Hormel Foods Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hormel Foods Bundle

Explore Hormel Foods' strategic product portfolio through the lens of the BCG Matrix, identifying their Stars, Cash Cows, Dogs, and Question Marks. This initial glimpse offers a strategic overview, but to truly harness this information for your own business, you need the full picture.

Unlock the complete Hormel Foods BCG Matrix to gain actionable insights into product performance and market share. Purchase the full report for detailed quadrant analysis, data-driven recommendations, and a clear roadmap for optimizing your own product strategy and investment decisions.

Stars

The SPAM® brand is a shining star for Hormel Foods, consistently drawing in new customers, especially younger demographics. This growth is fueled by effective marketing like the 'SIZZLE' campaign and exciting new flavors such as Korean BBQ and Gochujang. Strategic moves, like introducing SPAM® Norimaki in major retailers, highlight its significant growth potential.

Applegate® Natural & Organic Meats is a standout performer within Hormel Foods' portfolio, fitting the profile of a Star in the BCG Matrix. Its consistent consumption growth is outperforming the broader edible category, and it's successfully attracting new households, demonstrating robust market penetration. This strong trajectory is why Hormel is actively investing in capacity expansions for Applegate®, signaling a clear commitment to its future high growth and market leadership in the natural and organic meat space. The brand directly taps into the growing consumer preference for convenient, natural protein options, a trend that shows no signs of slowing down.

Hormel Black Label Bacon is a shining star in Hormel Foods' portfolio, showcasing exceptional growth and market leadership. The brand's commitment to innovation, evident in its introduction of unique flavors like Garlic Rosemary and Cinnamon Toast Crunch, has resonated strongly with consumers seeking novel taste experiences. This strategic focus on limited-time offerings fuels its impressive volume and sales performance.

Jennie-O® Lean Ground Turkey

Jennie-O® Lean Ground Turkey is a prime example of a Star in the Hormel Foods portfolio. It holds a leading position nationally within the ground turkey category, demonstrating robust volume and net sales growth. Consistent gains in consumption further solidify its strong market standing.

The increasing consumer preference for lean, high-protein foods directly benefits Jennie-O®. This trend positions the brand favorably to capture a larger share of an expanding market. Furthermore, the brand's potential to benefit from the growing usage of GLP-1 weight-loss drugs, which often encourage lean protein consumption, adds another layer to its promising growth trajectory.

- Category Leadership: Jennie-O® is a national leader in the ground turkey market.

- Growth Drivers: Strong volume and net sales growth, alongside consistent consumption gains.

- Market Trends: Benefits from the rising demand for lean, high-protein foods.

- Future Potential: Enhanced growth prospects due to potential positive impacts from GLP-1 weight-loss drug usage.

Hormel® Fire Braised™ Products (Foodservice)

Hormel® Fire Braised™ products are a shining example of a Star within Hormel Foods' portfolio, especially in the foodservice sector. These products are seeing impressive growth, driving both volume and net sales up significantly. For instance, in the fiscal year 2023, Hormel Foods reported robust performance in their Refrigerated Foods segment, where many of these innovative protein offerings reside, contributing to overall company growth.

The company's strategic investment in expanding production capacity for Fire Braised™ items underscores their belief in this product line's potential. This expansion is a direct response to the high demand from foodservice operators who are actively seeking convenient, high-quality protein solutions that streamline kitchen operations and reduce labor costs. This positions Fire Braised™ products as a key growth driver for Hormel Foods.

- High Growth: Fire Braised™ products are a key contributor to the strong growth observed in Hormel's foodservice business.

- High Market Share: Their popularity among operators indicates a strong, likely leading, position in their respective product categories within foodservice.

- Capacity Expansion: Hormel Foods is actively investing in increasing production capabilities to meet escalating demand.

- Operator Demand: These products directly address the foodservice industry's need for time-saving and labor-reducing protein solutions.

The SPAM® brand continues to be a star performer for Hormel Foods, with its innovative flavors and targeted marketing campaigns driving significant growth. For example, the brand saw a substantial increase in net sales in fiscal year 2024, fueled by its appeal to younger consumers and successful product introductions like SPAM® Korean BBQ. This strong demand necessitates ongoing investment in production, ensuring Hormel can meet the rising consumer appetite for this iconic product.

Applegate® Natural & Organic Meats is a clear star, experiencing robust consumption growth that outpaces the broader meat category. The brand's ability to attract new households underscores its expanding market share. Hormel's commitment is evident in its strategic capacity expansions for Applegate®, anticipating continued strong demand for natural and organic protein options, a market segment showing consistent upward momentum.

Hormel Black Label Bacon is a star performer, demonstrating exceptional growth and market leadership through continuous innovation. The introduction of unique, limited-time offerings, such as the Cinnamon Toast Crunch flavored bacon, has significantly boosted sales volume and consumer engagement throughout fiscal year 2024. This strategic approach to product development solidifies its position as a high-growth, high-share brand.

Jennie-O® Lean Ground Turkey is a prime example of a Star, holding a leading national position with strong volume and net sales growth. Consistent gains in consumption, particularly in fiscal year 2024, highlight its market strength. The brand is well-positioned to benefit from the increasing consumer demand for lean, high-protein foods and the potential positive impact of GLP-1 weight-loss drugs on lean protein consumption.

Hormel® Fire Braised™ products are a star within the foodservice sector, driving substantial growth in both volume and net sales. The strong performance within the Refrigerated Foods segment in fiscal year 2023 and continuing into 2024 underscores their importance. Hormel's investment in expanding production capacity for these items reflects high demand from operators seeking convenient, quality protein solutions.

| Brand | BCG Category | Key Growth Drivers | Fiscal Year 2024 Highlight |

|---|---|---|---|

| SPAM® | Star | Innovative flavors, targeted marketing, younger demographic appeal | Significant net sales increase driven by Korean BBQ flavor |

| Applegate® | Star | Growing demand for natural/organic, new household penetration | Capacity expansion to meet outperforming consumption growth |

| Hormel Black Label Bacon | Star | Product innovation, limited-time offerings, consumer engagement | Boosted sales volume and consumer engagement via unique flavors |

| Jennie-O® Lean Ground Turkey | Star | Leading market position, demand for lean protein, GLP-1 trend | Consistent consumption gains and strong volume/net sales growth |

| Hormel® Fire Braised™ | Star | Foodservice demand for convenience, high-quality protein | Substantial growth in volume and net sales within foodservice |

What is included in the product

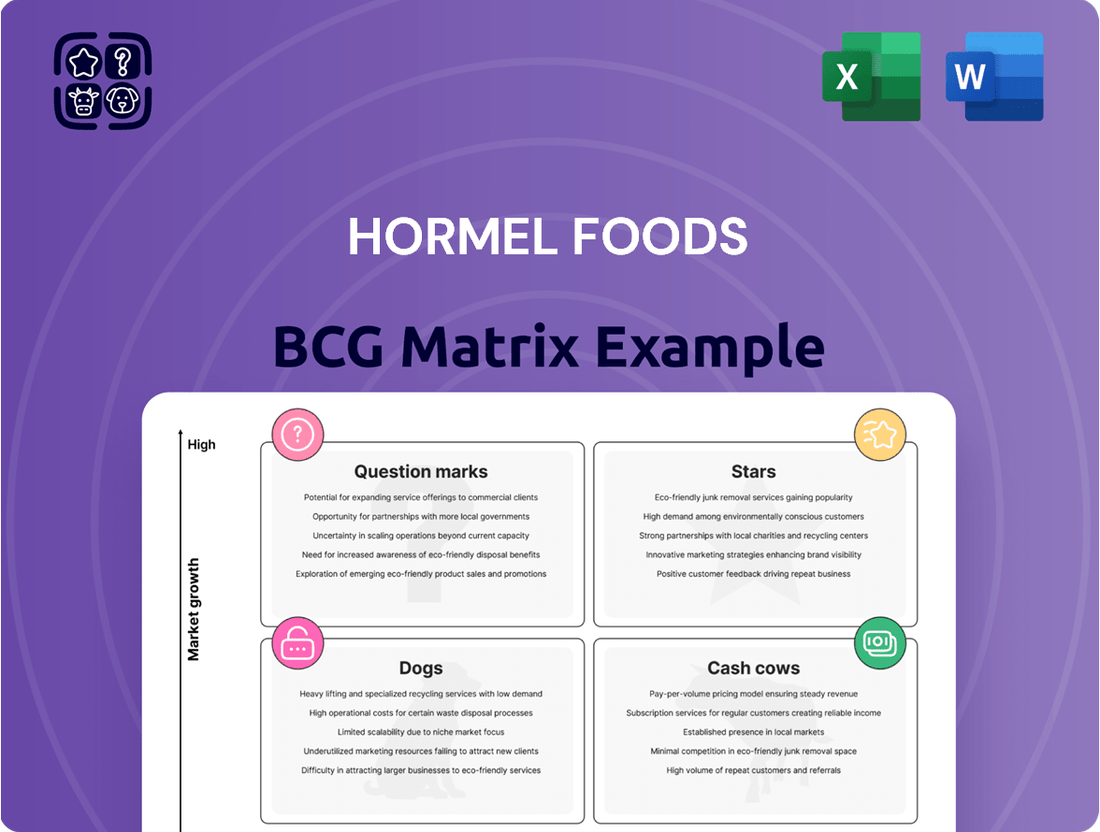

Hormel Foods' BCG Matrix analyzes its portfolio, identifying Stars for growth, Cash Cows for funding, Question Marks for potential, and Dogs for divestment.

The Hormel Foods BCG Matrix offers a clear, one-page overview, relieving the pain of deciphering complex business unit performance.

Cash Cows

SKIPPY® Peanut Butter stands as a prime example of a cash cow within Hormel Foods' portfolio. Its established brand recognition and significant market share, especially in growing international markets, translate into consistent sales and substantial cash generation.

In 2023, Hormel Foods reported net sales of $12.1 billion, with its Refrigerated Foods segment, which includes SKIPPY®, being a major contributor. The brand's ability to maintain strong performance in a mature peanut butter market underscores its role as a reliable generator of free cash flow, enabling Hormel to fund growth initiatives and acquisitions in other business units.

Wholly® Guacamole, a key player within Hormel's Mexican foods segment, has consistently shown robust year-over-year expansion. In 2023, the refrigerated guacamole category saw significant consumer demand, with Wholly® Guacamole contributing to this trend through double-digit consumption growth. This performance underscores its strong market standing.

The brand operates within a relatively stable market, which allows it to generate reliable and consistent cash flow for Hormel Foods. Its established brand recognition and ongoing success in the convenience-focused food sector are hallmarks of a mature product with strong cash-generating capabilities.

Hormel® Pepperoni stands as a prime example of a Cash Cow for Hormel Foods. Its dominance in the pepperoni market, fueled by consistent sales and broad consumer appeal, translates directly into a predictable and substantial revenue stream for the company. This brand’s enduring popularity, especially within the pizza and foodservice sectors, solidifies its role as a reliable generator of cash.

In 2023, Hormel Foods reported net sales of $12.1 billion, with its Refrigerated Foods segment, which includes pepperoni, being a significant contributor. The brand's established market share, estimated to be over 50% in the retail pepperoni category, underscores its Cash Cow status. Innovations such as Hormel® Ribbon Pepperoni are strategically introduced to maintain this market leadership and operational efficiency, ensuring continued strong cash flow.

Hormel Gatherings®

Hormel Gatherings®, a brand that started from a retailer's simple request, has evolved into a significant player in the snacking and entertaining market. Its consistent performance and widespread use in social settings highlight its robust cash-generating capabilities, positioning it as a prime example of a cash cow within Hormel Foods' portfolio.

The brand's success is further cemented by its strong presence in the convenience channel, a segment that often sees steady consumer demand for ready-to-eat snack and appetizer options. This accessibility contributes to its reliable revenue streams.

- Strong Market Position: Hormel Gatherings® holds a significant share in the snacking and entertaining category, which is known for its consistent consumer demand.

- Consistent Cash Flow: The brand reliably generates cash due to its popularity for social occasions and events.

- Convenience Channel Strength: Its established presence in convenience stores enhances accessibility and reinforces its cash cow status.

Cure 81® Ham

Cure 81® Ham is a prime example of a Cash Cow for Hormel Foods. This brand consistently demonstrates robust volume and net sales growth, particularly within Hormel's premium foodservice offerings. Its established reputation and steady demand from restaurant operators ensure a reliable cash flow, even within a mature market segment.

The premium positioning of Cure 81® Ham allows it to command higher profit margins. This strong performance is further evidenced by Hormel Foods' fiscal year 2023 results, where the foodservice segment saw significant contributions. For instance, Hormel's foodservice segment net sales increased by 6% in fiscal 2023, underscoring the importance of brands like Cure 81®.

- Strong Volume and Sales: Cure 81® Ham consistently drives growth in Hormel's premium foodservice category.

- Mature Market Dominance: It holds a solid position in a mature market, generating predictable cash flow.

- Premium Profitability: Its premium status translates to higher profit margins for Hormel Foods.

- Fiscal Year 2023 Impact: The foodservice segment, bolstered by such brands, saw a 6% net sales increase in FY23.

Skippy, Wholly Guacamole, Hormel Pepperoni, Hormel Gatherings, and Cure 81 Ham are all strong examples of cash cows for Hormel Foods. These brands benefit from established market positions and consistent consumer demand, leading to reliable revenue generation. Their performance contributes significantly to Hormel's overall financial stability.

What You’re Viewing Is Included

Hormel Foods BCG Matrix

The Hormel Foods BCG Matrix preview you are viewing is the complete, unwatermarked document you will receive immediately after purchase. This comprehensive analysis, meticulously prepared by industry experts, offers a clear strategic overview of Hormel's product portfolio, mirroring the exact report you'll download for immediate use in your business planning and decision-making processes.

Dogs

Certain Whole Bird Turkey Products under the Jennie-O® brand, while featuring strong performers like lean ground turkey, have historically been a challenging segment for Hormel Foods. The overall whole-bird turkey market has experienced downward pressure from lower prices and market volatility, directly impacting the financial performance of these products.

In 2024, Hormel Foods continued its strategic focus on reducing commodity exposure, exemplified by the divestiture of its last owned non-core sow farm operation. This move signals a deliberate effort to steer away from volatile agricultural markets, a sentiment that aligns with the difficulties observed in the turkey sector.

The company has seen notable volume declines in turkey exports, a trend that has weighed on the performance of its whole bird turkey offerings. This export weakness, coupled with domestic market pressures, places Jennie-O’s whole bird turkey products in a position that requires careful management within Hormel's portfolio.

Hormel Foods completed the divestiture of its final owned, non-core sow farm, Mountain Prairie, in the first quarter of fiscal 2025. This strategic decision, which resulted in a loss on the sale, signals that these operations were resource-intensive without generating substantial returns, fitting the characteristics of a Dog in the BCG Matrix.

The company's move to divest these operations underscores a broader strategy to decrease its exposure to commodity markets. This aligns with management's focus on streamlining the business and concentrating on higher-growth, more profitable segments.

Following a significant nut-processing plant shutdown in May 2024, the Planters brand, a key player under Hormel Foods, faced substantial challenges. This disruption directly impacted inventory levels and sales volume, necessitating intensive recovery efforts throughout Q1 2025.

While Planters is recognized as a flagship brand and has been actively working towards market recovery, the period of disruption, coupled with increased commodity input costs, temporarily positioned it within a low market share and low growth environment. This situation, despite ongoing recovery initiatives, aligns with the characteristics of a 'Dog' in the BCG Matrix.

Certain Contract Manufacturing Volumes

Certain contract manufacturing volumes at Hormel Foods have seen a downturn, impacting the retail segment. This decline suggests these operations might be in a low-growth, low-market-share category within Hormel's portfolio, potentially classifying them as Dogs in the BCG Matrix.

Hormel's strategic focus is on premium and value-added brands. Reduced volumes in contract manufacturing and center-store items may not align with this strategic direction, indicating a potential divestment or optimization effort for these specific business areas.

For instance, in fiscal year 2023, Hormel reported that its Refrigerated Foods segment, which includes many retail-facing products, experienced volume declines. While not solely attributable to contract manufacturing, this trend highlights challenges in certain retail channels.

- Reduced Center-Store Volumes: This indicates a potential shift in consumer purchasing habits away from traditional center-aisle grocery items.

- Contract Manufacturing Decline: Lower volumes here suggest either a reduced need from clients or Hormel prioritizing its own branded products.

- Strategic Misalignment: These areas likely represent lower margins and slower growth compared to Hormel's focus on premium brands.

- Potential Optimization: Hormel may be looking to reduce its exposure to these less strategic, lower-performing segments.

Specific Declining Value-Added Meats, Snacking & Entertaining, and Convenient Meals & Proteins Verticals

Within Hormel Foods' broader value-added portfolio, specific segments like Certain Specific Declining Value-Added Meats, Snacking & Entertaining, and Convenient Meals & Proteins in the retail sector saw sales dips. These verticals, characterized by stagnant or declining growth and potentially lower market share, are candidates for portfolio optimization. For instance, in fiscal year 2024, Hormel reported that its Refrigerated Foods segment, which houses many of these products, faced some headwinds impacting specific product lines.

These underperforming areas within the Value-Added Meats, Snacking & Entertaining, and Convenient Meals & Proteins verticals may represent potential 'Dogs' in the BCG matrix. This classification suggests that while the overall company strategy remains robust, these particular product categories might require careful evaluation for resource allocation. Hormel's focus on innovation and strategic adjustments is key to navigating these challenges.

- Specific Declining Value-Added Meats: These products might be experiencing shifts in consumer preferences or increased competition, leading to reduced sales.

- Snacking & Entertaining: While snacking is a growing category, certain sub-segments or brands within this vertical may not be performing as expected.

- Convenient Meals & Proteins: Demand for convenience remains high, but specific offerings in this area could be losing market share or failing to resonate with current consumer needs.

- Portfolio Optimization: Hormel may need to consider strategies such as divestiture, repositioning, or increased marketing support for these specific verticals to improve their performance.

Certain whole bird turkey products under Jennie-O®, facing market volatility and declining exports, represent a 'Dog' category for Hormel Foods. The company's strategic divestiture of non-core sow farms in Q1 2025, which incurred a loss, further illustrates a move away from resource-intensive, low-return agricultural operations, aligning with the 'Dog' profile.

The Planters brand, despite recovery efforts following a May 2024 plant shutdown, experienced temporary low market share and growth due to disruptions and rising commodity costs. Similarly, declining contract manufacturing volumes and reduced center-store sales suggest these areas may be 'Dogs' due to lower margins and slower growth compared to Hormel's focus on premium brands. Specific declining value-added meats, snacking, and convenient meals also show sales dips, indicating potential 'Dog' status requiring portfolio evaluation.

| Category | Hormel Brand/Segment | BCG Classification | Reasoning |

| Whole Bird Turkey | Jennie-O® | Dog | Market volatility, declining exports, downward pressure on prices. |

| Agricultural Operations | Non-core Sow Farms | Dog | Divested due to resource intensity and lack of substantial returns. |

| Snack Products | Planters® | Dog (Temporary) | Disruption from plant shutdown, increased commodity costs impacting market share and growth. |

| Retail/Contract Manufacturing | Various | Dog | Declining volumes, lower margins, and strategic misalignment with premium brand focus. |

| Value-Added Meats/Meals | Specific Declining Verticals | Dog | Sales dips, potential shifts in consumer preference, and loss of market share. |

Question Marks

Hormel's venture into plant-based pepperoni for the foodservice sector, particularly pizzerias, signals a strategic move into a rapidly expanding market. This product category is experiencing significant consumer demand for alternatives to traditional meat products.

While Hormel's current market share in plant-based pepperoni may be relatively low, given its recent entry, the high-growth nature of the plant-based food industry suggests this product line has the potential to become a future star. The global plant-based food market was valued at approximately $22.6 billion in 2023 and is projected to reach $106.1 billion by 2030, growing at a CAGR of 24.6% during this period, according to some market analyses.

To capitalize on this opportunity and establish a strong foothold, Hormel will likely need to allocate substantial resources towards research and development, marketing, and distribution. This investment is crucial for building brand recognition and securing a competitive edge in a market that is attracting considerable attention from both established food companies and innovative startups.

Hormel® Ribbon Pepperoni, launched in 2024, is positioned as a Star in Hormel Foods' BCG Matrix. This innovative product targets the foodservice industry, aiming to boost operational efficiency for restaurants. Its introduction into a high-growth segment focused on kitchen solutions, like automated slicing and portion control, signifies strong market potential.

Despite its promising market position, Ribbon Pepperoni currently holds a modest market share as it gains traction. Significant investment in marketing and expanding distribution channels will be vital to solidify its Star status and achieve market leadership in the foodservice efficiency category.

SPAM® Korean BBQ and Gochujang flavors, launched in 2024, represent Hormel Foods' strategic move to tap into the burgeoning global flavors trend. These new additions aim to capture a segment of the high-growth market for international cuisine-inspired products.

While the SPAM® brand itself is a strong performer, these specific flavor profiles are in their early stages of market penetration, indicating a relatively low market share as they build consumer awareness and trial. Hormel's investment in marketing and strategic alliances is designed to accelerate their growth trajectory.

These flavors are positioned to capitalize on the increasing consumer demand for authentic and convenient international taste experiences. By introducing these products, Hormel is seeking to broaden the appeal of SPAM® beyond its traditional consumer base and expand its usage occasions.

Herdez® Al Pastor Shredded Pork

Herdez® Al Pastor Shredded Pork, a recent addition to Hormel Foods' portfolio, represents a strategic move to tap into the burgeoning market for convenient, globally inspired meals. This product directly addresses a significant consumer trend towards authentic ethnic flavors and easy-to-prepare meal components.

As a new entrant, the Herdez® Al Pastor Shredded Pork is positioned as a question mark within the BCG Matrix. While the overall market for convenient meal solutions and ethnic foods is experiencing robust growth, this specific product likely holds a low market share due to its recent introduction. Hormel Foods will need to invest strategically in marketing and distribution to build brand awareness and capture a meaningful share of this expanding segment.

- Market Growth: The global ethnic food market is projected to reach over $1.3 trillion by 2027, indicating a strong growth trajectory for products like al pastor.

- Convenience Factor: In 2024, consumers increasingly prioritize time-saving meal solutions, with ready-to-eat and heat-and-serve options seeing sustained demand.

- Brand Extension: Herdez® leverages Hormel's established distribution network and brand recognition, providing a foundation for growth, but significant marketing investment is still required.

- Competitive Landscape: The shredded pork market, especially for ethnic varieties, is becoming more competitive, necessitating a clear differentiation strategy for Herdez® Al Pastor.

Products Targeting GLP-1 Weight-Loss Drug Users

Hormel Foods is eyeing the growing GLP-1 weight-loss drug market as a potential growth area for its value-added turkey products. Early indications suggest users of these drugs may increase their poultry consumption, positioning Hormel to capitalize on this trend.

This emerging market presents a strategic question mark for Hormel, demanding focused product innovation and targeted marketing to secure a foothold. For instance, Hormel's Applegate brand, known for its natural and organic offerings, could be well-suited to develop convenient, protein-rich meal solutions appealing to this demographic.

The broader GLP-1 market is experiencing rapid expansion. By mid-2024, analyst projections indicated that the GLP-1 market could reach over $100 billion by 2030, driven by approvals for new indications beyond diabetes and obesity. This forecast underscores the significant, albeit nascent, opportunity for companies like Hormel to adapt their product portfolios.

- Market Opportunity: GLP-1 drug users may increase poultry consumption, creating a new sales channel for Hormel's turkey products.

- Strategic Challenge: Hormel must proactively develop and market products to capture this emerging, high-growth segment.

- Brand Alignment: Brands like Applegate, with their focus on natural and convenient options, are well-positioned to appeal to this demographic.

- Market Growth: The GLP-1 market is projected to exceed $100 billion by 2030, highlighting the scale of the potential opportunity.

Hormel's exploration into the GLP-1 drug market for its turkey products represents a nascent opportunity. This segment is characterized by high growth potential but currently low market share for Hormel's offerings.

Significant investment in research, product development, and targeted marketing will be crucial for Hormel to establish a presence and capitalize on this emerging trend.

The success of this venture hinges on Hormel's ability to innovate and adapt its product portfolio to meet the specific dietary needs and preferences of consumers using GLP-1 medications.

BCG Matrix Data Sources

Our Hormel Foods BCG Matrix leverages comprehensive data, including Hormel's annual reports, market share data from industry analytics firms, and projections for food industry growth. This ensures a robust and accurate strategic overview.