HKT Trust and HKT PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HKT Trust and HKT Bundle

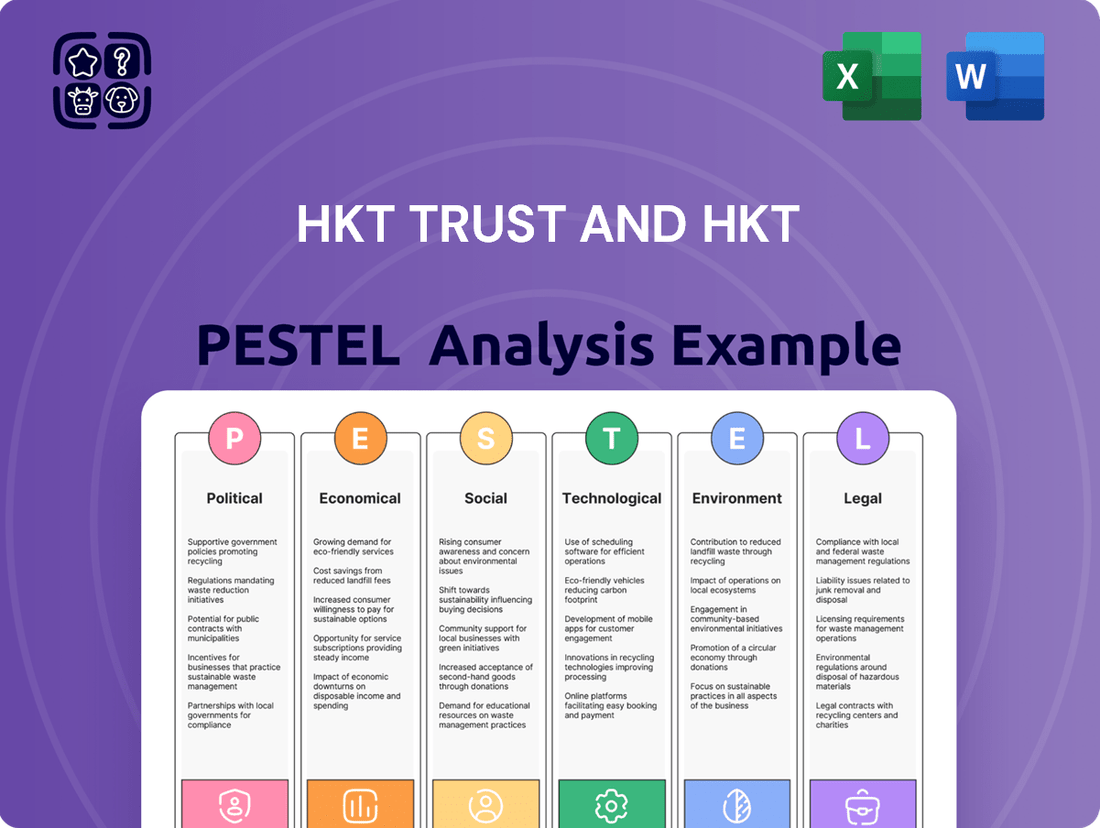

Unlock the strategic forces shaping HKT Trust and HKT's future with our comprehensive PESTLE analysis. Understand how political stability, economic shifts, technological advancements, societal trends, environmental regulations, and legal frameworks are influencing their operations and market position. Gain a critical advantage by leveraging these expertly analyzed insights to refine your own business strategy.

Don't be left behind in the dynamic telecommunications landscape. Our in-depth PESTLE analysis of HKT Trust and HKT provides actionable intelligence on the external factors driving success or posing challenges. Equip yourself with the knowledge to anticipate market changes and make informed decisions. Purchase the full analysis now and gain the clarity you need to thrive.

Political factors

The Hong Kong government, via the Office of the Communications Authority (OFCA), maintains a strong regulatory hand on the telecommunications industry, directly impacting HKT's business through spectrum allocation and licensing processes. For instance, the Telecommunications (Amendment) Ordinance 2024 introduced measures to accelerate 5G infrastructure development and broaden network reach across the territory.

OFCA's planned initiatives for 2024-2025 underscore this active oversight, focusing on facilitating the deployment of new submarine cables and critically reviewing the utilization of existing telephone exchange sites, which could influence HKT's infrastructure planning and operational efficiency.

Hong Kong's political environment is heavily influenced by the National Security Law (NSL) and the Safeguarding National Security Ordinance (SNSO) enacted in 2024. These laws have direct implications for civil liberties and can indirectly impact business operations, including those of telecommunications providers.

As a major telecommunications operator, HKT operates within a framework where increased surveillance powers and potential data flow restrictions, stemming from national security concerns, are present. This necessitates heightened vigilance and compliance with evolving regulatory demands.

The company's role as critical infrastructure means it may face more rigorous scrutiny and additional compliance burdens related to national security legislation, potentially affecting its operational strategies and data handling practices.

The Hong Kong government's commitment to smart city development, as detailed in its Smart City Blueprint 2.0 released in December 2020, presents significant opportunities for HKT. This blueprint focuses on enhancing areas like mobility, living, environment, and the economy, directly supporting HKT's strategic expansion into digital services and infrastructure.

HKT is a key player in this transformation, leveraging its robust network infrastructure to facilitate smart city advancements. The company's involvement extends to new digital ventures such as e-commerce and fintech, aligning perfectly with the government's digital agenda.

The ongoing drive for digital transformation by the Hong Kong government creates a highly favorable environment for HKT's enterprise solutions. For instance, HKT's participation in projects aimed at improving public transport connectivity or enhancing digital payment systems directly benefits from these government-led initiatives.

Cross-Border Relations and Mainland China Expansion

HKT Trust is strategically expanding its enterprise services into mainland China, targeting both domestic firms and international companies establishing a foothold there. This move is intrinsically linked to the dynamic political and economic ties between Hong Kong and mainland China, influencing trade agreements and regulatory frameworks. For instance, the Closer Economic Partnership Arrangement (CEPA) continues to facilitate market access for Hong Kong businesses, though specific sector regulations in China can shift.

Navigating these cross-border complexities is crucial for HKT's success. The firm leverages Hong Kong's established position as a global financial hub to bridge markets. As of early 2024, mainland China's digital economy is projected to grow significantly, with the ICT services sector being a key driver, presenting substantial opportunities for HKT.

- Cross-Border Growth: HKT's enterprise division is actively pursuing opportunities in mainland China.

- Regulatory Environment: Success depends on adapting to evolving trade policies and regulatory alignment between Hong Kong and mainland China.

- Leveraging Hong Kong's Status: HKT aims to capitalize on Hong Kong's international financial center status to facilitate its mainland expansion.

- Market Opportunity: Mainland China's digital economy growth, particularly in ICT, offers a substantial market for HKT's services.

Data Governance and Cybersecurity Policy

The Hong Kong government's commitment to bolstering its data governance and cybersecurity framework presents a key political factor for HKT. Recent proposals, such as the Protection of Critical Infrastructure (Computer System) Bill, expected in December 2024, alongside updated guidance on AI and personal data, signal a stricter regulatory environment. HKT must therefore allocate resources for continuous adaptation and investment in advanced data protection and cybersecurity measures to ensure resilience.

Compliance with these evolving legal mandates is paramount. Failure to adhere to new data protection and cybersecurity regulations could result in significant penalties and, more critically, damage customer trust. For instance, the Personal Data (Privacy) Ordinance already carries substantial fines for breaches, and upcoming legislation is likely to maintain or increase this pressure.

HKT's proactive approach to cybersecurity is essential, especially considering the increasing sophistication of cyber threats. The company's ability to demonstrate robust data handling practices and a strong defense against cyberattacks will be a competitive advantage. This includes ensuring that their systems are compliant with upcoming standards, potentially impacting their operational costs and strategic planning for the 2024-2025 period.

- Data Protection Legislation: Hong Kong's proposed Protection of Critical Infrastructure (Computer System) Bill (December 2024) mandates enhanced security protocols.

- AI and Data Guidance: Updated government guidance on AI and personal data necessitates HKT's review and potential overhaul of data processing practices.

- Cybersecurity Investment: HKT faces pressure to invest in resilient cybersecurity infrastructure to meet new regulatory demands and mitigate risks.

- Customer Trust and Penalties: Non-compliance with evolving data governance policies could lead to substantial fines and erosion of customer confidence.

The Hong Kong government's regulatory stance, exemplified by OFCA's oversight and initiatives like the Telecommunications (Amendment) Ordinance 2024, directly shapes HKT's operational landscape, particularly concerning 5G deployment and infrastructure management.

The enactment of the Safeguarding National Security Ordinance in 2024 introduces a complex political environment, potentially influencing HKT's data handling and surveillance compliance, requiring heightened vigilance.

HKT's strategic expansion into mainland China is influenced by evolving cross-border trade agreements and regulatory frameworks, such as CEPA, with China's digital economy growth in ICT services presenting significant market opportunities.

Hong Kong's push for smart city development, supported by initiatives like the Smart City Blueprint 2.0, creates a favorable ecosystem for HKT's digital services and infrastructure investments.

What is included in the product

This comprehensive PESTLE analysis delves into the Political, Economic, Social, Technological, Environmental, and Legal forces impacting the HKT Trust and its operations, providing a nuanced understanding of the external landscape.

It offers actionable insights for strategic decision-making by highlighting key trends and potential challenges faced by HKT within its operating environment.

The HKT Trust PESTLE analysis acts as a pain point reliever by offering a clear, summarized version of the full analysis for easy referencing during meetings or presentations, streamlining strategic discussions.

Economic factors

Hong Kong's economy showed resilience in 2024, with real GDP expanding by an estimated 2.5%. This growth was largely supported by a rebound in external demand, a key factor for businesses like HKT that rely on international trade and connectivity.

Looking ahead to 2025, projections suggest continued economic expansion, albeit at a slightly more measured pace of 2.2% to 2.5%. This sustained, albeit moderate, growth environment is crucial as it directly impacts consumer disposable income and business investment in telecommunications infrastructure and services, areas where HKT operates.

Private consumption expenditure in Hong Kong experienced a slight downturn in 2024. This was influenced by residents increasingly opting for outbound travel and a noticeable shift towards online purchasing channels. HKT must remain agile, adjusting its service portfolio to align with these evolving consumer preferences.

While underlying consumer price inflation remained subdued throughout 2024, a potential weakening of the Hong Kong dollar in 2025 could offer a tailwind for the retail sector. This presents an opportunity for HKT to leverage pricing strategies and potentially boost demand for its services.

Hong Kong’s economic landscape in 2024 was marked by elevated interest rates, creating a tighter financial environment. Despite this, HKT demonstrated resilience, successfully reducing its net debt-to-EBITDA ratio to 2.9x by year-end 2024 through effective deleveraging strategies.

Looking ahead to the first half of 2025, projections indicate a potential decline in the Hong Kong Interbank Offered Rate (HIBOR). This anticipated decrease in borrowing costs could alleviate liquidity constraints for businesses and potentially encourage increased bank lending activity.

A more favorable interest rate environment in 2025 would likely benefit HKT by lowering the cost of capital. This could, in turn, support the company's strategic investments in crucial infrastructure upgrades and the exploration of new business opportunities, fostering future growth.

Market Competition and Pricing Pressures

The Hong Kong telecommunications sector is a battleground, with HKT facing robust competition from established giants like China Mobile Hong Kong and SmarTone, as well as newer entrants vying for market share. This intense rivalry necessitates continuous innovation and a keen focus on customer retention.

HKT's Pay TV segment is particularly vulnerable to competition from a vast array of free and paid entertainment platforms, including streaming services and digital content providers. This broad competitive set significantly pressures HKT's ability to maintain subscriber numbers and pricing power for its television offerings.

The prevailing competitive environment forces HKT to differentiate its services and invest in new technologies to stay ahead. For instance, in early 2024, telecom operators were actively upgrading their 5G networks, a costly endeavor driven by the need to offer superior data speeds and services to attract and retain customers amidst fierce price competition.

- Market Share Dynamics: While specific up-to-the-minute market share data is proprietary, industry reports from late 2023 and early 2024 indicated a relatively stable, albeit highly contested, distribution of subscribers among the top three players.

- Pricing Strategies: Telecom providers in Hong Kong frequently engage in promotional pricing, offering bundled deals on mobile, broadband, and TV services to attract new customers and reduce churn.

- Content Costs: The rising cost of acquiring exclusive broadcasting rights for popular sports and entertainment content is a significant factor impacting the profitability of Pay TV services, further intensifying pricing pressures.

- Innovation Investment: Operators are channeling significant capital into 5G infrastructure and exploring new revenue streams like IoT and cloud services to offset potential declines in traditional revenue segments.

Investment in Digital Infrastructure

The telecommunications market in Hong Kong is characterized by substantial investment in digital infrastructure, notably the continued deployment of 5G networks and the expansion of fiber broadband services. HKT is a key player in this landscape, actively investing in its comprehensive high-speed network. By the close of 2024, HKT reported that its Fiber to the Home (FTTH) connections had reached an impressive 1.04 million households.

This ongoing commitment to upgrading and expanding network capabilities is essential. It directly addresses the escalating demand for data services and ensures the delivery of robust, high-speed connectivity to consumers and businesses alike. Such investments are critical for maintaining competitiveness and enabling future digital innovations.

- 5G Rollout: Continued investment in 5G infrastructure is a primary driver of market growth.

- Fiber Broadband Expansion: HKT's FTTH connections reached 1.04 million by the end of 2024, highlighting network expansion.

- Data Consumption: Investments are necessary to support the ever-increasing data consumption patterns of users.

- Connectivity: The focus remains on delivering high-speed and reliable connectivity to meet market demands.

Hong Kong's economic growth is projected to continue into 2025, with GDP expected to grow between 2.2% and 2.5%. This sustained expansion supports consumer spending and business investment, crucial for HKT's service offerings. However, private consumption saw a dip in 2024 due to increased outbound travel and online shopping, requiring HKT to adapt its strategies.

While inflation remained low in 2024, a potential weakening of the Hong Kong dollar in 2025 could benefit the retail sector, offering HKT opportunities for strategic pricing. The company also demonstrated financial strength by reducing its net debt-to-EBITDA ratio to 2.9x in 2024, despite elevated interest rates.

Anticipated lower interest rates in the first half of 2025 could reduce HKT's cost of capital, facilitating investments in network upgrades and new ventures. The telecommunications market remains highly competitive, with HKT facing rivals like China Mobile Hong Kong and SmarTone, driving the need for continuous innovation and customer focus.

HKT is actively investing in its high-speed network, with Fiber to the Home connections reaching 1.04 million households by the end of 2024. This commitment to infrastructure is vital for meeting escalating data demands and maintaining a competitive edge in the evolving digital landscape.

| Economic Indicator | 2024 (Estimate/Actual) | 2025 (Projection) | Impact on HKT |

|---|---|---|---|

| Real GDP Growth | 2.5% | 2.2% - 2.5% | Supports revenue from consumer and business segments. |

| Private Consumption Expenditure | Slight Downturn | [Data not available] | Requires agile service adaptation to evolving consumer behavior. |

| Inflation (CPI) | Subdued | [Data not available] | Stable pricing environment, potential currency impact on retail. |

| Interest Rates (HIBOR) | Elevated | Potential Decline (H1 2025) | Lower borrowing costs, enabling investment and growth. |

| Net Debt-to-EBITDA Ratio | 2.9x (End 2024) | [Data not available] | Demonstrates financial resilience and deleveraging success. |

What You See Is What You Get

HKT Trust and HKT PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. It details the HKT Trust and its comprehensive PESTLE analysis, providing a strategic overview of the external factors influencing its operations.

Sociological factors

Consumers increasingly expect a unified provider for all their connectivity needs, wanting seamless digital access whether they are at home or out and about. This trend highlights a growing demand for integrated services that simplify their digital lives.

The market is seeing a significant migration to digital and Over-The-Top (OTT) platforms, which directly impacts traditional mobile voice revenue. For instance, in 2024, the global OTT market was projected to reach over $200 billion, demonstrating the scale of this shift as consumers opt for internet-based communication.

HKT's strategic response includes enhancing its Now OTT service and promoting bundled solutions. These initiatives align with consumer desires for convenience and integrated digital experiences, aiming to capture a larger share of this evolving market.

Hong Kong's demographics are evolving post-pandemic, with potential implications for HKT's consumer base. New residents may exhibit different spending patterns and labor market participation, influencing local demand for HKT's services.

Despite a tight labor market in 2024, with unemployment rates hovering around 2.8%, HKT must proactively address talent acquisition and retention. Strategies focusing on upskilling existing staff and promoting diversity will be crucial for maintaining competitiveness and adapting to changing workforce needs.

The increasing digital literacy and adoption of advanced technologies, particularly 5G, are fundamentally reshaping consumer behavior and service expectations. In 2024, Hong Kong's mobile data consumption continued its upward trajectory, with average monthly data usage per subscriber reaching new heights, driven by video streaming and cloud-based applications. HKT's commitment to bridging the digital divide is evident in its ongoing community programs, including workshops aimed at improving digital skills among seniors, thereby fostering a more inclusive digital economy.

HKT's strategic focus on enhancing digital fluency directly supports its business objectives by cultivating a larger and more receptive customer base for its high-speed broadband and 5G services. Initiatives like university outreach programs and accessible smartphone training sessions are crucial in ensuring that a wider demographic can leverage the full potential of digital connectivity. This proactive approach to digital adoption is key to unlocking future revenue streams and maintaining a competitive edge in the evolving telecommunications landscape.

Evolving Work and Lifestyle Patterns

The persistent digital transformation and the widespread adoption of remote work are fueling a continuous demand for robust, high-speed telecommunications. This trend directly benefits HKT, as businesses increasingly rely on their services to maintain connectivity and productivity in evolving work environments.

HKT's enterprise offerings, such as integrated fixed-mobile solutions, cloud services, and cybersecurity, are instrumental in helping businesses navigate these new work paradigms. For instance, in 2024, the global remote workforce is projected to remain significantly higher than pre-pandemic levels, underscoring the sustained need for these digital enablers.

- Digital Transformation: Businesses continue to invest in digital infrastructure, with cloud adoption expected to grow substantially by 2025.

- Remote Work Demand: The sustained prevalence of remote and hybrid work models necessitates reliable connectivity, a core offering of HKT.

- Enterprise Solutions: HKT's focus on integrated solutions, cloud, and cybersecurity positions it to capture demand from businesses adapting to flexible work arrangements.

- Network Resilience: The increasing reliance on digital activities highlights the critical importance of resilient and high-performance network infrastructure, which HKT provides.

Public Trust and Data Privacy Concerns

Recent data breaches, such as the alleged exposure of millions of Hong Kong residents' personal information in late 2023, have intensified public scrutiny of data privacy. This heightened awareness directly impacts how consumers interact with telecommunications providers like HKT. The introduction of new data protection frameworks, like the Personal Data (Privacy) (Amendment) Ordinance 2021 in Hong Kong, further underscores the evolving regulatory landscape and public expectations.

HKT recognizes that maintaining robust data privacy and protection is not merely a compliance issue but a cornerstone of customer loyalty. The company is actively investing in advanced security measures and regularly updating its policies to safeguard customer information against an increasingly sophisticated threat environment. This proactive approach is crucial for mitigating risks and demonstrating a commitment to responsible data stewardship.

Building and sustaining public trust is paramount for HKT, especially in an era where data is a valuable asset. A strong reputation for data security can be a significant competitive differentiator. For instance, a 2024 survey indicated that over 70% of Hong Kong consumers consider a company's data privacy practices a key factor when choosing a service provider.

Key aspects of HKT's approach to public trust and data privacy include:

- Enhanced Data Encryption: Implementing state-of-the-art encryption technologies to protect customer data both in transit and at rest.

- Regular Security Audits: Conducting frequent internal and external audits to identify and address potential vulnerabilities.

- Transparent Data Policies: Clearly communicating HKT's data handling practices to customers through accessible privacy notices.

- Employee Training: Ensuring all staff are well-versed in data protection protocols and best practices.

Consumer expectations are shifting towards integrated digital experiences, with a strong preference for providers offering seamless home and mobile connectivity. This trend is amplified by the migration to Over-The-Top (OTT) platforms, which saw the global market surpass $200 billion in 2024, impacting traditional revenue streams.

Demographic shifts in Hong Kong, including potential changes in spending patterns from new residents, necessitate adaptive strategies for HKT's consumer base. Furthermore, the increasing digital literacy, evidenced by rising mobile data consumption in 2024, drives demand for advanced services like 5G.

The sustained prevalence of remote work and ongoing digital transformation continue to fuel demand for robust telecommunications, benefiting HKT's enterprise solutions. Businesses are increasingly investing in cloud adoption, with significant growth projected by 2025, highlighting the need for reliable connectivity and cybersecurity services.

Heightened public awareness around data privacy, spurred by incidents in late 2023 and reinforced by regulations like Hong Kong's Personal Data (Privacy) (Amendment) Ordinance 2021, makes robust data protection a critical factor for customer loyalty. A 2024 survey revealed that over 70% of Hong Kong consumers consider data privacy practices when selecting service providers.

Technological factors

HKT is making significant strides in its 5G network upgrades. By the close of December 2024, the company saw a substantial 25% year-on-year increase in its 5G customer base, bringing the total to 1.747 million subscribers. This expansion is crucial for the Hong Kong telecom landscape, paving the way for enhanced mobile experiences and innovative services.

The company's commitment to 5G is evident in its expanding network coverage. HKT has achieved a notable milestone, with over 50% of its mobile post-paid customers now utilizing 5G services. This widespread adoption underscores the growing demand for faster connectivity and the strategic importance of 5G deployment in driving market growth.

HKT is integrating artificial intelligence (AI) across its operations to boost efficiency and is actively marketing itself as a comprehensive technology solutions provider. This strategic push includes leveraging AI, the Internet of Things (IoT), cloud services, and robust cybersecurity for its enterprise clients.

The company is also exploring new high-growth digital sectors such as fintech and healthtech, demonstrating a forward-looking approach to technological adoption. HKT's Tech Week 2025, themed 'AI+ Your Business,' underscores its dedication to showcasing and implementing these cutting-edge technologies for business advancement.

HKT solidified its broadband market leadership by continuing its Fiber-to-the-Home (FTTH) upgrades, reaching 1.04 million connections by the close of 2024. This commitment to advanced infrastructure is vital for satisfying the escalating demand for faster internet services.

The company's pioneering efforts include being the first in Hong Kong to achieve the F5G-A standard and deploying 50G PON technology in March 2024. These technological leaps ensure HKT is well-prepared to support the data-intensive applications of the future.

Expansion into New Digital Ventures

HKT is actively broadening its horizons beyond traditional telecommunications by venturing into new digital territories. This includes significant investments in e-commerce, broader digital ventures, and fintech solutions, aiming to serve both individual households and businesses. These initiatives are designed to complement their established network services.

This strategic diversification is evident in HKT's development of loyalty platforms, such as The Club, and its foray into healthtech services. These efforts are central to HKT's strategy to cultivate multiple revenue streams and leverage the burgeoning digital economy. By doing so, HKT is positioning itself as a holistic technology solutions provider rather than solely a connectivity company.

- E-commerce and Digital Ventures: HKT's expansion into these areas aims to capture a larger share of the digital consumer market.

- Fintech Integration: The company is exploring financial technology solutions to enhance customer offerings and create new service models.

- Loyalty and Healthtech: Platforms like The Club and emerging healthtech services showcase HKT's commitment to a diversified service portfolio.

- Revenue Diversification: These digital initiatives are key to reducing reliance on traditional telecom revenues and capitalizing on growth sectors.

Cybersecurity and Data Protection Solutions

The escalating digital landscape means cybersecurity is paramount. HKT addresses this by offering robust cybersecurity solutions, integrating the latest technologies to protect its enterprise clients' operations. This focus is crucial, as cyber threats continue to evolve, impacting businesses globally.

HKT's commitment to data protection involves continuous improvement of its security policies, frameworks, and overall capabilities. This proactive approach aims to build resilience against new and emerging vulnerabilities, underscoring the critical nature of safeguarding sensitive information. For instance, in 2023, the global average cost of a data breach reached USD 4.45 million, highlighting the financial imperative for strong cybersecurity measures.

- HKT's Enterprise Solutions: Offers integrated cybersecurity services to businesses.

- Technological Integration: Utilizes advanced technologies for enhanced protection.

- Resilience Focus: Continuously updates policies and frameworks to counter evolving threats.

- Industry Context: Addresses the growing concern over cyber threats, with data breaches costing millions globally.

HKT is aggressively expanding its 5G network, with over 50% of its mobile post-paid customers now using 5G services, reflecting a 25% year-on-year increase in its 5G customer base to 1.747 million by December 2024. The company is also a leader in broadband infrastructure, achieving 1.04 million Fiber-to-the-Home connections by the end of 2024 and pioneering F5G-A standards and 50G PON technology deployments.

Beyond connectivity, HKT is integrating AI, IoT, cloud, and cybersecurity into its enterprise solutions, positioning itself as a comprehensive technology provider. The company is also diversifying into high-growth digital sectors like fintech and healthtech, exemplified by its loyalty platform, The Club, and its Tech Week 2025 initiative focused on AI for business.

| Metric | 2024/2025 Data | Significance |

| 5G Customer Base | 1.747 million (as of Dec 2024) | Indicates strong adoption of next-gen mobile services. |

| 5G Penetration (Post-paid) | Over 50% | Highlights customer shift towards 5G capabilities. |

| FTTH Connections | 1.04 million (as of Dec 2024) | Demonstrates leadership in high-speed broadband infrastructure. |

| New Digital Ventures | Fintech, Healthtech, E-commerce | Signals strategic diversification into emerging revenue streams. |

Legal factors

The telecommunications sector in Hong Kong operates under the Telecommunications Ordinance, with the Communications Authority (CA) serving as the primary regulator. This framework is crucial for companies like HKT, shaping their operational landscape and strategic decisions.

Recent legislative updates, including the Telecommunications (Amendment) Ordinance 2024, are particularly impactful. This amendment clarifies the rights of mobile network operators to install and maintain infrastructure in new constructions, a vital step for accelerating the rollout of 5G services across the city.

HKT's business is intrinsically linked to this regulatory environment, which dictates essential aspects such as spectrum assignment processes and the stringent licensing requirements for providing telecommunications services. Adherence to these regulations is paramount for HKT’s continued operation and growth.

The Personal Data (Privacy) Ordinance (PDPO) is fundamental to data protection in Hong Kong. The 2021 amendments introduced significant changes, including new offenses like doxxing, reflecting a growing concern for digital privacy.

Further proposed amendments in 2024 are expected to bolster data protection measures, potentially mandating data breach notifications and refining consent protocols. HKT must remain vigilant and ensure its operations align with these evolving legal requirements to safeguard customer information effectively.

Hong Kong's proposed Protection of Critical Infrastructure (Computer System) Bill, introduced in December 2024, will mandate enhanced cybersecurity measures for operators of essential services. This legislation requires critical infrastructure entities to develop comprehensive cybersecurity management plans and conduct regular security risk assessments to safeguard their computer systems.

As a major telecommunications provider, HKT is directly positioned to be affected by these new regulations. The company will need to ensure its operations and systems comply with the proposed bill's requirements, impacting its operational strategies and investment in cybersecurity infrastructure.

Competition Law and Anti-Trust Regulations

HKT operates within Hong Kong's telecommunications sector, which is governed by robust competition laws and anti-trust regulations. These frameworks are in place to foster a fair and competitive market, preventing any single entity from dominating through anti-competitive practices. The Office of the Communications Authority (OFCA) is the primary regulator overseeing this space, ensuring adherence to these principles.

While specific recent anti-trust enforcement actions directly targeting HKT are not prominently publicized as of mid-2025, the company’s operations are constantly under the scrutiny of these regulations. The competitive nature of the Hong Kong market, with multiple players offering mobile, broadband, and other related services, means that all operators, including HKT, must continuously ensure their business practices align with fair competition mandates. This regulatory environment is crucial for maintaining consumer choice and innovation.

- Regulatory Oversight: HKT is subject to the Hong Kong Competition Ordinance, Cap. 619, and specific telecommunications regulations enforced by OFCA.

- Market Dynamics: The telecommunications market in Hong Kong is highly competitive, with significant players like China Mobile Hong Kong, SmarTone, and 3 Hong Kong, necessitating strict adherence to fair competition rules.

- Consumer Protection: The regulatory framework aims to protect consumers by ensuring fair pricing, service quality, and preventing monopolistic behavior.

- Compliance Focus: HKT's strategy must incorporate ongoing compliance with competition law to avoid penalties and maintain market trust.

Spectrum Allocation and Usage Policies

The Office of the Communications Authority (OFCA) is actively managing spectrum resources, with recent assignments impacting mobile network operators like HKT. In 2024, spectrum in the 26 GHz and 28 GHz bands was allocated, crucial for enhancing 5G capabilities. Further strengthening the infrastructure, 300 MHz of spectrum in the 6/7 GHz band was assigned in March 2025, paving the way for future advancements, potentially including 6G services.

These spectrum allocations are fundamental to HKT's ability to expand its network capacity and introduce new, high-speed mobile services. Adherence to OFCA's usage policies is a non-negotiable requirement, ensuring fair competition and efficient use of the radio spectrum. For example, the 2024 assignments in the millimeter-wave bands are critical for dense urban 5G deployments, offering ultra-low latency and high bandwidth.

- Spectrum Auctions and Assignments: OFCA regularly conducts these processes to grant licenses for mobile services.

- 2024 Allocations: Spectrum in the 26 GHz and 28 GHz bands were assigned, boosting 5G performance.

- March 2025 Assignment: 300 MHz in the 6/7 GHz band was allocated, supporting future network evolution.

- Mandatory Compliance: HKT must adhere to all usage policies for these spectrum licenses.

HKT operates under a stringent legal framework, with the Telecommunications Ordinance and the Communications Authority (CA) setting the operational rules. Recent amendments like the Telecommunications (Amendment) Ordinance 2024 are key, facilitating 5G infrastructure deployment in new buildings. The Personal Data (Privacy) Ordinance (PDPO), particularly its 2021 amendments and anticipated 2024 updates, mandates robust data protection, impacting how HKT handles customer information. Furthermore, the proposed Protection of Critical Infrastructure (Computer System) Bill, introduced in late 2024, will require HKT to enhance its cybersecurity measures and risk assessments.

| Legislation/Regulation | Key Provisions Impacting HKT | Effective/Proposed Date |

|---|---|---|

| Telecommunications Ordinance | Regulatory oversight by Communications Authority (CA), spectrum assignment, licensing requirements. | Ongoing |

| Telecommunications (Amendment) Ordinance 2024 | Clarifies mobile network operator rights for infrastructure installation in new constructions. | 2024 |

| Personal Data (Privacy) Ordinance (PDPO) | Data protection, privacy rights, doxxing offenses (2021 amendments), potential data breach notification mandates (2024 proposals). | 2021 & Proposed 2024 |

| Protection of Critical Infrastructure (Computer System) Bill | Mandates enhanced cybersecurity management plans and risk assessments for essential service operators. | Proposed December 2024 |

Environmental factors

HKT Trust is actively integrating Environmental, Social, and Governance (ESG) principles into its operations, with a significant focus on enhancing its climate resilience. This commitment is reflected in its ambitious targets for reducing electricity consumption, greenhouse gas emissions, water usage, and waste generation by 2025.

These operational goals are closely aligned with Hong Kong's broader Climate Action Plan 2050, demonstrating HKT's dedication to contributing to the region's sustainability efforts. The company's strategic direction is increasingly shaped by these targets, driving innovation in its business practices.

By setting specific reduction milestones, HKT is embedding sustainability into its core operational strategies, aiming for a more environmentally responsible business model. This proactive approach positions HKT to navigate evolving climate regulations and consumer expectations effectively.

HKT, as a major telecommunications provider, has substantial energy requirements for its network infrastructure and data centers. In 2024, the company continued its commitment to sustainability by increasing its use of renewable energy sources, aiming to power a greater portion of its operations with cleaner alternatives.

Leveraging advanced technologies such as AI and IoT, HKT is actively implementing smart solutions to optimize energy consumption across its facilities. These initiatives are designed to enhance operational efficiency and reduce the company's overall carbon footprint, aligning with its environmental, social, and governance (ESG) goals.

These focused efforts on reducing electricity consumption not only support HKT's environmental targets but also yield tangible operational cost savings. For instance, by improving energy efficiency, HKT can mitigate the impact of fluctuating energy prices and contribute to a more sustainable business model.

HKT's commitment to reducing waste consumption by 2025 suggests a focus on managing electronic waste (e-waste) generated from its extensive network infrastructure and customer devices. This aligns with broader industry trends towards environmental responsibility in the telecommunications sector.

Adopting circular economy principles is crucial for HKT to minimize its environmental footprint. This could involve refurbishing, reusing, or recycling components from network equipment and consumer electronics, thereby diverting waste from landfills and conserving resources.

The telecommunications industry, in general, faces significant challenges with e-waste. For instance, global e-waste generation reached 53.6 million metric tons in 2019, with projections indicating a substantial increase. HKT's proactive approach to waste reduction is therefore a vital environmental stewardship strategy.

Green Technologies and Sustainable Solutions

HKT is actively contributing to environmental sustainability by offering electric vehicle charging services and smart energy solutions, enabling customers to lower their carbon emissions. This initiative goes beyond HKT's internal sustainability practices, demonstrating a commitment to broader ecological goals.

The company's focus on advancing connectivity and bridging the digital divide also plays a role in environmental efforts. By empowering communities with technology, HKT facilitates access to information and resources that can support sustainable living and practices, indirectly aiding in reducing environmental impact.

- HKT's EV charging network expansion: As of early 2025, HKT has deployed over 1,000 EV charging points across Hong Kong, with plans to double this by the end of 2025.

- Smart energy solutions adoption: In 2024, HKT reported a 15% year-on-year increase in the adoption of its integrated smart energy management solutions by commercial clients, leading to an average 10% reduction in energy consumption.

- Digital inclusion impact: HKT's "ConnectEd" program, launched in 2023, has provided subsidized broadband services to over 50,000 low-income households, fostering digital literacy that can support environmentally conscious behaviors.

ESG Reporting and Stakeholder Engagement

HKT Trust and HKT are committed to robust ESG reporting, employing a double materiality lens. This means they assess how environmental and social issues affect their business financially, and conversely, how their operations impact the environment and society. This comprehensive view is crucial for navigating the evolving regulatory landscape and investor expectations.

The company actively engages with a broad range of stakeholders, from investors to community groups, to shape its ESG priorities. This collaborative approach ensures that their sustainability efforts are relevant and impactful. For instance, in 2023, HKT conducted numerous stakeholder dialogues to refine its climate action strategy, reflecting a growing emphasis on climate resilience in its operations.

HKT's dedication to transparent ESG reporting, adhering to global frameworks like the Global Reporting Initiative (GRI), is vital for maintaining a strong reputation and attracting investment. Their 2023 ESG report highlighted a 15% reduction in Scope 1 and 2 greenhouse gas emissions compared to their 2020 baseline, demonstrating tangible progress. This commitment to clear communication and measurable outcomes bolsters investor confidence.

- Double Materiality Approach: HKT assesses both financial impacts of ESG issues on the company and the company's impact on the environment and society.

- Stakeholder Engagement: Regular dialogues with investors, employees, and community partners inform ESG strategy and prioritization.

- Transparent Reporting: Adherence to GRI standards ensures clear communication of ESG performance, with 2023 data showing a 15% reduction in Scope 1 & 2 GHG emissions.

- Reputation and Investor Relations: Strong ESG practices and transparent reporting are key to enhancing brand image and attracting socially responsible investment.

HKT Trust is actively addressing environmental concerns by focusing on climate resilience and reducing its operational footprint. The company has set ambitious targets for 2025 to lower electricity consumption, greenhouse gas emissions, water usage, and waste generation, aligning with Hong Kong's climate action goals.

HKT is increasing its use of renewable energy sources and implementing smart technologies like AI and IoT to optimize energy efficiency, which also leads to cost savings. Furthermore, HKT is tackling e-waste through circular economy principles and expanding its electric vehicle charging network, demonstrating a commitment to broader ecological sustainability.

| Environmental Focus Area | 2025 Target/Status | 2024/2025 Data/Initiatives |

|---|---|---|

| Electricity Consumption | Reduction | Smart energy solutions adoption increased 15% YoY in 2024, resulting in 10% average energy reduction for clients. |

| Greenhouse Gas Emissions | Reduction | 15% reduction in Scope 1 & 2 GHG emissions achieved by 2023 (vs. 2020 baseline). |

| Waste Generation | Reduction | Focus on managing e-waste from network infrastructure and devices. |

| Renewable Energy Use | Increase | Increased use of renewable energy sources for operations. |

| EV Charging Infrastructure | Expansion | Over 1,000 EV charging points deployed by early 2025, with plans to double by year-end. |

PESTLE Analysis Data Sources

Our HKT Trust and HKT PESTLE Analysis is built on a foundation of diverse and credible data sources, including official company filings, financial reports, and market research from reputable industry analysts. We integrate insights from telecommunications regulatory bodies, economic trend reports, and technological innovation publications to ensure a comprehensive understanding of the macro-environment.