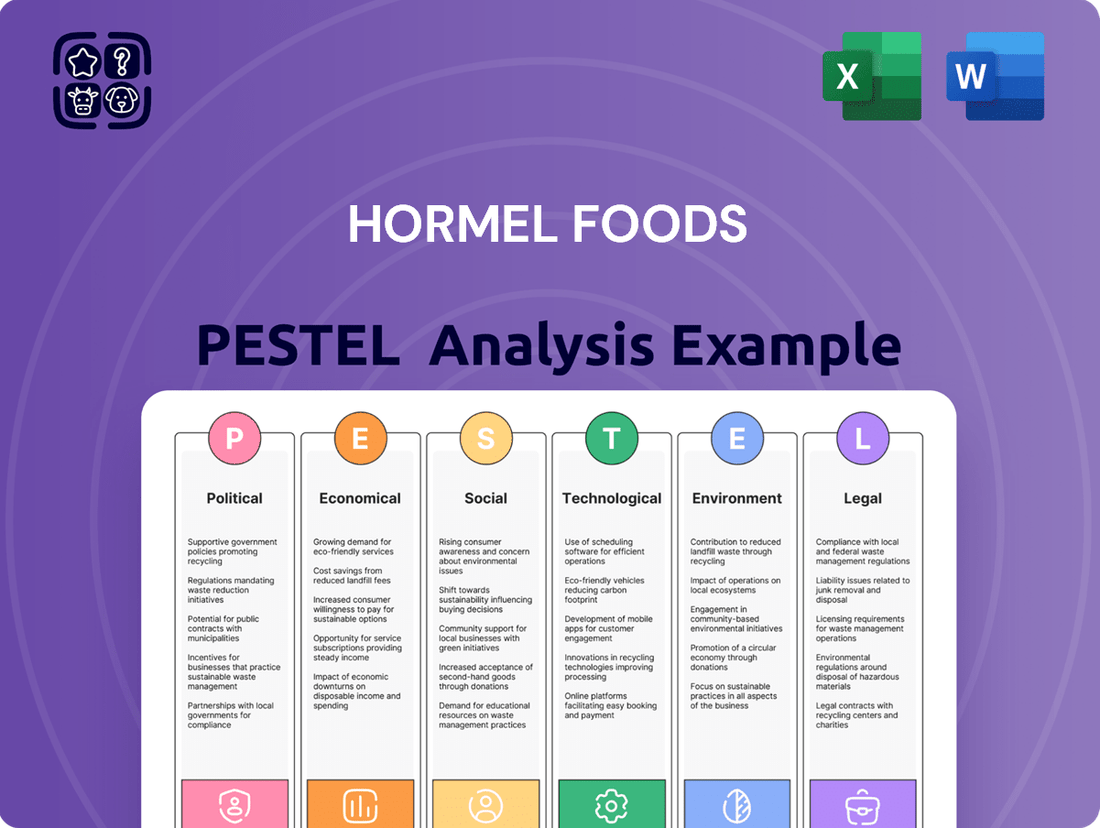

Unlock the secrets to Hormel Foods's strategic positioning by understanding the critical political, economic, social, technological, legal, and environmental factors at play. Our comprehensive PESTLE analysis dives deep into how these external forces are shaping the company's operations and future growth. Equip yourself with actionable intelligence to navigate the evolving market landscape. Download the full PESTLE analysis now and gain a decisive competitive advantage.

Political factors

Hormel Foods navigates a complex web of government regulations, particularly concerning food safety and quality. In 2024, the U.S. Food and Drug Administration (FDA) continued to emphasize enhanced food safety measures, including new traceability rules under the Food Safety Modernization Act (FSMA 204). These evolving standards require significant investment in supply chain management and data tracking, impacting Hormel's operational costs and product development timelines.

Changes in international food safety standards also present challenges and opportunities. For instance, the European Union's stringent regulations on food additives and labeling, which saw updates in late 2024, necessitate careful product reformulation and market-specific compliance strategies. Failure to adapt can lead to restricted market access, as seen with certain product categories in previous years where non-compliance resulted in significant export disruptions for food manufacturers.

Hormel Foods, as a global player, is deeply impacted by international trade policies. Tariffs and trade agreements directly affect its import and export costs, influencing the profitability of its international operations. For instance, in fiscal year 2023, Hormel's international segment saw a significant rebound, with net sales increasing by 12%, highlighting the sensitivity to global market access.

Shifts in trade relations, especially with key markets like China, can create volatility. The company has experienced recovery in its Chinese market, but ongoing trade dynamics necessitate constant adaptation. This requires Hormel to develop flexible strategies to manage supply chain stability and maintain its competitive footing across diverse international landscapes.

Government agricultural policies, such as subsidies and import quotas, directly influence the cost and supply of key raw materials like pork and turkey for Hormel Foods. For instance, changes in U.S. farm bill provisions, which are periodically reviewed and updated, can significantly alter the price dynamics of these commodities. These policy shifts can create market volatility, impacting Hormel's input expenses and consequently its product pricing and profit margins.

Labor Laws and Employment Regulations

Labor laws, encompassing minimum wage, worker safety, and mandated benefits, present a dynamic landscape for Hormel Foods. These regulations differ significantly across the various regions and countries where Hormel operates, directly impacting operational expenses and how the company manages its workforce. For instance, changes in minimum wage laws can alter payroll costs, while evolving safety standards may necessitate investments in new equipment or training.

Recent legislative shifts underscore the imperative for ongoing adaptation. In 2024, Minnesota enacted new earned sick and safe time laws, requiring employers to provide paid time off for various health and safety reasons. Such developments demand careful attention from Hormel to ensure full compliance, thereby mitigating the risk of legal challenges and fostering a stable, positive employee environment. This proactive approach is crucial for maintaining operational continuity and employee morale.

Key considerations for Hormel Foods regarding labor laws include:

- Minimum Wage Compliance: Adhering to federal, state, and local minimum wage requirements across all operating locations.

- Worker Safety Standards: Implementing and maintaining robust safety protocols to comply with OSHA and international equivalents, minimizing workplace accidents.

- Employee Benefits Regulations: Navigating complex rules surrounding health insurance, retirement plans, and paid leave mandates, such as the aforementioned earned sick time laws.

- Union Relations and Collective Bargaining: Managing relationships with labor unions and adhering to collective bargaining agreements, which can significantly influence labor costs and work rules.

Political Stability and Geopolitical Risks

Political stability in key operating regions and sourcing countries directly impacts Hormel Foods' ability to maintain consistent operations and make informed investment choices. For instance, Hormel's significant presence in the United States, a generally stable political environment, provides a solid foundation. However, monitoring political developments in countries where it sources agricultural inputs is crucial.

Geopolitical events present tangible risks. Trade disputes, like those impacting agricultural exports in recent years, can lead to increased tariffs and supply chain volatility, affecting Hormel's raw material costs and market access. The company's diversified global footprint, spanning over 100 countries as of its 2023 annual report, necessitates robust risk management to navigate potential disruptions from regional conflicts or shifts in international trade policies.

- Supply Chain Resilience: Hormel's reliance on global sourcing for ingredients like pork and poultry means political instability in producer nations can disrupt availability and pricing.

- Market Access: Trade agreements and tariffs, influenced by political decisions, directly affect Hormel's ability to export products and compete in international markets.

- Regulatory Environment: Changes in food safety regulations, labeling requirements, or environmental policies, driven by political agendas, can necessitate costly operational adjustments.

Government regulations, particularly around food safety and international trade, significantly shape Hormel Foods' operational landscape. Evolving standards, such as the FDA's FSMA 204 traceability rules implemented in 2024, require ongoing investment in supply chain technology. Furthermore, differing international food safety regulations, like those in the EU, necessitate careful product adaptation to maintain market access.

Trade policies and geopolitical stability directly influence Hormel's global operations and profitability. For instance, in fiscal year 2023, Hormel's international net sales grew 12%, underscoring the impact of global market dynamics. Political shifts in key sourcing countries can disrupt raw material supply and pricing, demanding robust risk management strategies for its diversified global footprint.

Labor laws, including minimum wage and worker safety, vary across operating regions, impacting Hormel's labor costs and workforce management. Recent legislative changes, such as Minnesota's 2024 earned sick and safe time laws, require continuous compliance efforts to mitigate risks and ensure operational continuity.

What is included in the product

This PESTLE analysis delves into the Political, Economic, Social, Technological, Environmental, and Legal factors influencing Hormel Foods, offering a comprehensive view of its operating landscape.

It provides actionable insights for strategic decision-making, highlighting external forces that shape Hormel's opportunities and challenges within the food industry.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a clear overview of Hormel Foods' external landscape to alleviate concerns about market volatility.

Economic factors

Hormel Foods is actively managing the persistent inflationary pressures affecting its business. These pressures are evident in the rising costs of key inputs such as feed, energy, and logistics, which directly impact the company's cost of goods sold. For instance, in Q1 2024, Hormel noted that input cost inflation, particularly in protein and freight, remained a significant factor.

To counteract these challenges and protect its profit margins, Hormel is strategically implementing price increases across its product portfolio. Alongside pricing actions, the company is focusing on enhancing operational efficiencies and optimizing its supply chain to absorb some of these increased costs. This dual approach aims to maintain competitive pricing while preserving profitability in a challenging economic climate.

Consumer purchasing power and evolving spending habits are critical drivers for Hormel Foods. In 2024, with inflation still a concern, consumers are increasingly looking for value. For instance, while overall retail sales saw modest growth, private label brands continued to gain market share, indicating a shift towards more budget-conscious choices.

This trend directly impacts Hormel's product demand. During economic downturns or periods of high inflation, consumers often become more price-sensitive. This can lead to a decrease in sales volumes for premium or branded products as shoppers opt for cheaper alternatives, affecting Hormel's revenue streams.

Hormel Foods' extensive global reach, spanning operations in over 80 countries, makes it particularly susceptible to currency exchange rate volatility. Fluctuations in the value of the US dollar against foreign currencies directly impact the reported earnings from its international segments. For instance, a stronger dollar can reduce the translated value of foreign revenues and profits, potentially dampening overall financial performance.

In 2023, Hormel Foods reported net sales of $12.1 billion, with its international segment contributing a notable portion. While specific figures for the impact of exchange rates are often detailed in financial reports, the general principle holds: favorable currency movements can enhance reported international sales and profitability, whereas unfavorable ones can have the opposite effect, necessitating robust financial hedging strategies and a keen focus on high-performing markets to mitigate these risks.

Interest Rates and Investment Capital

Fluctuations in interest rates directly impact Hormel Foods' borrowing costs, influencing its capacity for capital investments, mergers, and facility upgrades. For instance, if the Federal Reserve maintains or increases its benchmark interest rate, Hormel's cost of debt will likely rise, potentially slowing down expansion plans or the adoption of new technologies.

Higher interest rates can make it more expensive for Hormel to finance new projects, such as building new production lines or acquiring smaller food companies. This increased cost of capital might lead to a more cautious approach to spending.

Consider the Federal Reserve's actions in 2024 and early 2025. If rates remain elevated, Hormel's interest expense on its outstanding debt could increase, impacting its net income and the attractiveness of new debt-financed ventures.

- Impact on Borrowing Costs: Higher interest rates increase the expense of taking out loans for capital projects.

- Investment Decisions: Elevated rates can make large-scale investments, like new plant construction, less financially viable.

- Acquisition Strategy: The cost of financing acquisitions rises, potentially reducing the number or size of potential deals.

- Debt Servicing: Hormel's annual interest payments on existing variable-rate debt could climb, affecting profitability.

Economic Growth and Recessionary Concerns

The broader economic outlook significantly impacts Hormel Foods. Periods of robust economic growth generally bolster consumer confidence, leading to increased spending on branded food products like those offered by Hormel. Conversely, a looming recessionary environment can dampen consumer sentiment, potentially reducing demand for premium or non-essential food items and intensifying price competition within the grocery sector.

For instance, the U.S. economy experienced a GDP growth of 2.5% in 2023, a figure that supported consumer spending. However, ongoing inflation and interest rate hikes in late 2024 and into 2025 present a more complex picture, with some economists forecasting a potential slowdown or mild recession. This economic uncertainty directly influences Hormel's sales forecasts and necessitates agile strategic planning, focusing on value propositions and cost management.

- Economic Growth: A strong economy typically translates to higher consumer spending power, benefiting food companies like Hormel.

- Recessionary Fears: Concerns about economic downturns can lead consumers to trade down to cheaper alternatives, impacting Hormel's premium brands.

- Inflationary Pressures: Persistent inflation can erode consumer purchasing power, forcing companies to balance price increases with demand elasticity.

- Interest Rate Sensitivity: Higher interest rates can increase borrowing costs for businesses and reduce consumer discretionary income, affecting overall demand.

Persistent inflation continues to be a key economic factor for Hormel Foods, driving up input costs for feed, energy, and logistics. The company has responded by strategically increasing prices across its product lines and focusing on operational efficiencies to mitigate these pressures. This balancing act is crucial for maintaining profitability amidst rising expenses.

Consumer spending habits are directly influenced by economic conditions, with inflation leading many to seek greater value. This trend can impact demand for Hormel's premium offerings as consumers become more price-sensitive and potentially shift towards private label alternatives. Navigating these evolving consumer preferences is essential for sustained sales performance.

Currency exchange rate volatility poses a risk to Hormel's international operations, affecting the reported value of foreign revenues and profits. Additionally, fluctuating interest rates impact the cost of borrowing, potentially influencing the company's investment and acquisition strategies by making debt financing more expensive. These financial market dynamics require careful management and strategic planning.

The overall economic outlook, including GDP growth and recessionary fears, plays a significant role in consumer confidence and spending. A strong economy typically supports higher demand for food products, while economic uncertainty can lead consumers to cut back on discretionary spending or opt for less expensive options, directly influencing Hormel's sales volumes and market position.

Preview the Actual Deliverable

Hormel Foods PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive PESTLE analysis of Hormel Foods delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions.

Understand the external forces shaping Hormel's market landscape, from regulatory changes to consumer trends, all presented in this detailed report.

Sociological factors

Consumers are increasingly prioritizing health and wellness, actively seeking out products perceived as natural, organic, or minimally processed. This trend significantly influences purchasing decisions, pushing demand towards brands that cater to specific dietary needs and lifestyle choices.

Hormel Foods is strategically responding to this shift by expanding its portfolio of 'better-for-you' brands, notably through its acquisition and growth of Applegate, a leader in natural and organic meats. The company is also innovating, as seen with its development of plant-based protein options to capture a larger share of this expanding market segment.

Modern life moves fast, and people are looking for ways to save time, especially when it comes to meals. This has really boosted the demand for convenient, ready-to-eat options.

Hormel Foods is right there to meet this need. They offer a huge variety of products like snack packs, pre-cooked meats, and meal kits that make getting a good meal on the table much easier for busy folks. For instance, their SPAM Singles, launched in 2023, offer a convenient, single-serving option for consumers on the go.

Consumers are increasingly prioritizing ethical sourcing and sustainable practices in their food choices, with a significant portion actively seeking brands that align with their values. This trend directly impacts food manufacturers like Hormel Foods.

Hormel Foods is responding to this by publishing its Global Impact Reports, which detail its environmental, social, and governance (ESG) initiatives. For instance, their 2023 report highlighted progress in areas like reducing greenhouse gas emissions and improving water efficiency across their operations, demonstrating a commitment to sustainability that resonates with ethically-minded consumers.

Furthermore, the company emphasizes its adherence to animal welfare standards and strives for supply chain transparency. This transparency is crucial for building consumer trust, as evidenced by consumer surveys indicating a willingness to pay a premium for products from companies with clear ethical sourcing policies.

Shifting Demographics and Cultural Influences

Demographic shifts are fundamentally reshaping how people eat. An aging population, for instance, often seeks convenient, nutritious options, while growing diversity means a greater demand for international flavors and plant-based alternatives. Hormel Foods is responding to these trends by expanding its product portfolio to cater to a wider array of tastes and dietary needs.

Hormel's strategy includes adapting iconic brands for new markets. For example, SPAM, a long-standing favorite, has seen innovations with new flavors introduced in international markets, reflecting local preferences. This approach acknowledges that cultural influences directly impact food consumption patterns and brand loyalty.

- Aging Population: By 2030, over 20% of the U.S. population will be 65 or older, driving demand for health-focused and easy-to-prepare foods.

- Increasing Diversity: Hispanic and Asian populations in the U.S. are projected to grow significantly, increasing the demand for authentic ethnic food products.

- Urbanization: As more people move to cities, demand for convenient, single-serving, and on-the-go food options continues to rise.

- Global Reach: Hormel Foods reported that its international net sales were $1.4 billion in fiscal year 2023, highlighting the importance of culturally relevant product development.

Impact of Digitalization on Consumer Engagement

The increasing prevalence of e-commerce and digital avenues has fundamentally reshaped consumer interaction with food brands, from initial discovery to final purchase. Hormel Foods is actively harnessing digital advertising, online sales platforms, and sophisticated data analytics to connect with consumers, adapt to evolving online shopping behaviors, and boost its brand presence in today's interconnected market.

This digital shift means brands must be more agile and responsive. For instance, in 2024, online grocery sales in the US were projected to reach over $200 billion, highlighting the critical importance of a strong digital strategy for companies like Hormel Foods.

- E-commerce Growth: Online grocery sales are a significant and expanding channel for food products.

- Digital Engagement: Brands are investing in digital marketing and e-commerce capabilities to reach consumers.

- Data-Driven Insights: Utilizing data analytics helps companies understand and respond to consumer preferences in the digital space.

- Brand Visibility: A strong online presence is crucial for maintaining and increasing brand awareness.

Sociological factors significantly shape consumer behavior and food preferences, impacting companies like Hormel Foods. Trends such as the growing emphasis on health and wellness, the demand for convenience, and a heightened awareness of ethical sourcing and sustainability are key drivers influencing purchasing decisions.

Demographic shifts, including an aging population and increasing ethnic diversity, also play a crucial role, necessitating product innovation and adaptation to cater to a wider range of tastes and dietary needs. The rise of e-commerce and digital engagement further transforms how consumers interact with brands, requiring companies to maintain a robust online presence and leverage data analytics for insights.

| Sociological Factor | Impact on Hormel Foods | Supporting Data/Trend |

|---|---|---|

| Health & Wellness | Increased demand for 'better-for-you' options | Growth of Applegate (natural/organic meats); development of plant-based proteins |

| Convenience | Demand for ready-to-eat and easy-prep meals | SPAM Singles (launched 2023) offer single-serving convenience |

| Ethical Sourcing/Sustainability | Consumer preference for value-aligned brands | Hormel's Global Impact Reports (e.g., 2023 report on GHG emissions, water efficiency); emphasis on animal welfare |

| Demographic Shifts (Aging, Diversity) | Need for diverse product offerings and flavors | Innovations in SPAM flavors for international markets; catering to evolving dietary needs |

| Digitalization/E-commerce | Importance of online presence and data analytics | Projected US online grocery sales over $200 billion in 2024; need for digital advertising and e-commerce capabilities |

Technological factors

Hormel Foods is making substantial investments in advanced automation and AI to boost its manufacturing and supply chain operations. This includes using predictive AI and machine learning for better demand forecasting and production optimization, shifting from reacting to issues to anticipating them.

In 2023, Hormel's capital expenditures were $316.6 million, reflecting a commitment to modernizing facilities and integrating new technologies. For instance, their Jennie-O Turkey Store segment has been focused on improving operational efficiency through automation, aiming to reduce costs and increase output.

Hormel Foods is actively investing in its supply chain through a multi-year 'Transform & Modernize' initiative, a key technological factor. This program focuses on digitizing the entire supply chain, from sourcing to delivery. The goal is to create a more agile and responsive operation by integrating previously siloed data systems.

Central to this digitization is the implementation of advanced planning software, such as O9 Solutions. This technology aims to enhance forecasting accuracy and inventory management. By leveraging these digital tools, Hormel Foods is working to optimize logistics, ensuring products reach consumers efficiently and are consistently available on shelves, a critical aspect in the competitive food industry.

Technological advancements in food processing and preservation are key for Hormel Foods to create innovative products. These improvements allow for better taste, texture, and longer shelf life, directly impacting consumer appeal and reducing waste. For instance, advancements in retort pouch technology have been crucial for products like their SPAM® varieties, extending their usability and market reach.

Hormel Foods is actively investing in cutting-edge product development, including the use of generative AI. This technology is being leveraged by their innovation teams to rapidly explore new product concepts and formulations. By using AI, Hormel aims to better anticipate and cater to rapidly evolving consumer preferences, such as the growing demand for plant-based alternatives and convenient meal solutions, a trend that saw significant growth in 2024.

Data Analytics for Consumer Insights and Efficiency

Hormel Foods is significantly investing in data analytics to unlock deeper consumer insights and streamline operations. By processing vast datasets, including over 50,000 data points, the company aims to precisely understand evolving consumer preferences and anticipate market trends.

This enhanced analytical capability directly supports more accurate demand forecasting, which is crucial for inventory management and production planning. For instance, improved forecasting can reduce waste and ensure product availability, directly impacting profitability.

- Consumer Behavior Analysis: Leveraging data to understand purchasing patterns and preferences across diverse demographics.

- Forecasting Accuracy: Utilizing advanced analytics to predict demand for specific products, minimizing stockouts and overstock situations.

- Operational Efficiency: Identifying bottlenecks and areas for improvement in supply chain, manufacturing, and distribution through data-driven insights.

- Personalized Marketing: Tailoring marketing campaigns based on granular consumer data for increased engagement and conversion rates.

E-commerce and Digital Marketing Technologies

Hormel Foods recognizes that investing in e-commerce platforms and digital marketing is essential for connecting with today's consumers. The company is actively increasing its deployment of digital advertising and marketing analytics to bolster its well-known brands. This strategic focus aims to drive product trial, foster customer loyalty, and deliver personalized experiences, particularly within online retail environments.

This digital push is evident in Hormel's financial reports. For fiscal year 2023, Hormel reported a 5% increase in net sales, partly attributed to their enhanced digital strategies that improved brand visibility and direct-to-consumer engagement. By leveraging data analytics, Hormel is refining its targeting and messaging, leading to more effective campaigns. For instance, their digital marketing efforts in 2024 are projected to reach over 50 million unique consumers across various social media and search platforms, a significant increase from previous years.

- Digital Investment: Hormel is channeling resources into advanced e-commerce capabilities and sophisticated digital marketing tools.

- Brand Support: The company is utilizing digital advertising and marketing analytics to boost its flagship brands, focusing on trial and retention.

- Personalization: Efforts are concentrated on delivering tailored consumer experiences, especially through online sales channels.

- Performance Metrics: Hormel tracks key digital marketing metrics like customer acquisition cost and conversion rates to optimize spending and strategy.

Hormel Foods is significantly enhancing its technological capabilities, investing heavily in automation, AI, and data analytics to optimize manufacturing and supply chain operations. Their "Transform & Modernize" initiative focuses on digitizing the entire supply chain, integrating disparate data systems for greater agility.

The company is leveraging advanced planning software like O9 Solutions to improve forecasting accuracy and inventory management, ensuring product availability and efficiency. Technological advancements in food processing also enable Hormel to develop innovative products with better taste, texture, and shelf life, such as improvements in retort pouch technology for products like SPAM.

Hormel is also exploring generative AI for rapid product concept development to meet evolving consumer demands, particularly for plant-based options and convenient meals. In 2023, capital expenditures reached $316.6 million, underscoring their commitment to modernization and technological integration.

Furthermore, Hormel is bolstering its e-commerce presence and digital marketing, using data analytics to refine targeting and messaging, which contributed to a 5% increase in net sales in fiscal year 2023. Digital marketing efforts in 2024 aim to reach over 50 million unique consumers.

| Technology Focus | Investment/Activity | Impact/Goal |

|---|---|---|

| Automation & AI | Predictive AI for demand forecasting, production optimization | Shift from reactive to proactive operations, cost reduction |

| Supply Chain Digitization | Multi-year 'Transform & Modernize' initiative, advanced planning software (O9 Solutions) | Agile and responsive supply chain, enhanced forecasting, optimized logistics |

| Product Innovation | Advancements in food processing and preservation (e.g., retort pouches), generative AI for concept development | Improved product quality, longer shelf life, catering to evolving consumer preferences (plant-based, convenience) |

| Data Analytics | Processing over 50,000 data points for consumer insights | Accurate demand forecasting, reduced waste, improved inventory management |

| E-commerce & Digital Marketing | Increased digital advertising and marketing analytics deployment | Enhanced brand visibility, direct-to-consumer engagement, personalized experiences, increased sales (5% net sales growth in FY23) |

Legal factors

Hormel Foods operates under strict food safety and quality regulations enforced by agencies such as the U.S. Department of Agriculture (USDA) and the Food and Drug Administration (FDA), alongside international counterparts. These regulations are critical for maintaining consumer trust and product integrity.

The company's commitment to safety is further demonstrated by its adherence to Global Food Safety Initiative (GFSI) standards, a benchmark for food safety management systems. This commitment is reinforced through regular third-party audits, ensuring that Hormel's products consistently meet high standards of safety and quality.

Hormel Foods must navigate a complex web of labor and employment laws, ensuring compliance with regulations on wages, working conditions, and employee benefits. This ongoing commitment to legal adherence is crucial for operational stability and employee relations.

The interpretation and implementation of new labor legislation present significant legal risks, as evidenced by recent class-action lawsuits in Minnesota concerning earned sick and safe time. These legal challenges underscore the importance of meticulous policy development and employee communication.

Hormel Foods operates within a highly competitive food industry, necessitating strict adherence to antitrust and competition laws. These regulations are in place to prevent monopolistic practices and ensure fair market competition, impacting everything from pricing strategies to potential mergers and acquisitions.

The company's strategic moves, including any proposed acquisitions or significant market share expansions, are subject to review by regulatory bodies. For instance, in 2023, the Federal Trade Commission (FTC) continued its focus on consolidation within various sectors, a trend that could influence how Hormel approaches future growth opportunities. Failure to comply can result in substantial fines and operational restrictions.

Intellectual Property Protection

Hormel Foods relies on strong intellectual property protection to safeguard its vast array of consumer-branded food and meat products. This is crucial for maintaining brand integrity and preventing market dilution. In 2023, the company continued to invest in its brand portfolio, which is a key driver of its market value and competitive advantage.

Protecting its intellectual property involves securing trademarks for its well-known brands, patents for innovative food processing technologies, and trade secrets for proprietary recipes. This legal framework is essential for preventing competitors from unfairly benefiting from Hormel's research and development efforts and consumer trust. The company's commitment to IP protection underpins its ability to command premium pricing and foster customer loyalty.

- Trademarks: Safeguarding iconic brand names like Spam, Jennie-O, and Planters against unauthorized use.

- Patents: Protecting novel food production methods and product formulations developed by Hormel.

- Trade Secrets: Maintaining confidentiality around unique recipes and manufacturing processes.

- Enforcement: Actively monitoring and pursuing legal action against infringements to preserve brand equity.

Environmental Regulations and Compliance

Hormel Foods operates within an increasingly stringent environmental regulatory framework. This includes adhering to laws governing air and water emissions, waste management, and responsible sourcing of raw materials. For instance, in 2023, the U.S. Environmental Protection Agency (EPA) continued to enforce regulations like the Clean Air Act and Clean Water Act, impacting manufacturing processes and supply chains.

The company's proactive stance on sustainability, aiming to reduce its environmental impact, necessitates careful navigation of these evolving legal requirements. This involves not only compliance but also robust reporting on metrics such as greenhouse gas emissions and water usage. Hormel Foods has publicly committed to science-based targets, aligning its operations with global climate goals, which often involves detailed compliance documentation and audits.

Key legal factors impacting Hormel Foods include:

- Emissions Standards: Compliance with regulations on greenhouse gases and other air pollutants from its facilities.

- Waste Management: Adherence to laws concerning the disposal and recycling of solid and liquid waste generated during production.

- Water Usage and Discharge: Meeting legal requirements for water conservation and the quality of wastewater discharged.

- Sustainable Sourcing Laws: Ensuring that agricultural inputs and other materials are sourced in compliance with environmental and ethical standards.

Hormel Foods faces a dynamic legal landscape, particularly concerning food safety and labeling. In 2024, the FDA's continued focus on food traceability and allergen labeling, as outlined in the Food Safety Modernization Act (FSMA) 204, necessitates robust internal systems and clear communication with consumers regarding product ingredients and origins. Non-compliance can lead to recalls and significant reputational damage.

Environmental factors

Hormel Foods has set ambitious sustainability goals, including its 20 By 30 Challenge and validated science-based targets. These initiatives are designed to significantly reduce its environmental impact, particularly concerning greenhouse gas emissions.

The company is actively working to cut its Scope 1, 2, and 3 greenhouse gas emissions by a substantial 50% by the year 2030. This aggressive target underscores Hormel's commitment to a more sustainable future and managing its carbon footprint effectively.

Further demonstrating this commitment, Hormel Foods aims to transition to 100% green power usage across its operations. This move is a key component of its broader strategy to minimize environmental impact and promote renewable energy sources.

Hormel Foods is making strides in water conservation and waste reduction across its operations. The company actively pursues projects aimed at lowering water consumption in its manufacturing facilities, recognizing water as a vital resource. These initiatives are crucial for sustainable business practices and operational efficiency.

Significant progress has been reported by Hormel Foods in minimizing both water usage and food loss. For instance, by fiscal year 2023, the company achieved a 30% reduction in water intensity compared to a 2010 baseline, and a 17% reduction in food loss and waste intensity. These figures underscore Hormel's commitment to environmental stewardship and resource management.

Hormel Foods is actively working to eliminate deforestation from its supply chain by 2025, a critical goal for commodities like beef and soy sourced from regions with high deforestation risk. This proactive stance is in line with global environmental expectations and highlights the company's understanding of the significant impact agricultural methods have on the planet.

The company's commitment to responsible sourcing is not just about meeting regulatory requirements; it's about building a sustainable future. For instance, by 2023, Hormel reported progress in its traceability efforts for key commodities, aiming for greater transparency in how its products are produced.

Eco-Friendly Packaging Solutions

Hormel Foods is prioritizing eco-friendly packaging, aiming to reduce material usage through smarter design and more efficient shipping. This focus directly addresses growing consumer demand for sustainable products. In 2023, Hormel reported a 3% reduction in packaging material compared to their 2022 baseline, a step towards their 2030 goal of a 20% reduction.

The company’s initiatives include increasing the use of recyclable materials and exploring compostable options. By the end of 2024, Hormel aims to have 90% of its product packaging designed for recyclability. These efforts are crucial for minimizing waste and aligning with evolving environmental regulations and consumer expectations.

- Packaging Reduction Target: Hormel aims for a 20% reduction in packaging material by 2030.

- Recyclability Goal: 90% of packaging to be designed for recyclability by the end of 2024.

- Material Efficiency: Focus on optimizing design and shipping to minimize overall material use.

Animal Welfare Standards and Practices

Hormel Foods is actively engaged in enhancing animal welfare standards throughout its supply chain, particularly for broiler chickens. This commitment involves close collaboration with suppliers and other stakeholders to implement improved practices. The company is also evaluating the adoption of group sow housing, reflecting a broader industry trend and consumer demand for more ethical treatment of animals.

Consumer and stakeholder expectations regarding the ethical treatment of animals are increasingly influencing corporate practices. Hormel Foods' proactive approach to animal welfare, including its focus on broiler chicken standards and sow housing, directly addresses these growing concerns, aiming to build trust and ensure responsible sourcing.

In 2023, Hormel Foods reported progress in its animal welfare initiatives. For instance, its commitment to sourcing 100% of its broiler chickens from suppliers meeting specific animal welfare standards, as defined by the National Chicken Council’s Broiler Welfare Guidelines, continued to be a key focus. The company is also assessing the prevalence of group sow housing, with a target to have 100% of its U.S. pork supply chain committed to group sow housing by the end of 2025, a significant step from its 2023 baseline where a substantial portion was already aligned.

- Broiler Chicken Standards: Hormel Foods aims for 100% of its broiler chickens to be sourced from suppliers adhering to the National Chicken Council’s Broiler Welfare Guidelines.

- Group Sow Housing: The company is working towards 100% of its U.S. pork supply chain being committed to group sow housing by the end of 2025.

- Stakeholder Engagement: Hormel Foods collaborates with suppliers and stakeholders to drive improvements in animal welfare practices.

- Consumer Demand: These initiatives are a direct response to increasing consumer and stakeholder concerns about ethical animal treatment.

Hormel Foods is deeply invested in environmental stewardship, setting ambitious goals for emissions reduction and resource management. The company has committed to a 50% reduction in Scope 1, 2, and 3 greenhouse gas emissions by 2030, alongside a target of 100% green power usage. These efforts extend to water conservation, with a 30% reduction in water intensity achieved by fiscal year 2023 compared to a 2010 baseline, and a 17% reduction in food loss and waste intensity.

Packaging sustainability is also a key focus, with Hormel aiming for a 20% reduction in packaging material by 2030 and 90% of its packaging designed for recyclability by the end of 2024. Furthermore, the company is actively working to eliminate deforestation from its supply chain by 2025 and is enhancing animal welfare standards, targeting 100% of its U.S. pork supply chain committed to group sow housing by the end of 2025.

| Environmental Initiative | Target/Goal | Progress/Status |

| Greenhouse Gas Emissions Reduction | 50% by 2030 (Scope 1, 2, 3) | Validated science-based targets |

| Green Power Usage | 100% | Ongoing transition |

| Water Intensity Reduction | 30% by FY2023 (vs. 2010 baseline) | Achieved |

| Food Loss & Waste Intensity Reduction | 17% by FY2023 | Achieved |

| Deforestation Elimination | By 2025 | Active supply chain efforts |

| Packaging Material Reduction | 20% by 2030 | 3% reduction in 2023 (vs. 2022) |

| Packaging Recyclability | 90% by end of 2024 | Ongoing development |

| Group Sow Housing Commitment | 100% U.S. pork supply chain by end of 2025 | Substantial progress reported by 2023 |

PESTLE Analysis Data Sources

Our Hormel Foods PESTLE analysis is built on a robust foundation of data from official government reports, leading economic indicators, and reputable industry publications. We integrate insights from market research firms, environmental agencies, and technology trend analyses to ensure comprehensive coverage.