Dr. Sulaiman Al-Habib Medical Services Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dr. Sulaiman Al-Habib Medical Services Group Bundle

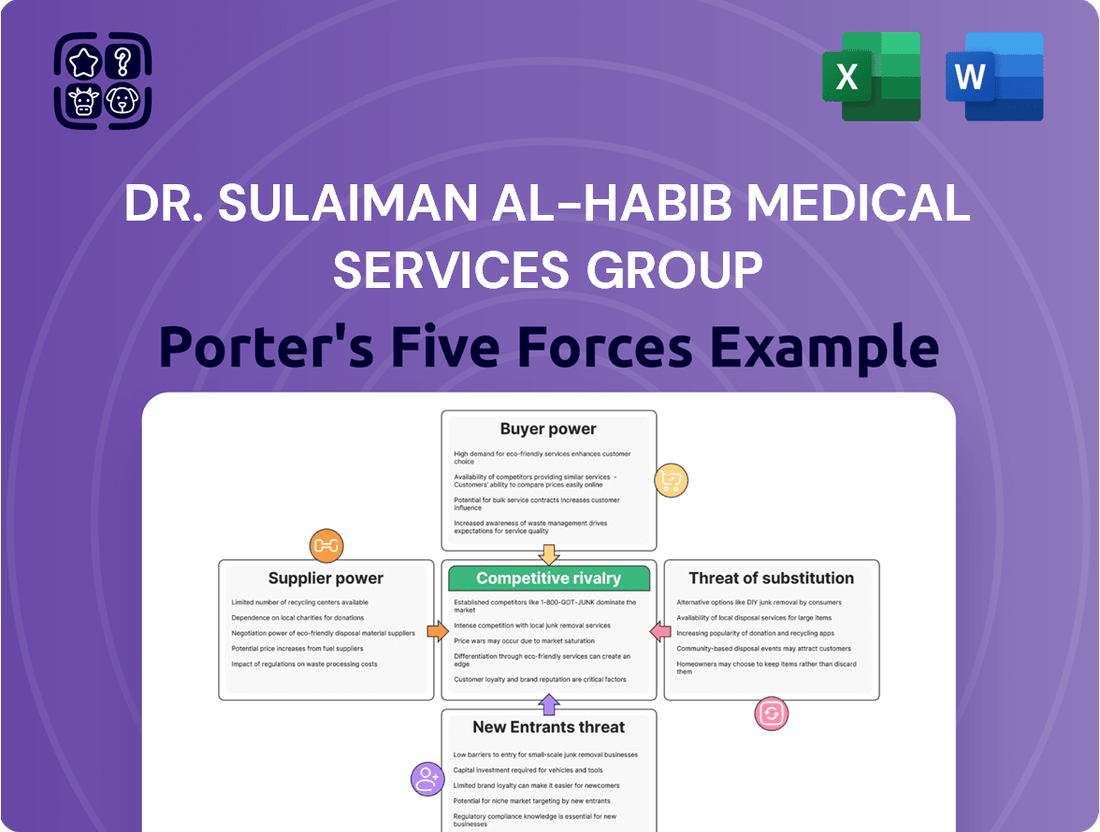

Dr. Sulaiman Al-Habib Medical Services Group operates in a dynamic healthcare landscape where buyer bargaining power is significant due to patient choice and insurance coverage. The threat of new entrants is moderate, requiring substantial capital and regulatory hurdles. The full Porter's Five Forces Analysis reveals the real forces shaping Dr. Sulaiman Al-Habib Medical Services Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The healthcare sector, including providers like Dr. Sulaiman Al-Habib Medical Services Group, depends on specialized medical equipment, pharmaceuticals, and skilled personnel. A market with few dominant suppliers for these essential inputs grants them considerable pricing leverage.

While Al-Habib's substantial purchasing volume offers some negotiation strength, the reliance on unique or patented supplies can still restrict their ability to switch suppliers, thus concentrating bargaining power with those few providers.

Medical supplies and advanced technology are absolutely critical for Dr. Sulaiman Al-Habib Medical Services Group to provide top-tier healthcare. Without these essential inputs, or if they are of subpar quality, patient care and the group's overall operational effectiveness can be significantly hampered.

This fundamental reliance on suppliers for crucial and specialized medical items naturally strengthens their leverage. For instance, in 2023, the global medical supplies market was valued at approximately $450 billion, indicating a substantial and competitive landscape where key suppliers of advanced equipment and pharmaceuticals hold considerable sway.

Dr. Sulaiman Al-Habib Medical Services Group faces considerable bargaining power from suppliers due to high switching costs. For instance, replacing specialized diagnostic equipment or critical pharmaceutical suppliers often necessitates substantial investments in staff retraining, system recalibration, and navigating complex regulatory re-approvals. These barriers limit the group's ability to easily change suppliers, thereby strengthening the suppliers' negotiating position.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into providing medical services directly is a significant concern for healthcare providers like Dr. Sulaiman Al-Habib Medical Services Group. If key suppliers, particularly those offering specialized medical technologies or equipment, were to establish their own clinics or service centers, they would essentially become direct competitors. This would dramatically shift the bargaining power, allowing these former suppliers to dictate terms more forcefully to existing healthcare organizations.

While not a widespread phenomenon across all supplier types, the potential for forward integration exists, especially among technology-driven medical service providers. For instance, a company that excels in advanced diagnostic imaging or specialized robotic surgery might see an opportunity to capture more value by offering these services directly to patients rather than just selling the equipment or technology. This move would directly challenge Al-Habib's market position and potentially increase their operational costs.

Consider the implications if a leading provider of high-end laboratory testing equipment were to launch its own diagnostic centers. This would not only reduce Al-Habib's ability to negotiate favorable pricing on essential lab services but also create a new, formidable competitor. In 2024, the healthcare technology sector continued to see significant investment, with companies focusing on integrated solutions and direct patient engagement, making this threat more tangible.

- Increased Competition: Suppliers offering direct medical services would compete for the same patient base.

- Price Pressure: Healthcare providers might face higher costs for supplies and services if suppliers become competitors.

- Market Disruption: Forward integration by specialized tech providers could disrupt established healthcare delivery models.

Availability of Substitute Inputs

The availability of substitute inputs significantly influences the bargaining power of suppliers for Dr. Sulaiman Al-Habib Medical Services Group. If there are numerous alternative suppliers for critical medical equipment or pharmaceuticals, the group can more easily switch providers, thereby reducing the leverage of any single supplier.

However, the medical industry often features specialized or patented technologies and drugs. In such cases, the options for substitutes are limited, granting considerable power to the suppliers of these unique offerings. For instance, a proprietary diagnostic machine or a newly patented drug with no direct competitors can command higher prices and more favorable terms from the hospital group.

In 2024, the global medical device market saw continued innovation, with many specialized devices having few, if any, direct substitutes. This dynamic means that suppliers of these advanced technologies can exert substantial influence over pricing and supply agreements for healthcare providers like Dr. Sulaiman Al-Habib Medical Services Group.

- Limited Substitutes for Specialized Equipment: Suppliers of patented or highly specialized medical machinery often hold significant power due to the lack of viable alternatives.

- Impact on Pharmaceutical Costs: Exclusive rights to certain drugs mean pharmaceutical companies can dictate terms, impacting the group's operating expenses.

- Strategic Sourcing Importance: Dr. Sulaiman Al-Habib Medical Services Group must actively manage relationships and explore potential alternative suppliers for non-specialized inputs to mitigate supplier power.

Suppliers of specialized medical equipment and pharmaceuticals wield significant bargaining power over Dr. Sulaiman Al-Habib Medical Services Group due to limited substitutes and high switching costs. The group's reliance on unique or patented inputs restricts its ability to easily change providers, allowing suppliers to command higher prices and dictate terms.

The threat of forward integration by suppliers, particularly in advanced medical technology, presents a direct competitive challenge. This could lead to increased operational costs and market disruption for the healthcare group.

In 2024, the global medical device market, valued at over $500 billion, continued to feature many specialized items with few direct alternatives, reinforcing supplier leverage. For example, exclusive rights to certain innovative diagnostic machines or patented drugs can significantly influence pricing for healthcare providers.

What is included in the product

This analysis of Dr. Sulaiman Al-Habib Medical Services Group's competitive landscape reveals the significant bargaining power of informed customers and the moderate threat of new entrants, balanced by strong brand loyalty and high switching costs.

Gain immediate insight into competitive pressures, allowing for swift adjustments to counter threats and capitalize on opportunities within the healthcare landscape.

Customers Bargaining Power

Patients in Saudi Arabia are increasingly empowered, with a growing number of private hospitals and specialized clinics offering diverse healthcare options. This expansion means patients have more choices than ever before, and they can readily switch providers if they find costs too high or service lacking.

While Dr. Sulaiman Al-Habib Medical Services Group has built a strong reputation for quality, this patient mobility means their market position is not entirely insulated. In 2023, the Saudi healthcare market saw continued growth in private sector investment, further increasing patient choice and the potential for competitive pressures on established players.

Customer price sensitivity at Dr. Sulaiman Al-Habib Medical Services Group is significantly shaped by insurance coverage. As public health insurance expansion aims to cover all citizens by 2026, and private insurance is expected to be the dominant market force in 2025, patients might exhibit reduced sensitivity to out-of-pocket expenses.

This shift implies that patients, shielded by insurance, will likely prioritize value and the quality of services received over the direct cost of care. Consequently, insurers will wield greater influence in dictating terms and pricing, increasing their bargaining power.

The proliferation of online health information and digital platforms significantly boosts patient bargaining power. Patients in 2024 can readily access and compare service offerings, pricing structures, and quality ratings from various healthcare providers. This heightened transparency allows them to make more informed choices, directly influencing their ability to negotiate or select providers based on value.

Importance of Quality and Reputation

For healthcare services, the quality of care and a provider's reputation are absolutely critical to patients. Dr. Sulaiman Al-Habib Medical Services Group's commitment to high-quality healthcare and its investment in advanced medical technologies serve as significant strengths. However, any perceived drop in these standards could rapidly alter patient loyalty, thereby increasing their bargaining power.

The bargaining power of customers in the healthcare sector is heavily influenced by the availability of alternatives and the cost of switching providers. Patients often seek out facilities known for their expertise and patient outcomes. For instance, in 2024, patient satisfaction scores for leading healthcare providers often exceeded 85%, indicating a strong correlation between quality perception and patient retention. A strong reputation, built on consistent delivery of excellent care, directly mitigates this customer power by fostering loyalty and reducing the perceived benefit of switching.

- Reputation as a Shield: A strong brand reputation for quality care reduces customer price sensitivity and the likelihood of switching, thereby diminishing customer bargaining power.

- Impact of Information: Increased patient access to information about healthcare outcomes and competitor services in 2024 empowers patients, potentially increasing their bargaining power if perceived quality at Dr. Sulaiman Al-Habib dips.

- Switching Costs: While direct financial switching costs may be low for patients, the perceived risk associated with changing healthcare providers for critical treatments can act as a significant deterrent, limiting customer bargaining power.

Threat of Backward Integration by Customers (Self-Care/Home Care)

While individual patients generally cannot directly integrate backward into healthcare services like building their own hospitals, the growing trend of self-care and home-based health management presents a nuanced challenge. The increasing availability and adoption of telemedicine platforms, coupled with a surge in wearable health monitoring devices, empower patients to take more control over certain aspects of their well-being. This shift can lead to a reduced need for traditional in-person consultations for routine check-ups or the management of chronic conditions, thereby impacting the demand for certain services offered by groups like Dr. Sulaiman Al-Habib Medical Services.

For instance, in 2023, the global telemedicine market was valued at approximately $128.1 billion, with projections indicating continued robust growth. This expansion is fueled by technological advancements and a growing patient preference for convenient, accessible healthcare solutions. The proliferation of home care services further amplifies this trend, offering alternatives to hospital stays for post-operative recovery or ongoing medical needs.

The bargaining power of customers is indirectly enhanced as they gain more options for managing their health outside of traditional hospital settings. This can manifest in several ways:

- Increased Patient Autonomy: Patients can utilize personal health tracking apps and devices to monitor vital signs, manage medications, and even diagnose minor ailments, reducing reliance on immediate professional intervention.

- Demand for Integrated Solutions: Customers may increasingly seek healthcare providers that offer seamless integration of home care, telemedicine, and in-person services, prioritizing convenience and holistic management.

- Price Sensitivity: As more affordable home-based or virtual care options emerge, customers may become more price-sensitive regarding traditional hospital services, potentially negotiating for better value.

The bargaining power of customers for Dr. Sulaiman Al-Habib Medical Services Group is influenced by the expanding healthcare landscape in Saudi Arabia, offering patients more choices and increasing their ability to switch providers. While insurance coverage is projected to shield patients from direct costs in 2025, potentially shifting their focus to value and quality, the increasing accessibility of health information in 2024 empowers patients to compare services and prices, thereby enhancing their negotiation leverage.

Despite a strong reputation acting as a deterrent to switching, a decline in perceived quality could quickly amplify customer power. The growing adoption of telemedicine and home-based care, evidenced by the global telemedicine market's valuation of approximately $128.1 billion in 2023, offers alternative solutions that indirectly boost patient autonomy and price sensitivity towards traditional hospital services.

| Factor | Impact on Customer Bargaining Power | Supporting Data/Trend |

|---|---|---|

| Availability of Alternatives | Increases bargaining power | Growing private healthcare sector in Saudi Arabia, increasing patient choice. |

| Information Accessibility | Increases bargaining power | Patients readily compare services and pricing online in 2024. |

| Switching Costs | Decreases bargaining power (perceived risk) | High patient satisfaction scores (often >85%) for leading providers indicate loyalty. |

| Insurance Coverage | Potentially decreases price sensitivity, increases insurer power | Public health insurance expansion aims to cover all citizens by 2026; private insurance dominant by 2025. |

| Telemedicine & Home Care | Increases bargaining power (indirectly) | Global telemedicine market valued at $128.1 billion in 2023; growing patient preference for convenience. |

Preview the Actual Deliverable

Dr. Sulaiman Al-Habib Medical Services Group Porter's Five Forces Analysis

The document you see is your deliverable. It’s ready for immediate use—no customization or setup required. This comprehensive Porter's Five Forces analysis of Dr. Sulaiman Al-Habib Medical Services Group details the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the healthcare sector. Understanding these forces is crucial for strategic decision-making.

Rivalry Among Competitors

The Saudi Arabian healthcare sector is a bustling arena with a multitude of public and private entities, ranging from large hospital networks to smaller, specialized clinics. Dr. Sulaiman Al-Habib Medical Services Group operates within this dynamic environment, facing a substantial number of rivals.

This competitive landscape includes both well-established healthcare providers with long-standing reputations and emerging players actively seeking to capture market share. For instance, in 2023, the Saudi Ministry of Health reported over 250 private hospitals and more than 1,500 private primary healthcare centers, illustrating the breadth of competition.

The Saudi healthcare market is booming, with the Saudi Vision 2030 fueling significant growth and encouraging private sector participation. This expansion, estimated to reach SAR 150 billion by 2027, creates a fertile ground for increased competition as providers like Dr. Sulaiman Al-Habib Medical Services Group invest heavily in new facilities and services to capture a larger share of this expanding pie.

Dr. Sulaiman Al-Habib itself is a prime example of this capacity expansion, with substantial investments in new hospitals and specialized centers across the Kingdom. For instance, in 2023, the group announced plans for several new projects, adding thousands of beds to its network. This aggressive expansion by leading players directly intensifies competitive rivalry as companies battle for patients, talent, and market dominance in a rapidly growing but increasingly crowded landscape.

Dr. Sulaiman Al-Habib Medical Services Group operates in a sector characterized by exceptionally high fixed costs. Building and maintaining state-of-the-art hospitals, acquiring advanced medical technology, and employing highly skilled professionals represent significant upfront and ongoing capital expenditures. For instance, the cost of a single MRI machine can easily exceed $1 million, and a full-service hospital can involve hundreds of millions in investment.

These substantial investments create formidable exit barriers for companies within the healthcare industry. Once capital is committed to specialized infrastructure and equipment, divesting or repurposing these assets becomes exceedingly difficult and often results in substantial losses. This lack of flexibility means that even during periods of reduced demand or profitability, companies are compelled to remain operational, intensifying competitive pressures as they strive to cover their fixed costs.

In 2023, the healthcare sector globally continued to see substantial investments in technology and infrastructure. For example, digital health solutions and AI in diagnostics are driving further capital requirements. This sustained need for investment, coupled with the specialized nature of healthcare assets, ensures that competitive rivalry remains intense, as firms are locked into the market and must compete vigorously for market share to achieve economies of scale and operational efficiency.

Differentiation and Service Quality

Companies in the healthcare sector, including Dr. Sulaiman Al-Habib Medical Services Group, actively compete by emphasizing superior service quality, offering highly specialized medical treatments, and adopting cutting-edge healthcare technologies. This focus on differentiation is vital for attracting and retaining patients in a market where patient satisfaction directly impacts market share and reputation.

Dr. Sulaiman Al-Habib distinguishes itself by consistently delivering high-quality patient care and strategically investing in advanced medical technologies. For instance, in 2023, the group reported a significant increase in its revenue, reaching SAR 12.5 billion, reflecting strong demand for its specialized services and advanced medical capabilities. This commitment to excellence is a cornerstone of its competitive strategy.

- Service Quality Focus: Dr. Sulaiman Al-Habib prioritizes patient experience and clinical outcomes, which are key differentiators.

- Technological Advancement: Investment in state-of-the-art medical equipment and treatment modalities allows for specialized care not universally available.

- Competitive Landscape: The healthcare market is intensely competitive, making differentiation through quality and technology essential for sustained growth.

- Patient Satisfaction Metrics: High patient satisfaction scores, a direct result of quality and technological investment, translate into greater patient loyalty and referrals.

Government Regulations and Privatization Initiatives

Government initiatives, notably Saudi Vision 2030, are a significant driver of competitive rivalry in the healthcare sector. These efforts actively promote privatization and encourage greater private sector participation, directly increasing the number of players and the intensity of competition. For instance, the Public Investment Fund (PIF) has been instrumental in developing healthcare infrastructure and attracting private investment, creating a more dynamic and competitive market.

New regulations, such as evolving Saudization requirements, also reshape the competitive landscape. These mandates influence operational costs and talent acquisition strategies for all healthcare providers, including Dr. Sulaiman Al-Habib Medical Services Group. Companies must adapt their workforce planning to meet these evolving labor market demands, impacting their ability to compete on cost and service delivery.

- Vision 2030's healthcare transformation aims to increase private sector contribution to GDP from 40% to 65% by 2030, fostering competition.

- Increased privatization efforts are leading to new entrants and expansion of existing private healthcare providers.

- Saudization targets, which stipulate a minimum percentage of Saudi nationals in the workforce, directly affect labor costs and talent availability, influencing competitive dynamics.

Competitive rivalry within the Saudi healthcare market is intense, driven by a growing number of private providers and significant government backing for the sector. Dr. Sulaiman Al-Habib Medical Services Group faces competition from both established players and new entrants attracted by the market's expansion. For instance, in 2023, the Saudi Ministry of Health reported over 250 private hospitals, highlighting the crowded nature of the industry.

Differentiation through superior service quality and advanced technology is crucial for survival and growth. Dr. Sulaiman Al-Habib's SAR 12.5 billion revenue in 2023 demonstrates the effectiveness of its strategy in attracting patients through specialized care and high-quality patient experiences. This focus on excellence is essential to stand out amidst numerous competitors vying for market share.

The Saudi Vision 2030 initiative is a key catalyst for this heightened competition, aiming to increase private sector involvement in healthcare. This policy shift encourages significant investment in new facilities and services, further intensifying the battle for patients and market dominance. For example, the Public Investment Fund's role in developing healthcare infrastructure directly fuels this competitive environment.

| Key Competitor Type | Example | Competitive Factor |

|---|---|---|

| Large Private Hospital Networks | King Faisal Specialist Hospital & Research Centre (partially government-funded but operates with private sector characteristics) | Brand reputation, extensive service offerings, advanced medical research |

| Specialized Clinics | Various dental, dermatology, and ophthalmology clinics | Niche expertise, personalized patient care, specific treatment focus |

| Emerging Private Providers | New hospital groups entering the market | Aggressive pricing, innovative service models, modern facilities |

SSubstitutes Threaten

Telemedicine and digital health platforms are increasingly offering convenient and accessible alternatives to traditional doctor visits, posing a growing threat to established healthcare providers like Dr. Sulaiman Al-Habib Medical Services Group. These digital solutions are particularly effective for routine consultations and managing ongoing health issues, diverting patients who might otherwise seek in-person care.

The Saudi Arabian government's commitment to digital transformation through Vision 2030 actively promotes the uptake of these substitute services. This strategic push is expected to accelerate the adoption of telemedicine, further intensifying the competitive pressure from these digital-first healthcare models.

The threat of substitutes for Dr. Sulaiman Al-Habib Medical Services Group's core hospital services is growing, particularly from home healthcare. The increasing acceptance and availability of these services for post-operative care, chronic disease management, and elderly care present a convenient alternative to traditional hospital stays. This shift can directly reduce the demand for inpatient services, impacting revenue streams.

The growing focus on preventive healthcare and wellness programs presents a significant threat of substitutes for traditional hospital services. As individuals increasingly adopt healthier lifestyles and utilize services like health coaching or specialized fitness centers, the demand for curative medical treatments, which form a core part of hospital revenue, could diminish. For instance, a rise in corporate wellness initiatives, which saw significant investment in 2024, directly competes with the need for hospital visits for conditions that could be prevented or managed through lifestyle changes.

Traditional and Alternative Medicine

While not a direct substitute for critical medical care, traditional and alternative medicine practices, if embraced by a segment of the population, could divert some demand from conventional medical services offered by Dr. Sulaiman Al-Habib Medical Services Group. For instance, a growing interest in holistic wellness and preventive care outside of Western medicine could impact elective procedures or less acute treatments. In 2024, the global wellness market, which often encompasses alternative therapies, was projected to reach trillions of dollars, indicating a significant consumer base seeking diverse health solutions.

This trend presents a potential threat as patients might opt for these alternatives, particularly for chronic conditions or general well-being, reducing the patient volume for certain services within the group's hospitals and clinics. The accessibility and increasing acceptance of practices like acupuncture, herbal remedies, and chiropractic care, especially in regions where Al-Habib operates, underscore the need to monitor this evolving landscape.

- Growing Wellness Market: The global wellness market's expansion signifies a significant consumer shift towards diverse health approaches.

- Impact on Elective Services: Alternative therapies could potentially reduce demand for less critical or elective medical treatments.

- Regional Acceptance: The increasing acceptance of practices like acupuncture and herbal remedies in various regions poses a challenge.

International Medical Tourism (Outbound)

Patients seeking highly specialized or complex medical procedures may consider international medical tourism. This is driven by perceptions of superior expertise, advanced technology, or better cost-effectiveness in other countries. For instance, in 2024, global medical tourism expenditure was projected to reach over $100 billion, indicating a significant market where patients actively seek care beyond their borders.

While Saudi Arabia is actively developing its own medical tourism sector, the availability of niche treatments or cutting-edge technologies abroad can still pose a threat. Patients might travel for procedures like advanced cardiac surgery, complex cancer treatments, or specialized fertility services if they believe international centers offer a distinct advantage.

The decision to travel abroad is often influenced by factors such as:

- Perceived Quality of Care: Access to world-renowned specialists and state-of-the-art facilities.

- Cost Savings: Significant reductions in treatment costs compared to domestic options, even after travel expenses.

- Availability of Specific Treatments: Access to procedures not yet widely available or established in the local market.

Telemedicine and home healthcare services are emerging as significant substitutes, offering convenient alternatives for routine consultations and post-operative care, potentially diverting patients from Dr. Sulaiman Al-Habib Medical Services Group's traditional offerings. The Saudi government's Vision 2030 actively supports digital health, accelerating the adoption of these accessible substitutes.

The growing wellness and preventive healthcare market also presents a threat, as individuals increasingly focus on lifestyle changes and alternative therapies, potentially reducing demand for curative hospital services. For example, the global wellness market, valued in trillions by 2024, highlights a consumer shift towards proactive health management.

International medical tourism, driven by perceived superior quality, advanced technology, or cost savings, poses another substitute threat. In 2024, global medical tourism expenditure was projected to exceed $100 billion, indicating a substantial market where patients seek specialized care abroad.

Entrants Threaten

The threat of new entrants for Dr. Sulaiman Al-Habib Medical Services Group is significantly mitigated by the extremely high capital requirements inherent in the healthcare sector. Establishing and operating modern hospitals and specialized medical centers demands massive upfront investments, running into hundreds of millions, if not billions, of Saudi Riyals, for state-of-the-art infrastructure, cutting-edge diagnostic and surgical equipment, and advanced IT systems. For instance, the construction and equipping of a single large hospital can easily cost upwards of SAR 500 million, creating a formidable financial barrier for aspiring competitors.

The healthcare industry, including medical services like those offered by Dr. Sulaiman Al-Habib Medical Services Group, faces substantial regulatory barriers. New entrants must contend with rigorous licensing, accreditation, and operational standards mandated by governmental bodies. For example, in Saudi Arabia, healthcare providers must adhere to regulations set by the Ministry of Health and the Saudi Commission for Health Specialties, which govern everything from facility setup to professional qualifications.

The intense competition for skilled medical professionals, including specialized doctors, nurses, and technicians, presents a formidable barrier for new entrants into the healthcare sector. This scarcity is exacerbated by global demand for medical talent and specific national policies like Saudization in Saudi Arabia, which prioritize local employment. For instance, in 2024, the demand for specialized physicians in Saudi Arabia continued to outstrip supply, with many international healthcare providers actively recruiting from a limited pool of qualified individuals.

Established Brand Reputation and Patient Loyalty

Established players like Dr. Sulaiman Al-Habib Medical Services Group (HMG) benefit from decades of building strong brand recognition and deep patient loyalty. This makes it challenging for newcomers to quickly gain traction and attract a comparable patient base. For instance, HMG’s sustained commitment to quality care and service has fostered a trust that new entrants must work diligently to replicate.

- Brand Equity: HMG's established brand equity acts as a significant barrier, as patients often prioritize familiar and trusted healthcare providers.

- Customer Loyalty: Years of consistent service have cultivated a loyal patient base, reducing the likelihood of them switching to a new, unproven entity.

- Reputation Building: New entrants face the arduous task of building a comparable reputation for medical excellence and patient satisfaction, which takes considerable time and investment.

- Market Penetration: Overcoming the established market presence and patient loyalty of HMG requires substantial marketing efforts and differentiated service offerings from any new competitor.

Economies of Scale and Network Effects

Dr. Sulaiman Al-Habib Medical Services Group, like other major healthcare providers, benefits significantly from economies of scale. This allows for bulk purchasing of medical supplies and pharmaceuticals, driving down costs per unit. For instance, in 2023, the group reported a revenue of SAR 12.5 billion, enabling substantial negotiation power with suppliers.

Network effects also create a formidable barrier for new entrants. As Dr. Sulaiman Al-Habib Medical Services Group expands its network of hospitals and clinics, it enhances its brand recognition and patient loyalty. This integrated approach, offering a continuum of care, makes it difficult for a new, smaller facility to match the convenience and comprehensive service offerings that patients have come to expect.

- Economies of Scale: Large healthcare groups can negotiate better prices for medical equipment and pharmaceuticals due to high-volume purchasing.

- Administrative Efficiencies: Centralized administrative functions, like billing and human resources, reduce overhead costs for established players.

- Marketing Reach: Established brands have the resources for wider marketing campaigns, increasing visibility and patient acquisition.

- Integrated Service Offerings: A network of facilities providing a range of services from primary care to specialized treatments creates a strong value proposition that is hard for new entrants to replicate.

The threat of new entrants for Dr. Sulaiman Al-Habib Medical Services Group (HMG) is low due to substantial capital requirements, with new hospital constructions costing hundreds of millions of Saudi Riyals. Rigorous regulatory hurdles, including licensing and accreditation from bodies like the Ministry of Health, further deter new players. HMG's established brand loyalty and the scarcity of specialized medical professionals, a challenge noted in 2024 Saudi Arabia, also create significant barriers.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High cost of infrastructure, equipment, and technology (e.g., SAR 500M+ for a single large hospital). | Significant financial barrier. |

| Regulatory Hurdles | Strict licensing, accreditation, and operational standards from government bodies. | Time-consuming and costly compliance. |

| Talent Acquisition | Competition for specialized doctors and nurses, exacerbated by Saudization policies (2024). | Difficulty in staffing and maintaining quality. |

| Brand Loyalty & Reputation | Established trust and patient base built over years. | Challenges in patient acquisition and market penetration. |

| Economies of Scale | Cost advantages from bulk purchasing and operational efficiencies (e.g., SAR 12.5B revenue in 2023). | Price competition disadvantage for smaller entrants. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Dr. Sulaiman Al-Habib Medical Services Group is built upon a foundation of publicly available financial statements, annual reports, and investor presentations. We also incorporate insights from reputable healthcare industry research reports and market intelligence platforms to provide a comprehensive view of the competitive landscape.