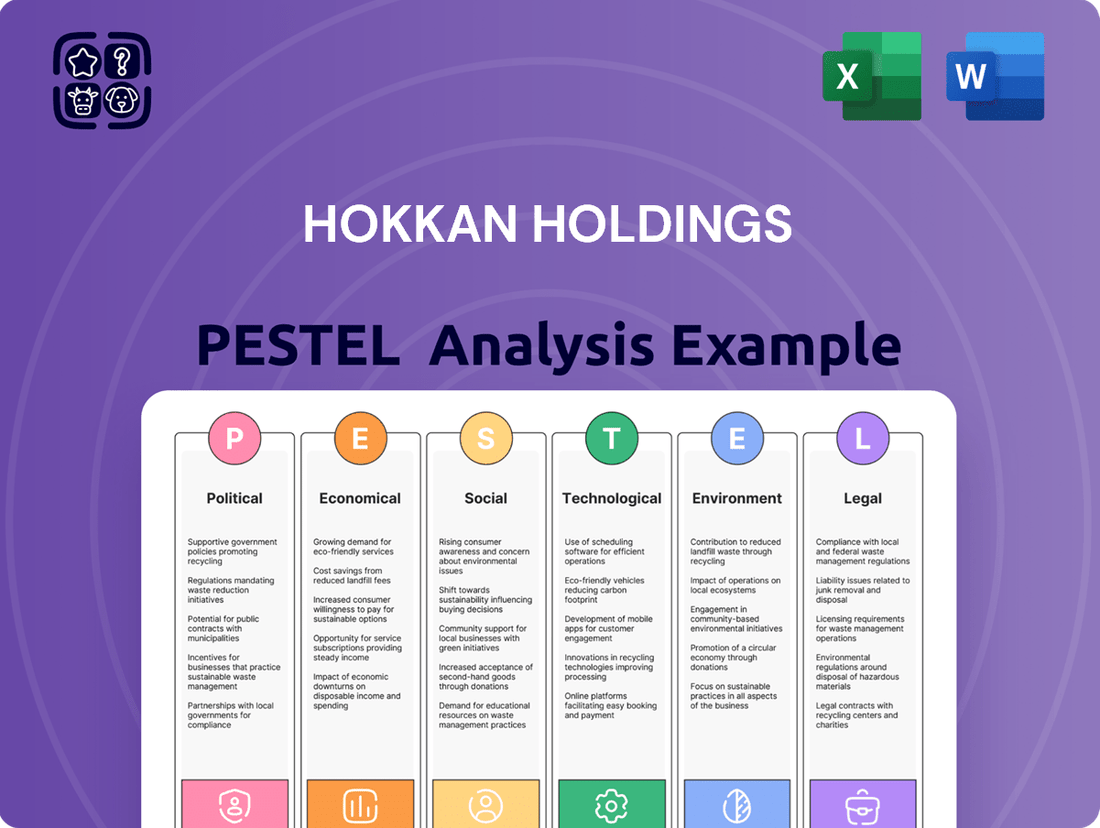

Hokkan Holdings PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hokkan Holdings Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Hokkan Holdings's trajectory. This comprehensive PESTLE analysis provides the essential external context needed to navigate market complexities and anticipate future challenges. Gain a strategic advantage by understanding these forces—download the full report now for actionable insights.

Political factors

Governments worldwide, including Japan, are tightening rules on packaging waste, with initiatives like Extended Producer Responsibility (EPR) and mandates for recycling and recycled content. For Hokkan Holdings, this means adapting to new requirements that affect how they source materials and manage their operations. For instance, Japan's Container and Packaging Recycling Law, updated in 2022, emphasizes increased recycling rates, directly influencing packaging design and material selection.

Hokkan Holdings' beverage can manufacturing is sensitive to shifts in global trade policies. For instance, the imposition of tariffs on imported aluminum, a key raw material, directly impacts production costs. In 2024, the average tariff rate on primary aluminum imports into the United States, a significant market, remained at 15%, a level that can substantially increase expenses for manufacturers like Hokkan.

Changes in trade agreements, such as renegotiations of existing pacts or the introduction of new ones, can alter the landscape of international sourcing. Disruptions to supply chains due to unexpected trade barriers or retaliatory tariffs could force Hokkan Holdings to seek alternative, potentially more expensive, suppliers. This necessitates a proactive strategy to diversify its supplier base, perhaps looking towards regions with more stable trade relations, to ensure consistent access to essential materials.

For Hokkan Holdings, navigating the complex web of food safety and beverage manufacturing regulations is critical. These rules, covering everything from hygiene to labeling, directly influence product integrity and consumer confidence. Failure to comply can lead to significant legal and financial repercussions.

In 2024, the global food and beverage industry faced increased scrutiny, with regulatory bodies like the FDA in the United States and the EFSA in Europe continuing to enforce stringent standards. For contract manufacturers like Hokkan, this means constant vigilance and investment in robust quality control systems to meet evolving national and international mandates, ensuring adherence to standards such as HACCP and ISO 22000.

Political Stability in Key Markets

Hokkan Holdings operates primarily in Japan, a market generally characterized by high political stability. This stability is crucial for business continuity and investment planning, as it minimizes disruptions from unexpected policy changes or geopolitical events. For instance, Japan's consistent governance framework allows for more predictable regulatory environments and economic forecasting.

However, even in stable markets, shifts in domestic policy or regional geopolitical tensions can introduce uncertainty. Changes in trade policies, tax regulations, or government spending priorities could impact consumer confidence and economic growth, affecting Hokkan's sales and expansion strategies. The ongoing geopolitical landscape in East Asia, while not directly impacting daily operations, remains a background consideration for long-term market outlooks.

A stable political climate fosters a predictable operating environment, enabling businesses like Hokkan Holdings to make informed long-term investment decisions and market expansion plans with greater confidence. For example, Japan's commitment to fiscal discipline and its established legal framework provide a solid foundation for business operations. In 2024, Japan's political landscape remained largely stable, with the Kishida administration continuing its focus on economic revitalization and social reforms.

- Japan's Political Stability: Japan consistently ranks high in global political stability indices, providing a predictable operating environment for businesses.

- Geopolitical Considerations: While domestic stability is high, regional geopolitical factors in East Asia are monitored for potential indirect impacts on economic sentiment and trade.

- Policy Impact: Domestic policy shifts, such as changes in corporate tax rates or consumer spending incentives, can directly influence Hokkan Holdings' financial performance and strategic planning.

Subsidies for Sustainable Initiatives

Government subsidies for sustainable initiatives can significantly boost Hokkan Holdings' transition to eco-friendly practices. For instance, the Japanese government's Green Innovation Fund, with a substantial allocation, supports companies developing technologies to reduce carbon emissions. This financial backing can directly offset the higher initial costs associated with adopting sustainable materials or advanced recycling infrastructure.

These incentives are crucial for encouraging innovation in areas like eco-friendly packaging and waste reduction. By lowering the financial barrier, such programs empower companies like Hokkan Holdings to invest in cleaner production processes. This not only aids in achieving environmental targets but also strengthens the company's market position by aligning with growing consumer demand for sustainability.

- Subsidies can reduce the upfront investment for sustainable technology adoption.

- Government support encourages innovation in eco-friendly packaging and recycling.

- Incentives help companies meet environmental goals and gain a competitive edge.

Japan's political stability provides a predictable operating environment, crucial for Hokkan Holdings' long-term planning and investment. While domestic policies like corporate tax rates can impact performance, regional geopolitical factors in East Asia are monitored for indirect economic influences. Government subsidies for sustainability initiatives, such as Japan's Green Innovation Fund, can significantly offset the costs of adopting eco-friendly practices.

What is included in the product

Hokkan Holdings' PESTLE analysis examines how political, economic, social, technological, environmental, and legal forces shape its operating landscape, identifying key external influences.

This comprehensive review provides actionable insights for strategic decision-making, highlighting potential risks and avenues for growth within Hokkan Holdings' market context.

Hokkan Holdings' PESTLE analysis provides a clear, summarized version of external factors, acting as a pain point reliver by simplifying complex market dynamics for easy referencing during strategic planning.

Economic factors

Hokkan Holdings faces significant challenges due to fluctuating raw material prices, especially for aluminum, steel, and plastics essential for its packaging. For instance, aluminum prices saw considerable swings in 2024, with LME aluminum futures trading between $2,100 and $2,500 per metric ton for much of the year, directly affecting Hokkan's input costs.

These price fluctuations, often driven by global supply chain snags and geopolitical tensions, can rapidly escalate manufacturing expenses. A 10% increase in aluminum costs, for example, could directly squeeze Hokkan's profit margins if not effectively managed through pricing adjustments or cost-saving measures.

To counter this, Hokkan Holdings likely utilizes advanced procurement strategies and financial instruments like futures contracts to hedge against adverse price movements. This proactive approach is crucial for maintaining cost stability and protecting profitability in a volatile market.

Consumer disposable income is a critical factor for Hokkan Holdings, directly impacting demand for its packaged beverages and food products. In 2024, many developed economies are seeing a stabilization or modest increase in real disposable incomes following periods of high inflation. For instance, in the United States, real disposable personal income saw an increase of approximately 2.1% in the first quarter of 2024 compared to the previous year, indicating a potential boost for consumer spending on non-essential items.

Economic headwinds like persistent inflation or potential recessions in 2024-2025 could, however, erode this purchasing power. If inflation outpaces wage growth, consumers may cut back on discretionary spending, including packaged goods, which would likely reduce Hokkan Holdings' sales volumes and revenue. Conversely, sustained growth in disposable income, driven by a strong labor market and controlled inflation, would likely translate to increased demand for Hokkan's diverse product portfolio.

Rising inflation presents a direct challenge to Hokkan Holdings, escalating costs for essential operational inputs like energy, labor, and transportation. For instance, global energy prices saw significant volatility throughout 2024, impacting logistics and utility expenses. This surge in operating expenses requires a strategic approach to cost management and potential price adjustments to safeguard profit margins.

Hokkan Holdings must carefully assess its capacity to pass these increased costs onto consumers without jeopardizing its market position. The company's ability to maintain competitive pricing while absorbing or mitigating higher operational expenses is a crucial determinant of its economic resilience. For example, in Q3 2024, consumer price index (CPI) figures indicated sustained inflationary pressures across many of Hokkan's operating regions, making price elasticity a key factor.

Exchange Rate Fluctuations

Exchange rate fluctuations present a significant economic factor for Hokkan Holdings, particularly if the company is involved in international trade or has overseas operations. A strengthening Japanese Yen (JPY) in 2024-2025 could reduce the cost of imported raw materials, a positive for Hokkan's procurement. However, this same strong yen would make Hokkan's exports more expensive for international buyers, potentially impacting sales volume and competitiveness.

For instance, if Hokkan Holdings relies heavily on imported components, a stronger yen in late 2024 could offer cost savings. Conversely, if a substantial portion of their revenue comes from exports, a strengthening yen could lead to reduced profitability when translated back into yen. Managing these currency risks through financial instruments like forward contracts or options is crucial for stabilizing earnings.

- Impact on Imports: A stronger JPY in 2024-2025 makes imported raw materials and components cheaper for Hokkan Holdings.

- Impact on Exports: A stronger JPY makes Hokkan's products more expensive for overseas customers, potentially hurting international sales.

- Currency Risk Management: Strategies like hedging are vital to mitigate the financial impact of unpredictable exchange rate movements.

Economic Growth Rates in Target Markets

Japan's economic growth is a key driver for Hokkan Holdings. For instance, the International Monetary Fund (IMF) projected Japan's GDP growth at 0.9% for 2024 and 1.0% for 2025, indicating a moderate but steady expansion. This growth directly impacts industrial output and consumer spending, which in turn affects the demand for packaging materials. A stronger economy generally translates to more goods being produced and purchased, benefiting Hokkan's core business.

Higher economic growth rates in target markets like Japan fuel industrial activity and boost consumer spending, directly correlating with the demand for packaging solutions offered by Hokkan Holdings. For example, if Japan's GDP grows by 1.5% in a given year, it suggests increased manufacturing output and higher disposable incomes, leading to greater consumption of packaged goods. This scenario presents a significant opportunity for Hokkan to expand its market share and increase sales volumes by meeting this heightened demand.

- Japan's projected GDP growth for 2024 is 0.9% (IMF).

- Japan's projected GDP growth for 2025 is 1.0% (IMF).

- Economic expansion generally leads to increased demand for packaged goods.

- Stagnant economic conditions can limit growth opportunities for packaging suppliers.

Fluctuating raw material costs, particularly for aluminum and plastics, directly impact Hokkan Holdings' profitability. For instance, LME aluminum futures traded between $2,100 and $2,500 per metric ton in 2024, highlighting significant input cost volatility. Economic growth in Japan, projected at 0.9% for 2024 and 1.0% for 2025 by the IMF, influences demand for packaging. Rising inflation escalates operational expenses like energy and labor, with Japan's CPI showing sustained pressures in Q3 2024, necessitating careful pricing strategies.

| Economic Factor | 2024 Data/Projection | 2025 Projection | Impact on Hokkan Holdings |

| Raw Material Prices (Aluminum) | LME Futures: $2,100 - $2,500/mt | N/A | Increased input costs, potential margin squeeze |

| Japan GDP Growth | 0.9% (IMF) | 1.0% (IMF) | Moderate demand growth for packaging |

| Inflation (CPI) | Sustained pressures (Q3 2024) | Projected to remain a factor | Higher operational costs, pricing challenges |

| Consumer Disposable Income (US Example) | +2.1% (Q1 2024) | Dependent on economic conditions | Potential for increased consumer spending on packaged goods |

Preview the Actual Deliverable

Hokkan Holdings PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Hokkan Holdings delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic direction.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain valuable insights into the external forces shaping Hokkan Holdings' business landscape, enabling informed decision-making.

Sociological factors

Consumers worldwide are increasingly prioritizing packaging that is sustainable and kind to the environment. This shift is fueled by a heightened awareness of issues like plastic pollution, with studies showing that over 70% of consumers are willing to pay more for products with eco-friendly packaging. For Hokkan Holdings, this means a significant opportunity to align with consumer values.

Responding to this trend involves investing in materials like recycled plastics, plant-based bioplastics, or even innovative reusable packaging solutions. Hokkan Holdings could also highlight its commitment to sustainability through clear labeling and marketing campaigns. For instance, a 2024 survey indicated that 65% of consumers actively seek out brands demonstrating environmental responsibility.

Failing to adapt to this growing demand for sustainable packaging could indeed impact Hokkan Holdings' market position. Brands that embrace eco-friendly practices often see improved customer loyalty and attract new demographics. In 2025, it's projected that the sustainable packaging market will reach over $400 billion globally, underscoring the substantial financial implications of this sociological factor.

Evolving health and wellness trends are significantly shaping consumer preferences in the beverage market. Consumers are increasingly gravitating towards healthier choices, such as sugar-free drinks, functional beverages with added benefits, and natural juices. This shift directly impacts Hokkan Holdings' client base, influencing the demand for specific types and sizes of beverage containers.

For instance, the global functional beverage market was valued at approximately $128 billion in 2023 and is projected to reach over $200 billion by 2030, indicating a strong and growing consumer interest. This growth necessitates that Hokkan Holdings remain agile, adapting its production capabilities to meet the demand for containers suitable for these evolving beverage categories.

Modern lifestyles are significantly altering how people consume products, with a notable rise in on-the-go eating, a preference for smaller, single-serve portions, and an overarching demand for convenience. This shift directly influences the types of packaging consumers seek, favoring designs that are easily portable, resealable, or pre-portioned for immediate use.

For Hokkan Holdings, this translates into a critical need for innovation in its container designs and filling services. For instance, the global market for flexible packaging, which often caters to convenience, was projected to reach over $130 billion by 2024, highlighting the substantial opportunity. Adapting to these evolving consumer behaviors is essential for Hokkan Holdings to maintain its competitive edge and relevance in the market.

Public Perception of Packaging Waste

Public sentiment towards packaging waste, especially plastics, is decidedly negative, fueling demands for less packaging and better recycling infrastructure. This growing societal concern directly impacts policymakers and brand manufacturers, compelling companies like Hokkan Holdings to expedite the development and promotion of eco-friendly packaging alternatives.

For instance, a 2024 survey indicated that over 70% of consumers are willing to pay more for products with sustainable packaging. This trend is a significant driver for Hokkan Holdings to innovate in areas such as biodegradable materials and refillable systems. Proactive and transparent communication regarding their sustainability initiatives is crucial for managing public perception and brand reputation.

- Growing Consumer Demand: Over 70% of consumers in a 2024 survey expressed a willingness to pay a premium for sustainable packaging.

- Policy Influence: Public outcry over plastic waste is leading to stricter regulations, such as extended producer responsibility schemes being considered or implemented in various markets by 2025.

- Brand Reputation: Companies with visible commitments to reducing packaging waste, like Hokkan Holdings, are likely to see improved public image and customer loyalty.

- Innovation Pressure: Societal expectations are pushing for advancements in biodegradable, compostable, and reusable packaging technologies.

Demographic Shifts

Demographic shifts are significantly reshaping consumer preferences for packaged goods. Japan's population is aging rapidly, with projections indicating that by 2025, over 30% of the population will be 65 or older. This trend suggests a growing demand for packaging that is easier to handle, such as pull-tabs or resealable options, and potentially smaller portion sizes to cater to single-person households, which are also on the rise.

Urbanization is another key demographic factor influencing consumption patterns. As more people move to cities, there's a corresponding increase in the demand for convenience foods and beverages. This includes ready-to-eat meals, single-serving drinks, and products with minimal preparation requirements, reflecting the time-constrained lifestyles often associated with urban living. Hokkan Holdings must closely monitor these evolving demographics to align its product development and packaging strategies with anticipated market needs.

- Aging Population Impact: By 2025, Japan's elderly population (65+) is expected to exceed 30%, driving demand for user-friendly packaging and smaller product formats.

- Urbanization Trends: Increased urban migration correlates with a higher demand for convenience foods and beverages, as city dwellers often seek time-saving options.

- Changing Household Structures: The rise in single-person households, particularly prevalent in urban areas, further supports the need for smaller, individually portioned products.

- Consumer Behavior Adaptation: Hokkan Holdings needs to adapt its product portfolio and packaging designs to meet the evolving needs of these demographic segments to maintain market relevance.

Societal values are increasingly emphasizing health and wellness, leading consumers to seek out beverages with lower sugar content, added functional ingredients, and natural components. This trend is a significant driver for Hokkan Holdings to innovate its packaging solutions to accommodate these evolving product formulations. The global functional beverage market, for instance, was valued at approximately $128 billion in 2023 and is projected to grow substantially, indicating a strong consumer shift towards healthier options.

Modern lifestyles are also dictating a preference for convenience, with a rise in on-the-go consumption and a demand for single-serve or easily portable packaging. This necessitates that Hokkan Holdings adapt its offerings to include more resealable, lightweight, and user-friendly container designs. The flexible packaging market, often catering to convenience, was projected to exceed $130 billion by 2024, underscoring the market's responsiveness to these lifestyle changes.

Public sentiment towards packaging waste, particularly plastics, is overwhelmingly negative, creating pressure for reduced packaging and enhanced recycling infrastructure. A 2024 survey revealed that over 70% of consumers are willing to pay more for sustainable packaging, pushing companies like Hokkan Holdings to prioritize biodegradable and reusable alternatives. This societal concern directly influences regulatory landscapes, with extended producer responsibility schemes gaining traction by 2025.

Demographic shifts, such as an aging population and increasing urbanization, are also shaping consumer needs. By 2025, Japan's elderly population (65+) is expected to represent over 30% of the total, highlighting a growing demand for packaging that is easy to open and handle. Urbanization further fuels the need for convenient, single-serving options, reflecting the fast-paced lifestyles of city dwellers.

Technological factors

Continuous advancements in packaging materials, like lighter, stronger, and more sustainable metals, advanced plastics, and compostable alternatives, directly influence Hokkan Holdings' product offerings. For example, the global bioplastics market is projected to reach $11.7 billion by 2027, indicating a significant shift towards eco-friendly options that Hokkan can leverage.

Investing in research and development to integrate these novel materials can boost product performance, minimize environmental footprints, and provide clients with a distinct competitive edge. Hokkan’s strategic focus on material science innovation is therefore paramount for maintaining market relevance and driving future growth in an increasingly environmentally conscious market.

Technological innovations like automation, robotics, and AI are revolutionizing manufacturing, boosting efficiency and cutting costs in producing beverage and food containers. Hokkan Holdings can harness these advancements to optimize its operations, scale up production, and improve energy efficiency, directly impacting profitability and sustainability efforts.

For instance, the global industrial robotics market was valued at approximately $50 billion in 2023 and is projected to grow significantly, indicating a strong trend towards automation that Hokkan can integrate. Embracing these technologies allows for enhanced precision and reduced waste, leading to higher quality products and a stronger competitive edge in the market.

The rise of smart packaging, incorporating features like QR codes for traceability and NFC tags for consumer interaction, offers significant avenues for Hokkan Holdings. By embedding these technologies into their container solutions, Hokkan can provide enhanced product safety, greater supply chain transparency, and novel interactive experiences for end-users, thereby creating a distinct market advantage.

New Recycling Technologies

Innovations in recycling technologies are crucial for Hokkan Holdings' sustainability goals. Advanced sorting systems and chemical recycling for plastics, for instance, can significantly boost efficiency and economic viability. These advancements are key to supporting circular economy initiatives and achieving recycled content targets, with the global chemical recycling market projected to reach USD 13.7 billion by 2030, growing at a CAGR of 14.7% from 2023.

Hokkan Holdings' commitment to these technologies directly impacts its ability to meet environmental regulations and consumer demand for sustainable products. For example, the European Union aims for 70% recycling rates for municipal waste by 2030, a target that necessitates sophisticated recycling infrastructure.

- Enhanced Material Recovery: New technologies improve the quality and quantity of materials recovered, making recycling more economically attractive.

- Circular Economy Enablement: Innovations like chemical recycling allow for the reprocessing of complex materials, closing loops in the value chain.

- Meeting Regulatory Demands: Staying ahead of evolving environmental legislation, such as extended producer responsibility schemes, requires investment in cutting-edge recycling solutions.

Digitalization of Supply Chain and Logistics

The ongoing digitalization of supply chain and logistics presents significant opportunities for Hokkan Holdings. Technologies such as blockchain, the Internet of Things (IoT), and advanced analytics are transforming how goods move and are managed. For instance, blockchain can offer unparalleled transparency in tracking product origins and movement, while IoT sensors provide real-time data on inventory and shipment status.

These advancements directly translate to operational efficiencies. By leveraging real-time tracking and predictive analytics, Hokkan Holdings can achieve more precise demand forecasting, leading to optimized inventory levels and reduced waste. This not only streamlines warehouse operations but also minimizes the risk of stockouts or overstocking, directly impacting cost savings. For example, companies globally are seeing significant improvements; a 2024 report indicated that businesses adopting IoT in logistics experienced an average reduction of 15% in transportation costs.

- Enhanced Inventory Management: Real-time data from IoT devices allows for precise tracking of stock levels, minimizing carrying costs and preventing stockouts.

- Reduced Transportation Costs: Advanced analytics enable route optimization and better load consolidation, cutting fuel consumption and delivery expenses.

- Improved Transparency and Traceability: Blockchain technology offers an immutable ledger for tracking goods throughout the supply chain, enhancing trust and compliance.

- Greater Responsiveness: Real-time visibility and predictive analytics empower Hokkan Holdings to react swiftly to market changes and customer demands.

Technological advancements in materials science are reshaping the packaging industry, with innovations in lighter, stronger, and more sustainable metals, advanced plastics, and compostable alternatives directly impacting Hokkan Holdings' product development. The global bioplastics market, for instance, is projected to reach $11.7 billion by 2027, highlighting a significant consumer and regulatory push towards eco-friendly packaging solutions that Hokkan can capitalize on.

Automation, robotics, and artificial intelligence are revolutionizing manufacturing processes, offering substantial gains in efficiency and cost reduction for beverage and food container production. Hokkan Holdings can leverage these technologies to optimize operations, scale production, and improve energy efficiency, a trend supported by the global industrial robotics market, valued at approximately $50 billion in 2023, which continues its upward trajectory.

Smart packaging, integrating features like QR codes for traceability and NFC tags for enhanced consumer interaction, presents a key growth area for Hokkan. These technologies allow for improved product safety, greater supply chain transparency, and novel end-user experiences, creating a distinct competitive advantage in the market.

Innovations in recycling technologies, particularly chemical recycling and advanced sorting systems, are crucial for Hokkan Holdings' sustainability objectives and its ability to meet stringent environmental regulations. The global chemical recycling market is expected to reach USD 13.7 billion by 2030, growing at a robust CAGR of 14.7% from 2023, underscoring the increasing importance of these solutions for achieving circular economy goals and recycled content targets.

Legal factors

Hokkan Holdings navigates a complex web of environmental protection laws, impacting everything from air emissions to waste disposal. For instance, in 2024, the EU's Emissions Trading System (ETS) saw carbon prices averaging around €65 per tonne, a significant cost factor for industrial emitters. Failure to comply with these evolving regulations, which are increasingly stringent globally, can lead to substantial fines and legal entanglements.

Staying ahead of these environmental mandates is paramount for Hokkan Holdings. This requires ongoing investment in advanced pollution control technologies and meticulous adherence to manufacturing process standards. For example, the company might need to upgrade wastewater treatment facilities to meet stricter discharge limits, a capital expenditure that needs careful budgeting. Proactive environmental stewardship is not just about compliance; it's crucial for maintaining a positive brand image and avoiding operational disruptions.

Hokkan Holdings, as a producer of food and beverage containers and a service provider for filling, operates under stringent product safety and liability regulations. These legal frameworks mandate that products are safe for their intended applications and establish accountability for manufacturers in cases of harm caused by defects. For instance, in 2024, the global food safety testing market was valued at over $20 billion, highlighting the extensive regulatory oversight in this sector.

Adherence to food-grade standards, robust quality control measures, and transparent product labeling are critical for Hokkan Holdings to minimize legal exposure and uphold consumer confidence. Failure to comply can lead to significant fines and reputational damage, as seen in past recalls impacting major food and beverage companies, which often incur millions in associated costs.

Hokkan Holdings must navigate a complex web of labor laws and employment regulations, covering everything from minimum wage requirements to workplace safety standards. For instance, in Japan, where Hokkan operates, the minimum wage varies by prefecture, with Tokyo often having the highest rates, impacting labor costs. Staying compliant is crucial to prevent costly disputes and maintain operational integrity.

Changes in these regulations, such as potential increases in the statutory working hours or new mandates for employee benefits, can directly affect Hokkan's operational expenses and necessitate adjustments to its human resources strategies. For example, a significant rise in the national minimum wage could increase payroll expenses, influencing pricing and profitability.

Competition and Anti-Trust Laws

Hokkan Holdings operates within a packaging sector where competition and anti-trust laws are paramount. These regulations are in place to ensure a level playing field, preventing monopolistic practices and unfair business dealings. For instance, in 2024, the Japan Fair Trade Commission (JFTC) continued its scrutiny of various industries for potential anti-competitive behavior, a landscape Hokkan must actively navigate.

Adherence to these legal frameworks directly impacts Hokkan's strategic decisions. It influences how the company approaches pricing, considers market expansion, and evaluates potential mergers or acquisitions. Each competitive move requires thorough legal vetting to ensure compliance and avoid significant penalties, which could include fines or mandated operational changes.

- Compliance with anti-trust regulations is essential for maintaining fair market competition.

- Legal review is critical for pricing strategies, market entry, and M&A activities.

- The JFTC's ongoing oversight in 2024 highlights the dynamic regulatory environment.

- Non-compliance can lead to substantial legal penalties and reputational damage.

Intellectual Property Laws

Intellectual property laws are a cornerstone for Hokkan Holdings, safeguarding its unique container designs, advanced manufacturing processes, and proprietary technological innovations. Protecting patents, trademarks, and trade secrets is absolutely vital for maintaining their competitive advantage and preventing others from unfairly benefiting from their hard work. Failure to adequately protect these assets could lead to significant financial losses and erosion of market share.

The company's ability to secure and defend its intellectual property directly impacts its valuation and future growth prospects. For instance, a strong patent portfolio can deter competitors and enable premium pricing for its innovative products. In 2024, companies in the packaging sector with robust IP protection often saw higher valuations, with some patent-heavy firms reporting R&D investments exceeding 5% of revenue, a figure Hokkan Holdings likely aims to match or surpass.

- Patent Protection: Securing patents for novel container designs and manufacturing techniques prevents direct imitation.

- Trademark Safeguarding: Protecting brand names and logos ensures consumer recognition and prevents brand dilution.

- Trade Secret Management: Implementing strict internal controls to protect confidential information related to production and innovation is critical.

- Infringement Monitoring: Proactively monitoring the market for potential infringements and being prepared for swift legal action is essential for asset preservation.

Hokkan Holdings must navigate a complex landscape of consumer protection laws, ensuring product safety, accurate labeling, and fair marketing practices. In 2024, regulatory bodies worldwide, including the Consumer Affairs Agency in Japan, continued to emphasize transparency in product origins and ingredient disclosure, impacting packaging and marketing claims. Violations can result in significant fines and damage to brand reputation.

Adherence to these regulations requires meticulous attention to detail in product development and communication. For example, clear and concise labeling on beverage containers, detailing ingredients and potential allergens, is not only a legal requirement but also builds consumer trust. Companies that proactively address consumer rights and safety concerns often experience stronger customer loyalty and a more resilient market position.

The company must also comply with data privacy regulations, such as Japan's Act on the Protection of Personal Information (APPI), which govern how customer data is collected, stored, and used. In 2024, global focus on data security intensified, with significant penalties for breaches. Hokkan's handling of customer information, whether for direct sales or service provision, must align with these stringent privacy standards to avoid legal repercussions and maintain trust.

Environmental factors

Hokkan Holdings faces mounting pressure to curb its carbon emissions, a direct consequence of the intensifying global commitment to combating climate change. This environmental imperative demands a comprehensive overhaul of operations, pushing companies like Hokkan to invest in greener technologies and sustainable practices throughout their value chains. For instance, the automotive sector, a key area for many manufacturing firms, saw a significant surge in electric vehicle (EV) sales in 2024, with global EV sales projected to reach over 17 million units, highlighting a clear market shift towards lower-emission alternatives.

Meeting these sustainability goals requires substantial capital outlays in areas such as energy-efficient machinery and the adoption of renewable energy sources. Companies are increasingly exploring solar and wind power to reduce reliance on fossil fuels, a trend reflected in the global renewable energy market, which was valued at approximately $1.3 trillion in 2024 and is expected to grow substantially. Optimizing logistics networks to minimize transportation-related emissions is also crucial, with many firms adopting route optimization software and exploring lower-emission shipping methods.

Hokkan Holdings' reliance on packaging materials like aluminum, steel, and plastics means it's directly impacted by the availability and price of bauxite, iron ore, and crude oil. These commodities are sensitive to global environmental policies and geopolitical shifts, which can disrupt supply chains and inflate costs. For instance, the price of aluminum, a key material for beverage cans, saw significant volatility in 2024 due to energy costs and supply chain constraints.

To counter this, Hokkan Holdings is focusing on enhancing its use of recycled content. This strategy not only addresses resource scarcity but also aligns with growing consumer demand for sustainable packaging. By increasing the proportion of recycled aluminum and plastic in its products, the company aims to build a more resilient supply chain and mitigate the risks associated with virgin material sourcing.

Hokkan Holdings' circular economy ambitions are directly tied to the efficiency of waste management infrastructure and regional recycling rates. For instance, in Japan, where Hokkan operates, the national recycling rate for plastic containers and packaging was around 28.6% in 2022, according to the Ministry of the Environment. This figure highlights the existing challenges and opportunities for companies like Hokkan to integrate recycled content and improve end-of-life product management.

The effectiveness of collection, sorting, and processing facilities significantly influences Hokkan's ability to source high-quality recycled materials for its beverage containers. If local infrastructure is underdeveloped or recycling rates remain low, Hokkan may face increased costs or limitations in its pursuit of sustainable packaging solutions, potentially necessitating direct investment in or partnerships to bolster these systems.

Climate Change Impacts on Supply Chains

Climate change presents significant environmental challenges for Hokkan Holdings, particularly concerning its supply chains. Extreme weather events, such as the record-breaking heatwaves and severe flooding experienced globally in 2024, can directly impact the availability and cost of raw materials, disrupt logistics networks, and halt manufacturing processes. For instance, agricultural yields crucial for many food-related supply chains can be decimated by unseasonal droughts or excessive rainfall, leading to price volatility and shortages.

These disruptions pose tangible risks to Hokkan Holdings' production schedules and overall operational costs. The company must proactively develop more resilient and diversified supply chains to buffer against climate-induced shocks. This includes identifying alternative sourcing regions and transportation routes, as well as implementing robust contingency plans. For example, investing in climate-resilient infrastructure and exploring partnerships with suppliers who demonstrate strong environmental risk management practices will be crucial. The increasing frequency and intensity of climate-related events underscore the urgency for such strategic adaptations.

- Supply Chain Vulnerability: Extreme weather events in 2024, like widespread flooding in Southeast Asia, disrupted key shipping lanes and raw material sourcing for multiple industries.

- Increased Operational Costs: Climate-related disruptions can lead to higher transportation expenses and the need for expedited shipping, potentially increasing Hokkan Holdings' cost of goods sold.

- Diversification Imperative: Building resilience requires exploring a wider range of suppliers and logistics partners, potentially reducing reliance on single geographic regions prone to climate impacts.

- Contingency Planning: Developing detailed plans for scenarios such as port closures or raw material scarcity is essential to maintain business continuity.

Corporate Social Responsibility (CSR) and ESG Reporting

Stakeholders increasingly demand robust Corporate Social Responsibility (CSR) and transparent Environmental, Social, and Governance (ESG) reporting from companies like Hokkan Holdings. This means Hokkan Holdings is expected to publicly disclose its environmental footprint, covering areas such as greenhouse gas emissions, waste management, and water consumption.

Strong ESG credentials can significantly boost a company's brand image, attract socially conscious investors, and improve its ability to secure capital. Conversely, weak ESG performance can invite public criticism and potentially lead to financial penalties or reduced investment.

For instance, in 2023, the global ESG investing market reached approximately $37.2 trillion, highlighting the financial significance of these factors. Companies demonstrating a commitment to sustainability are often viewed more favorably by a growing segment of consumers and investors.

- Growing Investor Demand: A significant portion of institutional investors now integrate ESG factors into their investment decisions, pressuring companies for transparency.

- Reputational Impact: Positive ESG reporting can enhance brand loyalty and customer preference, while negative reports can damage public perception.

- Regulatory Scrutiny: Governments worldwide are increasing regulations around environmental disclosures and corporate sustainability practices.

- Access to Capital: Strong ESG performance can lead to better loan terms and a wider pool of potential investors, as seen in the growing green bond market.

Hokkan Holdings must navigate increasing environmental regulations and consumer demand for sustainable products. The global push for decarbonization, evidenced by the automotive sector's projected over 17 million EV sales in 2024, necessitates investment in greener technologies and practices across all industries. This includes optimizing logistics for reduced emissions and sourcing materials from environmentally responsible suppliers.

The company's reliance on materials like aluminum and steel makes it vulnerable to commodity price volatility driven by environmental policies and geopolitical events, as seen with aluminum price fluctuations in 2024. To mitigate this, Hokkan is prioritizing recycled content, aligning with a market where ESG investing reached approximately $37.2 trillion in 2023, reflecting growing investor and consumer preference for sustainable operations.

Waste management infrastructure and recycling rates, such as Japan's 28.6% plastic recycling rate in 2022, directly impact Hokkan's ability to incorporate recycled materials. Furthermore, the increasing frequency of extreme weather events in 2024, disrupting supply chains and increasing operational costs, highlights the critical need for diversified and climate-resilient sourcing strategies.

| Environmental Factor | Impact on Hokkan Holdings | Relevant Data/Trend |

|---|---|---|

| Climate Change & Extreme Weather | Supply chain disruptions, increased operational costs. | Record heatwaves and floods in 2024 impacted global supply chains. |

| Resource Scarcity & Material Costs | Volatility in raw material prices (e.g., aluminum). | Aluminum prices saw significant volatility in 2024 due to energy and supply chain issues. |

| Sustainability & Consumer Demand | Pressure to adopt greener practices and recycled content. | Global ESG investing market valued at $37.2 trillion in 2023. |

| Waste Management & Recycling | Availability and cost of recycled materials. | Japan's plastic recycling rate was 28.6% in 2022. |

PESTLE Analysis Data Sources

Our Hokkan Holdings PESTLE Analysis is built on a robust foundation of data sourced from official government publications, reputable financial institutions, and leading market research firms. We ensure comprehensive coverage by incorporating insights from economic indicators, regulatory updates, technological advancements, and socio-cultural trends.