Dr. Sulaiman Al-Habib Medical Services Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dr. Sulaiman Al-Habib Medical Services Group Bundle

Gain a critical understanding of the external forces shaping Dr. Sulaiman Al-Habib Medical Services Group's trajectory. Our PESTLE analysis delves into political stability, economic growth, technological advancements, socio-cultural shifts, environmental regulations, and legal frameworks impacting the healthcare giant. Equip yourself with actionable intelligence to anticipate challenges and seize opportunities. Download the full PESTLE analysis now and elevate your strategic decision-making.

Political factors

The Saudi Vision 2030 framework is a powerful driver for healthcare sector evolution, actively encouraging privatization and greater involvement from private entities. This political mandate directly benefits established players like Dr. Sulaiman Al-Habib Medical Services Group, presenting clear avenues for expansion and the introduction of new services.

The Saudi government's dedication to enhancing both the accessibility and overall quality of healthcare services aligns perfectly with the operational strategy and growth ambitions of the Al-Habib group. This focus is evidenced by significant government investments, with the Ministry of Health allocating SAR 72.4 billion in its 2024 budget, a substantial increase from SAR 62.9 billion in 2023, underscoring this commitment.

The Ministry of Health and other regulatory bodies in Saudi Arabia, such as the Saudi Food and Drug Authority (SFDA), regularly update laws and regulations. These cover licensing, quality standards, drug approvals, and medical practice, directly impacting Dr. Sulaiman Al-Habib Medical Services Group. For instance, the SFDA's ongoing efforts to align drug approval processes with international standards, as seen in recent updates to its Good Manufacturing Practice (GMP) guidelines, necessitate continuous adaptation by the group's pharmaceutical procurement and quality assurance departments.

Strict adherence to these evolving frameworks is not just a legal requirement but is also critical for maintaining the group's operational integrity and its esteemed reputation within the healthcare sector. Failure to comply with updated regulations, such as those pertaining to patient data privacy or medical equipment safety standards, could lead to significant penalties and reputational damage, as experienced by other healthcare providers facing stricter enforcement in recent years.

Changes in these healthcare regulations can have a tangible impact on the group's financial performance and strategic direction. For example, new requirements for specialized medical equipment or increased staffing qualifications could raise operational costs. Similarly, shifts in regulations regarding healthcare service expansion or the introduction of new medical technologies might affect the group's ability to pursue its growth strategies and introduce innovative services to the market.

The political stability within Saudi Arabia and the wider Gulf Cooperation Council (GCC) region is a critical factor for Dr. Sulaiman Al-Habib Medical Services Group. This stability directly impacts investor confidence, a key driver for the group's ambitious expansion plans and long-term strategic development. For instance, Saudi Arabia's Vision 2030, a transformative economic and social reform plan, has been supported by a stable political framework, fostering an environment conducive to significant private sector investment in healthcare infrastructure.

Geopolitical developments, whether regional tensions or shifts in international relations, can introduce volatility. Such events could disrupt supply chains for essential medical equipment and pharmaceuticals, alter patient flows, particularly from neighboring countries, and generally dampen economic sentiment, which in turn affects healthcare demand. The group's ability to navigate these potential disruptions is paramount.

A consistently stable political landscape is fundamental for the sustained growth and substantial investment required for large-scale healthcare projects. In 2024, the Saudi healthcare sector continues to attract significant investment, with the government prioritizing its development as part of Vision 2030, underscoring the importance of this political stability for entities like Dr. Sulaiman Al-Habib Medical Services Group.

Privatization and Public-Private Partnerships (PPPs)

The Saudi government's strategic focus on healthcare privatization, as outlined in Vision 2030, presents significant growth avenues for private healthcare providers like Dr. Sulaiman Al-Habib Medical Services Group. This policy shift encourages private sector involvement in managing and operating public health assets, creating opportunities for expanded service delivery and infrastructure development. For instance, the Ministry of Health's privatization initiatives aim to enhance efficiency and patient care through collaboration.

Public-Private Partnerships (PPPs) are a key mechanism for realizing these privatization goals. Dr. Sulaiman Al-Habib Medical Services Group is well-positioned to capitalize on these partnerships, potentially managing existing public hospitals or developing new facilities. These collaborations allow the group to leverage its operational expertise and financial resources, thereby broadening its market presence and service portfolio within the Kingdom's evolving healthcare landscape.

These partnerships can translate into tangible benefits for the group:

- Expansion of Network: Access to new facilities and patient bases through managed public hospitals.

- Service Diversification: Opportunities to offer specialized services in previously public-sector dominated areas.

- Capital Efficiency: Sharing of investment burdens and risks associated with large-scale healthcare projects.

- Enhanced Reputation: Association with government initiatives can bolster public trust and brand image.

Healthcare Funding and Budget Allocation

Government allocation of funds directly shapes the healthcare landscape. In 2024, Saudi Arabia's Vision 2030 continues to prioritize healthcare, with significant investment aimed at enhancing service quality and accessibility. This includes potential incentives for private entities like Al-Habib Medical Services Group to expand their reach and capabilities.

Shifts in national healthcare budgets, such as changes in subsidies or the prioritization of specific medical services, can alter the competitive dynamics. For instance, increased government spending on primary care might reduce demand for specialized services offered by private hospitals, impacting their financial viability. Staying attuned to these budgetary trends is crucial for Al-Habib's strategic planning.

Key budgetary considerations for Al-Habib Medical Services Group include:

- Government healthcare spending targets: Monitoring national budget allocations to the health sector provides insight into the overall market growth potential.

- Incentives for private healthcare: Understanding any subsidies or tax breaks offered to private providers can influence investment decisions and expansion strategies.

- Public health priorities: Aligning services with government-focused areas, such as preventative care or specific disease management, can create partnership opportunities.

- Regulatory changes affecting funding: Keeping abreast of any new regulations that might alter how healthcare services are funded or reimbursed is vital for financial planning.

The Saudi government's commitment to healthcare reform under Vision 2030 directly benefits Dr. Sulaiman Al-Habib Medical Services Group by encouraging privatization and private sector participation. This political will is evident in substantial government investments, with the 2024 health budget reaching SAR 72.4 billion, an increase from SAR 62.9 billion in 2023, signaling a strong focus on sector development and private entity growth.

The group must navigate evolving regulations from bodies like the Ministry of Health and the SFDA, which impact licensing, quality standards, and drug approvals. For instance, the SFDA's ongoing alignment of drug approval processes with international standards requires continuous adaptation by Al-Habib.

Political stability within Saudi Arabia is crucial for investor confidence and the group's expansion plans, with Vision 2030 itself being supported by a stable political framework that fosters private sector investment in healthcare infrastructure.

Public-Private Partnerships (PPPs) are a key avenue for growth, allowing Al-Habib to leverage its expertise in managing public hospitals or developing new facilities, thereby broadening its market presence.

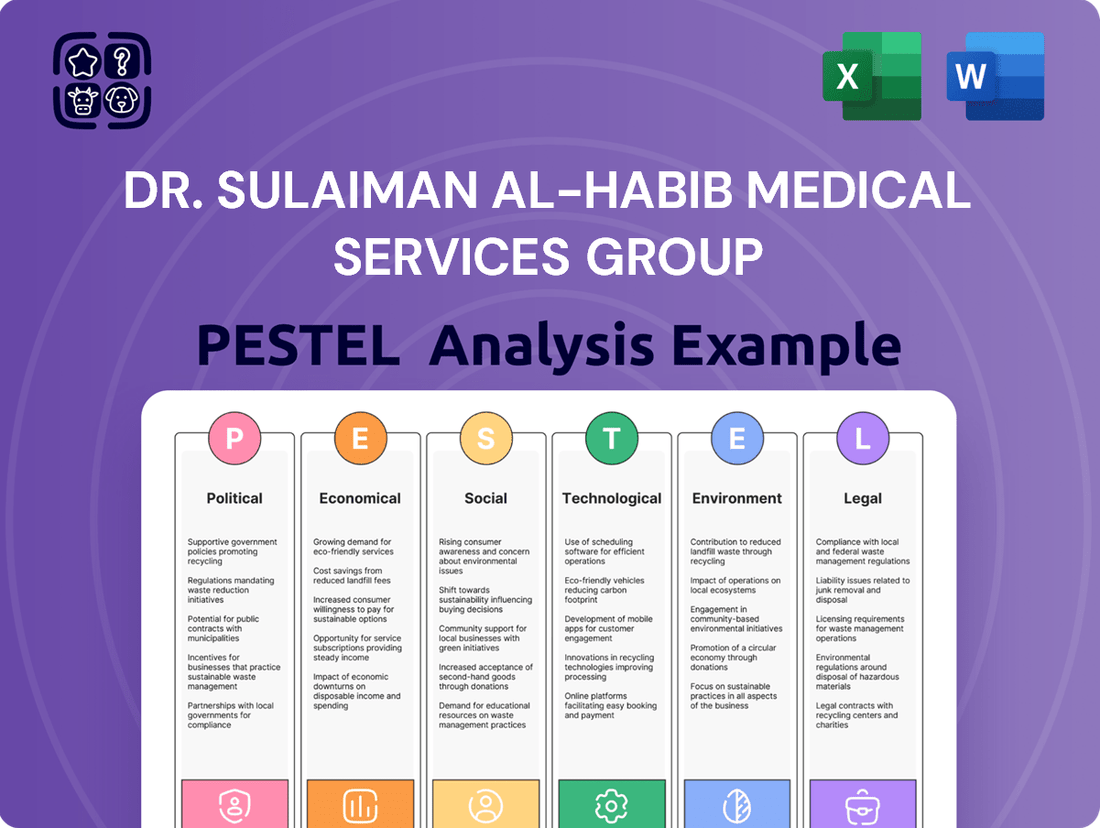

What is included in the product

This PESTLE analysis examines the Dr. Sulaiman Al-Habib Medical Services Group's operations through the lens of Political, Economic, Social, Technological, Environmental, and Legal factors, highlighting how these external forces shape its strategic landscape.

It provides actionable insights for stakeholders to navigate market complexities and capitalize on emerging opportunities within the healthcare sector.

A concise PESTLE analysis for Dr. Sulaiman Al-Habib Medical Services Group that highlights key external factors impacting the healthcare sector, serving as a pain point reliever by offering clarity on market dynamics and potential challenges.

Economic factors

Saudi Arabia's economy experienced a significant growth of 7.6% in 2022, driven by strong oil prices, and is projected to grow by 3.1% in 2024 and 3.0% in 2025 according to the IMF. This economic expansion directly translates to higher disposable incomes for the Saudi population.

As disposable incomes rise, there's a greater capacity and inclination for individuals to invest in private healthcare services. This trend particularly benefits premium healthcare providers like Dr. Sulaiman Al-Habib Medical Services Group, as consumers are more likely to opt for higher-quality, specialized medical treatments.

A healthy economic climate fosters increased patient volumes and greater utilization of healthcare services across the board. This robust economic environment is crucial for the sustained growth and profitability of healthcare entities operating within Saudi Arabia and the broader GCC region.

Rising national healthcare expenditure, fueled by population growth, an aging demographic, and a higher prevalence of chronic diseases, directly translates into a burgeoning market for healthcare providers like Dr. Sulaiman Al-Habib Medical Services Group. This upward trajectory in spending, projected to continue its robust growth through 2024 and beyond, underpins sustained demand for the group's extensive medical services and provides a solid foundation for its ongoing expansion strategies.

The global healthcare market, valued at approximately $10 trillion in 2023 and anticipated to grow further, highlights the significant opportunities arising from increased health consciousness and the demand for advanced medical interventions. This expansion is further bolstered by a growing emphasis on preventive care initiatives and the development of specialized treatments, both of which contribute to higher per capita healthcare spending and reinforce the positive outlook for established healthcare conglomerates.

Inflationary pressures are a significant concern for Dr. Sulaiman Al-Habib Medical Services Group, directly impacting the cost of essential operational inputs. In 2024, the healthcare sector, like many others, experienced elevated costs for medical supplies and pharmaceuticals, with some categories seeing price increases upwards of 5-7% year-over-year due to global supply chain disruptions and raw material costs.

Managing these rising operational expenses is paramount for maintaining profitability and competitive service pricing. The group's ability to effectively negotiate with suppliers and optimize inventory management will be critical in mitigating the impact of these cost increases on its bottom line.

Strategizing to counter inflation's effects on the supply chain and human resources is a key focus. This includes exploring bulk purchasing agreements, diversifying supplier bases, and implementing efficiency improvements in procurement processes. Furthermore, competitive compensation strategies are necessary to retain skilled medical professionals amidst rising salary expectations driven by the inflationary environment.

Foreign Investment and Capital Availability

The Saudi Arabian healthcare sector is increasingly attractive to foreign direct investment (FDI), with significant capital inflows expected to fuel expansion and technological advancements for groups like Dr. Sulaiman Al-Habib Medical Services. This influx of foreign capital directly supports the group's ambitious plans for new facilities and the adoption of cutting-edge medical technologies.

Access to a variety of funding sources, both domestically and internationally, is crucial for Dr. Sulaiman Al-Habib Medical Services Group. This financial flexibility underpins their strategic investments in state-of-the-art infrastructure and advanced medical equipment, enhancing service delivery and market competitiveness.

A favorable investment climate in Saudi Arabia is a key enabler for the healthcare sector's growth. This environment encourages foreign investment, providing Dr. Sulaiman Al-Habib Medical Services Group with the necessary capital to pursue its growth objectives and maintain its leadership position.

- FDI Inflows: Saudi Arabia's Vision 2030 aims to attract significant FDI, with the healthcare sector identified as a priority area for investment.

- Capital Markets Access: The group benefits from access to both local Saudi stock markets and international capital markets for financing.

- Investment Climate: Government initiatives to streamline regulations and encourage foreign participation bolster the investment climate for healthcare providers.

- Sector Growth: The Saudi healthcare market is projected to grow, driven by increased government spending and private sector investment, offering attractive returns for foreign capital.

Currency Fluctuations and Exchange Rates

Currency fluctuations significantly impact Dr. Sulaiman Al-Habib Medical Services Group, especially given its international sourcing of medical equipment and pharmaceuticals. For instance, if the Saudi Riyal (SAR) weakens against major currencies like the US Dollar or Euro, the cost of imported goods rises, directly affecting procurement expenses. This volatility can create unpredictability in the company's financial performance.

A stable exchange rate environment is crucial for minimizing financial risks in international transactions. For a company with import-heavy operations, like Al-Habib Medical, predictable operational expenses are essential for accurate budgeting and financial planning. This stability allows for better cost management, particularly when dealing with large capital expenditures on advanced medical technology.

The group's reliance on imported supplies means that shifts in exchange rates can directly impact its profitability. For example, a strengthening USD against the SAR in late 2024 or early 2025 could increase the SAR-denominated cost of essential medical supplies. Conversely, a weaker USD would offer cost savings.

- Impact on Procurement Costs: Fluctuations in the SAR against the USD and EUR directly affect the cost of imported medical equipment and drugs.

- Financial Performance: Unfavorable currency movements can lead to higher operational expenses and reduced profit margins.

- Risk Mitigation: A stable exchange rate environment helps the company manage financial risks associated with international sourcing.

- Predictability of Expenses: Stable exchange rates ensure more predictable operating costs, aiding in financial forecasting and budgeting.

Saudi Arabia's economic growth, projected at 3.1% for 2024 and 3.0% for 2025 by the IMF, translates to increased disposable income for its citizens. This economic uplift directly fuels demand for private healthcare services, benefiting premium providers like Dr. Sulaiman Al-Habib Medical Services Group as people opt for higher-quality medical care.

Inflation remains a key concern, with medical supplies and pharmaceuticals seeing cost increases of 5-7% in 2024 due to supply chain issues. Managing these rising operational expenses through strategic procurement and supplier diversification is crucial for maintaining profitability and competitive pricing.

Saudi Arabia's healthcare sector is attracting significant foreign direct investment (FDI), with capital inflows supporting expansion and technological advancements for groups like Al-Habib Medical. This favorable investment climate, bolstered by government initiatives, provides essential capital for growth objectives.

Currency fluctuations, particularly the SAR against the USD and EUR, directly impact procurement costs for imported medical equipment and pharmaceuticals. A weakening SAR can increase expenses, necessitating robust risk mitigation strategies for financial stability.

| Economic Factor | 2024 Projection | 2025 Projection | Impact on Al-Habib Medical |

|---|---|---|---|

| Saudi GDP Growth | 3.1% (IMF) | 3.0% (IMF) | Increased disposable income, higher demand for private healthcare. |

| Inflation (Healthcare Inputs) | 5-7% increase (estimated) | Continued pressure | Higher operational costs, need for cost management. |

| FDI in Healthcare | Significant inflows expected | Continued trend | Capital for expansion and technology adoption. |

| SAR Exchange Rate | Volatile | Volatile | Impacts cost of imported medical supplies and equipment. |

What You See Is What You Get

Dr. Sulaiman Al-Habib Medical Services Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Dr. Sulaiman Al-Habib Medical Services Group delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations.

Sociological factors

Saudi Arabia's population is experiencing robust growth, with a significant youth bulge. This demographic, coupled with a rising expatriate population, fuels a consistent and expanding demand for healthcare services. For instance, the Kingdom's population was estimated to be around 36.9 million in mid-2024, a substantial increase that directly translates to a larger patient base.

Furthermore, an increasing life expectancy, a positive societal development, means more people are living longer. This, in turn, often correlates with a higher prevalence of age-related and lifestyle-induced chronic diseases, such as diabetes and cardiovascular conditions. These shifts necessitate a greater need for specialized and advanced medical treatments and ongoing care, directly impacting the service offerings of medical groups like Dr. Sulaiman Al-Habib Medical Services.

Growing public consciousness around health and preventative measures is fueling a greater need for extensive medical services. This includes a rise in demand for specialized diagnostic tools and regular health check-ups, directly benefiting providers like Dr. Sulaiman Al-Habib Medical Services Group.

The societal trend towards adopting healthier living habits translates into a more proactive approach to healthcare engagement. People are increasingly seeking out medical professionals for ongoing wellness management rather than solely for treating illness.

This cultural shift presents an opportunity for the group to expand its offerings, particularly in areas like wellness programs and preventative care initiatives. For instance, in 2024, the global wellness market was projected to reach over $5.6 trillion, indicating a significant consumer interest in health-focused services.

Cultural attitudes profoundly shape how people approach healthcare. In many societies, there's a strong preference for traditional remedies or a reliance on family advice before seeking professional medical help. This can impact the uptake of modern medical services offered by groups like Dr. Sulaiman Al-Habib Medical Services Group.

The choice between public and private healthcare often hinges on cultural perceptions of quality and accessibility. For instance, in some Middle Eastern cultures, there's a growing appreciation for the personalized care and advanced technology offered by private institutions, boosting demand for services like those provided by Al-Habib Medical. In 2023, the private healthcare sector in Saudi Arabia saw significant growth, with patient preference increasingly leaning towards specialized and high-quality care, a trend Al-Habib is well-positioned to capitalize on.

Furthermore, cultural beliefs can influence the acceptance of specific medical treatments, such as organ transplantation or certain reproductive technologies. Dr. Sulaiman Al-Habib Medical Services Group's success is partly due to its ability to navigate these sensitivities, offering culturally appropriate patient engagement and ensuring diverse cultural expectations are met, which contributes to higher patient satisfaction rates.

Education and Healthcare Literacy

A more educated population in Saudi Arabia is increasingly health-conscious and actively seeks out superior medical services, often gravitating towards private healthcare providers. This growing demand aligns perfectly with Dr. Sulaiman Al-Habib Medical Services Group's strategic emphasis on delivering high-quality, specialized medical treatments.

Enhanced healthcare literacy empowers patients to engage more actively in their treatment decisions and drives demand for specialized medical services. For instance, by 2023, Saudi Arabia's overall literacy rate stood at approximately 99%, indicating a strong foundation for increased health awareness and patient engagement.

- Increased Demand for Specialized Care: Higher education levels correlate with a greater understanding of health issues, leading individuals to seek out advanced and specialized medical solutions offered by groups like Al-Habib.

- Informed Patient Decisions: A more educated populace is better equipped to research and choose healthcare providers and treatment plans that best suit their needs, fostering a competitive environment that rewards quality.

- Preference for Advanced Facilities: Educated individuals often associate advanced medical technology and expertise with better health outcomes, making private, well-equipped hospitals a preferred choice.

Urbanization and Access to Services

The continued migration of people to urban centers across the GCC, including Saudi Arabia, is a significant sociological driver for healthcare demand. This concentration of population in cities like Riyadh, Jeddah, and Dammam directly translates to a greater need for accessible, high-quality medical services. For Dr. Sulaiman Al-Habib Medical Services Group, this urban shift means a larger potential patient pool within easy reach of their strategically located facilities.

This trend supports the expansion of modern healthcare infrastructure in urban hubs, aligning with the group's strategy. For instance, by 2023, Saudi Arabia's urban population was estimated to be over 85%, a figure that continues to grow, underscoring the importance of urban healthcare accessibility. This focus on urban centers allows Al-Habib Medical to cater efficiently to a concentrated demographic, enhancing service delivery and patient convenience.

- Urban Population Growth: Saudi Arabia's urban population exceeded 85% in 2023, a key indicator of concentrated healthcare demand.

- Strategic Urban Placement: Al-Habib Medical's hospitals and clinics are positioned in major cities to capitalize on this demographic trend.

- Increased Demand for Quality: Urbanization fuels the need for advanced, accessible healthcare solutions, benefiting providers like Al-Habib Medical.

- Service Accessibility: Proximity to large urban patient bases supports the group's mission to provide convenient and high-quality medical care.

Saudi Arabia's demographic profile, marked by a growing population and a significant youth segment, alongside an increasing expatriate presence, consistently drives demand for healthcare services. The Kingdom's population reached approximately 36.9 million by mid-2024, indicating a substantial and expanding patient base for medical providers.

An aging population, a positive societal shift, leads to a higher incidence of chronic and age-related illnesses, necessitating specialized medical interventions and ongoing care. This trend directly influences the service portfolio of healthcare groups like Dr. Sulaiman Al-Habib Medical Services.

Societal awareness regarding health and preventative care is on the rise, boosting the demand for comprehensive medical services, including advanced diagnostics and routine check-ups, which benefits providers such as Dr. Sulaiman Al-Habib Medical Services Group.

Cultural attitudes significantly shape healthcare seeking behaviors, with some preferences for traditional remedies or family advice influencing the adoption of modern medical services. However, there's a growing appreciation for the quality and technology offered by private healthcare institutions, such as Al-Habib Medical, especially in urban centers.

| Sociological Factor | Impact on Dr. Sulaiman Al-Habib Medical Services | Supporting Data (2023-2025 Estimates) |

|---|---|---|

| Population Growth & Youth Bulge | Increased demand for a broad range of healthcare services. | Saudi population ~36.9 million (mid-2024); significant youth dependency ratio. |

| Rising Life Expectancy & Chronic Diseases | Higher demand for specialized and long-term care. | Increased prevalence of diabetes and cardiovascular diseases. |

| Health Consciousness & Preventative Care | Growth in demand for diagnostics, wellness programs, and check-ups. | Global wellness market projected over $5.6 trillion (2024). |

| Urbanization | Concentrated demand in major cities, aligning with facility locations. | Saudi urban population >85% (2023); continued migration to urban centers. |

| Education & Health Literacy | Informed patient choices, preference for advanced facilities and quality care. | Saudi literacy rate ~99% (2023); increased patient engagement in treatment decisions. |

Technological factors

Rapid advancements in medical equipment, diagnostic tools, and surgical techniques demand ongoing investment in cutting-edge technology. For instance, the global medical technology market was valued at approximately $513.1 billion in 2023 and is projected to reach $777.1 billion by 2030, showcasing a significant growth trajectory.

Dr. Sulaiman Al-Habib Medical Services Group's dedication to integrating these advanced medical technologies directly improves service quality and patient outcomes. Their investment in areas like AI-powered diagnostics and robotic surgery, for example, can lead to more accurate diagnoses and less invasive procedures.

Staying current with these innovations is paramount for maintaining a competitive advantage in the healthcare sector. Companies that fail to adapt risk falling behind in terms of patient care efficiency and treatment effectiveness, impacting their market position.

The increasing adoption of digital health solutions, including telemedicine and online consultations, is fundamentally reshaping healthcare delivery. Dr. Sulaiman Al-Habib Medical Services Group, like many forward-thinking healthcare providers, is leveraging these technologies to enhance patient access and streamline operations. For instance, the global telemedicine market was projected to reach over $250 billion by 2027, highlighting the significant shift towards remote healthcare services, a trend that directly impacts patient engagement and data management strategies for the group.

The integration of Artificial Intelligence (AI) into healthcare presents a transformative opportunity for Dr. Sulaiman Al-Habib Medical Services Group. AI's capabilities in diagnostics, personalized medicine, and operational efficiency can significantly enhance patient care and hospital management. For instance, AI-powered diagnostic tools are showing remarkable accuracy, with some systems achieving over 90% accuracy in identifying certain conditions, potentially reducing diagnostic errors and speeding up treatment initiation.

Dr. Sulaiman Al-Habib Medical Services Group can leverage AI to refine diagnostic processes, automate routine administrative tasks, and develop highly personalized treatment regimens. This strategic adoption of AI is crucial for staying competitive and improving outcomes. The global AI in healthcare market was valued at approximately $15.4 billion in 2023 and is projected to reach over $187 billion by 2030, indicating substantial growth and investment potential.

Data Analytics and Electronic Health Records (EHR)

Dr. Sulaiman Al-Habib Medical Services Group leverages robust data analytics and comprehensive Electronic Health Record (EHR) systems to significantly enhance patient care coordination, drive research initiatives, and boost operational efficiency. These integrated systems are crucial for managing patient information effectively, which directly translates to improved clinical decision-making and the delivery of more personalized healthcare experiences.

The group's investment in secure EHRs allows for seamless data management, providing clinicians with timely and accurate patient histories. This data-driven approach not only supports better patient outcomes but also offers valuable insights that inform strategic planning and resource allocation across its facilities. For instance, in 2024, the group reported a substantial increase in the utilization of its digital health platforms, indicating a growing reliance on data for operational improvements.

- Enhanced Patient Data Management: Secure EHRs facilitate efficient storage and retrieval of patient information, crucial for continuity of care.

- Improved Clinical Decision Support: Access to comprehensive patient data through analytics enables more informed and personalized treatment plans.

- Strategic Planning Insights: Data analysis from EHRs helps identify trends, optimize service offerings, and forecast future healthcare needs.

- Operational Efficiency Gains: Streamlined data processes reduce administrative burdens and improve workflow within the group's hospitals.

Cybersecurity and Data Protection

As healthcare increasingly digitizes, cybersecurity is critical for protecting sensitive patient data and maintaining trust. Dr. Sulaiman Al-Habib Medical Services Group, like all healthcare providers, faces evolving cyber threats. In 2024, the global healthcare cybersecurity market was valued at approximately $30 billion, highlighting the significant investment required.

Robust cybersecurity measures are essential to prevent data breaches and ensure compliance with stringent data protection regulations, such as Saudi Arabia's Personal Data Protection Law. Failure to comply can result in substantial fines and reputational damage.

The group must continuously invest in and update its cybersecurity infrastructure to safeguard patient privacy and operational integrity. This includes advanced threat detection, data encryption, and regular security audits. For instance, spending on cybersecurity in the Middle East healthcare sector is projected to grow significantly in the coming years, reflecting this ongoing need.

- Cybersecurity Investment: Healthcare providers are increasing spending to combat rising cyber threats.

- Data Protection Compliance: Adherence to regulations like Saudi Arabia's PDPL is non-negotiable.

- Patient Trust: Strong data security is fundamental to maintaining patient confidence.

- Operational Integrity: Protecting digital systems ensures uninterrupted medical services.

Technological advancements are reshaping healthcare delivery, necessitating continuous investment in cutting-edge medical equipment and digital solutions. The global medical technology market, valued at around $513.1 billion in 2023, is expected to reach $777.1 billion by 2030, underscoring this rapid growth.

Dr. Sulaiman Al-Habib Medical Services Group's adoption of AI in diagnostics and robotic surgery enhances patient care and operational efficiency, with AI in healthcare projected to grow from $15.4 billion in 2023 to over $187 billion by 2030.

The increasing reliance on digital health, including telemedicine, is transforming patient access and data management, with the telemedicine market anticipated to exceed $250 billion by 2027.

Robust Electronic Health Record (EHR) systems and data analytics are crucial for coordinating patient care and improving clinical decision-making, with the group seeing increased utilization of its digital health platforms in 2024.

| Technological Factor | Market Size/Growth (2023/2024 Data) | Impact on Dr. Sulaiman Al-Habib Medical Services Group |

|---|---|---|

| Medical Technology | Global market ~$513.1 billion (2023) | Requires ongoing investment for improved diagnostics and treatments. |

| AI in Healthcare | Global market ~$15.4 billion (2023) | Enhances diagnostic accuracy, personalized medicine, and operational efficiency. |

| Telemedicine | Projected market >$250 billion (by 2027) | Improves patient access, streamlines operations, and reshapes healthcare delivery. |

| Cybersecurity (Healthcare) | Global market ~$30 billion (2024) | Essential for protecting patient data, ensuring compliance, and maintaining trust. |

Legal factors

Healthcare licensing and accreditation in Saudi Arabia, where Dr. Sulaiman Al-Habib Medical Services Group primarily operates, are overseen by the Ministry of Health and the Saudi Commission for Health Specialties. These bodies enforce stringent regulations for facility operations, medical staff qualifications, and service delivery. For instance, the Council of Cooperative Health Insurance (CCHI) also plays a role in ensuring that healthcare providers meet specific standards for patient care and billing, impacting revenue streams and operational costs.

Failure to adhere to these evolving legal frameworks can result in significant penalties, including fines and suspension of operating licenses, directly impacting Dr. Sulaiman Al-Habib Medical Services Group's ability to generate revenue and maintain patient trust. In 2023, the Ministry of Health conducted numerous inspections, leading to sanctions against facilities that did not meet updated safety and quality benchmarks, underscoring the critical need for continuous compliance. This regulatory environment necessitates substantial investment in quality management systems and staff training to ensure ongoing accreditation.

Dr. Sulaiman Al-Habib Medical Services Group operates within a landscape of increasingly stringent patient rights and data privacy laws, akin to GDPR and HIPAA. These regulations dictate how sensitive patient information can be collected, stored, and utilized, directly influencing operational procedures and technology investments.

Compliance is paramount for maintaining patient trust and avoiding significant legal repercussions, including substantial fines. For instance, data breaches can lead to costly litigation and reputational damage, underscoring the need for proactive measures.

The group must therefore maintain robust data protection policies and provide continuous training to staff on these evolving legal requirements. This commitment ensures the secure handling of patient data, a critical factor in the healthcare sector's digital transformation.

Laws governing medical malpractice and professional liability directly shape how Dr. Sulaiman Al-Habib Medical Services Group manages risk and what insurance coverage it needs. These regulations are critical for safeguarding the group's financial health and its standing in the community.

For instance, the Saudi Arabian legal framework, including regulations from the Saudi Commission for Health Specialties, sets standards for medical practice and outlines penalties for negligence. Staying compliant involves robust internal controls and ongoing education for all medical staff to minimize potential litigation and associated costs.

Pharmaceutical and Medical Device Regulations

Dr. Sulaiman Al-Habib Medical Services Group operates within a highly regulated pharmaceutical and medical device landscape. The import, distribution, and utilization of these products require rigorous approvals and quality assurance measures, impacting everything from sourcing to patient care. For instance, in 2024, Saudi Arabia's Food and Drug Authority (SFDA) continued to emphasize strict adherence to international standards for medical device registration and pharmacovigilance.

Compliance with these evolving national and international regulations is non-negotiable for the group's pharmacies and medical centers, directly influencing operational costs and market access. In 2025, the healthcare sector anticipates potential shifts in regulatory frameworks concerning data privacy for medical devices and the approval pathways for novel pharmaceuticals, which could necessitate strategic adjustments to supply chains and treatment offerings.

Key regulatory considerations include:

- Product Registration and Approval: Ensuring all pharmaceuticals and medical devices meet the stringent requirements of regulatory bodies like the SFDA before they can be offered to patients.

- Quality Control and Assurance: Maintaining high standards in the handling, storage, and dispensing of all medical products to guarantee efficacy and patient safety.

- Supply Chain Integrity: Adhering to regulations that govern the import and distribution of pharmaceuticals and devices to prevent counterfeit or substandard products from entering the market.

- Post-Market Surveillance: Implementing robust systems for monitoring the safety and performance of medical products after they have been made available to the public.

Labor and Employment Laws

Labor and employment laws are critical for Dr. Sulaiman Al-Habib Medical Services Group, dictating everything from employment contracts and working hours to wages and the management of its expatriate workforce. For instance, in Saudi Arabia, the Labor Law (Royal Decree No. M/51) sets strict guidelines on employment terms and conditions. Compliance ensures fair practices, aids in retaining skilled staff, and prevents costly legal entanglements.

The group must remain agile, adapting to evolving national labor policies to maintain operational integrity and ethical employment standards. As of early 2024, Saudi Arabia continues to refine its labor regulations, often focusing on Saudization targets and worker protections, which directly influence hiring strategies and operational costs for healthcare providers like Al-Habib.

Key aspects of labor law compliance for the group include:

- Employment Contracts: Ensuring all contracts adhere to legal requirements regarding duration, duties, and compensation.

- Working Hours and Wages: Strict adherence to mandated maximum working hours and minimum wage regulations, which can vary by region and employee classification.

- Expatriate Workforce Management: Navigating specific regulations for foreign workers, including visa requirements, work permits, and repatriation rules, a significant factor given the healthcare sector's reliance on international talent.

- Compliance Updates: Proactively monitoring and implementing changes to labor laws to avoid penalties and maintain a positive employer reputation.

Legal frameworks in Saudi Arabia, particularly those from the Ministry of Health and the Food and Drug Authority (SFDA), heavily influence Dr. Sulaiman Al-Habib Medical Services Group's operations. Compliance with licensing, accreditation, and stringent product registration laws is non-negotiable, impacting everything from patient care standards to supply chain management. For instance, the SFDA's ongoing emphasis in 2024 on international standards for medical device registration and pharmacovigilance necessitates continuous adaptation. Anticipated regulatory shifts in 2025 concerning data privacy for medical devices and pharmaceutical approvals could also require strategic adjustments.

Environmental factors

Healthcare facilities, including those operated by Dr. Sulaiman Al-Habib Medical Services Group, generate substantial volumes of medical waste. This necessitates stringent adherence to evolving environmental regulations governing its safe collection, treatment, and final disposal. For instance, in 2024, Saudi Arabia continued to emphasize stricter waste management practices within its healthcare sector as part of its Vision 2030 environmental goals.

Compliance with these regulations is paramount, not only for safeguarding public health but also for protecting the environment from potential contamination. Failure to comply can result in significant penalties and reputational damage. The group must therefore maintain robust waste management protocols and invest in the necessary infrastructure, such as specialized treatment facilities or partnerships with certified disposal providers, to ensure ongoing adherence.

Dr. Sulaiman Al-Habib Medical Services Group, like all healthcare providers, faces scrutiny over its significant energy consumption and resulting carbon footprint. Hospitals are inherently energy-intensive, powering everything from life support systems to climate control. In 2023, the healthcare sector globally accounted for a substantial portion of energy use, with a growing mandate to reduce environmental impact.

The group can achieve considerable cost savings and enhance its environmental credentials by adopting energy-efficient technologies. This includes upgrading to LED lighting, optimizing HVAC systems, and investing in modern, low-energy medical equipment. For instance, adopting smart building management systems can dynamically adjust energy usage based on occupancy and operational needs, a strategy being increasingly adopted by leading global healthcare networks.

Exploring renewable energy sources is another key environmental strategy. The group could investigate installing solar panels on its facilities, particularly in regions with high solar irradiance, to offset a portion of its electricity demand. This aligns with broader sustainability goals and can provide long-term energy cost stability, especially as energy prices remain volatile through 2024 and into 2025.

Water scarcity in the Middle East, particularly in Saudi Arabia where Dr. Sulaiman Al-Habib Medical Services Group (HMG) operates extensively, presents a significant environmental challenge. HMG’s commitment to sustainability requires robust water management. For instance, the Kingdom's Vision 2030 emphasizes water conservation, aiming to reduce per capita consumption by 43% by 2030.

Efficient water usage and conservation are paramount for HMG’s operational resilience and environmental stewardship. Implementing water-saving fixtures, optimizing cooling systems, and promoting responsible water use among staff and patients are key strategies. These efforts not only mitigate environmental impact but also contribute to cost savings, as water prices in Saudi Arabia have been progressively increasing, with tariffs for commercial users seeing substantial hikes in recent years.

HMG can further enhance its water management by exploring advanced solutions such as greywater recycling for non-potable uses like irrigation and toilet flushing within its facilities. This aligns with global healthcare trends towards greater environmental responsibility and could lead to significant reductions in overall water consumption, supporting the group's long-term sustainability goals and operational efficiency.

Sustainable Sourcing and Supply Chain

Growing awareness of environmental impact is increasingly influencing the medical sector, extending to the sourcing of everything from basic supplies to sophisticated equipment and pharmaceuticals. Dr. Sulaiman Al-Habib Medical Services Group, like others, faces pressure to consider the environmental footprint of its procurement processes.

By actively preferring suppliers who demonstrate sustainable practices and offer environmentally friendly products, the group can significantly bolster its corporate social responsibility (CSR) image. This aligns with global trends; for instance, a 2024 report indicated that over 60% of healthcare organizations are prioritizing sustainability in their procurement decisions.

A well-managed sustainable supply chain offers tangible benefits beyond CSR, such as mitigating environmental risks and fostering ethical procurement. This can lead to more resilient operations and a stronger reputation among stakeholders.

- Supplier Sustainability Audits: Implementing regular audits for key suppliers to assess environmental compliance and ethical sourcing.

- Green Procurement Policies: Developing and enforcing policies that favor suppliers with certifications like ISO 14001 or those demonstrating reduced carbon emissions.

- Waste Reduction Initiatives: Collaborating with suppliers to minimize packaging waste and explore reusable or recyclable materials in the supply chain.

- Ethical Sourcing Standards: Ensuring that all procured medical supplies and equipment adhere to fair labor practices and environmental regulations in their production.

Climate Change Impact on Public Health

Climate change poses a significant threat to public health, potentially driving an increased demand for healthcare services. For Dr. Sulaiman Al-Habib Medical Services Group, this translates to a need to anticipate and prepare for a rise in climate-sensitive illnesses. For instance, the World Health Organization (WHO) projects that between 2030 and 2050, climate change could cause approximately 250,000 additional deaths per year from malnutrition, malaria, diarrhea, and heat stress alone.

The group must consider the growing prevalence of heat-related illnesses, such as heatstroke and dehydration, especially in regions experiencing more frequent and intense heatwaves. Furthermore, worsening air quality due to climate change can exacerbate respiratory conditions like asthma and COPD, leading to more hospital admissions and a greater need for specialized care.

By understanding these environmental shifts and their direct impact on public health, Dr. Sulaiman Al-Habib Medical Services Group can proactively adapt its service offerings. This foresight allows for strategic planning, ensuring the availability of specialized treatments and resources to manage the anticipated increase in climate-related health challenges, thereby maintaining its competitive edge and commitment to patient well-being.

- Increased Disease Prevalence: Climate change can foster conditions favorable to vector-borne diseases like Dengue fever and Malaria, requiring enhanced diagnostic and treatment capabilities.

- Heat-Related Illnesses: Rising global temperatures, with 2023 being the hottest year on record, necessitate preparedness for heat exhaustion, heatstroke, and cardiovascular strain.

- Respiratory Issues: Air pollution and increased pollen counts linked to climate change can lead to a surge in asthma attacks and other respiratory ailments.

- Adaptation Strategy: Proactive investment in telemedicine, air quality monitoring, and specialized clinics for infectious and respiratory diseases will be crucial for service adaptation.

Dr. Sulaiman Al-Habib Medical Services Group must navigate stringent environmental regulations concerning medical waste, with Saudi Arabia reinforcing stricter practices in 2024 as part of Vision 2030. The group's energy-intensive operations also demand a focus on reducing its carbon footprint, a trend seen across the global healthcare sector in 2023, with an increasing push for energy efficiency and renewable sources like solar power.

PESTLE Analysis Data Sources

Our Dr. Sulaiman Al-Habib Medical Services Group PESTLE Analysis is built on a comprehensive review of official government publications, reputable financial news outlets, and leading healthcare industry reports. We meticulously gather data on regulatory changes, economic indicators, and societal trends impacting the healthcare sector in Saudi Arabia and beyond.