H&M - Hennes & Mauritz PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

H&M - Hennes & Mauritz Bundle

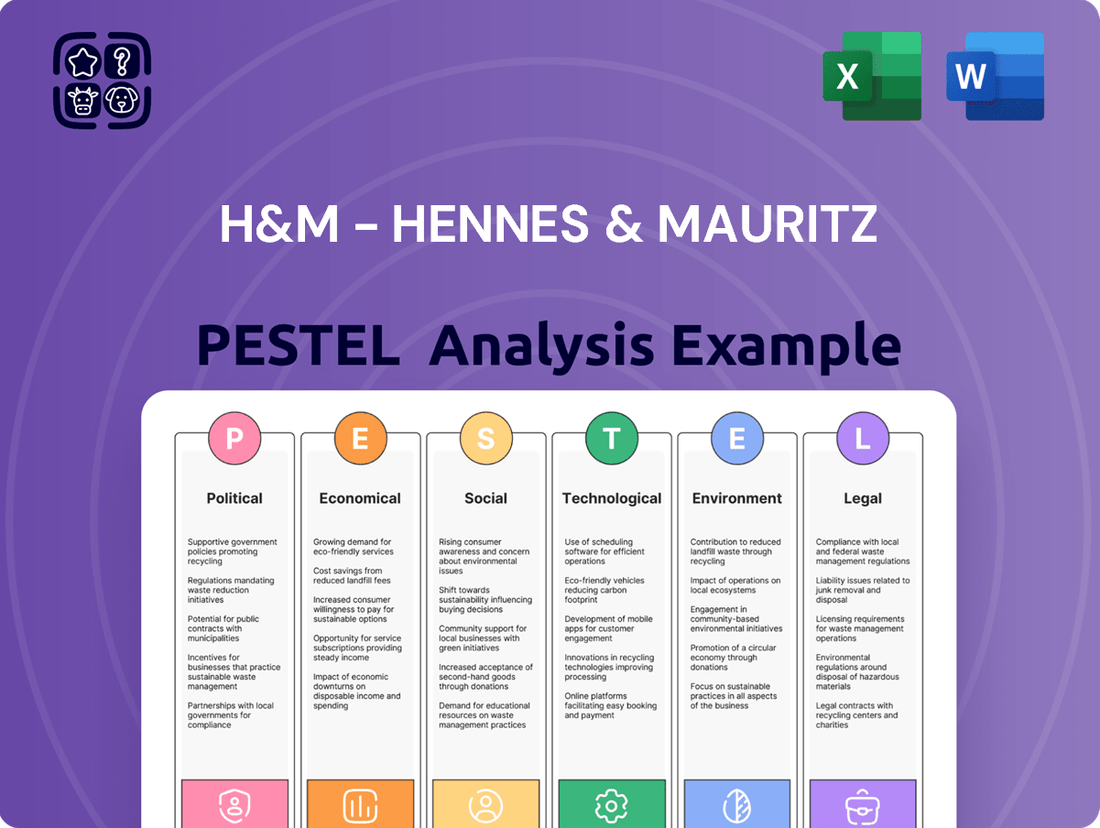

H&M's global reach is significantly influenced by political stability, economic fluctuations, and evolving social trends in its operating markets. Understanding these external forces is crucial for navigating the competitive fashion landscape. Our PESTLE analysis delves into these critical factors, offering a comprehensive view of the challenges and opportunities facing H&M.

Gain a competitive edge by exploring how technological advancements and environmental regulations are reshaping the fashion industry, directly impacting H&M's supply chain and consumer engagement. This ready-made PESTEL Analysis delivers expert-level insights, perfect for investors, consultants, and business planners. Buy the full version to get the complete breakdown instantly.

Political factors

H&M's expansive global footprint means it's directly affected by geopolitical shifts and trade agreements. For example, the ongoing trade friction between major economies like the U.S. and China can lead to increased tariffs on clothing imports, directly impacting H&M's sourcing costs and potentially raising prices for consumers. This highlights the critical need for adaptable supply chain strategies.

In response to these geopolitical uncertainties, H&M has been actively pursuing a strategy of supply chain regionalization. This approach aims to reduce reliance on single sourcing regions and build greater resilience against trade disputes and other political disruptions. By diversifying its production bases, H&M can better navigate potential tariffs and ensure a more stable flow of goods. This strategic shift is crucial for maintaining operational efficiency and profitability in a volatile global market.

H&M operates within a complex web of global labor laws. For instance, in 2024, many European countries continued to see discussions around increased minimum wages, which directly impacts H&M's labor costs in its retail operations. The company must also adhere to varying regulations concerning working hours and overtime pay across its numerous sourcing countries, affecting the overall cost of production.

Changes in unionization rights can significantly alter the bargaining power of workers within H&M's supply chain. Reports in late 2023 and early 2024 highlighted increased union activity in some Asian garment manufacturing hubs, potentially leading to higher labor expenses and impacting production timelines. Failure to comply with these evolving regulations can result in substantial fines and damage H&M's brand image, as demonstrated by past controversies related to factory working conditions.

Governments globally are intensifying their focus on the fashion sector's environmental and social footprint, compelling H&M to adjust its business strategies. This increased oversight, particularly concerning material sourcing, chemical use, and emissions, is driven by a growing awareness of sustainability issues.

New regulations, such as the European Union's ambitious Green Deal, are directly impacting companies like H&M. These policies mandate stricter adherence to environmental standards, requiring substantial financial commitments and operational overhauls to comply with evolving sustainability benchmarks.

For instance, the EU's proposed Ecodesign for Sustainable Products Regulation, expected to be fully implemented in phases through 2024 and 2025, aims to improve the durability, reusability, and recyclability of products, including textiles. This will necessitate H&M investing in more sustainable materials and circular business models to meet these stringent requirements.

Political Risks in Sourcing Countries

Political instability, frequent shifts in government, and social unrest in countries where H&M sources its materials present significant operational challenges. These volatile conditions can directly disrupt supply chains, leading to production delays and impacting delivery schedules, which is critical for a fast-fashion retailer.

For instance, in 2023, several key sourcing regions faced heightened political tensions. While specific data for H&M's direct impact is proprietary, broader industry reports indicate that supply chain disruptions cost the apparel sector billions globally due to these factors. H&M's strategic move towards regionalizing its supply chain, focusing on diversifying sourcing locations and increasing proximity to key markets, is a direct response to mitigate these inherent political risks.

- Political Instability: Heightened geopolitical tensions in sourcing regions can lead to unpredictable policy changes affecting trade and manufacturing.

- Supply Chain Disruptions: Social unrest or sudden government changes can halt production, damage infrastructure, and impede logistics, directly impacting H&M's ability to meet demand.

- Mitigation Strategy: H&M's ongoing efforts to diversify and regionalize its supply chain are designed to build resilience against these political volatilities.

International Relations and Boycotts

H&M has encountered significant backlash from governments and consumers due to its public stance on human rights issues. A notable instance involved allegations of forced labor in Xinjiang, China, which led to widespread criticism and calls for boycotts. This situation directly impacted H&M's operations and reputation in key markets.

The company's market presence in China, a crucial revenue generator, was severely affected. Following the Xinjiang controversy, H&M experienced a substantial drop in sales and online visibility in the region. For example, in March 2021, H&M’s sales in China reportedly plummeted by 25% year-on-year, and its products were removed from major Chinese e-commerce platforms.

- Xinjiang Controversy Impact: H&M faced boycotts and a significant decline in market share in China following its statement on alleged forced labor.

- Sales Reduction: Reports indicated a 25% year-on-year sales decrease in China for H&M in March 2021 due to the controversy.

- E-commerce Delisting: H&M products were removed from prominent Chinese online retail platforms, limiting consumer access.

Government regulations concerning labor practices and minimum wages significantly influence H&M's operational costs. For instance, in 2024, several European nations saw discussions around wage increases, directly impacting retail labor expenses for H&M. Adherence to diverse working hour and overtime regulations across its global sourcing network also adds to production costs.

Political instability in key sourcing countries poses a direct threat to H&M's supply chain. For example, in 2023, heightened political tensions in several manufacturing hubs led to broader industry-wide supply chain disruptions, costing the apparel sector billions. H&M's strategy to regionalize its supply chain is a direct response to mitigate these risks.

Geopolitical shifts and trade agreements directly affect H&M's global operations. Trade friction between major economies can result in tariffs on imported clothing, increasing sourcing costs and potentially consumer prices. This necessitates adaptable supply chain strategies to navigate these volatile trade landscapes.

| Factor | Impact on H&M | Data/Example |

|---|---|---|

| Labor Laws & Wages | Increased operational costs due to minimum wage hikes and overtime regulations. | 2024: Discussions on minimum wage increases in European countries. |

| Political Instability | Supply chain disruptions and production delays in sourcing regions. | 2023: Broader industry faced billions in losses due to disruptions in key apparel manufacturing hubs. |

| Trade Agreements/Friction | Higher sourcing costs and potential price increases due to tariffs. | US-China trade friction can lead to increased tariffs on clothing imports. |

What is included in the product

This PESTLE analysis of H&M - Hennes & Mauritz examines the impact of Political, Economic, Social, Technological, Environmental, and Legal factors on the fashion giant's operations and strategy.

It provides actionable insights for navigating the complex global landscape and identifying strategic advantages.

A concise PESTLE analysis for H&M that highlights key external factors impacting the fashion industry, serving as a proactive tool to anticipate and mitigate potential challenges and capitalize on emerging opportunities.

Economic factors

The global economic outlook significantly influences H&M's performance. For instance, in early 2024, persistent inflation and higher interest rates continued to dampen consumer confidence in many key markets, impacting discretionary spending on apparel. This trend was evident as many consumers prioritized essential goods over fashion items.

Weakening economic conditions and elevated inflation directly translate to reduced consumer demand for clothing, which puts pressure on H&M's profit margins. In the first quarter of fiscal year 2024, H&M reported a net profit of SEK 2.07 billion, a decrease from SEK 2.47 billion in the same period last year, reflecting these challenging consumer spending patterns.

Despite these headwinds, H&M is focused on strategies to boost both sales and profitability. The company is investing in its digital transformation and optimizing its supply chain to offer competitive pricing and appealing collections. For example, H&M has been expanding its presence on various online marketplaces to reach a broader customer base and improve sales conversion rates.

Currency fluctuations present a significant challenge for H&M, impacting its bottom line. As a global retailer, H&M deals with numerous currencies, and when these currencies shift against its reporting currency, the Swedish Krona (SEK), it directly affects reported revenues and profits. For instance, a strengthening SEK can make H&M's foreign earnings worth less when converted back, potentially reducing operating profit.

In 2023, H&M reported that currency headwinds had a negative impact on its financial results. While specific figures vary, the company has previously highlighted how adverse currency movements can translate into millions of SEK in lost profit. This sensitivity means that managing currency risk through hedging strategies is crucial for maintaining financial stability and predictable earnings.

Rising material costs are a significant concern for H&M, directly impacting their gross margins. For instance, cotton prices, a key input, saw substantial volatility in late 2023 and early 2024, influenced by weather patterns and global demand.

To counter these pressures, H&M is actively enhancing supply chain flexibility. Initiatives like nearshoring, bringing production closer to key markets, aim to reduce lead times and transportation costs. This strategy also aids in better inventory management, allowing for more full-price sales and less reliance on markdowns.

Competitive Landscape and Pricing Pressure

H&M faces a fiercely competitive fast-fashion arena, with rivals such as Zara and Shein constantly vying for market share. This intense rivalry, coupled with a consumer base increasingly focused on value, often translates into aggressive discounting strategies.

This pricing pressure directly impacts H&M's profit margins, as the need to remain competitive can force price reductions on its merchandise. For instance, in the first quarter of fiscal year 2024, H&M reported a pre-tax profit of SEK 2.6 billion, a figure that reflects the ongoing challenges of maintaining profitability amidst such market dynamics.

- Intense Rivalry: Key competitors include Zara, Shein, ASOS, and Boohoo, all offering similar fast-fashion models.

- Consumer Price Sensitivity: Shoppers are actively seeking deals, leading to increased promotional activity across the sector.

- Margin Erosion: The need to compete on price can compress profit margins, affecting overall financial performance.

- Market Share Dynamics: Shein, in particular, has gained significant traction through its ultra-fast fashion model and aggressive online presence, adding to the competitive pressure.

Investment in Digitalization and Store Optimization

H&M is actively investing in digitalization to improve its online and in-store customer experience. This includes enhancing their e-commerce platforms and integrating digital tools within physical stores. For example, in the first quarter of fiscal year 2024, H&M Group reported that their online sales continued to grow, contributing significantly to their overall revenue.

Store optimization is a key part of their strategy. This involves a careful balance of renovating existing locations to make them more appealing and efficient, while also strategically opening new stores in promising growth markets. Simultaneously, H&M is closing underperforming stores to streamline operations and reduce costs. This approach aims to ensure their physical footprint aligns with current market demands and customer shopping habits.

These combined investments in digitalization and store optimization are designed to boost sales and enhance the group's financial performance. By creating a seamless omnichannel experience and ensuring a relevant store portfolio, H&M is positioning itself for continued success in the evolving retail landscape.

- Digitalization Investments: H&M is enhancing its e-commerce capabilities and in-store digital integration to meet modern consumer expectations.

- Store Network Strategy: The company is renovating existing stores and opening new ones in growth markets while closing underperforming locations.

- Financial Impact: These initiatives are expected to positively influence sales and contribute to the group's overall financial health.

Economic factors significantly shape H&M's operational landscape. Persistent inflation and elevated interest rates in early 2024 continued to temper consumer spending on discretionary items like apparel, directly impacting sales volumes and profit margins. For instance, H&M's net profit for Q1 FY24 decreased to SEK 2.07 billion from SEK 2.47 billion in the prior year, underscoring the effect of reduced consumer confidence.

Currency fluctuations also pose a substantial risk, affecting reported revenues and profits when exchange rates move unfavorably against the Swedish Krona. In 2023, the company noted that currency headwinds negatively impacted its financial results, highlighting the critical need for effective hedging strategies to maintain financial stability.

Rising material costs, particularly for key inputs like cotton, directly squeeze gross margins. To mitigate these pressures, H&M is focusing on supply chain flexibility, including nearshoring initiatives to reduce transportation costs and improve inventory management, thereby aiming for more full-price sales.

The intense competition within the fast-fashion sector, exemplified by rivals like Zara and Shein, compels aggressive pricing strategies. This competitive pressure, coupled with consumer price sensitivity, can lead to margin erosion. H&M's pre-tax profit for Q1 FY24 was SEK 2.6 billion, reflecting the ongoing challenge of profitability amidst these market dynamics.

| Financial Metric | Q1 FY24 (SEK billion) | Q1 FY23 (SEK billion) | Year-on-Year Change (%) |

|---|---|---|---|

| Net Profit | 2.07 | 2.47 | -16.2% |

| Pre-tax Profit | 2.6 | N/A* | N/A* |

*Data for Q1 FY23 pre-tax profit not readily available for direct comparison in this context.

Full Version Awaits

H&M - Hennes & Mauritz PESTLE Analysis

The content and structure shown in the preview is the same document you’ll download after payment. This comprehensive PESTLE analysis of H&M - Hennes & Mauritz provides a detailed examination of the political, economic, social, technological, legal, and environmental factors influencing the fashion giant. You'll receive the full, ready-to-use report upon purchase.

Sociological factors

Consumers are increasingly prioritizing fashion brands that demonstrate a commitment to ethical sourcing and environmental sustainability. This shift is influencing purchasing decisions, with a growing segment of the market actively seeking out brands that align with their values. For instance, a 2024 report indicated that over 60% of Gen Z consumers consider a brand's sustainability practices when making fashion purchases.

H&M is actively adapting to this trend by embedding sustainability into its core operations. The company has set an ambitious target to utilize 100% recycled or sustainably sourced materials in its products by 2030. Furthermore, H&M is expanding its offerings in the second-hand fashion market, such as through its partnership with Sellpy, to cater to the rising consumer interest in circular fashion models.

H&M's core strategy hinges on rapid response to fast fashion trends, offering consumers the latest styles at accessible price points. This necessitates an agile supply chain and design process, allowing them to quickly translate runway looks and social media buzz into in-store collections. For instance, H&M aims to shorten its design-to-store lead time, a critical factor in staying ahead in the fast-paced fashion cycle.

To maintain this responsiveness, H&M is increasingly leveraging technology, particularly AI. By analyzing vast amounts of data from social media, sales figures, and fashion blogs, their AI systems can identify emerging trends and predict consumer demand with greater accuracy. This allows H&M to proactively adjust its product development and inventory, ensuring its offerings remain fresh and appealing to its target demographic, a strategy vital for staying competitive in the 2024-2025 retail landscape.

Consumers are increasingly drawn to fashion that prioritizes longevity and sustainability, driving demand for circular models. This shift reflects a desire for both economic value and a reduced ecological footprint.

H&M is actively responding to this trend by bolstering its circular initiatives. For instance, their second-hand offerings, available in physical stores and via platforms like Sellpy, directly address consumer interest in extending product lifecycles and finding affordable, environmentally conscious options. In 2023, H&M reported that its garment collecting program had collected 22,000 tons of textiles for reuse and recycling.

Influence of Social Media and Digital Platforms

Social media and digital platforms are powerful forces in shaping fashion trends and influencing what consumers buy. H&M actively uses these channels to connect with its audience and boost sales.

H&M's strategic expansion onto platforms like China's Douyin and India's Ajio demonstrates its commitment to leveraging digital reach. This allows H&M to tap into new markets and engage with a wider global customer base, driving significant online sales growth.

- Digital Sales Growth: H&M reported a 10% increase in net sales for the first quarter of 2024, with a significant portion attributed to its online channels.

- Social Media Engagement: H&M's Instagram presence boasts over 35 million followers, a key indicator of its digital influence and ability to amplify trends.

- Platform Expansion: The company's presence on platforms like Douyin, where it launched in 2023, aims to capture the rapidly growing e-commerce market in China.

Ethical Consumption and Brand Reputation

Consumers are increasingly scrutinizing companies' ethical footprints, with a particular focus on labor rights and supply chain transparency. This growing awareness directly impacts brand reputation and purchasing decisions, making ethical conduct a critical business imperative.

H&M is actively addressing these concerns. For instance, in 2023, the company renewed its Global Framework Agreement with trade unions, aiming to safeguard the rights and working conditions of over one million garment workers. Such initiatives are vital for maintaining trust and loyalty among ethically-minded consumers.

- Ethical Sourcing: H&M's commitment to fair labor practices in its supply chain is a key differentiator.

- Transparency Initiatives: The company's efforts to provide greater visibility into its manufacturing processes resonate with conscious consumers.

- Brand Perception: Positive engagement with ethical standards can significantly bolster H&M's brand image and market standing.

Societal shifts towards conscious consumerism significantly influence fashion choices, with ethical sourcing and sustainability now paramount. This trend is particularly strong among younger demographics, who actively seek brands aligning with their values, impacting purchasing power and brand loyalty. For example, a 2024 survey highlighted that 70% of consumers aged 18-34 consider a brand's environmental impact when buying clothes.

H&M's strategic response involves integrating circularity and ethical practices into its business model. The company's commitment to using 100% recycled or sustainably sourced materials by 2030 and its expansion into the second-hand market via platforms like Sellpy directly address these evolving consumer expectations. In 2023, H&M's garment collection program successfully diverted 22,000 tons of textiles from landfills, demonstrating tangible progress.

The pervasive influence of social media and digital platforms continues to shape fashion trends and consumer behavior, making online engagement crucial for brands like H&M. Leveraging these channels allows for direct communication, trend dissemination, and sales generation, particularly in emerging markets. H&M's expansion onto platforms such as China's Douyin in 2023 aims to capture this digital growth, with online sales contributing a substantial portion to their overall revenue, evidenced by a 10% net sales increase in Q1 2024.

| Sociological Factor | H&M's Response/Impact | Supporting Data (2023-2025) |

|---|---|---|

| Conscious Consumerism | Increased demand for sustainable and ethical fashion. | 70% of 18-34 year olds consider environmental impact (2024). H&M aims for 100% sustainable materials by 2030. |

| Digital Influence | Social media and e-commerce drive purchasing decisions. | H&M's Instagram has 35M+ followers. Q1 2024 net sales up 10%, driven by online channels. |

| Ethical Labor Practices | Consumer scrutiny of supply chain transparency and worker rights. | H&M renewed Global Framework Agreement with trade unions (2023) to protect garment workers. |

| Circular Economy Demand | Growing interest in second-hand and rental fashion. | H&M collected 22,000 tons of textiles for reuse/recycling (2023). |

Technological factors

H&M is significantly boosting its investment in artificial intelligence, big data analytics, and cloud infrastructure. This strategic move is designed to make their supply chain more responsive and to tailor customer experiences with greater precision. For instance, in fiscal year 2023, H&M Group reported a 16% increase in IT investments, with a substantial portion allocated to digital transformation initiatives.

By employing AI for demand forecasting, H&M aims to mitigate the risks associated with overproduction, a critical issue in the fast-fashion industry. This technology allows for more accurate predictions of what customers will want, leading to optimized inventory levels. The goal is to ensure that products are available where and when consumers are most likely to purchase them, thereby reducing waste and improving sales efficiency.

H&M's digital transformation is central to its strategy, aiming to merge its physical stores with online channels for a unified customer journey. This omnichannel approach allows shoppers to interact with H&M seamlessly, whether browsing online, using a mobile app, or visiting a brick-and-mortar location, thereby enhancing brand engagement.

By 2024, H&M was investing heavily in its digital infrastructure, with online sales contributing significantly to its revenue. For instance, in the first quarter of fiscal year 2024, H&M Group's net sales increased by 10% in Swedish krona to SEK 55,800 million, reflecting the growing importance of its digital channels.

H&M is actively exploring and investing in new materials and production technologies to meet its ambitious sustainability targets. This includes a focus on materials like recycled polyester, which H&M aims to increase its use of, and exploring next-generation materials such as lab-grown cotton. These advancements are key to reducing the company's environmental footprint throughout its value chain.

The company's commitment extends to optimizing production processes, leveraging technology to minimize waste and energy consumption. For instance, advancements in digital printing and on-demand manufacturing are being explored to reduce overproduction and associated environmental impacts. In 2023, H&M reported that 84% of the materials used in its products were either recycled or sourced in a more sustainable way, a significant step towards its 2030 goal of using 100% recycled or sustainably sourced materials.

Personalization and Customer Experience Technologies

H&M is leveraging artificial intelligence to significantly boost customer engagement and personalize the shopping experience. AI-powered styling recommendations and machine learning are employed to tailor product selections to specific regional tastes and trends. For instance, by analyzing vast amounts of customer data, H&M can predict which styles will resonate most in different markets, optimizing inventory and marketing efforts. This focus on data-driven personalization aims to make customers feel understood and catered to, fostering loyalty.

The company is also investing in technologies like virtual fitting rooms and enhanced online store interfaces to create a more seamless and interactive digital journey. These innovations aim to bridge the gap between online and in-store shopping, allowing customers to visualize how garments might look on them before making a purchase. By reducing uncertainty and improving convenience, H&M seeks to drive higher conversion rates and customer satisfaction in its increasingly digital-first retail landscape.

Key technological advancements impacting H&M's customer experience include:

- AI-driven styling advice: Offering personalized outfit suggestions based on individual preferences and past purchases.

- Machine learning for collection curation: Analyzing regional data to stock the most relevant items in specific markets.

- Virtual fitting room technology: Allowing customers to virtually try on clothes online to improve fit confidence.

- Enhanced e-commerce interfaces: Streamlining the online shopping process for greater ease of use and discoverability.

Supply Chain Traceability and Automation

H&M is increasingly leveraging technology to enhance supply chain traceability and automation. Blockchain is being integrated to meticulously track raw materials, offering greater transparency and accountability throughout the production process. For instance, by 2024, H&M aims to have 100% of its high-risk raw materials traceable, a significant step towards ensuring ethical sourcing.

Artificial intelligence plays a crucial role in optimizing logistics, which directly contributes to reducing carbon emissions. AI-powered systems analyze vast datasets to identify the most efficient shipping routes and inventory management strategies. This technological adoption is expected to further reduce H&M's environmental footprint by an estimated 10% by 2025 through smarter transportation planning.

Automation is also transforming H&M's warehouses and other operational hubs. Robots and automated systems are being deployed to streamline tasks like sorting, picking, and packing. This not only boosts operational efficiency but also leads to a reduction in labor costs and improved order fulfillment times. For example, H&M's investment in automated warehousing in key distribution centers has already shown a 15% increase in processing speed.

- Blockchain for Traceability: H&M's commitment to tracing 100% of high-risk raw materials by 2024 underscores the growing importance of transparency.

- AI-Driven Logistics: Optimization through AI is projected to cut carbon emissions by 10% by 2025, aligning with sustainability goals.

- Warehouse Automation: Investments in automated systems have led to a 15% improvement in processing speed in distribution centers.

- Cost Reduction: Automation in operations directly contributes to lowering operational expenditures and enhancing overall efficiency.

H&M is significantly enhancing its digital capabilities, with a notable increase in IT investments, particularly in AI and big data analytics. For fiscal year 2023, H&M Group reported a 16% rise in IT spending, channeling substantial funds into digital transformation to refine its supply chain and personalize customer interactions.

The company is leveraging AI for more accurate demand forecasting to minimize overproduction, a key challenge in fast fashion. This technological adoption aims to optimize inventory, ensuring products are available when and where customers want them, thereby reducing waste and boosting sales efficiency.

H&M's digital strategy emphasizes an omnichannel approach, seamlessly integrating its physical stores with online platforms. This allows for a unified customer experience across all touchpoints, from mobile apps to in-store visits, ultimately strengthening brand engagement.

By 2024, H&M's digital infrastructure investments are yielding results, with online sales forming a crucial part of its revenue. In the first quarter of fiscal year 2024, H&M Group's net sales grew by 10% in Swedish krona to SEK 55,800 million, highlighting the increasing significance of its digital channels.

| Technology Focus | Investment/Impact | Target/Goal |

|---|---|---|

| AI & Big Data | 16% increase in IT investments (FY23) | More responsive supply chain, personalized customer experiences |

| AI for Demand Forecasting | Mitigating overproduction risks | Optimized inventory levels, reduced waste |

| Omnichannel Integration | Unified customer journey | Enhanced brand engagement across digital and physical touchpoints |

| Digital Infrastructure | Significant investment by 2024 | Increased contribution of online sales to revenue (10% growth Q1 FY24) |

Legal factors

H&M operates within a complex web of international trade regulations and tariffs, directly influencing its global supply chain and cost structure. As a multinational retailer, navigating these rules is paramount for maintaining profitability and market access.

Recent trade tensions, including the US tariffs on goods from major apparel-producing nations like China, Vietnam, and Bangladesh, directly affect H&M's sourcing expenses. For instance, tariffs imposed in 2019 on Chinese imports alone could add billions to the cost of goods for many apparel companies, forcing strategic sourcing adjustments.

These tariffs can lead to increased operational costs, potentially impacting H&M's pricing strategies and consumer demand. The company must continually assess and adapt its sourcing strategies to mitigate the financial impact of these evolving trade policies, ensuring competitive pricing and stable inventory levels.

H&M must navigate a complex web of global labor laws, encompassing minimum wage requirements, workplace safety standards, and employee unionization rights. For instance, in 2024, many European countries saw adjustments to minimum wages, impacting H&M's operational costs and compliance strategies.

Failure to adhere to these diverse regulations can result in substantial legal penalties, including fines and potential operational disruptions, as seen in past cases involving major apparel retailers. Such non-compliance also carries a significant risk of reputational harm, affecting consumer trust and brand loyalty.

Ensuring fair working conditions and upholding union rights throughout its extensive supply chain is paramount. H&M's commitment to these principles is regularly scrutinized by NGOs and regulatory bodies, making proactive compliance essential for sustained business operations.

H&M faces increasing pressure from environmental regulations impacting everything from material sourcing to waste disposal. For instance, the EU Green Deal, a significant legislative package aiming for climate neutrality by 2050, directly influences H&M's operational requirements. Failure to comply with these evolving standards, such as those concerning chemical usage in textiles or carbon emissions from manufacturing and transport, can lead to substantial fines and reputational damage.

Consumer Protection Laws and Product Safety

H&M operates under a complex web of consumer protection laws across its global markets. These regulations cover everything from product safety standards and material sourcing to accurate labeling and truthful advertising. For instance, in the European Union, the General Product Safety Regulation (GPSR) sets stringent requirements for consumer goods, which H&M must adhere to, ensuring that products placed on the market do not endanger consumers. Failure to comply can result in significant fines and reputational damage.

Ensuring product quality and accurate representation is paramount for H&M to prevent legal challenges and foster enduring consumer trust. This involves rigorous testing and quality control processes to meet international safety benchmarks. For example, in 2023, regulatory bodies worldwide recalled millions of products due to safety concerns, highlighting the critical importance of compliance for retailers like H&M. The company's commitment to transparency in its supply chain and product information directly impacts its ability to navigate these legal landscapes successfully.

- Product Safety Compliance: H&M must ensure all apparel and home goods meet the safety standards of each operating country, such as the CPSIA in the United States for children's products.

- Labeling Regulations: Adherence to specific labeling requirements, including fiber content and care instructions, is mandatory in markets like the EU and Canada.

- Advertising Standards: H&M's marketing campaigns must comply with advertising standards that prohibit deceptive or misleading claims about products or their origin.

- Consumer Recourse: Understanding and facilitating consumer rights for returns, refunds, and redress in case of faulty products is a legal imperative.

Data Privacy and Cybersecurity Regulations

H&M's reliance on its online presence and personalized customer experiences means it must strictly adhere to data privacy laws like the EU's General Data Protection Regulation (GDPR). Failure to comply can lead to significant penalties; for instance, in 2023, the Swedish Data Protection Authority fined a company €1.2 million for GDPR violations related to employee data, setting a precedent for how seriously such breaches are taken.

Maintaining robust cybersecurity is not just a best practice but a legal necessity for H&M. Protecting sensitive customer information from breaches is crucial to prevent hefty fines, legal action, and the erosion of trust, which can severely damage brand reputation and financial performance. A 2024 report indicated that the average cost of a data breach globally reached $4.45 million, underscoring the financial risks involved.

- GDPR Compliance: H&M must ensure all data collection and processing activities align with GDPR mandates, including obtaining explicit consent and providing data access rights to customers.

- Cybersecurity Investments: Continuous investment in advanced cybersecurity measures is legally required to safeguard customer data against evolving threats.

- Data Breach Penalties: Non-compliance can result in substantial fines, potentially impacting H&M's profitability and market standing.

- Customer Trust: Upholding data privacy and security is paramount for maintaining customer confidence and loyalty in the digital age.

H&M faces stringent product safety and labeling regulations globally, requiring meticulous adherence to standards like the EU's General Product Safety Regulation. For instance, in 2023, millions of products were recalled worldwide due to safety concerns, emphasizing the critical need for compliance. Accurate fiber content and care instructions are mandatory, with non-compliance risking significant fines and reputational damage, impacting consumer trust and brand loyalty.

Environmental factors

H&M is actively pursuing its commitment to utilizing 100% recycled or sustainably sourced materials by 2030. By 2024, they had already achieved 89% of this goal, demonstrating significant progress.

The company's use of recycled materials reached 29.5% in 2024, exceeding its 2025 target a year early. This includes a substantial amount of recycled polyester and a full commitment to 100% sustainably sourced cotton.

H&M is making significant strides in reducing its environmental footprint, particularly concerning greenhouse gas emissions throughout its extensive supply chain. The company is committed to ambitious climate goals.

In 2024, H&M achieved a notable 41% reduction in its scope 1 and 2 emissions compared to a 2019 baseline. Furthermore, the company reported a 24% decrease in scope 3 emissions over the same period. These achievements demonstrate a strong alignment with science-based targets, underscoring H&M's dedication to its objective of reaching net-zero climate impact by 2040.

H&M is actively working to reduce its water footprint across its supply chain. The company reported a significant achievement in 2023, reducing freshwater consumption by 9.5% among its garment suppliers compared to a 2022 baseline. This progress puts them close to their ambitious 10% reduction goal, largely due to implementing more efficient production methods and investing in water recycling technologies.

Waste Reduction and Circularity

H&M is actively pursuing waste reduction and circularity, a key environmental consideration. The company has demonstrated significant progress by achieving a 54% reduction in plastic packaging as of 2023, exceeding its initial 2025 target. This commitment extends to expanding its second-hand fashion offerings, now available in 26 markets through both physical stores and the online platform Sellpy.

The company's ambition is to eliminate waste sent to landfills or incineration. This focus on circularity is not just about packaging but also about extending the life cycle of garments, thereby minimizing environmental impact.

- Plastic Packaging Reduction: Achieved a 54% decrease since 2018, surpassing its 2025 goal.

- Circular Business Models: Expanded second-hand fashion options to 26 markets.

- Zero Waste Ambition: Aims for zero waste ending in landfill or incineration.

Deforestation and Biodiversity Impact

H&M is actively addressing deforestation by striving for a deforestation-free supply chain, aiming to significantly reduce its impact on land use. This commitment is crucial given that the fashion industry's reliance on raw materials like cotton and wood pulp can contribute to habitat destruction. For instance, in 2023, H&M reported that 99.9% of its cotton was sourced from more sustainable sources, a key step in mitigating land-use impacts.

The company's dedication extends to actively contributing to reversing nature loss and achieving global biodiversity goals. This involves a multi-pronged approach focused on enhancing soil health and championing regenerative agricultural practices throughout its supply chain. By prioritizing these methods, H&M seeks to foster ecosystems that support a wider array of plant and animal life, thereby improving overall biodiversity.

- Deforestation-Free Goal: H&M is working towards ensuring its entire supply chain is free from deforestation.

- Land Use Impact Reduction: The company aims to decrease its overall footprint on land resources.

- Biodiversity Contribution: H&M is committed to reversing nature loss and supporting global biodiversity targets.

- Regenerative Practices: Focus on improving soil health and promoting regenerative agriculture is central to their strategy.

H&M is making significant strides in reducing its environmental impact, with a focus on sustainable materials and emissions reduction. By 2024, 89% of its materials were from recycled or sustainably sourced origins, and recycled materials use reached 29.5%, surpassing its 2025 target. The company also achieved a 41% reduction in scope 1 and 2 emissions and a 24% decrease in scope 3 emissions compared to a 2019 baseline, aligning with its net-zero ambition by 2040.

Water conservation is another key environmental focus, with a 9.5% reduction in freshwater consumption by garment suppliers in 2023 compared to 2022. H&M is also committed to waste reduction, having cut plastic packaging by 54% as of 2023 and expanding its second-hand fashion offerings to 26 markets, aiming for zero waste to landfill.

Addressing deforestation and biodiversity loss, H&M reported that 99.9% of its cotton was sourced from more sustainable sources in 2023. The company actively promotes regenerative agriculture to enhance soil health and biodiversity across its supply chain.

| Environmental Factor | 2023/2024 Data | Target/Goal |

|---|---|---|

| Recycled/Sustainably Sourced Materials | 89% (by 2024) | 100% by 2030 |

| Recycled Materials Use | 29.5% (by 2024) | Exceeded 2025 target |

| Scope 1 & 2 Emissions Reduction | 41% (vs. 2019) | Net-zero by 2040 |

| Scope 3 Emissions Reduction | 24% (vs. 2019) | Net-zero by 2040 |

| Freshwater Consumption Reduction | 9.5% (vs. 2022) | 10% goal |

| Plastic Packaging Reduction | 54% (as of 2023) | Exceeded 2025 target |

| Second-hand Fashion Markets | 26 markets | Expansion ongoing |

| Sustainably Sourced Cotton | 99.9% (in 2023) | Ongoing commitment |

PESTLE Analysis Data Sources

Our H&M PESTLE Analysis is built on a robust foundation of data from official industry reports, financial statements, and reputable market research firms. We integrate insights from global economic indicators, legislative updates, and technological trend analyses to ensure comprehensive coverage.