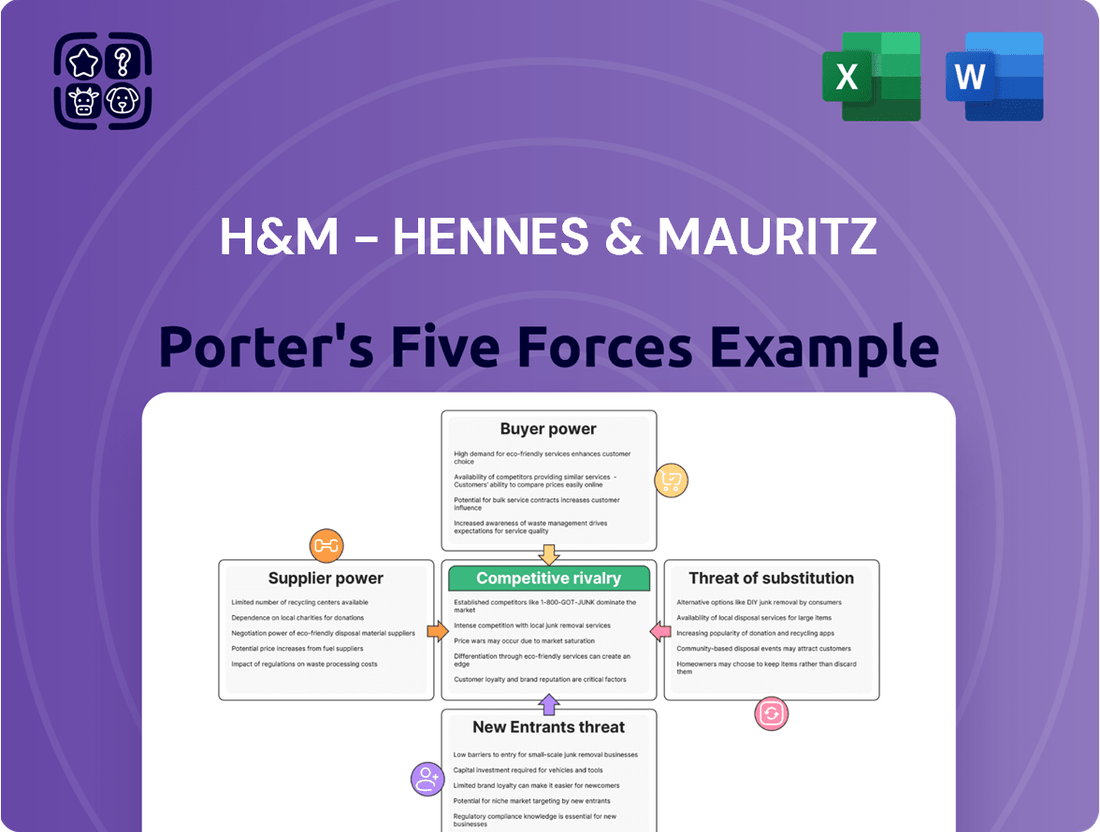

H&M - Hennes & Mauritz Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

H&M - Hennes & Mauritz Bundle

H&M - Hennes & Mauritz faces intense rivalry from established fast-fashion brands and a growing threat from online retailers, significantly impacting its market position.

The complete report reveals the real forces shaping H&M - Hennes & Mauritz’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

H&M's reliance on a sprawling network of over 700 independent suppliers, predominantly in Europe and Asia, generally dilutes the bargaining power of any single supplier. This broad supplier base allows H&M to readily shift production, mitigating the risk of any one supplier dictating terms.

However, this extensive outsourcing model creates a different dynamic. H&M's significant volume of orders means that while individual suppliers may lack power, the collective reliance on these external manufacturers can still present challenges. For instance, disruptions in key manufacturing regions, such as those experienced in Southeast Asia during 2023 due to geopolitical tensions and logistical issues, can impact H&M's ability to source goods efficiently, indirectly bolstering supplier leverage in specific instances.

While H&M benefits from a wide supplier network, its push for sustainable materials, such as organic cotton and recycled polyester, creates a growing dependence on specialized suppliers. This concentration for key inputs means a few suppliers hold significant sway, potentially increasing costs for H&M.

For instance, in 2024, the global organic cotton market, a crucial material for H&M's sustainability goals, faced price volatility due to supply chain disruptions and increased demand, impacting sourcing costs.

The costs H&M incurs when changing suppliers can be substantial. This is especially true if a supplier offers specialized machinery, unique fabric blends, or has established deeply integrated production workflows. Higher switching costs naturally give these suppliers more influence in negotiations with H&M.

For instance, a recent industry analysis from 2024 indicated that the average costs associated with switching suppliers in the textile sector can range from 8% to 12% of the total contract value. This financial impact directly influences H&M's bargaining power when dealing with its suppliers.

Supply Chain Disruptions

Supply chain disruptions, like the Red Sea crisis in early 2024, significantly impacted global shipping, causing delays and escalating costs for retailers such as H&M. This event temporarily bolstered the bargaining power of suppliers situated in less affected areas or those possessing more robust logistics networks. Consequently, H&M faced pressure to adjust its product launch timelines and optimize its production capabilities to mitigate these disruptions.

These disruptions can lead to a temporary imbalance in the supply chain, giving suppliers leverage to negotiate better terms or prioritize certain clients. For H&M, this means potentially higher input costs or the need to secure alternative sourcing, both of which affect profitability and operational efficiency.

- Increased Shipping Costs: The Red Sea crisis, for instance, saw shipping rates from Asia to Europe surge by over 100% in early 2024 due to rerouting around Africa.

- Production Delays: H&M's reliance on timely delivery of materials and finished goods means disruptions can directly impact inventory availability and sales.

- Supplier Leverage: Suppliers with unaffected supply chains or those who could maintain delivery schedules gained a stronger negotiating position, potentially demanding higher prices or stricter payment terms.

Sustainability Initiatives and Collaboration

H&M's commitment to sustainability, including its 2025 and 2030 decarbonization and material sourcing targets, necessitates deep collaboration and investment within its supply chain. This focus on ethical practices and long-term partnerships can empower suppliers by increasing their strategic importance to H&M's brand and operational goals. Consequently, suppliers who meet or exceed these sustainability benchmarks may gain leverage in negotiating terms or pricing.

- Supplier Collaboration: H&M actively partners with suppliers on initiatives like the Higg Index to improve environmental and social performance, fostering interdependence.

- Investment in Sustainability: The company's investments in sustainable materials and production processes can create dependencies on suppliers capable of meeting these evolving standards.

- Increased Supplier Influence: Suppliers demonstrating strong sustainability credentials and alignment with H&M's goals are better positioned to influence pricing and contract terms.

- 2025 Targets: H&M aims for 100% recycled or sustainably sourced materials by 2025, a goal that relies heavily on supplier capacity and innovation.

While H&M utilizes a vast supplier network, its increasing focus on specialized, sustainable materials like organic cotton and recycled polyester in 2024 has narrowed its sourcing options. This concentration on a fewer number of suppliers capable of meeting these stringent requirements grants them increased bargaining power, potentially driving up input costs for H&M.

The significant switching costs associated with finding and integrating new suppliers, estimated by industry analysis in 2024 to be between 8% and 12% of contract value, further solidify the leverage of existing, specialized suppliers. This financial barrier discourages H&M from easily changing partners, even if terms become less favorable.

Supply chain disruptions, such as the Red Sea crisis in early 2024 which doubled shipping costs from Asia to Europe, temporarily empowered suppliers with unaffected logistics. This situation forced H&M to consider higher prices or adjust production schedules, highlighting the suppliers' ability to dictate terms during periods of global instability.

H&M's ambitious 2025 target for 100% recycled or sustainably sourced materials necessitates deep collaboration with suppliers, making those who meet these benchmarks strategically vital. This interdependence strengthens the negotiating position of these key suppliers, as H&M relies on their capacity and innovation to achieve its sustainability goals.

What is included in the product

This analysis dissects H&M's competitive environment, examining the intensity of rivalry, the power of buyers and suppliers, the threat of new entrants and substitutes, all to illuminate H&M's strategic positioning and profitability drivers.

H&M's Porter's Five Forces analysis provides a clear, actionable framework to identify and mitigate competitive threats, offering strategic clarity for navigating the fast-fashion landscape.

Customers Bargaining Power

The bargaining power of customers for H&M is significantly influenced by low switching costs in the fast-fashion industry. Consumers can easily move from one brand to another with little to no financial or practical inconvenience. This means H&M needs to consistently offer compelling value to keep customers loyal.

In 2023, the global apparel market saw intense competition, with consumers prioritizing trendiness and affordability. For instance, online fashion retailers often report very low customer retention rates without active engagement strategies, highlighting how easily customers can explore new options. H&M's ability to maintain its market share hinges on its capacity to adapt quickly to changing fashion trends and maintain competitive pricing, directly addressing this customer power.

H&M's core customer base, especially within the fast-fashion market, exhibits significant price sensitivity. These shoppers actively hunt for trendy clothing at accessible price points, making affordability a primary driver of their purchasing decisions.

This constant demand for value forces H&M to adopt aggressive pricing strategies. For instance, in 2023, H&M reported a net sales increase of 6% to SEK 236 billion (approximately $22.5 billion), but this growth was achieved while managing significant cost pressures, highlighting the delicate balance required to maintain competitive pricing.

The fast-fashion market is incredibly crowded, with brands like Zara, ASOS, and Shein offering a vast selection of similar clothing. This means customers have many options to choose from, easily comparing prices, styles, and quality across different retailers.

In 2023, the global fast fashion market was valued at approximately $110 billion, with projections indicating continued growth. This sheer volume of competitors, including a surge in online-only retailers, amplifies customer bargaining power as they can readily switch to a competitor offering better value or a more appealing product.

Moderate Brand Loyalty

While H&M has cultivated a recognizable brand, the fast-fashion industry generally experiences moderate brand loyalty. Consumers are often swayed by rapidly changing trends and competitive pricing, making them less inclined to stick with a single brand exclusively. This necessitates H&M's ongoing efforts to refresh its collections and maintain attractive price points to retain its customer base.

In 2023, H&M's net sales reached SEK 236.05 billion (approximately $22.5 billion USD), indicating significant market reach. However, the churn rate in fast fashion means that a substantial portion of this revenue is driven by new customer acquisition and repeat purchases based on immediate appeal rather than deep-seated brand devotion. This environment highlights the importance of H&M's strategic focus on trend responsiveness and value proposition to counter the customer's inherent willingness to switch for better deals or newer styles.

- Brand Loyalty Dynamics: Fast fashion customers often prioritize trendiness and price, leading to moderate brand loyalty.

- H&M's Market Position: H&M's 2023 net sales of SEK 236.05 billion demonstrate its broad appeal, yet this is sustained by continuous adaptation.

- Competitive Landscape: The industry's nature encourages customers to explore various brands for the latest styles and best value.

Information Access and Online Platforms

The rise of online shopping platforms and digital tools has dramatically amplified customer bargaining power for retailers like H&M. Consumers now have unprecedented access to information, allowing them to easily research products, compare prices across numerous competitors, and scrutinize customer reviews. This transparency forces H&M to maintain competitive pricing and product quality to attract and retain shoppers.

In 2024, it's estimated that around 70% of consumers conduct online research before making a purchase, a significant increase from previous years. This trend means H&M must continually adapt its strategies to meet informed customer expectations. The ability to instantly compare offerings means customers have more leverage than ever before.

- Increased Information Availability: Online platforms provide easy access to product details, pricing, and competitor analysis.

- Price Transparency: Customers can readily compare H&M's prices with those of other fashion retailers globally.

- Influence of Reviews: Online reviews significantly impact purchasing decisions, giving customers a collective voice.

- Digital Comparison Tools: Apps and websites allow for quick and efficient product and price comparisons.

The bargaining power of customers in the fast-fashion sector, including for H&M, is substantial due to low switching costs and a highly competitive market. Consumers can easily shift between brands based on price, style, and availability, forcing H&M to continuously offer value and stay on-trend.

In 2023, global apparel market data showed that a significant portion of consumers actively sought discounts and promotions, underscoring price sensitivity. For instance, H&M's net sales of SEK 236 billion in 2023 reflect its ability to capture market share, but this is achieved in an environment where customers readily compare offerings from numerous competitors like Zara and ASOS.

The proliferation of online retail and comparison tools in 2024 has further amplified customer leverage. With approximately 70% of consumers researching purchases online before buying, H&M must ensure its pricing, product assortment, and brand messaging are compelling enough to retain shopper attention against a backdrop of abundant alternatives.

| Factor | Impact on H&M | 2023/2024 Data Point |

|---|---|---|

| Switching Costs | Low, allowing easy brand changes | Fast fashion industry characterized by minimal customer lock-in. |

| Price Sensitivity | High, driving demand for affordability | H&M's 2023 net sales of SEK 236 billion achieved amidst cost pressures. |

| Information Availability | Increased transparency, enabling easy comparison | ~70% of consumers research online before purchasing in 2024. |

| Competitive Landscape | Numerous alternatives available | Global fast fashion market valued at ~$110 billion in 2023, with many players. |

Full Version Awaits

H&M - Hennes & Mauritz Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces analysis for H&M - Hennes & Mauritz, providing an in-depth examination of competitive rivalry, the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, and the threat of substitute products. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy, offering a comprehensive understanding of the strategic landscape influencing H&M's operations and market position.

Rivalry Among Competitors

H&M operates in a crowded global clothing market, facing intense competition from numerous players. Direct fast-fashion rivals like Zara, Uniqlo, and the rapidly growing Shein are significant threats, alongside other major brands such as Boohoo, Primark, Temu, and AliExpress.

This high number of competitors means H&M must constantly innovate and adapt to maintain its market share. For instance, Shein's aggressive pricing and rapid trend adoption, particularly in 2024, have put considerable pressure on established brands.

H&M operates within the fast-fashion sector, characterized by extremely rapid design cycles and the constant introduction of new collections, sometimes on a weekly basis. This pace means companies must be agile, quickly translating runway trends into affordable garments for consumers. For instance, in 2023, H&M's revenue reached SEK 236 billion (approximately $22.7 billion USD), underscoring the scale of operations in this competitive landscape.

This relentless demand for newness fuels intense rivalry, as brands vie to capture consumer attention and market share by being the first to offer the latest styles. The pressure to innovate and deliver quickly is a defining feature, making it challenging for any single player to maintain a sustained competitive advantage solely on trend responsiveness.

The fast-fashion arena is intensely price-driven, compelling companies like H&M to continually adjust their pricing to remain competitive. This constant pressure to offer lower prices is a defining characteristic of the industry.

With market saturation becoming a significant factor in the fast-fashion sector, growth rates have slowed. This lack of substantial market expansion intensifies the competition, forcing brands into aggressive pricing tactics to capture or maintain their existing customer base.

In 2023, H&M reported net sales of SEK 236.0 billion (approximately $22.7 billion USD), highlighting the sheer volume of business in this competitive landscape. Companies are locked in a continuous battle for market share, often using price as a primary weapon.

Low Switching Costs for Consumers

The fast-fashion landscape is defined by extremely low switching costs for consumers. This means shoppers can easily move from one brand to another with minimal effort or expense, putting constant pressure on companies like H&M. For instance, a customer can decide to shop at Zara or Shein instead of H&M for their next purchase of a trendy top without incurring any fees or significant hassle. This ease of transition fuels intense competition as brands fight to capture and hold onto customer attention and loyalty. H&M's 2023 annual report highlighted the need for agility in responding to evolving consumer preferences, a direct consequence of this low switching cost environment.

To counter this, H&M must consistently deliver fresh, desirable merchandise and maintain competitive pricing. They need to offer compelling reasons for customers to remain loyal, such as unique product assortments, engaging marketing campaigns, or enhanced shopping experiences. Failing to do so can lead to a rapid erosion of market share as consumers readily explore alternatives. The global apparel market, valued at approximately $1.7 trillion in 2024, illustrates the vastness of this competitive arena where even small shifts in consumer preference can have significant impacts.

- Low Switching Costs: Consumers can easily change between fast-fashion retailers without incurring significant financial or practical barriers.

- Constant Competition: This ease of switching forces brands like H&M to continuously innovate and offer attractive value propositions to retain customers.

- Impact on Loyalty: H&M must focus on building brand loyalty through product differentiation, pricing strategies, and customer experience to mitigate customer churn.

- Market Dynamics: The global fast-fashion market's rapid pace and low barriers to entry exacerbate the effects of low switching costs, demanding constant adaptation from established players.

Global Presence and Online Platforms

H&M contends with rivals who boast expansive global physical store networks alongside sophisticated online platforms, enabling broad customer reach. This dual approach is crucial for capturing market share in both traditional and digital retail spaces.

The competitive landscape is intensified by digitally native ultra-fast fashion brands. These companies often leverage strong online presences and data-driven strategies to quickly adapt to consumer trends, posing a significant challenge to established players like H&M.

- Global Store Networks: Competitors maintain extensive physical store footprints worldwide, offering immediate customer access and brand visibility.

- Online Platform Strength: Robust e-commerce capabilities are essential, with many rivals investing heavily in user experience and digital marketing.

- Digital Native Challengers: Brands like SHEIN and Temu, known for their ultra-fast fashion models, demonstrate agility through data analytics and rapid supply chain responses.

- Market Share Dynamics: In 2023, the global apparel market saw continued growth, with online channels becoming increasingly dominant, impacting traditional retail strategies.

The competitive rivalry within the fast-fashion industry, where H&M operates, is exceptionally fierce. This is driven by a high number of players, including direct rivals like Zara, Uniqlo, and the rapidly expanding Shein, as well as other major brands. Shein's aggressive pricing and swift adoption of trends in 2024 have notably intensified this pressure.

The industry's core characteristic is its rapid design cycles and constant introduction of new collections, demanding agility from companies like H&M. With low switching costs for consumers, brands must continuously innovate and offer compelling value to retain customers, as evidenced by the global apparel market's approximate $1.7 trillion valuation in 2024.

| Competitor | Key Strategy | 2023 Revenue (Approx.) |

|---|---|---|

| Zara (Inditex) | Agile supply chain, trend responsiveness | €35.9 billion |

| Uniqlo (Fast Retailing) | Focus on quality basics, technological innovation | ¥2.75 trillion (approx. $18.6 billion USD) |

| Shein | Ultra-fast fashion, aggressive online marketing, low pricing | Undisclosed, significant growth |

| Boohoo | Online-first, influencer marketing, broad product range | £786 million (approx. $995 million USD) |

| Primark (Associated British Foods) | Value pricing, extensive store network | £9.0 billion (approx. $11.4 billion USD) |

SSubstitutes Threaten

The rise of slow and sustainable fashion presents a significant threat of substitutes for companies like H&M. Consumers are increasingly choosing durable, ethically produced clothing over disposable fast fashion items. This trend is driven by growing environmental awareness and a desire for quality that lasts longer.

This shift directly impacts H&M's traditional business model. For instance, a significant portion of consumers, particularly younger demographics, are actively seeking out brands with transparent supply chains and eco-friendly materials. Reports indicate that the global ethical fashion market is projected to reach over $10 billion by 2025, demonstrating a clear and growing consumer demand for alternatives to fast fashion.

The increasing popularity of second-hand and resale markets presents a significant threat of substitutes for H&M. Platforms like ThredUp and Vinted, alongside H&M Group's own Sellpy, provide consumers with readily available alternatives to purchasing new clothing. These platforms cater to a growing demand for sustainable and affordable fashion, directly impacting the volume of new items sold.

The global second-hand apparel market is experiencing robust growth. Projections indicate this market could reach $350 billion by 2027, up from $177 billion in 2022, demonstrating a clear consumer shift towards extending garment lifecycles and embracing pre-owned fashion.

Consumers might opt for alternative apparel categories that satisfy similar needs but fall outside H&M's primary fast-fashion market. This includes specialized sportswear, high-end luxury goods, or custom-made clothing, diverting discretionary spending. For instance, the global sportswear market alone was valued at approximately $200 billion in 2023, showcasing a significant alternative spending channel.

Non-Apparel Substitutes for Discretionary Spending

Consumers increasingly allocate discretionary income to non-apparel categories, acting as substitutes for fashion purchases. For instance, in 2024, global spending on experiences like travel and entertainment saw significant growth, potentially reducing the budget available for clothing.

These alternatives directly compete for consumer dollars. A significant portion of disposable income, which could otherwise be spent on fast fashion, might be directed towards new technology gadgets or home improvement projects, thereby diminishing demand for apparel.

- Experiences: Travel, dining, and entertainment compete for discretionary spending, diverting funds from apparel purchases.

- Technology: New electronics and gadgets often capture consumer budgets, offering an alternative to fashion upgrades.

- Home Goods: Investments in home décor and furnishings can also reduce spending on clothing.

- Other Consumer Products: A broad range of non-apparel goods vies for the same consumer wallet.

DIY and Customization Trends

The rise of DIY fashion and customization poses a significant threat to H&M. Consumers increasingly seek unique pieces, moving away from mass-produced items. This trend is fueled by platforms that enable personalization and by the growing visibility of small, independent designers.

These alternatives offer a distinct value proposition: individuality and a personal touch that fast fashion often lacks. For instance, the global custom apparel market was valued at over $10 billion in 2023 and is projected to grow substantially, indicating a clear shift in consumer preference.

- DIY & Customization: Consumers are actively engaging in personalizing their clothing, either through direct customization services or by creating items themselves.

- Independent Designers: Small-scale creators on platforms like Etsy and Instagram offer unique, often artisanal, clothing that stands out from mainstream offerings.

- Consumer Desire for Uniqueness: This trend directly challenges H&M's business model, which relies on high-volume sales of standardized fashion.

- Market Growth: The increasing demand for personalized and unique fashion items represents a growing segment of the apparel market that H&M must contend with.

The threat of substitutes for H&M is substantial, encompassing both direct apparel alternatives and non-apparel spending. Consumers are increasingly drawn to sustainable fashion, second-hand markets, and personalized clothing, all of which offer distinct value propositions. Beyond apparel, experiences, technology, and home goods actively compete for discretionary income.

| Substitute Category | Description | Market Size/Growth (2024-2027 Estimates) | Impact on H&M |

|---|---|---|---|

| Sustainable Fashion | Ethically produced, durable clothing | Global ethical fashion market projected over $10 billion by 2025 | Directly challenges fast fashion model, appeals to environmentally conscious consumers |

| Second-hand Market | Resale platforms and pre-owned clothing | Global second-hand apparel market projected to reach $350 billion by 2027 (from $177 billion in 2022) | Offers affordable and sustainable alternatives, reducing demand for new items |

| DIY & Customization | Personalized or self-made apparel | Global custom apparel market valued over $10 billion in 2023 | Appeals to desire for uniqueness, bypassing mass-produced offerings |

| Experiences & Other Goods | Travel, technology, home goods, etc. | Global spending on experiences saw significant growth in 2024; Global sportswear market ~ $200 billion in 2023 | Diverts discretionary spending away from apparel purchases |

Entrants Threaten

The apparel industry, including fast fashion giants like H&M, generally exhibits low technical barriers to entry. This means that aspiring fashion retailers don't need extensive specialized knowledge or complex machinery to start. For instance, the rise of e-commerce platforms in 2024 allows new businesses to easily set up online storefronts and reach customers without the significant overhead of brick-and-mortar stores.

While it's certainly possible for new players to enter the fast-fashion arena, truly competing with established giants like H&M demands a substantial financial commitment. This isn't just about opening a few stores; it's about building the infrastructure for mass production, launching widespread marketing campaigns, and creating efficient global supply chains. For instance, H&M's 2023 annual report showed capital expenditures of SEK 10.5 billion (approximately $1 billion USD), highlighting the scale of investment needed just to maintain and grow operations.

Newcomers often find themselves at a disadvantage because they lack the deep pockets and accumulated expertise necessary for immediate, large-scale operations. This financial hurdle makes it difficult to achieve the economies of scale that H&M leverages to keep prices competitive and product availability high across numerous markets.

Established brands like H&M enjoy significant brand awareness and deep-seated customer loyalty, creating a substantial hurdle for newcomers. This loyalty, built over years of consistent product offerings and marketing, means new entrants must pour considerable resources into building their own brand identity and marketing campaigns to even begin to challenge H&M's entrenched market position.

Access to Efficient Supply Chains

H&M's competitive edge is deeply intertwined with its highly optimized and extensive global supply chain, crucial for rapidly delivering fast-fashion items. Newcomers struggle to replicate this intricate network, which demands substantial investment and years of development, especially when navigating complex global logistics and sourcing.

Establishing a supply chain that can match H&M's speed and cost-efficiency is a formidable barrier. For instance, H&M's ability to move clothing from design to store in as little as three weeks relies on a sophisticated network of suppliers and distribution centers. A new entrant would face immense challenges in securing reliable manufacturing partners and building the necessary infrastructure to achieve similar turnaround times and economies of scale.

- Significant Capital Investment: Replicating H&M's global sourcing and logistics infrastructure requires billions in investment, a hurdle for most new fashion retailers.

- Established Supplier Relationships: H&M benefits from long-standing, deeply integrated relationships with a vast network of suppliers, ensuring quality, speed, and favorable terms.

- Logistical Expertise: Managing a complex, international supply chain for high-volume, trend-sensitive merchandise demands specialized knowledge and advanced technology, which new entrants often lack.

Competitive Response of Incumbents

Existing players like H&M are well-positioned to deter new entrants through aggressive responses. Their established economies of scale, particularly evident in their vast global supply chains and bulk purchasing power, allow for competitive pricing strategies that newcomers struggle to match. In 2023, H&M reported a net sales increase of 6% to SEK 236 billion (approximately $22.5 billion USD), showcasing their significant market presence and financial muscle.

Furthermore, H&M's extensive distribution network, encompassing thousands of stores worldwide and a robust online presence, presents a substantial barrier. New entrants would find it incredibly difficult and costly to replicate this reach. The company's agility in adapting to fast-changing fashion trends, a core competency honed over decades, also serves as a deterrent, as newcomers may not possess the same speed and insight to capture market share.

- Economies of Scale: H&M's massive operational size allows for lower per-unit production costs, making it harder for smaller new entrants to compete on price.

- Brand Loyalty and Recognition: Decades of operation have built significant brand awareness and customer loyalty, which new brands must overcome.

- Distribution Network: H&M's vast physical and online retail presence provides immediate access to a large customer base.

- Adaptability to Trends: The company's efficient supply chain and design process enable rapid response to fashion cycles, a challenge for less established competitors.

While technical barriers to entry in the fast fashion sector are relatively low, the significant capital required to build a competitive global supply chain and achieve economies of scale acts as a substantial deterrent. New entrants struggle to match H&M's established supplier relationships, logistical expertise, and brand recognition, which are critical for rapid, cost-effective production and market penetration.

H&M's financial muscle, demonstrated by its substantial capital expenditures and net sales, allows it to invest heavily in infrastructure and marketing, creating a high barrier for newcomers. The company's extensive distribution network and proven ability to adapt to fashion trends further solidify its market position, making it challenging for new players to gain traction.

| Barrier | H&M's Advantage | New Entrant Challenge |

| Capital Investment | SEK 10.5 billion (2023) in CapEx | Requires billions to replicate infrastructure |

| Supply Chain | 3-week turnaround capability | Difficulty securing reliable partners and infrastructure |

| Brand Recognition | Decades of operation | Needs significant marketing investment |

| Distribution | Thousands of global stores and online presence | High cost and time to build reach |

Porter's Five Forces Analysis Data Sources

Our H&M Porter's Five Forces analysis is built upon a foundation of comprehensive data, including H&M's official annual reports, investor presentations, and sustainability reports. We also leverage industry-specific market research from firms like Statista and IBISWorld, alongside news and trade publications to capture current market dynamics.