Dr. Sulaiman Al-Habib Medical Services Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dr. Sulaiman Al-Habib Medical Services Group Bundle

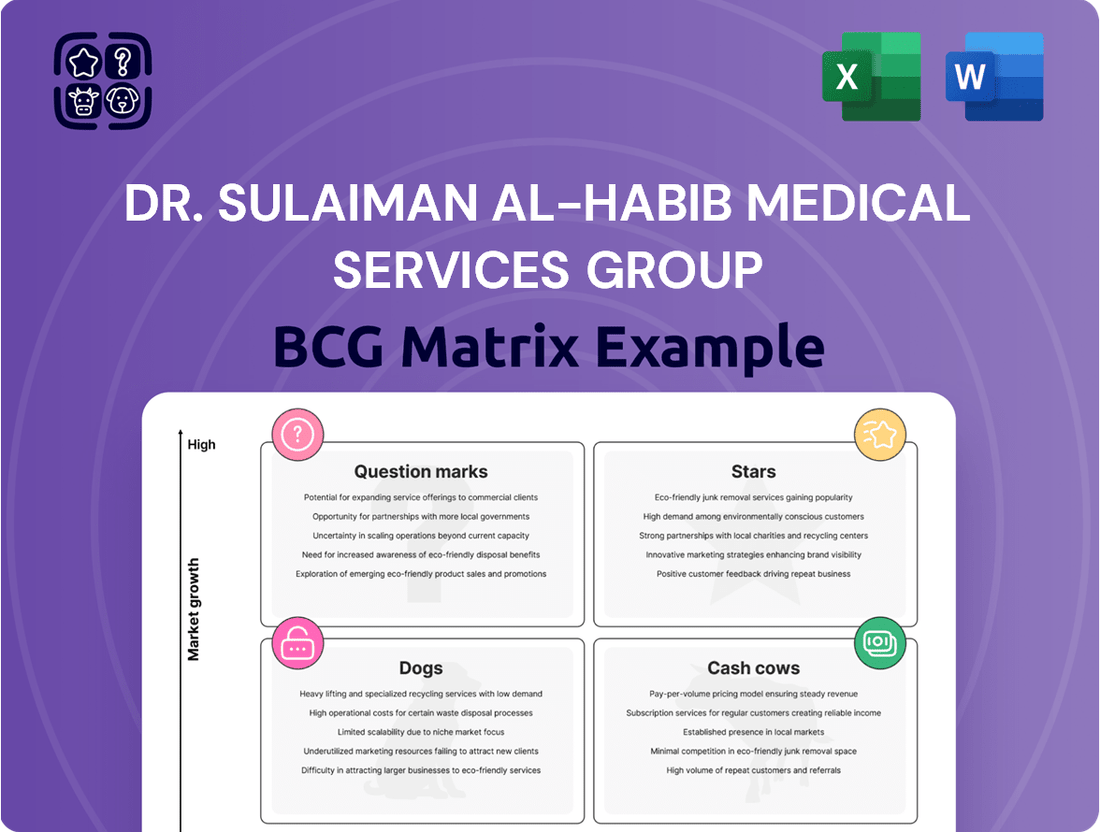

Curious about the strategic positioning of Dr. Sulaiman Al-Habib Medical Services Group? This preview offers a glimpse into their product portfolio's potential, but to truly grasp their market dynamics, you need the full BCG Matrix.

Unlock the complete picture of their Stars, Cash Cows, Dogs, and Question Marks. Purchase the full version for a detailed breakdown and actionable insights to inform your investment and strategic decisions.

Don't miss out on the comprehensive analysis that will provide you with a clear roadmap for navigating the competitive healthcare landscape. Get the full BCG Matrix report today!

Stars

Dr. Sulaiman Al-Habib Medical Services Group (HMG) is actively growing its hospital network. New hospitals like Al-Fayhaa in Jeddah and Shamal Al Riyadh are currently in their revenue ramp-up stages in 2024. These new facilities, along with others expected to open in 2025, are key investments in areas with strong growth potential.

Dr. Sulaiman Al-Habib Medical Services Group's specialized medical services, like its dedicated Women's Health Hospital in Riyadh and its focus on non-communicable diseases (NCDs) such as cardiology and diabetes, are strong candidates for Stars in the BCG Matrix. These areas represent high-growth markets with significant demand.

With NCDs being a leading cause of mortality in Saudi Arabia, and a projected increase in demand for specialized treatments, these high-margin niches are poised for substantial growth. HMG's strategic positioning to meet these critical health needs supports its aim for a high market share within this expanding and vital sector.

Dr. Sulaiman Al-Habib Medical Services Group's investment in advanced medical technology and AI integration, exemplified by solutions like Lunit INSIGHT MMG for mammography, positions this segment as a significant growth driver. This commitment to innovation is further strengthened by their Cloud Solutions subsidiary, which is actively pursuing digital transformation within healthcare, evidenced by the completion of numerous projects and strategic international partnerships.

Pharmaceutical Segment Growth

The pharmacy segment of Dr. Sulaiman Al-Habib Medical Services Group (HMG) has demonstrated robust expansion, with revenues climbing by more than 18% in 2024. This surge is significantly influenced by the addition of 11 new pharmacy branches, broadening HMG's reach within the healthcare landscape. The growth trajectory of the pharmacy segment closely mirrors the increase in hospital patient numbers, suggesting a strong market position within an expanding pharmaceutical sector.

HMG's strategic expansion of its pharmacy outlets, extending beyond its hospital facilities, has effectively reinforced its market presence and accessibility. This diversification of locations caters to a wider customer base, contributing to the segment's impressive revenue growth and solidifying its standing in the competitive pharmaceutical market.

- Revenue Growth: Pharmacy segment revenues increased by over 18% in 2024.

- Expansion: 11 new pharmacy branches were opened in 2024.

- Market Correlation: Growth is linked to increased hospital patient numbers, indicating strong market share.

- Strategic Positioning: Expansion includes outlets outside hospital facilities, enhancing market presence.

Regional Expansion beyond Saudi Arabia

Dr. Sulaiman Al-Habib Medical Services Group (HMG) has strategically expanded its footprint beyond Saudi Arabia, establishing a significant presence in the broader Middle East region. As of December 2023, HMG operated 25 medical facilities across Bahrain and the United Arab Emirates, solidifying its position as a key player in regional healthcare. This geographic diversification is a testament to HMG's ambition to capture market share in rapidly growing healthcare landscapes throughout the Middle East.

By leveraging its strong brand reputation and a comprehensive suite of medical services, HMG is well-positioned to capitalize on the increasing demand for quality healthcare in these new markets. This expansion not only broadens its revenue streams but also enhances its competitive advantage through greater operational scale and market reach.

- Regional Presence: Operations in Bahrain and UAE, totaling 25 facilities as of December 2023.

- Market Capture: Aiming to secure market share in growing Middle Eastern healthcare markets.

- Brand Leverage: Utilizing established brand recognition and extensive service offerings.

- Growth Strategy: Geographic diversification as a core component of its expansion strategy.

Dr. Sulaiman Al-Habib Medical Services Group's specialized medical services, particularly in areas like cardiology and diabetes, are strong candidates for Stars. These segments operate in high-growth markets with increasing demand for specialized treatments, especially given the prevalence of non-communicable diseases in Saudi Arabia.

HMG's investment in advanced medical technology and AI, such as its work with Lunit INSIGHT MMG, also positions this area as a Star. This commitment to innovation, coupled with its Cloud Solutions subsidiary's digital transformation efforts, drives significant growth potential in a rapidly evolving healthcare landscape.

The pharmacy segment is another Star, demonstrating robust expansion with over 18% revenue growth in 2024 driven by 11 new branches. This growth is closely tied to increased hospital patient numbers, indicating a strong market position and expanding reach within the pharmaceutical sector.

HMG's international expansion into Bahrain and the UAE, with 25 facilities by the end of 2023, also represents a Star. This geographic diversification leverages its strong brand to capture market share in growing regional healthcare markets.

| Segment | BCG Category | Key Drivers |

|---|---|---|

| Specialized Medical Services (NCDs) | Star | High demand for NCD treatment, strong market position |

| Advanced Medical Technology & AI | Star | Commitment to innovation, digital transformation |

| Pharmacy Segment | Star | 18%+ revenue growth in 2024, 11 new branches, strong patient correlation |

| International Operations (Bahrain, UAE) | Star | 25 facilities by Dec 2023, regional market capture, brand leverage |

What is included in the product

The Dr. Sulaiman Al-Habib Medical Services Group's BCG Matrix offers strategic insights into its diverse healthcare offerings.

It highlights which medical services to invest in, hold, or divest for optimal growth and profitability.

The Dr. Sulaiman Al-Habib Medical Services Group BCG Matrix offers a clear, one-page overview, simplifying complex portfolio analysis for stakeholders.

Its export-ready design allows for seamless integration into presentations, alleviating the pain point of manual data formatting.

Cash Cows

Dr. Sulaiman Al-Habib Medical Services Group's (HMG) established hospital network, featuring seven facilities operating at full capacity, represents a significant cash cow. These mature assets are highly profitable due to their strong reputation, loyal patient base, and efficient operational management.

The consistent cash flow generated by these fully operational hospitals is a cornerstone of HMG's financial stability. This success means they require minimal additional investment for expansion, allowing capital to be allocated to other strategic areas of the business.

In 2023, HMG reported a net profit of SAR 2.3 billion, with its established hospital network forming the backbone of this profitability. The group's revenue for the same period reached SAR 13.3 billion, underscoring the financial strength derived from these mature, high-performing assets.

Comprehensive General Medical Care within Dr. Sulaiman Al-Habib Medical Services Group is a classic Cash Cow. This segment consistently holds a high market share due to its essential nature, serving a wide patient base across the group's extensive network of hospitals and medical centers.

These foundational healthcare services are in steady demand, contributing to predictable and robust cash flow. For instance, in 2023, Dr. Sulaiman Al-Habib Medical Services Group reported a significant portion of its revenue derived from outpatient services, which encompasses general medical care, highlighting its stable performance in a mature market.

Diagnostic services, encompassing radiology and laboratory testing, are a cornerstone of Dr. Sulaiman Al-Habib Medical Services Group (HMG), strongly indicating their role as cash cows. These essential services are utilized across nearly all patient interactions, ensuring a consistent and predictable revenue stream. In 2023, HMG reported a significant portion of its revenue derived from its core medical services, which heavily includes diagnostics, showcasing their high utilization and stable cash generation.

Investment and Management of Healthcare Facilities

Dr. Sulaiman Al-Habib Medical Services Group (HMG) actively invests in and manages healthcare facilities beyond its wholly-owned hospitals. This strategic approach capitalizes on HMG's extensive experience in healthcare operations and infrastructure development, creating a reliable income stream. These ventures often involve management fees or equity stakes in other healthcare entities, typically operating within established and mature markets where operational efficiency and proven systems are paramount for sustained profitability.

HMG's cash cow segment in investment and management of healthcare facilities demonstrates consistent performance. For instance, in 2023, the group reported a net profit of SAR 1.3 billion, with a significant portion attributed to its diversified service offerings, including management contracts. This segment benefits from the group's strong brand reputation and its ability to optimize resource allocation and operational workflows in various healthcare settings.

- Revenue Generation: Steady income derived from management fees and equity participation in affiliated healthcare facilities.

- Market Position: Leverages established expertise in mature healthcare markets, focusing on operational excellence.

- Profitability: Contributes consistent returns due to efficient management and optimized resource utilization.

- Strategic Value: Extends HMG's influence and operational footprint without direct capital expenditure on new hospital builds in every instance.

Long-standing Reputation and Brand Loyalty

Dr. Sulaiman Al-Habib Medical Services Group benefits immensely from its established reputation and deep-rooted brand loyalty. This trust, built over years of providing quality healthcare, acts as a significant moat, ensuring a steady flow of patients. In 2024, the group continued to leverage this by focusing on patient retention and organic growth, which is typical for a cash cow.

This strong brand equity means less reliance on costly advertising campaigns to maintain market share. Instead, patient satisfaction and positive word-of-mouth are powerful drivers for consistent revenue streams within its established service areas. For instance, the group's commitment to advanced medical technology and patient-centric care has historically translated into high occupancy rates and a strong payer mix, even in a competitive and mature healthcare landscape.

- Established Brand Recognition: Dr. Sulaiman Al-Habib Medical Services Group is a well-recognized name in the Middle Eastern healthcare sector, fostering trust and preference among patients.

- Customer Loyalty: A history of positive patient experiences and high-quality medical services cultivates a loyal patient base, reducing churn and ensuring repeat business.

- Reduced Marketing Costs: Brand loyalty diminishes the need for extensive and expensive marketing efforts, allowing the group to allocate resources more efficiently.

- Consistent Revenue Streams: The combination of reputation and loyalty translates into predictable patient volumes and stable revenue, characteristic of a cash cow.

Dr. Sulaiman Al-Habib Medical Services Group's (HMG) fully operational hospitals are its primary cash cows. These mature facilities generate substantial and consistent profits due to strong brand recognition and a loyal patient base. Their efficiency means they require minimal new investment, freeing up capital for growth in other areas.

In 2023, HMG's established hospital network was a key driver of its SAR 13.3 billion revenue and SAR 2.3 billion net profit, highlighting the financial stability these assets provide.

General medical care and diagnostic services, including radiology and lab testing, are also significant cash cows for HMG. These essential services are consistently in high demand across the group's network, ensuring predictable revenue streams.

HMG's management of other healthcare facilities, through fees and equity stakes, adds another layer of stable income. This strategy leverages their operational expertise in mature markets, contributing to consistent profitability.

| Segment | Role in BCG Matrix | 2023 Revenue Contribution (Indicative) | Key Strengths |

|---|---|---|---|

| Established Hospitals | Cash Cow | High | Brand Loyalty, Operational Efficiency |

| General Medical Care | Cash Cow | Significant | Steady Demand, Wide Patient Base |

| Diagnostic Services | Cash Cow | Significant | High Utilization, Predictable Revenue |

| Managed Facilities | Cash Cow | Consistent | Expertise in Mature Markets, Fee-Based Income |

Preview = Final Product

Dr. Sulaiman Al-Habib Medical Services Group BCG Matrix

The BCG Matrix preview you are currently viewing is the exact, fully formatted Dr. Sulaiman Al-Habib Medical Services Group report you will receive upon purchase. This comprehensive analysis, meticulously crafted with industry-specific data, will be instantly downloadable, ready for your strategic planning and decision-making processes without any watermarks or demo content.

Dogs

Underperforming older medical centers within Dr. Sulaiman Al-Habib Medical Services Group, often categorized as Dogs, represent facilities that haven't kept pace with modernization or are situated in areas experiencing population stagnation. These centers might exhibit low patient volumes and a dwindling market share, demanding significant resources for upkeep with little financial return. For instance, a facility established decades ago in a region that has seen a population decline of 5% between 2020 and 2024, and which has not undergone significant technological upgrades, could fall into this category.

Outdated medical technologies or services, those superseded by newer, more effective treatments or facing declining patient demand, represent the Dogs in Dr. Sulaiman Al-Habib Medical Services Group's BCG Matrix. For instance, while specific financial data for discontinued services isn't publicly detailed, the group's commitment to innovation implies a continuous evaluation process. In 2024, the healthcare sector globally saw significant investment in areas like AI-driven diagnostics and robotic surgery, making older imaging techniques or less precise diagnostic tools candidates for divestment.

Dr. Sulaiman Al-Habib Medical Services Group may categorize certain non-core ancillary services as 'Dogs' in their BCG Matrix. These are services that don't strongly support their primary strategy of specialized, high-quality care and contribute little to revenue or have low usage. For example, a diagnostic imaging service with outdated equipment and low patient volume might fall into this category.

These 'Dog' services could be those that were once important but now experience reduced demand or compete in a crowded market with slim profit margins. Divesting or streamlining these offerings could free up resources and boost overall financial performance. In 2024, many healthcare providers are re-evaluating their service portfolios to focus on profitable, high-demand areas.

Ventures in Saturated or Highly Competitive Micro-Markets

Ventures in saturated or highly competitive micro-markets, such as smaller, localized medical clinics in areas with many existing providers and similar service offerings, often face significant hurdles. These units might be classified as Dogs in the BCG matrix. For instance, a small clinic in a densely populated urban area of Riyadh, already served by several large hospitals and numerous specialized clinics, could struggle to differentiate itself. In 2024, many such independent clinics reported operating margins below 5%, a stark contrast to the 15-20% seen in less competitive or specialized healthcare segments.

These micro-market ventures can tie up valuable capital without generating substantial returns. The difficulty in gaining market share or achieving high growth means they may only break even or even incur losses. This scenario is common when a new clinic opens in a district where established players already command patient loyalty and have economies of scale. For example, reports from early 2024 indicated that over 30% of new, small-scale medical practices opened in the previous two years in highly competitive urban centers failed to achieve profitability within their first 18 months.

The strategic implication for a group like Dr. Sulaiman Al-Habib Medical Services Group is to carefully evaluate the long-term viability of such ventures.

- Low Market Share: Difficulty in capturing a significant portion of the customer base due to intense competition.

- Slow Growth Potential: Limited opportunities for expansion or increased revenue due to market saturation.

- Profitability Challenges: Often operate at break-even or a loss, consuming resources without promising future returns.

- Capital Immobilization: Funds invested in these ventures could be better allocated to Stars or Question Marks with higher growth prospects.

Inefficient or Underutilized Support Functions

Inefficient or underutilized support functions within Dr. Sulaiman Al-Habib Medical Services Group, such as administrative departments or certain back-office operations, could be considered Dogs in the BCG Matrix context. These areas might consume considerable resources, for example, if IT support is overstaffed or if procurement processes are unnecessarily complex, without directly contributing to the group's market share or revenue growth in key service lines.

While not direct revenue generators, these functions represent a significant cash outflow. For instance, if a hospital's administrative overhead as a percentage of revenue is higher than industry benchmarks, it indicates potential inefficiency. Optimizing these internal operations is crucial for freeing up capital that could be reinvested in high-growth areas.

- Potential for cost savings through process automation in administrative tasks.

- Overstaffing in non-clinical support roles can lead to increased labor costs without proportional output gains.

- Underutilization of specialized equipment or software in support departments represents wasted investment.

- Streamlining supply chain management can reduce procurement costs and improve operational efficiency.

Dogs within Dr. Sulaiman Al-Habib Medical Services Group's portfolio represent underperforming units with low market share and growth potential. These could be older facilities in declining areas or services with diminishing patient demand, such as outdated diagnostic imaging techniques. For example, a clinic in a neighborhood experiencing a population decrease of 5% between 2020 and 2024, and lacking technological upgrades, would fit this profile.

These ventures often consume resources without generating significant returns, potentially operating at break-even or a loss. In 2024, the healthcare sector's focus on innovation means older, less efficient services are prime candidates for divestment or restructuring to free up capital for more promising areas.

Dr. Sulaiman Al-Habib Medical Services Group might also classify inefficient support functions or non-core ancillary services as Dogs. For instance, administrative departments with high overheads or diagnostic services with outdated equipment and low patient volume could be categorized as such, representing a drain on resources rather than a contributor to growth.

The strategic imperative is to re-evaluate these Dog units, considering divestment or streamlining to improve overall financial health and reallocate capital to high-potential Stars or Question Marks.

Question Marks

Newly opened hospitals, such as Al-Fayhaa Hospital in Jeddah and Shamal Al Riyadh Hospital, both launched in 2024, are currently navigating their revenue ramp-up phase. These facilities represent significant growth opportunities within Saudi Arabia's expanding healthcare sector, supported by substantial investment. For instance, the Saudi healthcare market was projected to reach over SAR 200 billion by 2024, indicating strong underlying demand.

These hospitals, while possessing high growth potential, are positioned as Question Marks in the BCG Matrix. They currently hold a relatively low market share as they focus on building patient volume and optimizing operational efficiency. This phase requires continued, significant capital infusion to reach their full operational capacity and transition into Stars within the group's portfolio.

Dr. Sulaiman Al-Habib Medical Services Group's digital health and telemedicine initiatives are positioned as question marks in the BCG matrix. These ventures operate within a rapidly expanding market, fueled by Saudi Arabia's Vision 2030 and a growing emphasis on public health awareness.

While the overall market for digital health is experiencing robust growth, with projections indicating continued expansion, the specific market share of HMG's nascent telemedicine platforms and digital health solutions may currently be modest. This is typical for emerging segments where adoption is still gaining momentum.

Significant capital allocation towards technology development and aggressive marketing campaigns will be crucial. These investments are necessary to foster wider patient and provider adoption, ultimately aiming to transform these question mark businesses into market leaders with substantial market share.

Dr. Sulaiman Al-Habib Medical Services Group (HMG) is actively exploring emerging specialized clinics and niche services, such as advanced genetic diagnostics and personalized oncology treatments. These ventures tap into a growing demand for highly specific medical solutions, positioning them as potential stars within the BCG matrix. For instance, the global personalized medicine market was valued at approximately USD 600 billion in 2023 and is projected to grow significantly by 2030.

Expansion into New Geographic Markets

Expansion into entirely new geographic markets for Dr. Sulaiman Al-Habib Medical Services Group (HMG) would place it in the Stars quadrant of the BCG Matrix. These markets, characterized by high growth potential, would likely see HMG starting with a low market share. This necessitates substantial upfront investment in infrastructure, aggressive market penetration strategies, and dedicated brand building efforts to secure a strong presence.

For instance, HMG's potential expansion into Southeast Asian markets, such as Vietnam or Indonesia, exemplifies this. These regions exhibit robust economic growth and increasing demand for advanced healthcare services. In 2024, the healthcare market in Vietnam was projected to grow at a compound annual growth rate of over 10%, driven by rising incomes and a growing middle class. Similarly, Indonesia's healthcare sector is also experiencing significant expansion, with government initiatives aimed at improving healthcare access and quality.

- High Growth Potential: Emerging economies often present untapped customer bases and increasing healthcare needs.

- Low Initial Market Share: Entering unfamiliar territories means competing against established local and international players from a nascent position.

- Significant Investment Required: Building new facilities, recruiting specialized staff, and marketing campaigns demand considerable capital outlay.

- Strategic Importance: Successful penetration can diversify revenue streams and establish HMG as a global healthcare provider.

Partnerships in Innovative Healthcare Technologies

Dr. Sulaiman Al-Habib Medical Services Group's strategic focus on partnerships in innovative healthcare technologies, such as gene therapies and personalized medicine, positions these ventures as potential question marks in the BCG matrix. These initiatives operate within rapidly expanding, high-growth markets, but currently hold a low market share, reflecting their nascent stage.

These ventures necessitate significant research and development expenditure, alongside a well-defined strategy for scaling and achieving market leadership. For instance, the global personalized medicine market was valued at approximately $583.2 billion in 2023 and is projected to reach $1,102.8 billion by 2030, indicating substantial growth potential but also intense competition and high investment requirements.

- High R&D Investment: These partnerships demand substantial capital outlays for research, clinical trials, and regulatory approvals, characteristic of question mark assets.

- Low Market Share, High Growth Potential: Despite currently holding a small market share, these innovative technologies are situated in segments experiencing rapid expansion, offering significant future upside.

- Strategic Importance: Aligning with cutting-edge technologies is crucial for long-term competitive advantage and market positioning in the evolving healthcare landscape.

Dr. Sulaiman Al-Habib Medical Services Group's newly established hospitals, like Al-Fayhaa and Shamal Al Riyadh launched in 2024, are classified as Question Marks. They are in a phase of building patient volume and operational efficiency within a robust Saudi healthcare market projected to exceed SAR 200 billion in 2024.

These facilities require ongoing investment to capture market share and transition from low market share, high growth potential entities to Stars.

Similarly, HMG's digital health and telemedicine initiatives, though operating in a high-growth market driven by Vision 2030, currently hold modest market share, necessitating substantial capital for adoption and market leadership.

Innovative ventures like advanced genetic diagnostics and gene therapy partnerships also fall into the Question Mark category, characterized by high R&D investment and low initial market share within rapidly expanding, high-potential segments.

| Business Unit | Market Growth | Relative Market Share | BCG Classification | Strategic Implication |

|---|---|---|---|---|

| Newly Opened Hospitals (e.g., Al-Fayhaa, Shamal Al Riyadh) | High (Saudi healthcare market > SAR 200 billion in 2024) | Low | Question Mark | Requires continued investment for growth and market share capture. |

| Digital Health & Telemedicine | High (Driven by Vision 2030) | Low | Question Mark | Needs significant capital for technology development and adoption to become a market leader. |

| Innovative Healthcare Partnerships (e.g., Gene Therapies) | Very High (Global personalized medicine market ~$583.2 billion in 2023, projected to reach $1,102.8 billion by 2030) | Low | Question Mark | Demands substantial R&D investment to capitalize on future growth. |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive financial disclosures, detailed market research reports, and industry growth forecasts specific to the healthcare sector to provide a clear strategic overview.