Bank of East Asia Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bank of East Asia Bundle

The Bank of East Asia faces moderate threat from new entrants due to high capital requirements and regulatory hurdles. Buyer power, primarily from individual and corporate depositors, is generally low, but can increase with digital banking alternatives.

The threat of substitutes is significant, with fintech companies and other financial institutions offering innovative solutions that challenge traditional banking models.

Rivalry among existing competitors is intense, driven by price competition and the pursuit of market share in a mature industry.

Supplier power is relatively low, as banks have many options for technology and service providers.

The complete report reveals the real forces shaping Bank of East Asia’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Depositors are the lifeblood of a bank, providing the essential capital for lending and operations. For Bank of East Asia, individual depositors typically have low bargaining power. This is largely because basic savings and checking accounts are seen as commodities, with little differentiation between institutions. However, this dynamic shifts significantly for larger, institutional depositors, or during times of economic stress when liquidity is tight.

In such environments, banks like Bank of East Asia must actively compete for these substantial deposits, leading to increased bargaining power for those depositors. For instance, as of Q1 2024, the average interest rate on savings accounts in Hong Kong remained relatively low, reflecting the general stability and limited bargaining power of most retail depositors. Conversely, as interest rates rise, or during periods of economic uncertainty, larger depositors can command more favorable terms, impacting a bank's cost of funds.

The banking sector's growing dependence on cutting-edge technology, including robust cybersecurity and sophisticated digital platforms, significantly bolsters the bargaining power of specialized IT vendors. Financial institutions like the Bank of East Asia (BEA) rely heavily on these suppliers for critical infrastructure, from core banking systems to cloud services and innovative fintech solutions.

This reliance grants IT vendors considerable leverage in negotiating pricing and service level agreements. For instance, the global IT spending in the banking sector was projected to reach over $200 billion in 2024, highlighting the substantial market for these essential technology providers.

The banking sector, including institutions like Bank of East Asia, heavily relies on a workforce possessing specialized skills. This includes expertise in wealth management, intricate risk assessment, stringent compliance protocols, and cutting-edge financial technology. The demand for these professionals often outstrips supply, especially in dynamic financial hubs.

In 2024, the competition for top-tier talent in financial services remained intense. For instance, a report indicated that demand for cybersecurity professionals within banks saw a 15% year-over-year increase, driving up compensation expectations. This scarcity directly translates into increased bargaining power for these skilled individuals, influencing their demands for higher salaries, comprehensive benefits packages, and clear pathways for career advancement within the bank.

Interbank Market and Wholesale Funding

The interbank market and other wholesale funding sources are critical for banks like Bank of East Asia to maintain liquidity for their operations. These sources act as suppliers of essential funds, and their bargaining power directly influences a bank's cost of doing business.

The bargaining power of these wholesale funding suppliers is significantly shaped by broader market conditions. Factors such as overall market liquidity, the monetary policies enacted by central banks, and prevailing global economic sentiment play a crucial role. For instance, in 2024, with persistent inflation concerns and potential interest rate adjustments by major central banks, the cost of wholesale funding has seen fluctuations.

- Market Liquidity: In periods of tight liquidity, such as the aftermath of significant market shocks, suppliers of funds can command higher rates, increasing the cost of borrowing for banks.

- Central Bank Policies: Actions like quantitative tightening or changes in reserve requirements by central banks can reduce the overall supply of funds, empowering suppliers.

- Global Economic Conditions: During economic downturns or periods of uncertainty, investors may demand higher premiums for lending, thereby increasing the bargaining power of suppliers.

- Bank-Specific Risk: A bank's perceived financial health and creditworthiness also influence the terms offered by wholesale funders.

During times of financial stress, the cost and availability of wholesale funding can dramatically impact a bank's operational capacity and profitability. For example, a sudden drying up of the interbank market could force a bank to seek more expensive alternative funding, compressing its net interest margins.

Regulatory Bodies and Compliance Providers

Regulatory bodies like the Hong Kong Monetary Authority (HKMA) and the People's Bank of China (PBOC) exert considerable influence over Bank of East Asia's operations. These entities set capital adequacy ratios, anti-money laundering protocols, and data privacy standards, forcing the bank to invest heavily in compliance infrastructure. For instance, in 2024, global banks anticipated increased spending on regulatory technology (RegTech) to manage evolving compliance demands, directly impacting their operational costs and potentially limiting their flexibility.

The increasing complexity of financial regulations worldwide empowers third-party compliance solution providers. These firms offer specialized software and consulting services that help banks like East Asia navigate intricate rules, such as those related to Know Your Customer (KYC) and Anti-Money Laundering (AML). The global RegTech market was projected to reach over $20 billion by 2024, highlighting the significant reliance and bargaining power of these specialized service providers.

- Regulatory bodies set operational parameters: HKMA and PBOC mandates on capital, liquidity, and risk management directly influence Bank of East Asia's strategic decisions and operational costs.

- Compliance costs are substantial: Adhering to stringent regulations requires significant investment in technology, personnel, and training, impacting profitability.

- Third-party providers gain leverage: Specialized compliance solution providers are crucial for navigating complex regulatory landscapes, giving them pricing power.

- Market growth in RegTech: The expanding RegTech market, valued in the billions of dollars, underscores the essential nature of these services and the increasing dependence of banks on external expertise.

The bargaining power of suppliers for Bank of East Asia (BEA) is a multifaceted consideration, encompassing everything from essential capital providers to specialized technology vendors and critical human talent.

For BEA, the cost and availability of funds are heavily influenced by wholesale funding markets and interbank lending. In 2024, with ongoing economic uncertainties and central bank policy shifts, the cost of these funds has been dynamic, impacting BEA's net interest margins.

Key factors influencing supplier power include market liquidity levels, central bank monetary policies, and overall global economic sentiment. For instance, tighter liquidity in 2024 generally meant higher borrowing costs for banks, increasing the leverage of funding suppliers.

The bank's reliance on specialized IT vendors for core banking systems and fintech solutions also grants these suppliers significant leverage, especially given the projected over $200 billion global IT spending in the banking sector for 2024.

| Supplier Category | Key Influence on BEA | 2024 Trend/Data Point |

|---|---|---|

| Wholesale Funders | Cost of Capital, Liquidity Availability | Fluctuating rates due to inflation concerns and potential central bank adjustments. |

| IT Vendors | Core System Functionality, Digital Platform Development | High demand for cybersecurity and cloud services; global banking IT spending over $200 billion projected. |

| Skilled Workforce | Operational Efficiency, Risk Management, Innovation | Intense competition for talent; 15% YoY increase in demand for bank cybersecurity professionals. |

What is included in the product

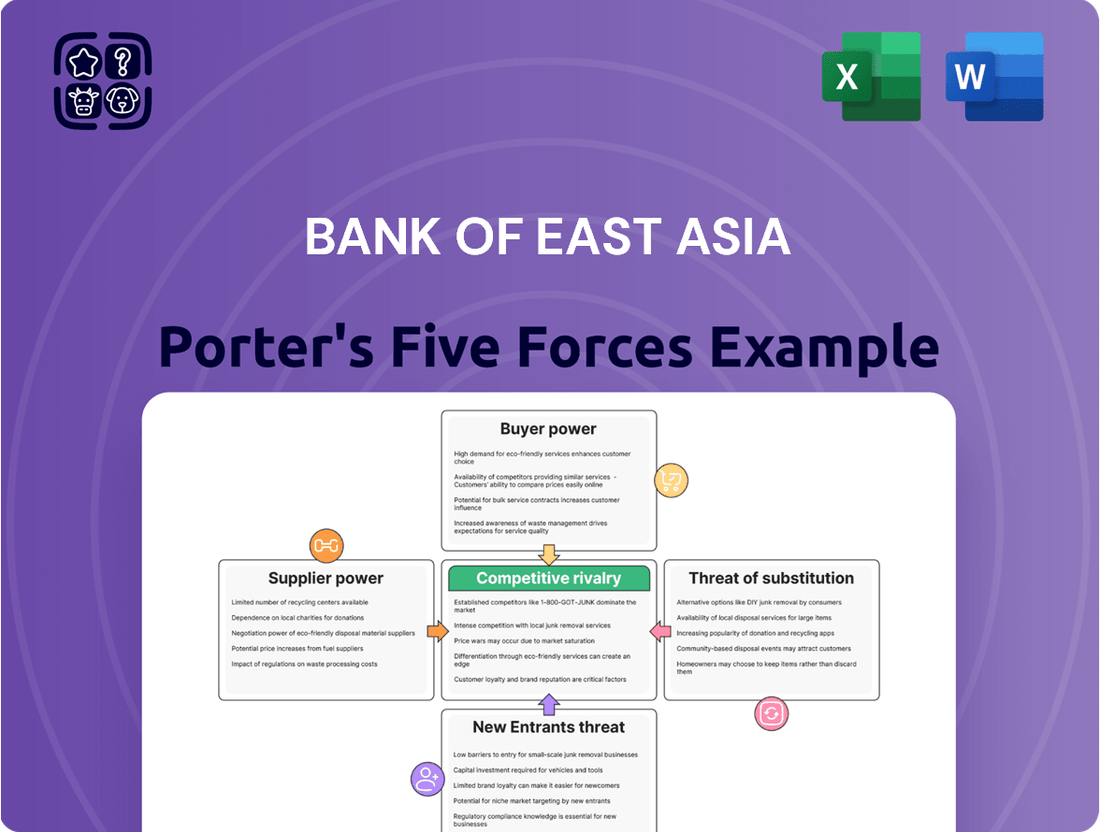

This Porter's Five Forces analysis for the Bank of East Asia dissects the competitive intensity, buyer and supplier power, threat of new entrants and substitutes within its operating environment.

Easily assess the competitive landscape and identify key threats to the Bank of East Asia's profitability, providing actionable insights for strategic adjustments.

Customers Bargaining Power

Individual retail customers typically have limited bargaining power with banks like Bank of East Asia. Their individual transaction sizes are small compared to the bank's overall operations, meaning one customer switching has a minimal impact. However, this is evolving.

The collective strength of retail customers is increasing. As more people become digitally savvy, they can easily compare banking services and fees online. This transparency, coupled with the reduced hassle of switching, especially with the growth of virtual banking options, gives customers more leverage than before.

For instance, in 2023, Hong Kong's virtual banks reported a significant surge in customer acquisition, with some seeing their customer base grow by over 50% year-on-year. This trend indicates a growing willingness among consumers to switch for better digital experiences and potentially more competitive pricing, thereby increasing their collective bargaining power.

Large corporate clients and institutional investors, like pension funds and asset managers, hold significant sway over banks. Their substantial transaction volumes mean they can easily shift their business to a competitor if they don't get favorable terms. For instance, in 2024, major institutional investors were actively seeking fee reductions on large asset management mandates, demonstrating this persistent pressure.

These clients often have intricate financing requirements, such as syndicated loans or complex derivatives, which necessitate specialized expertise and customized solutions from banks. This complexity, coupled with their ability to negotiate with multiple banking partners simultaneously, amplifies their bargaining power, pushing banks to offer more competitive pricing and value-added services to retain their business.

Wealth management clients, particularly high-net-worth individuals, wield significant bargaining power. Their substantial assets, often running into millions, allow them to dictate terms and easily shift to competitors offering superior returns or tailored services.

This client segment expects personalized advice and exclusive offerings, forcing wealth management firms to compete fiercely on fees, investment performance, and service quality. For instance, in 2024, the global wealth management market saw intense competition, with many firms actively enhancing their value propositions to retain and attract these demanding clients.

Access to Information and Digital Tools

The proliferation of digital tools and readily available information significantly bolsters the bargaining power of bank customers. Online comparison sites and mobile banking apps allow consumers to easily research and compare offerings, from interest rates to fees, reducing the information gap that previously favored banks. This increased transparency means customers can more readily identify superior deals and are more inclined to switch providers if better terms are available. For instance, in 2024, the number of fintech apps offering banking services continued to grow, providing consumers with more alternatives and increasing their leverage.

This accessibility directly translates into heightened customer power by:

- Facilitating informed comparisons: Customers can quickly assess product features and pricing across multiple institutions.

- Lowering switching costs: Digital platforms streamline the process of moving accounts, making it less burdensome to change banks.

- Driving price competition: Banks are compelled to offer more competitive rates and lower fees to retain customers in this transparent environment.

- Increasing customer loyalty through better digital experiences: Banks that invest in user-friendly digital interfaces often see higher retention rates as customers value convenience.

Low Switching Costs for Basic Services

The bargaining power of customers is influenced by low switching costs for basic banking services, particularly with the growth of digital platforms. For instance, in 2024, many neobanks and challenger banks offer streamlined onboarding processes, often completed within minutes via mobile apps, significantly lowering the friction associated with opening new accounts compared to traditional methods. This ease of transition means customers can more readily explore and adopt alternative banking solutions if they perceive better rates, lower fees, or superior digital experiences elsewhere.

The development of open banking regulations globally further empowers customers by allowing them to securely share their financial data with third-party providers. This facilitates easier comparison of financial products and services across different institutions. For example, aggregation apps can pull data from multiple bank accounts, providing a consolidated view and making it simpler for customers to identify the most advantageous offerings without extensive manual research. Such transparency and interoperability directly contribute to increased customer mobility and leverage.

- Digital Onboarding: Many banks now offer digital account opening that takes less than 10 minutes.

- Open Banking Impact: Facilitates easier comparison and switching between financial providers.

- Customer Mobility: Increased willingness to switch for better rates or services due to reduced effort.

- Perceived Value: Customers are more likely to move if they find offerings that better match their needs or offer cost savings.

The bargaining power of customers for Bank of East Asia is notably influenced by the increasing ease of switching and access to information. For retail customers, the ability to compare services digitally has amplified their leverage, as evidenced by the growth in virtual banking adoption. While individual retail clients have limited power, their collective action, facilitated by technology, presents a growing challenge to traditional banking models. This trend is further supported by data showing continued growth in fintech and digital banking alternatives throughout 2024.

| Customer Segment | Bargaining Power Factor | 2024 Trend/Data Point |

|---|---|---|

| Retail Customers | Digital comparison & ease of switching | Continued rise in virtual bank customer acquisition, with some expanding 50%+ YoY in 2023, indicating increasing willingness to switch. |

| Large Corporate Clients | Transaction volume & complex needs | Active pursuit of fee reductions on large mandates by institutional investors in 2024. |

| Wealth Management Clients | Asset size & demand for tailored services | Intense competition among wealth management firms globally in 2024, focusing on fees and service quality. |

Preview the Actual Deliverable

Bank of East Asia Porter's Five Forces Analysis

The document you see is your deliverable. It’s ready for immediate use—no customization or setup required. This comprehensive Porter's Five Forces analysis for The Bank of East Asia offers a deep dive into the competitive landscape, detailing the bargaining power of both buyers and suppliers, the threat of new entrants and substitute products, and the intensity of rivalry within the banking sector. You’ll gain actionable insights into the strategic positioning and potential challenges faced by the bank.

Rivalry Among Competitors

The banking landscape in Hong Kong and mainland China is incredibly crowded, featuring a mix of dominant local institutions and strong international banks. This saturation means Bank of East Asia faces fierce competition across all its service areas, from everyday banking to sophisticated corporate finance.

Well-known local giants like HSBC, Standard Chartered, and Bank of China (Hong Kong) alongside global players create a highly competitive environment. This forces banks to continually innovate and offer competitive rates to attract and retain customers, impacting profitability.

In 2024, the Asian banking sector, particularly in Greater China, continued to see intense rivalry. For instance, many banks were actively pursuing digital transformation to enhance customer experience and operational efficiency, a direct response to competitive pressures. This often translates to aggressive pricing strategies in loans and deposits.

The banking landscape in Hong Kong has seen a significant shake-up with the advent of virtual banks and the aggressive expansion of fintech firms. This surge in digital-first competitors directly challenges traditional players like Bank of East Asia, especially within the retail and small-to-medium enterprise (SME) markets. These newcomers are attracting customers with their typically lower fee structures and highly intuitive digital platforms.

For instance, by the end of 2023, Hong Kong's virtual banks had collectively attracted over 1.5 million customers, processing billions in deposits. Companies like Ant Group's AlipayHK and Tencent's Weixin Pay have also broadened their financial service offerings, further intensifying competition for payment and lending services. This competitive pressure compels established institutions to invest heavily in their own digital capabilities to remain relevant and retain market share.

The banking industry, including players like Bank of East Asia, faces intense competitive rivalry stemming from product and service homogenization. Many core banking offerings, such as savings accounts, mortgages, and basic payment services, are virtually indistinguishable across different institutions. This makes it difficult for banks to stand out based on product features alone.

This lack of differentiation pushes competition towards price, with banks heavily reliant on interest rates and fees to attract customers. For instance, the average savings account interest rate in Hong Kong, a key market for Bank of East Asia, remained very low in early 2024, hovering around 0.01% for many institutions, forcing banks to compete on minor rate differences or other service aspects. This price-based competition can significantly compress profit margins.

In 2023, the net interest margin for many Hong Kong banks remained under pressure due to rising funding costs and competition, impacting overall profitability. Bank of East Asia, like its peers, must constantly innovate or focus on superior customer service to carve out a competitive edge in this commoditized environment.

Geographic Concentration and Market Saturation

Bank of East Asia's (BEA) primary focus on Hong Kong and mainland China places it in intensely competitive and frequently saturated banking environments. This geographic concentration means that opportunities for organic growth are often constrained, compelling banks like BEA to engage in aggressive competition for market share. This often manifests through robust marketing efforts, strategic expansion of branch networks, and a strong emphasis on superior customer service to retain and attract clients.

The banking sector in both Hong Kong and mainland China is characterized by a high density of domestic and international players. For instance, Hong Kong boasts a significant number of licensed banks, with the Hong Kong Monetary Authority (HKMA) overseeing a highly developed financial system. In mainland China, while state-owned banks dominate, there's also a growing presence of foreign banks and a rapidly evolving landscape of digital banking. This intense rivalry means that BEA must constantly innovate and differentiate its offerings to stand out.

- High Density of Competitors: Hong Kong has one of the highest bank-to-population ratios globally, leading to intense competition for every customer.

- Price Sensitivity: In saturated markets, pricing of services like loans and deposits can become a key competitive differentiator, impacting profit margins.

- Customer Acquisition Costs: The need to attract and retain customers in a crowded market drives up marketing and service expenditures for banks like BEA.

- Digital Disruption: The rise of fintech and digital-only banks further intensifies competition, forcing traditional players to invest heavily in technology and digital transformation.

Focus on Niche Segments and Customer Relationships

Competitive rivalry within the banking sector, particularly concerning Bank of East Asia (BEA), is significantly shaped by a focus on niche segments and the cultivation of strong customer relationships. Many banks, including BEA, differentiate themselves by targeting specific customer groups or by prioritizing personalized service to foster loyalty. This strategy intensifies competition as rivals also invest in customized solutions and superior customer experiences to win and retain business.

- Niche Specialization: Banks increasingly concentrate on specific market segments like high-net-worth individuals, small and medium-sized enterprises (SMEs), or particular industries, offering tailored products and services.

- Customer Relationship Management: Emphasis is placed on building deep, long-term relationships through dedicated relationship managers, personalized financial advice, and proactive service.

- Service Differentiation: Beyond product offerings, banks compete on the quality of their customer service, aiming for seamless digital experiences and responsive support across all channels.

- Intensified Loyalty Programs: To combat churn, banks are enhancing loyalty programs and offering exclusive benefits to retain their most valuable customers, creating a crowded landscape for customer attention.

Competitive rivalry is a defining characteristic of Bank of East Asia's operating environment, particularly in Hong Kong and mainland China. The market is densely populated with both established local banks and international financial institutions, creating an intensely competitive landscape across all banking services.

This high degree of competition forces players like BEA to constantly innovate and often engage in aggressive pricing strategies for loans and deposits, as evidenced by the very low average savings account interest rates seen in early 2024. Digital disruption from fintech firms and virtual banks further amplifies this rivalry, compelling traditional banks to invest heavily in technology to maintain market share and customer relevance.

The homogenization of core banking products means that competition frequently shifts to price and customer service quality. In 2023, many Hong Kong banks experienced pressure on their net interest margins due to rising funding costs and this intense competition, underscoring the challenges BEA faces in maintaining profitability.

| Metric | 2023/Early 2024 Data Point | Implication for BEA |

|---|---|---|

| Hong Kong Bank-to-Population Ratio | Among the highest globally | Intensifies competition for every customer |

| Average Savings Account Interest Rate (HK) | Around 0.01% (early 2024) | Drives competition towards price and service differentiation |

| Virtual Bank Customer Acquisition (HK) | Over 1.5 million customers by end-2023 | Direct challenge to traditional players in retail/SME segments |

| Net Interest Margin Pressure (HK Banks) | Under pressure in 2023 | Impacts profitability due to funding costs and competition |

SSubstitutes Threaten

Fintech companies present a substantial threat of substitution for traditional banking services. Platforms like Alipay and WeChat Pay have become dominant in mobile payments, capturing a significant share of transaction volume and revenue that might otherwise flow through banks. In 2023, global mobile payment transaction value was projected to exceed $2.5 trillion, showcasing the scale of this shift away from traditional methods.

The rise of peer-to-peer lending and crowdfunding also offers viable alternatives for both consumers and businesses seeking financing. These platforms bypass traditional bank loan origination processes, directly connecting borrowers with lenders and investors. This disintermediation erodes a key revenue source for banks, as individuals and companies increasingly turn to these agile, often lower-cost, fintech solutions for their capital needs.

The rise of direct investment platforms and robo-advisors presents a significant threat of substitutes for traditional banking services. These platforms allow individuals to bypass banks for investment activities, directly accessing markets. For instance, by the end of 2023, the global robo-advisory market was valued at approximately USD 26.7 billion, with projections indicating substantial growth. This disintermediation directly impacts banks' revenue streams from wealth management and advisory fees, as customers opt for lower-cost, automated solutions.

The burgeoning adoption of cryptocurrencies and blockchain technology presents a significant, albeit evolving, threat of substitutes for traditional banking services. These digital assets offer alternative avenues for value transfer and remittances, potentially circumventing established banking channels. For instance, by mid-2024, global cryptocurrency transaction volumes continued to demonstrate robust activity, with stablecoins playing an increasingly prominent role in facilitating cross-border payments, offering a faster and often cheaper alternative to traditional wire transfers. While mainstream integration is ongoing, the underlying blockchain technology itself provides decentralized platforms for asset management and trading, posing a long-term challenge to banks’ core functions.

Non-Bank Insurance Providers and Aggregators

The threat of substitutes for Bank of East Asia's insurance offerings is significant, primarily from non-bank insurance providers and online aggregators. Customers can easily bypass traditional banking channels to acquire insurance directly from specialized insurers or through comparison websites.

This disintermediation directly impacts BEA's ability to cross-sell insurance products, a key revenue stream. For instance, the global insurtech market, which fuels many aggregator platforms, was valued at approximately $2.1 billion in 2023 and is projected to grow substantially, indicating a strong customer preference for digital and direct insurance purchasing.

- Direct Purchase: Customers can buy policies directly from insurance companies, eliminating the need for a bank intermediary.

- Online Aggregators: Platforms like CompareAsiaGroup or GoBear allow consumers to compare and purchase insurance from various providers in one place.

- Reduced Cross-Selling: This bypass diminishes the bank's opportunity to bundle insurance with other banking products.

- Commission Erosion: BEA may see reduced commission income from insurance sales as customers opt for direct channels.

Alternative Lending and Funding Sources

The threat of substitutes for traditional banking services, particularly lending, is escalating. Beyond peer-to-peer lending platforms, a diverse array of non-bank financial institutions and private capital markets are providing robust alternative funding solutions. These include sophisticated options like supply chain finance, venture debt, and private equity, directly challenging the dominance of conventional bank loans and credit facilities.

This shift signifies a growing independence for businesses and individuals from traditional banking channels. For instance, in 2024, the global alternative lending market continued its expansion, with various reports indicating significant year-over-year growth in deal volume and capital deployment. This trend means customers have more choices, potentially weakening the Bank of East Asia's pricing power and market share in its lending segments.

The availability of these alternatives directly impacts customer loyalty and the cost of capital for borrowers. Consider these key substitute areas:

- Supply Chain Finance: This allows companies to get paid faster by financiers based on their customers' creditworthiness, reducing the need for traditional working capital loans.

- Venture Debt: Specialized debt financing for venture-backed startups, offering an alternative to equity dilution.

- Private Equity and Debt Funds: These entities provide substantial capital for a wide range of corporate needs, from growth funding to acquisitions, often with more flexible terms than banks.

- Crowdfunding and P2P Lending: While established, these continue to offer accessible funding for smaller businesses and individuals.

The threat of substitutes for traditional banking services, particularly in payments and lending, is substantial. Fintech innovations like mobile payment platforms and peer-to-peer lending offer consumers and businesses faster, often cheaper, alternatives, directly impacting banks' revenue streams and customer relationships.

Digital investment platforms and robo-advisors also provide viable substitutes for wealth management, bypassing traditional bank advisory services and eroding fee-based income. Cryptocurrencies and blockchain technology introduce further disintermediation possibilities for value transfer and remittances.

Alternative lending sources, including supply chain finance and private capital markets, are growing, providing businesses with funding options outside of conventional bank loans. This diversification of funding channels reduces reliance on banks, potentially weakening their pricing power.

| Substitute Area | Description | Impact on Banks | Example Data (2023/2024) |

|---|---|---|---|

| Mobile Payments | Digital platforms for transactions | Reduced transaction fees, customer loyalty | Global mobile payment value projected to exceed $2.5 trillion (2023) |

| Peer-to-Peer Lending | Direct lending between individuals/businesses | Loss of loan origination revenue | Significant growth in alternative lending market volume (2024) |

| Robo-Advisors | Automated investment management | Reduced wealth management fees | Global robo-advisory market valued at approx. USD 26.7 billion (end of 2023) |

| Alternative Lending | Non-bank financing options (e.g., supply chain finance) | Decreased market share in lending segments | Continued expansion of global alternative lending market (2024) |

Entrants Threaten

The banking sector, particularly in Hong Kong where Bank of East Asia operates, faces formidable regulatory hurdles that significantly deter new entrants. The Hong Kong Monetary Authority (HKMA) imposes stringent licensing requirements, demanding substantial capital reserves and a robust operational framework before any new entity can even begin banking operations. For instance, obtaining a full banking license often requires a minimum paid-up capital of HK$3 billion, a substantial sum that weeds out many potential competitors.

Beyond initial licensing, ongoing compliance with capital adequacy ratios, liquidity requirements, and anti-money laundering regulations demands continuous investment and expertise. These stringent capital adequacy rules, such as Basel III requirements, necessitate that banks maintain a certain level of capital relative to their risk-weighted assets. In 2024, banks are still navigating these complex frameworks, which require considerable financial muscle and sophisticated risk management systems, making it incredibly challenging for newcomers to compete on a level playing field.

Establishing a bank, like the Bank of East Asia, necessitates a colossal initial capital investment. Regulatory bodies mandate substantial minimum capital to ensure financial stability and protect depositors. For instance, in 2024, many jurisdictions require new banks to have hundreds of millions of dollars in seed capital, a sum that deters all but the most well-funded entities from entering the market.

The banking sector inherently relies on trust and a strong brand reputation, making it a significant barrier for new entrants. Established institutions like the Bank of East Asia (BEA) have cultivated customer loyalty over many years, a hard-won asset that new players must painstakingly build from scratch.

For instance, in 2024, the average customer tenure in traditional banking services remained high, with many individuals demonstrating a preference for the perceived stability and reliability of legacy banks. This deep-seated customer inertia means new entrants need substantial marketing investment and demonstrable security protocols to even begin challenging established trust levels.

Convincing customers to shift their assets and financial relationships requires overcoming ingrained habits and a natural inclination towards familiar, reputable brands. The cost and time involved in building this level of brand recognition and trust represent a formidable hurdle for any aspiring new bank.

Economies of Scale and Network Effects

Existing banks like Bank of East Asia (BEA) possess substantial economies of scale, leveraging vast branch networks and extensive ATM deployments. This established infrastructure creates a significant cost advantage, making it difficult for new entrants to match their operational efficiency and reach. For instance, in 2023, BEA operated a significant number of branches and ATMs across its key markets, providing a robust foundation that new digital-only banks would find challenging to replicate quickly.

Network effects also play a crucial role, where a larger customer base enhances the value proposition for all users. As more customers bank with BEA, the bank can offer more competitive services and attract further business, creating a virtuous cycle. This makes it harder for newcomers to gain traction, as they lack the established community and trust that incumbent institutions have cultivated over years.

New entrants often face considerable hurdles in overcoming these ingrained advantages:

- High initial investment: Replicating an incumbent's scale requires substantial capital for technology, infrastructure, and marketing.

- Customer acquisition cost: Attracting customers away from established banks with strong network effects is expensive and time-consuming.

- Regulatory compliance: New entrants must navigate complex regulatory landscapes that established players already understand and manage efficiently.

Technological Infrastructure and Cybersecurity Costs

The substantial cost and complexity of establishing and maintaining a secure, scalable technological infrastructure present a significant barrier for potential new entrants into the banking sector. This includes investing in core banking systems, digital platforms, advanced data analytics capabilities, and robust cybersecurity measures. For instance, in 2024, the global spending on cybersecurity alone was projected to exceed $230 billion, highlighting the immense investment required to protect financial institutions from evolving threats.

New players must therefore commit substantial capital from the outset, a daunting prospect that can deter many. This upfront investment in cutting-edge technology, coupled with the ongoing costs of upgrades and maintenance, creates a formidable hurdle. Consider that the average cost of a data breach for financial services firms in 2023 was around $5.9 million, illustrating the direct financial consequences of inadequate security infrastructure.

- High Upfront Investment: New entrants face significant capital expenditure for core banking systems and digital channels.

- Ongoing Technology Costs: Continuous investment is needed for system upgrades, maintenance, and innovation.

- Cybersecurity Expenses: Protecting sensitive customer data requires substantial spending on advanced security solutions.

- Regulatory Compliance: Ensuring technology meets stringent financial regulations adds to the overall cost burden.

The threat of new entrants for Bank of East Asia remains relatively low due to significant barriers to entry in the banking sector. Stringent regulatory requirements, such as substantial capital infusion mandates and ongoing compliance costs, effectively deter potential new players. For instance, in 2024, the cost of establishing a new bank often runs into hundreds of millions of dollars, a figure that most aspiring entrants cannot meet.

Furthermore, established trust and brand loyalty, cultivated over years by incumbents like BEA, present a formidable challenge for newcomers. Acquiring customers is an expensive and lengthy process, as demonstrated by the high customer retention rates observed in traditional banking in 2024, where inertia towards established brands remains a powerful force.

Economies of scale and network effects enjoyed by existing banks also create a cost advantage and enhanced value proposition that new entrants struggle to replicate. The substantial investment required in technology infrastructure and cybersecurity, exemplified by global cybersecurity spending projected to exceed $230 billion in 2024, further solidifies this barrier.

| Barrier | Description | Impact on New Entrants | Example Data (2024) |

| Regulatory Requirements | Strict licensing, capital adequacy, and compliance rules. | High initial capital and operational hurdles. | Minimum paid-up capital for a full banking license in Hong Kong is HK$3 billion. |

| Brand Reputation & Trust | Customer loyalty built over time. | Difficult and costly customer acquisition. | High average customer tenure in traditional banking services. |

| Economies of Scale | Cost advantages from large-scale operations (branches, ATMs). | Lower operational costs for incumbents. | BEA's extensive branch and ATM network provides a significant infrastructure advantage. |

| Technology Investment | Need for advanced core banking systems, digital platforms, and cybersecurity. | Substantial upfront and ongoing capital expenditure. | Global cybersecurity spending projected over $230 billion; average cost of data breach for financial services firms around $5.9 million (2023). |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Bank of East Asia is built upon a foundation of comprehensive data, including the bank's annual reports, investor presentations, and publicly available financial statements. We supplement this with industry-specific research from reputable financial news outlets and market analysis firms that track the banking sector.