HKT Trust and HKT Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HKT Trust and HKT Bundle

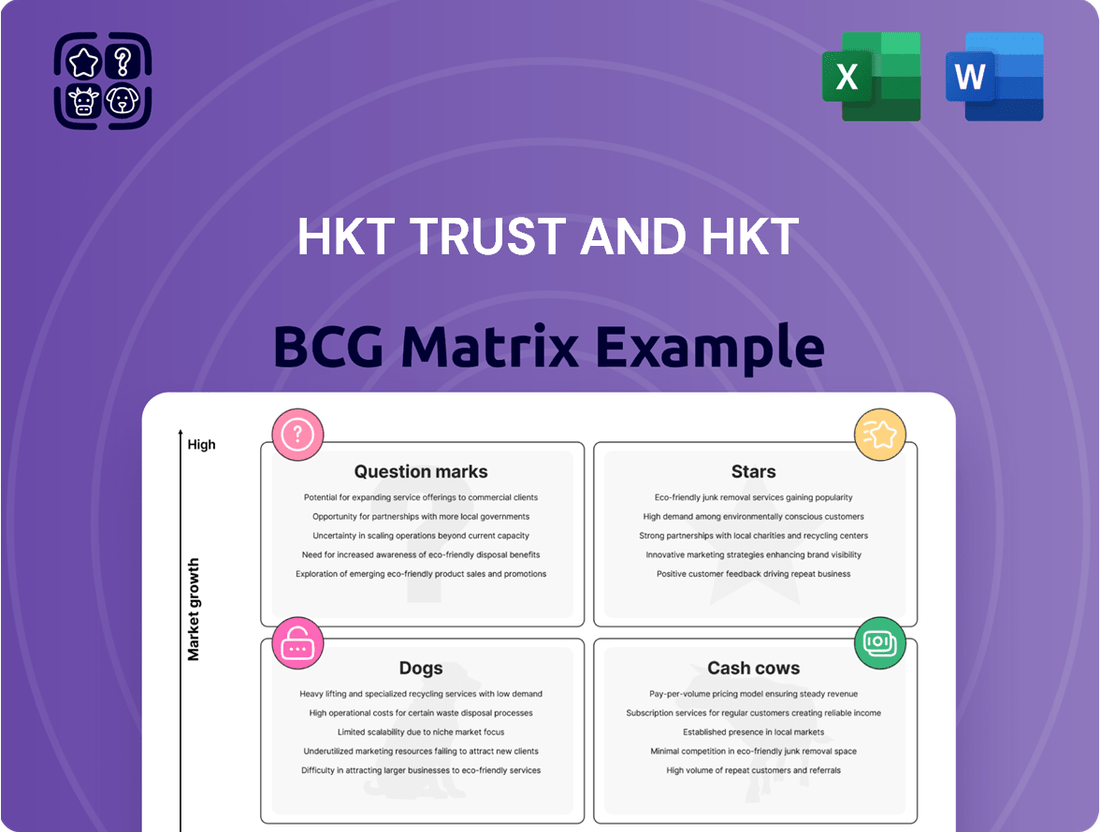

HKT Trust, a prominent telecommunications and digital services provider, operates within a dynamic market. Understanding its product portfolio through the lens of the BCG Matrix is crucial for strategic decision-making.

This preview offers a glimpse into HKT Trust's position, highlighting potential Stars, Cash Cows, Dogs, or Question Marks. To truly grasp the strategic implications and unlock actionable insights for optimizing HKT's product mix and investment, dive deeper into the complete BCG Matrix.

Purchase the full version for a comprehensive breakdown, detailed quadrant placements, and data-backed recommendations that will empower you to make informed strategic moves and drive HKT Trust's future success.

Stars

HKT's 5G mobile services are a significant growth engine, as evidenced by a 25% increase in its 5G customer base, reaching 1.747 million by the close of 2024. This strong adoption rate highlights the market's embrace of the technology.

The company has successfully transitioned over half of its post-paid mobile customers to 5G, a crucial step that boosts revenue. The 5G ARPU is approximately 40% higher than that of 4G, making this segment a vital contributor to HKT's financial performance.

The broader Hong Kong telecom market is experiencing a boom fueled by 5G deployment, with mobile data services expected to continue their upward trajectory. HKT is well-positioned to capitalize on this trend, solidifying its leadership in a high-potential sector.

HKT's enterprise solutions segment is a clear Star, demonstrating impressive growth in both its local and mainland China operations. In 2024, local data revenue surged by 8%, underscoring HKT's role as a key technology partner for businesses.

The company's commitment to integrated solutions paid off, with new project wins surpassing HK$5 billion, an 11% increase from the previous year. This highlights a strong market appetite for HKT's offerings.

Crucially, HKT's strategic push into mainland China yielded significant results, achieving its HK$1 billion revenue target for 2024 with a remarkable 37% growth. This expansion, fueled by demand for 5G, IoT, AI, cloud, and cybersecurity services, solidifies its Star status.

HKT's commitment to high-speed fibre broadband, including its pioneering 2.5G and 50G PON services, positions it strongly within the BCG matrix. The company achieved its 17th consecutive year of growth in this segment, with revenue climbing 3% in 2024. This sustained performance, evidenced by 1.04 million FTTH connections by the end of 2024, highlights its dominant market share and the ongoing demand for advanced connectivity.

The strategic adoption of 50G PON technology in March 2024 further solidifies HKT's position as a market leader, anticipating future ultra-high-speed needs. The successful rollout and increased Average Revenue Per User (ARPU) from its 2.5G service demonstrate the market's readiness for and appreciation of superior broadband capabilities, marking this as a star performer with significant growth potential.

Consumer Outbound Roaming Services

Consumer outbound roaming services for HKT are a clear Star in the BCG matrix. Following the full recovery of travel, HKT's consumer outbound roaming revenue not only surpassed 2019 pre-pandemic levels but also saw a significant 37% year-on-year increase in total roaming revenue for 2024. This robust performance indicates a strong post-pandemic rebound and sustained growth for this segment.

The substantial growth in roaming revenue is a primary driver for the overall increase in HKT's mobile services revenue. This rapid recovery and high growth rate in a rebounding travel market firmly establish outbound roaming services as a Star for HKT.

- Consumer Outbound Roaming Revenue: Surpassed 2019 pre-pandemic levels.

- 2024 Roaming Revenue Growth: Achieved a 37% year-on-year increase.

- Market Position: Demonstrates significant post-pandemic rebound and sustained growth.

- Contribution to Mobile Services: Key factor underpinning growth in overall mobile services revenue.

AI-powered Network Enhancements and Solutions

HKT Trust is strategically investing in AI-powered network enhancements, positioning these offerings as a burgeoning Star within its business portfolio. The company is actively deploying AI applications across its operations to boost efficiency and is also advancing its research and development in AI-driven operational improvements.

HKT is extending these AI capabilities to enterprises, providing solutions such as intelligent automation, predictive analytics, and data-driven insights through tools like chatbots and smart address systems. This focus on AI-driven enterprise solutions reflects a commitment to leveraging advanced technology for business growth.

A significant indicator of HKT's commitment to this high-growth sector is the recent launch of its 800G AI Superhighway service. This service is specifically designed to cater to the demands of data centers and cloud providers, highlighting substantial investment in infrastructure that supports AI workloads.

- AI Deployment: HKT is integrating AI across its operations for enhanced efficiency.

- Enterprise Solutions: Offering intelligent automation, predictive analytics, and data insights via chatbots and smart address solutions.

- Infrastructure Investment: Launched an 800G AI Superhighway service targeting data centers and cloud providers.

- Market Position: Significant investment and industry trends suggest a strong growth trajectory for HKT's AI offerings.

HKT's 5G mobile services, enterprise solutions, high-speed fibre broadband, consumer outbound roaming, and AI-powered network enhancements are all identified as Stars in its BCG matrix. These segments exhibit strong market growth and high relative market share, indicating significant potential for future revenue and profit generation.

| Segment | 2024 Performance Highlights | BCG Status |

|---|---|---|

| 5G Mobile Services | 1.747 million customers (25% growth), 40% higher ARPU than 4G | Star |

| Enterprise Solutions | 8% local data revenue growth, HK$5 billion new project wins (11% increase), 37% growth in mainland China revenue | Star |

| High-Speed Fibre Broadband | 17 consecutive years of growth, 3% revenue increase, 1.04 million FTTH connections | Star |

| Consumer Outbound Roaming | 37% year-on-year revenue increase, surpassing 2019 levels | Star |

| AI-Powered Network Enhancements | Launch of 800G AI Superhighway, AI enterprise solutions | Star |

What is included in the product

HKT Trust's BCG Matrix analyzes its diverse business units, categorizing them to guide strategic decisions.

This framework helps HKT Trust identify which services to invest in, maintain, or divest for optimal growth.

The HKT Trust and HKT BCG Matrix offers a clear, visual overview of each business unit's strategic position, alleviating the pain of complex portfolio analysis.

This tool simplifies decision-making by highlighting which HKT businesses require investment, which should be maintained, and which might need divestment.

Cash Cows

Fixed-line broadband, represented by NETVIGATOR, is a cornerstone of HKT's portfolio and a classic cash cow. The company holds a commanding position in Hong Kong's broadband market, with its Fiber-to-the-Home (FTTH) connections making up 71% of its 1.474 million consumer broadband subscribers.

Hong Kong's broadband landscape is deeply entrenched, boasting a household penetration rate of approximately 97%. Despite this maturity, the segment saw a 3% revenue increase in 2024, underscoring its resilience and consistent demand.

The significant cash flow generated by this segment stems from its market leadership and widespread adoption. Crucially, it demands minimal promotional investment relative to its substantial cash generation, a hallmark of a mature cash cow.

HKT's traditional mobile post-paid services, representing an established base, are a key Cash Cow. In 2024, this segment saw a 5% increase in services revenue, primarily due to its substantial post-paid subscriber numbers.

While 5G adoption contributes, the steady revenue from core post-paid services, independent of 5G, highlights its stability. This segment enjoys high customer loyalty and leverages HKT's robust network infrastructure, consistently producing reliable cash flow in a mature market.

Now TV, HKT's pay-TV and OTT service, stands as a solid cash cow. Despite a competitive landscape, its subscriber base grew by 15% in early 2024, reaching 1.433 million. This expansion highlights the service's resilience and its ability to generate consistent, recurring revenue.

The Club (Loyalty Program)

The Club, HKT's loyalty and e-commerce platform, continues to be a strong performer. In 2024, spending by its members grew by 4%, demonstrating sustained engagement.

This program, with its established and sizable member base, is a key contributor to HKT's revenue through consistent member activity and the integration of various services. It acts as a significant driver of customer loyalty and recurring income.

- The Club's revenue generation: Driven by consistent member spending and integrated services.

- Customer stickiness: A mature platform that enhances customer retention within HKT's digital ecosystem.

- Investment needs: Requires less aggressive investment compared to nascent ventures, focusing on maintaining its high market presence.

- 2024 performance: Saw a 4% increase in member spending.

Wholesale Telecommunications Services

Wholesale telecommunications services for HKT function as a cash cow within the BCG matrix. This segment, which includes interconnection services provided to other carriers, leverages HKT's substantial network infrastructure and established market presence to generate reliable income.

This area of HKT's business is characterized by stability rather than rapid expansion. It consistently contributes to the company's overall revenue through essential infrastructure sharing and long-standing partnerships.

For instance, in the fiscal year ending December 31, 2023, HKT reported total revenue of HK$20.1 billion. While specific segment breakdowns for wholesale services are not always granularly detailed in summary reports, the business's nature as a foundational service provider indicates a significant and steady contribution to this overall figure.

- Stable Revenue Generation: Wholesale interconnection services provide a consistent income stream for HKT.

- Infrastructure Leverage: HKT's extensive network assets are key to the profitability of this segment.

- Market Position: Established relationships and essential infrastructure sharing solidify its cash cow status.

- Contribution to Cash Flow: This segment is vital for supporting the company's overall financial health.

HKT's fixed-line broadband, led by NETVIGATOR, is a prime example of a cash cow. Despite Hong Kong's 97% household broadband penetration, this segment saw a 3% revenue increase in 2024, demonstrating its enduring demand and HKT's market dominance with 71% of its 1.474 million consumer subscribers on FTTH.

Traditional mobile post-paid services also represent a significant cash cow, with a 5% revenue increase in 2024 driven by a large, loyal subscriber base that relies on HKT's robust infrastructure, ensuring consistent cash flow independent of newer technologies.

Now TV, HKT's pay-TV service, is another strong cash cow, evidenced by its 15% subscriber growth in early 2024 to 1.433 million, indicating its resilience and ability to generate recurring revenue in a competitive market.

The Club, HKT's loyalty platform, functions as a cash cow through consistent member engagement, with member spending up 4% in 2024, reinforcing customer loyalty and contributing stable, recurring income.

| Segment | BCG Category | 2024 Performance Highlight | Key Driver | Subscriber/User Base |

|---|---|---|---|---|

| Fixed-line Broadband (NETVIGATOR) | Cash Cow | 3% Revenue Increase | Market Leadership, FTTH Penetration | 1.474 million (71% FTTH) |

| Mobile Post-paid Services | Cash Cow | 5% Services Revenue Increase | High Subscriber Loyalty, Network Infrastructure | Established Post-paid Base |

| Now TV | Cash Cow | 15% Subscriber Growth | Resilience, Recurring Revenue | 1.433 million |

| The Club | Cash Cow | 4% Member Spending Growth | Customer Loyalty, Integrated Services | Sizable Member Base |

Preview = Final Product

HKT Trust and HKT BCG Matrix

The preview you are seeing is the identical, fully formatted HKT Trust BCG Matrix report you will receive immediately after purchase. This comprehensive document, designed for strategic insight, contains no watermarks or demo content, ensuring you get a professional and ready-to-use analysis of HKT Trust's business units.

Dogs

HKT's Local Telephony Services, a component of its broader portfolio, experienced a revenue contraction of 10% in 2024. This downturn is directly linked to a decrease in active fixed lines, which fell from 2.227 million to 2.114 million.

The primary drivers behind this decline are the persistent migration of customers towards mobile and data-centric solutions, alongside subdued performance within the Small and Medium-sized Enterprise (SME) sector. The overall market for traditional fixed-line voice is clearly contracting.

Projections indicate a continued significant decrease in fixed voice revenues over the upcoming years, underscoring the strategic challenges for this legacy service within HKT's business model.

Traditional International Telecommunications Services, a segment within HKT Trust, experienced a minor revenue dip in 2024, falling from HK$7,297 million to HK$7,107 million. This decline is largely attributed to the growing popularity of Over-The-Top (OTT) communication apps and a general decrease in traditional international call usage.

This business unit operates in a low-growth market characterized by a relatively low market share, as consumer preference shifts towards internet-based communication platforms. Consequently, it occupies a position in the BCG matrix that suggests limited future potential for significant expansion.

Legacy broadband plans, those not utilizing fiber-to-the-home technology, are a segment HKT Trust is likely to view as a declining asset. As the market overwhelmingly shifts towards faster, more reliable fiber connections, customers are actively phasing out older copper-based or other non-fiber services.

While HKT's primary focus and investment are clearly in its robust fiber network, the older plans represent a diminishing revenue stream. The broader telecommunications industry trend, with an increasing number of households gaining access to fiber, directly impacts the relevance and customer base of these legacy offerings.

Although precise, publicly disclosed figures for HKT's legacy non-fiber subscriber decline are not readily available, industry-wide data from 2024 consistently shows a strong migration to fiber. For instance, reports indicate global fiber broadband subscriptions continued their upward trajectory throughout 2024, often at the expense of older technologies.

Older Mobile Technologies (e.g., 3G)

Older mobile technologies, such as 3G, are clearly in a declining phase for HKT. By the end of September 2024, the number of 3G mobile customers in Hong Kong dropped by 13.7%, settling at approximately 563,000. This trend highlights a shrinking market for these legacy services.

The continued migration of users to newer, faster networks like 5G, alongside the strong presence of 4G, means 3G is no longer a growth area. HKT, like its competitors, is actively pushing 5G upgrades, making older technologies like 3G a diminishing part of the subscriber landscape. These services are primarily maintained for a smaller base of existing users rather than for future expansion.

- Declining User Base: 3G customer numbers in Hong Kong fell by 13.7% to 563,000 by September 2024.

- Low Growth Market: Older technologies like 3G represent a market with minimal growth potential.

- Strategic Shift: HKT and the industry are prioritizing 5G and 4G, sidelining 3G for future development.

- Legacy Support: 3G services are likely maintained for existing users, not as a strategic growth driver.

Basic Paging Services

Basic paging services, if still operational within HKT's portfolio, would likely be categorized as a Dog in the BCG Matrix. This is due to the significant technological advancements that have rendered paging largely obsolete for the general consumer market.

The rise of smartphones and instant messaging platforms means that the demand for traditional paging has drastically shrunk. While specific 2024 figures for HKT's paging services are not readily available, the broader trend indicates a severely contracted market. For instance, global paging revenues have been on a steady decline for years, with many providers ceasing operations entirely.

- Market Share: Negligible in the current telecommunications landscape.

- Growth Rate: Negative, reflecting a shrinking user base.

- Strategic Recommendation: Divestment or minimal resource allocation for maintenance.

- Financial Performance: Likely low revenue generation and potentially high per-user operational costs.

HKT's legacy mobile technologies, such as its 3G services, are firmly positioned as Dogs in the BCG Matrix. By September 2024, 3G customer numbers had fallen by 13.7% to 563,000, reflecting a shrinking market with minimal growth potential. The company's strategic focus on 5G and 4G upgrades further marginalizes these older services, which are likely maintained only for a small, existing user base rather than for any future expansion.

Similarly, basic paging services, if still part of HKT's offerings, would be classified as Dogs. The widespread adoption of smartphones and instant messaging has made traditional paging largely obsolete, resulting in a severely contracted market. While specific 2024 data for HKT's paging is unavailable, global trends show a consistent decline in paging revenues, with many providers exiting the market entirely.

These services, characterized by declining user bases and negative growth rates, represent a strategic challenge. The recommended approach for such assets typically involves divestment or a minimal allocation of resources solely for essential maintenance, as they offer little to no prospect of future profitability or market expansion.

| Service Segment | 2024 Revenue (HK$ Million) | Change vs. Prior Year | BCG Classification | Key Rationale |

| Local Telephony (Fixed Lines) | (Not specified, but revenue contracted 10%) | -10% | Dog | Declining active lines due to migration to mobile/data. |

| Older Mobile Technologies (e.g., 3G) | (Not specified) | -13.7% (customer decline by Sep 2024) | Dog | Shrinking user base, focus on 5G/4G. |

| Basic Paging Services | (Not specified, negligible market) | (Not specified, but market is severely contracted) | Dog | Obsolete technology, minimal demand. |

Question Marks

HKT's Digital Ventures, encompassing fintech services like Tap & Go and HKT Merchant Services, are positioned within Hong Kong's rapidly expanding fintech sector. The number of fintech companies in Hong Kong saw a notable increase from 2022 to 2024, reflecting robust market growth across various segments, which bodes well for HKT's offerings.

While the overall fintech market is dynamic, HKT's specific market share within this competitive landscape, particularly when compared to specialized fintech firms and established banks, may still be developing. Capturing a more substantial portion of this promising yet uncertain market will likely necessitate continued and significant investment from HKT.

HKT is strategically investing in new digital ventures, including its Club Care service and emerging e-commerce platforms, aiming to tap into the high-growth potential of the digital economy. These ventures are designed to serve both residential and business customers, broadening HKT's digital footprint.

While these initiatives represent significant future growth opportunities, they are currently in their nascent stages. Their market share is likely minimal, necessitating substantial investment in marketing, product refinement, and customer acquisition to transition them from question marks to future market leaders, or Stars, within the BCG matrix.

HKT is actively developing advanced AI-driven solutions for external enterprise clients, focusing on areas like machine learning and predictive analytics. This strategic move positions HKT beyond its traditional connectivity role, targeting the rapidly expanding AI solutions market. The company's investment in this high-growth sector aims to capture a significant share of this specialized, competitive landscape.

Emerging IoT Solutions and Platforms

HKT is actively building and delivering comprehensive IoT solutions for businesses, capitalizing on Hong Kong's booming connected device environment. The expanding smart city infrastructure and the growing number of internet-connected devices are fueling substantial growth in this sector. For example, by the end of 2024, it's estimated that over 30 billion IoT devices will be in use globally, a trend HKT aims to leverage.

While HKT's focus on integrated IoT solutions positions it for future expansion, its market share across various IoT segments, such as smart homes, industrial applications, and urban management systems, is likely still developing. This dynamic places HKT's IoT offerings in the 'Question Mark' quadrant of the BCG matrix, indicating high growth potential but currently a limited market share. Strategic investment will be crucial to solidify its position.

- Developing Integrated IoT Solutions: HKT is creating end-to-end IoT services for enterprises.

- Leveraging Hong Kong's IoT Ecosystem: The company is tapping into the city's increasing adoption of connected devices and smart city projects.

- High Growth, Low Share: HKT's IoT business is characterized by rapid market expansion but a nascent market share across diverse verticals, fitting the 'Question Mark' profile.

- Strategic Investment Needed: Significant investment is required to grow HKT's presence and capture market share in the competitive IoT landscape.

Next-Generation Network Technologies (e.g., 800G AI Superhighway)

HKT's introduction of Asia's first 800Gbps private Wide Area Network, termed the 800G AI Superhighway, directly addresses the burgeoning demand for ultra-high-speed connectivity essential for AI and supercomputing workloads. This strategic move positions HKT at the vanguard of next-generation network infrastructure, catering to data centers and cloud service providers who require immense bandwidth.

While this venture signifies significant innovation and future growth potential, the immediate market for such specialized, extremely high-capacity services remains relatively niche. Consequently, these advanced network technologies, despite their technological prowess, are categorized within the Question Mark quadrant of the BCG Matrix. This classification reflects their high growth potential but currently limited market share and uncertain immediate profitability until wider adoption and market penetration are achieved. For instance, the global AI infrastructure market is projected to reach hundreds of billions of dollars by the late 2020s, underscoring the long-term opportunity, yet the specific segment for 800Gbps private WANs is still developing.

- Technological Advancement: HKT's 800G AI Superhighway represents a significant leap in network speed, crucial for AI and high-performance computing.

- Market Niche: While targeting a high-growth area, the immediate customer base for 800Gbps private WANs is specialized, impacting current market share.

- Future Growth Potential: The increasing reliance on AI and data-intensive applications suggests substantial future demand for such infrastructure.

- BCG Classification: Positioned as a Question Mark due to its high investment and potential, but currently unproven broad market success.

HKT's fintech ventures, like Tap & Go, operate in a rapidly growing sector in Hong Kong. While the overall fintech market is expanding, HKT's specific market share is still developing, requiring significant investment to capture more of this dynamic space.

New digital initiatives, such as Club Care and e-commerce platforms, target high-growth digital economy segments. These are currently nascent with minimal market share, necessitating substantial investment to evolve into market leaders.

HKT's AI solutions and IoT offerings are positioned in high-growth markets but currently hold limited market share. These ventures, fitting the 'Question Mark' profile, require strategic investment to increase penetration and solidify their market presence.

The 800G AI Superhighway, while technologically advanced and targeting a high-growth AI infrastructure market, serves a niche customer base. This places it as a Question Mark, with significant future potential but currently unproven broad market success.

BCG Matrix Data Sources

This HKT Trust BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.