Hd Hyundai Mipo PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hd Hyundai Mipo Bundle

Navigate the complex global landscape impacting Hd Hyundai Mipo with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are reshaping the shipbuilding industry, presenting both challenges and opportunities for the company. Gain a strategic advantage by leveraging these critical insights to inform your investment decisions and market strategies. Download the full PESTLE analysis now for an actionable roadmap to success.

Political factors

The South Korean government is a significant enabler for the shipbuilding sector, with a strong focus on future-proofing the industry. In 2024, the Ministry of Trade, Industry and Energy announced plans to invest approximately 1 trillion KRW (around $750 million USD) into R&D for eco-friendly and smart shipbuilding technologies through 2027. This aligns with global decarbonization efforts and positions companies like HD Hyundai Mipo to capitalize on the growing demand for greener vessels.

This robust government backing translates into a more stable and predictable operating environment for HD Hyundai Mipo. By channeling funds into critical areas like green ship technology and autonomous vessel development, the government is actively working to preserve South Korea's dominant global market share in shipbuilding, which stood at over 35% in 2023 for new vessel orders.

Global trade policies and geopolitical tensions have a significant influence on the shipbuilding sector. For instance, the U.S. imposition of sanctions on Chinese shipyards in late 2023 has redirected a notable portion of shipbuilding orders toward South Korean firms, including HD Hyundai Mipo. This shift is reflected in the strong order book growth experienced by South Korean shipbuilders during this period.

However, the landscape remains subject to volatility. Ongoing tariff negotiations and the general uncertainty surrounding international trade policies can disrupt global trade patterns, potentially impacting demand for new vessels and the cost of raw materials for shipbuilding.

Geopolitical stability significantly impacts HD Hyundai Mipo. For instance, the ongoing Red Sea crisis, which escalated in late 2023 and continued through early 2024, has rerouted many shipping vessels. This disruption can affect the demand for new ships as companies reassess their fleet needs and can also increase operational costs for shipbuilders due to extended transit times for materials.

While such conflicts introduce uncertainty, they can also spur demand for specific shipbuilding services. The need for fleet modernization to navigate new trade routes or for specialized vessels capable of operating in challenging environments could present opportunities for HD Hyundai Mipo. For example, increased demand for tankers or ice-class vessels might arise from altered shipping patterns.

Maritime Regulations and Compliance

International maritime bodies, such as the International Maritime Organization (IMO), and regional authorities like the European Union, are progressively enforcing stricter environmental regulations. These new rules, coming into effect from 2025, mandate the construction of vessels that are both eco-friendly and highly efficient. This directly supports HD Hyundai Mipo's strategic emphasis on developing and building such advanced ship designs, positioning them favorably within the evolving regulatory landscape.

The push for decarbonization in shipping is a significant driver. For instance, the IMO's strategy aims to reduce greenhouse gas emissions from international shipping by at least 20%, striving for 30% by 2030 compared to 2008 levels. HD Hyundai Mipo's expertise in constructing LNG-fueled and other alternative fuel vessels directly addresses these mandates.

- IMO 2025 Regulations: Increased focus on emissions reduction and fuel efficiency for new builds.

- EU Maritime Policy: Directives promoting greener shipping practices and sustainable maritime transport.

- HD Hyundai Mipo's Advantage: Specialization in eco-friendly vessel technologies aligns with compliance needs.

- Market Demand: Growing global demand for vessels meeting stringent environmental standards.

Bilateral and Multilateral Agreements

South Korea's active participation in bilateral and multilateral agreements significantly shapes the operating environment for companies like HD Hyundai Mipo. These agreements, particularly those focused on trade and maritime cooperation, are crucial for accessing new markets and cultivating strategic alliances. For example, ongoing discussions and potential agreements concerning shipbuilding cooperation with the United States present promising avenues for new contracts and foreign investment.

These international frameworks can directly impact HD Hyundai Mipo's competitive positioning and growth prospects. The benefits often include reduced tariffs, streamlined customs procedures, and enhanced opportunities for technology transfer and joint ventures.

- Trade Facilitation: Agreements like the Korea-US Free Trade Agreement (KORUS FTA) continue to influence trade dynamics, potentially lowering barriers for shipbuilding exports and component imports.

- Maritime Cooperation: International maritime organizations and bilateral agreements set standards and foster collaboration, impacting shipbuilding regulations and the demand for specialized vessels.

- Investment Incentives: Bilateral investment treaties can offer protections and incentives for foreign direct investment, which could benefit HD Hyundai Mipo through partnerships or acquisitions.

- Geopolitical Alignment: South Korea's strategic alliances, such as with the US and Japan, can lead to joint defense initiatives or infrastructure projects that require advanced shipbuilding capabilities.

Government support is a cornerstone for HD Hyundai Mipo, with South Korea's Ministry of Trade, Industry and Energy planning to invest approximately 1 trillion KRW (around $750 million USD) by 2027 into eco-friendly and smart shipbuilding R&D. This initiative directly bolsters the sector's technological advancement, reinforcing South Korea's leading market share, which exceeded 35% of global new vessel orders in 2023.

Geopolitical shifts, such as the Red Sea crisis that intensified in late 2023 and continued into early 2024, have rerouted shipping and could influence fleet demand, potentially benefiting shipbuilders like HD Hyundai Mipo if it spurs orders for specialized vessels or fleet modernization. International trade policies also play a crucial role; sanctions imposed on certain shipyards in late 2023 redirected orders, benefiting South Korean firms.

Stricter environmental regulations from international bodies like the IMO, with new rules effective from 2025, are driving demand for eco-friendly vessels. HD Hyundai Mipo's expertise in LNG-fueled and alternative fuel ships positions it well to meet these evolving global standards, aligning with the IMO's goal to reduce shipping emissions significantly.

South Korea's participation in trade agreements, such as the KORUS FTA, facilitates smoother exports and imports, potentially reducing costs and enhancing competitive positioning for HD Hyundai Mipo. These agreements also open doors for strategic alliances and technology transfers, crucial for maintaining an edge in the global shipbuilding market.

What is included in the product

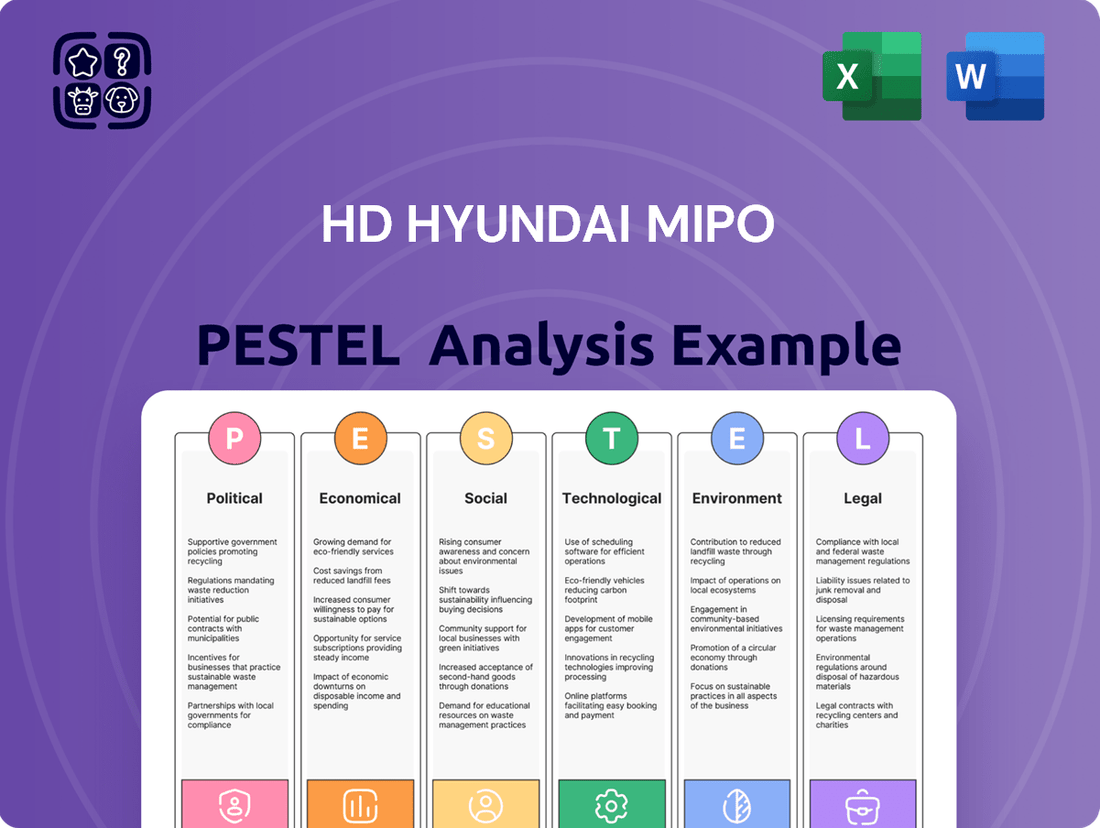

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Hd Hyundai Mipo, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights and forward-looking perspectives to aid strategic decision-making and identify potential opportunities and threats within the shipbuilding industry.

A concise PESTLE analysis for HD Hyundai Mipo offers a clear roadmap for navigating external challenges, acting as a pain point reliever by highlighting opportunities and mitigating potential risks in the shipbuilding industry.

Economic factors

The global economy is showing resilience, with projections indicating a notable increase in world merchandise trade volume for both 2024 and 2025. This upward trend is a direct positive indicator for HD Hyundai Mipo, as it directly fuels demand for the mid-sized vessels and tankers that form the core of their shipbuilding business.

A robust global economic environment inherently leads to heightened shipping activity, as more goods are produced and transported across international borders. For instance, the IMF's April 2024 World Economic Outlook projected global growth at 3.2% for 2024, a pace expected to continue into 2025, bolstering the need for maritime logistics and new vessel construction.

The global shipbuilding industry is currently in a robust 'super cycle,' characterized by surging newbuilding prices and a substantial order backlog. This trend is a direct result of increased demand for new vessels, particularly eco-friendly and specialized ships, coupled with limited shipyard capacity. For instance, as of early 2024, average prices for large container vessels have seen significant increases compared to pre-pandemic levels, reflecting this heightened demand and cost pressures.

HD Hyundai Mipo is well-positioned to capitalize on this favorable market. The company has successfully secured a considerable number of newbuilding orders, which not only bolsters its projected profitability for the upcoming years but also ensures a stable and predictable revenue stream. This strong order book provides a significant buffer against short-term market fluctuations.

Favorable currency exchange rates, especially the USD/KRW pairing, are a significant tailwind for South Korean shipbuilders like Hd Hyundai Mipo. When the Korean won weakens against the U.S. dollar, the dollar-denominated payments received for shipbuilding contracts translate into more won for the company. This directly boosts their operating margins and overall profitability.

For instance, in early 2024, the USD/KRW rate hovered around 1,300 KRW per USD, a level that generally benefits exporters. A stronger dollar means that for every million dollars earned on a contract, the company receives a larger amount in its local currency, enhancing its bottom line and competitive pricing power in the global market.

Demand for Eco-Friendly Vessels

The global push for decarbonization, fueled by initiatives like the IMO's 2023 strategy aiming for net-zero GHG emissions by or around 2050, is significantly boosting the demand for greener shipping solutions. This regulatory environment directly supports HD Hyundai Mipo's emphasis on eco-friendly vessel designs.

HD Hyundai Mipo is well-positioned to capitalize on this shift, evidenced by its strong order book for dual-fuel vessels. For instance, in 2023, the company secured a substantial number of orders for LNG-powered container ships and methanol-fueled carriers, reflecting the market's appetite for sustainable technologies.

- Growing Demand for LNG Carriers: Global LNG trade is projected to continue its upward trajectory, increasing the need for LNG-fueled vessels.

- Methanol as a Future Fuel: Major shipping lines are increasingly opting for methanol-powered newbuildings, a segment where HD Hyundai Mipo has a competitive edge.

- Stricter Emissions Standards: Upcoming regulations, such as the EU Emissions Trading System (ETS) for shipping, will further incentivize the adoption of eco-friendly technologies.

Ship Repair and Conversion Market Growth

The ship repair and conversion market is a significant growth area, complementing newbuild orders. This sector is booming as shipowners invest in retrofitting their fleets to meet increasingly stringent environmental regulations, such as the International Maritime Organization's (IMO) 2020 sulfur cap and upcoming greenhouse gas reduction targets. These upgrades not only ensure compliance but also extend the useful life of existing vessels, making them more attractive and efficient for longer periods.

HD Hyundai Mipo benefits directly from this trend, as conversions and repairs represent a valuable additional revenue stream. For instance, the demand for scrubber installations and ballast water treatment systems has been a major driver. In 2023, the global maritime industry saw significant investment in retrofitting, with estimates suggesting billions of dollars spent on compliance upgrades alone. This trend is projected to continue through 2024 and into 2025, as more vessels need to adapt to evolving environmental standards.

Key drivers for HD Hyundai Mipo's involvement in this market include:

- Environmental Compliance: Retrofitting vessels with technologies like scrubbers and alternative fuel systems (e.g., LNG, methanol) to meet stricter emissions standards.

- Fleet Modernization: Extending the operational lifespan of existing ships through upgrades and conversions, rather than immediate replacement.

- Market Demand: A strong pipeline of conversion projects, particularly for LNG-ready vessels and those requiring energy-saving devices.

- Profitability: Repair and conversion services often offer higher profit margins compared to standard newbuilds due to specialized labor and engineering requirements.

The global economic outlook for 2024 and 2025 remains positive, with continued growth projected for world merchandise trade volume. This expansion directly benefits HD Hyundai Mipo by increasing demand for its mid-sized vessels and tankers, as more goods are shipped internationally. The IMF's April 2024 forecast of 3.2% global growth for 2024, expected to persist into 2025, underpins the need for maritime logistics and new vessel construction.

Favorable currency exchange rates, particularly the USD/KRW pairing, are a significant advantage for South Korean shipbuilders. A weaker Korean won against the U.S. dollar increases the won-denominated revenue from dollar-priced contracts, boosting HD Hyundai Mipo's operating margins. For context, the USD/KRW rate in early 2024 was around 1,300 KRW per USD, a level generally supportive of exporters.

The shipbuilding industry is experiencing a 'super cycle,' marked by high newbuilding prices and extensive order backlogs, driven by demand for eco-friendly and specialized vessels. This environment, coupled with limited shipyard capacity, has led to significant price increases for large container vessels compared to pre-pandemic levels. HD Hyundai Mipo is capitalizing on this, securing numerous newbuilding orders that ensure stable future revenue.

| Economic Factor | 2024 Projection | 2025 Projection | Impact on HD Hyundai Mipo |

| World Merchandise Trade Volume Growth | Positive Growth | Continued Positive Growth | Increased demand for new vessels |

| Global GDP Growth | 3.2% (IMF April 2024) | Sustained Growth | Higher shipping activity, demand for fleet expansion |

| USD/KRW Exchange Rate | Around 1,300 KRW/USD (Early 2024) | Variable, but generally favorable for exporters | Enhanced profitability from dollar-denominated contracts |

Preview the Actual Deliverable

Hd Hyundai Mipo PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of HD Hyundai Mipo provides a deep dive into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic direction.

Sociological factors

The shipbuilding sector critically depends on a highly skilled workforce, making labor availability and skill sets a significant factor. South Korea's shipbuilding industry, including players like HD Hyundai Mipo, faces the challenge of ensuring a sufficient pool of qualified workers to maintain productivity and efficiency.

To counter potential labor shortages and enhance operational continuity, South Korean shipbuilders are actively implementing innovative solutions. For instance, the adoption of technologies that offer language support is a key strategy to better integrate foreign workers, thereby broadening the available talent pool and mitigating skill gaps.

Shipyards are seeing a significant push for better safety management. HD Hyundai Mipo is investing in digital tools, like its AI-powered HiCams system, to actively monitor and improve worker safety, aiming to prevent accidents before they happen.

Growing public awareness of environmental issues and a strong demand for sustainable business practices are increasingly pressuring companies like HD Hyundai Mipo to showcase robust corporate social responsibility (CSR). This societal shift means companies must actively demonstrate their commitment to ethical operations and environmental stewardship to maintain public trust and a positive brand image.

HD Hyundai Mipo's strategic emphasis on developing eco-friendly ship designs, such as those incorporating advanced hull coatings to reduce fuel consumption and emissions, directly addresses these evolving societal expectations. For instance, the company's ongoing investments in research and development for technologies like ammonia-fueled vessels highlight their proactive approach to meeting environmental regulations and consumer demand for greener shipping solutions.

Consumer Demand for Sustainable Practices

Consumer demand for sustainable shipping practices is a significant sociological driver impacting HD Hyundai Mipo. The growing preference for eco-friendly transportation solutions from cargo owners and end consumers directly translates into a stronger market for vessels powered by alternative fuels.

This societal shift is clearly visible in the orderbooks of shipbuilding companies. For instance, as of early 2024, container vessels represent the largest segment of orders for alternative-fueled ships, underscoring the influence of sustainability demands. This trend is expected to continue, with projections indicating a substantial increase in green vessel orders through 2025.

HD Hyundai Mipo is well-positioned to capitalize on this trend, as their focus on developing and delivering eco-friendly vessels aligns with evolving consumer expectations. The company’s investment in technologies like dual-fuel engines for LNG and methanol, as well as preparations for ammonia and hydrogen fuels, directly addresses this burgeoning market need.

- Growing Consumer Pressure: End consumers are increasingly scrutinizing the environmental footprint of products, extending to the shipping methods used.

- Cargo Owner Mandates: Major corporations are setting their own sustainability targets, requiring their logistics partners to utilize greener shipping options.

- Regulatory Alignment: Societal demand for sustainability often precedes and influences stricter environmental regulations, creating a proactive market for eco-friendly solutions.

- Market Share Growth: Companies like HD Hyundai Mipo that offer leading green technologies are likely to see increased market share as demand for sustainable shipping escalates through 2025.

Aging Workforce and Knowledge Transfer

The shipbuilding industry, including companies like HD Hyundai Mipo, is grappling with an aging workforce, a common issue in many heavy industries. This demographic shift poses a significant challenge to maintaining operational expertise and fostering innovation.

Effective knowledge transfer is crucial for HD Hyundai Mipo to ensure that the skills and experience of its seasoned employees are passed on to the next generation of workers. This process is vital for preserving the company's competitive edge and operational efficiency.

Attracting and retaining younger talent is equally important. For instance, in South Korea, the average age of workers in manufacturing sectors has been steadily increasing, highlighting the need for proactive recruitment strategies. HD Hyundai Mipo must invest in training programs and create an appealing work environment to secure a skilled workforce for the future.

- Aging Workforce: The average age of industrial workers in South Korea's manufacturing sector is rising, impacting sectors like shipbuilding.

- Knowledge Transfer Initiatives: Companies are implementing mentorship programs and digital archiving of technical knowledge to combat skill loss.

- Talent Attraction: Focus on vocational training and apprenticeships to bring in new, skilled labor.

- Innovation Impact: A younger workforce often brings fresh perspectives, crucial for adopting new technologies and improving processes in shipbuilding.

Societal expectations are increasingly shaping the shipbuilding industry, with a strong emphasis on environmental responsibility and worker safety. HD Hyundai Mipo is responding by investing in eco-friendly vessel technologies and advanced safety monitoring systems.

The demand for sustainable shipping solutions is growing, influencing order books for greener vessels. This trend is expected to continue, with companies like HD Hyundai Mipo, which focus on green technologies, poised for market share growth through 2025.

An aging workforce presents a challenge for HD Hyundai Mipo, necessitating robust knowledge transfer programs and strategies to attract younger talent. This focus on talent development is crucial for maintaining operational expertise and fostering innovation in the shipbuilding sector.

| Sociological Factor | Impact on HD Hyundai Mipo | Supporting Data/Trend (2024-2025) |

|---|---|---|

| Environmental Awareness & Sustainability Demand | Increased demand for eco-friendly vessels, influencing R&D and product offerings. | Projections indicate a substantial increase in green vessel orders through 2025; container vessels lead alternative-fueled ship orders as of early 2024. |

| Worker Safety & Well-being | Investment in advanced safety technologies to improve workplace conditions and prevent accidents. | HD Hyundai Mipo's AI-powered HiCams system actively monitors and enhances worker safety. |

| Demographic Shifts (Aging Workforce) | Need for effective knowledge transfer and new talent acquisition to maintain operational expertise. | The average age of workers in South Korea's manufacturing sector is rising, impacting skill availability. |

| Labor Availability & Skill Sets | Focus on integrating foreign workers and developing training programs to address potential labor shortages. | Adoption of language support technologies to integrate foreign workers; initiatives to attract younger talent through vocational training. |

Technological factors

The maritime sector is actively shifting towards cleaner energy sources, with a significant push for alternative fuels such as Liquefied Natural Gas (LNG), ammonia, hydrogen, and methanol. This transition is driven by the urgent need to curb greenhouse gas emissions and meet stricter environmental regulations.

HD Hyundai Mipo is strategically positioned to capitalize on this trend, leveraging its established expertise in constructing LNG dual-fuel vessels. Furthermore, the company's development of ammonia-ready carriers demonstrates its forward-thinking approach to accommodating future fuel technologies, a critical factor for shipowners navigating the evolving energy landscape.

HD Hyundai Mipo is heavily invested in digital transformation, aiming to create smart shipyards. Their Future of Shipyard (FOS) project integrates advanced technologies like AI, VR, and AR to boost efficiency and safety.

This digital push is designed to cut down shipbuilding times and improve overall productivity. For instance, by 2023, the company reported significant gains in operational efficiency through these smart technologies, though specific percentage increases are proprietary.

The adoption of automation and data-driven decision-making is central to their strategy, allowing for real-time monitoring and optimization of complex shipbuilding processes.

The shipbuilding industry, including HD Hyundai Mipo, is increasingly integrating robotics and automation to boost efficiency and cut costs. This shift aims to overcome labor shortages and improve the precision of complex tasks. For instance, automated welding systems can significantly speed up hull construction and ensure consistent quality.

HD Hyundai Mipo's commitment to this technological advancement is evident in its ongoing investments. In 2023, the company continued to explore and implement advanced robotic solutions, such as automated block assembly and painting systems. These investments are crucial for maintaining competitiveness in a global market that demands higher productivity and lower operational expenses.

Advanced Materials and Design

The shipbuilding industry, including HD Hyundai Mipo, is increasingly leveraging advanced materials like composites, aluminum alloys, and high-strength steels. These materials are crucial for enhancing vessel performance, extending durability, and significantly improving fuel efficiency. For instance, the adoption of lighter yet stronger materials can directly translate to reduced operational costs for shipowners.

HD Hyundai Mipo's strategic focus on high-efficiency ship designs inherently incorporates these material advancements. Their commitment to innovation in hull design and propulsion systems often goes hand-in-hand with the selection of cutting-edge materials. This integration is vital for meeting stricter environmental regulations and the growing demand for greener shipping solutions.

The impact of these technological factors is measurable. For example, advancements in materials can contribute to a fuel consumption reduction of up to 15-20% in new vessel designs compared to older models. This translates to substantial operational savings and a lower carbon footprint for the vessels HD Hyundai Mipo delivers.

- Material Innovation: Composites, aluminum alloys, and high-strength steels are key to improved vessel performance.

- Efficiency Focus: HD Hyundai Mipo integrates advanced materials into high-efficiency ship designs.

- Environmental Benefits: Lighter and stronger materials reduce fuel consumption and emissions.

- Cost Savings: Enhanced durability and fuel efficiency lead to lower long-term operational costs for clients.

Data Analytics and Predictive Maintenance

HD Hyundai Mipo is increasingly leveraging big data and AI to optimize operations. This includes developing smarter route solutions and enhancing process management across its shipbuilding and repair activities. The company is actively implementing predictive maintenance strategies to anticipate and address potential issues before they impact vessel performance or safety.

A key aspect of this technological push is the use of digital twin technology. By creating virtual replicas of ships, HD Hyundai Mipo can monitor vessels in real-time, allowing for early detection of anomalies and potential malfunctions. This proactive approach is designed to significantly improve overall safety standards and operational efficiency.

The integration of AI-based systems further strengthens these capabilities. These systems analyze vast amounts of data from sensors and operational logs to predict maintenance needs and optimize ship performance. For instance, AI can identify subtle changes in engine performance that might indicate an impending failure, enabling timely intervention.

- AI-driven route optimization is projected to reduce fuel consumption by up to 15% for commercial vessels by 2025, a benefit HD Hyundai Mipo can extend to its clients.

- Digital twin adoption in the shipbuilding industry is expected to cut design and testing costs by an average of 20% by 2026.

- Predictive maintenance in maritime operations has shown the potential to decrease unscheduled downtime by as much as 30%.

HD Hyundai Mipo is at the forefront of adopting advanced materials like composites and high-strength steels, crucial for enhancing vessel performance and fuel efficiency. Their focus on high-efficiency designs integrates these material advancements, contributing to potential fuel consumption reductions of up to 20% in new builds. This commitment to material innovation directly supports the industry's drive for greener shipping solutions.

The company is actively integrating big data and AI for operational optimization, including predictive maintenance and route solutions. The adoption of digital twin technology allows for real-time vessel monitoring and early anomaly detection, aiming to boost safety and efficiency. These AI-driven strategies are projected to improve fuel consumption and reduce downtime.

HD Hyundai Mipo's investment in smart shipyards, utilizing AI, VR, and AR through its FOS project, aims to significantly boost efficiency and safety. Automation and robotics are key to overcoming labor challenges and improving precision, with automated welding systems already enhancing hull construction speed and quality. These technological advancements are vital for maintaining competitiveness.

The maritime sector's shift to alternative fuels like LNG, ammonia, and methanol is a significant technological driver. HD Hyundai Mipo's expertise in LNG dual-fuel vessels and its development of ammonia-ready carriers position it to capitalize on this transition, meeting evolving environmental regulations and client demands for sustainable shipping.

| Technology Area | Impact | HD Hyundai Mipo's Focus |

|---|---|---|

| Advanced Materials | Improved performance, fuel efficiency (up to 20% reduction potential) | Integration into high-efficiency designs |

| AI & Big Data | Operational optimization, predictive maintenance, route solutions | Implementing AI for maintenance and process management |

| Digitalization (Smart Shipyards) | Increased efficiency, safety, reduced build times | FOS project with AI, VR, AR integration |

| Alternative Fuels | Environmental compliance, future-proofing vessels | Expertise in LNG dual-fuel, ammonia-ready carriers |

Legal factors

The International Maritime Organization (IMO) is rolling out significant new rules starting in 2025, aimed at making shipping greener, safer, and more efficient. These updates include much tighter controls on sulfur oxide (SOx) emissions, with a global cap of 0.5% sulfur content in fuel oil, down from 3.5%.

Furthermore, the IMO is strengthening ballast water management systems to prevent the spread of invasive aquatic species. By 2025, a substantial portion of the global fleet will need to comply with these advanced ballast water treatment standards, a critical step for marine ecosystem protection.

Additionally, there's a new mandate for reporting lost shipping containers overboard. In 2023 alone, over 1,600 containers were lost at sea, highlighting the urgent need for better tracking and reporting mechanisms to improve maritime safety and environmental awareness.

The EU Emissions Trading System (EU ETS) now encompasses the maritime sector, obligating ship operators to purchase and surrender emission allowances for their greenhouse gas output. This means companies like Hd Hyundai Mipo must factor in the cost of carbon emissions into their operational expenses and potentially their vessel pricing strategies.

Furthermore, FuelEU Maritime, set to take effect in January 2025, will impose stricter requirements on the greenhouse gas intensity of marine fuels used by ships visiting EU ports. This regulation will directly influence vessel design, pushing for greater adoption of cleaner fuels and potentially impacting the types of ships Hd Hyundai Mipo will prioritize in its order books, as seen with the increasing demand for LNG-powered vessels in 2024.

The upcoming enforcement of the Hong Kong International Convention for the Safe and Environmentally Sound Recycling of Ships in June 2025 will significantly impact shipbuilders like HD Hyundai Mipo. This convention mandates stringent standards for ship recycling, requiring a proactive approach to vessel design that considers the entire lifecycle, including end-of-life disposal.

This means HD Hyundai Mipo must integrate sustainable practices and material choices from the initial design stages to comply with the convention's requirements. Failure to adhere could result in penalties and affect the company's ability to operate globally in the maritime sector.

National Environmental Laws and Subsidies

South Korea's commitment to environmental protection is evident in its robust national environmental laws and proactive government initiatives. These policies are designed to steer the maritime industry towards sustainability, directly impacting shipbuilders like HD Hyundai Mipo.

The South Korean government actively promotes the construction and refitting of eco-friendly vessels through various subsidies and financial incentives. These programs are crucial for encouraging the adoption of greener technologies and practices within the shipbuilding sector, aligning with national environmental objectives.

For HD Hyundai Mipo, these legal and policy frameworks translate into a clear mandate to prioritize and invest in environmentally conscious shipbuilding solutions. This strategic focus is essential for remaining competitive and compliant in a rapidly evolving regulatory landscape.

- Green Ship Subsidies: South Korea offers financial support for building and retrofitting ships that meet stringent environmental standards, encouraging innovation in low-emission technologies.

- Emission Reduction Targets: National laws often include targets for reducing greenhouse gas emissions from shipping, pushing companies to adopt cleaner fuels and designs.

- International Compliance: Korean environmental laws frequently align with international maritime regulations, such as those from the International Maritime Organization (IMO), ensuring global market access.

- R&D Support: Government funding is often available for research and development into advanced eco-friendly shipbuilding technologies, fostering a competitive edge for domestic firms.

Labor Laws and Regulations

HD Hyundai Mipo must navigate a complex web of national and international labor laws. This includes strict adherence to South Korean labor standards, as well as international maritime labor conventions that govern working conditions and safety for seafarers, even for land-based shipyard workers involved in global operations. Failure to comply can lead to significant fines and operational disruptions.

Compliance directly affects operational costs. For instance, South Korea's minimum wage increased by 2.5% to 9,860 KRW per hour in 2024, impacting labor expenses. Furthermore, regulations concerning worker safety, such as those mandated by the Occupational Safety and Health Act, require ongoing investment in training and equipment to prevent accidents, which are particularly critical in the hazardous shipbuilding environment.

The company's reputation is also intrinsically linked to its labor practices. Positive labor relations and a strong safety record can enhance its standing with clients and potential employees. Conversely, reports of labor law violations or poor working conditions, such as those that might arise from issues with overtime pay or workplace discrimination, can damage brand image and deter skilled labor. In 2023, South Korea saw a notable increase in labor disputes, highlighting the importance of proactive engagement with workforce concerns.

International regulations are increasingly shaping the maritime industry, demanding stricter environmental compliance from shipbuilders like HD Hyundai Mipo. The International Maritime Organization's (IMO) 2025 sulfur cap of 0.5% and enhanced ballast water management standards necessitate advanced vessel designs and technologies. Furthermore, the EU Emissions Trading System (ETS) and FuelEU Maritime regulations, effective from 2025, directly impact operational costs and fuel choices, pushing for greener solutions.

The upcoming enforcement of the Hong Kong Convention in June 2025 mandates responsible ship recycling, requiring HD Hyundai Mipo to consider lifecycle sustainability in its designs. South Korea's national environmental laws and government incentives, such as green ship subsidies, further encourage the adoption of eco-friendly shipbuilding. These legal frameworks underscore a growing global emphasis on sustainability within the maritime sector.

Environmental factors

The global maritime industry is under immense pressure to decarbonize, with organizations like the International Maritime Organization (IMO) and various regional authorities setting stringent targets for reducing greenhouse gas emissions. These regulations are fundamentally reshaping shipbuilding, pushing for innovation in fuel efficiency and alternative propulsion systems.

HD Hyundai Mipo is actively responding to this environmental imperative by prioritizing the design and construction of eco-friendly vessels. Their commitment to high-efficiency ship designs, including those utilizing liquefied natural gas (LNG) and exploring ammonia and methanol-fueled options, directly tackles the industry's need to cut its carbon footprint. For instance, in 2023, HD Hyundai Mipo secured orders for several LNG-fueled container ships, a clear indicator of their strategic alignment with decarbonization trends.

The global push for decarbonization is accelerating the adoption of alternative fuels such as Liquefied Natural Gas (LNG), methanol, and ammonia in the maritime sector. This shift is driven by stringent environmental regulations and a growing demand for sustainable shipping solutions.

HD Hyundai Mipo's expertise in constructing vessels capable of operating on these cleaner fuels positions them favorably to meet evolving environmental mandates. For instance, the International Maritime Organization's (IMO) 2023 greenhouse gas strategy aims for net-zero emissions by or around 2050, making dual-fuel vessels increasingly essential.

The company's investment in developing dual-fuel engine technology and shipbuilding capabilities for methanol-powered carriers, for example, directly addresses this market trend. By 2024, orders for methanol-fueled container ships have surged, with major shipping lines committing to the fuel, underscoring the strategic importance of HD Hyundai Mipo's offerings.

Stricter environmental regulations, particularly concerning sulfur oxides (SOx) and particulate matter (PM) emissions, are significantly impacting the shipbuilding industry. These rules compel shipyards like HD Hyundai Mipo to integrate advanced pollution control technologies. For instance, the International Maritime Organization's (IMO) 2020 regulation, which capped sulfur content in marine fuel at 0.5%, drove demand for scrubbers and alternative fuels.

HD Hyundai Mipo's vessel designs must now proactively incorporate exhaust gas cleaning systems, commonly known as scrubbers, or be engineered to utilize compliant low-sulfur fuels. This adaptation is crucial for ensuring that the vessels they build can operate globally without facing penalties or being denied port access, directly affecting their competitiveness and marketability.

Ballast Water Management

Amendments to the Ballast Water Management Convention, effective February 2025, will mandate stricter ballast water treatment and reporting to curb invasive species spread. This regulatory shift is driving significant investment in advanced ballast water treatment systems for both new builds and retrofits. For instance, the global ballast water treatment systems market was valued at approximately USD 5.5 billion in 2023 and is projected to reach over USD 10 billion by 2030, indicating substantial growth opportunities.

These upcoming regulations mean shipyards like Hd Hyundai Mipo must integrate compliant treatment technologies. This includes systems utilizing UV, electrolysis, or filtration methods. The industry faces a substantial undertaking, with estimates suggesting that over 60,000 vessels worldwide will require ballast water treatment system installations or upgrades in the coming years, presenting both a challenge and a market opportunity.

The environmental imperative to protect marine ecosystems from invasive species is paramount. The International Maritime Organization (IMO) estimates that around 10 billion tons of ballast water are transferred globally each year. Effective management systems are crucial to mitigate the ecological and economic damage caused by these introductions, which can disrupt local biodiversity and impact industries like fisheries.

- Regulatory Compliance: Upcoming IMO amendments effective February 2025 require advanced ballast water treatment systems.

- Market Growth: The global ballast water treatment systems market is expected to grow significantly, reaching over USD 10 billion by 2030.

- Technological Integration: Shipyards need to incorporate technologies like UV, electrolysis, and filtration into vessel designs and retrofits.

- Environmental Impact: An estimated 10 billion tons of ballast water are transferred annually, necessitating robust management to prevent invasive species spread.

Sustainable Materials and Waste Management

The shipbuilding sector is increasingly prioritizing sustainable materials and enhanced waste management. This trend is driven by a global push for reduced environmental impact across a vessel's entire lifecycle, from initial construction to eventual decommissioning and recycling. For instance, the International Maritime Organization's (IMO) 2023 strategy aims to achieve net-zero greenhouse gas emissions from international shipping by or around 2050, directly influencing material choices and waste disposal methods. Shipbuilders are exploring materials with lower embodied carbon and greater recyclability, alongside implementing advanced systems to manage hazardous and non-hazardous waste generated during production and operation.

Key initiatives and considerations include:

- Material Selection: Focus on materials like advanced composites and recycled metals that offer durability and a smaller ecological footprint.

- Waste Reduction: Implementing stricter protocols for minimizing waste generation during the manufacturing process, with a target of reducing landfill waste by 20% by 2028 in many leading shipyards.

- Hazardous Waste Management: Developing specialized procedures for the safe handling, treatment, and disposal of hazardous substances, adhering to regulations like the IMO's Ballast Water Management Convention.

- End-of-Life Planning: Designing vessels with their eventual recycling in mind, ensuring that materials can be easily separated and repurposed, contributing to a circular economy in shipbuilding.

The maritime industry's environmental focus is intensifying, with strict regulations mandating decarbonization and cleaner operations. HD Hyundai Mipo is strategically positioned to meet these demands by specializing in eco-friendly vessel designs, including those powered by LNG, methanol, and ammonia. The company's proactive investment in dual-fuel technologies and efficient hull designs directly addresses the global push for reduced emissions, aligning with targets like the IMO's 2050 net-zero goal.

Stricter environmental rules, such as the IMO's 2020 sulfur cap, necessitate advanced pollution control systems like scrubbers or the use of low-sulfur fuels. Furthermore, upcoming amendments to the Ballast Water Management Convention, effective February 2025, will require sophisticated treatment systems to prevent the spread of invasive species. The market for these systems is substantial, projected to exceed USD 10 billion by 2030, presenting a significant opportunity for shipyards capable of integrating such technologies.

| Environmental Factor | Impact on HD Hyundai Mipo | Key Data/Regulations |

|---|---|---|

| Decarbonization & Emissions Reduction | Drives demand for eco-friendly vessel designs and alternative fuel capabilities. | IMO 2050 Net-Zero target; Orders for LNG-fueled ships in 2023. |

| Fuel Regulations (Sulfur Caps) | Requires integration of scrubbers or use of low-sulfur fuels in vessel construction. | IMO 2020 sulfur cap (0.5% sulfur content). |

| Ballast Water Management | Mandates inclusion of advanced ballast water treatment systems in new builds and retrofits. | IMO Ballast Water Management Convention amendments effective Feb 2025; Global market for treatment systems projected to exceed USD 10 billion by 2030. |

| Sustainable Materials & Waste Management | Encourages use of eco-friendly materials and efficient waste reduction protocols. | IMO 2023 strategy influencing material choices; Target of 20% landfill waste reduction by 2028 in leading shipyards. |

PESTLE Analysis Data Sources

Our HD Hyundai Mipo PESTLE analysis is built on a robust foundation of data, drawing from official maritime industry reports, global economic indicators, and environmental regulatory updates. We leverage insights from shipbuilding market research firms and geopolitical analyses to ensure comprehensive coverage.