H&M - Hennes & Mauritz Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

H&M - Hennes & Mauritz Bundle

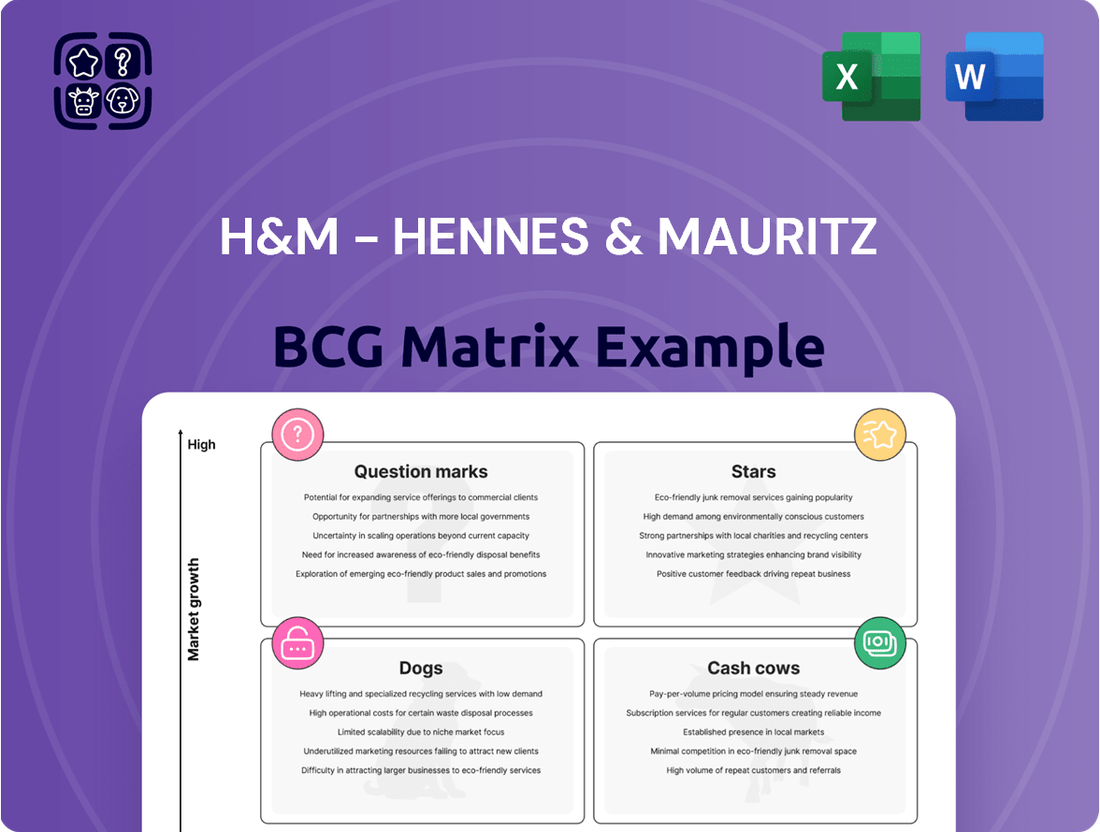

Curious about H&M's strategic product positioning? Our BCG Matrix analysis reveals which of their offerings are driving growth (Stars), generating consistent revenue (Cash Cows), lagging behind (Dogs), or present exciting but uncertain potential (Question Marks).

Unlock the full picture and understand the dynamics behind H&M's success and challenges. Purchase the complete BCG Matrix report for detailed quadrant placements, actionable insights, and a clear roadmap for strategic decision-making.

Stars

H&M's digital sales and online platform are a powerhouse, driving substantial growth. In fiscal year 2024, these channels represented a remarkable 30% of the company's total sales.

The momentum continues into 2025, with strong performance observed in the first quarter. This digital success is underpinned by significant investments in improving the online customer experience.

For instance, the integration of AI-generated styling recommendations has demonstrably enhanced conversion rates, showcasing the effectiveness of their digital strategy.

H&M is strategically targeting emerging markets for growth, with planned store and e-commerce expansion into Brazil and Venezuela slated for 2025. This move is designed to tap into burgeoning consumer bases and unlock substantial revenue streams. For instance, Brazil's apparel market was valued at approximately $70 billion in 2024, presenting a significant opportunity.

H&M's core womenswear collections are performing exceptionally well, demonstrating robust market appeal and driving significant revenue. These collections are pivotal to H&M's fast-fashion identity and have seen an increase in full-price selling, a strong indicator of their desirability.

Omnichannel Integration

H&M's commitment to omnichannel integration is a key driver of its current market position. By seamlessly blending its physical stores with its online presence, the company is creating a unified customer journey that boosts engagement and sales.

This strategy aims to provide customers with flexibility, allowing them to browse online and pick up in-store, or return online purchases at a physical location. This convenience factor is crucial in today's retail landscape.

In the first quarter of 2024, H&M reported a 7% increase in net sales in local currencies, reaching SEK 53.6 billion (approximately $5.1 billion USD). This growth is partly attributed to the successful implementation of their integrated retail strategy.

- Seamless Customer Experience: Unifying online and in-store operations to offer a consistent brand interaction.

- Enhanced Engagement: Omnichannel strategies foster deeper customer relationships across all touchpoints.

- Sales Performance: Integrated channels contribute to overall revenue growth, as seen in Q1 2024 sales figures.

- Operational Efficiency: Streamlining inventory management and fulfillment across the network.

Sustainability Leadership and Innovation

H&M's dedication to sustainability is a significant driver of its market position. By 2024, the company reported that 89% of its materials were recycled or sustainably sourced, demonstrating a tangible commitment to environmental responsibility. This focus resonates with an increasing number of consumers who prioritize ethical and eco-friendly products.

This leadership in sustainability can be viewed through the lens of a BCG matrix as a potential "Star." The growing consumer demand for sustainable fashion creates a high-growth market, and H&M's established progress positions it favorably to capture and expand its market share within this segment. The company's investments in circularity, such as garment collection and recycling initiatives, further solidify this advantage.

- Sustainability Metric: 89% of materials used by H&M were recycled or sustainably sourced in 2024.

- Market Trend: Increasing consumer preference for environmentally conscious and ethically produced fashion.

- Strategic Implication: H&M's sustainability efforts attract a growing customer base, potentially increasing market share.

- Innovation Focus: Investment in circular economy models and material innovation supports long-term growth.

H&M's strong performance in digital sales and expansion into emerging markets positions these segments as potential Stars in the BCG matrix. Their commitment to sustainability, with 89% of materials being recycled or sustainably sourced in 2024, also aligns with a high-growth market trend, further solidifying their Star status.

These areas represent high growth, high market share opportunities for H&M. The company's strategic investments in online platforms and new geographic markets are designed to capitalize on these expanding segments.

The success of their digital channels, which accounted for 30% of sales in fiscal year 2024, and the planned expansion into markets like Brazil, highlight H&M's focus on high-potential growth areas.

H&M's sustainability initiatives are attracting environmentally conscious consumers, a growing market segment where the company is well-positioned to gain share.

| BCG Category | H&M Segment | Market Growth | Market Share | Rationale |

|---|---|---|---|---|

| Stars | Digital Sales & Online Platform | High | High | 30% of total sales in FY24; ongoing investment in customer experience. |

| Stars | Emerging Market Expansion (e.g., Brazil) | High | Growing | Brazil's apparel market valued at ~$70 billion in 2024; strategic expansion planned. |

| Stars | Sustainability Initiatives | High | Strong & Growing | 89% sustainably sourced materials in 2024; increasing consumer demand for eco-friendly products. |

What is included in the product

H&M's BCG Matrix likely shows established Cash Cows in core markets and Stars in emerging ones, with Question Marks in new ventures and potential Dogs in declining segments.

The H&M BCG Matrix provides a clear, one-page overview of their business units, relieving the pain point of strategic confusion.

This export-ready design streamlines presentation, alleviating the stress of creating C-level reports.

Cash Cows

H&M's extensive global physical store network, boasting over 4,000 locations across more than 75 markets, serves as a significant cash cow. This vast footprint provides a stable and substantial revenue stream, underpinning the company's financial strength.

Despite some strategic store closures, this established physical presence continues to be a powerful generator of cash flow. In 2023, H&M reported a net sales increase of 6% in local currencies, demonstrating the enduring contribution of its brick-and-mortar operations to overall revenue generation.

H&M's core fast-fashion business model, centered on offering affordable, trend-driven apparel for a wide demographic, secures a substantial market share within the mature fashion industry. This efficient, broadly appealing approach consistently yields robust profit margins and healthy cash flow.

H&M's enduring global brand recognition and deep customer loyalty are cornerstones of its stable market position and reliable sales performance. This widespread appeal allows H&M to consistently capture a significant share of the mass-market fashion segment.

In 2023, H&M reported net sales of SEK 248.2 billion (approximately $23.7 billion USD), underscoring its substantial presence and the continued strength of its brand in a competitive landscape.

Efficient Supply Chain and Cost Control

H&M's dedication to an efficient supply chain and rigorous cost control is a cornerstone of its Cash Cow status. This operational excellence allows the company to maintain healthy profit margins, even when facing economic headwinds or increased competition. The company's ability to manage costs effectively ensures that its substantial market share, a key characteristic of a Cash Cow, directly translates into significant cash flow generation.

These efficiencies are crucial for H&M's profitability. For instance, in the first quarter of 2024, H&M Group reported a profit after tax of SEK 2,075 million. This demonstrates their capability to convert sales into profits, a hallmark of a mature and stable business unit. Their strategic sourcing and logistics management play a vital role in achieving this.

- Streamlined Logistics: H&M utilizes sophisticated logistics networks to minimize transportation costs and delivery times, ensuring products reach stores efficiently.

- Strategic Sourcing: The company leverages its scale to negotiate favorable terms with suppliers, driving down the cost of goods sold.

- Inventory Management: Advanced inventory systems help reduce waste and holding costs, optimizing cash tied up in stock.

- Operational Leverage: Fixed costs are spread over a large sales volume, increasing profitability per unit sold.

H&M Home Division

The H&M HOME division operates as a significant contributor to the H&M Group, benefiting from the parent company's established infrastructure and strong brand recognition. This synergy allows H&M HOME to effectively penetrate the competitive home goods market, offering a diverse range of products that complement the fashion offerings.

This division represents a stable revenue generator for H&M. In 2023, H&M Group's sales increased by 6% to SEK 248.2 billion (approximately $23.7 billion USD), indicating a robust overall performance where divisions like H&M HOME contribute to this steady growth within a mature market segment.

- Leverages existing infrastructure: H&M HOME utilizes H&M's extensive retail network and online presence for distribution and marketing.

- Brand recognition: The established H&M brand provides immediate customer trust and awareness for the home goods offerings.

- Steady revenue stream: The home décor market generally exhibits stable demand, providing a reliable income source for the group.

- Product diversification: It broadens H&M's appeal beyond apparel, capturing a wider consumer base interested in lifestyle products.

H&M's core fast-fashion business, with its established global presence and efficient supply chain, functions as a significant cash cow. This model consistently generates substantial revenue and profit, supported by strong brand recognition and customer loyalty in the mass market. The company's operational efficiencies, including strategic sourcing and inventory management, are key to maintaining healthy profit margins.

In 2023, H&M's net sales reached SEK 248.2 billion (approximately $23.7 billion USD), reflecting the enduring strength of its mature business segments. The company's ability to manage costs effectively ensures that its large market share translates directly into robust cash flow generation, as evidenced by a profit after tax of SEK 2,075 million in Q1 2024.

The H&M HOME division also contributes as a stable revenue generator, leveraging the parent company's infrastructure and brand trust. This division benefits from the general stability of the home décor market, broadening H&M's appeal and providing a reliable income stream within the group's overall performance.

| Business Segment | BCG Category | Key Characteristics | 2023 Performance Indicator |

| Core Fast Fashion (Physical & Online) | Cash Cow | High Market Share, Low Growth Market, Strong Brand Recognition, Efficient Supply Chain | Net Sales: SEK 248.2 billion (approx. $23.7 billion USD) |

| H&M HOME | Cash Cow | Leverages Existing Infrastructure, Stable Demand, Brand Trust, Product Diversification | Contributes to overall Group Sales Growth (6% in 2023) |

What You See Is What You Get

H&M - Hennes & Mauritz BCG Matrix

The H&M - Hennes & Mauritz BCG Matrix preview you see is the definitive document you will receive upon purchase, offering a comprehensive strategic analysis of their product portfolio. This is not a sample or a demo; it's the complete, professionally formatted report ready for immediate application in your business planning. You'll gain access to the full, unwatermarked BCG Matrix, meticulously detailing H&M's market position and growth potential for each product category. Once purchased, this analysis-ready file is instantly downloadable, allowing you to seamlessly integrate its insights into your strategic decision-making and competitive evaluations.

Dogs

H&M's strategy includes a net reduction of around 60 stores in 2024, primarily targeting established markets. This move suggests that a portion of their physical store portfolio is underperforming, likely characterized by limited growth potential and a diminished market share within their operating regions. These underperforming locations may represent a drain on company resources, impacting overall profitability.

Certain older or less innovative product lines within H&M's extensive offerings, such as their basic knitwear or certain seasonal fast-fashion items that haven't been refreshed, might be experiencing declining demand. These items often require significant markdowns to clear inventory, impacting overall profitability.

For instance, in H&M's 2023 fiscal year, while overall sales grew, the company noted challenges with inventory management in certain segments, leading to increased promotional activities. This suggests that some product categories may indeed be underperforming, fitting the description of a 'dog' in the BCG matrix.

Brands with limited market penetration, like Monki within the H&M Group, often represent potential question marks in a BCG matrix. These brands might have a small share of their respective markets and face difficulties in scaling up. For example, Monki's strategic adjustments, including store wind-downs in certain regions, point to the challenges of gaining traction and profitability in competitive fashion landscapes.

Inefficient Operational Processes

H&M's operational inefficiencies, particularly in areas like inventory management and supply chain logistics, can lead to increased markdowns. For instance, if a significant portion of inventory remains unsold at the end of a season due to poor forecasting or slow distribution, it necessitates heavy discounting to clear stock, directly impacting profitability. These inefficiencies represent a drain on resources without a commensurate increase in sales.

These operational drains can manifest in several ways:

- Higher Administrative Expenses: Complex or outdated systems can inflate administrative costs related to stock management, returns processing, and general overhead.

- Increased Markdowns: Poor inventory turnover and demand forecasting lead to excess stock that must be sold at reduced prices, eroding profit margins. In 2023, H&M reported a net profit of SEK 4.59 billion (approximately $440 million USD), a decrease from previous years, partly attributable to these operational challenges.

- Reduced Resource Allocation: Capital and human resources tied up in inefficient processes could otherwise be invested in growth areas or innovation, hindering overall business development.

Limited Adoption of Certain Circular Initiatives

H&M's commitment to circularity includes initiatives like resale platforms, but their current impact on overall revenue is minimal. In 2024, these programs contributed only 0.6% to the company's turnover. If these circular efforts fail to gain traction and scale effectively, they could be categorized as dogs within the BCG matrix, despite their potential for future growth.

The limited adoption of certain circular initiatives poses a challenge for H&M's strategic positioning.

- Low Revenue Contribution: Resale platforms accounted for a mere 0.6% of H&M's turnover in 2024.

- Scaling Challenges: The ability of these initiatives to grow and become significant revenue drivers remains uncertain.

- Potential "Dog" Status: Without substantial scaling, these programs might be classified as dogs due to their low current market share.

Dogs within H&M's portfolio represent business units or product lines with low market share and low growth potential. These are often characterized by declining sales and profitability, requiring careful management to avoid becoming a significant drain on resources. Identifying and addressing these "dogs" is crucial for optimizing H&M's overall strategic allocation.

H&M's strategy includes a net reduction of around 60 stores in 2024, primarily targeting established markets, indicating some physical locations are underperforming with limited growth potential. Certain older or less innovative product lines, like basic knitwear, may also be experiencing declining demand, necessitating significant markdowns. For instance, H&M reported challenges with inventory management in fiscal year 2023, leading to increased promotional activities, a common trait of dog categories.

The limited adoption of certain circular initiatives poses a challenge for H&M's strategic positioning. For example, resale platforms accounted for a mere 0.6% of H&M's turnover in 2024, indicating low revenue contribution and potential scaling challenges. Without substantial growth, these programs might be classified as dogs due to their low current market share.

| Category | Market Share | Growth Potential | H&M Example |

| Dogs | Low | Low | Underperforming stores, certain basic product lines, nascent circularity initiatives with low uptake. |

Question Marks

H&M's strategic expansion into markets like Brazil, Venezuela, and El Salvador by 2025 positions them to tap into significant growth opportunities. These new ventures, while holding minimal current market share for H&M, represent potential Stars in the BCG matrix, demanding substantial capital investment to build brand recognition and capture market share.

H&M is channeling significant resources into advanced technologies like AI, big data analytics, and cloud computing. These investments are primarily aimed at making their supply chain more responsive and tailoring customer experiences with greater precision. For instance, in 2023, H&M reported a substantial increase in its IT spending, with a focus on digital transformation initiatives, though specific figures for AI and cloud investments are often embedded within broader capital expenditure reports.

These technological advancements represent potential stars in the BCG matrix for H&M. They offer the promise of considerable operational efficiencies and deeper customer engagement, which could translate into significant market share gains and revenue growth. However, the full market impact and the definitive return on these developing technologies are still being realized, placing them in a category that requires continued observation and strategic cultivation.

H&M's ventures into circular business models, such as expanding its second-hand offerings to 26 markets and investing in textile recycling technologies, represent significant future growth potential. These initiatives are currently in their nascent stages, with a relatively low contribution to overall revenue and market share.

These nascent circular initiatives, while promising, fall into the question mark category of the BCG matrix. They demand substantial ongoing investment to nurture their growth and market penetration. For instance, H&M's commitment to increasing the use of recycled materials in its products is a key area where capital is being deployed to build future market leadership.

Lifestyle Brands (H&M Move, H&M Beauty)

H&M is strategically expanding its footprint with lifestyle brands like H&M Move and H&M Beauty, recognizing their significant growth potential. These ventures aim to capture a larger share of the activewear and beauty markets, respectively, by leveraging the established H&M brand while cultivating unique identities.

While these segments are still developing their market presence, H&M's investment signals confidence in their future performance. For instance, H&M Move launched in early 2022, quickly establishing a physical presence and online offering, indicating a focused effort to build momentum in the competitive sportswear sector.

- H&M Move: Launched in February 2022, this activewear line aims to make movement accessible and stylish for everyone, tapping into the growing global athleisure market.

- H&M Beauty: This segment offers a wide range of beauty products, from makeup to skincare and haircare, under its own branding and through curated third-party brands, seeking to compete in the expansive beauty industry.

- Market Potential: The global activewear market was valued at approximately USD 350 billion in 2023 and is projected to grow, as is the global beauty market, providing ample room for H&M's expansion.

ARKET's Cautious International Expansion

ARKET, a key player in the H&M Group's portfolio, is exhibiting characteristics of a 'Question Mark' in the BCG matrix with its deliberate expansion into markets such as Austria and Ireland in 2025. This strategy reflects a strong belief in ARKET's future growth potential, a common trait for brands in this category.

The brand's current market share in these new territories is understandably low, necessitating significant investment to establish a foothold and capture consumer interest. This investment is crucial for transforming ARKET from a nascent market presence into a dominant force.

For context, H&M Group's overall revenue for the first quarter of fiscal year 2024 reached SEK 60.5 billion (approximately $5.8 billion USD), demonstrating the financial capacity to support such strategic growth initiatives. ARKET's performance within this larger structure is a key indicator of its individual trajectory.

- High Growth Potential: ARKET's expansion into new European markets signals ambitious growth targets.

- Low Market Share: In these nascent regions, ARKET is starting with a small market share, typical of 'Question Marks'.

- Strategic Investment: The brand requires substantial investment to build brand awareness and market penetration.

- Future Star Potential: Successful cultivation could elevate ARKET to a 'Star' within the H&M Group's portfolio.

H&M's new market entries, like Brazil and El Salvador by 2025, are classic question marks. They require significant capital to build brand awareness and market share from a low starting point.

Similarly, H&M's investments in AI and cloud computing, while promising future efficiencies, are still in their early stages of market impact. Their success hinges on continued investment and development to solidify their position.

The circular business models, such as expanded second-hand offerings and textile recycling, also fall into this category. These initiatives need substantial funding to grow and gain traction in the market, aiming to become future leaders.

H&M Move and H&M Beauty represent strategic bets on high-growth markets. Their current low market share in these segments necessitates considerable investment to capture a larger piece of the pie.

ARKET's expansion into Austria and Ireland in 2025 places it firmly in the question mark quadrant. It has a low market share in these new territories, demanding significant investment to build its presence and brand recognition.

| Business Unit | Market Growth | Relative Market Share | BCG Category | Strategic Rationale |

| New Market Entries (Brazil, El Salvador) | High | Low | Question Mark | Build brand presence, capture future growth |

| AI & Cloud Computing Initiatives | High (Technology Adoption) | Low (Market Penetration) | Question Mark | Enhance operations, customer experience |

| Circular Business Models | High (Sustainability Trend) | Low (Current Revenue Contribution) | Question Mark | Future market leadership, brand differentiation |

| H&M Move / H&M Beauty | High (Market Segments) | Low (New Ventures) | Question Mark | Diversify offerings, tap into growing lifestyle trends |

| ARKET (New Markets) | High | Low | Question Mark | Expand brand reach, establish new territories |

BCG Matrix Data Sources

Our H&M BCG Matrix draws from H&M's annual reports, investor presentations, and reputable fashion industry market research. This ensures a comprehensive understanding of product performance and market share.