Honest Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Honest Bundle

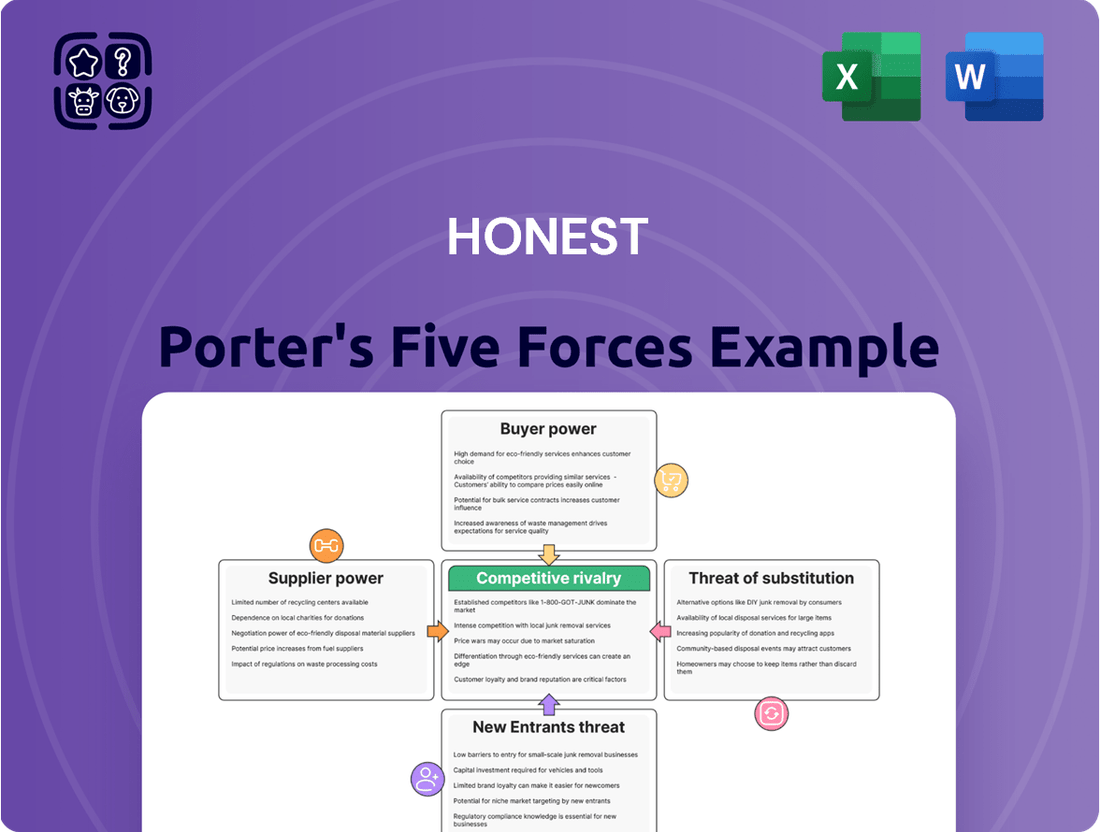

Honest Porter's Five Forces Analysis reveals a dynamic competitive landscape. Understanding the bargaining power of suppliers and buyers is crucial for Honest's profitability. We've identified key threats from new entrants and the intense rivalry within the industry.

The threat of substitute products also presents a significant challenge that Honest must navigate. This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Honest’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The Honest Company's reliance on a concentrated supplier base for critical products like diapers and wipes significantly amplifies supplier bargaining power. Currently, the company sources all its diapers from a single provider and nearly all its wipes from another.

This single-sourcing strategy grants these suppliers considerable leverage over pricing and contract terms. Switching suppliers for such essential components involves substantial costs and potential disruptions, including production delays and inventory stockouts, which further emboldens the suppliers' position.

The Honest Company's commitment to eco-friendly, sustainable, and chemical-free ingredients means they depend on specialized inputs. This specialization naturally shrinks the available supplier base, giving those who can consistently deliver these unique, high-quality, and certified sustainable materials more leverage.

This supplier power is amplified because the ability to source truly sustainable and traceable ingredients is not just a preference but a cornerstone of Honest Company's brand identity and its product claims. For instance, in 2024, the global market for sustainable personal care ingredients was projected to reach billions, highlighting the demand and the specialized nature of these components.

The Honest Company faces significant supplier bargaining power due to high switching costs for its core products, such as diapers and wipes. Transitioning to new suppliers for these critical components requires substantial investment in re-tooling manufacturing processes and implementing rigorous new quality control measures. This operational overhaul can lead to production delays and potential disruptions in product availability for consumers.

These disruptions directly impact The Honest Company's revenue streams and inventory management. For instance, a sudden halt in supply could mean lost sales opportunities and damage to brand reputation. In 2023, the consumer staples sector, which includes baby products, saw an average increase in operating costs of 5-7%, making supplier price adjustments more impactful.

Consequently, existing suppliers of essential materials like plant-based fibers or absorbent gels can leverage these switching costs to negotiate more favorable terms. The potential for extended downtime and financial penalties associated with a supplier change amplifies the leverage held by current partners, making it challenging for The Honest Company to secure better pricing or more flexible contract terms.

Threat of Forward Integration by Suppliers

While less common, a supplier’s threat of forward integration can significantly impact The Honest Company. Imagine a key supplier of a niche, sustainable ingredient deciding to launch its own consumer product line. This move allows them to capture more of the profit by selling directly to customers, effectively cutting out The Honest Company.

This scenario bypasses The Honest Company and directly competes for the same consumer base. The supplier would aim to capture a larger portion of the value chain, potentially leveraging their specialized ingredient as a unique selling proposition.

However, the significant capital investment and extensive brand-building efforts needed to establish a presence in the consumer goods market serve as a deterrent for many suppliers. Launching a new consumer brand requires substantial marketing, distribution networks, and consumer trust, which are considerable hurdles to overcome.

For instance, the average cost to launch a new consumer packaged goods brand in the US can range from hundreds of thousands to millions of dollars, depending on the product category and marketing scope. This high barrier to entry, coupled with the established brand equity of companies like The Honest Company, generally mitigates the immediate risk of widespread forward integration by its suppliers.

Key considerations regarding supplier forward integration include:

- Supplier Specialization: The threat is higher for suppliers providing unique or proprietary ingredients not easily sourced elsewhere.

- Market Dynamics: A rapidly growing or highly profitable market segment can incentivize suppliers to integrate forward.

- Capital Requirements: High upfront investment in branding, marketing, and distribution can deter suppliers.

- Competitive Landscape: The presence of established brands and intense competition can make direct market entry challenging for suppliers.

Importance of Supplier's Input to Honest Company's Product Differentiation

The Honest Company's brand identity is intrinsically linked to its promise of clean, safe, and eco-conscious products. This commitment makes the caliber and origin of its raw materials absolutely critical. Suppliers offering certified organic, non-toxic, or sustainably harvested components are not just vendors; they are foundational to Honest Company’s ability to stand out in a crowded market. Their specialized inputs directly bolster Honest's product differentiation and safeguard its brand integrity.

This dependence on suppliers providing unique, high-quality attributes significantly amplifies their bargaining power. For instance, a supplier of exclusively GOTS-certified organic cotton for Honest's baby diapers holds considerable leverage. In 2023, the global organic cotton market was valued at approximately $2.5 billion, with growth projected due to increasing consumer demand for sustainable textiles. Companies like Honest, which prioritize such certifications, are more susceptible to price increases or stricter supply terms from these specialized providers.

- Supplier Specialization: Suppliers providing certified organic, non-toxic, or sustainably sourced ingredients are vital for Honest Company's product differentiation.

- Brand Reputation Link: The quality and sourcing of these raw materials directly impact Honest Company's brand image and consumer trust.

- Increased Leverage: This reliance on specific input characteristics grants these suppliers enhanced bargaining power over Honest Company.

- Market Context: The growing demand for organic and sustainable products, evidenced by the $2.5 billion global organic cotton market in 2023, reinforces the position of these key suppliers.

The Honest Company faces significant supplier bargaining power due to its reliance on a concentrated base for specialized, eco-friendly materials. This dependence, particularly for core products like diapers and wipes, grants suppliers considerable leverage over pricing and terms. The company's commitment to sustainable and chemical-free ingredients further narrows the supplier pool, amplifying the power of those who can meet these stringent requirements.

Switching suppliers for these critical components incurs substantial costs and risks, including production delays and potential inventory stockouts, which emboldens existing suppliers. For instance, in 2023, the consumer staples sector, including baby products, saw operating cost increases of 5-7%, making supplier price adjustments more impactful for companies like Honest.

Suppliers of unique, high-quality, and certified sustainable materials, such as GOTS-certified organic cotton, hold significant sway. The global organic cotton market was valued at approximately $2.5 billion in 2023, underscoring the demand and specialized nature of these inputs, which directly bolsters supplier leverage.

| Factor | Impact on Honest Company | Supplier Leverage |

| Concentrated Supplier Base | High reliance on few suppliers for critical products | Increased |

| Product Specialization (Eco-friendly) | Dependence on niche, certified ingredients | Increased |

| High Switching Costs | Significant investment and disruption risk in changing suppliers | Increased |

| Brand Identity Link to Materials | Suppliers are integral to product differentiation and brand integrity | Increased |

What is included in the product

This analysis dissects the competitive forces impacting Honest, evaluating industry rivalry, the threat of new entrants, buyer and supplier power, and the threat of substitutes to reveal Honest's strategic positioning.

Effortlessly visualize competitive intensity with an intuitive interactive dashboard, transforming complex data into actionable insights.

Customers Bargaining Power

Customer price sensitivity is a key factor. While consumers of eco-friendly and premium goods, like those offered by The Honest Company, often prioritize values, their willingness to pay can be tested, particularly during economic slowdowns. In 2024, inflation continued to impact household budgets, making even ethically-minded consumers more discerning about price.

The Honest Company's strategy of positioning its products at a premium compared to conventional alternatives means customers are more prone to explore other options if price points become too elevated. For instance, if a competitor offers a similar eco-friendly diaper at a significantly lower price, a price-sensitive customer might switch. This dynamic underscores the importance of balancing premium positioning with competitive pricing to retain market share.

Customers possess significant bargaining power due to the wide availability of substitute products in the baby and personal care market. This includes everything from traditional, widely available options to a growing number of eco-friendly alternatives. For instance, the global baby care market was valued at approximately $86.7 billion in 2023 and is projected to reach $130.6 billion by 2030, indicating a competitive landscape with numerous players offering diverse product lines.

The presence of private label brands from major retailers and the extensive product portfolios of large consumer packaged goods (CPG) companies further amplify this power. Consumers can easily shift their purchasing decisions if they perceive Honest Company's products as too expensive or lacking in certain features. This ease of switching, driven by abundant alternatives, puts considerable pressure on Honest Company to maintain competitive pricing and product quality.

The Honest Company's customer base is characterized by a strong demand for transparency regarding ingredients and ethical sourcing. This informed consumer group actively researches products and company practices, wielding significant influence through their purchasing choices. For instance, surveys in 2024 indicated that over 70% of consumers prioritize brands that are open about their supply chains and product formulations, directly impacting companies like Honest, which has built its brand on these principles.

Customer Switching Costs

For many consumer goods, like baby products, personal care items, and everyday household necessities, the cost for a customer to switch brands is quite low. Think about it: if your preferred baby wipes are out of stock, it's usually a simple matter to grab a different brand right off the shelf or find one with a quick online search. This abundance of choice and minimal effort to change suppliers directly translates to greater power for the customer. They can easily shift their spending elsewhere if they aren't satisfied with price, quality, or availability.

This low barrier to switching is a significant factor in the bargaining power of customers. In 2024, the consumer packaged goods (CPG) sector, where these products are prevalent, continues to see intense competition. For instance, Nielsen data from early 2024 indicated that private label brands, often offering a lower price point, continued to gain market share in many CPG categories, a trend directly fueled by consumers’ ability to switch easily.

- Low Switching Costs: Consumers face minimal financial or psychological hurdles when moving from one brand to another in categories like baby care or personal hygiene.

- Abundant Alternatives: The retail landscape, both brick-and-mortar and online, offers a vast array of competing brands, making it easy for customers to find substitutes.

- Increased Customer Power: This ease of switching empowers consumers to demand better pricing, higher quality, or improved service, as they can readily take their business elsewhere.

- Market Share Dynamics: In 2024, the CPG market saw private label brands increasing their share, demonstrating how easily consumers can switch to more cost-effective options, thereby pressuring national brands.

Online Distribution and Direct-to-Consumer Channels

The Honest Company leverages both e-commerce and retail partnerships, offering customers direct access and robust comparison shopping through digital channels. This online presence significantly amplifies customer bargaining power by fostering price transparency and a wider array of choices.

While Honest Company's direct-to-consumer (DTC) channel plans to shift focus from shipping and fulfillment beyond 2025 towards education and product showcasing, the broader trend of online retail empowers consumers. By 2024, e-commerce sales in the US reached over $1.1 trillion, demonstrating the significant leverage consumers gain from readily available online information and competitive pricing.

- Direct Access: Online platforms allow customers to bypass intermediaries, directly engaging with brands like Honest Company.

- Price Transparency: Consumers can easily compare prices across multiple retailers and brands online, driving down margins.

- Information Availability: Extensive product reviews and detailed specifications empower informed purchasing decisions, increasing customer leverage.

- Convenience: The ease of online shopping encourages consumers to seek out the best value, putting pressure on companies to remain competitive.

Customers hold substantial bargaining power when switching costs are low, as is common in consumer packaged goods. This means consumers can easily shift to competitors if they find better pricing or quality. For example, the ease of finding alternative baby wipes or diapers empowers consumers to demand more from brands.

The vast number of available substitutes further amplifies this power. In 2024, the consumer packaged goods sector continued to see private label brands gain market share, a clear indicator of consumers readily switching to more cost-effective options, thus pressuring established brands.

Online channels and readily available information empower consumers with price transparency and choice. By 2024, US e-commerce sales exceeded $1.1 trillion, reflecting how easily consumers can compare options and seek the best value, increasing their leverage.

| Factor | Impact on Customer Bargaining Power | 2024 Relevance |

|---|---|---|

| Switching Costs | Low costs increase power. | Minimal financial/psychological hurdles for brand changes in CPG. |

| Availability of Substitutes | More options increase power. | Global baby care market projected to reach $130.6B by 2030, indicating high competition. |

| Information Access | Transparency empowers decisions. | Over 70% of consumers in 2024 prioritized brands open about supply chains. |

| Online Retail Growth | Facilitates comparison and switching. | US e-commerce sales surpassed $1.1 trillion in 2024. |

Full Version Awaits

Honest Porter's Five Forces Analysis

This preview shows the exact, professionally crafted Honest Porter's Five Forces Analysis you'll receive immediately after purchase, offering a comprehensive examination of competitive forces within the industry. You're looking at the actual document, which delves into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing competitors. Once you complete your purchase, you’ll get instant access to this exact, fully formatted file, ready to inform your strategic decisions. No mockups, no samples—the document you see here is precisely what you’ll be able to download and utilize for your business planning.

Rivalry Among Competitors

The Honest Company faces a crowded marketplace, contending with behemoths like Procter & Gamble and Kimberly-Clark, which boast extensive product lines and dominant market share. This intense rivalry extends to a multitude of smaller, nimble brands focused on natural and eco-friendly alternatives, creating a dynamic and challenging environment.

In 2024, the consumer packaged goods sector, where Honest Company primarily operates, continues to see significant competition. For instance, the natural and organic personal care market alone is projected to reach over $25 billion by 2025, indicating a large and attractive, yet highly contested, segment.

The sheer diversity means Honest Company must constantly innovate and differentiate itself. Competitors range from household names with vast distribution networks and established brand loyalty to niche players rapidly capturing consumer attention with specialized offerings.

The burgeoning demand for eco-friendly, natural, and organic products across baby care, personal care, and household goods is a significant magnet for new entrants. This trend intensifies competitive rivalry as more companies vie for market share in these rapidly expanding segments.

The global organic baby toiletries market is a prime example, with projections indicating a Compound Annual Growth Rate (CAGR) of 7.9% from 2025 to 2030. This robust growth rate signals a highly attractive market, naturally inviting increased competition.

Furthermore, the overall baby products market is also experiencing considerable expansion. This broader growth, coupled with the specific appeal of natural and organic offerings, creates a fertile ground for both established players and new businesses to enter and compete.

The Honest Company carves out its niche by emphasizing 'cleanly-formulated, sustainably-designed' products, a strategy amplified by its celebrity founder, Jessica Alba. This distinct positioning aims to cultivate a loyal customer base. However, in 2024, the market for natural and sustainable goods is increasingly crowded, making it a challenge to maintain this differentiation.

Many competitors have also adopted similar messaging around natural ingredients and eco-friendly practices. For instance, brands like Grove Collaborative and Seventh Generation are prominent players, often leveraging aggressive marketing and competitive pricing. This intense competition means Honest Company must continually innovate and reinforce its brand message to retain customer loyalty and prevent customers from switching to alternatives.

Exit Barriers

Exit barriers can significantly influence a company's strategic decisions, particularly in industries with substantial upfront investments. For consumer goods companies, high fixed costs related to manufacturing facilities, intricate distribution channels, and ongoing brand building efforts create significant hurdles for exiting the market.

The Honest Company, despite its robust financial standing with no debt and a healthy cash reserve, faces these complexities. The imperative to consistently fund innovation and marketing to maintain its competitive edge means that a simple exit would be far from straightforward.

- High Fixed Costs: Manufacturing, distribution, and brand presence require substantial, often sunk, investments.

- Innovation & Marketing Needs: Continuous spending is crucial for competitiveness, making a clean break difficult.

- Brand Reputation: Divesting or ceasing operations could impact brand equity and customer trust, influencing exit strategies.

- Supply Chain Commitments: Existing agreements with suppliers and distributors can create contractual obligations that complicate an exit.

Intensity of Advertising and Marketing

The consumer goods industry, particularly in the sustainable and natural product space where The Honest Company operates, is characterized by fierce competition fueled by substantial advertising and marketing expenditures. Companies pour significant resources into creating brand awareness and differentiating their offerings, making it challenging for newer or smaller players to gain traction. For The Honest Company, this means a constant need to invest in robust marketing campaigns to communicate its unique value proposition, focusing on its commitment to transparency, ingredient safety, and sustainability, especially when competing against established giants with much larger marketing war chests.

In 2024, the consumer packaged goods (CPG) advertising spending continued to be a major factor. For example, major CPG companies often allocate billions annually to marketing. The Honest Company must therefore strategically deploy its marketing budget to effectively reach its target demographic, which values ethical sourcing and product efficacy.

- High Advertising Spend: The CPG sector typically sees companies invest heavily in advertising to build brand loyalty and drive sales.

- Brand Differentiation: Marketing efforts are crucial for The Honest Company to highlight its commitment to non-toxic ingredients and eco-friendly practices.

- Competitive Landscape: Rivals with vast marketing budgets can often dominate consumer mindshare through continuous promotional activities.

- Strategic Investment: The Honest Company needs to ensure its marketing investments are efficient, targeting key consumer segments and emphasizing its core values.

The Honest Company faces intense rivalry from both large, established companies and a growing number of niche brands focused on natural and eco-friendly products. This competitive pressure is particularly strong in the lucrative baby care and personal care markets.

In 2024, the natural and organic personal care market is a key battleground, with projections indicating significant growth. This expansion attracts numerous players, forcing The Honest Company to continually innovate and reinforce its brand messaging to stand out.

Competitors frequently leverage aggressive marketing and competitive pricing, making it essential for The Honest Company to strategically invest in its own promotional efforts to maintain customer loyalty and market share.

The high fixed costs associated with manufacturing, distribution, and brand building in the consumer goods sector create substantial exit barriers, requiring companies like The Honest Company to maintain consistent investment in innovation and marketing.

| Competitor Type | Key Characteristics | Impact on Honest Company |

|---|---|---|

| Large CPG Companies (e.g., P&G) | Extensive product lines, dominant market share, vast distribution networks, significant marketing budgets. | Threatens market share through brand recognition and economies of scale. |

| Niche Natural/Eco-Friendly Brands | Focused product lines, agile innovation, strong appeal to specific consumer segments, often leveraging digital marketing. | Captures market share through specialized offerings and targeted messaging, intensifying the need for differentiation. |

| Emerging Direct-to-Consumer (DTC) Brands | Innovative product development, direct customer relationships, often emphasizing sustainability and transparency. | Challenge brand loyalty by offering unique value propositions and a more personalized customer experience. |

SSubstitutes Threaten

A significant threat to Honest Porter's eco-friendly offerings stems from the sheer abundance and lower price points of conventional, non-eco-conscious alternatives in the baby, personal care, and household product markets. These standard products fulfill the same fundamental consumer needs, making them an easy choice for budget-minded shoppers. For instance, in 2024, the global market for conventional cleaning products alone was valued at over $200 billion, showcasing the massive scale and accessibility of these substitutes.

Consumers often weigh the price against performance when considering substitutes. If Honest's eco-friendly products carry a significant price premium, and consumers find conventional alternatives offer comparable performance for less, they might stick with the cheaper options. This is evident in the diaper market, where despite the rise of biodegradable options, traditional plastic diapers remain a dominant choice due to their lower cost, even as the biodegradable segment saw a 7% growth in 2023.

Consumers increasingly explore DIY and homemade alternatives, especially in cleaning and personal care. This trend is driven by a desire for ingredient control and a growing awareness of chemical sensitivities. For instance, the global DIY personal care market was valued at approximately USD 11.2 billion in 2023 and is projected to grow, indicating a tangible shift in consumer behavior.

Private Label and Store Brands

Retailers increasingly leverage private label and store brands, directly substituting for national brands like Honest. These offerings often compete on price, and as they evolve to include 'clean' or 'natural' attributes, they pose a significant threat by mimicking Honest's core value proposition. For instance, in 2024, private label penetration in the U.S. grocery market reached approximately 20%, with some categories seeing much higher adoption rates, directly impacting market share for established brands.

The growing sophistication of private label products means they are no longer just budget alternatives but are becoming aspirational choices for consumers. This trend is particularly concerning for brands like Honest that build their identity around specific product attributes and quality perceptions. By offering similar benefits at a lower cost, private labels can effectively siphon demand.

- Private Label Growth: In 2024, NielsenIQ reported that private label sales in the US increased by 4.8% year-over-year, outpacing national brand growth in many CPG categories.

- Price Sensitivity: Consumers consistently seek value; a 10-20% price difference, common between national and private labels, can be a decisive factor, especially for everyday consumables.

- Brand Mimicry: Retailers are investing heavily in product development to replicate the formulations and perceived quality of popular brands, blurring the lines for consumers.

- Retailer Power: Strong retailer relationships are crucial; retailers can prioritize shelf space for their private labels, limiting visibility for competing brands.

Shifting Consumer Priorities

Consumer priorities can significantly impact the threat of substitutes. While there's a growing demand for sustainable products, economic headwinds can shift this focus. For instance, if inflation remains high or job security feels uncertain, consumers might gravitate towards more budget-friendly options, even if they are less sustainable.

This shift can bolster the appeal of cheaper, less eco-conscious substitutes that were previously overlooked. In 2024, persistent inflation and global economic volatility are likely to make price a more dominant factor for a larger segment of the market, increasing the attractiveness of these alternatives.

- Economic Uncertainty: Rising inflation and potential recessions in 2024 could force consumers to cut back on discretionary spending, including premium sustainable goods.

- Price Sensitivity: Data from early 2024 suggests a noticeable increase in price sensitivity across various consumer categories, making lower-cost substitutes more appealing.

- Shifting Values: While sustainability remains important, immediate financial pressures can temporarily eclipse long-term environmental concerns for many households.

The availability of numerous conventional products that serve the same basic needs as Honest's eco-friendly items presents a significant substitute threat. These alternatives, often available at lower price points, appeal to budget-conscious consumers. The sheer scale of the conventional market, with the global cleaning products market exceeding $200 billion in 2024, underscores the accessibility of these substitutes.

Consumers' willingness to switch is heavily influenced by price and perceived performance. If Honest's products are considerably more expensive and conventional options perform comparably, consumers may opt for the cheaper choices. For example, while biodegradable diapers grew by 7% in 2023, traditional plastic diapers remain dominant due to cost, highlighting this trade-off.

The rise of DIY and homemade alternatives, particularly in personal care and cleaning, offers another layer of substitution. Consumers seeking ingredient control or avoiding certain chemicals are driving this trend, with the DIY personal care market valued at approximately $11.2 billion in 2023.

Private label brands are increasingly mimicking Honest's value proposition, offering 'clean' or 'natural' attributes at a lower cost. With private label penetration reaching about 20% in the U.S. grocery market in 2024, these brands pose a direct challenge by providing accessible alternatives that blur the lines of differentiation.

| Substitute Type | Key Characteristic | 2024 Market Context | Impact on Honest |

|---|---|---|---|

| Conventional Products | Lower Price, Wide Availability | Global cleaning market >$200B | Attracts budget-conscious consumers |

| DIY/Homemade | Ingredient Control, Cost Savings | DIY Personal Care ~$11.2B (2023) | Appeals to ingredient-aware consumers |

| Private Labels | Mimicked Attributes, Lower Cost | US Grocery PL penetration ~20% (2024) | Direct competitor on value proposition |

Entrants Threaten

The Honest Company has built a formidable brand around its commitment to clean, safe, and sustainable products, a reputation significantly amplified by its celebrity founder. This strong consumer trust makes it challenging for new entrants to gain traction. For instance, in 2023, The Honest Company reported net sales of $277.6 million, demonstrating its established market presence.

New competitors would require substantial financial resources dedicated to marketing and brand development to even begin to erode the loyalty Honest has cultivated. Overcoming the existing consumer perception of quality and ethical sourcing demands a significant upfront investment, potentially deterring many would-be entrants.

Entering the consumer goods sector, particularly with a focus on product design, manufacturing, and widespread distribution, necessitates significant upfront capital. These investments are crucial for research and development, setting up production lines, extensive marketing campaigns, and building robust supply chain networks. For instance, launching a new beverage brand in 2024 could easily require millions for initial production runs, packaging, and securing shelf space, with major players like Coca-Cola and PepsiCo investing billions annually in marketing and infrastructure.

Access to distribution channels presents a significant barrier for new entrants in the consumer goods sector, impacting companies like Honest Company. Honest Company effectively utilizes a dual approach, combining its direct-to-consumer e-commerce site with strategic alliances with major retailers such as Target and Walmart.

For newcomers, gaining comparable retail shelf space is a formidable hurdle, often requiring substantial investment and time. In 2024, the increasing dominance of large retail chains means that securing prime placement is even more competitive, with many retailers prioritizing established brands or offering limited slots for new products.

Building out a robust online distribution network also demands considerable resources. This includes developing user-friendly websites, managing logistics, and implementing effective digital marketing strategies to drive traffic and sales, all of which can be prohibitively expensive for startups aiming to compete with established players.

Regulatory Hurdles and Certifications

New entrants face substantial regulatory hurdles and the need for certifications, particularly for products emphasizing 'clean,' 'natural,' and 'sustainable' attributes. These requirements, often referred to as 'Honest Standards,' can be intricate and costly to obtain, acting as a significant barrier to entry. For instance, obtaining certifications like USDA Organic or Fair Trade requires rigorous auditing and adherence to specific production and sourcing guidelines. In 2024, the global organic food market alone was valued at over $280 billion, indicating the scale of operations that must comply with stringent regulations.

Navigating these complex regulatory landscapes demands significant upfront investment in compliance, testing, and legal counsel. Smaller startups may find it challenging to allocate the necessary resources compared to established players who have existing infrastructure and expertise. This financial and operational burden deters many potential new competitors from entering the market, protecting incumbent businesses.

- Certification Costs: Obtaining and maintaining certifications can cost new entrants thousands of dollars annually.

- Regulatory Compliance: Adhering to varying national and international regulations for product labeling and ingredient sourcing is complex.

- Time Investment: The process of securing necessary approvals and certifications can take months, delaying market entry.

- Market Access: Certain retailers and distribution channels mandate specific certifications, effectively blocking non-compliant products.

Economies of Scale in Sourcing and Manufacturing

Established players in the personal care and household goods market, like The Honest Company, leverage significant economies of scale. This translates to lower per-unit costs for sourcing raw materials and manufacturing finished products. For instance, bulk purchasing of ingredients such as plant-derived surfactants or organic cotton can significantly reduce input expenses.

New entrants, conversely, would likely struggle to achieve similar cost efficiencies. Without the established volume of The Honest Company, they would face higher per-unit costs for materials and production. This cost disadvantage makes it challenging to compete on price with established brands while still achieving healthy profit margins.

Consider the impact on a new entrant trying to source key ingredients. If The Honest Company secures a large, multi-year contract for a specific natural preservative at a favorable price, a newcomer might have to pay a premium for smaller, spot purchases. This disparity in sourcing costs can be a substantial barrier.

- Economies of Scale: Established companies benefit from reduced per-unit costs due to large-scale operations in sourcing and manufacturing.

- Cost Disadvantage for Newcomers: New entrants typically face higher initial costs for raw materials and production, hindering price competitiveness.

- Sourcing Power: Large players negotiate better terms with suppliers, securing lower prices for key ingredients and packaging.

- Manufacturing Efficiency: High-volume production allows established firms to optimize manufacturing processes and reduce overhead per unit.

The threat of new entrants for The Honest Company is moderate, primarily due to high capital requirements and established distribution networks. While the brand's strong reputation and focus on clean products attract potential competitors, the cost of building a similar brand presence and securing shelf space is substantial. For example, in 2024, the cost of a national advertising campaign for a new consumer product could easily run into tens of millions of dollars, a significant hurdle for startups.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a foundation of robust data, incorporating financial statements, industry-specific market research reports, and publicly available company filings. This blend ensures a comprehensive understanding of competitive intensity, supplier and buyer power, and the threat of new entrants and substitutes.