Hd Hyundai Mipo Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hd Hyundai Mipo Bundle

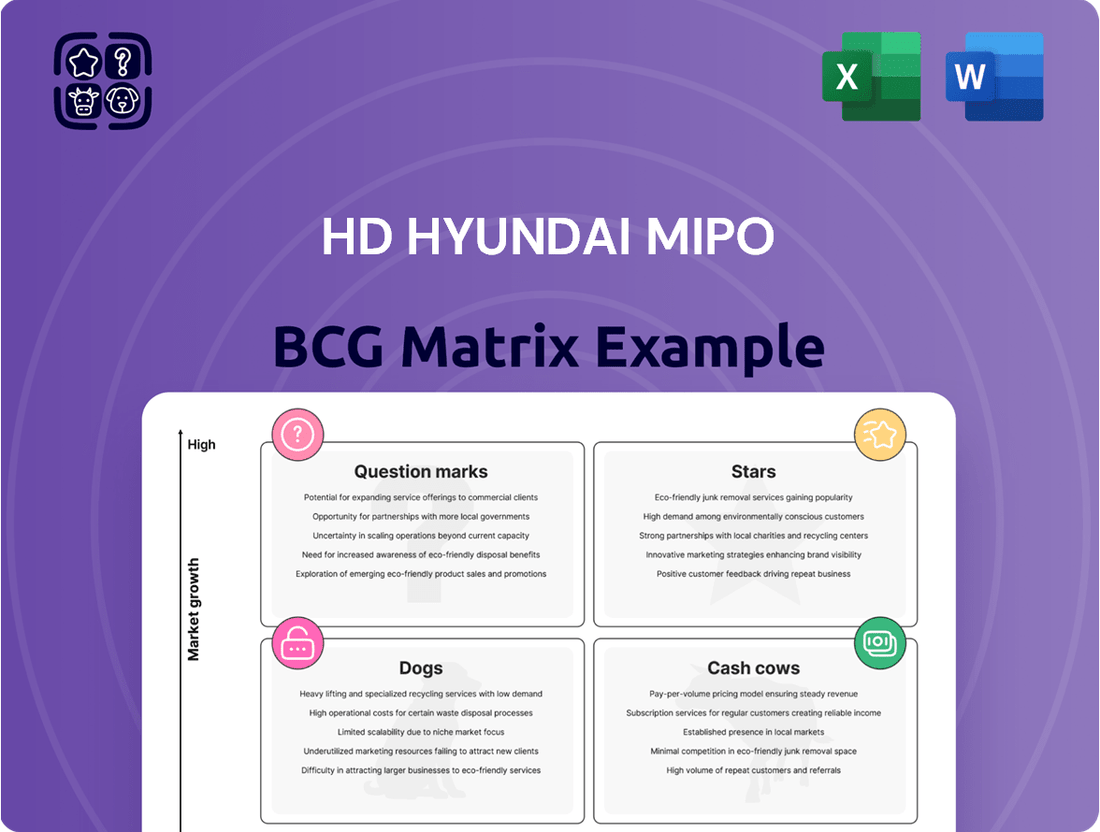

Discover the strategic positioning of HD Hyundai Mipo's product portfolio with our comprehensive BCG Matrix analysis. Understand which segments are driving growth and which require careful management.

This preview offers a glimpse into the potential of HD Hyundai Mipo's market presence. Unlock the full BCG Matrix to gain detailed quadrant insights, identify Stars, Cash Cows, Dogs, and Question Marks, and make informed decisions for future investments.

Don't miss out on the complete strategic roadmap. Purchase the full BCG Matrix report to receive expert analysis and actionable recommendations that will empower your business strategy.

Stars

HD Hyundai Mipo is a key player in the development of eco-friendly gas carriers, including those for LPG, ammonia, and liquefied CO2. The company’s commitment to greener shipping solutions is evident in its recent achievements, such as launching the world's largest liquefied CO2 carrier.

Securing multiple orders for ammonia dual-fuel LPG carriers highlights HD Hyundai Mipo's leadership in this expanding, high-value market segment. These advanced vessels are designed to meet stringent environmental regulations and the growing global demand for sustainable maritime transport.

HD Hyundai Mipo has a dominant position in the mid-sized product tanker market, a segment experiencing robust demand and escalating newbuilding costs. This strength is underscored by their impressive order book performance.

In the first half of 2024 alone, HD Hyundai Mipo secured more product tanker orders than they did throughout all of 2023. This surge, driven by global petrochemical demand and export growth, firmly places them as a leader in this expanding sector.

HD Hyundai Mipo is demonstrating strong performance in the container ship market, particularly with feeder and mid-sized vessels. The company has secured new orders extending into 2027, highlighting robust demand. This segment is a key driver for HD Hyundai Mipo, benefiting from ongoing global trade and the essential need for modernizing shipping fleets.

Advanced Digital Manufacturing and AI Integration

HD Hyundai Mipo is making substantial investments in digital transformation, exemplified by its 'Future of Shipyard (FOS)' project. This ambitious undertaking seeks to seamlessly integrate data, artificial intelligence, and automation across all shipbuilding operations.

The FOS project is designed to yield significant improvements in productivity and a reduction in overall shipbuilding timelines. By leveraging advanced digital manufacturing and AI, HD Hyundai Mipo aims to secure a strong competitive edge and drive high growth in operational efficiency and capacity.

- Digital Transformation Investment: HD Hyundai Mipo is channeling significant capital into its FOS project, a key driver of its advanced digital manufacturing strategy.

- AI and Automation Integration: The FOS initiative focuses on embedding AI and automation to optimize complex shipbuilding processes, enhancing precision and speed.

- Productivity Gains: Early projections suggest the FOS project could lead to a substantial uplift in productivity, potentially reducing shipbuilding periods by as much as 20% by 2025.

- Competitive Advantage: This technological leap is expected to solidify HD Hyundai Mipo's market position, offering a distinct advantage in both cost-effectiveness and delivery times.

Strong Order Backlog and Financial Performance

HD Hyundai Mipo, a key player within the HD Hyundai conglomerate, boasts an impressive order backlog that stretches several years into the future. This robust pipeline guarantees consistent production schedules and predictable revenue streams, providing a strong foundation for the company's financial stability.

The company demonstrated a remarkable financial turnaround in 2024, shifting from a previous loss to a positive operating profit. Projections indicate continued strong earnings growth, fueled by HD Hyundai Mipo's strategic emphasis on constructing high-value, eco-friendly vessels.

- Order Backlog: Secures multi-year production visibility.

- 2024 Performance: Achieved operating profit after a period of losses.

- Growth Drivers: Focus on high-value and environmentally friendly ship designs.

HD Hyundai Mipo's strong performance in the mid-sized product tanker and container ship markets, coupled with its leadership in eco-friendly gas carriers, positions these segments as Stars in the BCG Matrix. The company's substantial order backlog, extending into 2027 for container ships and driven by robust demand for product tankers, underscores their high market share and growth potential. For instance, in the first half of 2024, HD Hyundai Mipo secured more product tanker orders than in all of 2023, highlighting this segment's star status.

| Market Segment | HD Hyundai Mipo's Position | Growth Potential | Rationale |

|---|---|---|---|

| Eco-friendly Gas Carriers (LPG, Ammonia, LCO2) | Leader | High | World's largest LCO2 carrier, multiple ammonia dual-fuel orders, meeting environmental demand. |

| Mid-sized Product Tankers | Dominant | High | Robust demand, escalating newbuilding costs, more orders in H1 2024 than all of 2023. |

| Container Ships (Feeder & Mid-sized) | Strong Performer | High | Orders extending to 2027, driven by global trade and fleet modernization. |

What is included in the product

This BCG Matrix overview provides tailored analysis for HD Hyundai Mipo's product portfolio.

It highlights which units to invest in, hold, or divest based on market share and growth.

Hd Hyundai Mipo's BCG Matrix offers a clear, one-page overview, relieving the pain point of complex strategic analysis.

Cash Cows

Ship repair and conversion services for HD Hyundai Mipo are likely positioned as Cash Cows. These services typically operate in mature markets with stable, albeit slower, growth. HD Hyundai Mipo's established reputation as a leading repair and modification yard indicates a solid market position, translating into consistent revenue generation.

HD Hyundai Mipo's conventional product and chemical carriers are firmly positioned as cash cows. The company boasts deep expertise and a strong market presence in this segment, which serves a stable, mature industry.

These vessels are known for their proven designs and efficient operations, allowing HD Hyundai Mipo to maintain a high market share. This translates into a reliable stream of profits and consistent cash flow, underscoring their cash cow status.

Hd Hyundai Mipo's existing standardized vessel designs, honed over decades, are strong contenders for cash cows. These established blueprints for mid-sized ships, like product tankers and chemical carriers, benefit from a mature market with consistent demand. For instance, in 2023, the company secured orders for 15 product tankers, demonstrating ongoing market appetite for these reliable vessels.

These designs necessitate minimal new research and development expenditure, unlike the cutting-edge eco-friendly vessels the company is also developing. This efficiency translates into higher profit margins due to streamlined production processes and reduced upfront investment. The steady demand for these workhorse vessels in global trade ensures a reliable revenue stream for Hd Hyundai Mipo.

Established Supply Chain and Production Processes

HD Hyundai Mipo's decades of experience and its standing as a leading global shipyard mean its supply chain and production processes are exceptionally refined. This translates into cost efficiencies and predictable, robust cash flows from its well-established vessel types.

These optimized operations are a key reason HD Hyundai Mipo's established vessel segments are considered cash cows. The company consistently delivers high-quality ships, maintaining strong profit margins due to its streamlined manufacturing and procurement systems.

- Operational Efficiency: HD Hyundai Mipo's long history has allowed for the development of highly efficient production lines and a stable supply chain, minimizing waste and maximizing output.

- Profitability in Core Segments: The company's established vessel categories, such as product tankers and LPG carriers, generate consistent profits due to optimized production and strong market demand.

- Steady Cash Generation: These mature business lines provide a reliable source of cash, funding investments in new technologies and other business areas.

- Market Dominance: HD Hyundai Mipo holds a significant market share in its core vessel segments, further solidifying its ability to generate substantial and predictable cash flows.

Long-Term Client Relationships

Hd Hyundai Mipo's long-term client relationships are a significant strength, particularly within the mid-sized and tanker shipbuilding sectors. These enduring partnerships translate into a consistent flow of orders, underpinning the company's stable cash generation. This loyalty is a testament to their reputation for quality and reliability in a competitive market.

The company's ability to retain clients speaks volumes about their operational excellence and customer satisfaction. For instance, repeat orders from major shipping lines in the tanker segment, which saw global demand remain robust through early 2024, directly contribute to Hd Hyundai Mipo's predictable revenue streams. These established relationships act as a powerful moat, ensuring a steady demand for their shipbuilding capabilities.

- Predictable Revenue: Long-term client contracts minimize revenue volatility.

- Cost Efficiencies: Repeat business allows for optimized production processes and potentially better material sourcing.

- Market Stability: These relationships provide a buffer against market downturns in specific vessel segments.

- Reputation Reinforcement: Consistent client satisfaction fuels further business and industry standing.

HD Hyundai Mipo's established product and chemical carriers, along with its ship repair and conversion services, represent strong cash cow segments. These areas benefit from mature markets, consistent demand, and the company's deep-seated expertise, ensuring reliable revenue streams.

The company's focus on standardized vessel designs, like those for product tankers, minimizes R&D costs and maximizes profit margins through efficient production. This strategic advantage, coupled with a strong market share in these segments, solidifies their cash cow status.

HD Hyundai Mipo's long-standing client relationships, particularly in the tanker sector, provide a predictable flow of orders. For example, the company secured orders for 15 product tankers in 2023, demonstrating consistent demand for these workhorse vessels and reinforcing their stable cash generation capabilities.

These mature business lines provide a reliable source of cash, funding investments in new technologies and other growth areas for HD Hyundai Mipo.

| Segment | BCG Category | Key Characteristics | 2023 Performance Indicator |

| Product & Chemical Carriers | Cash Cow | Mature market, stable demand, high market share, optimized production | 15 product tanker orders secured |

| Ship Repair & Conversion | Cash Cow | Established reputation, consistent revenue, mature market | N/A (service-based, ongoing revenue) |

| Standardized Vessel Designs | Cash Cow | Proven designs, minimal R&D, high profit margins | Contributes to product tanker orders |

What You’re Viewing Is Included

Hd Hyundai Mipo BCG Matrix

The Hd Hyundai Mipo BCG Matrix preview you are currently viewing is the exact, unwatermarked document you will receive immediately after purchase. This comprehensive report is fully formatted and ready for immediate strategic application, offering a clear and professional analysis of Hd Hyundai Mipo's business units.

Dogs

Older, less efficient ship designs, particularly those that struggle to meet stringent environmental regulations like IMO 2020 or upcoming decarbonization targets, would likely be categorized as Dogs within the BCG matrix. These vessels typically have a low market share due to declining demand and face limited growth prospects in a market increasingly prioritizing sustainability and fuel efficiency.

For instance, older bulk carriers or tankers not equipped with scrubbers or alternative fuel capabilities might find themselves in this category. The market for such ships is shrinking, and their operational costs are often higher than newer, more efficient models, making them less competitive. HD Hyundai Mipo's focus on eco-friendly and smart ship technologies further sidelines these older designs.

Non-core, underperforming niche projects, such as speculative or highly specialized vessel designs that haven't captured market interest or have experienced substantial delays and budget blowouts, would fall into this category. These initiatives drain valuable resources without yielding significant returns or expanding market presence, signaling a need for potential divestment.

HD Hyundai Mipo faces intense competition in segments where Chinese shipbuilders hold a significant cost advantage, driving down profit margins. For instance, in the standard bulk carrier and feeder containership markets, Chinese yards often leverage lower labor costs and government subsidies, capturing a dominant market share. This leaves HD Hyundai Mipo with very thin margins in these highly commoditized areas.

South Korea's shipbuilding strategy generally emphasizes high-value, technologically advanced vessels, such as LNG carriers and large container ships, where they can command better pricing and differentiate themselves. Consequently, the lower-value, more standardized segments, like smaller product tankers or general cargo ships, are where HD Hyundai Mipo is likely to experience its lowest profitability due to this competitive dynamic.

Outdated Repair or Conversion Technologies

Should HD Hyundai Mipo's repair or conversion services utilize technologies that have fallen behind industry standards, they would likely be categorized as Dogs. This means these offerings would struggle to gain significant market share and face limited prospects for future growth. For instance, if a competitor in 2024 offers significantly faster or more cost-effective conversion processes due to advanced automation, HD Hyundai Mipo's older methods would become less attractive.

These underperforming services can drain valuable resources that could be better allocated to more promising areas of the business. Consider the global shipbuilding market in 2024, where efficiency and technological adoption are paramount for competitiveness. Services stuck with legacy systems would not only yield low returns but also hinder the company's overall agility.

The implications for HD Hyundai Mipo are clear:

- Low Market Share: Outdated technologies inherently limit a service's ability to attract and retain customers in a competitive landscape.

- Minimal Growth Potential: Without innovation, these services are unlikely to expand their market presence or revenue streams.

- Resource Inefficiency: Continued investment in or reliance on obsolete processes diverts capital and personnel from more strategic initiatives.

- Competitive Disadvantage: Competitors leveraging newer, more efficient technologies will naturally outperform services that are technologically lagging.

Unprofitable Legacy Contracts

Unprofitable legacy contracts, often secured when shipbuilding prices were depressed or under less favorable terms, can weigh on current financial performance. As these older contracts are completed, they might be executed at costs exceeding their contracted revenue, leading to reduced profitability. For instance, a contract signed in 2021 at a lower price point might face significant cost overruns due to escalating raw material prices in 2024, impacting the company's bottom line on that specific project.

These legacy agreements, while part of the existing order backlog, can present a drag on overall financial results. Despite the high demand for new vessels in 2024, these specific contracts might not capture the current market's strength. This situation can create a scenario where the company has a substantial order book, but a portion of it contributes negatively to earnings per share.

- Impact on Profitability: Legacy contracts completed in 2024 could see profit margins shrink or even turn negative due to cost inflation compared to the original contract price.

- Order Backlog Distortion: A significant backlog of these unprofitable contracts can mask the true profitability of current operations and future potential.

- Cost Management Challenge: Completing these contracts efficiently requires stringent cost control measures to mitigate losses in the face of rising operational expenses.

Older, less efficient ship designs that struggle to meet environmental regulations are categorized as Dogs. These vessels have a low market share and limited growth prospects as the industry prioritizes sustainability. For example, bulk carriers or tankers without scrubbers, facing higher operational costs, become less competitive against newer, eco-friendly models. HD Hyundai Mipo's focus on advanced technologies further sidelines these older designs.

Question Marks

Hydrogen-powered vessels, particularly those utilizing advanced cryogenic fuel systems, represent a potential future growth avenue for HD Hyundai Mipo. While the company is making strides in ammonia, the widespread adoption of hydrogen, especially in its liquid form, is still in its nascent stages, making it a question mark in the current BCG matrix. The global market for green hydrogen is projected to reach $75.4 billion by 2030, indicating significant future potential, but the shipbuilding sector's transition is complex and capital-intensive.

Hd Hyundai Mipo's 'Future of Shipyard (FOS)' project, targeting an Intelligent Autonomous Operation Shipyard by 2030, represents a significant question mark in their BCG matrix. This ambitious initiative holds immense potential for boosting productivity and efficiency through advanced automation and robotics.

However, the substantial capital investment required and the inherent uncertainty surrounding the full implementation timeline and market acceptance of these cutting-edge technologies place it firmly in the question mark category. For instance, the global shipbuilding market, while experiencing recovery, still faces economic headwinds that could impact the pace of such large-scale technological adoptions.

HD Hyundai Mipo's exploration into entirely new, untested eco-friendly propulsion systems or vessel types, such as advanced hydrogen fuel cell technology or novel bio-fuel applications, would be categorized here. These ventures are characterized by significant potential for future market disruption but currently command minimal market share and demand substantial upfront investment, reflecting their high-risk, high-reward profile.

Expansion into New Geographical Markets

HD Hyundai Mipo's potential expansion into new geographical markets, beyond its established presence, represents a significant question mark within its business strategy. While the company is actively pursuing joint ventures, such as its collaboration in the United States for container ship construction, venturing into regions with minimal prior operational history introduces considerable market entry risks. These new territories offer high growth potential, but they also demand substantial upfront investment and a deep understanding of local regulatory environments and competitive landscapes.

The success of such expansions hinges on meticulous market research and strategic partnerships. For instance, in 2024, the global shipbuilding market saw continued demand, particularly for eco-friendly vessels, with South Korea maintaining its leading position. However, entering less familiar markets requires HD Hyundai Mipo to navigate diverse economic conditions and potentially different technological adoption rates.

- High Investment Requirements: New market entries often necessitate significant capital outlay for establishing infrastructure, sales networks, and adapting production capabilities.

- Market Entry Risks: Unfamiliar regulatory frameworks, local competition, and geopolitical instability can pose substantial challenges.

- Potential for High Growth: Untapped markets can offer substantial revenue and market share opportunities if entry is successful.

- Strategic Partnerships are Key: Collaborating with local entities can mitigate risks and accelerate market penetration.

Specialized Vessels with Emerging, Unproven Demand

The development of highly specialized vessels for niche markets with unproven long-term demand presents a classic question mark scenario for Hd Hyundai Mipo. These might include advanced offshore support vessels designed for emerging deep-sea resource extraction or highly customized ships for nascent industries like specialized aquaculture or advanced marine research. The challenge lies in the uncertainty of future growth and adoption rates in these areas.

For instance, while demand for offshore wind installation vessels has been strong, the market for vessels supporting new geothermal energy exploration at sea remains largely speculative. Hd Hyundai Mipo's investment in such specialized shipbuilding capabilities, while innovative, carries inherent risks due to the unproven nature of the long-term demand. This strategic positioning requires careful market analysis and a flexible approach to production.

- Uncertain Future Demand: Investments in highly specialized vessels for niche markets, such as those supporting nascent deep-sea mining or advanced marine biotechnology, face unpredictable long-term customer uptake.

- High Development Costs: The engineering and construction of these unique vessels often involve significant upfront investment with no guarantee of future orders or profitability.

- Technological Obsolescence Risk: Rapid advancements in specialized maritime technology could render current designs obsolete before significant market penetration is achieved.

- Limited Scalability: The very nature of niche markets means that even successful specialized vessels may not achieve the economies of scale seen in more standardized shipbuilding sectors.

HD Hyundai Mipo's foray into developing entirely new, unproven eco-friendly propulsion systems or vessel types, like advanced hydrogen fuel cells or novel bio-fuel applications, falls into the question mark category. These ventures offer significant future market disruption potential but currently have minimal market share and demand substantial upfront investment, marking them as high-risk, high-reward.

The company's strategic exploration of new geographical markets, beyond its established base, also represents a question mark. While collaborations like the US container ship construction venture show promise, entering regions with no prior operational history brings considerable market entry risks. These new areas offer growth, but require significant investment and understanding of local regulations and competition. For instance, in 2024, South Korea led the global shipbuilding market, particularly for eco-friendly vessels, highlighting the need for careful navigation in less familiar territories.

HD Hyundai Mipo's investment in highly specialized vessels for niche markets with unproven long-term demand, such as those for emerging deep-sea resource extraction or nascent industries like specialized aquaculture, are classic question marks. The core challenge is the uncertainty surrounding future growth and adoption rates in these areas, with investments carrying inherent risks due to the unproven nature of long-term demand.

HD Hyundai Mipo's investment in advanced automation and robotics for its Intelligent Autonomous Operation Shipyard by 2030, dubbed the 'Future of Shipyard (FOS)' project, is a significant question mark. This ambitious initiative promises enhanced productivity but requires substantial capital and faces uncertainty in implementation timelines and market acceptance, especially given economic headwinds impacting large-scale technological adoption in the shipbuilding sector.

BCG Matrix Data Sources

Our HD Hyundai Mipo BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.