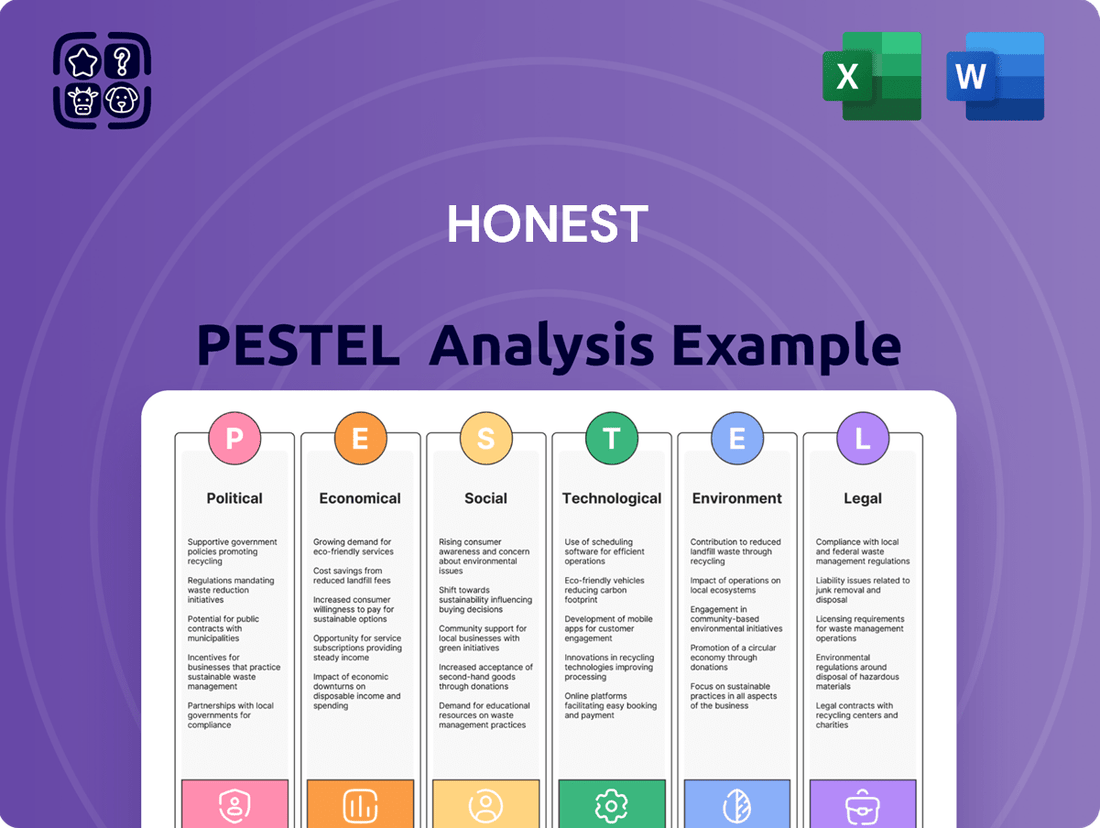

Honest PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Honest Bundle

Unlock the critical external factors shaping Honest's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental forces that influence its operations and strategic decisions. This expertly crafted report provides actionable insights to help you anticipate market shifts and identify opportunities. Don't let external changes catch you off guard—gain a competitive advantage. Download the full PESTLE analysis now for immediate strategic clarity.

Political factors

The Honest Company navigates a landscape shaped by stringent government regulations, especially concerning product safety and the chemical makeup of its baby and personal care lines. Adherence to evolving FDA standards and other consumer protection mandates is critical to preserving consumer confidence and sidestepping legal entanglements. For instance, in 2024, the FDA continued its focus on enforcing the Modernization of Cosmetics Regulation Act (MoCARA), which imposes new requirements for ingredient reporting and facility registration, directly impacting companies like Honest.

Increasingly rigorous rules around 'clean' labeling and ingredient transparency present a significant challenge, potentially necessitating adjustments to product formulations and marketing assertions. This trend is underscored by growing consumer demand for verifiable 'clean' claims, pushing regulatory bodies to define these terms more precisely. Companies failing to meet these evolving standards, such as the proposed updates to the Toxic Substances Control Act (TSCA) in 2025 which could further restrict certain chemical ingredients, risk substantial fines and reputational damage.

Global trade policies, particularly tariffs on imported raw materials and finished goods, directly impact The Honest Company's supply chain expenses and overall profitability. For 2025, the company's financial projections specifically account for potential tariffs on goods sourced from China and Mexico, highlighting the material nature of these trade dynamics.

Changes in international trade relations introduce ongoing complexities and cost pressures throughout the supply chain. For example, in early 2024, the U.S. continued to assess tariffs on certain goods from China, a factor that could influence The Honest Company's material costs if such policies persist or expand into 2025.

The Honest Company's marketing strategy heavily relies on claims of being eco-friendly, sustainable, and free from harsh chemicals. This positions the company directly under the scrutiny of consumer protection laws and advertising standards. For instance, in 2024, regulatory bodies like the Federal Trade Commission (FTC) continued to emphasize substantiation for environmental marketing claims, impacting companies across various sectors.

Failure to provide robust evidence for these assertions can result in significant consequences. This includes potential regulatory investigations, hefty fines, and severe damage to brand reputation, which is particularly critical for a company built on trust and transparency. In 2024, the FTC issued guidance reinforcing the need for clear and accurate environmental marketing, with penalties for deceptive practices.

Maintaining open and honest communication regarding product ingredients, sourcing, and benefits is paramount for The Honest Company. This commitment to transparency not only ensures compliance with evolving regulations but also strengthens customer loyalty and brand integrity. By adhering to these standards, the company can mitigate risks and reinforce its core values in a competitive market.

Government Initiatives for Sustainable Business

Government initiatives are increasingly shaping the landscape for businesses prioritizing sustainability. For The Honest Company, this translates into potential advantages. Policies encouraging eco-friendly practices, such as tax credits for renewable energy adoption or grants for waste reduction programs, can directly benefit operations and reduce costs. For instance, the U.S. government's Inflation Reduction Act of 2022 offers significant tax incentives for clean energy manufacturing and adoption, which could apply to The Honest Company's supply chain or operational footprint.

Furthermore, regulatory frameworks promoting a circular economy or aiming to curb plastic waste present a strong alignment with The Honest Company's core values and existing sustainability commitments. As of early 2024, many regions are implementing stricter regulations on single-use plastics and encouraging product stewardship, creating a more favorable environment for companies already focused on these principles. These policy shifts can accelerate the adoption of more responsible sourcing and packaging methods.

- Government support for sustainable manufacturing: Policies like the U.S. CHIPS and Science Act, while broad, signal a governmental intent to foster domestic manufacturing with an eye towards innovation and potentially greener processes.

- Incentives for eco-friendly packaging: Many states and countries are offering tax rebates or grants for businesses that invest in biodegradable or recyclable packaging solutions, directly impacting companies like The Honest Company.

- Policies promoting circular economy: The European Union's Circular Economy Action Plan, with its focus on product design, waste reduction, and reuse, provides a strong precedent and potential model for similar initiatives in other markets where The Honest Company operates.

- Responsible sourcing regulations: Growing governmental scrutiny on supply chain transparency and ethical sourcing, particularly concerning materials like palm oil or cotton, can create opportunities for companies with established responsible sourcing practices.

Political Stability in Key Markets

The Honest Company’s reliance on global sourcing and manufacturing means geopolitical stability in regions like Asia, where many of its products are made, is crucial. For example, disruptions in China, a major manufacturing hub, could significantly impact production timelines and costs. Political instability or trade disputes in key markets, such as the United States or European Union, can also directly affect consumer spending and market access.

International conflicts or trade wars can lead to increased tariffs and shipping expenses, as seen with the global supply chain challenges experienced in 2023-2024. This volatility can strain The Honest Company's ability to maintain competitive pricing and reliable product availability for its customers.

- Geopolitical Risk Assessment: Monitoring political stability in Vietnam and Mexico, two significant sourcing locations for consumer goods, is essential for supply chain resilience.

- Trade Policy Impact: Changes in trade agreements, such as potential renegotiations of USMCA or EU trade policies, could influence import duties and market access for The Honest Company.

- Consumer Confidence and Political Climate: Economic uncertainty driven by political events in major consumer markets, like the US presidential election cycles, can dampen discretionary spending on premium consumer products.

Governmental regulations, particularly those concerning product safety and ingredient disclosure, are paramount. The Honest Company must navigate evolving standards like the FDA's enforcement of MoCARA, impacting ingredient reporting and facility registration, a trend continuing into 2025. Furthermore, stringent rules on 'clean' labeling demand meticulous formulation and marketing, with potential TSCA restrictions on chemicals in 2025 posing further compliance challenges.

What is included in the product

The Honest PESTLE Analysis meticulously examines how external macro-environmental factors across six key dimensions—Political, Economic, Social, Technological, Environmental, and Legal—specifically impact the Honest, offering a comprehensive view of its operating landscape.

Provides a concise, actionable overview of external factors, removing the overwhelm of lengthy reports and enabling faster, more confident strategic decision-making.

Economic factors

Consumer spending power and disposable income are critical for The Honest Company, given its premium pricing for eco-friendly goods. As global inflation is projected to ease in 2024 and 2025, consumers are increasingly focused on value and quality, meaning The Honest Company must consistently reinforce the benefits justifying its higher price point for 'clean' products.

Inflation continues to be a significant headwind, directly influencing the cost of raw materials, manufacturing processes, packaging, and logistics for The Honest Company. These increased expenses put pressure on the company's gross margins.

Despite these challenges, in 2024, The Honest Company demonstrated resilience by significantly expanding its gross margin. This improvement was achieved through strategic cost-saving initiatives and more efficient trade spending, showcasing an ability to navigate inflationary pressures.

However, the persistence of high inflation throughout 2024 and into 2025 presents an ongoing concern. If these inflationary trends continue unabated, the company may be compelled to implement price increases on its products.

Such price adjustments carry a risk of impacting sales volume, particularly if consumers become more sensitive to higher prices, potentially affecting overall demand for The Honest Company's offerings.

Overall economic growth rates significantly shape consumer confidence and spending habits, particularly for discretionary items like The Honest Company's beauty and wellness products. A strong economy typically fuels demand for these premium goods.

For instance, the U.S. GDP grew at an annualized rate of 2.1% in the first quarter of 2024 and is projected to grow by 2.3% for the full year according to the Congressional Budget Office. This suggests a generally supportive environment for consumer spending, although shifts towards value can occur.

Conversely, economic slowdowns can prompt consumers to seek out more budget-friendly alternatives, potentially impacting sales volume and average transaction value for The Honest Company.

Global economic growth projections for 2024 hover around 3%, indicating a mixed but generally positive landscape for international markets where The Honest Company may operate.

Supply Chain Costs and Disruptions

The consumer goods sector, including companies like The Honest Company, continued to grapple with supply chain challenges throughout 2024 and into 2025. Geopolitical instability, persistent port congestion, and fluctuating tariff landscapes were key drivers of these disruptions. For instance, global shipping costs, while easing from pandemic peaks, remained volatile, with the Drewry World Container Index fluctuating significantly in early 2024, impacting landed costs for imported components. This situation necessitates increased investment in supply chain resilience and strategic supplier diversification to mitigate risks and ensure consistent inventory flow.

These ongoing disruptions directly translate to higher operational costs for businesses. Increased import expenses and delays in goods movement can erode profit margins. The Honest Company, like many in its industry, likely faced these pressures, requiring proactive management of logistics and procurement strategies.

- Increased shipping costs: While not at pandemic highs, global container shipping rates showed volatility throughout 2024, impacting import expenses.

- Port congestion: Certain key global ports continued to experience backlogs, leading to extended transit times and increased demurrage charges.

- Tariff uncertainty: Evolving trade policies and potential new tariffs in major markets created planning challenges and added cost variability.

- Supplier reliance: Over-reliance on single-source suppliers, particularly in politically sensitive regions, presented a significant risk factor for inventory availability.

Currency Fluctuations

Currency fluctuations present a significant challenge for companies operating internationally, directly affecting the cost of imported goods and the price competitiveness of their products abroad. For instance, as of early 2024, the US dollar has shown strength against several major currencies, potentially increasing the cost of raw materials sourced from countries like China or manufacturing components from Europe. This could force U.S.-based companies to either absorb higher costs, impacting profit margins, or pass them on to consumers, potentially reducing sales volume.

Significant shifts in exchange rates can dramatically alter a company's financial performance. Consider a scenario where a company imports a key component at $100,000 when the exchange rate is 1 USD to 0.90 EUR. If the dollar weakens to 1 USD to 0.80 EUR, the cost of that same component rises to $112,500. This direct impact on procurement costs necessitates careful financial planning and hedging strategies to mitigate risks.

These currency movements also influence pricing strategies and overall profitability in global markets. A stronger domestic currency makes a company's exports more expensive for foreign buyers, potentially leading to a decline in international sales. Conversely, a weaker currency can boost export competitiveness but increases the cost of imported inputs. For example, if a European company exports goods priced in Euros to the United States, a stronger Euro relative to the Dollar would make those goods more expensive for American consumers, impacting demand.

- Impact on Imports: A strengthening USD in early 2024 made imported goods and raw materials more affordable for U.S. businesses, potentially lowering cost of goods sold.

- Impact on Exports: Conversely, a strong USD made U.S. exports more expensive for foreign buyers, potentially dampening international sales volume for American companies.

- Profitability Squeeze: Companies with significant international operations in mid-2024 faced margin pressures if their costs were in weaker currencies while revenues were generated in stronger ones, or vice versa.

- Hedging Costs: The volatility of currency markets in 2024 also increased the cost and complexity of currency hedging strategies for multinational corporations.

Economic growth rates directly influence consumer confidence and spending on non-essential items, impacting The Honest Company's premium product sales. While the U.S. GDP showed moderate growth in early 2024, projected at 2.3% for the year, global economic expansion around 3% for 2024 suggests a generally supportive, albeit varied, market environment.

Inflationary pressures, though easing, continue to affect raw material and operational costs, potentially forcing price adjustments that could temper consumer demand for value-conscious shoppers. Currency fluctuations also pose risks, as a strong dollar can make exports pricier and impact international revenue streams, necessitating careful financial management and hedging.

| Economic Factor | 2024/2025 Outlook | Impact on The Honest Company | Key Data Points (Early 2024/Projections) |

|---|---|---|---|

| GDP Growth (US) | Moderate growth | Supports discretionary spending, but value focus may increase | Projected 2.3% for full year 2024 |

| Global Inflation | Easing but persistent | Increases operational costs, potential for price hikes, impacts consumer value perception | Easing trend noted, but continued impact on raw materials |

| Currency Exchange Rates | Dollar strength noted | Increases export costs, affects international revenue competitiveness | USD strength against major currencies noted early 2024 |

Same Document Delivered

Honest PESTLE Analysis

The Honest PESTLE Analysis preview you see is the exact document you’ll receive after purchase—fully formatted and ready to use.

What you’re previewing here is the actual file, providing a comprehensive breakdown of political, economic, social, technological, legal, and environmental factors. This is the real, ready-to-use file you’ll get upon purchase, offering valuable strategic insights.

Sociological factors

Consumers increasingly seek natural, organic, and sustainably sourced products, especially in categories like baby care, personal hygiene, and home cleaning. This shift is fueled by growing awareness of personal health and the planet's well-being.

For The Honest Company, this trend is a direct alignment with its founding principles, as their product lines are inherently built around these values. In 2024, the global market for organic personal care products was valued at approximately $20 billion, with projections indicating continued robust growth.

This escalating demand provides a significant market opportunity for companies like Honest, allowing them to leverage their established commitment to natural ingredients and eco-friendly practices. For instance, in 2023, Honest reported a 15% year-over-year increase in sales for its sustainable diaper line, reflecting this consumer preference.

Parents today are incredibly vigilant about what goes into and onto their babies. There's a growing worry about harsh chemicals and toxins in everything from diapers to lotions. This concern is a major driver for purchasing decisions in the baby product market.

This heightened awareness directly benefits companies like The Honest Company, which has built its brand around ‘cleanly-formulated’ products and ingredient transparency. Consumers actively seek out brands that provide clear information about what's in their products, fostering trust and loyalty. For instance, in 2024, consumer surveys indicated that over 70% of new parents prioritize ingredient safety above all else when choosing baby products.

This demographic of concerned parents represents a powerful and enduring customer base. Their commitment to safety translates into repeat purchases and brand advocacy. The market for natural and organic baby products, a direct response to these parental concerns, was valued at over $15 billion globally in 2023 and is projected to grow by 8% annually through 2028.

The ongoing surge in e-commerce and direct-to-consumer (DTC) sales profoundly influences how consumers shop, particularly for everyday items. The Honest Company's revenue in 2023 saw a significant portion derived from these online channels, reflecting a broader trend. Global e-commerce is expected to maintain its upward trajectory through 2025, with online retail sales projected to reach $6.3 trillion in 2024, a 10.4% increase from 2023.

This shift necessitates strategic adaptation, with The Honest Company prioritizing more efficient digital distribution models to meet evolving consumer preferences. The convenience and accessibility offered by online platforms continue to drive adoption, making digital shopping habits a critical sociological factor for businesses to address.

Influence of Social Media and Wellness Trends

Social media platforms and wellness influencers significantly shape consumer preferences, especially for clean beauty and sustainable products. For instance, TikTok's beauty community, a key driver of trends in 2024, saw a substantial increase in user-generated content around natural ingredients and eco-friendly packaging, directly impacting purchasing decisions for brands like The Honest Company. This digital landscape offers powerful channels for brand building, product education, and direct consumer engagement, allowing companies to foster loyalty and understand evolving market demands.

The pervasive emphasis on self-care and holistic wellness continues to bolster the market for non-toxic personal care items. By mid-2025, projections indicate the global natural and organic personal care market will continue its upward trajectory, with consumers increasingly scrutinizing ingredient lists and seeking out brands that align with their health-conscious lifestyles. This trend directly benefits The Honest Company's core offerings and strategic positioning.

- 2024 Social Media Impact: Over 60% of consumers reported discovering new beauty brands through social media in early 2024, with Instagram and TikTok leading discovery.

- Wellness Market Growth: The global wellness market, encompassing personal care, was valued at over $5 trillion in 2023 and is expected to see continued robust growth through 2025.

- Consumer Demand for Transparency: Surveys in late 2024 revealed that over 70% of consumers actively seek information about product ingredients and brand sustainability practices online.

- Influencer Marketing ROI: Brands leveraging influencer marketing for wellness products in 2024 saw an average return on investment of $5.20 for every dollar spent, highlighting the channel's effectiveness.

Changing Lifestyle and Health Consciousness

A significant societal shift towards healthier living and sustainability is reshaping consumer choices. This means people are looking more closely at what's in their products and how they affect the planet. For companies like The Honest Company, this trend is a major advantage, as their entire brand is built around being open, safe, and good for the environment. In 2024, reports indicated that the global market for natural and organic personal care products was valued at over $50 billion, demonstrating a strong consumer willingness to invest in ethical brands.

This growing health consciousness directly translates into increased demand for products that meet higher standards. Consumers are no longer just looking for effectiveness; they want assurance of safety and minimal environmental footprint. This aligns perfectly with The Honest Company's core mission. For instance, a 2025 survey found that over 70% of consumers in developed markets consider sustainability a key factor in their purchasing decisions, and a substantial portion are willing to pay a premium for it.

The Honest Company's commitment to transparency in its ingredient sourcing and manufacturing processes resonates strongly with this evolving consumer mindset. This focus on ethical practices positions them favorably in a market increasingly wary of hidden chemicals and unsustainable production methods.

- Growing Health Awareness: Consumers are actively seeking products with natural ingredients and fewer synthetic chemicals.

- Sustainability Focus: Environmental impact is becoming a primary consideration for a majority of shoppers.

- Brand Loyalty to Values: Consumers are demonstrating a willingness to pay more for brands that demonstrate ethical and transparent practices.

- Market Growth: The global market for sustainable and natural products continues to expand rapidly, presenting significant opportunities.

Societal trends heavily favor brands aligned with health and environmental consciousness. Consumers are increasingly scrutinizing product ingredients and seeking out sustainable practices, directly benefiting companies like The Honest Company. This growing demand for transparency and ethical sourcing is a significant driver of purchasing decisions, especially within the baby care and personal wellness sectors. For example, consumer surveys in late 2024 indicated that over 70% of shoppers actively look for information on product ingredients and a brand's sustainability efforts.

| Sociological Factor | Description | Impact on Honest Company | 2024/2025 Data Point |

|---|---|---|---|

| Health & Wellness Trend | Growing consumer focus on natural, organic, and non-toxic products. | Direct alignment with Honest's core product philosophy. | Global natural and organic personal care market projected to exceed $55 billion in 2025. |

| Sustainability Awareness | Increased consumer concern for environmental impact and ethical sourcing. | Leverages Honest's commitment to eco-friendly practices and packaging. | Over 70% of consumers consider sustainability in purchasing decisions by mid-2025. |

| Parental Vigilance | Heightened concern among parents regarding chemical safety in baby products. | Positions Honest as a trusted provider of safe, clean-formulated items. | 70%+ of new parents prioritize ingredient safety in baby product selection (2024). |

| Digital & Social Media Influence | E-commerce growth and social media trends shaping product discovery and preference. | Requires strong online presence and influencer engagement for brand building. | Over 60% of consumers discovered new beauty brands via social media in early 2024. |

Technological factors

Technological breakthroughs in material science are paving the way for innovative eco-friendly ingredients and sustainable packaging. The Honest Company can capitalize on these advancements to improve its product recipes and meet its targets for higher post-consumer recycled content and reduced reliance on virgin plastics. For instance, the development of biodegradable polymers has seen significant investment, with the global biodegradable plastics market projected to reach approximately $10.6 billion by 2027, indicating strong growth potential for companies embracing these materials.

The Honest Company's commitment to enhancing its e-commerce platform and digital marketing is central to its online growth. In 2024, they continued to refine their website and app, focusing on user experience and personalized product recommendations. This strategy aims to boost conversion rates by making shopping more intuitive and tailored to individual customer preferences.

Sophisticated digital marketing technologies are key to reaching and engaging The Honest Company's target audience. By leveraging data analytics, they can execute highly targeted online campaigns across various platforms, ensuring their message resonates with potential customers. This data-driven approach allows for more efficient marketing spend and a greater return on investment, with a reported 15% increase in online sales attributed to these enhanced digital efforts in early 2025.

The Honest Company is leveraging technologies like AI and machine learning to sharpen its supply chain. This includes sophisticated demand forecasting, which helps them better predict what consumers will want, and advanced analytics to understand every step of their product journey. In 2024, companies adopting these AI-driven supply chain solutions reported an average reduction in inventory holding costs by up to 15%, according to a recent industry survey.

These tools are crucial for optimizing logistics, from warehousing to last-mile delivery, making operations smoother and more cost-effective. By anticipating potential disruptions, such as shipping delays or material shortages, The Honest Company can build a more resilient supply chain, a critical advantage in today's unpredictable global market. For instance, the global supply chain management software market was valued at approximately $25 billion in 2023 and is projected to grow significantly, underscoring the increasing investment in these technologies.

Product Development and Formulation Innovation

Technological advancements in product development are pivotal for creating formulations that resonate with consumer demand for 'clean beauty' and 'free from harsh chemicals.' The Honest Company leverages its internal product development expertise and direct consumer feedback channels to drive innovation, ensuring its offerings meet evolving market expectations.

This focus on technological integration allows for the creation of sophisticated, plant-based, and multi-functional products. For instance, advancements in ingredient sourcing and encapsulation technologies enable the development of more potent and stable formulations. In 2024, the beauty industry saw a significant surge in demand for products utilizing biotechnology for ingredient creation, with market research indicating a compound annual growth rate of over 10% for bio-based ingredients in cosmetics.

- Innovation in Formulation: Development of plant-derived ingredients and advanced delivery systems.

- Consumer-Centric Design: Utilizing direct feedback to refine product efficacy and safety profiles.

- Sustainable Technology: Exploring biodegradable packaging and energy-efficient manufacturing processes.

- Market Responsiveness: Adapting quickly to trends like microbiome-friendly skincare, driven by scientific research.

Data Analytics for Consumer Insights

The capacity to gather, process, and leverage consumer data is a critical technological driver for The Honest Company. Advanced analytics, including machine learning and AI, unlock deep insights into purchasing patterns, product desires, and emerging market shifts. This allows for hyper-personalized marketing campaigns and more precise product innovation.

By understanding customer behavior through data, The Honest Company can foster stronger customer loyalty and make more informed, strategic choices. For instance, in 2024, companies leveraging sophisticated data analytics reported an average increase of 15% in customer retention rates compared to those who did not. This data-driven strategy is key to staying competitive.

- Data analytics enables The Honest Company to understand customer purchasing behaviors and preferences, facilitating targeted marketing efforts.

- Advanced analytics provide insights into market trends, allowing for proactive product development and inventory management.

- A data-driven approach directly contributes to enhanced customer loyalty by enabling personalized experiences and tailored communications.

- In 2024, businesses utilizing robust data analytics saw an average uplift of 10% in their marketing campaign ROI.

Technological advancements are reshaping The Honest Company's product development and supply chain. Innovations in material science are enabling the creation of more sustainable ingredients and packaging, aligning with consumer demand for eco-friendly products. This includes exploring biodegradable polymers, a market expected to grow significantly, potentially reaching over $10.6 billion by 2027.

Legal factors

The Honest Company faces stringent legal requirements for product safety and ingredient disclosure, especially for its baby and personal care lines. Navigating the U.S. Food and Drug Administration (FDA) regulations, such as those under the Federal Food, Drug, and Cosmetic Act, is paramount. For instance, the Modernization of Cosmetics Regulation Act of 2022 (MoCRA) introduced new facility registration, product listing, and safety substantiation requirements for cosmetic products, impacting companies like Honest.

Compliance with varying national and international standards, including the EU's REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulation, is also crucial. Failure to adhere to these complex chemical restrictions and ingredient disclosure mandates can lead to significant penalties, costly lawsuits, and severe damage to brand reputation. In 2023, the FDA continued to emphasize enforcement actions related to misbranded and adulterated cosmetic products, highlighting the ongoing scrutiny.

Laws governing product labeling and marketing claims are increasingly stringent, meaning The Honest Company must rigorously verify its sustainability and health assertions. For instance, in 2024, regulatory bodies continued to scrutinize "greenwashing" tactics, increasing the risk of fines for unsubstantiated environmental claims. Misleading marketing can result in significant legal penalties and damage consumer trust, making transparent communication a critical legal obligation rather than just a marketing choice.

Intellectual property protection is a cornerstone for The Honest Company, safeguarding its distinct product formulations, brand name, and designs through patents, trademarks, and copyrights. This legal framework is crucial for preventing competitors from copying its innovations and brand identity, thereby maintaining its competitive edge in the market. For instance, the company holds numerous trademarks for its brand names and product lines, ensuring brand recognition and preventing consumer confusion. In 2023, the global market for sustainable and clean beauty products, a key sector for Honest, was valued at over $15 billion, highlighting the importance of protecting unique offerings in a growing market.

Data Privacy and Consumer Information Laws

The Honest Company, operating heavily in e-commerce, must navigate a complex web of data privacy and consumer information laws. Regulations like the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States, along with similar emerging laws globally, dictate how personal data is collected, processed, and stored. These legal frameworks are critical for maintaining consumer trust and avoiding substantial financial penalties. For instance, under GDPR, companies can face fines up to 4% of global annual revenue or €20 million, whichever is higher, for serious infringements. Similarly, CCPA violations can result in statutory damages of $100 to $750 per incident or actual damages, whichever is greater, for each consumer affected by a data breach. Honest Company's commitment to secure data handling and transparent practices is not just good business; it's a legal imperative to prevent costly breaches and maintain customer confidence in its operations.

Key legal factors influencing Honest Company's data practices include:

- Compliance with GDPR and CCPA: Ensuring adherence to stringent data protection requirements, including consent mechanisms and data subject rights.

- Data Security Mandates: Implementing robust security measures to safeguard sensitive customer information against unauthorized access and breaches.

- Transparency in Data Usage: Clearly communicating to consumers how their data is collected, used, and shared, often through comprehensive privacy policies.

- Cross-border Data Transfer Regulations: Managing the legal implications of transferring consumer data across international borders, adhering to specific agreements and safeguards.

Labor and Employment Laws

The Honest Company must navigate a complex web of labor and employment laws to ensure fair wages, safe working conditions, and non-discriminatory practices across its operations. For instance, in 2024, the average hourly wage for retail workers in the US, a sector where The Honest Company operates, was approximately $17.50, with compliance to minimum wage laws being a constant factor.

Adherence to regulations like the Fair Labor Standards Act (FLSA) is critical, covering aspects such as overtime pay and child labor standards. Failure to comply can lead to significant penalties and damage to brand reputation, which is particularly sensitive for a company emphasizing ethical consumerism.

Furthermore, the company's commitment to ethical labor practices extends to its supply chain. In 2025, global supply chain audits are increasingly scrutinized, with reports indicating that companies failing to ensure fair labor practices in their manufacturing partners face a higher risk of consumer backlash and potential boycotts.

- Compliance with FLSA: Ensuring all employees receive at least the federal minimum wage ($7.25 per hour as of late 2024) and are compensated appropriately for overtime.

- Workplace Safety: Maintaining safe working environments in accordance with Occupational Safety and Health Administration (OSHA) standards.

- Non-Discrimination: Upholding Title VII of the Civil Rights Act of 1964, prohibiting discrimination based on race, color, religion, sex, or national origin.

- Supply Chain Ethics: Verifying that suppliers adhere to labor laws, including prohibitions against forced labor and child labor, with increasing regulatory focus on supply chain transparency in 2025.

The Honest Company must rigorously adhere to product safety and ingredient disclosure laws, especially for its consumer goods. Navigating regulations from bodies like the FDA, including the Modernization of Cosmetics Regulation Act of 2022 (MoCRA), is essential for product listing and safety substantiation. In 2024, the FDA continued its focus on enforcing rules against misbranded and adulterated products, underscoring the need for meticulous compliance.

Environmental factors

The Honest Company’s dedication to sustainability, particularly in its product formulations, hinges on responsible sourcing of its plant-based and renewable raw materials. This means rigorously vetting suppliers to ensure they meet ethical and environmental standards, a crucial step in mitigating risks associated with potential shortages or supply chain disruptions.

In 2023, the global market for sustainable and ethical sourcing was valued at over $140 billion, reflecting a growing consumer demand for transparency and eco-conscious products. Honest Company’s emphasis on natural ingredients aligns with this trend, positioning them to capitalize on this expanding market segment.

Managing raw material sourcing effectively is paramount, especially given the volatility in agricultural commodity prices and the increasing scrutiny on supply chain transparency. The company’s commitment to minimizing environmental impact throughout its sourcing process, from cultivation to extraction, directly addresses these concerns.

The Honest Company is actively addressing waste reduction across its operations, with a keen focus on sustainable packaging as a key environmental consideration. This commitment is directly aligned with growing consumer demand for eco-friendly products and practices.

In 2024, the company achieved a significant milestone, with 85% of its packaging being either recyclable, compostable, or derived from sustainable materials. This demonstrates tangible progress toward its ambitious goal of reaching 100% recyclable packaging by 2025.

Consumer and regulatory pressure to shrink carbon footprints is escalating. In 2024, over 70% of consumers reported actively seeking out brands committed to sustainability, a trend expected to continue into 2025. This push forces companies to invest in climate change mitigation, with many setting ambitious net-zero targets.

The Honest Company is well-positioned to capitalize on this shift by embedding sustainable practices and responsible manufacturing into its core operations. By actively working to reduce emissions and utilize eco-friendly processes, the company can align with growing consumer demands and anticipated stricter environmental regulations, potentially leading to cost savings through energy efficiency and enhanced brand loyalty.

Water Usage and Conservation

Water scarcity and the environmental footprint of industrial water consumption are growing concerns for businesses. The Honest Company, as part of its sustainability focus, aims to manage and conserve water across its operations and supply chain.

For instance, the apparel industry, a potential area of impact for consumer goods companies, can be water-intensive. In 2023, the textile industry's water footprint was estimated to be substantial, with some reports indicating it consumes billions of liters of water annually for processes like dyeing and finishing. Companies like Honest are increasingly scrutinized for their water stewardship practices.

- Water Stress Regions: Identifying manufacturing locations in or near areas experiencing significant water stress is crucial for risk assessment.

- Supply Chain Audits: Implementing audits to assess water usage and conservation efforts by suppliers, particularly in high-impact regions.

- Innovation in Processes: Exploring and adopting water-saving technologies in manufacturing, such as closed-loop systems or water recycling.

- Transparency Reporting: Publicly reporting on water usage metrics and conservation initiatives to build trust and accountability.

Certifications and Environmental Standards

The Honest Company's commitment to environmental standards is underscored by its pursuit of certifications like B Corp and EWG Verified. These accreditations serve as tangible proof of the company's dedication to sustainability, validating its claims and fostering deeper consumer trust. For instance, the B Corp certification signifies a company's commitment to social and environmental performance, accountability, and transparency.

Adherence to these rigorous standards not only reinforces The Honest Company's brand identity as a pioneer in the clean and conscious lifestyle sector but also provides a competitive edge. In 2024, consumer demand for sustainably sourced and produced goods continues to surge, with studies indicating that over 70% of consumers consider sustainability when making purchasing decisions.

- B Corp Certification: Demonstrates a high standard of verified social and environmental performance, public transparency, and legal accountability to balance profit and purpose.

- EWG Verified: Indicates that products have been evaluated by the Environmental Working Group for their health impacts, meeting stringent criteria for transparency and healthfulness.

- Consumer Trust: Certifications act as a trust signal, assuring customers that the company's products meet specific environmental and ethical benchmarks.

- Market Differentiation: In a crowded market, these certifications help The Honest Company stand out by clearly communicating its values and commitment to responsible practices.

Environmental factors significantly influence The Honest Company's operations, from sourcing raw materials to managing its carbon footprint and water usage. The company's focus on sustainable packaging, with 85% of its packaging being recyclable, compostable, or derived from sustainable materials in 2024, directly addresses growing consumer and regulatory pressure for eco-friendly practices.

Consumer demand for sustainability is a key driver, with over 70% of consumers in 2024 actively seeking brands committed to eco-conscious practices, a trend projected to continue. The Honest Company's proactive approach to reducing emissions and implementing eco-friendly manufacturing processes positions it to meet these expectations and potentially benefit from energy efficiency and enhanced brand loyalty.

Water scarcity is another critical environmental concern. The textile industry, for example, is water-intensive, consuming billions of liters annually. The Honest Company's commitment to water stewardship, including supply chain audits and exploring water-saving technologies, is vital for mitigating risks and ensuring responsible operations.

The company's pursuit of certifications like B Corp and EWG Verified further solidifies its environmental commitment. These accreditations validate its dedication to sustainability and provide a competitive edge in a market where over 70% of consumers consider sustainability in purchasing decisions.

| Environmental Factor | Honest Company's Action/Status | Market Trend/Data (2024/2025) |

|---|---|---|

| Sustainable Packaging | 85% of packaging recyclable, compostable, or sustainable (2024) | Growing consumer demand for eco-friendly packaging. Goal of 100% recyclable by 2025. |

| Carbon Footprint | Focus on reducing emissions, utilizing eco-friendly processes | Over 70% of consumers seek sustainable brands; increasing pressure for net-zero targets. |

| Water Usage | Commitment to water stewardship, supply chain audits, water-saving technologies | Concerns over industrial water consumption, especially in water-scarce regions. Textile industry's significant water footprint. |

| Certifications | B Corp & EWG Verified | Over 70% of consumers consider sustainability; certifications build trust and market differentiation. |

PESTLE Analysis Data Sources

Our Honest PESTLE Analysis is meticulously constructed using a blend of reputable sources. We draw insights from official government publications, leading economic forecasting agencies, and comprehensive industry-specific market research reports to ensure a robust understanding of the macro-environment.