Hd Hyundai Mipo Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hd Hyundai Mipo Bundle

Hd Hyundai Mipo navigates a competitive shipbuilding landscape where supplier power is moderate due to specialized materials, while buyer power is significant, driven by large, discerning clients seeking cost-effectiveness. The threat of new entrants is relatively low, given the high capital investment and technological expertise required. The intensity of rivalry is high, with established players vying for market share through innovation and efficiency.

The complete report reveals the real forces shaping Hd Hyundai Mipo’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The shipbuilding sector, including companies like HD Hyundai Mipo, often faces a concentrated supplier base for essential components. For instance, the marine engine market is dominated by a few key global players. Companies such as MAN Energy Solutions and Wärtsilä are critical suppliers, meaning their ability to dictate terms can be substantial. This limited competition among suppliers for high-value, specialized parts grants them considerable leverage.

Raw material price volatility, especially for steel, significantly impacts HD Hyundai Mipo's production costs. While steel plate prices experienced a downward trend in early 2024, forecasts suggest an upward movement heading into 2025, which could squeeze shipyard profit margins.

The global steel for shipbuilding market is anticipated to expand, fueled by the persistent demand for new vessels, indicating a growing need for this essential input. This market growth, however, also points to potential future price pressures as demand intensifies.

Switching between major marine engine suppliers or other specialized component providers can involve significant costs and complexities for shipbuilders like HD Hyundai Mipo. These costs can include re-engineering vessel designs to accommodate new components, retraining technical staff on different systems, and potentially undergoing new certification processes for the modified ships. For instance, a major engine change could necessitate alterations to the engine room layout, cooling systems, and fuel lines, all of which add substantial expense and time to the shipbuilding process.

Technological Specialization of Suppliers

Suppliers offering cutting-edge eco-friendly technologies, like dual-fuel engines for LNG or ammonia, wield considerable influence. This is driven by shipbuilders’ urgent need to comply with increasingly stringent environmental regulations. HD Hyundai Mipo's commitment to building vessels equipped with these advanced propulsion systems directly increases its dependence on these specialized providers.

For instance, the demand for dual-fuel engines, crucial for meeting IMO 2030 targets and beyond, has seen significant growth. In 2024, orders for vessels capable of running on alternative fuels like LNG and methanol are projected to continue their upward trend, underscoring the strategic importance of suppliers mastering these technologies.

- Technological Dependency: HD Hyundai Mipo's investment in eco-friendly vessel construction necessitates reliance on suppliers with specialized, advanced technological capabilities in areas such as dual-fuel engine systems.

- Regulatory Compliance: The global push for decarbonization in shipping, driven by regulations like those from the International Maritime Organization (IMO), elevates the bargaining power of suppliers providing compliant technologies.

- Market Demand for Green Shipping: Growing customer demand for environmentally conscious shipping solutions further strengthens the position of suppliers who can deliver innovative, sustainable propulsion technologies.

Supplier's Forward Integration Threat

While forward integration by suppliers into shipbuilding is a less common threat for HD Hyundai Mipo, large, diversified suppliers could theoretically pursue this. The immense capital required and the highly specialized nature of shipbuilding present significant barriers to entry, making this a challenging strategy for most suppliers.

However, the landscape is nuanced. Some key engine manufacturers, for instance, are part of larger industrial conglomerates. These conglomerates possess substantial financial resources and existing operational expertise, which could potentially lower the barriers for them to consider forward integration.

- Capital Intensity: Shipbuilding requires billions in investment for facilities, technology, and workforce, a significant hurdle for most suppliers.

- Specialized Expertise: The complex engineering, design, and manufacturing processes involved in shipbuilding demand unique skills not typically found in component suppliers.

- Conglomerate Advantage: Major engine suppliers belonging to diversified industrial groups may have a more feasible path to integration due to existing scale and resources.

Suppliers of critical, specialized components for HD Hyundai Mipo, particularly marine engines and advanced eco-friendly technologies, hold significant bargaining power. This is amplified by the limited number of dominant global players in these niche markets, such as MAN Energy Solutions and Wärtsilä, who can dictate terms due to the high switching costs for shipbuilders.

The increasing demand for vessels compliant with stringent environmental regulations, like those mandating dual-fuel engines, further strengthens the hand of suppliers offering these cutting-edge solutions. For instance, orders for LNG and methanol-fueled vessels are projected to rise through 2024 and into 2025, making these suppliers indispensable.

While forward integration by suppliers into shipbuilding is a low probability due to the immense capital and specialized expertise required, large industrial conglomerates with existing resources could pose a theoretical challenge. However, the inherent barriers remain substantial for most component manufacturers.

| Supplier Type | Key Players | Bargaining Power Drivers | Impact on HD Hyundai Mipo |

|---|---|---|---|

| Marine Engines | MAN Energy Solutions, Wärtsilä | Concentrated market, high switching costs, technological specialization | Higher component costs, potential delays if supply is constrained |

| Eco-Friendly Propulsion Systems | Various specialized firms | Regulatory compliance demand, technological innovation | Increased reliance on specific suppliers, potential for price premiums |

| Steel for Shipbuilding | Global steel producers | Raw material price volatility, market demand | Fluctuating production costs, potential margin squeeze |

What is included in the product

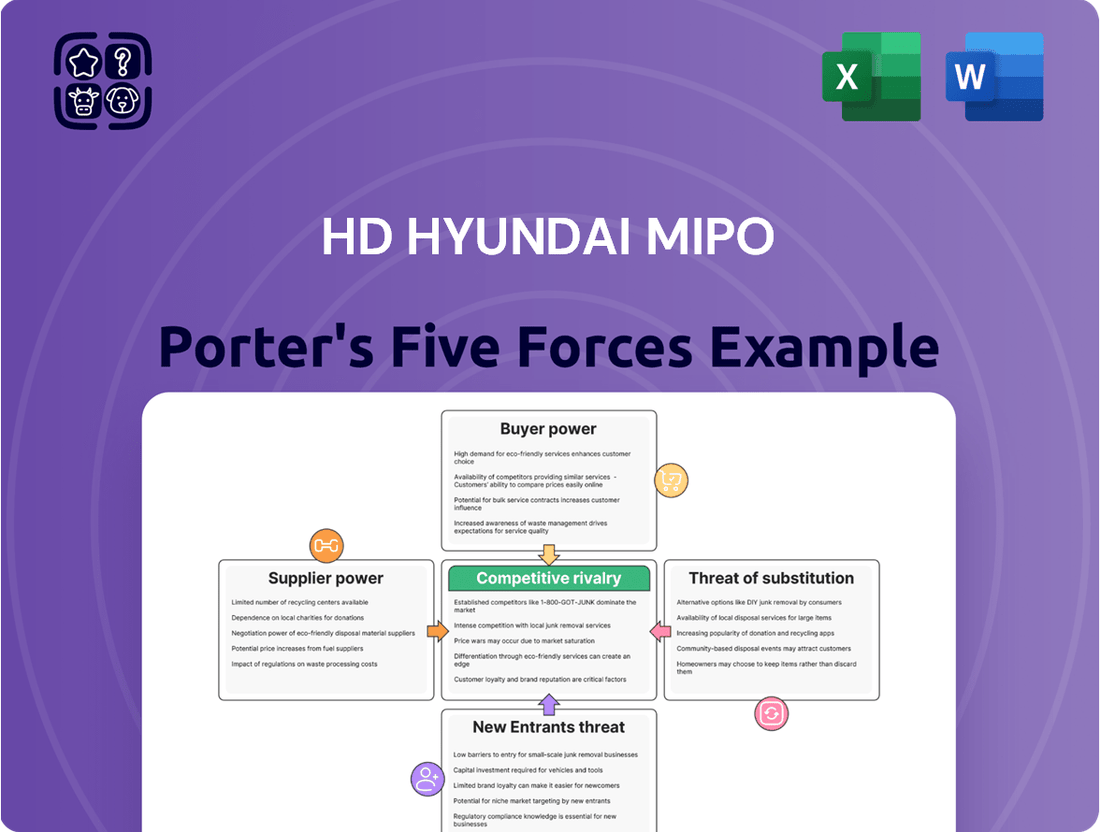

This Porter's Five Forces analysis for HD Hyundai Mipo identifies the intense rivalry among shipbuilders, the significant bargaining power of large shipping clients, and the high barriers to entry for new competitors, all shaping the company's strategic environment.

Instantly identify and mitigate competitive threats with a visual breakdown of buyer power and supplier leverage, streamlining strategic responses.

Customers Bargaining Power

The global container shipping industry is highly consolidated, with a few major players like MSC, Maersk, CMA CGM, and COSCO controlling a significant portion of the market. For instance, in 2023, MSC and Maersk alone accounted for approximately 30% of global container capacity.

This consolidation grants these large shipping companies substantial bargaining power when placing orders for new vessels. HD Hyundai Mipo, specializing in mid-sized container ships, product carriers, and chemical carriers, faces customers who can leverage their market dominance to negotiate favorable terms on new builds.

Large orders from major shipping companies, while ensuring a stable order book, also grant these customers significant bargaining power. HD Hyundai Mipo's substantial backlog, a testament to robust demand, means that these key clients can leverage their order volume to negotiate favorable pricing and contract terms.

Customers are increasingly prioritizing eco-friendly and high-efficiency ship designs, driven by stricter environmental regulations and the desire to lower operational expenses. This growing demand grants significant bargaining power to buyers, who can now select shipyards that specialize in advanced, compliant vessel construction. HD Hyundai Mipo's strategic emphasis on these cutting-edge designs directly addresses this powerful customer preference.

Bargaining Power in Ship Repair and Conversion

In the ship repair and conversion sector, customers can wield significant bargaining power. This is partly due to the modularity of certain repair services, allowing clients to pick and choose specific components of a job, and the sheer number of global repair facilities available. For instance, as of early 2024, the global ship repair market was projected to reach over $60 billion, indicating a competitive landscape where customers have choices.

The increasing demand for fleet upgrades to meet evolving environmental regulations, such as those from the International Maritime Organization, also influences customer leverage. Yards must compete to secure these conversion projects. In 2024, the focus on decarbonization is driving a surge in demand for retrofitting vessels with new fuel systems, creating opportunities for shipowners to negotiate favorable terms.

- Customer Choice: The presence of numerous ship repair yards worldwide provides customers with a wide array of options.

- Service Modularity: The ability to segment repair and conversion services allows customers to tailor their needs and potentially negotiate individual service costs.

- Market Growth and Demand: The expanding ship repair market, fueled by regulatory upgrades, means yards are keen to attract and retain business, enhancing customer bargaining power.

- Global Competition: With an estimated over 1,000 shipyards globally, competition is fierce, especially for high-value conversion projects.

Customer Switching Costs (Low for New Builds, Higher for Specific Designs)

For standard new vessel construction, customers face moderate switching costs. This is because numerous shipyards globally possess the capability to build similar vessels, allowing buyers to shift between yards with relative ease if pricing or delivery schedules become unfavorable. In 2023, the global shipbuilding order book saw significant activity, with major players like South Korea, China, and Japan securing substantial new contracts, indicating a competitive landscape where yard choice is flexible for common vessel types.

However, the bargaining power of customers diminishes significantly when dealing with highly specialized or customized vessel designs. In such cases, the unique engineering, proprietary technology, or specific certifications required mean that only a limited number of shipyards can fulfill the order, increasing switching costs. Similarly, for ongoing repair, maintenance, or conversion services, if a customer has established a strong working relationship and trust with a particular yard that has proven its expertise on their specific fleet, the cost and effort to switch to a new provider for these critical services would be considerably higher.

- Moderate switching costs for standard new builds due to a competitive global shipbuilding market.

- Higher switching costs for specialized or customized vessel designs, limiting customer options.

- Increased switching costs for ongoing repair and conversion services based on established yard relationships and proven expertise.

HD Hyundai Mipo's customers, particularly large shipping conglomerates, possess considerable bargaining power. This stems from the industry's consolidation, where major players like MSC and Maersk, controlling around 30% of global capacity in 2023, can negotiate favorable terms due to their order volume. The increasing demand for eco-friendly designs also empowers buyers to choose shipyards specializing in advanced, compliant vessels.

For standard new builds, switching costs are moderate, as many global shipyards can produce similar vessels, offering customers flexibility. However, for highly specialized designs or established repair relationships, switching costs rise significantly. The ship repair market, projected to exceed $60 billion in 2024, highlights customer choice and leverage due to global competition and service modularity.

| Customer Type | Bargaining Power Driver | Impact on HD Hyundai Mipo |

|---|---|---|

| Large Shipping Conglomerates | Market consolidation, significant order volume | Ability to negotiate pricing and contract terms on new builds. |

| Buyers prioritizing eco-friendly designs | Demand for advanced, compliant vessels | Can select shipyards with specialized capabilities, influencing yard selection. |

| Customers for standard new builds | Moderate switching costs due to global shipyard competition | Flexibility to choose alternative yards if terms are unfavorable. |

| Customers for specialized designs/established repair relationships | Higher switching costs due to unique requirements or proven expertise | Reduced ability to negotiate, greater reliance on the specific yard. |

What You See Is What You Get

Hd Hyundai Mipo Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for HD Hyundai Mipo, detailing the competitive landscape and strategic implications. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy, offering an in-depth examination of industry rivalry, buyer and supplier power, threat of new entrants, and substitute products. You can trust that the insights and formatting you see are precisely what you will receive, enabling immediate strategic planning.

Rivalry Among Competitors

The global shipbuilding industry, especially for commercial vessels, has long grappled with overcapacity, fueling fierce price wars among shipyards. This persistent issue directly impacts HD Hyundai Mipo's profitability, as it operates within an intensely competitive landscape where pricing power is significantly diminished.

In 2023, the global shipbuilding order book reached approximately 130 million gross tons, a substantial figure that, while indicating demand, also highlights the capacity available from numerous shipbuilders worldwide. This oversupply environment means shipyards often compete aggressively on price to secure contracts, squeezing margins for all players, including HD Hyundai Mipo.

The shipbuilding industry is intensely competitive, with Asian nations leading the charge. China, South Korea, and Japan collectively account for the vast majority of global shipbuilding output, creating a highly concentrated market. This regional dominance fuels fierce rivalry among these key players.

In 2023, China secured approximately 50% of global shipbuilding orders, solidifying its position as the market leader. South Korea followed closely, capturing around 30% of new orders. This significant market share held by just two countries underscores the intense competitive pressure faced by all shipbuilders operating in this arena.

South Korean shipbuilders, including HD Hyundai Mipo, are intensifying competition by concentrating on high-value vessels and cutting-edge eco-friendly technologies. This includes a strong push into LNG and ammonia carriers, areas where they aim to gain an edge over Chinese rivals.

This strategic focus on specialized, environmentally conscious shipbuilding directly heightens rivalry within these premium market segments. For instance, in 2023, South Korea secured a significant portion of the global orders for eco-friendly vessels, demonstrating this competitive trend.

Government Support and Subsidies

Governments, especially in South Korea and China, are major players in supporting their shipbuilding sectors. This backing often takes the form of subsidies and financial incentives, which can significantly alter the competitive landscape.

These government interventions allow shipyards to offer more attractive pricing, making it harder for less-supported competitors to match their offers. Furthermore, subsidies can fuel substantial investments in research and development, pushing technological advancements and capacity expansion.

- South Korean Government Support: The South Korean government has historically provided significant financial aid and policy support to its major shipbuilders, including HD Hyundai Mipo.

- Chinese Shipbuilding Subsidies: China's state-owned shipyards benefit from extensive government subsidies, which have been instrumental in their rapid growth and global market share expansion. For instance, in 2023, Chinese shipyards secured a dominant share of global orders, partly due to this support.

- Impact on Pricing: Subsidized yards can often undercut market prices, creating intense pressure on non-subsidized competitors to reduce their own margins or lose business.

Backlog and Order Intake Dynamics

HD Hyundai Mipo benefits from a robust order backlog, providing a degree of insulation from immediate competitive pressures. However, the global shipbuilding market is anticipating a downturn in newbuilding orders for 2025. This projected decline is likely to heighten competition among shipyards vying for limited contracts, potentially impacting pricing and profitability.

The intensifying rivalry for new orders could lead to increased price competition as yards strive to keep their facilities utilized. This dynamic directly affects HD Hyundai Mipo's ability to secure future business and maintain its market share.

- Projected decline in global newbuilding orders for 2025

- Increased competition for contracts among shipyards

- Potential for price erosion due to heightened rivalry

- HD Hyundai Mipo's strong backlog offers some buffer

The competitive rivalry in the shipbuilding sector, particularly for HD Hyundai Mipo, is intense due to global overcapacity and the dominance of Asian shipbuilders. China and South Korea, in particular, hold significant market shares, leading to aggressive price competition. For instance, in 2023, China captured around 50% of global shipbuilding orders, with South Korea securing approximately 30%, intensifying the battle for contracts.

Shipyards are increasingly focusing on high-value, eco-friendly vessels to differentiate themselves, a strategy HD Hyundai Mipo is also pursuing. This specialization, however, creates heightened competition within these premium segments, as evidenced by South Korea's strong performance in eco-friendly vessel orders in 2023. Government support, especially in South Korea and China through subsidies, further fuels this rivalry by enabling more competitive pricing and investment in R&D.

Looking ahead, a projected decline in newbuilding orders for 2025 is expected to escalate competition, potentially leading to price erosion. While HD Hyundai Mipo's current order backlog provides some stability, the intensifying scramble for future contracts will test its ability to maintain market share and profitability.

| Metric | 2023 Value | Significance |

|---|---|---|

| Global Shipbuilding Order Book | ~130 million gross tons | Indicates substantial global capacity and potential for oversupply. |

| China's Market Share (2023) | ~50% | Highlights China's dominant position and competitive pressure. |

| South Korea's Market Share (2023) | ~30% | Shows South Korea's strong presence and direct competition with China. |

| Projected Newbuilding Orders | Decline expected for 2025 | Suggests heightened competition for limited future contracts. |

SSubstitutes Threaten

While maritime transport excels in moving large volumes over long distances, intermodal options like rail, road, and air freight can substitute for specific cargo types or shorter hauls. However, for the mid-sized vessels that HD Hyundai Mipo specializes in, direct, cost-effective substitutes for their core market of bulk, long-distance transport remain limited. The global container shipping market saw freight rates fluctuate significantly in 2024, with some routes experiencing a 20% increase compared to early 2023, underscoring the continued reliance on maritime for efficiency.

Technological advancements allowing for the retrofitting and upgrading of existing vessels with eco-friendly solutions and improved efficiency present a significant threat of substitution for new ship orders. For instance, the global maritime industry is seeing substantial investment in technologies like scrubbers and ballast water treatment systems, which can extend the operational life and compliance of older ships. This means companies might opt to upgrade their current fleet rather than commission entirely new builds, impacting demand for new shipbuilding.

Geopolitical shifts and infrastructure developments can significantly alter shipping dynamics. For instance, the expansion of the Northern Sea Route, driven by climate change and increased Arctic accessibility, offers a potential alternative to traditional Suez Canal passages for some cargo, impacting demand for certain vessel types.

New rail links or pipeline projects can also divert freight that might otherwise move by sea, especially for landlocked regions or specific bulk commodities. This substitution effect can reduce the need for new vessel construction in those specific market segments.

Digitalization and Logistics Optimization

Digitalization and AI are significantly impacting the logistics sector, potentially reducing the demand for new ship construction. Advances in these technologies allow for better route optimization, improved cargo loading efficiency, and real-time tracking, all of which can maximize the utilization of existing shipping capacity. For instance, many shipping companies are investing heavily in digital platforms to streamline operations. Maersk, a global leader, has been at the forefront of this, implementing AI-driven systems to predict vessel maintenance and optimize port calls, aiming to cut down on idle time and fuel consumption.

These operational efficiencies can directly substitute the need for additional vessels. By making current fleets more productive, companies might delay or cancel orders for new ships. The International Maritime Organization (IMO) continues to push for greener shipping, and digital solutions are key to achieving these goals, further incentivizing efficiency over expansion. For example, in 2024, the adoption of AI in supply chain management saw a notable increase, with reports indicating potential efficiency gains of up to 15% in some areas.

- Digitalization reduces the need for new vessels by optimizing existing capacity.

- AI and IoT improve route planning and cargo utilization, enhancing efficiency.

- Companies like Maersk are investing in AI to cut down on vessel idle time.

- Efficiency gains from digitalization can substitute the demand for new ship builds.

Emergence of New Vessel Types or Transport Technologies

While still in early stages, the potential emergence of novel cargo transport methods, such as advanced airships for heavy freight, represents a long-term threat. These could offer alternative solutions to traditional shipping.

Furthermore, the development of radically different vessel designs, like highly autonomous and ultra-efficient ships, might diminish the demand for existing ship types. This technological evolution could fundamentally alter the competitive landscape.

For instance, advancements in drone technology and hyperloop systems, though currently more suited for lighter or shorter-distance transport, highlight the ongoing innovation in logistics that could eventually impact bulk cargo movement.

The shipping industry is continuously exploring new technologies; a significant breakthrough in alternative propulsion or autonomous operation could drastically reduce the operational costs and transit times compared to current HD Hyundai Mipo Porter offerings.

The threat of substitutes for HD Hyundai Mipo is moderate, primarily stemming from advancements in logistics technology and efficiency improvements in existing fleets rather than entirely new transport modes for their core mid-sized vessel market. Digitalization and AI are key disruptors, allowing for better route optimization and cargo utilization, which can reduce the perceived need for new vessel orders by maximizing the efficiency of current shipping capacity. For example, in 2024, the adoption of AI in supply chain management saw a notable increase, with reports indicating potential efficiency gains of up to 15% in some areas, directly impacting the demand for new builds.

While entirely new transport methods for bulk cargo are not yet a significant threat, improvements in intermodal transport and the potential for retrofitting older vessels with new technologies can divert demand. For instance, the global maritime industry is seeing substantial investment in technologies like scrubbers and ballast water treatment systems, which can extend the operational life and compliance of older ships, making upgrades a more attractive alternative to new construction for some operators.

The expansion of alternative shipping routes, such as the Northern Sea Route, and the development of new rail or pipeline infrastructure can also substitute for certain shipping needs, particularly for specific cargo types or regions. These shifts can reduce the demand for new vessel construction in those particular market segments.

Entrants Threaten

The shipbuilding sector, including companies like HD Hyundai Mipo, demands enormous upfront capital. Building and equipping a modern shipyard with specialized heavy machinery and advanced manufacturing technology can easily run into billions of dollars. For instance, establishing a new large-scale shipyard capable of constructing complex vessels often requires an investment exceeding $500 million to over $1 billion.

These substantial fixed costs, encompassing land acquisition, construction, advanced robotics, and research and development for new shipbuilding techniques, create a formidable financial barrier. Potential new entrants face the daunting task of securing such vast sums, making it incredibly difficult to compete with established players who have already amortized these initial investments.

The shipbuilding industry, particularly for mid-sized vessels with advanced eco-friendly and high-efficiency features, presents a significant hurdle for new entrants due to its inherent technological complexity. HD Hyundai Mipo, for instance, relies on decades of accumulated engineering know-how and a highly specialized workforce to design and construct these intricate vessels. This deep technical expertise, often protected by proprietary knowledge, makes it exceptionally difficult and costly for newcomers to replicate the necessary capabilities and compete effectively.

Established shipbuilders, including HD Hyundai Mipo, benefit from deeply entrenched relationships with major global shipping lines. These long-standing partnerships translate into a substantial order backlog, effectively locking in future business. For instance, as of the first quarter of 2024, HD Hyundai Mipo reported a robust order backlog valued at billions of dollars, ensuring capacity utilization for years to come.

New entrants face a formidable barrier in trying to replicate these established customer connections. They would find it exceptionally difficult to secure initial orders and compete for the limited available building slots that are already committed to existing, trusted suppliers. This backlog acts as a significant deterrent, making it challenging for newcomers to gain a foothold in the market.

Regulatory Hurdles and Environmental Standards

The shipbuilding industry faces significant regulatory hurdles, particularly concerning international safety and environmental standards. For instance, the International Maritime Organization's (IMO) regulations, such as those for emissions control (e.g., IMO 2020 sulfur cap), require substantial investment in new technologies and retrofitting. These complex compliance requirements act as a substantial barrier to entry, increasing both the initial capital outlay and the time-to-market for potential new competitors.

Meeting these stringent standards necessitates advanced engineering capabilities and significant financial resources. New entrants must navigate a web of international conventions and national laws, which often include:

- Compliance with International Maritime Organization (IMO) standards: This includes safety certifications, emissions regulations (like SOx and NOx limits), and ballast water management.

- National environmental protection laws: Shipyards must adhere to local regulations regarding waste disposal, pollution control, and the use of hazardous materials.

- Classification society rules: Vessels must be built to the standards of recognized classification societies (e.g., DNV, Lloyd's Register) for insurance and operational legitimacy.

Government Support for Incumbents

Government support for established players significantly raises the barrier to entry. Many shipbuilding nations offer substantial subsidies and protectionist policies to bolster their domestic industries, mirroring historical trends where state backing was crucial for national development. For instance, the Jones Act in the United States mandates that only domestically built, owned, and crewed ships can engage in coastal trade, effectively shielding US shipyards from foreign competition. This creates an uneven playing field, making it exceedingly challenging for new, unsupported entrants to gain a foothold against well-capitalized and government-backed incumbents.

This support can manifest in various forms, including direct financial aid, tax incentives, and favorable regulatory environments. These measures allow established companies to absorb costs, invest in R&D, and maintain competitive pricing in ways that new entrants, lacking such backing, cannot easily replicate. For example, in 2023, South Korea's government announced a KRW 3.1 trillion (approximately $2.4 billion USD) plan to support its shipbuilding sector, focusing on eco-friendly vessels and technological advancement, further solidifying the advantage of its major players like HD Hyundai Mipo.

- Government Subsidies: Many leading shipbuilding countries provide significant financial assistance to their domestic firms, enabling them to offer more competitive pricing.

- Protectionist Policies: Measures like the Jones Act in the US create protected domestic markets, limiting foreign competition and benefiting local shipyards.

- Uneven Playing Field: This government backing creates substantial hurdles for new entrants, who often lack similar access to capital and regulatory advantages.

- Impact on New Entrants: Unsupported new companies face immense difficulty competing with established, government-supported giants in terms of cost, scale, and market access.

The threat of new entrants in the shipbuilding sector, particularly for companies like HD Hyundai Mipo, is significantly mitigated by the industry's massive capital requirements and technological complexity. Establishing a new shipyard capable of advanced vessel construction can cost upwards of $500 million to over $1 billion, a hurdle that deters most newcomers. Furthermore, the deep technical expertise and proprietary knowledge accumulated by established players, such as HD Hyundai Mipo's decades of engineering know-how, make it exceedingly difficult for new firms to replicate the necessary capabilities.

Existing customer relationships and substantial order backlogs, like HD Hyundai Mipo's multi-billion dollar backlog as of Q1 2024, create a further barrier. New entrants struggle to secure initial orders against these long-standing, trusted supplier connections. Regulatory compliance with stringent international safety and environmental standards, such as IMO regulations, also demands significant investment and expertise, adding to the entry barriers.

Government support, including subsidies and protectionist policies like the US Jones Act, creates an uneven playing field. For instance, South Korea's 2023 plan of KRW 3.1 trillion ($2.4 billion USD) to support its shipbuilding sector exemplifies how incumbent firms benefit from state backing, making it challenging for unsupported new entrants to compete effectively on cost and market access.

| Barrier Type | Description | Example for HD Hyundai Mipo |

| Capital Requirements | Enormous upfront investment needed for shipyard construction and advanced machinery. | Costs exceeding $500 million to over $1 billion for a large-scale shipyard. |

| Technological Complexity | Deep engineering know-how and specialized workforce required for intricate vessel design. | Decades of accumulated expertise in eco-friendly and high-efficiency vessel construction. |

| Customer Relationships & Backlog | Established long-term partnerships and secured future business. | Multi-billion dollar order backlog as of Q1 2024, ensuring capacity utilization. |

| Regulatory Compliance | Adherence to complex international safety and environmental standards. | Meeting IMO regulations for emissions control and safety certifications. |

| Government Support | Subsidies and protectionist policies favoring domestic industries. | South Korean government's KRW 3.1 trillion support plan for the shipbuilding sector. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for HD Hyundai Mipo is built upon a foundation of industry-specific data, including shipbuilding market research reports, financial statements from key players, and trade publications that track global maritime trends.