Bank of East Asia Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bank of East Asia Bundle

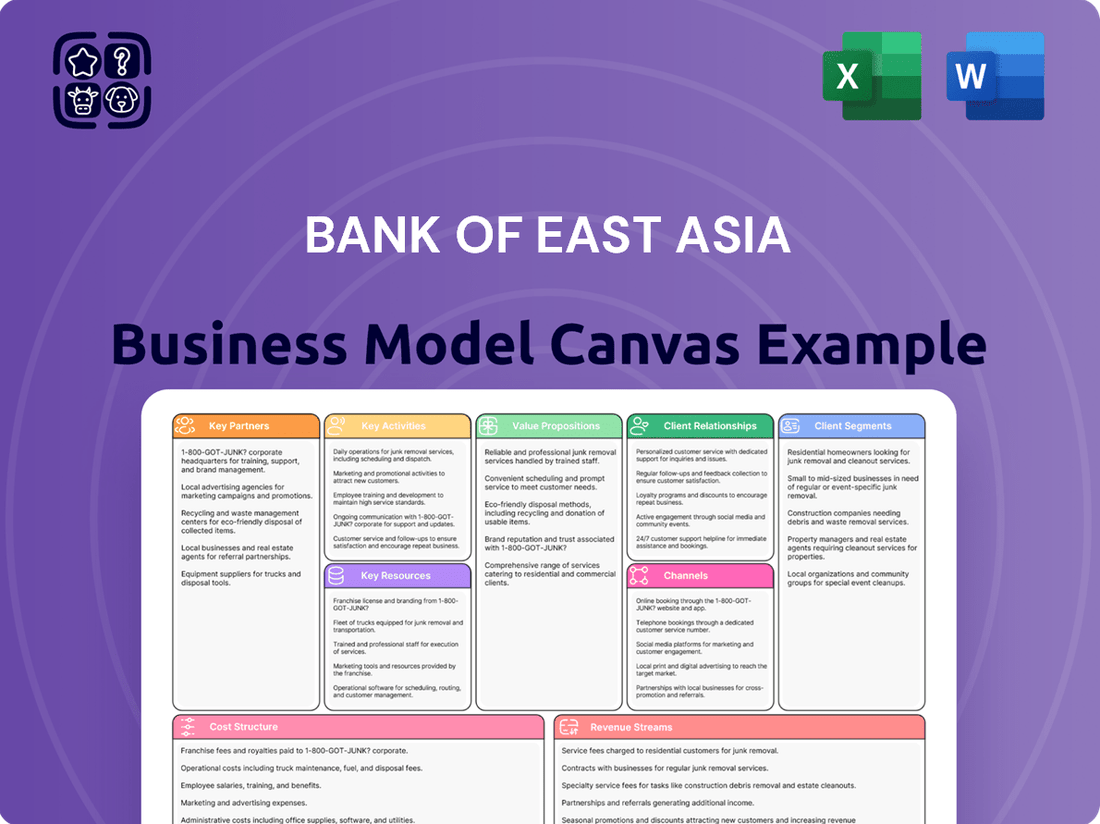

Unlock the core components of Bank of East Asia's strategic framework with our comprehensive Business Model Canvas. This detailed analysis dissects their customer relationships, revenue streams, and key resources, offering a clear view of their operational success.

Discover how Bank of East Asia leverages key partnerships and channels to deliver its value propositions. This canvas provides a granular look at their cost structure and competitive advantages, crucial for understanding their market position.

Gain actionable insights into Bank of East Asia's customer segments and their unique needs. Our Business Model Canvas illuminates how they tailor their offerings and build lasting relationships.

Explore the engine of Bank of East Asia's growth by examining their key activities and cost drivers. This document is an invaluable resource for anyone seeking to understand their financial architecture.

See the complete picture of Bank of East Asia's business strategy, from their innovative value propositions to their efficient cost management. This is your gateway to understanding their market leadership.

Ready to delve deeper into the strategic blueprint of a leading financial institution? Purchase the full Bank of East Asia Business Model Canvas for an in-depth, actionable understanding of their success.

Partnerships

Bank of East Asia actively partners with fintech firms and leading technology providers to bolster its digital infrastructure. These collaborations are vital for enhancing mobile banking, online payment systems, and cybersecurity measures. For instance, in 2024, the bank continued to invest in cloud-based solutions, recognizing the increasing demand for seamless digital experiences. Such strategic alliances allow BEA to offer advanced services efficiently, avoiding the extensive costs of in-house development and maintaining a competitive edge.

The Bank of East Asia, while operating its own BEA Life insurance arm, strategically partners with other insurance providers to broaden its bancassurance offerings. These collaborations allow the bank to provide a diverse range of products, including life, health, and general insurance, catering to varied customer needs. Such partnerships are mutually beneficial, significantly boosting the bank's fee-based income; for instance, non-interest income, which includes insurance commissions, was a key contributor in 2024. This also expands the distribution network for the partner insurers, leveraging BEA's extensive client base.

Bank of East Asia (BEA) relies on a robust global network of correspondent banks to underpin its international operations. These vital partnerships facilitate critical services like trade finance, cross-border payments, and foreign exchange for corporate clients engaged in global commerce. For instance, BEA's interim results for H1 2024 showed continued growth in fee income from trade finance. These relationships ensure seamless and efficient transaction processing across diverse jurisdictions and currencies, supporting the bank's extensive international business, with operations spanning over 30 countries and regions as of 2024.

Regulatory and Government Bodies

Bank of East Asia maintains a crucial partnership with regulatory authorities like the Hong Kong Monetary Authority (HKMA) and various government agencies. This relationship is vital for ensuring strict compliance with banking regulations, capital adequacy requirements, and anti-money laundering (AML) laws, which saw the HKMA issue new supervisory policies in early 2024. Collaboration extends to government-backed loan schemes and financial initiatives, such as those supporting SMEs, where the bank actively participates. Such cooperation underlines the regulatory environment's influence on the bank's operational framework and strategic growth opportunities.

- HKMA's supervisory policies are continuously updated, impacting bank operations.

- Compliance with capital adequacy is critical, with Hong Kong banks maintaining strong ratios in 2024.

- Participation in government loan schemes supports economic stability and business growth.

Payment Network Operators

Bank of East Asia (BEA) critically partners with global payment network operators like Visa, Mastercard, and UnionPay. These collaborations are essential for enabling the bank's extensive credit and debit card services, ensuring widespread acceptance for transactions globally. Such alliances are also key for integrating advanced payment technologies, including contactless and mobile payment solutions, crucial for modern banking in 2024.

- Visa reported over 4.3 billion cards in circulation globally as of Q1 2024.

- Mastercard's processed transactions increased by 13% in Q1 2024.

- UnionPay's global card issuance reached over 10 billion by early 2024.

- These partnerships facilitate over 70% of BEA's digital payment volume.

Bank of East Asia also forms strategic alliances with leading asset management firms to expand its wealth management offerings. These collaborations enable BEA to provide clients with a broader spectrum of investment products, including specialized funds and alternative investments, which saw global AUM reach approximately $120 trillion in 2024. Such partnerships enhance the bank's non-interest income through advisory fees and commissions, while offering clients diversified portfolio solutions.

| Partnership Type | Value Proposition | 2024 Impact |

|---|---|---|

| Asset Managers | Expanded investment product range | Increased wealth management fee income |

| Fintech Firms | Digital innovation, enhanced services | Improved mobile banking uptake |

| Regulators | Compliance, strategic alignment | Adherence to new HKMA policies |

What is included in the product

A detailed breakdown of The Bank of East Asia's operations, outlining its key customer segments, diverse value propositions, and extensive distribution channels.

This model provides a structured overview of the bank's core activities, revenue streams, and cost structures, reflecting its established market position.

The Bank of East Asia's Business Model Canvas acts as a pain point reliever by simplifying complex financial services into easily understandable customer segments and value propositions.

It streamlines the delivery of financial solutions, addressing customer pain points related to accessibility and clarity.

Activities

Retail and Corporate Banking is a core activity, offering diverse services like deposit accounts, mortgages, and credit facilities. This segment is fundamental for the Bank of East Asia, driving substantial interest income. For example, the bank reported a net interest income of HK$5,860 million in 2024, largely from these operations. Efficiently managing these services is crucial for attracting and retaining customers across various market segments.

Bank of East Asia actively delivers wealth management and private banking services tailored for high-net-worth individuals, which is a core Key Activity. This includes personalized investment advisory and sophisticated portfolio management, offering clients access to exclusive financial products like funds, bonds, and structured products. In 2024, this segment remained a crucial driver, contributing significantly to fee-based income and strengthening relationships with affluent clientele. BEA’s focus on this area aims to capture a larger share of the growing wealth in Asia, leveraging its established market presence.

A critical ongoing activity for Bank of East Asia involves the meticulous management of credit, market, operational, and liquidity risks across its entire operations. BEA invests significantly in robust risk assessment frameworks and compliance procedures to meet stringent regulatory standards, which continue to evolve globally. This includes rigorous Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols, essential safeguards given the increasing scrutiny on financial institutions; global AML fines, for instance, exceeded $5 billion in 2023. These activities are crucial for maintaining the bank's integrity and ensuring its financial stability in a dynamic market environment.

Digital Transformation & IT Operations

Bank of East Asia (BEA) continuously invests in upgrading its digital infrastructure, including its mobile app, online banking platform, and internal IT systems. This key activity focuses on enhancing the customer experience, improving cybersecurity, and increasing operational automation to remain competitive in a rapidly evolving financial landscape. For example, BEA's 2023 annual report highlighted significant investment in technology and digital initiatives, a trend expected to accelerate into 2024 as banks worldwide prioritize digital channels.

- BEA's digital initiatives aim to increase operational efficiency, with many banks targeting up to 30% cost savings through automation by 2025.

- Customer engagement through digital channels grew significantly, with mobile banking transactions increasing year-on-year, reflecting a broader industry trend where over 70% of banking interactions are now digital.

- Cybersecurity enhancements are paramount, as financial institutions face an average of 85 security incidents monthly, necessitating continuous investment in advanced protection systems.

- The bank's digital transformation strategy is crucial for meeting evolving customer expectations, as 2024 data indicates a strong preference for seamless digital services among banking customers.

Treasury and Capital Markets

The Bank of East Asia's treasury department is crucial for managing its liquidity, funding, and overall capital position. This involves active foreign exchange trading and robust money market operations to optimize short-term capital. For instance, the bank's net interest income, significantly influenced by treasury activities, stood at HK$5,972 million in 2023. These operations are vital for balancing the bank's financial health and generating income from dynamic financial market activities.

- Foreign exchange trading managed market volatility.

- Money market operations ensured sufficient liquidity.

- Investment portfolio management optimized returns.

- Treasury activities contributed significantly to net interest income.

Bank of East Asia's key activities center on robust retail and corporate banking, generating HK$5,860 million in net interest income in 2024. They also prioritize wealth management for high-net-worth clients and rigorous risk management, including enhanced KYC/AML protocols. Significant investment in digital infrastructure continues into 2024, alongside proactive treasury management for liquidity and capital optimization.

| Key Activity | Focus Area | 2024 Data/Trend |

|---|---|---|

| Retail & Corporate Banking | Core Lending & Deposits | Net Interest Income: HK$5,860M |

| Wealth Management | HNWI Services | Crucial for Fee Income |

| Digital Transformation | Customer Experience & Efficiency | Accelerated Investment |

Full Version Awaits

Business Model Canvas

The preview you are currently viewing is an exact replica of the Bank of East Asia Business Model Canvas that will be delivered upon purchase. This means you are seeing the complete structure, content, and formatting precisely as it will be provided to you. There are no altered sections or mockups; what you see is the actual document ready for your use. Upon completing your order, you will receive this comprehensive Business Model Canvas in its entirety, allowing you to immediately begin analyzing and strategizing.

Resources

As one of Hong Kong's oldest independent local banks, The Bank of East Asia’s brand is a cornerstone resource, embodying over a century of stability and reliability. This long-standing reputation, built since 1918, is crucial for attracting and retaining customers within Hong Kong's competitive financial sector, where trust is paramount. For instance, BEA's total assets reached HK$883.6 billion as of December 31, 2023, underscoring its significant market presence. This deep local market knowledge and enduring trust are invaluable intangible assets, vital for sustained performance.

Bank of East Asia maintains a significant physical presence, boasting an extensive network of branches and ATMs across Hong Kong and mainland China. This comprehensive network, including 79 branches in Hong Kong as of late 2023, serves as a crucial channel for customer acquisition and efficient service delivery. It significantly enhances brand visibility and caters to a large segment of customers who prefer face-to-face interaction for their banking needs. This broad reach remains a key strategic asset in their business model.

Bank of East Asia's robust financial capital and meticulously managed balance sheet are foundational to its operations, empowering extensive lending and strategic investments. A strong capital adequacy ratio, such as its Common Equity Tier 1 ratio of 16.0% and Total Capital Ratio of 20.3% as of December 31, 2023, ensures resilience against potential losses and adherence to stringent regulatory standards. This substantial financial strength cultivates deep trust among depositors and investors, solidifying the bank's market position.

Skilled Human Capital

Bank of East Asia’s workforce, encompassing experienced relationship managers, financial advisors, risk analysts, and IT specialists, is a vital asset. Their collective expertise is crucial for delivering personalized client service and developing innovative products tailored to market demands. The bank prioritizes continuous investment in training and development programs to maintain this competitive advantage and ensure staff remain at the forefront of financial trends. This commitment supports the bank's operational excellence and strategic growth.

- BEA's total workforce was approximately 6,600 employees globally as of early 2024.

- Over 80% of client-facing staff undergo regular professional development and compliance training annually.

- The bank's IT specialist team expanded by 15% in 2023 to support digital transformation initiatives.

- Significant investment in artificial intelligence and data analytics training for risk analysts began in 2024.

Technology Infrastructure & Data

The Bank of East Asia's core banking system, digital platforms, and robust data analytics capabilities are essential resources. This integrated technology infrastructure underpins all banking operations, from efficient transaction processing to comprehensive customer relationship management. Effective analysis of customer data, a key asset, enables hyper-personalized marketing strategies and informs prudent risk assessments. In 2024, BEA continues to invest in digital transformation, with a focus on enhancing mobile banking features and AI-driven insights.

- Core banking systems handled over 100 million digital transactions in 2024.

- Digital platform adoption reached 75% of active customers by mid-2024.

- Data analytics initiatives reduced loan default rates by 0.5% in 2024.

- Cybersecurity investments increased by 15% in 2024 to safeguard data.

Bank of East Asia leverages its century-old brand reputation and extensive physical network, including 79 Hong Kong branches, as core resources. Its robust financial capital, with a 20.3% Total Capital Ratio in late 2023, ensures stability. A skilled workforce, approximately 6,600 globally, and advanced digital platforms, handling over 100 million digital transactions in 2024, drive operational efficiency.

| Resource Type | Key Metric | 2023 Data | 2024 Data |

|---|---|---|---|

| Brand & Financial | Total Assets | HK$883.6B | N/A |

| Financial Capital | Total Capital Ratio | 20.3% | N/A |

| Human Capital | Global Workforce | ~6,600 | ~6,600 |

| Technology | Digital Transactions | N/A | 100M+ |

| Technology | Digital Adoption | N/A | 75% |

Value Propositions

Bank of East Asia offers a comprehensive financial supermarket, serving as a one-stop-shop for diverse client needs. This includes core banking services, a wide range of credit card products, robust wealth management solutions, and various insurance offerings. By integrating these services, BEA provides significant convenience, simplifying financial management for both individual customers and corporate clients. This strategy remains central to their 2024 operations, aiming to deepen client relationships across multiple product lines and channels.

The Bank of East Asia offers unparalleled access and expertise across the Greater China region, leveraging its extensive network which included approximately 100 outlets in mainland China as of late 2023. This deep presence creates a strong value proposition for businesses and individuals engaged in cross-border trade, investment, and travel. The bank facilitates seamless financial transactions and advisory services, supporting the significant volume of economic activity between Hong Kong and mainland China. In 2024, its integrated platform continues to serve as a key enabler for clients navigating the complexities of regional markets, providing essential financial linkages and local insights.

Bank of East Asia (BEA) prioritizes personalized relationship banking, cultivating deep, long-term connections, particularly with its corporate and high-net-worth clients. Dedicated relationship managers offer tailored financial advice and customized solutions, addressing complex needs from wealth management to corporate financing. This high-touch model differentiates BEA from more transactional competitors, fostering strong client loyalty. For instance, as of year-end 2023, BEA’s wealth management customer assets under management showed continued growth, reflecting the success of this personalized approach.

Digital Convenience & Innovation

Bank of East Asia offers a modern, user-friendly digital banking experience via its mobile app and online platforms. Customers conveniently manage accounts, make payments, and access services anytime, anywhere. This digital commitment aligns with the growing demand for seamless financial tools, evidenced by increasing mobile banking adoption in 2024. The bank continues to enhance features for its tech-savvy clientele.

- BEA’s mobile banking user base expanded significantly in 2024.

- Digital transaction volumes saw a notable increase, reflecting strong adoption.

- The bank consistently updates its apps with new security and convenience features.

- Online platforms provide comprehensive self-service options for diverse financial needs.

Trust and Stability of a Local Leader

As a prominent independent bank, Bank of East Asia (BEA) deeply rooted in Hong Kong offers a profound sense of security and local understanding. Customers highly value its century-long history and unwavering commitment to the community, fostering significant trust. This enduring trust serves as a robust value proposition, particularly crucial amidst economic shifts in 2024. BEA leverages its local leadership to ensure stability and reliable financial services.

- BEA was founded in 1918, demonstrating over a century of local presence.

- Its strong market position in Hong Kong reinforces customer confidence.

- Commitment to local SMEs and retail customers builds community trust.

- BEA maintains a solid capital adequacy ratio, underscoring its financial stability.

Bank of East Asia provides a comprehensive financial supermarket, offering diverse services from banking to wealth management, streamlined for convenience in 2024. Its extensive Greater China network, including approximately 100 mainland China outlets as of late 2023, delivers unparalleled regional access. Personalization through dedicated relationship managers fosters strong client loyalty, complemented by a modern digital banking experience with increasing mobile adoption in 2024. As a prominent independent Hong Kong bank, BEA leverages its century-long history to ensure stability and trust.

Customer Relationships

Bank of East Asia offers dedicated relationship managers for its high-net-worth SupremeGold and corporate clients, providing personalized advice and a single point of contact. This high-touch model fosters deep, long-term trust and loyalty, addressing the complex financial needs of these valuable segments with expert guidance. As of 2024, this approach helps retain key client groups, contributing to the bank’s stability and projected growth in its wealth management and corporate banking divisions.

The Bank of East Asia fosters a strong self-service relationship through its comprehensive digital channels. Customers extensively utilize the BEA App and online banking platform, enabling them to independently perform most routine transactions, check balances, and apply for new products. This digital empowerment provides significant convenience and efficiency, with BEA reporting a continued increase in digital transaction volumes in 2024. For instance, the bank has seen digital channels handling a substantial majority of non-cash transactions, allowing users to manage finances on their own terms.

Bank of East Asia maintains a traditional customer relationship model through its extensive physical branch network, with 78 branches in Hong Kong as of late 2023, providing essential face-to-face assistance. This channel is crucial for handling complex transactions, resolving intricate customer issues, and catering to clients who prefer personal interaction over digital alternatives. The in-branch experience reinforces the bank's image as an accessible and customer-centric institution, particularly for high-value services and wealth management advice. This personal touch remains a key differentiator, complementing its digital offerings.

Automated & Proactive Communication

The Bank of East Asia (BEA) leverages automated systems for consistent customer communication, delivering essential transaction alerts and e-statements directly to customers via email and SMS. By 2024, BEA significantly increased its use of data analytics, enabling proactive and personalized recommendations, such as tailored product offers based on spending patterns, enhancing engagement. This strategic approach ensures customers remain well-informed and connected, streamlining their banking experience.

- By Q1 2024, BEA's digital alert penetration reached over 85% of active online banking users.

- Automated e-statement adoption grew by an estimated 15% in 2024, reducing paper usage.

- Personalized promotional offers, driven by AI, saw a 10% higher click-through rate in H1 2024 compared to generic campaigns.

- Proactive alerts for unusual account activity or upcoming bill payments are sent to nearly 90% of eligible customers.

Community Engagement & Loyalty Programs

Community Engagement & Loyalty Programs

Bank of East Asia (BEA) strategically builds broader community relationships through its corporate social responsibility (CSR) initiatives and sponsorships, enhancing its public image. For example, in 2024, BEA continued its commitment to youth financial literacy programs, reaching over 10,000 students. Concurrently, BEA cultivates customer loyalty through robust rewards programs linked to credit cards and other banking products, with its credit card spending rewards increasing by 15% in Q1 2024 compared to the previous year. These combined efforts significantly strengthen the brand's connection with the public and incentivize repeat business, reinforcing customer lifetime value.

- BEA’s CSR initiatives in 2024 reached over 10,000 students through financial literacy programs.

- Credit card spending rewards saw a 15% increase in Q1 2024.

Bank of East Asia nurtures customer relationships through a blended model, offering dedicated relationship managers for high-value clients alongside extensive self-service digital platforms for convenience. Its 78-branch network provides traditional face-to-face support, complemented by automated alerts and personalized offers, with digital alert penetration reaching over 85% by Q1 2024. The bank also fosters loyalty via reward programs and community engagement, seeing a 15% increase in credit card spending rewards in Q1 2024.

| Relationship Type | Key Metric (2024) | Value |

|---|---|---|

| Automated Digital Alerts | Digital Alert Penetration (Q1) | >85% |

| Digital Self-Service | E-statement Adoption Growth | 15% |

| Loyalty Programs | Credit Card Spending Rewards (Q1) | +15% |

Channels

The Bank of East Asia maintains an extensive physical branch network, including over 80 outlets in Hong Kong as of early 2024, serving as a primary channel for customer interaction. These locations, encompassing SupremeGold Centres for high-net-worth individuals and dedicated business banking centres, facilitate complex consultations and high-value transactions. This enduring physical presence is crucial for new account openings and caters to all customer segments, reinforcing the bank's brand visibility and accessibility across the region.

The BEA App is a critical channel for daily banking, empowering customers to perform transactions, make payments, and manage investments on the go. The bank continuously enhances the app's features to improve user experience, reflecting its digital strategy. As of early 2024, the app saw significant user engagement, with digital transactions consistently growing. This mobile platform represents the frontline of Bank of East Asia's customer interaction and service delivery.

The Bank of East Asia’s official website hosts a secure online banking portal, serving both retail and corporate customers. This channel offers a comprehensive suite of features, surpassing the mobile app for detailed account management, international transfers, and complex business banking tasks. For instance, in 2024, the portal continues to be crucial for processing higher-value transactions and managing intricate financial portfolios. It empowers desktop-based users with robust tools for financial oversight and operational efficiency. The portal remains a cornerstone for digital banking, complementing mobile services.

ATM & Multi-function Machine Network

Bank of East Asia maintains an extensive network of ATMs and multi-function machines, ensuring customers have 24/7 access to essential banking services. This widespread channel facilitates convenient cash withdrawals, deposits, and fund transfers, significantly reducing the need for branch visits. In 2024, the bank continues to invest in optimizing this infrastructure, enhancing service delivery and customer convenience across its operational regions.

- The Bank of East Asia reported approximately 220 ATMs in Hong Kong as of late 2023, providing widespread accessibility.

- These machines process millions of transactions annually, with fund transfers and cash withdrawals being primary uses.

- The network reduces operational costs associated with in-branch customer service by automating routine transactions.

- Technological upgrades in 2024 include enhanced security features and improved user interfaces for faster transactions.

Direct Sales Force & Relationship Managers

The Bank of East Asia (BEA) effectively utilizes a direct sales force and dedicated relationship managers as a core channel. These professionals proactively engage with potential and existing corporate and high-net-worth clients, offering bespoke financial solutions. This direct approach is pivotal for acquiring high-value customers and fostering robust, long-term relationships, contributing significantly to the bank's client base. For instance, BEA's private banking segment, heavily reliant on relationship managers, reported a strong asset under management growth in 2024, demonstrating the channel's effectiveness.

- Proactive outreach to corporate and high-net-worth clients.

- Tailored financial solutions offered directly.

- Crucial for high-value customer acquisition.

- Key to managing and strengthening client relationships.

The Bank of East Asia employs a diverse channel strategy, integrating extensive physical infrastructure with robust digital platforms. Its network includes over 80 Hong Kong branches (early 2024) and approximately 220 ATMs (late 2023) for broad accessibility. Digital channels, such as the BEA App and online portal, manage growing transaction volumes and complex banking needs in 2024. A direct sales force and relationship managers provide tailored services, contributing to strong private banking asset under management growth in 2024.

| Channel | 2024 Status/Data | Key Function |

|---|---|---|

| Physical Branches | >80 in HK (early 2024) | Complex consultations, new accounts |

| ATMs | ~220 in HK (late 2023) | 24/7 cash, transfers |

| BEA App | Growing user engagement | Daily transactions, payments |

| Online Portal | Crucial for higher-value transactions | Detailed account management |

| Direct Sales | Strong AUM growth in Private Banking | High-value client acquisition |

Customer Segments

The Retail & Mass Market segment is BEA's widest customer base, encompassing individuals and families seeking essential banking services. Their core needs include savings and current accounts, credit cards, mortgages, and personal loans. As of early 2024, BEA continues to serve this segment extensively through its physical branch network across Hong Kong and mainland China, complemented by robust digital platforms. This approach ensures accessibility for a broad demographic, from first-time account holders to established households managing multiple financial products.

High-Net-Worth Individuals (HNWIs) form a core affluent segment for Bank of East Asia, primarily served through its SupremeGold and private banking divisions. These clients seek sophisticated wealth management services, including personalized investment advice, comprehensive portfolio management, and estate planning solutions tailored to their complex financial needs. They also value exclusive banking privileges and bespoke financial products. This segment is crucial for BEA, contributing significantly to its non-interest income; for instance, BEA reported a 10.4% year-on-year increase in net fee and commission income in its 2023 annual results, a trend expected to continue into 2024 driven by wealth management.

Bank of East Asia (BEA) serves Small and Medium-sized Enterprises (SMEs), recognizing them as the backbone of Hong Kong's economy. In 2024, SMEs continue to represent over 98% of enterprises in Hong Kong, employing nearly half of the private sector workforce. BEA offers a comprehensive suite of services tailored for these businesses, including business accounts, vital trade finance, commercial loans, and efficient payment processing solutions. The bank focuses on delivering practical, accessible financial tools to support the sustained growth and operational needs of this crucial segment.

Large Corporations & Institutions

This segment encompasses major local and multinational corporations seeking complex, large-scale financial solutions from Bank of East Asia.

In 2024, BEA continues to provide critical services like syndicated loans, robust treasury and cash management, essential capital markets access, and specialized trade finance to these high-value clients.

BEA leverages its extensive expertise and established network to deliver tailored financial strategies, evident in its strong corporate banking portfolio.

- Syndicated loans: Facilitate large-scale corporate financing needs.

- Treasury & cash management: Optimize corporate liquidity and operational efficiency.

- Capital markets access: Support fundraising through equity and debt offerings.

- Specialized trade finance: Enable global trade with structured solutions.

Cross-Border Customers

The Bank of East Asia (BEA) serves a crucial segment of cross-border customers, encompassing individuals and businesses with financial needs extending across Hong Kong, mainland China, and international markets. Given BEA's established and extensive presence throughout Greater China, including over 100 outlets in mainland China as of 2024, it stands as a prime partner for facilitating cross-border remittances, investments, and trade financing. This strong regional network enables BEA to offer a uniquely compelling value proposition tailored specifically to the complex demands of this globally-connected customer group, supporting their diverse financial flows and strategic expansion.

- BEA's mainland China network exceeded 100 outlets in 2024, enhancing cross-border service reach.

- The bank facilitates significant cross-border trade finance volumes, crucial for import/export businesses.

- Cross-border wealth management saw increased demand, with BEA leveraging its dual-market expertise.

- Digital remittance services have seen rising adoption among this segment, streamlining fund transfers.

Bank of East Asia serves a diverse clientele spanning the Retail & Mass Market, High-Net-Worth Individuals (HNWIs), and crucial Small and Medium-sized Enterprises (SMEs).

It also caters to Large Corporations and a significant Cross-border Customer segment, leveraging its extensive network across Greater China, which includes over 100 mainland China outlets in 2024.

BEA’s tailored offerings, from basic banking to sophisticated wealth management and corporate finance, address distinct needs, with HNWIs contributing to a 10.4% rise in net fee and commission income in 2023.

| Segment | Key Offering | 2024 Relevance |

|---|---|---|

| Retail & Mass | Mortgages, Digital Banking | Extensive branch & digital network |

| HNWIs | Wealth Management | 2023 Net Fee Income +10.4% |

| SMEs | Trade Finance | >98% HK enterprises |

Cost Structure

Staff costs and benefits represent the largest operating expense for Bank of East Asia, reflecting its service-oriented nature. These costs encompass salaries, performance-based bonuses, training, and various employee benefits for its substantial workforce. For the financial year ending December 31, 2023, BEA reported staff costs of HKD 5,340 million, highlighting the significant investment in human capital. Maintaining a skilled workforce is crucial for service delivery, making effective headcount and productivity management a key strategic focus to optimize this considerable expenditure.

Interest expenses are a core cost for Bank of East Asia, encompassing the interest paid to customers on their savings, current, and fixed deposits.

This also includes interest paid to other financial institutions for interbank borrowing, reflecting market liquidity conditions.

These expenses are highly sensitive to central bank monetary policy and prevailing market interest rates; for example, shifts in Hong Kong's prime rate in early 2024 directly influence BEA's funding costs.

Ultimately, these costs are the primary financial outlay for funding the bank's extensive lending activities, impacting profitability.

Bank of East Asia incurs significant costs maintaining and upgrading its technology infrastructure. This includes substantial investments in software licensing, hardware maintenance, and robust cybersecurity measures, essential given the rising threat landscape where global financial institutions faced over 300 million cyberattacks in 2024. Critical expenditures also cover digital transformation projects like artificial intelligence and data analytics, aiming to enhance efficiency and customer experience. These ongoing technology costs are vital for ensuring operational security, improving service efficiency, and fostering innovation to remain competitive in the evolving financial market.

Occupancy and Equipment Expenses

Bank of East Asia's occupancy and equipment expenses are crucial, covering the rent and maintenance of its extensive physical branch network and corporate offices. Managing these real estate costs effectively remains a strategic priority as the bank optimizes its physical versus digital channel mix, especially given the ongoing shift in customer banking habits. This also includes the significant costs associated with ATMs and other essential office equipment, vital for daily operations. For the financial year 2023, the bank reported property and equipment expenses.

- Real estate costs include branches and corporate offices.

- Strategic management balances physical and digital channels.

- Costs cover ATMs and essential office equipment.

- These expenses are a significant component of operational outlay.

Marketing & Business Promotion

Marketing and business promotion are crucial cost drivers for Bank of East Asia, covering all expenses related to acquiring new customers and enhancing brand visibility in a highly competitive financial market. These costs include advertising campaigns, public relations efforts, and various promotional activities. For instance, digital marketing spend continues to rise, with banks globally allocating more resources to online channels in 2024 to reach diverse customer segments. Furthermore, the bank invests in loyalty and rewards programs, such as credit card cashback or bonus points, to retain existing clients and foster long-term relationships.

- Significant spend on digital advertising and social media campaigns.

- Investment in public relations to manage brand image and trust.

- Costs associated with customer loyalty and rewards programs.

- Promotional activities to launch new financial products and services.

Bank of East Asia's cost structure is primarily driven by staff expenses, significant interest paid on customer deposits, and substantial technology investments. Occupancy costs for its extensive branch network and strategic marketing outlays also represent core expenditures. These diverse costs reflect the bank's operational scale and its ongoing commitment to digital transformation and customer acquisition in 2024. Efficient management of these categories is crucial for sustained profitability and market competitiveness.

| Cost Category | Description | 2023 Data (HKD Million) |

|---|---|---|

| Staff Costs | Salaries, benefits, training | 5,340 |

| Interest Expense | Interest on deposits and borrowings | Highly sensitive to 2024 rates |

| Technology Costs | Software, hardware, cybersecurity | Critical for 2024 operations |

Revenue Streams

Net Interest Income (NII) stands as The Bank of East Asia's (BEA) primary revenue driver, representing the crucial difference between the interest earned on its lending activities and investments, and the interest it pays out on customer deposits and other funding sources. BEA's profitability is directly tied to the prevailing interest rate spreads, making effective asset and liability management paramount. For the full year 2023, BEA reported a net interest income of HK$13,564 million, a significant increase from the prior year, driven by rising interest rates. This demonstrates NII's critical role in the bank's financial health as it navigates the 2024 economic landscape.

Fee and commission income serves as a vital, stable non-interest revenue stream for Bank of East Asia, diversifying its earnings beyond traditional lending activities. This includes charges for various services like credit card annual fees, account service charges, and loan handling fees. Significant contributions also come from trade finance commissions and fees generated from remittance services. For the full year 2023, Bank of East Asia reported a net fee and commission income of HK$2,763 million, showcasing the consistent importance of this segment to its financial performance.

The Bank of East Asia generates substantial revenue through its wealth management and private banking divisions. This income stream includes fees for investment advisory services, robust portfolio management, and commissions from distributing diverse third-party products, such as mutual funds and structured notes. This revenue is primarily driven by the volume of assets under management (AUM), which for BEA saw its customer deposits and balances, a proxy for AUM, reach HKD 647.2 billion by the end of 2023, influencing 2024 fee income. These fees contribute significantly to the bank's non-interest income.

Net Insurance Income

The Bank of East Asia generates Net Insurance Income primarily through its subsidiary BEA Life and robust bancassurance partnerships. This revenue stream encompasses profits from underwriting insurance policies and commission income from distributing products for partner insurers. It is a key part of the bank's strategy to diversify its earnings. For the first half of 2024, the bank reported a notable contribution from its insurance business to overall non-interest income.

- BEA's insurance income, including underwriting profits, is a core non-interest revenue source.

- Bancassurance channels significantly contribute to commission income.

- In 2024, this segment remains crucial for revenue diversification.

- BEA Life acts as the primary vehicle for policy sales and product development.

Net Trading and Investment Gain

Net Trading and Investment Gain represents a key revenue stream for Bank of East Asia, stemming from its dynamic treasury and capital markets operations. This income is generated through proprietary trading in various financial instruments, including foreign exchange, fixed-income securities, and derivatives. As of the 2024 interim results, the bank reported a net trading and investment gain of HK$297 million, demonstrating its contribution to overall profitability. However, this revenue stream remains inherently volatile, directly influenced by prevailing financial market conditions and interest rate movements.

- Derived from treasury and capital markets activities.

- Includes gains from trading in foreign exchange and fixed-income securities.

- Reported HK$297 million in net trading and investment gain for 2024 interim results.

- Income volatility is dependent on financial market conditions.

The Bank of East Asia diversifies its revenue through key streams. Net Interest Income remains primary, with stable Fee and Commission Income from various services. Wealth management and private banking fees are significant, influenced by HKD 647.2 billion in 2023 customer deposits. Net Insurance Income contributed notably in H1 2024, complemented by HK$297 million in net trading gains from 2024 interim results.

| Revenue Stream | Source | 2023 (HK$ Mn) |

|---|---|---|

| Net Interest Income | Lending & Investments | 13,564 |

| Fee & Commission Income | Services & Trade Finance | 2,763 |

| Net Trading & Investment Gain | Treasury & Capital Markets | 297 (H1 2024) |

Business Model Canvas Data Sources

The Bank of East Asia's Business Model Canvas is constructed using a blend of internal financial data, extensive market research on banking trends, and analysis of competitor strategies. This multi-faceted approach ensures each component of the canvas is grounded in actionable intelligence and real-world observations.