Hokkan Holdings Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hokkan Holdings Bundle

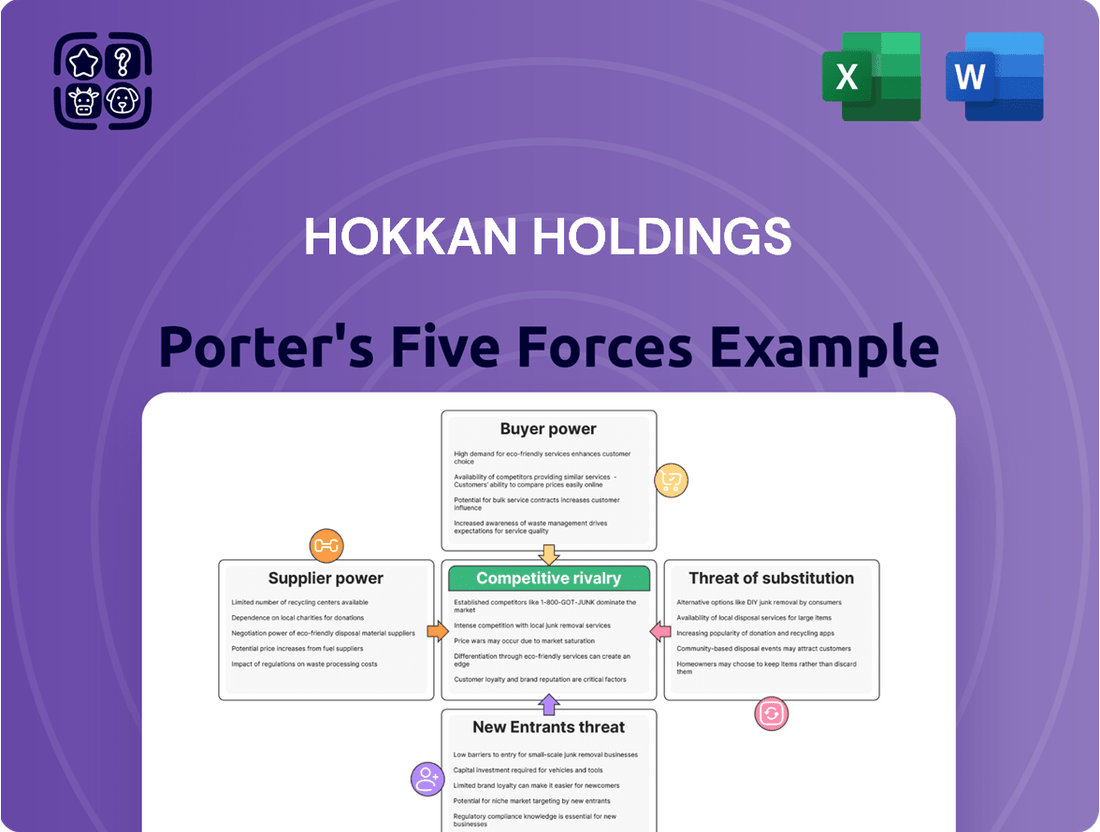

Hokkan Holdings operates in a market where buyer power is a significant factor, influencing pricing and product differentiation. Understanding the intensity of rivalry and the threat of substitutes is crucial for navigating this landscape effectively.

The complete report reveals the real forces shaping Hokkan Holdings’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Hokkan Holdings' reliance on key materials such as aluminum, steel, and plastics for its container and packaging production exposes it to significant supplier bargaining power. The prices of these essential inputs have demonstrated considerable volatility, with some experiencing persistent increases, directly inflating production expenses.

For example, aluminum prices experienced a notable surge between 2020 and 2022. Looking ahead to 2025, anticipated new tariffs are expected to further escalate the cost of imported steel and aluminum, posing a direct challenge to the packaging industry and Hokkan Holdings' cost structure.

Hokkan Holdings' reliance on specialized container manufacturing and filling services can create a dependency on a select group of suppliers. For instance, if advanced filling machinery or unique container designs are sourced from only a few providers, these suppliers gain considerable bargaining power. This leverage intensifies if Hokkan faces substantial costs or operational disruptions when trying to switch to alternative suppliers, a situation common in industries requiring highly specific manufacturing capabilities.

Supplier concentration significantly impacts bargaining power. If Hokkan Holdings relies on a limited number of suppliers for critical raw materials or specialized equipment, those suppliers gain considerable leverage. For instance, in 2024, the semiconductor industry, crucial for many technology-dependent businesses, saw major foundries like TSMC operating at near-full capacity, leading to extended lead times and price increases for chip manufacturers, a scenario that could mirror Hokkan's challenges if similar conditions arise in its supply chain.

Switching Costs for Hokkan

The cost and complexity of switching suppliers for core materials or equipment present a significant barrier for Hokkan Holdings, directly impacting the bargaining power of its suppliers. These switching costs encompass not only the direct financial expenses associated with finding and onboarding a new supplier but also the less tangible, yet equally impactful, disruptions to ongoing production. For instance, a switch in a key component supplier might necessitate extensive re-qualification processes, potentially delaying product launches and impacting revenue streams. In 2024, many manufacturing sectors reported increased lead times and price volatility for essential raw materials, amplifying the financial implications of such transitions for companies like Hokkan.

Beyond the financial outlay, the operational complexities of supplier transitions are substantial. Hokkan would need to consider the potential for production downtime during the changeover period, the costs associated with retraining staff on new materials or equipment, and the rigorous re-qualification of any new materials to ensure they meet existing quality standards. These factors collectively serve to strengthen the bargaining position of existing suppliers, as the effort and risk involved in switching can outweigh the perceived benefits of finding a new partner. For example, a 2024 industry report indicated that the average time to qualify a new material supplier in the electronics sector could extend up to six months, highlighting the significant operational drag.

- High Financial Outlay: Direct costs for new supplier contracts, potential tooling modifications, and inventory adjustments.

- Operational Disruptions: Risk of production halts, delays in delivery schedules, and potential quality control issues during the transition.

- Retraining and Re-qualification: Costs associated with training employees on new processes and re-validating material specifications.

- Loss of Volume Discounts: Existing suppliers may offer better pricing due to the scale of Hokkan's past business.

Forward Integration Threat from Suppliers

The threat of suppliers integrating forward is a significant consideration for Hokkan Holdings. If a major supplier, perhaps one providing specialized packaging materials or unique filling technology, possessed the capacity and motivation to move into Hokkan's core business of beverage manufacturing and distribution, they could emerge as a direct competitor. This scenario, while less frequent, would dramatically shift the supplier-customer dynamic.

This potential for forward integration by suppliers directly enhances their bargaining power. Imagine a supplier controlling a proprietary ingredient or a unique bottle design; if they could leverage this control to enter the beverage market themselves, they would have less incentive to offer favorable terms to Hokkan. For instance, if a supplier of high-barrier PET resin, crucial for preserving beverage freshness, decided to bottle and sell their own branded drinks, Hokkan would face increased competition and potentially higher material costs.

- Forward Integration Threat: Suppliers may enter Hokkan's business if they have the capability and incentive.

- Increased Bargaining Power: This threat allows suppliers to demand better terms from Hokkan.

- Example Scenario: A specialized packaging material supplier could become a direct competitor.

- Impact on Hokkan: Increased competition and potentially higher input costs for Hokkan.

Hokkan Holdings faces substantial bargaining power from its suppliers due to the concentrated nature of key material providers and the high costs associated with switching. Volatile input prices, such as those for aluminum and steel, directly impact Hokkan's production expenses, with anticipated 2025 tariffs expected to further inflate these costs.

The reliance on specialized machinery and unique container designs further empowers a limited supplier base. For instance, if advanced filling equipment is sourced from only a few providers, these suppliers gain significant leverage, especially if Hokkan encounters substantial disruption or cost when seeking alternatives.

In 2024, many industries, including those supplying critical components, experienced extended lead times and price volatility, underscoring the financial and operational risks Hokkan faces when transitioning suppliers. The complexity and time required for re-qualification, potentially up to six months in sectors like electronics, highlight the entrenched power of existing suppliers.

| Factor | Impact on Hokkan Holdings | 2024/2025 Relevance |

|---|---|---|

| Supplier Concentration | Increased leverage for limited providers | Mirroring semiconductor industry capacity constraints |

| Switching Costs | Financial and operational barriers to changing suppliers | Extended lead times and price volatility for raw materials |

| Forward Integration Threat | Potential for suppliers to become competitors | Suppliers could leverage proprietary technology to enter beverage market |

What is included in the product

This analysis of Hokkan Holdings examines the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, all within its specific industry context.

Instantly identify and address competitive pressures with a clear, actionable breakdown of Hokkan Holdings' Porter's Five Forces, enabling targeted strategy development.

Customers Bargaining Power

Hokkan Holdings supplies packaging to major beverage and food manufacturers, many of whom are large-scale buyers. For instance, in 2023, the global food and beverage market was valued at over $7.8 trillion, indicating the immense scale of Hokkan's potential client base.

The ongoing trend of consolidation within the food and beverage sector means that customers are becoming increasingly larger and more concentrated. This trend amplifies their bargaining power, as these consolidated entities can negotiate for more favorable pricing, extended payment terms, and highly tailored packaging solutions from suppliers like Hokkan Holdings.

Customer price sensitivity is a major factor for Hokkan Holdings. In the competitive food and beverage sector, consumers are keenly aware of how packaging costs impact the final price of products. This means Hokkan Holdings must remain cost-competitive to avoid losing business to rivals who might offer lower prices.

For example, in 2024, the global food and beverage packaging market saw continued pressure on raw material costs, with some plastic resin prices fluctuating significantly. This directly translates to packaging manufacturers like Hokkan Holdings needing to absorb or pass on these costs, directly influencing their pricing strategies and, consequently, customer purchasing decisions.

This sensitivity can erode profit margins if Hokkan Holdings cannot efficiently manage its production costs or if competitors are able to source materials or manufacture more cheaply. The ability to offer value, not just price, becomes crucial in retaining customers.

Customers now have a wider array of packaging choices beyond traditional cans and rigid containers. Flexible packaging, glass, and paperboard options are readily available, offering alternatives that cater to different product needs and consumer preferences.

The increasing demand for sustainable and eco-friendly packaging further amplifies this trend. Biodegradable and compostable solutions are gaining traction, providing consumers with even more choices and consequently strengthening their bargaining power against suppliers like Hokkan Holdings.

Low Switching Costs for Customers

For Hokkan Holdings, the bargaining power of customers is significantly influenced by low switching costs. If customers can easily move to a different packaging supplier without incurring substantial costs or effort, they gain leverage. This is particularly true for standardized packaging solutions where differentiation is minimal.

This ease of switching allows customers to actively compare offerings, pushing Hokkan Holdings to remain competitive on price and quality. For instance, in 2024, the global packaging market saw intense competition, with many suppliers offering similar materials and production capabilities, thereby amplifying customer power.

- Low Switching Costs: Customers can readily change packaging suppliers, especially for commodity products.

- Price Sensitivity: This ease of switching increases customer focus on price, pressuring Hokkan Holdings.

- Competitive Landscape: A crowded market in 2024 meant numerous alternatives for buyers.

- Innovation Drive: Customers may switch to suppliers offering more advanced or tailored packaging solutions.

Customer Backward Integration Threat

The threat of customer backward integration can significantly amplify the bargaining power of Hokkan Holdings' clients. Large beverage and food manufacturers, particularly those with substantial volume requirements or unique packaging specifications, might explore bringing packaging production in-house. This strategic move, though requiring considerable capital investment, directly challenges Hokkan's market position.

Should major customers pursue backward integration, Hokkan Holdings would likely face increased pressure to negotiate more competitive pricing and enhanced service agreements. For instance, if a key client representing 15% of Hokkan's revenue were to integrate, it could necessitate a review of Hokkan's cost structure and value proposition to retain business.

- Customer Backward Integration: Large clients may produce their own packaging to control costs and supply.

- Impact on Hokkan: This integration increases customer bargaining power, potentially forcing Hokkan to offer better terms.

- Capital Intensity: While costly, backward integration is a viable threat for high-volume buyers.

- Market Dynamics: The potential for integration compels Hokkan to remain competitive in pricing and service.

Customers wield considerable power over Hokkan Holdings due to low switching costs and intense price sensitivity within the food and beverage industry. In 2024, the global packaging market's competitive nature, with numerous suppliers offering similar capabilities, further amplified buyer leverage. This environment compels Hokkan to remain highly competitive on both price and quality to retain its client base.

| Factor | Description | Impact on Hokkan Holdings | 2024 Context |

|---|---|---|---|

| Switching Costs | Ease for customers to change suppliers | Increases customer bargaining power | Low for standardized packaging |

| Price Sensitivity | Customer focus on cost impact on final product price | Pressures Hokkan for competitive pricing | High in cost-conscious food/beverage sector |

| Availability of Alternatives | Variety of packaging types and suppliers | Strengthens customer negotiation position | Diverse options including sustainable materials |

| Customer Consolidation | Growth in size and concentration of buyers | Magnifies customer influence on terms | Ongoing trend in food/beverage sector |

Full Version Awaits

Hokkan Holdings Porter's Five Forces Analysis

This preview showcases the comprehensive Hokkan Holdings Porter's Five Forces analysis, detailing competitive rivalry, the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, and the threat of substitute products. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, ensuring full transparency and immediate usability for your strategic planning.

Rivalry Among Competitors

The beverage can manufacturing sector, a key area for Hokkan Holdings, is populated by a substantial number of global and regional competitors. This fragmentation means that no single player dominates the entire market, fostering a highly competitive environment.

Leading the charge are giants such as Ardagh Group, Ball Corporation, Crown Holdings, and Canpack, all of whom are major forces in the beverage can industry. Their substantial size and market presence contribute significantly to the intensity of competition that Hokkan Holdings navigates.

The beverage can market is projected for robust growth, with an estimated compound annual growth rate of 6.2% between 2025 and 2029. While this indicates a healthy overall market, mature segments within the broader packaging industry can intensify competitive rivalry.

In these mature areas, companies often face increased pressure to capture market share, potentially leading to price wars or heightened marketing expenditures. This dynamic can significantly impact profitability for players like Hokkan Holdings.

Competitive rivalry in the packaging industry, including for Hokkan Holdings, is significantly fueled by product differentiation, often achieved through relentless innovation. Companies are constantly exploring advancements like sustainable packaging materials, which saw global demand grow substantially in 2024, and lightweighting solutions to reduce costs and environmental impact. Smart packaging technologies, offering features like track-and-trace capabilities or temperature monitoring, also represent a key area of innovation.

Hokkan Holdings's strategic emphasis on providing comprehensive solutions and leveraging its contract manufacturing capabilities can serve as a unique selling proposition. However, to maintain and enhance its competitive standing, a sustained commitment to continuous innovation across its product portfolio and service offerings is absolutely essential. This proactive approach ensures they remain at the forefront of evolving market demands and technological shifts.

High Fixed Costs and Capacity Utilization

The beverage can manufacturing sector, including players like Hokkan Holdings, is characterized by substantial upfront investments in specialized machinery and production facilities. These high fixed costs create a strong pressure for companies to maintain high levels of capacity utilization to spread the costs over a larger output.

When the industry experiences overcapacity, perhaps due to new entrants or a slowdown in demand, companies are compelled to lower prices to fill their production lines. This aggressive pricing behavior directly intensifies competitive rivalry, as firms fight to secure market share and cover their fixed expenses.

- High Capital Intensity: The initial outlay for advanced can-making equipment represents a significant barrier to entry and a major ongoing cost for established players.

- Capacity Utilization Drive: Companies strive for near-maximum operational efficiency to amortize these fixed costs, often leading to price competition when demand falters.

- Impact on Pricing: In 2023, the global beverage can market saw fluctuating demand, with some regions experiencing oversupply which pressured manufacturers to offer more competitive pricing structures.

Mergers and Acquisitions Activity

The packaging industry has seen a significant uptick in mergers and acquisitions (M&A) activity, with 2024 and early 2025 marking a period of notable consolidation. This trend creates larger, more powerful entities within the market.

For Hokkan Holdings, this means facing intensified competition from these consolidated giants. The ongoing M&A wave reshapes the competitive landscape, potentially leading to increased pricing pressure and a demand for greater operational efficiency to remain competitive.

- Industry Consolidation: The packaging sector is actively consolidating, with M&A deals becoming more frequent.

- Increased Competitive Pressure: Larger, merged entities can exert greater influence on pricing and market share.

- Strategic Implications: Hokkan Holdings must adapt its strategies to compete effectively in this evolving, consolidated market.

Hokkan Holdings operates in a highly competitive beverage can manufacturing sector, facing pressure from global giants like Ball Corporation and Crown Holdings. The market's projected 6.2% CAGR from 2025 to 2029, while indicating growth, also intensifies rivalry, particularly in mature segments where price wars and aggressive marketing are common.

Innovation in areas like sustainable and lightweight packaging, which saw significant global demand growth in 2024, is a key battleground. High capital intensity and the drive for capacity utilization to cover fixed costs also fuel price competition, especially when overcapacity arises, as seen with fluctuating demand impacting pricing structures in 2023.

The packaging industry's consolidation trend, with increased M&A activity in 2024 and early 2025, further heightens competitive pressure. Hokkan Holdings must adapt to larger, more influential competitors by focusing on differentiation and efficiency.

| Competitor | Market Position | Key Strengths |

| Ball Corporation | Global Leader | Scale, Innovation, Sustainability Focus |

| Crown Holdings | Global Leader | Diversified Packaging Solutions, Strong Customer Relationships |

| Ardagh Group | Global Leader | Broad Product Portfolio, Extensive Manufacturing Footprint |

| Canpack | Significant Global Player | Specialization in Beverage Cans, Emerging Market Presence |

SSubstitutes Threaten

Hokkan Holdings, a key player in beverage and food containers, primarily focuses on metal cans. However, the threat of substitutes is significant, with alternatives like glass bottles, plastic bottles, flexible pouches, and paperboard cartons readily available. These materials offer different benefits, such as perceived premium quality (glass) or lighter weight and recyclability (plastic, paperboard), directly impacting Hokkan's market share.

While the industry has seen a historical shift from glass to cans, driven by factors like durability and cost-efficiency, other materials continue to hold their ground. For instance, the global plastic packaging market was valued at approximately $1.05 trillion in 2023 and is projected to grow, indicating sustained consumer and manufacturer preference for certain plastic applications, posing a challenge to can manufacturers like Hokkan.

Growing environmental concerns and increasingly stringent regulations are fueling a significant shift towards sustainable and eco-friendly packaging options. This trend directly impacts industries like Hokkan Holdings by promoting alternatives such as biodegradable, compostable, and reusable packaging. For instance, the global market for sustainable packaging was valued at approximately $280 billion in 2023 and is projected to reach over $400 billion by 2028, indicating a substantial and growing threat from these substitutes.

These environmentally conscious alternatives, including mono-materials designed for enhanced recyclability, directly challenge traditional packaging methods. As both consumers and major brands increasingly prioritize environmental impact in their purchasing and sourcing decisions, the appeal and adoption of these substitutes are escalating rapidly. This growing preference for sustainability means that companies not offering or transitioning to these greener solutions risk losing market share.

Flexible packaging, such as stand-up pouches, is a burgeoning market, fueled by consumer demand for convenience and a desire for reduced material usage. This trend presents a significant threat of substitutes for Hokkan Holdings, particularly as these flexible options are often lighter and more economical than traditional rigid packaging.

In 2024, the global flexible packaging market was valued at approximately $130 billion and is projected to grow steadily. This growth is largely attributed to its suitability for a wide range of products, from food and beverages to pharmaceuticals, directly competing with rigid packaging solutions that Hokkan Holdings may offer.

Cost-Effectiveness of Substitutes

The cost-effectiveness of alternative packaging materials is a significant factor influencing their adoption. If substitutes can provide comparable functionality at a more attractive price, their appeal grows. For instance, if the raw material costs for traditional packaging such as aluminum and steel continue their upward trend, the threat of substitution for Hokkan Holdings will likely intensify.

Consider the following points regarding the cost-effectiveness of substitutes:

- Price Sensitivity: Consumers and businesses are often price-sensitive, making lower-cost alternatives more attractive, especially for high-volume products.

- Material Cost Fluctuations: Volatility in the prices of aluminum and steel, key materials for Hokkan Holdings, can directly impact the competitiveness of their products against substitutes. For example, aluminum prices saw significant fluctuations throughout 2024, impacting manufacturing costs.

- Performance vs. Cost Trade-offs: While substitutes might be cheaper, they may not always offer the same level of performance, durability, or aesthetic appeal as traditional materials. Evaluating this trade-off is crucial.

- Innovation in Substitute Materials: Advances in materials science are continually introducing new packaging options that may offer a better balance of cost and performance, thereby increasing the threat.

Consumer Preferences and Trends

Consumer preferences are a significant driver of substitute threats. The growing demand for convenience, portability, and healthier options directly influences the appeal of alternative products. For instance, the rise of functional beverages, often packaged in pouches or innovative single-serve formats, presents a challenge to traditional canned drinks. This shift reflects a broader trend where consumers prioritize ease of use and perceived health benefits.

In 2024, the beverage market continued to see a surge in demand for products catering to these evolving tastes. Data from market research firms indicated that the functional beverage segment, including those with added vitamins or adaptogens, experienced robust growth, outpacing more traditional categories. This indicates a clear shift in consumer priorities, making it easier for substitutes to gain traction.

- Evolving Consumer Demands: Consumers increasingly seek convenience, portability, and health-conscious packaging in their beverage choices.

- Impact on Substitutes: These preferences can accelerate the adoption of alternative products that better meet these evolving needs.

- Functional Hydration Growth: The popularity of functional hydration products is a prime example, driving innovation in packaging that may favor alternatives to traditional cans.

- Market Trends: In 2024, the functional beverage sector demonstrated strong growth, highlighting a significant shift in consumer priorities towards convenience and perceived health benefits.

The threat of substitutes for Hokkan Holdings is substantial, with glass, plastic, and paperboard packaging offering viable alternatives. Growing environmental concerns are a key driver, pushing demand for sustainable options. For example, the global sustainable packaging market was valued at approximately $280 billion in 2023 and is projected to exceed $400 billion by 2028, indicating a significant and expanding threat.

Flexible packaging, like pouches, is also a growing concern due to its convenience and lighter weight. The global flexible packaging market reached about $130 billion in 2024, directly competing with rigid packaging solutions. Consumer preferences for convenience and health-conscious options further bolster the appeal of these substitutes.

| Packaging Type | 2023 Market Value (Approx.) | Projected 2028 Market Value (Approx.) | Key Drivers for Substitution |

|---|---|---|---|

| Sustainable Packaging | $280 billion | $400 billion | Environmental concerns, regulations |

| Flexible Packaging | $130 billion (2024) | N/A | Convenience, lighter weight, cost-effectiveness |

Entrants Threaten

Entering the packaging manufacturing sector, particularly for items like beverage cans, demands significant upfront capital. Hokkan Holdings, for instance, operates in an industry where establishing advanced production lines and securing necessary technology can easily run into tens of millions of dollars.

This substantial financial commitment acts as a formidable deterrent for potential new competitors. For example, setting up a single modern beverage can manufacturing plant can cost upwards of $50 million, a figure that immediately filters out many smaller or less capitalized players.

The need for specialized machinery, sophisticated quality control systems, and efficient logistics infrastructure further escalates these entry barriers. This high capital requirement therefore limits the number of new entrants capable of competing effectively with established players like Hokkan Holdings.

Established players like Hokkan Holdings enjoy significant cost advantages due to economies of scale in their operations. This means they can produce goods, purchase raw materials, and distribute their products more cheaply per unit than a new entrant could. For instance, in 2023, Hokkan Holdings reported a substantial revenue of ¥1.2 trillion, indicating a high volume of business that underpins these scale efficiencies.

The packaging industry faces a significant barrier to entry due to increasingly strict regulations. For instance, in 2024, the European Union continued to implement and enforce the Packaging and Packaging Waste Regulation (PPWR), which mandates higher recycling rates and the use of recycled content. New companies entering this market must invest substantial capital to ensure their packaging materials meet these evolving safety, recyclability, and environmental impact standards, a considerable hurdle for startups.

Established Supply Chains and Distribution Networks

Hokkan Holdings benefits from deeply entrenched supply chains and distribution networks. These established relationships provide a significant barrier to entry, as new competitors would struggle to replicate the same level of efficiency and reliability in sourcing raw materials and delivering finished goods. For instance, in 2024, the cost of establishing a comparable distribution network for a beverage company could easily run into millions of dollars, encompassing warehousing, logistics, and retail partnerships.

The time and capital investment required for new entrants to build out comparable supply chains and distribution channels are substantial. This includes securing reliable suppliers for key ingredients, negotiating favorable terms, and developing the infrastructure to reach a wide customer base. Hokkan's existing infrastructure, honed over years of operation, offers a distinct competitive advantage that is difficult and expensive to overcome.

- Established supplier relationships: Hokkan Holdings has cultivated long-standing partnerships with its raw material providers, ensuring consistent quality and supply.

- Robust distribution network: The company possesses an extensive network of warehouses, transportation, and retail channels, facilitating efficient product delivery.

- High upfront investment for new entrants: Building a similar supply chain and distribution system requires significant capital outlay and considerable time.

- Cost and time barriers: Newcomers face substantial costs and lengthy timelines to establish the necessary infrastructure to compete effectively.

Brand Loyalty and Customer Relationships

The threat of new entrants for Hokkan Holdings is somewhat mitigated by strong brand loyalty and established customer relationships within the food and beverage sector. Existing players, like Hokkan, often have deep, long-standing partnerships with major food and beverage companies, built on trust and consistent performance. For instance, in 2024, many of these relationships involve multi-year contracts for specialized packaging or ingredient supply, making it difficult for newcomers to break in.

Newcomers would need to present a significantly compelling value proposition to sway these established clients. This could involve offering advanced, more sustainable packaging technologies, innovative product designs that enhance shelf appeal, or achieving substantially lower operational costs that translate into price advantages. Without such clear benefits, the inertia of existing supplier relationships acts as a barrier.

- Established Relationships: Hokkan Holdings likely benefits from long-term contracts with major food and beverage manufacturers, securing a stable customer base.

- Brand Equity: Decades of operation have likely fostered significant brand recognition and trust among Hokkan's clientele.

- Switching Costs: For large food and beverage companies, switching suppliers can involve significant costs related to re-tooling, quality assurance validation, and supply chain integration.

- Innovation Imperative: New entrants must demonstrate clear technological or cost advantages to overcome the loyalty enjoyed by incumbents like Hokkan Holdings.

The threat of new entrants for Hokkan Holdings is generally considered moderate. Significant capital investment is required to establish modern manufacturing facilities, with costs for a single beverage can plant potentially exceeding $50 million. Furthermore, stringent environmental regulations, such as the EU's Packaging and Packaging Waste Regulation in 2024, add complexity and cost for newcomers needing to meet recyclability and recycled content standards.

Established players like Hokkan benefit from economies of scale, with 2023 revenues of ¥1.2 trillion underscoring their production volume advantages. They also possess deeply entrenched supply chains and distribution networks, which would cost millions to replicate in 2024. Brand loyalty and long-term contracts with major food and beverage clients further solidify Hokkan's market position, creating high switching costs for customers.

| Barrier | Description | Estimated Cost/Impact (Illustrative) |

|---|---|---|

| Capital Requirements | Establishing advanced production lines and technology. | Beverage can plant: >$50 million (2024 estimate) |

| Regulatory Compliance | Meeting evolving environmental standards (e.g., EU PPWR 2024). | Significant investment in material sourcing and process adaptation. |

| Economies of Scale | Cost advantages from high production volume. | Hokkan Holdings 2023 Revenue: ¥1.2 trillion |

| Supply Chain & Distribution | Building robust logistics and supplier relationships. | Network replication: Millions of dollars (2024 estimate) |

| Customer Loyalty & Switching Costs | Overcoming established client relationships and contracts. | Requires demonstrably superior value proposition from new entrants. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Hokkan Holdings leverages data from their annual reports, investor presentations, and industry-specific market research reports. We also incorporate information from financial news outlets and regulatory filings to provide a comprehensive view of the competitive landscape.