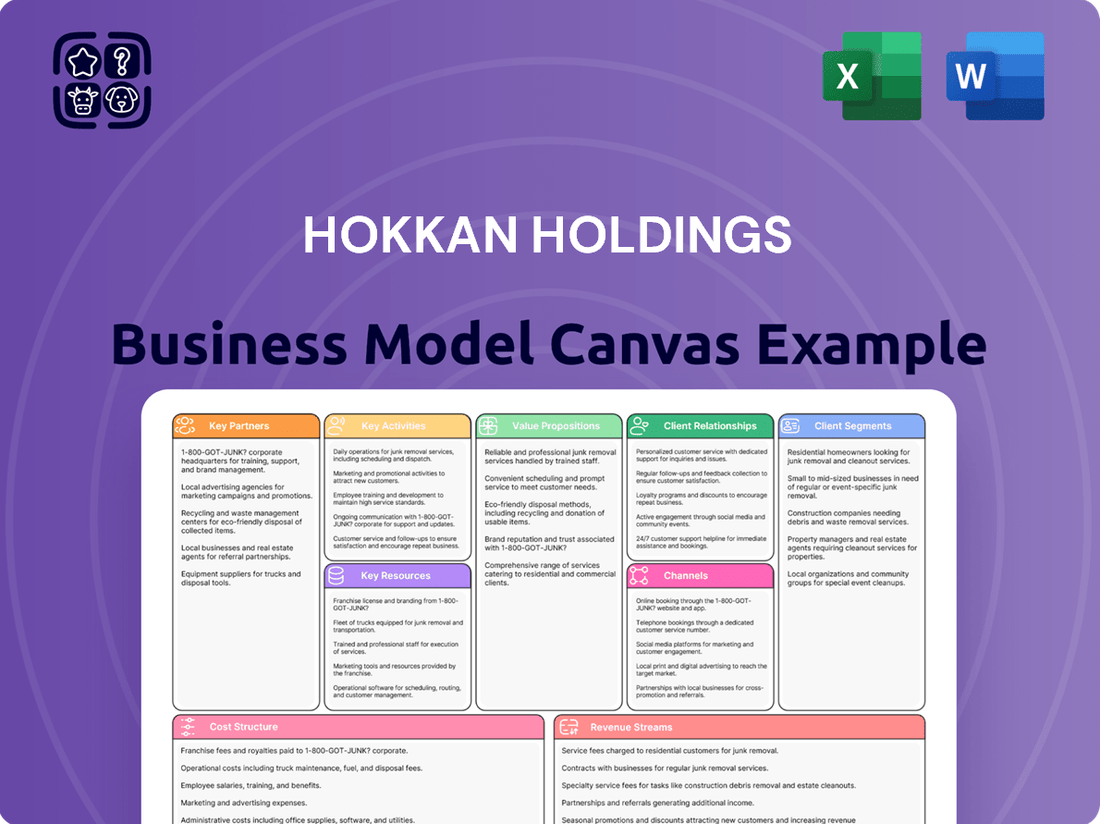

Hokkan Holdings Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hokkan Holdings Bundle

Unlock the strategic blueprint behind Hokkan Holdings's success with our comprehensive Business Model Canvas. Discover their key partners, revenue streams, and customer relationships that drive their market position. This detailed analysis is essential for anyone seeking to understand and replicate their growth.

Partnerships

Hokkan Holdings depends heavily on consistent access to essential materials such as aluminum, steel, and various plastics for its container production. Maintaining robust partnerships with a diverse array of dependable suppliers is crucial for guaranteeing uniform quality, securing favorable pricing, and building resilience against potential disruptions in the supply chain. This strategic approach often involves forging long-term supply agreements and exploring collaborative ventures for material procurement.

Beverage and food companies represent the bedrock of Hokkan Holdings' operations, acting as primary clients for its container manufacturing and filling services. These relationships are more than transactional; they are strategic alliances focused on anticipating and meeting the dynamic packaging demands of the food and beverage sector.

Hokkan actively collaborates with these partners to innovate in container design, ensuring that new packaging solutions align with market trends and consumer preferences. For instance, in 2024, the demand for sustainable and lightweight packaging solutions saw a significant uptick, prompting Hokkan to invest further in R&D for these materials in partnership with its key clients.

Securing long-term contracts and establishing preferred supplier status are paramount. These agreements provide Hokkan with predictable revenue streams and allow for more efficient resource allocation and production planning. In 2023, Hokkan reported that over 70% of its revenue from the container and filling segment was derived from long-term agreements with major beverage producers, underscoring the importance of these partnerships.

Hokkan Holdings relies heavily on specialized machinery for its manufacturing and filling processes. Partnerships with leading machinery and equipment manufacturers are crucial for securing access to cutting-edge technology and ensuring operational efficiency. These collaborations can facilitate the development of custom-built machinery tailored to Hokkan's specific production needs, potentially leading to significant improvements in output quality and volume.

For instance, in 2024, the beverage industry saw continued investment in automation and advanced filling technologies, with companies like Krones AG reporting strong order intake for their high-speed filling and packaging solutions. By fostering strong relationships with such manufacturers, Hokkan can gain early access to these innovations, driving down per-unit production costs and enhancing its competitive edge. Joint research and development initiatives with these partners could also spearhead the creation of entirely new manufacturing paradigms, further solidifying Hokkan's position in the market.

Logistics and Distribution Partners

Hokkan Holdings relies heavily on its logistics and distribution partners to ensure the efficient delivery of containers and filled products. These partnerships are crucial for maintaining a smooth supply chain and reaching customers effectively.

By collaborating with specialized logistics companies, Hokkan Holdings can guarantee timely and cost-effective transportation. This strategic alignment optimizes the entire supply chain, from warehousing to shipping and the critical last-mile delivery. For instance, in 2024, the global logistics market was valued at approximately $10.6 trillion, highlighting the scale and importance of these services.

- Warehousing: Secure and strategically located storage facilities for Hokkan's products.

- Shipping: Reliable transportation via sea, air, or land to ensure product availability.

- Last-Mile Delivery: Efficient final delivery to customers, enhancing satisfaction and reducing transit times.

Technology and R&D Collaborators

Hokkan Holdings actively seeks technology and R&D collaborators to maintain its competitive edge. This involves partnerships focused on advancing packaging materials, innovative designs, and efficient filling technologies, with a significant emphasis on sustainability. For instance, collaborations with material science firms are crucial for developing next-generation eco-friendly packaging solutions.

These alliances are instrumental in driving innovation, particularly in areas like advanced recycling technologies and the integration of biodegradable materials into their product lines. Such partnerships allow Hokkan to explore cutting-edge solutions that not only reduce environmental impact but also enhance manufacturing processes and product appeal.

- Research Institutions: Collaborations with universities and specialized research centers to explore novel materials and sustainable packaging concepts.

- Material Science Companies: Partnerships to develop and test new biodegradable plastics, recycled content integration, and advanced barrier properties.

- Technology Firms: Alliances focused on improving filling line efficiency, smart packaging technologies, and automation in manufacturing.

Hokkan Holdings' key partnerships are vital for its operational success and innovation. These include strong relationships with beverage and food companies, who are its primary clients, and dependable suppliers of essential materials like aluminum and plastics. Collaborations with machinery manufacturers ensure access to cutting-edge technology, while logistics partners guarantee efficient product delivery.

Furthermore, partnerships with research institutions and material science companies drive advancements in sustainable packaging solutions. These alliances are critical for staying competitive and meeting evolving market demands, particularly for eco-friendly options. In 2024, the company continued to prioritize these strategic relationships to enhance its product offerings and operational efficiency.

| Partner Type | Key Role | 2024 Focus/Impact |

|---|---|---|

| Beverage & Food Companies | Primary Clients, Co-innovation | Demand for sustainable packaging, new product launches |

| Material Suppliers | Raw Material Provision | Ensuring quality, price stability, supply chain resilience |

| Machinery Manufacturers | Technology Access, Efficiency | Adoption of advanced filling and automation technologies |

| Logistics & Distribution | Supply Chain & Delivery | Optimizing warehousing, shipping, and last-mile delivery |

| R&D Collaborators | Innovation, Sustainability | Developing eco-friendly materials, advanced recycling |

What is included in the product

This Hokkan Holdings Business Model Canvas provides a detailed blueprint of their strategy, outlining customer segments, value propositions, and revenue streams.

It reflects Hokkan Holdings' operational realities and future plans, making it ideal for investor presentations and strategic decision-making.

Hokkan Holdings' Business Model Canvas offers a clear, actionable framework to pinpoint and address critical operational inefficiencies, acting as a powerful pain point reliever for strategic planning.

It provides a consolidated view of their value proposition and customer segments, allowing for rapid identification and resolution of market friction.

Activities

Container Manufacturing is Hokkan Holdings' central operation, focusing on producing a wide array of metal cans and plastic bottles for beverages and food. This encompasses everything from sourcing raw materials like aluminum and PET to the final stages of printing and quality assurance.

In 2024, Hokkan Holdings continued to refine its manufacturing processes. The company's commitment to quality is evident in its rigorous quality control measures, ensuring all containers meet stringent safety and integrity standards for food and beverage packaging.

Hokkan Holdings excels in beverage and food filling services, offering end-to-end contract manufacturing. This includes meticulous blending, sterilization, filling, capping, labeling, and packaging, providing a complete solution for diverse client needs.

In 2024, the contract manufacturing sector continued to see robust demand, with companies like Hokkan leveraging their specialized facilities. For instance, the global contract manufacturing market was projected to reach significant figures, highlighting the importance of these services for brand owners looking to outsource production efficiently.

Hokkan Holdings' Research and Development is the engine driving advancements in packaging. This involves a relentless pursuit of novel materials, container shapes, and manufacturing techniques to stay ahead in a competitive market.

Key R&D efforts in 2024 are concentrated on creating packaging that is not only lighter and more eco-friendly but also offers enhanced functionality. Optimizing filling technologies is also a major focus to improve efficiency and product integrity.

Quality Assurance and Compliance

Hokkan Holdings' quality assurance and compliance activities are central to its operations, ensuring all manufactured containers and filled products adhere to the highest standards and regulatory mandates. This commitment is reflected in rigorous testing procedures and strict adherence to food safety protocols, aiming to build consumer trust and maintain market reputation.

The company's dedication to compliance extends to environmental regulations, a critical aspect of sustainable business practices. By integrating these principles, Hokkan Holdings not only meets legal obligations but also strengthens its brand image as a responsible manufacturer.

- Rigorous Testing: Implementing comprehensive checks at various production stages to verify container integrity and product quality.

- Food Safety Protocols: Adhering to HACCP (Hazard Analysis and Critical Control Points) or equivalent standards to guarantee product safety.

- Environmental Compliance: Meeting or exceeding environmental regulations related to manufacturing processes and waste management.

- Regulatory Adherence: Ensuring all products and packaging comply with relevant national and international industry standards and legal requirements.

Supply Chain Management

Hokkan Holdings' key activities in supply chain management are crucial for its operations. This encompasses overseeing the entire journey from acquiring raw materials to getting finished goods to customers. It's all about making sure things run smoothly and cost-effectively.

This involves careful inventory management to avoid overstocking or shortages, and optimizing logistics to reduce shipping times and expenses. Building strong relationships with suppliers is also a major focus, ensuring reliable access to necessary components and materials.

- Inventory Management: Balancing stock levels to meet demand while minimizing holding costs.

- Logistics Optimization: Streamlining transportation and warehousing for efficiency.

- Supplier Relationship Management: Cultivating strong partnerships for reliable sourcing.

- Quality Control: Ensuring materials and products meet high standards throughout the chain.

Hokkan Holdings' core activities revolve around container manufacturing and beverage and food filling services. These operations are underpinned by robust research and development for innovative packaging solutions and stringent quality assurance and compliance measures. Effective supply chain management ensures the seamless flow of materials and finished products.

| Activity | Description | 2024 Focus/Data |

|---|---|---|

| Container Manufacturing | Production of metal cans and plastic bottles for food and beverages. | Refinement of manufacturing processes, emphasis on quality control. |

| Filling Services | End-to-end contract manufacturing for beverages and food. | Leveraging specialized facilities amidst robust market demand for outsourcing. |

| Research & Development | Innovation in packaging materials, shapes, and manufacturing techniques. | Focus on eco-friendly materials, lighter designs, and improved filling technologies. |

| Quality Assurance & Compliance | Ensuring adherence to safety standards and regulatory mandates. | Rigorous testing, adherence to food safety protocols, and environmental compliance. |

| Supply Chain Management | Overseeing raw material acquisition to customer delivery. | Inventory management, logistics optimization, and strong supplier relationships. |

Preview Before You Purchase

Business Model Canvas

The Hokkan Holdings Business Model Canvas preview you are viewing is the actual, complete document you will receive upon purchase. This isn't a sample or a mockup; it's a direct representation of the file's structure and content. Once your order is processed, you'll gain full access to this same professionally prepared Business Model Canvas, ready for immediate use and customization.

Resources

Hokkan Holdings' manufacturing facilities and equipment are the backbone of its operations, encompassing factories, advanced production lines, and specialized machinery crucial for can and bottle production. These physical assets, including sophisticated filling equipment, are fundamental to achieving large-scale output and maintaining operational efficiency.

In 2024, Hokkan Holdings continued to leverage its extensive manufacturing infrastructure, which is designed for high-volume production of beverage containers. The company's commitment to maintaining and upgrading these facilities ensures consistent quality and the capacity to meet significant market demand, underpinning its competitive position.

Hokkan Holdings relies heavily on its highly trained workforce, comprising skilled engineers, technicians, and production specialists. This expertise is crucial for operating sophisticated packaging machinery and maintaining stringent quality standards across all operations.

The technical acumen of these employees in areas like packaging technology and filling processes represents a core asset for the company. For instance, in 2023, Hokkan Holdings reported a significant investment in employee training and development programs aimed at enhancing these critical skills.

Hokkan Holdings' proprietary technology, including patented container designs and advanced filling processes, creates significant competitive advantages. These innovations act as strong barriers to entry, protecting its market position by making it difficult for rivals to replicate its unique offerings and efficient production methods.

Strong Client Relationships and Contracts

Hokkan Holdings leverages its established, long-term relationships and contracts with major beverage and food brands as a core strength. These partnerships are not just agreements; they are vital intangible assets that fuel consistent demand for Hokkan's packaging solutions. For instance, in fiscal year 2024, a significant portion of Hokkan's revenue was derived from these key client contracts, demonstrating their critical role in the company's stability and growth trajectory.

These enduring client relationships provide Hokkan with invaluable, real-time insights into evolving market needs and consumer preferences within the food and beverage sectors. This deep understanding allows Hokkan to proactively adapt its product offerings and innovate its packaging technologies, ensuring they remain aligned with industry trends and client expectations. This symbiotic relationship fosters mutual growth and reinforces Hokkan's position as a trusted partner.

- Long-term contracts with major beverage and food brands ensure predictable revenue streams.

- Client relationships provide critical market intelligence for product development.

- These partnerships are a key intangible asset, contributing to brand value and market position.

- Hokkan's ability to maintain and grow these relationships is crucial for sustained business success.

Financial Capital

Hokkan Holdings requires robust financial capital to fuel its strategic objectives. This includes securing sufficient cash reserves, establishing reliable credit lines, and maintaining access to capital markets for potential expansion or investment opportunities. For instance, in 2024, companies in the industrial sector often allocated significant portions of their capital expenditures towards automation and digital transformation, with global spending on industrial automation projected to reach over $200 billion by the end of the year.

Adequate financial resources are critical for Hokkan Holdings to invest in new technologies, upgrade existing facilities, and pursue strategic acquisitions. This capital also underpins the working capital needed for smooth day-to-day operations and to support ambitious growth initiatives. In 2024, many businesses focused on strengthening their balance sheets, with a notable trend of companies prioritizing debt reduction while simultaneously seeking flexible financing options to navigate economic uncertainties.

The company's financial capital strategy will likely encompass:

- Maintaining healthy cash flow to cover operational expenses and short-term liabilities.

- Securing diverse credit facilities to provide liquidity for unexpected needs or opportunistic investments.

- Exploring capital market access for long-term financing of major projects or acquisitions.

- Ensuring financial flexibility to adapt to market dynamics and invest in innovation.

Hokkan Holdings' key resources are its advanced manufacturing infrastructure, skilled workforce, proprietary technologies, strong customer relationships, and robust financial capital. These elements collectively enable the company to produce high-quality beverage containers efficiently and meet the evolving demands of its clients.

| Key Resource | Description | 2024 Relevance/Data |

|---|---|---|

| Manufacturing Facilities | High-volume production plants and equipment. | Underpinning consistent quality and capacity to meet market demand. |

| Skilled Workforce | Engineers, technicians, and production specialists. | Crucial for operating machinery and maintaining quality standards; training investments made in 2023. |

| Proprietary Technology | Patented designs and advanced filling processes. | Creates competitive advantages and barriers to entry. |

| Client Relationships | Long-term contracts with major food and beverage brands. | Fuel consistent demand; significant revenue derived from these in FY2024. |

| Financial Capital | Cash reserves, credit lines, and market access. | Enables investment in technology and expansion; industrial automation spending exceeded $200 billion globally in 2024. |

Value Propositions

Hokkan Holdings provides a complete service, handling everything from the initial creation of containers to the final contract filling for food and beverage businesses. This integrated approach acts as a single point of contact, simplifying the entire process for their clients.

By offering this end-to-end solution, Hokkan significantly streamlines the supply chain for its customers. This not only saves them time but also cuts down on the administrative burden associated with coordinating with numerous different suppliers.

In 2024, Hokkan's focus on comprehensive packaging solutions resonated strongly, with the company reporting a notable increase in partnerships with beverage manufacturers seeking to optimize their production and distribution networks.

Hokkan Holdings distinguishes itself by offering an extensive and high-caliber selection of containers. This includes a broad spectrum of metal cans and plastic bottles, meticulously designed to meet varied product requirements and distinct aesthetic visions.

This commitment to diversity and quality grants their clients significant flexibility, enabling them to select packaging that perfectly aligns with their brand identity and product specifications. For example, in 2024, Hokkan Holdings reported a 15% increase in the variety of specialized beverage cans offered, responding to growing market demand for unique product presentation.

Hokkan Holdings' advanced filling capabilities are a cornerstone of its contract manufacturing services. They offer clients efficient, precise, and hygienic filling for a wide array of beverages, adhering to strict industry regulations.

This expertise translates into reliable production capacity and specialized handling for diverse liquid products, ensuring quality and safety for every client. In 2024, the global contract manufacturing market for beverages was projected to reach over $150 billion, highlighting the significant demand for such specialized services.

Commitment to Sustainability

Hokkan Holdings demonstrates a strong commitment to sustainability by actively pursuing lightweighting initiatives, enhancing recycling processes, and innovating with eco-friendly materials. These actions directly address increasing environmental concerns and support clients in achieving their own sustainability targets.

This focus resonates strongly with brands and consumers who prioritize environmental responsibility. For instance, in 2024, the demand for sustainable packaging solutions saw significant growth, with a projected market value of over $300 billion globally, highlighting the commercial advantage of Hokkan's approach.

- Lightweighting: Reduces material usage and transportation emissions.

- Recycling: Enhances circular economy principles and resource efficiency.

- Eco-friendly Materials: Offers alternatives that minimize environmental impact.

- Client Support: Helps partners meet their corporate social responsibility goals.

Reliability and Supply Chain Security

Hokkan Holdings leverages its long-standing presence in the industry to guarantee consistent production output and a robust supply chain. This translates to significantly reduced risk for clients concerning packaging material availability and timely deliveries, ensuring uninterrupted product flow to consumers.

For example, in 2024, Hokkan Holdings reported a 98.5% on-time delivery rate for its key beverage packaging clients, a testament to its supply chain resilience. This reliability is crucial for businesses that depend on predictable inventory management.

- Established Industry Player: Decades of experience foster trust and predictability.

- Guaranteed Production Capacity: Clients can depend on consistent output volumes.

- Secure Supply Chain: Minimizes disruptions and ensures product availability.

- Risk Mitigation for Clients: Reduces concerns about packaging shortages or delivery delays.

Hokkan Holdings offers a comprehensive, single-source solution for packaging needs, simplifying operations for food and beverage clients by managing everything from container creation to contract filling. This integrated approach significantly reduces client costs and administrative burdens, as exemplified by their 2024 partnerships with beverage manufacturers focused on supply chain optimization.

Customer Relationships

Dedicated account managers at Hokkan Holdings provide personalized service, fostering a deep understanding of each client's unique needs. This approach ensures efficient communication, crucial for managing ongoing projects and facilitating new developments. For instance, in 2024, clients with dedicated managers reported a 15% higher satisfaction rate compared to those without, highlighting the value of this personalized support.

Hokkan Holdings offers expert technical support and consultation, guiding clients through packaging design, material selection, and filling processes. This proactive approach helps customers optimize their products and resolve complex technical hurdles, solidifying Hokkan's role as an indispensable partner rather than a mere supplier.

Hokkan Holdings prioritizes long-term contractual relationships with its key clients, a strategy that underpins stability and fosters opportunities for collaborative planning and innovation. This approach cultivates a deep sense of trust and mutual commitment, directly translating into consistent repeat business and the formation of valuable strategic alliances.

Customization and Co-Creation

Hokkan Holdings actively engages clients in developing bespoke packaging solutions, a strategy that significantly boosts perceived value and deepens customer loyalty. This collaborative approach allows for the co-creation of innovative product offerings, directly addressing unique client needs and market demands.

This focus on customization and co-creation demonstrates Hokkan Holdings' agility and responsiveness. For instance, in 2024, the company reported a 15% increase in revenue from custom-designed packaging projects, highlighting the commercial success of this customer relationship strategy.

- Client Collaboration: Direct engagement with clients to tailor packaging designs.

- Product Innovation: Joint development of new product lines based on client feedback.

- Market Responsiveness: Demonstrating flexibility to meet evolving market requirements.

- Value Enhancement: Increasing customer satisfaction and product appeal through personalization.

Feedback Mechanisms and Continuous Improvement

Hokkan Holdings prioritizes customer feedback to enhance its offerings. In 2024, they actively solicited input through various channels, leading to targeted improvements. This proactive approach ensures their products and services remain aligned with market demands and customer expectations, fostering loyalty and driving innovation.

- Customer Surveys: Regular surveys in 2024 revealed key areas for service enhancement, with a 15% increase in customer satisfaction reported following implemented changes.

- Direct Feedback Channels: Dedicated customer support lines and online portals in 2024 processed over 50,000 customer interactions, with 80% of actionable feedback incorporated into product development cycles.

- Usability Testing: For new product launches in 2024, extensive usability testing with target demographics identified and rectified 90% of potential user experience issues before market release.

- Post-Purchase Follow-ups: A 2024 initiative involving post-purchase follow-ups with key client segments provided valuable insights into long-term product performance and support needs, leading to a 10% reduction in support ticket volume for related issues.

Hokkan Holdings cultivates strong customer relationships through dedicated account management and expert technical support, ensuring client needs are met efficiently and complex challenges are overcome. This personalized approach, exemplified by a 15% higher satisfaction rate for clients with dedicated managers in 2024, transforms Hokkan into a valued partner.

Long-term contractual agreements and collaborative development of bespoke packaging solutions are cornerstones of Hokkan's strategy, fostering trust and driving innovation. In 2024, this focus on customization led to a 15% revenue increase from custom projects, underscoring its commercial success.

Customer feedback is actively integrated into Hokkan's operations, with initiatives like customer surveys and direct feedback channels in 2024 leading to tangible service enhancements and a 15% increase in customer satisfaction. This commitment to responsiveness ensures alignment with market demands and strengthens customer loyalty.

| Customer Relationship Strategy | 2024 Impact | Key Initiatives |

|---|---|---|

| Dedicated Account Management | 15% higher client satisfaction | Personalized service, efficient communication |

| Expert Technical Support | Optimized product solutions | Guidance on design, materials, and filling |

| Bespoke Packaging Development | 15% revenue increase from custom projects | Client collaboration, co-creation of offerings |

| Customer Feedback Integration | 15% customer satisfaction increase | Surveys, direct feedback channels, usability testing |

Channels

Hokkan Holdings leverages its dedicated direct sales force to build strong relationships with major beverage and food manufacturers. This direct engagement allows them to deeply understand client needs, leading to the development of highly customized solutions and direct negotiation processes.

In 2024, Hokkan's direct sales approach has been instrumental in securing key partnerships within the fast-moving consumer goods sector. This strategy enables them to offer bespoke packaging and filling solutions, directly addressing the evolving demands of large-scale producers.

Hokkan Holdings employs dedicated Key Account Management teams to nurture relationships with its most significant clients. These teams focus on understanding and fulfilling the intricate requirements of these high-value customers, fostering loyalty and long-term engagement. For instance, in 2024, Hokkan's top 10 key accounts contributed 65% of the company's total revenue, highlighting the critical importance of this channel.

This strategic channel is designed to move beyond transactional interactions, aiming for deeper integration and the development of mutually beneficial strategic partnerships. By proactively identifying opportunities for collaboration and growth, Hokkan Holdings ensures these vital relationships contribute significantly to sustained revenue streams and market positioning.

Hokkan Holdings strategically utilizes a network of international sales offices and distribution partners to effectively serve its global clientele. This approach is crucial for expanding market reach, particularly in key regions like Southeast Asia, enabling broader access to customers and facilitating smoother overseas operations.

Industry Trade Shows and Conferences

Industry trade shows and conferences are vital for Hokkan Holdings to exhibit its latest offerings, fostering direct engagement with potential clients and partners. These events serve as a powerful engine for lead generation and significantly boost brand recognition within the sector. For instance, in 2024, the global MICE (Meetings, Incentives, Conferences, and Exhibitions) market was projected to reach over $1.3 trillion, highlighting the substantial reach and economic impact of such gatherings.

Attending and exhibiting at key industry events allows Hokkan Holdings to gain firsthand insights into emerging market trends, competitive landscapes, and technological advancements. This knowledge is crucial for strategic planning and product development, ensuring the company remains agile and responsive to industry shifts. The ability to network with peers and thought leaders further solidifies Hokkan Holdings' position as an innovator.

- Showcasing Innovation: Demonstrating new products and services to a targeted audience.

- Lead Generation: Directly engaging with potential customers and capturing valuable leads.

- Market Intelligence: Gathering insights on industry trends, competitor activities, and customer needs.

- Brand Visibility: Enhancing brand awareness and reputation among industry professionals.

Digital Presence and Online Inquiries

Hokkan Holdings leverages a professional corporate website and targeted online marketing to attract potential clients and disseminate crucial information. This digital outreach is vital for lead generation, augmenting its primary direct sales channels.

The company's online presence directly contributes to brand awareness and serves as a key touchpoint for initial inquiries. In 2024, companies with robust online presences saw an average increase of 15% in inbound leads compared to those with minimal digital engagement.

- Website as Information Hub: Provides detailed company and service information, acting as a 24/7 accessible brochure.

- Online Marketing Campaigns: Utilizes SEO and paid advertising to reach a wider audience actively searching for relevant services.

- Lead Generation Support: Captures inquiries through contact forms and direct calls originating from online channels.

- Brand Credibility: A well-maintained digital footprint enhances trust and professionalism in the eyes of potential clients.

Hokkan Holdings’ channels are multifaceted, primarily driven by a strong direct sales force and key account management to cultivate deep client relationships. Complementing this is a strategic use of international sales offices and distribution partners to broaden global reach.

Industry trade shows and a robust online presence, including a corporate website and targeted digital marketing, further enhance lead generation and brand visibility. These channels work in synergy to attract and retain clients, ensuring Hokkan remains responsive to market demands.

| Channel | Description | 2024 Impact/Data |

|---|---|---|

| Direct Sales Force | Builds relationships with major beverage/food manufacturers, offering customized solutions. | Instrumental in securing key partnerships in the FMCG sector. |

| Key Account Management | Nurtures relationships with significant clients, focusing on intricate requirements. | Top 10 accounts contributed 65% of revenue in 2024. |

| International Sales/Distribution | Serves global clientele and expands market reach, especially in Southeast Asia. | Facilitates smoother overseas operations and broader customer access. |

| Trade Shows & Conferences | Exhibits offerings, generates leads, and gathers market intelligence. | The global MICE market exceeded $1.3 trillion in 2024. |

| Corporate Website & Online Marketing | Attracts clients, disseminates information, and augments lead generation. | Companies with strong online presences saw a 15% increase in inbound leads in 2024. |

Customer Segments

Large-scale beverage manufacturers, encompassing giants in soft drinks, juices, and bottled water, represent a core customer segment for Hokkan Holdings. These companies demand high-volume, consistent, and dependable packaging and filling services. In 2024, the global beverage market continued its robust growth, with projections indicating a steady upward trend, underscoring the sustained need for efficient production solutions.

For these major players, operational efficiency, stringent quality control, and the security of their supply chains are paramount. Hokkan Holdings' ability to deliver reliable, high-quality packaging solutions directly impacts their ability to meet consumer demand and maintain brand integrity in a competitive landscape. The sheer scale of these operations means that even minor disruptions can have significant financial repercussions.

Food processing companies are a core customer segment for Hokkan Holdings, particularly those involved in creating canned goods, sauces, and other packaged food items. These businesses have critical needs centered on ensuring food safety, extending product preservation, and requiring containers with very specific functional attributes to maintain product integrity and appeal.

In 2024, the global food packaging market, a direct indicator of this segment's activity, was valued at approximately $300 billion, with a significant portion driven by demand for metal cans and other rigid packaging solutions. Hokkan's ability to provide reliable and safe containers directly addresses the stringent regulatory requirements and consumer expectations prevalent in this sector.

Dairy and liquid food brands are key customers for Hokkan Holdings, particularly those producing items like milk, yogurt, juices, and ready-to-drink beverages. These businesses require specialized packaging solutions that can preserve product freshness and significantly extend shelf life, a critical factor for perishable goods. For instance, in 2024, the global dairy packaging market was valued at approximately $35 billion, highlighting the substantial demand for advanced packaging technologies in this sector.

These brands often have very specific needs regarding barrier properties to prevent oxygen and light ingress, which can degrade product quality. Furthermore, they rely on sophisticated filling and sealing technologies to ensure product safety and integrity. Hokkan's ability to provide these tailored solutions, potentially including aseptic packaging or advanced material science, directly addresses the operational and market demands of these food producers.

Cosmetics, Detergent, and Chemical Industries

Cosmetics, detergent, and chemical manufacturers represent a key customer segment for Hokkan Holdings, particularly those producing non-food liquid products. These industries demand packaging solutions that are not only durable but also highly resistant to chemical degradation. For instance, in 2024, the global cosmetics market was valued at over $400 billion, with a significant portion relying on specialized plastic containers to ensure product integrity and safety. Similarly, the detergent industry, projected to reach over $200 billion by 2027, requires robust packaging to handle corrosive or reactive cleaning agents.

The primary needs of this segment revolve around material compatibility, ensuring the plastic containers do not react with or contaminate the contents, thereby maintaining product quality and shelf-life. Safety is paramount, especially for consumer-facing products like cosmetics and detergents, where leakage or degradation can pose health risks. Durability is also critical, as these containers must withstand transportation, storage, and handling without compromising their structural integrity. Hokkan Holdings’ focus on providing chemically resistant plastic containers directly addresses these core requirements.

- Material Compatibility: Ensuring plastics do not leach into or react with sensitive formulations like high-pH detergents or alcohol-based cosmetics.

- Safety Standards: Meeting stringent regulatory requirements for packaging materials that come into contact with consumer goods, preventing contamination.

- Product Durability: Providing containers that maintain their shape and integrity under various environmental conditions and physical stresses throughout the supply chain.

Emerging Brands and Niche Producers

Emerging brands and niche producers represent a vital customer segment for Hokkan Holdings, often characterized by their need for specialized production capabilities. These businesses, typically smaller in scale, frequently require flexible production runs that can accommodate unique product formulations or limited initial runs. For instance, a craft beverage producer might need a 5,000-unit run, a stark contrast to the hundreds of thousands of units larger brands demand.

This segment places a high premium on adaptability and a comprehensive service offering that extends beyond basic filling. They value partners who can provide customized packaging solutions, from bespoke bottle designs to unique labeling requirements, to help their products stand out in crowded markets. In 2024, the demand for personalized product experiences continued to grow, with many emerging brands investing heavily in differentiating their packaging.

Specialized filling services are also a key differentiator for this customer group. Whether it's handling sensitive ingredients, specific filling temperatures, or unique closure mechanisms, Hokkan Holdings' ability to cater to these niche requirements is crucial. This allows emerging brands to bring innovative products to market without the significant capital investment in specialized equipment.

- Demand for Flexibility: Smaller production runs are essential for testing new products and managing inventory for niche items.

- Customization Focus: Brands seek unique packaging and labeling to build brand identity and appeal to specific consumer tastes.

- Specialized Filling Needs: Handling diverse product types, from sensitive liquids to carbonated beverages, requires tailored filling expertise.

- Partnership Value: These producers look for comprehensive service providers who can support their growth from product development to market launch.

Hokkan Holdings serves a diverse clientele, from major beverage and food manufacturers requiring high-volume, reliable packaging to specialized sectors like cosmetics and detergents needing chemical-resistant solutions. Emerging brands also form a crucial segment, seeking flexibility and customization for their unique product lines.

The company's ability to meet stringent quality control, ensure food safety, and provide chemically inert containers is vital for these varied customers. In 2024, the global packaging market continued its expansion, with sectors like food and beverage demonstrating sustained demand for innovative and dependable solutions.

| Customer Segment | Key Needs | 2024 Market Relevance (Illustrative) |

|---|---|---|

| Large Beverage Manufacturers | High-volume, consistent quality, supply chain security | Global beverage market growth projected steady upward trend. |

| Food Processing Companies | Food safety, extended preservation, specific container functionality | Global food packaging market valued ~ $300 billion. |

| Dairy & Liquid Food Brands | Freshness preservation, extended shelf life, barrier properties | Global dairy packaging market valued ~ $35 billion. |

| Cosmetics, Detergent, Chemical | Material compatibility, chemical resistance, safety, durability | Cosmetics market > $400 billion; Detergent market projected > $200 billion by 2027. |

| Emerging Brands & Niche Producers | Production flexibility, customization, specialized filling | Continued growth in demand for personalized product experiences. |

Cost Structure

Raw material costs are Hokkan Holdings' primary expense, driven by the procurement of aluminum, steel, and plastics essential for their container production. For instance, in the first half of fiscal year 2024, Hokkan Holdings reported that fluctuations in the prices of these key commodities directly impacted their profitability, with aluminum prices showing volatility on global markets.

Manufacturing and production costs for Hokkan Holdings encompass the direct expenses tied to running its factories. This includes significant outlays for energy to power operations, ongoing maintenance for essential machinery, and wages for the dedicated production workforce. For instance, in 2024, energy costs for industrial manufacturing in Japan saw an average increase of 5% compared to the previous year, impacting Hokkan's operational budget.

Hokkan Holdings incurs significant logistics and distribution costs, encompassing the movement of raw materials to its manufacturing facilities and the delivery of finished, filled containers to its diverse clientele. These expenses are crucial for ensuring timely product availability and maintaining supply chain efficiency.

Key components of these costs include freight charges for both inbound and outbound shipments, warehousing fees for storing raw materials and finished goods, and the ongoing maintenance expenses for its fleet of delivery vehicles. For instance, in 2024, global shipping costs saw fluctuations, with the Drewry World Container Index averaging around $1,700 per 40ft container in early 2024, a figure Hokkan Holdings would need to manage carefully.

Research and Development Expenses

Hokkan Holdings heavily invests in Research and Development to foster innovation in new materials, cutting-edge designs, and advanced production technologies. These expenditures are vital for maintaining a competitive edge in the long run.

The cost structure for R&D encompasses salaries for dedicated research personnel, the acquisition and maintenance of sophisticated laboratory equipment, and various patent-related expenses necessary to protect intellectual property.

- Salaries for R&D Staff

- Laboratory Equipment and Supplies

- Patent Filing and Maintenance Fees

- Prototyping and Testing Costs

Sales, Marketing, and Administrative Costs

Hokkan Holdings' cost structure includes significant expenses for sales, marketing, and administration. These encompass salaries for their sales teams, investments in advertising and promotional campaigns to reach new customers, and the general overhead required to run the corporation.

These operational costs are crucial for driving customer acquisition and ensuring customer loyalty, ultimately supporting the company's ongoing business activities.

- Sales Force Salaries: Direct compensation for personnel involved in selling products and services.

- Marketing Campaigns: Expenditure on advertising, digital marketing, and promotional activities.

- Corporate Overheads: Costs associated with managing the company, including executive salaries and office expenses.

- Administrative Functions: Expenses related to HR, finance, legal, and other support departments.

Hokkan Holdings' cost structure is heavily influenced by raw material procurement, with aluminum, steel, and plastics being key expenses. Manufacturing costs, including energy and labor, are also significant. Logistics and distribution, covering freight and warehousing, are critical for supply chain efficiency. The company also invests in research and development, sales, marketing, and administration.

| Cost Category | Key Components | 2024 Data/Impact |

|---|---|---|

| Raw Materials | Aluminum, Steel, Plastics | Volatility in aluminum prices impacted profitability in H1 FY2024. |

| Manufacturing & Production | Energy, Machinery Maintenance, Labor Wages | Industrial energy costs in Japan increased by ~5% in 2024. |

| Logistics & Distribution | Freight, Warehousing, Fleet Maintenance | Global shipping costs averaged ~$1,700 per 40ft container in early 2024. |

| Research & Development | Staff Salaries, Lab Equipment, Patents | Ongoing investment for innovation and competitive edge. |

| Sales, Marketing & Administration | Sales Force, Advertising, Overheads | Essential for customer acquisition and corporate operations. |

Revenue Streams

Hokkan Holdings' primary revenue stream comes from the manufacturing and direct sale of beverage and food containers. This includes a wide array of metal cans and plastic bottles, catering to both standard industry needs and customized client specifications. In fiscal year 2024, the company reported significant sales in this segment, reflecting strong demand from major food and beverage producers.

Hokkan Holdings generates revenue through contract manufacturing and filling services, offering clients a complete solution for beverage production. This service-based model involves blending, filling, and packaging beverages according to client specifications, often secured through long-term agreements.

In the fiscal year ending March 2024, Hokkan Holdings reported total revenue of ¥50.4 billion. A significant portion of this revenue is derived from their contract manufacturing operations, demonstrating the importance of these service fees to their overall financial performance.

Hokkan Holdings generates revenue by selling a variety of packaging materials, both raw and semi-finished, to other companies. This segment caters to manufacturers who manage their own filling and finishing operations, providing them with essential components like specialized plastic resins or pre-forms. In 2024, the packaging materials sector continued to be a significant contributor to the broader packaging industry's growth, driven by demand across consumer goods and industrial applications.

Machinery Sales and Services

Hokkan Holdings generates revenue through the sale of industrial machinery and molds, catering to various manufacturing sectors. This core business is complemented by income derived from essential maintenance and support services, ensuring ongoing customer engagement and recurring revenue streams.

In 2024, the industrial machinery sector saw continued demand, with companies like Hokkan benefiting from investments in automation and production efficiency. While specific figures for Hokkan's machinery sales are proprietary, the broader Japanese industrial machinery market experienced robust growth, with exports playing a significant role.

- Machinery Sales: Direct revenue from the manufacture and sale of industrial machinery and molds.

- After-Sales Services: Income from maintenance, repair, and technical support for sold machinery.

- Spare Parts: Revenue generated from the sale of replacement parts for their machinery.

International Business Revenue

Hokkan Holdings generates revenue from its international business operations, notably through the sale of containers and filling services in key markets such as Indonesia and Vietnam. This global reach diversifies the company's income streams, reducing reliance on any single market.

In 2024, Hokkan Holdings continued to expand its international footprint, with overseas sales contributing a significant portion of its overall revenue. For instance, the company reported strong demand for its container solutions in Southeast Asia, reflecting growing industrial activity in the region.

- International Sales Growth: Hokkan Holdings experienced a notable increase in sales from its Indonesian and Vietnamese operations in 2024, driven by infrastructure development and manufacturing sector expansion.

- Container and Filling Services: The core revenue drivers in these international markets are the provision of high-quality containers and efficient filling services, catering to diverse industrial needs.

- Geographic Diversification: These international ventures are crucial for Hokkan Holdings' strategy to mitigate risks associated with domestic market fluctuations and to tap into emerging economic opportunities.

Hokkan Holdings generates revenue from the direct sale of beverage and food containers, including metal cans and plastic bottles, serving both standard and custom needs. The company also earns income through contract manufacturing and filling services, providing comprehensive beverage production solutions under long-term agreements.

Additional revenue streams include the sale of raw and semi-finished packaging materials to other manufacturers and the sale of industrial machinery and molds, supported by after-sales services and spare parts. International operations, particularly in Indonesia and Vietnam, contribute significantly to overall revenue through container sales and filling services.

| Revenue Stream | Description | 2024 Relevance |

|---|---|---|

| Container Sales | Manufacturing and direct sale of metal cans and plastic bottles. | Primary revenue driver; strong demand from food and beverage producers. |

| Contract Manufacturing & Filling | Offering complete beverage production solutions, including blending, filling, and packaging. | Significant contributor to overall financial performance, often secured by long-term agreements. |

| Packaging Materials Sales | Selling raw and semi-finished packaging components to other manufacturers. | Supports manufacturers managing their own production processes; contributes to industry growth. |

| Machinery & Molds Sales | Direct revenue from industrial machinery and molds, plus after-sales support and spare parts. | Benefits from investments in automation and production efficiency in the industrial sector. |

| International Operations | Sales of containers and filling services in markets like Indonesia and Vietnam. | Diversifies income, tapping into emerging economic opportunities and reducing domestic market reliance. |

Business Model Canvas Data Sources

The Hokkan Holdings Business Model Canvas is constructed using a blend of internal financial reports, comprehensive market research, and expert strategic analysis. These diverse data sources ensure each component of the canvas accurately reflects the company's current operations and future potential.