Honest SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Honest Bundle

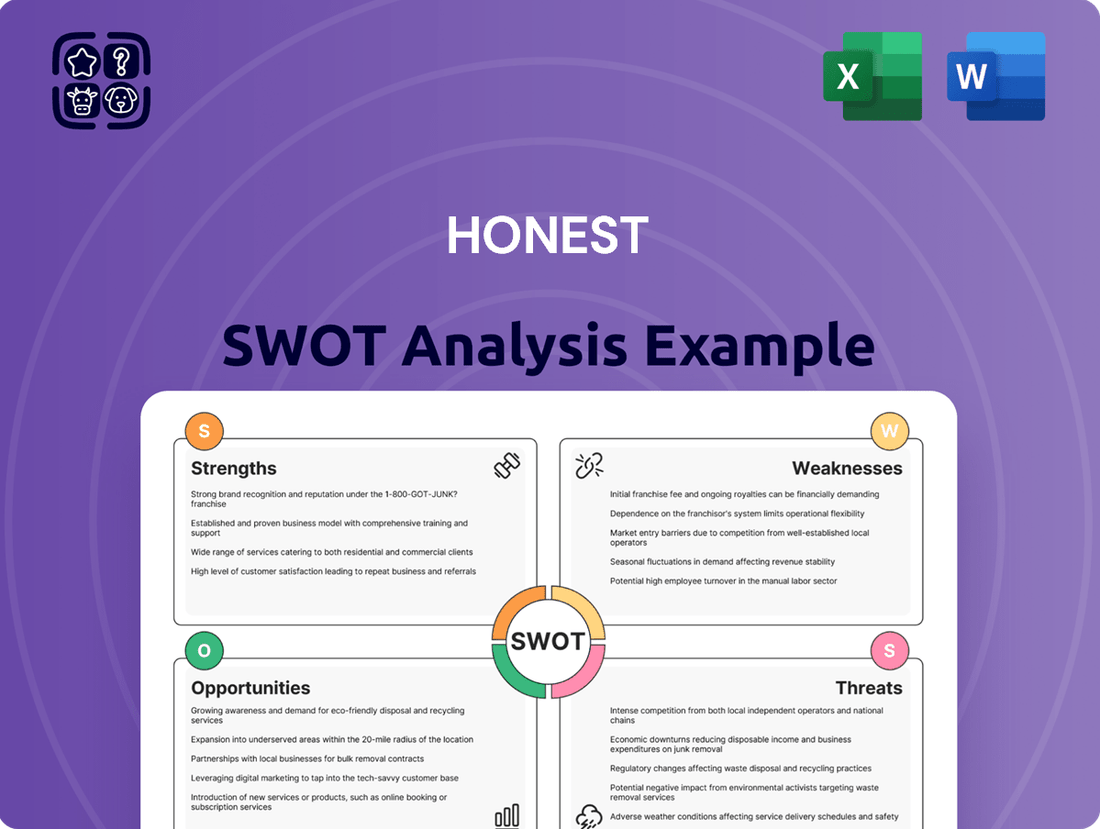

While this snapshot reveals key elements, imagine unlocking the full strategic potential. Our comprehensive SWOT analysis dives deep into market dynamics, internal capabilities, and competitive advantages, offering a clear roadmap for growth.

Want to truly understand the forces shaping this company's future? Purchase the complete SWOT analysis for detailed insights, actionable strategies, and expert commentary designed to inform your next move.

This is just a glimpse of the powerful information available. Gain access to a professionally crafted, fully editable SWOT analysis that provides the critical context needed for confident decision-making and strategic planning.

Don't just see the highlights; understand the entire picture. Acquire the full SWOT analysis to uncover hidden opportunities and potential threats, empowering you to strategize with precision.

Ready to transform insights into impactful action? Invest in the complete SWOT analysis for a robust understanding and the tools to outmaneuver the competition.

Strengths

The Honest Company has built a powerful brand known for its dedication to eco-friendly, sustainable, and chemical-free products, a strategy that has earned significant consumer trust. This commitment strongly appeals to the increasing number of health-conscious and environmentally aware shoppers, cultivating deep loyalty. The company’s rigorous ‘Honest Standard,’ which excludes over 3,500 ingredients, clearly sets it apart in the market and attracts consumers who prioritize clean product formulations.

The Honest Company boasts a diversified product portfolio, spanning baby care, personal care, and household categories. This broad offering effectively diversifies revenue streams, lessening dependence on any single product line and enhancing financial stability.

This multi-category strategy allows The Honest Company to address a wide array of consumer needs within its core 'clean and sustainable' market positioning. It also creates fertile ground for cross-selling opportunities, encouraging customers to explore different product segments.

As of its latest available reporting, the baby and wipes segment, alongside skin and personal care, consistently represent the largest contributors to the company's overall revenue. For instance, in the first quarter of 2024, the baby and wellness segment showed robust growth.

The Honest Company excels with its robust omnichannel distribution, seamlessly blending its direct-to-consumer e-commerce site with crucial partnerships at major retailers like Target and Walmart. This dual strategy significantly broadens customer reach, making their products readily available across diverse shopping preferences.

This integrated approach fuels considerable consumption across both online and brick-and-mortar sales channels. For example, in the fourth quarter of 2024, their largest digital customer experienced a remarkable 35% surge in product consumption, underscoring the effectiveness of their accessible strategy.

Commitment to Sustainability and Transparency

The Honest Company's unwavering commitment to sustainability, ethical sourcing, and ingredient transparency forms a cornerstone of its competitive strength. This dedication is evident in their prioritization of packaging made from post-consumer recycled (PCR) materials, glass, and paper, alongside the use of plant-based and renewable ingredients. This focus resonates strongly with a growing consumer base actively seeking out environmentally responsible products, with studies in 2024 indicating a significant willingness among consumers to pay a premium for sustainable goods.

This commitment translates into tangible benefits:

- Enhanced Brand Reputation: Builds trust and loyalty among consumers who value ethical business practices.

- Market Differentiation: Sets The Honest Company apart in a crowded marketplace by appealing to conscious consumers.

- Reduced Environmental Impact: Contributes to a circular economy and minimizes the company's ecological footprint.

- Attracting Talent: Appeals to employees who seek to work for companies aligned with their personal values.

Improved Financial Performance and Profitability

The Honest Company has achieved a significant financial turnaround. In 2024, the company reported its first full year of positive Adjusted EBITDA as a public entity, coupled with record annual revenue. This success was further bolstered by an expanding gross margin.

Building on this momentum, Q1 2025 results showcased accelerated revenue growth and continued margin improvement. These figures strongly suggest that the company's strategic transformation initiatives are yielding substantial positive results.

- Record Revenue: The company achieved its highest annual revenue in 2024.

- Positive EBITDA: 2024 marked the first full year of positive Adjusted EBITDA.

- Margin Expansion: Gross margin saw notable expansion during the same period.

- Accelerated Growth: Q1 2025 demonstrated a pickup in revenue growth rates.

The Honest Company's brand equity is a significant strength, built on a foundation of eco-friendly, sustainable, and chemical-free products. This resonates deeply with a growing consumer base prioritizing clean formulations and ethical sourcing, fostering strong brand loyalty and market differentiation. The company's rigorous 'Honest Standard,' which excludes over 3,500 ingredients, clearly positions it as a leader in the "clean" market segment.

The company's diversified product portfolio across baby care, personal care, and household categories provides multiple revenue streams and reduces reliance on any single market. This multi-category approach allows for cross-selling opportunities and caters to a broad range of consumer needs within its core brand promise.

The Honest Company has demonstrated a significant financial turnaround, achieving its first full year of positive Adjusted EBITDA in 2024 alongside record annual revenue and expanding gross margins. This positive financial trajectory continued into Q1 2025 with accelerated revenue growth and further margin improvements, indicating successful strategic execution.

Their robust omnichannel distribution strategy, effectively combining a strong direct-to-consumer e-commerce presence with key retail partnerships at major players like Target and Walmart, significantly broadens customer accessibility and drives consumption across various channels.

| Financial Metric | 2024 Performance | Q1 2025 Performance |

|---|---|---|

| Annual Revenue | Record High | Accelerated Growth |

| Adjusted EBITDA | First Full Year Positive | Continued Improvement |

| Gross Margin | Expanding | Further Expansion |

What is included in the product

Provides a clear SWOT framework for analyzing Honest’s business strategy, detailing its internal capabilities and external market dynamics.

Uncovers hidden weaknesses and threats, enabling proactive problem-solving and risk mitigation.

Weaknesses

The Honest Company's commitment to premium, eco-friendly ingredients and sustainable manufacturing often results in higher product prices. This premium pricing can be a barrier for budget-conscious shoppers, potentially capping market share expansion when compared to less expensive alternatives. For instance, in 2023, while specific price comparisons are dynamic, general market data suggests that natural and organic personal care products can command a 10-50% price premium over conventional counterparts.

Honest Company faces a formidable challenge in the consumer goods sector, where established multinational corporations and agile niche brands, including private-label sustainable options from major retailers, vie for consumer attention. This intense competitive landscape means Honest must constantly innovate and differentiate itself to capture and retain market share.

Many competitors boast extensive product portfolios and significantly larger marketing war chests, enabling them to command greater shelf space and reach a wider audience. For instance, in 2023, major players in the baby care segment, a key area for Honest, saw substantial marketing spend, with companies like Procter & Gamble allocating billions globally to promote their brands.

This disparity in resources can make it difficult for Honest to expand its footprint and maintain its competitive edge, particularly as consumer preferences shift rapidly and new entrants emerge with innovative approaches to product development and distribution.

The very appeal of 'clean' and 'natural' labeling, while a significant draw for consumers, also presents a substantial weakness due to the industry's lack of standardized definitions for these terms. This ambiguity opens the door for heightened regulatory oversight and potential challenges from consumer advocacy groups. For instance, in 2024, the Food and Drug Administration (FDA) continued its review of marketing claims, indicating a growing focus on the substantiation of such descriptors across various product categories.

This lack of universal definition can lead to increased scrutiny, potentially resulting in costly litigation for false advertising if claims are perceived as misleading by consumers or regulatory bodies. Companies relying heavily on these descriptors might face negative publicity and a loss of consumer trust if their product's ingredients or processing methods are found to be inconsistent with the 'clean' or 'natural' image they project.

The challenge is compounded as consumers become more sophisticated and demand greater transparency regarding ingredient sourcing and manufacturing processes. A report by Nielsen in late 2024 highlighted that over 60% of consumers actively seek out products with clearly defined 'clean' ingredient lists, underscoring the need for precise and defensible labeling to avoid misinterpretation and subsequent backlash.

Potential for Supply Chain Vulnerabilities

The Honest Company's dedication to ethical and eco-friendly sourcing means it often depends on specialized suppliers for its organic and natural ingredients. This reliance on a narrower supplier base can create vulnerabilities, as there may be limited alternative sources if a primary supplier encounters problems. For instance, a disruption in the supply of a key natural preservative, crucial for product stability and shelf life, could halt production for a significant product line.

This concentration, coupled with stringent quality control demanded by The Honest Company, can lead to several potential issues. These include:

- Supply Chain Constraints: Limited supplier options can make it difficult to scale production rapidly to meet unexpected demand surges.

- Cost Volatility: Reliance on specialized, often niche, suppliers can expose the company to price fluctuations in raw materials.

- Disruption Risk: Any operational issues, quality control failures, or even natural disasters affecting a key supplier could directly impact The Honest Company's ability to produce and distribute its products. In 2023, for example, disruptions in global logistics impacted many consumer goods companies, highlighting the fragility of extended supply chains.

Moderated Growth Outlook and Stock Volatility

The Honest Company anticipates mid-single-digit revenue growth for 2025, a slowdown from its earlier, more aggressive expansion phases. This moderated outlook might not align with investors seeking rapid, high-percentage top-line increases.

Despite positive financial reporting, the company's stock has experienced notable volatility. This suggests that the market is still grappling with its valuation and the sustainability of its growth trajectory amidst a crowded consumer goods landscape.

- Projected 2025 Revenue Growth: Mid-single digits, indicating a more measured pace.

- Investor Sentiment: Volatility suggests ongoing debate about long-term growth potential and market positioning.

- Competitive Pressures: The consumer goods sector remains highly competitive, impacting market share and pricing power.

The Honest Company's premium pricing strategy, while aligning with its brand ethos, can limit its appeal to a broader market segment. Competitors, including large corporations with substantial marketing budgets and private-label sustainable options, present a significant challenge, often commanding greater visibility and consumer reach. This intense competition necessitates continuous innovation and differentiation to maintain market share in a dynamic consumer goods sector.

Same Document Delivered

Honest SWOT Analysis

The preview you're seeing is the exact SWOT analysis document you will receive upon purchase. This ensures transparency and demonstrates the quality and detail of the final product. You can be confident that what you see is what you get, with no hidden surprises. Purchase now to unlock the complete, professional analysis.

Opportunities

The Honest Company has a considerable runway to broaden its product portfolio beyond existing baby and personal care essentials. Targeting new segments within the booming wellness and sustainable living sectors could significantly tap into untapped consumer demand and amplify its established brand reputation for clean products.

Recent product introductions, like the vegan collagen skincare line, serve as a clear indicator of this expansion strategy's viability. This move into higher-margin beauty and wellness categories aligns with broader market trends favoring natural and ethically sourced ingredients, a space where Honest has already built strong consumer trust.

Consumers are increasingly prioritizing sustainability, with studies showing a significant portion of shoppers willing to pay more for eco-friendly and ethically produced goods. For instance, a 2024 survey indicated that over 60% of consumers consider sustainability when making purchasing decisions, a notable increase from previous years.

This growing preference creates a prime opportunity for The Honest Company to leverage its existing commitment to transparency and clean ingredients, directly appealing to this expanding consumer base. The company can further capitalize by highlighting its sustainable sourcing and production practices, potentially attracting new customers and increasing loyalty among existing ones.

The market for sustainable products is projected to continue its upward trajectory through 2025 and beyond, offering a sustained growth avenue. The Honest Company's established brand identity aligns well with this trend, positioning it to capture a larger share of this lucrative and expanding market segment.

There's a clear chance to grow by reaching customers through new retail avenues like dollar stores and club stores. These channels often reach different shoppers and could tap into markets that haven't been fully explored yet, making products more readily available. For instance, while major grocery chains are a focus, extending into discount retail could capture a broader consumer base.

Looking beyond domestic borders, international expansion presents another significant opportunity. As demand for environmentally friendly and sustainable goods rises globally, entering markets where these products are less common or currently unavailable could be a smart move. Emerging economies, in particular, often show a strong appetite for innovative and conscious consumer products, offering substantial growth potential.

Leveraging E-commerce and Digital Engagement

The Honest Company's digital channels are a significant growth engine, particularly with its largest digital customer. This highlights a clear opportunity to capitalize on the burgeoning e-commerce market.

Further investment in direct-to-consumer (DTC) strategies and e-commerce infrastructure can directly translate to enhanced customer retention and increased lifetime value. For instance, in 2023, The Honest Company saw continued strength in its digital sales, contributing a substantial portion of its overall revenue, though specific figures are often proprietary. This trend is expected to persist into 2024 and 2025 as consumer shopping habits continue to shift online.

Strengthening digital marketing efforts will be crucial for building deeper brand loyalty. This includes personalized customer journeys and data-driven engagement strategies. For example, by late 2024, many DTC brands are expected to have refined their customer segmentation models, allowing for more targeted promotions and content, which can boost repeat purchases.

Key opportunities in this area include:

- Expanding DTC Platform Capabilities: Enhancing website functionality, subscription models, and user experience.

- Optimizing Digital Marketing Spend: Focusing on channels with proven ROI, such as social media marketing and influencer collaborations.

- Leveraging Data Analytics: Utilizing customer data to personalize offers and improve product development based on online trends.

- Exploring New Digital Channels: Investigating partnerships with emerging online marketplaces or social commerce platforms.

Innovation in Product Formulation and Packaging

Honest can gain a significant edge by continuously innovating its product formulations and packaging. Developing more effective, sustainable, and user-friendly options sets the brand apart. For instance, a focus on advanced biotech solutions for eco-friendly ingredients, as seen in the growing demand for plant-based cosmetics, can attract environmentally conscious consumers.

Expanding refillable or highly recyclable packaging aligns perfectly with current consumer expectations and reinforces Honest's core commitment to sustainability. The global sustainable packaging market is projected to reach over $435 billion by 2027, indicating substantial growth potential for brands prioritizing these initiatives.

- Enhanced Brand Loyalty: Sustainable and innovative products foster stronger customer connections.

- Market Differentiation: Unique formulations and eco-friendly packaging can create a distinct brand identity.

- Attracting New Demographics: A commitment to sustainability appeals to a growing segment of environmentally aware consumers.

- Cost Efficiencies: Long-term, sustainable practices can sometimes lead to reduced material and waste disposal costs.

The Honest Company has a significant opportunity to expand its product lines into growing markets like wellness and sustainable living, leveraging its reputation for clean products. Recent ventures into vegan collagen skincare demonstrate this strategy's potential, tapping into higher-margin beauty categories that align with consumer demand for natural and ethically sourced goods.

Consumers increasingly prioritize sustainability, with a significant portion willing to pay more for eco-friendly products; a 2024 survey showed over 60% of consumers consider sustainability in purchasing decisions. This trend provides a prime avenue for Honest to highlight its transparent sourcing and production, attracting new customers and deepening loyalty.

Expanding into new retail channels like dollar and club stores offers a chance to reach different customer segments and untapped markets, increasing product accessibility beyond traditional grocery chains. International expansion is another avenue, particularly in emerging economies where demand for conscious consumer products is rising, offering substantial growth potential.

The company can further capitalize on the booming e-commerce market by investing in its direct-to-consumer (DTC) platform and digital marketing. Enhancing website capabilities, optimizing digital ad spend, and leveraging customer data for personalized experiences are key to boosting customer retention and lifetime value, with digital sales expected to remain a strong revenue contributor through 2025.

Threats

The clean beauty and sustainable consumer goods market is a hotbed of activity, with new brands popping up constantly. Established players are also jumping on the bandwagon, launching their own eco-friendly lines, and even store brands are getting in on the action. This crowded marketplace means The Honest Company faces a real challenge to stand out.

This intense competition often triggers price wars, forcing companies to lower their prices to attract customers. For Honest, this could mean smaller profits per item sold. In 2024, reports indicated that the beauty industry, in particular, saw a significant increase in new product launches within the 'clean' segment, with over 30% more SKUs introduced compared to the previous year, directly impacting market share dynamics.

Furthermore, to capture consumer attention in such a busy environment, marketing and advertising costs tend to skyrocket. Honest will likely need to spend more on reaching its target audience, which can further squeeze its gross margins. As of early 2025, digital marketing spend in the sustainable consumer goods sector has seen a year-over-year increase of approximately 15%, a clear indicator of the rising cost of customer acquisition.

This pressure can lead to a dilution of market share as consumers have more choices than ever. Honest's unique selling proposition is tested daily, and maintaining its position requires constant innovation and strategic pricing to avoid losing ground to both niche startups and large conglomerates.

The Honest Company faces significant threats from regulatory bodies due to the ambiguity surrounding terms like 'clean,' 'natural,' and 'non-toxic.' This lack of standardized definitions creates a vulnerability to increased scrutiny and potential legal challenges concerning their product claims and ingredient disclosures.

Evolving regulatory landscapes, particularly in markets like the European Union, could compel the company to undertake expensive product reformulations or alter its marketing strategies to comply with new standards. For instance, new EU regulations on chemical safety and labeling, expected to be fully implemented by 2025, could impact ingredient sourcing and product formulations across their entire range.

The Honest Company faces a significant threat from rising raw material and production costs. Fluctuations in the prices of organic, natural, and sustainably sourced ingredients can directly impact its profitability. For instance, a 2024 report indicated that the cost of key organic cotton, a core material for many of its products, saw an average increase of 8% year-over-year due to adverse weather conditions affecting harvests in major producing regions.

Moreover, potential hikes in manufacturing and transportation expenses further squeeze gross margins. Increased energy costs and global supply chain disruptions, which were particularly acute in 2023 and continued to be a concern in early 2024, add to these pressures. These factors can make it challenging for The Honest Company to maintain its competitive pricing while upholding its commitment to quality and sustainability.

The company's reliance on specific sourcing regions, such as China and Mexico for certain components and manufacturing, also exposes it to the threat of tariff fluctuations. Changes in trade policies or imposition of new tariffs could lead to unexpected cost increases, impacting the final price of goods for consumers and potentially affecting demand.

Negative Publicity and Product Recalls

The Honest Company's reliance on trust and safety makes it highly vulnerable to negative publicity and product recalls. Concerns about ingredients, effectiveness, or manufacturing flaws could significantly harm its reputation and financial standing. For instance, past lawsuits have underscored this susceptibility, potentially impacting consumer confidence and sales.

Such incidents can lead to immediate financial repercussions, including the cost of recalls, potential fines, and a drop in sales. In 2023, the consumer goods sector saw an increase in product recalls, with safety concerns being a primary driver, highlighting the broader industry risk Honest Company faces.

- Brand Reputation Damage: Negative events can erode the trust consumers place in Honest Company's products, which are marketed as safe and natural.

- Financial Impact: Recalls and associated lawsuits can result in substantial financial losses, affecting profitability and cash flow.

- Competitive Disadvantage: Competitors who avoid such issues may gain market share and customer loyalty.

Economic Downturns Affecting Consumer Spending

Economic downturns pose a significant threat to The Honest Company. During periods of high inflation or recession, consumers tend to cut back on non-essential purchases. This means premium-priced goods, like many offered by The Honest Company, are particularly vulnerable as shoppers shift towards more budget-friendly options.

For instance, the U.S. inflation rate remained elevated in 2023, impacting consumer purchasing power. If economic conditions worsen, a notable decline in discretionary spending could directly translate to reduced demand for The Honest Company's products. This could force a reevaluation of pricing strategies or marketing efforts to appeal to a more cost-conscious consumer base.

- Reduced Discretionary Spending: Consumers may postpone or cancel purchases of premium products.

- Shift to Alternatives: A move towards lower-priced competitors is likely.

- Impact on Premium Positioning: The company's brand image could be challenged if price becomes a primary driver for consumers.

The intense competition in the clean beauty and sustainable goods market, with new brands and established players constantly entering, forces The Honest Company to fight harder for market share and can lead to price wars. In 2024, the beauty sector saw over a 30% increase in new 'clean' product launches, intensifying this challenge. This crowded space also drives up marketing costs, with digital ad spend in sustainable goods rising about 15% year-over-year by early 2025, squeezing profit margins.

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, incorporating financial reports, comprehensive market research, and expert industry insights to provide a truly honest assessment.