HKT Trust and HKT Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HKT Trust and HKT Bundle

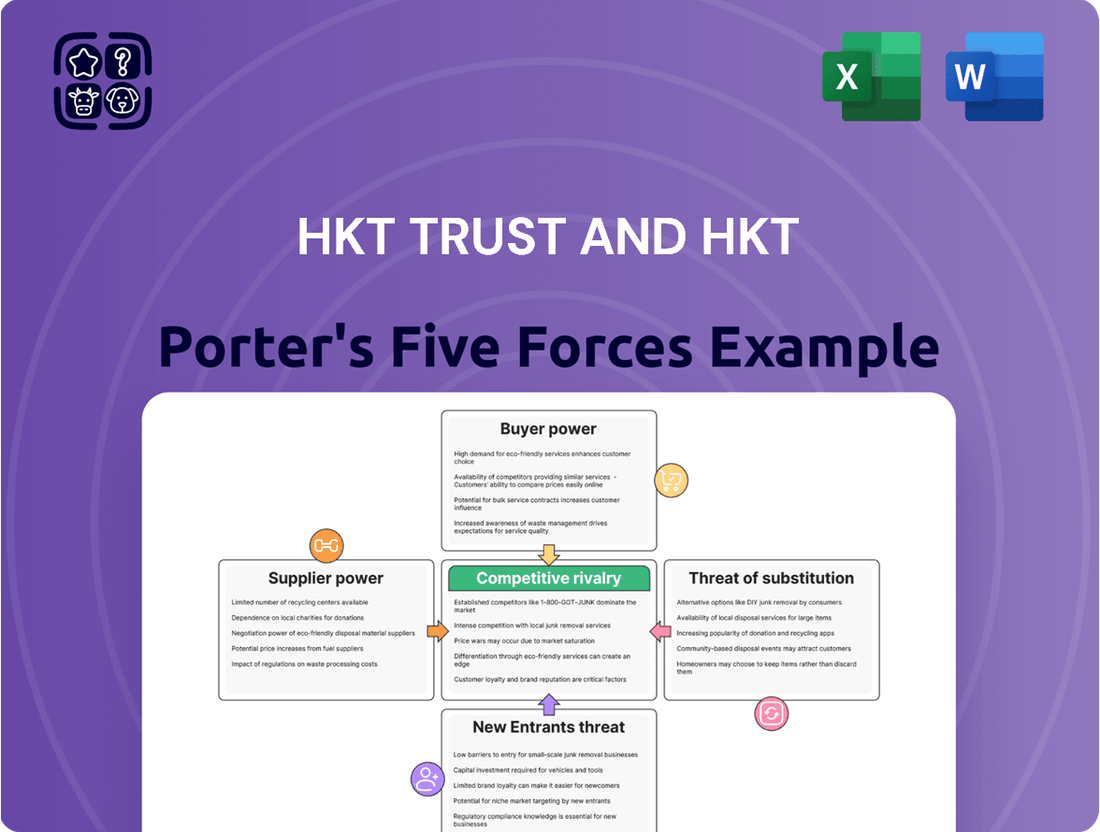

The HKT Trust and HKT operate within a dynamic telecommunications and digital services landscape, where understanding competitive pressures is paramount. Porter's Five Forces analysis offers a robust framework to dissect these forces, from the bargaining power of buyers to the threat of new entrants.

The complete report reveals the real forces shaping HKT Trust and HKT’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The telecommunications sector, including HKT Trust, is heavily dependent on a small number of global technology providers for essential network infrastructure, equipment, and software. This limited supplier base grants these specialized companies substantial bargaining power over HKT, especially concerning cutting-edge technologies like 5G and fiber-optic advancements.

HKT's significant investments in upgrading its network infrastructure, which includes the rollout of 5G services and the expansion of its fiber-to-the-home (FTTH) connections, underscore its reliance on these key technology suppliers. For instance, in 2024, HKT continued its aggressive 5G network deployment, requiring specialized equipment from a select few vendors.

Changing core network equipment suppliers for a telecommunications giant like HKT involves immense financial outlays, significant operational disruptions during the transition, and intricate integration processes with existing systems. These substantial switching costs inherently limit HKT's ability to easily change vendors, thereby strengthening the bargaining power of its current infrastructure suppliers.

HKT's continuous investments in upgrading its network infrastructure, including the rollout of 5G technology and the exploration of advancements like 50G Passive Optical Network (PON) technology, highlight a deep and ongoing integration with its present vendor ecosystems. This deep integration further entrenches the high switching costs associated with changing suppliers.

Suppliers possessing proprietary technologies or patents for crucial components, such as advanced chipsets or specialized software, can exert significant influence over terms and pricing. This is particularly relevant for HKT, as their commitment to cutting-edge infrastructure, including the adoption of 50G PON and F5G-A standards, indicates a reliance on suppliers with unique intellectual property in these advanced areas.

Skilled Labor and Specialized Services

The availability of highly skilled engineers and technical experts for network deployment, maintenance, and cybersecurity is absolutely critical for HKT Trust. A scarcity of such specialized labor or consulting services directly translates to increased bargaining power for these suppliers, potentially impacting HKT's operational costs and project timelines. For instance, in 2024, the demand for cybersecurity professionals in Hong Kong saw a significant surge, with specialized roles experiencing salary increases of up to 15% according to industry reports.

HKT's strategic expansion into advanced areas like AI-enabled services and complex enterprise solutions further amplifies the need for access to this specialized human capital. The ability to secure top talent in these niche fields will be a key determinant of HKT's success in these growth areas. The global shortage of AI specialists, for example, means that companies like HKT must compete fiercely for a limited pool of qualified individuals, driving up the cost of specialized consulting and recruitment.

- Scarcity of specialized engineers: Increased bargaining power for suppliers of skilled technical labor.

- Impact on costs: Higher operational expenses and potential project delays for HKT.

- AI and enterprise solutions: Growing reliance on specialized human capital for innovation.

- 2024 labor market trends: Reports indicate up to 15% salary increases for cybersecurity roles in Hong Kong.

Increasing Demand for Digital Transformation Solutions

As HKT Trust diversifies into areas like e-commerce, digital ventures, and fintech, its reliance on specialized IT service providers, cloud infrastructure vendors, and cybersecurity firms grows. The escalating global demand for digital transformation solutions, a trend that saw significant acceleration in 2024 with many enterprises prioritizing cloud migration and cybersecurity upgrades, can amplify the bargaining power of these key suppliers. For instance, the global cloud computing market was projected to reach over $1.3 trillion by 2024, indicating a strong supplier position.

HKT's strategic push to integrate advanced technologies such as AI, IoT, and multi-cloud architectures into its enterprise solutions further solidifies the leverage of suppliers offering these cutting-edge capabilities. The market for AI solutions alone was estimated to grow substantially in 2024, with some reports suggesting a market size exceeding $200 billion globally. This increasing dependence on sophisticated, often proprietary, technological components means suppliers can command higher prices and more favorable terms.

- Increased Dependence: HKT's expansion into new digital sectors necessitates reliance on external IT, cloud, and cybersecurity expertise.

- Market Dynamics: The robust global demand for digital transformation in 2024, estimated to drive significant market growth for cloud and AI solutions, strengthens supplier leverage.

- Technological Sophistication: HKT's adoption of AI, IoT, and multi-cloud technologies means suppliers of these advanced solutions hold considerable bargaining power.

- Vendor Pricing Power: The specialized nature and high demand for these digital tools allow suppliers to potentially dictate terms and pricing.

The bargaining power of suppliers for HKT Trust is significant due to the concentrated nature of the telecommunications equipment market. A few global technology providers dominate the supply of essential network infrastructure, granting them considerable leverage over HKT, particularly for advanced technologies like 5G and fiber optics.

HKT's substantial investments in network upgrades, including its 2024 5G deployment, highlight its reliance on these key vendors. The high financial and operational costs associated with switching suppliers, coupled with the proprietary nature of much of this technology, further solidify supplier influence over pricing and terms.

The scarcity of specialized technical talent, especially in areas like cybersecurity and AI, also empowers suppliers of these services. In 2024, Hong Kong saw up to a 15% salary increase in cybersecurity roles, demonstrating the premium placed on such expertise and its impact on HKT's operational costs and project timelines.

HKT's diversification into e-commerce, digital ventures, and fintech increases its dependence on IT service providers, cloud vendors, and cybersecurity firms. The booming demand for digital transformation solutions in 2024, with the global cloud computing market projected to exceed $1.3 trillion, strengthens the bargaining position of these suppliers.

What is included in the product

Analyzes the competitive forces impacting HKT Trust and HKT, revealing the intensity of rivalry, buyer and supplier power, threat of new entrants, and substitute products within the telecommunications and digital services sectors.

Navigate the competitive landscape of Hong Kong's telecommunications and utilities with an HKT Trust Porter's Five Forces Analysis, offering a simplified, visual representation of market pressures to inform strategic decisions.

Gain instant clarity on HKT's competitive positioning with an HKT Porter's Five Forces Analysis, allowing for quick identification of key threats and opportunities to proactively address market challenges.

Customers Bargaining Power

Hong Kong's telecommunications sector is a prime example of a highly penetrated market. In 2024, mobile penetration rates consistently hover around 230% and broadband penetration exceeds 90%, indicating that most households and individuals already subscribe to these services. This saturation fuels fierce competition among providers.

HKT faces significant pressure from rivals like HKBN, China Mobile Hong Kong, and SmarTone, all vying for a share of this established customer base. The abundance of choices empowers consumers, making them less reliant on any single provider and more inclined to seek out the best value.

Consequently, customers possess substantial bargaining power. They can readily switch to competitors offering more attractive pricing, superior service quality, or bundled packages, forcing HKT to continuously innovate and offer competitive deals to retain its subscribers.

For many standard telecommunication services, such as mobile plans or broadband internet, the costs and effort associated with switching providers are minimal. This ease of switching directly empowers individual consumers, enabling them to exert considerable pressure on pricing and service quality from providers like HKT. In 2023, the Hong Kong telecommunications market saw intense competition, with operators frequently adjusting their offerings to attract and retain subscribers, reflecting this low switching cost dynamic.

Customers can often bundle services like fixed-line, mobile, broadband, and TV from different providers. This ability to mix and match increases their leverage when negotiating prices or demanding better terms. For instance, if a customer can get a superior bundle from a competitor at a lower cost, HKT faces pressure to match or beat that offer.

HKT provides a wide range of integrated services, but the market is highly competitive. Many rivals also offer bundled packages, meaning HKT must continuously innovate and price its offerings attractively to retain customers who have numerous choices. The availability of these bundled alternatives directly impacts HKT's ability to dictate terms.

Price Sensitivity of Residential Customers

Residential customers, unlike their enterprise counterparts who value reliability and tailored services, exhibit significant price sensitivity. This makes it challenging for HKT to implement price hikes without potentially losing customers, especially for fundamental connectivity offerings.

The primary driver for mobile revenue growth at HKT is data consumption. Conversely, revenue from voice services is on a downward trend as customer preferences increasingly shift towards data-centric communication methods.

- Price Sensitivity: Residential users often prioritize cost savings, impacting HKT's pricing flexibility.

- Data-Driven Growth: Mobile revenue relies heavily on increased data usage.

- Voice Revenue Decline: Traditional voice service revenue continues to shrink.

Increasing Sophistication of Enterprise Customers

Enterprise clients, particularly those seeking IT services, cloud solutions, and cybersecurity, are becoming more knowledgeable and expect customized, high-performance offerings. These sophisticated customers wield considerable bargaining power because of the size of their agreements and their capacity to negotiate specific conditions. For instance, in 2023, HKT's enterprise segment reported revenue growth, underscoring the critical need to address intricate business requirements and the resultant customer leverage.

This increasing sophistication translates into a demand for greater value and flexibility. Customers are less likely to accept standard packages, instead pushing for solutions that precisely align with their operational needs and strategic objectives. This trend directly impacts HKT's ability to dictate terms, as clients can leverage their understanding of the market and available alternatives to secure more favorable pricing and service level agreements.

- Sophisticated Demands: Enterprise clients require tailored IT, cloud, and cybersecurity solutions.

- Negotiating Power: Large contracts and the ability to customize terms give these customers significant leverage.

- Market Trends: HKT's enterprise segment growth highlights the importance of meeting these complex client needs.

- Value Proposition: Customers expect more than standard offerings, pushing for bespoke solutions and better terms.

Customers in Hong Kong's telecommunications market, including HKT's base, possess considerable bargaining power due to high service penetration and intense competition. This is evident as mobile penetration neared 230% in 2024, with broadband exceeding 90%, leaving little room for providers to significantly expand their customer base without aggressive offers.

The ease with which customers can switch providers, often with minimal cost or effort, further amplifies their leverage. In 2023, operators frequently adjusted plans, a clear indicator of this dynamic, forcing HKT to remain competitive on pricing and service quality to retain subscribers.

Both residential and enterprise clients leverage their choices and increasing market knowledge to negotiate favorable terms, particularly as bundled services become more prevalent and data consumption drives mobile revenue.

| Customer Segment | Key Bargaining Factors | Impact on HKT |

|---|---|---|

| Residential | Price sensitivity, low switching costs, bundled service availability | Limits pricing flexibility, necessitates competitive offers |

| Enterprise | Sophisticated demands (IT, cloud, cybersecurity), large contract values, customization needs | Requires tailored solutions, impacts negotiation on service level agreements and pricing |

What You See Is What You Get

HKT Trust and HKT Porter's Five Forces Analysis

This preview showcases the complete HKT Trust and HKT Porter's Five Forces Analysis, offering an in-depth examination of the competitive landscape. You are looking at the actual document; once your purchase is complete, you’ll gain instant access to this exact, professionally formatted file. This comprehensive analysis is ready for your immediate use, providing valuable insights into the strategic positioning of HKT Trust.

Rivalry Among Competitors

The telecommunications landscape in Hong Kong is intensely competitive, featuring several well-established and strong contenders alongside HKT. These include Hong Kong Broadband Network Limited (HKBN), China Mobile Hong Kong (CMHK), SmarTone, and Hutchison Telecommunications Hong Kong Holdings Limited. This crowded market means companies are constantly battling for customer acquisition and retention across a wide array of services, from mobile and broadband to enterprise solutions.

This rivalry significantly impacts pricing strategies and innovation efforts. For instance, in 2023, the intense competition likely contributed to aggressive promotional offers and bundled service packages aimed at attracting and keeping subscribers. Companies must continuously invest in network upgrades and new service development to differentiate themselves, as seen in the ongoing rollout of 5G services by multiple providers.

Telecommunication firms like HKT face intense competition driven by high fixed costs associated with network infrastructure, spectrum licenses, and ongoing technology upgrades. These significant upfront investments necessitate a constant drive to acquire and retain customers to spread costs and achieve profitability.

This pressure to fill network capacity often leads to aggressive pricing strategies and promotional offers within the industry. For instance, HKT's substantial investments in 5G and fiber optic networks in 2024 underscore the ongoing need to attract users to justify these capital expenditures and gain a competitive edge.

Intense competition within Hong Kong's telecommunications sector, characterized by high market penetration, forces players like HKT to engage in aggressive pricing and frequent promotional activities. This dynamic is particularly evident in mobile, broadband, and fixed-line services, where numerous providers vie for market share.

For instance, in 2024, the average monthly mobile data plan prices remained highly competitive, often bundled with other services to attract and retain customers. This constant promotional push, including device subsidies and service discounts, directly impacts profit margins across the industry.

Product and Service Differentiation Efforts

Competitors in the telecommunications sector are constantly striving to differentiate themselves. This often involves significant investment in technology upgrades, creating attractive bundled service packages, and focusing on improving the overall customer experience to capture market share.

HKT has actively engaged in these differentiation efforts. The company has been a leader in advancing its fibre optic broadband and mobile service capabilities. A key area of focus has been the expansion and enhancement of its 5G network technology, aiming to provide superior speed and connectivity to its users.

Furthermore, HKT is investing in the development of artificial intelligence (AI)-enabled services. These innovative solutions are designed to offer personalized experiences and more efficient customer support, setting HKT apart from competitors who may not be as advanced in AI integration.

- Technology Advancements: HKT’s commitment to 5G expansion is a prime example of technological differentiation.

- Service Bundling: Offering integrated packages of mobile, broadband, and entertainment services creates added value for consumers.

- Customer Experience: HKT's focus on AI-driven services aims to personalize interactions and improve overall satisfaction.

- Market Competition: These efforts are crucial in a market where rivals are also aggressively innovating to attract and retain customers.

Expansion into New Digital and Enterprise Segments

Competitive rivalry within HKT Trust's sector is intensifying as companies, including HKT, push beyond traditional telecommunications into burgeoning digital and enterprise segments. This strategic shift means HKT is now directly contending with a broader array of competitors in areas such as IT solutions, cloud computing, and various digital ventures. For instance, in 2023, the global IT services market was valued at approximately $1.3 trillion, highlighting the significant growth potential and the competitive landscape HKT is entering.

HKT's aggressive expansion of its enterprise business, notably into mainland China, and its concerted efforts to build a comprehensive digital ecosystem, directly pit it against other telecommunication and technology firms also seeking to diversify their revenue streams. This multi-faceted competition is reshaping market dynamics, as players vie for market share in these high-growth sectors. In 2024, many telecommunication companies are reporting significant investments in enterprise solutions and digital transformation initiatives, indicating a sector-wide trend of diversification.

- Diversification Beyond Core Telecom: HKT's move into IT solutions and cloud services creates new competitive battlegrounds with technology providers.

- Enterprise Segment Growth: Expansion into mainland China for enterprise services intensifies rivalry with established local and international players.

- Digital Ecosystem Development: Building a digital ecosystem means competing with platform providers and other digital service aggregators.

- Revenue Stream Diversification: The shared goal of diversifying revenue streams across these new segments fuels aggressive competition among all market participants.

The competitive rivalry within Hong Kong's telecommunications sector is fierce, with HKT facing strong opposition from players like HKBN, CMHK, and SmarTone. This intense competition drives aggressive pricing and constant innovation, especially with the ongoing 5G rollout and fiber optic network upgrades. Companies must continuously invest to attract and retain customers to manage high fixed costs.

In 2024, telecommunication firms are heavily investing in enterprise solutions and digital transformation, expanding beyond traditional services. This diversification means HKT is now competing with a wider range of technology companies in areas like IT solutions and cloud computing, intensifying the battle for market share in these high-growth segments.

| Competitor | Key Service Areas | 2024 Focus/Strategy |

|---|---|---|

| HKBN | Broadband, Mobile, Enterprise Solutions | Aggressive bundling, network expansion |

| CMHK | Mobile, Broadband | 5G penetration, value-added services |

| SmarTone | Mobile, Broadband | Customer experience, advanced network features |

| Hutchison Telecom | Mobile, Fixed-line | Service differentiation, integrated offerings |

SSubstitutes Threaten

The proliferation of Over-the-Top (OTT) communication services like WhatsApp and Zoom presents a significant threat of substitutes for HKT's traditional voice and messaging offerings. These platforms offer free or low-cost alternatives for voice calls and messaging, directly competing with HKT's core mobile and fixed-line services.

This substitution trend has demonstrably impacted revenue streams, with mobile voice service revenue for many telecom operators experiencing declines. For instance, in 2024, the global mobile voice revenue growth continued to be challenged by the increasing use of OTT messaging and calling apps, forcing telcos to adapt their strategies.

The threat of substitutes for HKT's media entertainment solutions is significant, primarily from the proliferation of global and local streaming services. Platforms like Netflix, YouTube, and Disney+, alongside numerous regional offerings, present direct alternatives to HKT's Pay TV services. This intense competition necessitates ongoing investment in content diversification and platform improvements to retain subscribers.

In 2024, the global video streaming market was valued at over $200 billion, demonstrating the scale of this substitute threat. HKT's Pay TV operations must contend with the increasing consumer preference for on-demand content and flexible subscription models offered by these digital platforms, pushing HKT to innovate its service delivery and content acquisition strategies.

The availability of free and low-cost Wi-Fi networks presents a significant threat of substitutes for HKT's mobile data services. In Hong Kong, a city with a high internet penetration rate, numerous public and private Wi-Fi hotspots are readily accessible, particularly in urban centers and commercial areas.

These Wi-Fi alternatives can directly substitute for mobile data, especially for data-intensive activities like streaming videos or downloading large files. This reduces customer reliance on cellular data plans, potentially impacting HKT's revenue streams from mobile broadband. For instance, as of early 2024, Hong Kong reported over 90% household broadband penetration, indicating widespread access to fixed internet, often bundled with Wi-Fi.

Cloud-Based and Software-as-a-Service (SaaS) Solutions

The rise of cloud-based and Software-as-a-Service (SaaS) solutions presents a significant threat of substitution for HKT's enterprise offerings. For businesses, these cloud platforms can replace traditional on-premise IT infrastructure, including some aspects of fixed-line communication services. This shift means HKT faces increasing competition from a dynamic and expanding market of cloud and SaaS providers, forcing it to innovate and adapt its service portfolio to remain competitive.

The global cloud computing market is projected to reach substantial figures, indicating the scale of this substitution threat. For instance, the worldwide public cloud services market is expected to grow significantly, with some estimates suggesting it could surpass $1 trillion by 2025. This rapid expansion highlights how readily businesses are adopting cloud alternatives, potentially reducing their reliance on traditional telecom infrastructure and services that HKT provides.

- Cloud Adoption Growth: The increasing adoption of cloud services by businesses globally means less reliance on traditional on-premise IT and communication systems.

- SaaS Versatility: SaaS platforms offer flexible, scalable, and often cost-effective alternatives for communication, collaboration, and other enterprise functions.

- Competitive Landscape: HKT must contend with a broad array of cloud and SaaS providers, from tech giants to specialized niche players, all vying for enterprise market share.

- Shifting Customer Needs: As businesses prioritize agility and digital transformation, their demand for integrated, cloud-native solutions intensifies, potentially sidelining legacy infrastructure.

Emerging Technologies and Decentralized Networks

Emerging technologies like satellite internet, exemplified by services such as Starlink, present a potential future threat of substitutes for traditional fixed-line and mobile communication services offered by HKT. While satellite internet is not yet a significant force in Hong Kong's dense urban environment, its increasing global reach and potential for improved accessibility warrant close monitoring by HKT. Decentralized communication networks, leveraging peer-to-peer technologies, could also offer alternative communication channels that bypass incumbent providers.

HKT is proactively addressing these potential disruptions through strategic investments in advanced technologies. The company is actively deploying 50G Passive Optical Network (PON) technology, which offers significantly higher speeds and lower latency compared to existing infrastructure, enhancing its competitive edge. Furthermore, HKT is integrating Artificial Intelligence (AI) into its network management and service delivery, aiming to improve efficiency, personalize customer experiences, and anticipate future technological shifts.

- Satellite Internet: While currently less prevalent in Hong Kong, global players like Starlink are expanding, posing a long-term substitute threat.

- Decentralized Networks: Peer-to-peer communication platforms could offer alternative channels, reducing reliance on traditional telcos.

- HKT's Investment: HKT is investing in 50G PON for enhanced speed and AI for network optimization to counter these potential threats.

- Market Adaptation: Continuous monitoring and adaptation to disruptive innovations are crucial for HKT to maintain its market leadership.

The threat of substitutes for HKT's core telecommunications services, particularly voice and messaging, is substantial due to the widespread adoption of Over-the-Top (OTT) applications. Services like WhatsApp, Telegram, and Zoom offer feature-rich, often free alternatives that directly compete with traditional mobile and fixed-line offerings. This trend has led to a decline in traditional voice revenue for many operators globally, a challenge HKT must actively manage.

Furthermore, HKT's media and entertainment division faces intense competition from a vast array of global and local streaming services. Platforms such as Netflix, Disney+, and local broadcasters provide on-demand content that directly substitutes for HKT's Pay TV services. The global video streaming market's significant growth, exceeding $200 billion in 2024, underscores the scale of this substitute threat, pushing HKT to continually enhance its content and platform offerings.

The availability of ubiquitous Wi-Fi networks, especially in a well-connected city like Hong Kong, acts as a direct substitute for HKT's mobile data services. With household broadband penetration rates exceeding 90% in early 2024, consumers can easily offload data-intensive activities to Wi-Fi, reducing their reliance on cellular data plans and impacting HKT's mobile revenue streams.

For HKT's enterprise solutions, the rise of cloud-based and Software-as-a-Service (SaaS) platforms presents a significant substitution threat. Businesses are increasingly migrating to these flexible, scalable, and often cost-effective cloud solutions, which can replace traditional on-premise IT infrastructure and some communication services. The global cloud computing market's rapid expansion, with projections to surpass $1 trillion by 2025, highlights the substantial shift towards these alternatives.

Entrants Threaten

Entering the telecommunications sector, particularly for services like mobile and broadband, necessitates enormous upfront capital. This includes building out extensive network infrastructure, acquiring costly spectrum licenses, and investing in cutting-edge technology. For instance, HKT's ongoing commitment to 5G and fiber optic network expansion in Hong Kong exemplifies this capital intensity, with significant expenditures required to maintain and upgrade these essential services.

The telecommunications sector in Hong Kong operates under a robust and intricate regulatory framework. New companies must secure various licenses and adhere to stringent compliance standards and government policies, creating a substantial barrier to entry.

Navigating this complex web of regulations and obtaining necessary approvals is a significant hurdle for potential new entrants aiming to compete with established players like HKT. This regulatory environment, while demanding, is also actively supported by the Hong Kong government to foster a conducive industry landscape.

Established brand loyalty is a significant barrier to entry for new telecommunications providers in Hong Kong, a market where HKT has cultivated deep customer relationships over decades. This loyalty is reinforced by substantial network effects; the more users HKT has on its network, the more valuable that network becomes to each individual user, creating a powerful incentive to stay with the incumbent. For instance, in 2024, HKT continued to serve a substantial portion of Hong Kong's mobile and broadband subscribers, making it challenging for newcomers to attract a critical mass of customers quickly.

Access to Distribution Channels and Customer Relationships

New entrants into the telecommunications and digital services market, like HKT, face considerable hurdles in establishing robust distribution channels and cultivating strong customer relationships. Building an extensive network to reach both individual households and corporate clients requires substantial investment and time. For instance, as of early 2024, HKT operates a vast network of retail stores and online platforms, providing a readily accessible touchpoint for customers.

HKT's established presence in the market, coupled with its deep-rooted relationships with enterprise clients, acts as a significant deterrent to newcomers. These existing ties often translate into preferential access and bundled service offerings that are difficult for new players to replicate. The company’s loyalty program, The Club, further solidifies customer loyalty by offering exclusive benefits and rewards, making it harder for competitors to attract and retain subscribers.

- Distribution Network: HKT leverages its extensive retail footprint and online presence, making its services easily accessible to a broad customer base.

- Customer Relationships: Strong, long-standing relationships with enterprise clients provide HKT with a stable revenue stream and a competitive advantage.

- Customer Loyalty: The Club loyalty program enhances customer retention by offering attractive rewards and personalized experiences, increasing switching costs for consumers.

Technological Expertise and Talent Acquisition

Developing and maintaining cutting-edge telecommunications infrastructure and digital services demands significant technological expertise and a highly skilled workforce. New entrants face a substantial hurdle in acquiring and retaining talent capable of competing with established players like HKT, who are already investing heavily in advanced technologies such as AI. For instance, in 2023, HKT reported substantial investments in network upgrades and digital transformation initiatives, highlighting the capital-intensive nature of staying competitive.

To effectively challenge incumbents, new entrants must commit considerable resources to research and development (R&D) and talent acquisition. This includes attracting engineers, software developers, and network specialists who possess the knowledge to build and manage complex systems. The cost of attracting this talent can be prohibitive, especially when competing against companies with established employer brands and competitive compensation packages.

- Talent Acquisition Costs: New entrants may need to offer premium salaries and benefits to attract top-tier tech talent, potentially increasing operational expenses by 15-20% compared to incumbents with established talent pools.

- R&D Investment: Significant upfront investment in R&D is crucial for developing proprietary technologies and services, with industry averages suggesting that leading telcos allocate 5-10% of their revenue to R&D.

- Network Deployment: Building a competitive network requires massive capital expenditure, often in the billions of dollars, for spectrum acquisition, infrastructure build-out, and ongoing maintenance.

The threat of new entrants for HKT Trust in Hong Kong's telecommunications sector is generally low due to substantial barriers. These include the immense capital required for network infrastructure and spectrum licenses, as evidenced by HKT's ongoing 5G and fiber optic expansions. Furthermore, a stringent regulatory environment and the need for extensive licensing processes significantly deter new players.

HKT's established brand loyalty, cultivated over decades, and strong network effects make it difficult for newcomers to gain traction. The company’s extensive distribution channels, including numerous retail outlets and online platforms, and its deep-rooted relationships with enterprise clients further solidify its market position. Loyalty programs like The Club also enhance customer retention, increasing switching costs for consumers.

| Barrier | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Building and maintaining advanced network infrastructure (5G, fiber) and acquiring spectrum licenses require billions of dollars in investment. | Very High - Prohibitive for most potential entrants. |

| Regulatory Hurdles | Obtaining multiple licenses and adhering to strict compliance standards set by the Hong Kong government. | High - Time-consuming and costly process. |

| Brand Loyalty & Network Effects | Decades of customer relationships and the increasing value of HKT's network as more users join. | High - Difficult to attract and retain customers from an established incumbent. |

| Distribution & Customer Relationships | Extensive retail presence and strong ties with enterprise clients. | High - New entrants struggle to match reach and established business partnerships. |

| Technological Expertise & Talent | Need for skilled personnel in advanced technologies like AI and network management. | Moderate to High - Attracting and retaining top talent is expensive and competitive. |

Porter's Five Forces Analysis Data Sources

Our analysis of HKT Trust and HKT Porter's Five Forces is built upon a robust foundation of data, drawing from HKT's annual reports, investor presentations, and official company disclosures. We also incorporate insights from reputable telecommunications industry research reports and market intelligence databases to ensure a comprehensive understanding of the competitive landscape.