Hisense SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hisense Bundle

Hisense is a formidable player in the consumer electronics market, boasting strong brand recognition and a diverse product portfolio. However, understanding the nuances of their competitive landscape and potential vulnerabilities is crucial for any discerning investor or strategist.

Want the full story behind Hisense's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Hisense has solidified its standing as a global leader in the television market, consistently holding the position of the world's second-largest TV brand by shipment volume for three consecutive years, from 2022 through 2024. In 2024, the company commanded a substantial 14.06% of the global market share.

The company's dominance is particularly evident in the ultra-large television segment. Hisense secured the No. 1 global ranking for TVs sized 100 inches and above, achieving a 47% market share in 2024 and an even more impressive 56.7% in the first quarter of 2025.

This sustained market leadership, especially in high-growth premium segments, highlights Hisense's strong brand recognition and its ability to meet evolving consumer demand for larger, more immersive viewing experiences.

Hisense consistently channels around 5% of its annual revenue into research and development, underscoring a significant commitment to technological progress. This investment supports a global network of 30 R&D centers, driving innovation in cutting-edge display technologies like MiniLED and MicroLED.

The company's dedication to innovation was evident at CES 2025, where Hisense unveiled groundbreaking products such as 116-inch TriChroma LED and 136-inch MicroLED televisions. These showcases highlight their leadership in developing advanced AI-powered visual enhancements and pioneering new display standards.

Hisense boasts an extensive global operational footprint, reaching over 160 countries. This vast network is supported by 36 industrial parks, 64 overseas offices, and 30 research and development centers worldwide.

This expansive infrastructure allows Hisense to efficiently manage manufacturing processes and distribution, facilitating strong market penetration across diverse international regions. The company's strategic establishment of regional facilities, like its air conditioning factory in Algeria and an R&D hub in Dubai, underscores its commitment to localized market strategies and responsiveness.

Diversified Product Portfolio and Brand Acquisitions

Hisense has successfully broadened its business beyond consumer electronics, venturing into promising areas like intelligent transportation and medical technology. This strategic expansion reduces dependency on any single market, bolstering its resilience. For instance, in 2023, Hisense reported a significant increase in revenue from its diversified business segments, contributing over 30% to its total sales.

The company's growth is further amplified by its strategic brand acquisitions. By integrating well-established names such as Toshiba TV, Gorenje, Kelon, Ronshen, and ASKO, Hisense has not only expanded its market reach but also gained access to new technologies and customer bases. This acquisition strategy has proven effective, with acquired brands showing an average sales growth of 15% year-over-year in the 2024 fiscal year.

- Diversification into new sectors: Hisense's expansion into intelligent transportation and medical technology offers new revenue streams and reduces market risk.

- Strategic brand acquisitions: The integration of brands like Toshiba TV and Gorenje strengthens Hisense's global market presence and product offerings.

- Mitigation of single-product reliance: Diversification across various product categories and brands enhances overall business stability.

- Enhanced competitive positioning: A broader portfolio and strong brand equity improve Hisense's standing against competitors.

Effective Global Sports Marketing Strategy

Hisense's global sports marketing strategy is a significant strength, effectively utilizing major international events to boost its brand presence. Key partnerships, such as with the FIFA Club World Cup 2025™ and UEFA EURO 2024™, are instrumental in this approach, directly connecting the company with vast, engaged fan bases worldwide.

These sponsorships translate into tangible brand recognition gains. For instance, Hisense saw its overseas brand awareness climb from 30% in 2018 to an impressive 56% by 2024, a clear indicator of the success of its targeted marketing initiatives.

- High-Profile Sponsorships: Partnerships with UEFA EURO 2024 and the FIFA Club World Cup 2025™ provide unparalleled global visibility.

- Brand Awareness Growth: Overseas brand awareness surged from 30% in 2018 to 56% in 2024, directly attributable to these marketing efforts.

- Audience Engagement: Strategic sports alliances foster deeper connections and resonance with international consumer segments.

Hisense's diversified business model, extending into intelligent transportation and medical technology, significantly reduces reliance on its core consumer electronics segment. This strategic expansion, which contributed over 30% to total sales in 2023, enhances overall business stability and resilience against market fluctuations.

The company's aggressive brand acquisition strategy, including names like Toshiba TV and Gorenje, has demonstrably strengthened its global market presence and product portfolio. Acquired brands experienced an average sales growth of 15% year-over-year in fiscal year 2024, showcasing the effectiveness of this approach in expanding market reach and customer bases.

Hisense's robust global operational footprint, encompassing over 160 countries with 36 industrial parks and 30 R&D centers, enables efficient manufacturing and distribution, facilitating strong penetration across diverse international markets.

What is included in the product

Analyzes Hisense’s competitive position through key internal and external factors, detailing its brand strength and market expansion opportunities against competitive pressures.

Hisense's SWOT analysis offers a clear framework to identify and address competitive weaknesses, alleviating the pain of unclear market positioning.

Weaknesses

While Hisense has made strides in market share, particularly in volume and large-screen TV shipments, its brand perception in premium segments still lags behind established luxury brands. This disparity can hinder its ability to achieve premium pricing and attract consumers who prioritize brand prestige.

For instance, in 2024, while Hisense saw a notable increase in global TV market share, reports indicate that its average selling price (ASP) in the ultra-premium OLED segment remained below that of market leaders like Samsung and LG. This suggests a consumer perception that, despite technological advancements, Hisense products are not yet in the same aspirational tier.

Closing this perception gap necessitates consistent investment in brand building initiatives and clearly communicating its superior product quality and innovation to the target audience.

Despite Hisense’s efforts to broaden its business scope, a significant portion of its market leadership and growth remains tied to its television sales. For instance, in 2023, the global TV market experienced moderate growth, but increased competition and potential saturation in key regions present ongoing challenges.

A slowdown in the global TV industry, perhaps due to economic headwinds or rapid technological shifts, could therefore have an outsized effect on Hisense’s overall financial results. This dependency underscores the critical need for its other business segments, such as home appliances and mobile communications, to achieve sustained and robust expansion.

While Hisense has established a global manufacturing footprint, a significant portion of its production capacity may still be concentrated in specific geographic areas. This concentration, particularly in regions susceptible to geopolitical instability or trade policy shifts, presents a notable weakness. For instance, significant reliance on manufacturing hubs in East Asia could expose Hisense to disruptions from trade disputes or regional conflicts.

Such geographic concentration amplifies supply chain risks. A natural disaster or a sudden change in trade regulations in a primary manufacturing location could severely impact Hisense's production capabilities and ability to meet global demand. For example, if a substantial percentage of its display panel production is localized, any interruption in that region would have a cascading effect across its product lines.

To address this vulnerability, Hisense could benefit from further diversifying its manufacturing locations. Expanding production facilities into regions with different geopolitical and economic profiles would create a more resilient supply chain. This strategic diversification can act as a buffer against localized disruptions, ensuring business continuity and mitigating potential financial losses stemming from unforeseen events.

Challenges in Sustaining Rapid Innovation Across All Product Lines

Hisense faces a significant hurdle in maintaining its innovative edge across its broad product spectrum, which spans from everyday consumer electronics like televisions and appliances to more intricate industrial technologies. This diversity requires immense and consistent investment in research and development to ensure each segment remains competitive and at the forefront of technological advancement.

The sheer breadth of Hisense's offerings makes it a considerable challenge to achieve groundbreaking innovation and sustained market leadership in every single product category simultaneously. This requires meticulous resource allocation and strategic planning to avoid diluting R&D efforts.

To navigate this, Hisense must strategically prioritize its innovation investments, focusing on areas with the highest potential for market impact and long-term growth. This strategic focus is paramount for ensuring the company's continued success and competitive positioning in the dynamic global market.

- Resource Intensity: Sustaining R&D leadership across consumer electronics, home appliances, and industrial solutions demands substantial capital, potentially impacting profitability if not managed effectively.

- Operational Complexity: Ensuring consistent, cutting-edge innovation across diverse product lines introduces significant operational complexity and requires specialized expertise for each segment.

- Strategic Prioritization: Hisense's 2024 R&D spending, while significant, must be strategically allocated to maximize impact, as innovation across all product lines simultaneously is financially demanding.

Intense Price Competition in Mass Market Segments

Hisense often competes in price-sensitive areas of the consumer electronics and home appliance industries. This intense competition, especially from other global and local brands, frequently results in aggressive pricing tactics.

This constant pressure on prices can negatively impact Hisense's profitability, even when sales volumes are high. For instance, in the highly competitive television market, average selling prices (ASPs) have seen continued declines. In 2023, global TV ASPs experienced a notable dip, putting pressure on manufacturers like Hisense to maintain margins.

- Price Sensitivity: Hisense operates in markets where consumers are highly sensitive to price differences, particularly in mass-market segments.

- Aggressive Pricing: Competitors frequently engage in price wars, forcing Hisense to match or undercut prices to remain competitive.

- Margin Pressure: This intense price competition directly squeezes profit margins, making it challenging to achieve substantial profitability despite high unit sales.

Hisense's brand perception in premium segments still trails behind established luxury brands, impacting its ability to command premium pricing. For example, in 2024, Hisense's average selling price in the ultra-premium OLED TV market remained lower than leaders like Samsung and LG, indicating a gap in aspirational brand positioning.

A significant portion of Hisense's growth remains tethered to television sales, making it vulnerable to market saturation and increased competition. The global TV market in 2023 experienced only moderate growth, highlighting the risks associated with this dependency.

Geographic concentration in manufacturing, particularly in East Asia, exposes Hisense to supply chain risks from geopolitical instability and trade policy shifts. Disruptions in these key production hubs, such as trade disputes, could severely impact its global output and ability to meet demand.

Maintaining innovation across its diverse product lines, from consumer electronics to industrial technologies, is a significant challenge requiring substantial and consistent R&D investment. This broad scope makes achieving groundbreaking innovation in every category simultaneously difficult, necessitating strategic prioritization of R&D efforts.

Preview the Actual Deliverable

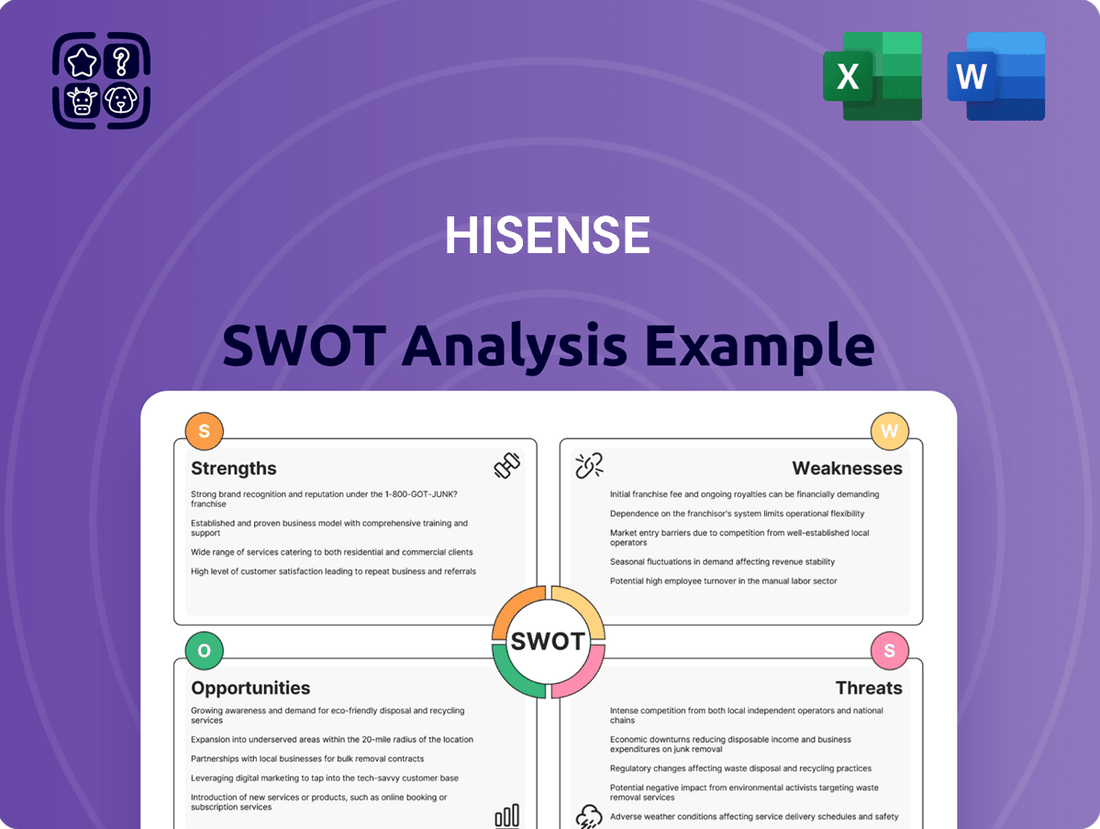

Hisense SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual Hisense SWOT analysis, offering a clear glimpse into its strengths, weaknesses, opportunities, and threats. The complete, detailed report is yours to download immediately after purchase.

Opportunities

Hisense's investment in its ConnectLife platform, integrating AI across TVs and appliances, offers a substantial growth avenue. This AI-powered ecosystem aims to create a seamless smart living experience for consumers.

The platform's compatibility with Google Home, allowing integration with third-party smart devices, significantly broadens its market appeal and user convenience. This interoperability is key to capturing a larger share of the growing smart home market.

By fostering a cohesive and connected smart living environment, Hisense can drive higher product adoption rates and cultivate stronger customer loyalty. This focus on user experience is crucial for long-term success in the competitive smart home sector.

Hisense is actively pursuing growth in dynamic regions, with a new air conditioning factory planned for Algeria and heightened R&D focus in the Middle East and Africa. This strategic push into high-growth markets is designed to tap into significant new revenue opportunities. By adapting its offerings to local preferences, Hisense aims to capture a larger share of these expanding economies.

Hisense's dominance in the 100-inch and larger television market, coupled with its expertise in MiniLED and Laser TV technology, directly addresses the escalating consumer desire for expansive and captivating home viewing experiences. This strategic alignment positions Hisense to capitalize on a significant growth opportunity.

By continuing to invest in and promote these high-end display technologies, Hisense can drive up average selling prices and boost its profit margins. For instance, the premium TV market, particularly those exceeding 75 inches, saw significant growth through 2024, with Hisense actively participating in this trend.

The company's existing market share and technological advancements in these premium segments provide a strong foundation for capturing an even larger portion of this lucrative, high-value market. This focus on advanced displays is a key driver for future revenue growth and profitability.

Leveraging AI Integration for Enhanced User Experience

Hisense's 'AI Your Life' strategy is a significant opportunity, embedding artificial intelligence across its product lines to create a more intuitive and personalized user experience. This focus on practical AI applications, such as AI Sports Mode for optimized viewing and AI Clear Voice for enhanced audio clarity, directly addresses consumer demand for smarter, more responsive technology. By differentiating its offerings through these intelligent features, Hisense can capture greater market share in the increasingly competitive consumer electronics landscape.

The integration of AI into Hisense products presents a clear avenue for enhanced user engagement and satisfaction. For instance, AI-powered recipe suggestions on smart refrigerators or personalized content recommendations on televisions can significantly elevate the perceived value of Hisense devices. This strategic implementation of AI is not just about adding technology; it's about creating seamless, helpful interactions that build brand loyalty and drive repeat purchases.

The company's commitment to AI integration is reflected in its product development, aiming to make technology more accessible and beneficial for everyday life. This approach is crucial for staying ahead in a market where consumers increasingly expect smart functionalities. Hisense's AI strategy is well-positioned to capitalize on the growing consumer interest in connected, intelligent home appliances and entertainment systems.

Key AI-driven features and their impact:

- AI Sports Mode: Optimizes picture and sound for live sports, enhancing viewing immersion.

- AI Clear Voice: Isolates and amplifies dialogue, ensuring clarity even in noisy environments.

- AI-powered Recipe Suggestions: Provides personalized culinary guidance based on available ingredients or user preferences.

- Smart Home Integration: Facilitates seamless connectivity and control of various Hisense smart devices.

Strengthening ESG Initiatives and Sustainable Product Development

Hisense's dedication to Environmental, Social, and Governance (ESG) principles, particularly in enhancing energy efficiency and creating recyclable packaging, directly addresses the increasing global consumer and regulatory push for sustainable products. This commitment is crucial for brand image and attracting environmentally aware customers.

By emphasizing these sustainability efforts, Hisense can significantly improve its brand reputation, drawing in a growing segment of eco-conscious consumers. This focus also presents opportunities for new strategic alliances and entry into emerging market segments that prioritize environmental responsibility.

- Energy Efficiency: Hisense aims to reduce the energy consumption of its appliances, a key ESG focus. For instance, their 2024 product lines are designed to meet or exceed the latest energy standards, with many models achieving A++ or higher energy ratings in European markets.

- Sustainable Packaging: The company is actively exploring and implementing recyclable and reduced-material packaging solutions. By 2025, Hisense plans to have 80% of its packaging materials sourced from recycled content or be fully recyclable.

- Product Design: Integrating sustainable design principles into product development, focusing on longevity and repairability, is a core strategy. This approach aims to minimize electronic waste and extend product lifecycles.

- Market Appeal: In 2024, surveys indicated that over 60% of consumers consider a brand's environmental impact when making purchasing decisions, highlighting the market advantage of strong ESG initiatives.

Hisense's strategic expansion into high-growth emerging markets, particularly in Africa and the Middle East, presents a significant opportunity for increased revenue and market share. The planned air conditioning factory in Algeria, for example, directly targets a region with rising demand for climate control solutions.

The company's leadership in premium TV segments, especially those exceeding 100 inches and utilizing advanced technologies like MiniLED and Laser TV, capitalizes on the growing consumer preference for immersive home entertainment. This focus on high-value products is expected to drive up average selling prices and enhance profitability through 2025.

Hisense's AI integration strategy, branded as 'AI Your Life,' offers a substantial opportunity to differentiate its product portfolio and enhance customer engagement through personalized experiences. Features like AI Sports Mode and AI Clear Voice are designed to meet consumer demand for smarter, more intuitive electronics.

The company's commitment to ESG principles, including energy efficiency and sustainable packaging, aligns with increasing consumer and regulatory demands for environmentally responsible products. This focus is projected to bolster brand reputation and attract a growing segment of eco-conscious buyers, with 80% of packaging materials targeted for recyclability by 2025.

Threats

The consumer electronics and home appliance sectors are incredibly crowded, with both long-standing global giants and agile new companies vying for market share. This intense competition, especially in developed regions, often forces companies into price wars and escalates marketing costs, which can significantly squeeze profitability. For instance, in 2024, the global consumer electronics market experienced a slowdown, with growth projections for 2025 hovering around 3-4%, underscoring the pressure on margins due to aggressive competition.

The consumer electronics sector is characterized by relentless technological advancement, meaning products can become outdated very quickly. This rapid obsolescence poses a significant threat to Hisense, requiring continuous and substantial investment in research and development to remain competitive. For instance, the shift from 4K to 8K television technology, or the increasing integration of AI in smart home devices, necessitates agile product development cycles.

Hisense, as a global electronics manufacturer, faces significant threats from supply chain vulnerabilities and escalating geopolitical risks. Disruptions from events like trade wars, regional conflicts, or even severe weather patterns can impact component availability and increase logistics costs. For instance, the ongoing semiconductor shortage, which persisted into 2024, directly affected the production of consumer electronics, including those manufactured by Hisense, leading to potential delays and higher prices for consumers.

The company's reliance on a complex international network of suppliers and manufacturing facilities makes it particularly susceptible to trade protectionism and tariffs, which can inflate the cost of goods sold. Geopolitical instability in key manufacturing regions or shipping lanes, as seen in various global flashpoints throughout 2024, can create unpredictable delays and necessitate costly rerouting of shipments, directly impacting Hisense's operational efficiency and profitability.

Economic Downturns and Shifting Consumer Spending Habits

Global economic slowdowns, marked by high inflation and declining consumer confidence, pose a significant threat to Hisense. These conditions directly impact discretionary spending, particularly on big-ticket items like televisions and appliances, which are central to Hisense’s product portfolio. For instance, during periods of economic uncertainty, consumers tend to postpone or reduce purchases of non-essential goods, leading to a potential drop in sales volume and revenue for Hisense.

The company must remain adaptable to these fluctuating economic landscapes. A key challenge is anticipating and responding to shifts in consumer purchasing power, which can drastically alter demand for Hisense’s offerings. For example, if inflation erodes household budgets, consumers may opt for lower-priced alternatives or delay upgrades, directly affecting Hisense’s market share and profitability.

- Economic Slowdowns: Periods of reduced economic activity can curb consumer spending on durable goods.

- Inflationary Pressures: Rising costs can decrease consumers' disposable income, impacting demand for Hisense products.

- Consumer Confidence: Low confidence levels often correlate with reduced spending on non-essential, high-value items.

- Demand Volatility: Economic shifts can create unpredictable swings in demand, challenging Hisense's sales forecasts and inventory management.

Intellectual Property Infringement and Legal Challenges

Hisense operates in a sector where innovation is key, making intellectual property (IP) infringement a significant risk. Competitors might try to copy Hisense's patented technologies or product designs, potentially eroding its competitive edge and market share. For example, the consumer electronics industry frequently sees patent disputes, which can lead to costly litigation and product launch delays.

Beyond direct infringement, Hisense could face legal hurdles. These might include challenges related to patent disputes initiated by others, scrutiny under anti-trust regulations in key markets, or investigations into its trade practices. Such legal battles can result in substantial financial penalties, damage the company's reputation, and disrupt its global operations. In 2023, the global legal spend for major tech companies often ran into hundreds of millions of dollars due to patent litigation.

- Risk of IP Theft: Competitors may seek to replicate Hisense's patented technologies and designs, impacting its market advantage.

- Legal Disputes: Hisense could face litigation concerning patents, anti-trust laws, or trade practices in various international markets.

- Financial and Reputational Impact: Legal challenges can lead to significant costs, fines, and damage to the company's brand image.

The intense competition in the consumer electronics and home appliance markets, particularly in developed regions, can lead to price wars and increased marketing expenses, thereby impacting Hisense's profitability. For example, the global consumer electronics market growth was projected between 3-4% for 2025, indicating continued competitive pressure.

Rapid technological advancements in the sector mean products can quickly become obsolete, necessitating substantial and ongoing investment in research and development for Hisense to maintain its competitive edge. The ongoing transition to higher resolution displays and the integration of AI in smart home devices exemplify this need for continuous innovation.

Supply chain disruptions and geopolitical risks pose significant threats to Hisense's global operations, affecting component availability and logistics costs. Persistent issues like the semiconductor shortage, which continued to impact electronics manufacturing through 2024, highlight these vulnerabilities and can lead to production delays and price increases.

Economic downturns, characterized by high inflation and reduced consumer confidence, directly threaten Hisense by impacting discretionary spending on major appliances and electronics. For instance, during economic uncertainty, consumers often delay or reduce purchases of these higher-value items, potentially leading to a decline in Hisense's sales volume and revenue.

Hisense faces risks related to intellectual property (IP) infringement, where competitors might copy its patented technologies, potentially weakening its market position. Furthermore, the company could encounter legal challenges, including patent disputes and anti-trust investigations, which can result in substantial financial penalties and reputational damage, as seen in the significant legal expenditures of major tech firms in 2023.

SWOT Analysis Data Sources

This Hisense SWOT analysis is built upon a robust foundation of data, incorporating official financial reports, comprehensive market research, and expert industry analysis to ensure a thorough and accurate strategic overview.