Hisense Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hisense Bundle

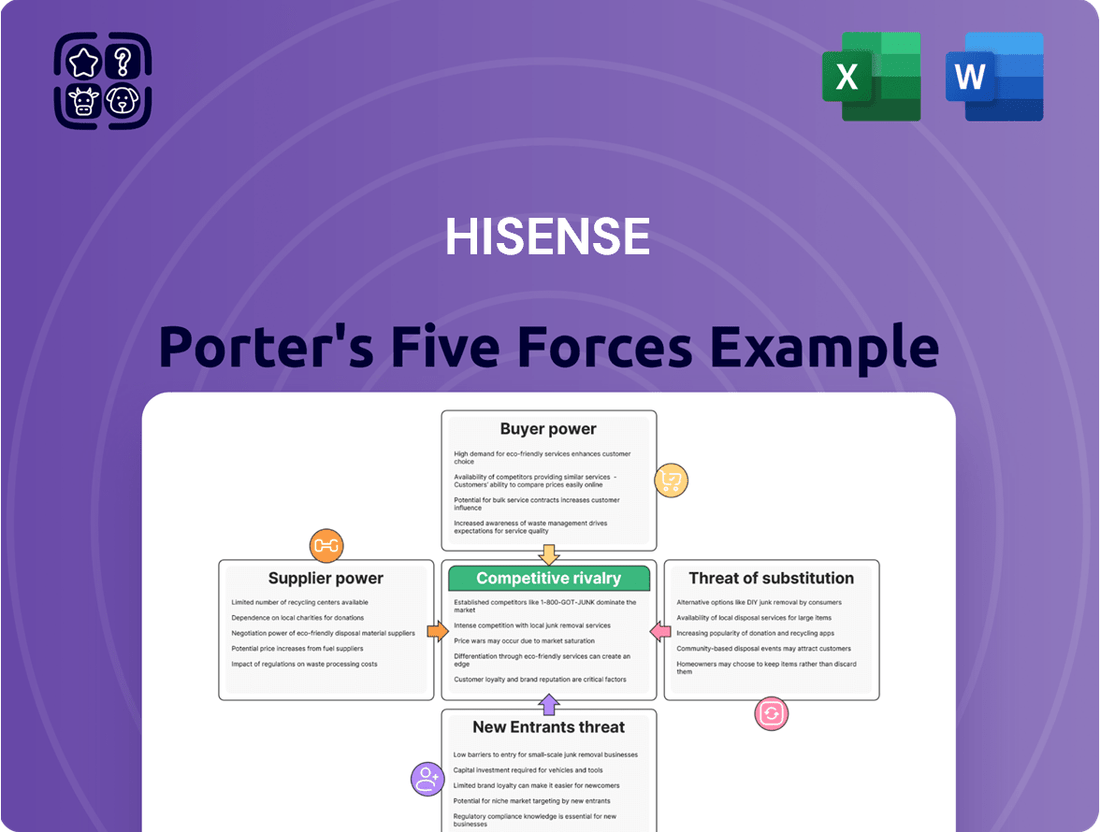

Hisense faces a dynamic market shaped by intense rivalry and the growing power of buyers, particularly in the consumer electronics sector. Understanding the threat of new entrants and the influence of suppliers is crucial for navigating this competitive landscape.

This brief overview only scratches the surface of Hisense's strategic positioning. Unlock the full Porter's Five Forces Analysis to explore Hisense’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Hisense faces significant bargaining power from its suppliers due to its reliance on a limited number of providers for crucial components like advanced display panels and semiconductors. For instance, the market for high-end OLED and Mini-LED panels is dominated by a few key manufacturers, giving them considerable sway over pricing and supply terms. This dependency is amplified by the proprietary nature of some of these technologies, making it costly and time-consuming for Hisense to find or develop alternative sources. In 2024, ongoing global semiconductor shortages and geopolitical tensions have further bolstered the leverage of these specialized component suppliers, directly impacting Hisense's production costs and lead times.

For highly specialized or custom-designed components, Hisense faces significant costs if it needs to switch suppliers. These costs can include R&D investments, re-tooling manufacturing lines, and rigorous re-qualification processes for new parts. This situation grants considerable leverage to incumbent suppliers of these critical inputs, as Hisense's flexibility is diminished.

These substantial switching costs mean that suppliers of specialized components for Hisense, such as advanced display panels or proprietary chipsets, hold significant bargaining power. For instance, a supplier of a unique OLED display technology might command higher prices, knowing that finding and integrating an alternative would be both time-consuming and expensive for Hisense. While long-term contracts can offer some stability, they don't entirely negate the inherent supplier power in such scenarios.

Large component suppliers, especially in critical areas like displays and semiconductors, could potentially move into producing finished consumer electronics. This forward integration threat gives them more bargaining power with Hisense, as they could become direct competitors.

For instance, a major display panel manufacturer with advanced production capabilities might decide to launch its own line of televisions, directly challenging Hisense. This scenario highlights the need for Hisense to carefully manage these supplier relationships and explore strategic partnerships to counter this potential competitive pressure.

Commoditization of Basic Raw Materials

The commoditization of basic raw materials significantly weakens supplier bargaining power for companies like Hisense. When materials such as plastics, standard metals, and common electronic components are widely available from multiple sources, Hisense can leverage this abundance to negotiate favorable pricing. The ease with which Hisense can switch between suppliers in these markets further diminishes any single supplier's ability to dictate terms.

This dynamic is evident in the global markets for these commodities. For instance, the price of aluminum, a key component in many electronic casings, experienced fluctuations in 2024, but the sheer number of global producers meant that no single supplier held substantial sway over Hisense's procurement. Similarly, the market for basic semiconductors, while subject to supply chain considerations, still offers numerous manufacturers for standard chips, preventing excessive price increases.

- Widespread Availability: Basic raw materials like plastics and standard metals are sourced from a vast number of global suppliers.

- Ease of Switching: Hisense can readily switch suppliers for commoditized components, limiting individual supplier leverage.

- Price Sensitivity: Global commodity price swings, such as those seen in copper in early 2024, impact costs but are managed through broad sourcing.

- Limited Differentiation: Suppliers of these basic materials typically offer little product differentiation, further reducing their bargaining power.

Impact of Technological Advancements on Supplier Power

Rapid technological advancements, particularly in areas like AI chips and advanced display technologies, are reshaping the supplier landscape for companies like Hisense. These innovations can foster new, powerful suppliers who possess critical intellectual property and specialized manufacturing capabilities. For Hisense, a strong commitment to research and development necessitates access to these cutting-edge components, thereby amplifying the leverage of suppliers leading these technological frontiers. Navigating this dynamic requires securing early access and negotiating favorable terms to maintain a competitive edge.

The increasing complexity and specialization of components mean that only a limited number of suppliers can meet the stringent requirements of leading electronics manufacturers. For instance, the development of microLED displays, a technology Hisense is actively pursuing, relies on a few key suppliers with the necessary fabrication expertise and patents. This concentration of specialized knowledge grants these suppliers significant bargaining power, as Hisense and its competitors vie for limited production capacity and technological leadership.

- Emergence of Specialized Suppliers: New suppliers with unique technological capabilities, such as those in advanced semiconductor manufacturing for AI processors, gain considerable leverage.

- Intellectual Property Control: Suppliers holding patents for critical technologies, like next-generation display materials, can command higher prices and stricter terms.

- R&D Dependency: Hisense's investment in R&D makes it reliant on suppliers at the forefront of innovation, increasing their bargaining power.

- Scarcity of Advanced Components: Limited availability of highly specialized components, such as those for advanced camera sensors or high-speed connectivity modules, strengthens supplier positions.

Hisense's bargaining power with suppliers is notably constrained by the specialized nature and limited availability of key components, particularly advanced display panels and high-performance semiconductors. The concentration of manufacturers in these critical areas, coupled with proprietary technologies, grants suppliers significant leverage over pricing and supply terms. This was particularly evident in 2024, where ongoing global supply chain disruptions and geopolitical factors amplified the power of these specialized component providers, impacting Hisense's production costs and delivery schedules.

The costs associated with switching suppliers for highly specialized or custom-designed components are substantial for Hisense. These include investments in research and development, retooling manufacturing facilities, and rigorous qualification processes for new parts. Consequently, existing suppliers of critical inputs like advanced display panels or proprietary chipsets possess considerable bargaining power, as Hisense's ability to source alternatives is significantly limited.

| Component Type | Supplier Concentration | Impact on Hisense |

|---|---|---|

| Advanced Display Panels (OLED, Mini-LED) | High (few dominant manufacturers) | Increased pricing power for suppliers, potential supply constraints. |

| Semiconductors (High-Performance, AI Chips) | High (limited specialized foundries) | Vulnerability to shortages, price volatility, and extended lead times. |

| Proprietary Chipsets | Very High (few patent holders) | Significant switching costs, strong supplier negotiation leverage. |

| Commoditized Raw Materials (Plastics, Standard Metals) | Low (many global suppliers) | Weak supplier bargaining power, ability to negotiate favorable pricing. |

What is included in the product

This analysis delves into the competitive forces impacting Hisense, examining supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within the consumer electronics market.

Quickly identify and address competitive threats with a visual breakdown of Hisense's Porter's Five Forces, enabling proactive strategy adjustments.

Customers Bargaining Power

Consumers in the global consumer electronics and home appliance markets, especially for mid-range and entry-level products, exhibit significant price sensitivity. This means they are very focused on getting the best deal. For example, in 2023, global sales of consumer electronics reached over $1 trillion, with a substantial portion driven by price-conscious purchasing decisions.

The abundance of competing brands and models readily available allows customers to easily compare prices and opt for the most economical choice. This ease of comparison directly amplifies their bargaining power. In 2024, the average consumer spent approximately 15% more on electronics compared to the previous year, yet price remained a primary factor in over 60% of purchase decisions for appliances.

Hisense faces the challenge of maintaining competitive pricing while simultaneously pursuing its commitment to quality and innovation. This balancing act is crucial, as a 2024 survey indicated that while 70% of consumers desired innovative features, 85% would still prioritize a lower price point for everyday appliances.

For many of Hisense's products, like televisions and refrigerators, consumers face very low switching costs. It's generally inexpensive and straightforward for a customer to move from one brand to another, with no major penalties or steep learning curves involved. This makes it easy for buyers to explore and select alternatives if they find better deals or features elsewhere.

Customers today have an unprecedented amount of product information at their fingertips. Online platforms offer detailed specifications, independent reviews, and direct comparisons between various brands, including Hisense. This transparency empowers consumers, allowing them to make highly informed purchasing decisions.

With this wealth of knowledge, customers are better equipped to negotiate and demand competitive pricing and superior product features from Hisense. For instance, in 2024, online review platforms saw a significant increase in user-generated content, with millions of product reviews published across major electronics categories, directly influencing consumer choices and pushing brands like Hisense to maintain high standards.

Influence of Large Retailers and Distributors

Large retailers and distributors hold significant sway over Hisense due to their substantial purchasing volumes. For instance, major electronics retailers like Walmart or Best Buy, and online giants such as Amazon, can command better pricing and terms simply by committing to large orders. Their ability to dictate shelf space and influence consumer purchasing decisions through prominent placement and promotional campaigns further amplifies their bargaining power.

These powerful intermediaries can pressure Hisense to offer favorable pricing, extended payment terms, or significant marketing support. In 2024, the concentration of retail power means that a few key partners can represent a substantial portion of Hisense's sales, making it crucial to maintain strong relationships. Failure to appease these large buyers could result in reduced market access and sales volume, impacting Hisense's overall profitability.

- Volume Purchasing: Large retailers buy in bulk, giving them leverage to negotiate lower prices per unit from Hisense.

- Channel Control: Distributors and retailers control access to the end consumer, influencing product visibility and sales through placement and promotions.

- Market Influence: Key retail partners can significantly impact consumer perception and purchasing behavior, making their satisfaction vital for Hisense.

- Competitive Pressure: If Hisense doesn't meet the demands of large buyers, these buyers can easily switch to competitors offering better terms.

Brand Loyalty Versus Feature Preference

Hisense faces a challenge where brand loyalty, built on quality and innovation, is often overshadowed by consumer focus on specific features and technological advancements in the electronics sector. Many buyers prioritize smart home integration or cutting-edge capabilities, potentially switching brands if a competitor offers a more appealing package. This dynamic can dilute the impact of Hisense's brand-building efforts, giving customers more leverage.

The electronics market in 2024 saw continued emphasis on smart features. For instance, by mid-2024, smart TV penetration in developed markets approached 80%, with consumers actively seeking seamless integration with other devices. This means if Hisense doesn't match or exceed competitor offerings in areas like AI-powered features or cross-platform compatibility, customers have a clear alternative, increasing their bargaining power.

- Feature-driven switching: Consumers readily switch brands for superior or novel features, diminishing the protective effect of brand loyalty.

- Smart home ecosystem importance: Compatibility and integration within a broader smart home network are becoming key purchasing drivers, influencing brand choice over established loyalty.

- Competitive feature parity: When competitors quickly match or surpass Hisense's innovations, the perceived unique value of Hisense's offerings decreases, empowering customers.

The bargaining power of customers for Hisense is high due to price sensitivity and the easy availability of alternatives. In 2024, despite increased spending on electronics, price remained a dominant factor in over 60% of appliance purchases. This means customers can easily switch if Hisense doesn't offer competitive pricing.

Low switching costs further empower consumers, allowing them to readily explore different brands without significant barriers. With abundant online information and reviews available in 2024, customers are well-informed and can effectively negotiate for better deals, increasing their leverage over Hisense.

Large retailers and distributors, due to their substantial purchase volumes, wield considerable influence over Hisense. These key partners, representing a significant portion of Hisense's sales in 2024, can dictate terms, demand favorable pricing, and influence product visibility, amplifying their bargaining power.

| Factor | Impact on Hisense | 2024 Data Point |

| Price Sensitivity | High | 60% of appliance purchases driven by price. |

| Switching Costs | Low | Minimal barriers to changing brands. |

| Information Availability | High | Millions of product reviews influence choices. |

| Retailer Concentration | High | Key partners represent substantial sales volume. |

Preview Before You Purchase

Hisense Porter's Five Forces Analysis

This preview showcases the complete Hisense Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the industry. The document you see here is the exact file you will receive immediately after purchase, ensuring no surprises or missing sections. You can confidently expect to download this professionally formatted and ready-to-use analysis the moment your transaction is complete.

Rivalry Among Competitors

Hisense faces fierce competition from global powerhouses like Samsung, LG, Sony, and Panasonic, alongside formidable regional brands and rapidly growing Chinese manufacturers such as TCL, Xiaomi, and Haier. This crowded market demands constant innovation and robust marketing efforts for Hisense to secure and expand its market position.

The intense rivalry often translates into aggressive pricing strategies and rapid feature development across the industry. For instance, in 2024, the global consumer electronics market saw price fluctuations driven by component costs and promotional activities, with major players like Hisense actively participating in price wars, particularly in the television and appliance segments.

The consumer electronics and home appliance sectors, where Hisense operates, are characterized by substantial capital outlays for manufacturing facilities, advanced machinery, and ongoing research and development. These high fixed costs create a strong pressure for companies to maximize production output to distribute these expenses over a larger volume, thereby achieving economies of scale.

This drive for high capacity utilization often fuels aggressive pricing tactics and fierce competition as firms strive to secure sufficient sales volume to cover their fixed costs. For instance, in 2024, the global television market, a key segment for Hisense, experienced intense price competition, with average selling prices for many models seeing declines due to oversupply in certain regions.

Consequently, the industry becomes acutely sensitive to periods of oversupply, where excess inventory can lead to significant price wars. Hisense, like its competitors, must navigate this environment by balancing production levels with market demand to maintain profitability and market share.

The electronics industry, particularly in areas like televisions and smartphones, experiences incredibly fast technological shifts and short product lifecycles. This means companies like Hisense need to constantly pour money into research and development to bring out new features and better performance. For instance, the push towards AI integration and higher resolutions like 8K in TVs requires significant ongoing investment.

This relentless drive for innovation directly intensifies competition. Companies are locked in a race to be the first to market with the latest advancements, whether it's in display technology, processing power, or smart connectivity. In 2023, global R&D spending in the consumer electronics sector continued its upward trend, with major players allocating substantial portions of their revenue to stay competitive, creating a dynamic environment where staying still means falling behind.

Aggressive Marketing and Brand Building

Companies like Hisense face intense competition, often pushing them to invest heavily in aggressive marketing and brand building. This is crucial because many products offer similar core functionalities, making it difficult to stand out. Extensive promotional campaigns, sponsorships, and celebrity endorsements are common tactics to capture consumer attention and build loyalty.

The battle for brand recognition and consumer trust is a significant driver of competitive rivalry in this sector. For instance, in 2024, the global advertising spending on consumer electronics was projected to reach hundreds of billions of dollars, with a substantial portion allocated to digital and broadcast media by major players. This intense marketing spend directly impacts the cost of customer acquisition and the overall competitive landscape.

- Aggressive marketing is a key differentiator in a market with similar product features.

- Sponsorships and celebrity endorsements are common strategies to enhance brand visibility.

- The significant investment in advertising by competitors amplifies competitive rivalry.

- Brand recognition and consumer trust are critical battlegrounds for market share.

Mergers, Acquisitions, and Strategic Alliances

The competitive landscape is constantly reshaped by mergers, acquisitions, and strategic alliances as companies seek to consolidate market share, gain access to new technologies, or expand into new geographic regions. Hisense itself has expanded through acquisitions, indicating the dynamic nature of this rivalry. Such activities can further intensify competition by creating larger, more formidable competitors with broader portfolios and greater resources.

In 2024, the global M&A market saw significant activity, with tech and consumer electronics sectors being particularly active. For instance, the semiconductor industry, a key area for Hisense's component sourcing and product development, experienced several high-profile consolidation plays. These moves aim to secure supply chains and bolster R&D capabilities, directly impacting the competitive intensity for companies like Hisense.

- Increased Market Concentration: Mergers and acquisitions can lead to fewer, larger players in the market, potentially increasing pricing power and reducing competitive pressures in some segments, while intensifying them in others.

- Technological Advancement: Alliances and acquisitions often focus on acquiring new technologies, accelerating innovation cycles and forcing competitors to either keep pace or risk falling behind.

- Geographic Expansion: Companies use M&A to enter new markets, bringing fresh competitive dynamics and challenging established players in those regions.

- Hisense's Strategic Moves: Hisense's own history of strategic acquisitions demonstrates its proactive approach to navigating this evolving competitive environment and enhancing its market position.

The competitive rivalry for Hisense is exceptionally high, driven by global giants like Samsung and LG, alongside strong regional players and other Chinese brands such as TCL and Xiaomi. This crowded marketplace necessitates continuous innovation and substantial marketing investment to maintain and grow market share.

In 2024, the consumer electronics sector, a key area for Hisense, saw intense price competition, particularly in the television market, with average selling prices declining due to oversupply in certain regions. This pressure is amplified by high fixed costs in manufacturing, pushing companies to maximize production and potentially engage in price wars to cover expenses.

Product lifecycles in electronics are rapidly shortening, compelling companies like Hisense to invest heavily in R&D to introduce new features and technologies, such as AI integration and higher resolution displays. This constant innovation race is a significant factor in the fierce competition, with global R&D spending in consumer electronics continuing to rise, as evidenced by the significant investments made by major players in 2023.

| Key Competitor | 2023 Global TV Market Share (Approx.) | 2024 Focus Areas |

| Samsung | 29.4% | QLED, Neo QLED, MicroLED, AI features |

| LG | 16.1% | OLED, QNED, AI Picture Pro, webOS enhancements |

| TCL | 11.9% | Mini-LED, Google TV integration, budget-friendly options |

| Hisense | 12.5% | ULED, Mini-LED, Laser TVs, smart home integration |

| Sony | 6.1% | OLED, Cognitive Processor XR, gaming features |

SSubstitutes Threaten

Consumers increasingly access entertainment and information through a widening range of devices beyond traditional televisions. Smartphones, tablets, and laptops offer portable and personalized viewing experiences, directly competing for consumer attention. In 2024, global smartphone shipments were projected to reach 1.17 billion units, highlighting the widespread adoption of these alternative devices.

These multipurpose devices can fulfill many of the functions previously reserved for televisions, acting as substitutes for secondary screen usage or even primary viewing for some demographics. The convenience and versatility of these alternatives can thus dampen the demand for new TV purchases, impacting Hisense's market share.

Hisense's smart home solutions contend with robust substitution threats from established tech giants. Companies like Google, Amazon, and Apple offer comprehensive smart home ecosystems that can integrate a wide array of devices, potentially drawing consumers away from Hisense's individual smart appliances if they don't offer superior interoperability. For instance, by mid-2024, Amazon Alexa devices were estimated to be in over 40 million US households, showcasing the widespread adoption of competing ecosystems.

The threat of substitutes for Hisense's home appliance offerings exists, particularly from highly specialized, single-purpose devices. For example, consumers might opt for professional laundry services instead of purchasing a washing machine, especially in urban areas where convenience is paramount. In 2024, the global laundry services market was valued at approximately $100 billion, indicating a significant segment that bypasses appliance sales.

Similarly, dedicated kitchen gadgets, such as high-end blenders or specialized coffee makers, can substitute for the integrated functions found in Hisense's multi-functional refrigerators or ovens. While these niche alternatives may not replace entire appliance suites, they can erode market share within specific product categories, impacting Hisense's sales volume for those particular features.

Durability and Longevity of Existing Products

The increasing durability and longevity of existing consumer electronics and home appliances present a significant threat of substitutes for new purchases. When older models continue to perform reliably and satisfy fundamental consumer needs, the motivation to upgrade to newer Hisense products weakens. This necessitates that Hisense consistently introduces compelling new features and enhanced energy efficiencies to encourage replacement cycles.

For instance, a study in 2024 indicated that the average lifespan of a television has extended to over 8 years, with many consumers opting to repair rather than replace functional but older units. Similarly, washing machines and refrigerators are often designed for longevity, with a substantial percentage of consumers reporting satisfaction with appliances that are 10 years or older. This trend directly impacts the demand for new models, as the perceived value proposition of upgrading must be exceptionally strong to overcome the inertia of owning a still-functional product.

- Extended Product Lifespans: Consumer electronics and home appliances are increasingly built to last, reducing the frequency of necessary replacements.

- Repair vs. Replace Mentality: Consumers are more inclined to repair existing, functional items rather than purchase new ones, especially if the cost of repair is significantly lower than a new purchase.

- Diminished Upgrade Incentive: If older products meet basic needs, the perceived benefit of upgrading to newer Hisense models with incremental improvements may not be enough to drive sales.

- Innovation Imperative: Hisense must continuously innovate with truly differentiating features, superior performance, or significant energy savings to overcome the threat posed by durable existing products and stimulate replacement demand.

Services as Substitutes for Appliance Ownership

The rise of service-based alternatives presents a significant threat to appliance manufacturers like Hisense. For instance, subscription meal kit services, which saw substantial growth, particularly during and after 2020, can reduce the demand for certain kitchen appliances by simplifying meal preparation. Similarly, the increasing availability and adoption of professional cleaning services might dampen the perceived need for consumers to invest in high-end cleaning appliances.

These services, while not directly replacing the physical appliance, chip away at the perceived value and necessity of owning them. This shift in consumer behavior can lead to a decrease in sales volume for appliances that were once considered essential. For example, the global market for home cleaning services is projected to continue its upward trajectory, indicating a sustained shift in consumer preference away from DIY cleaning.

- Meal Kit Services: Companies like HelloFresh and Blue Apron have expanded their customer base, potentially reducing the reliance on multiple kitchen appliances for diverse meal preparation.

- On-Demand Cleaning: The growth of services such as Merry Maids or local independent cleaning businesses offers consumers an alternative to investing in and maintaining their own cleaning equipment.

- Appliance-Free Living Trends: While niche, some lifestyle trends emphasize minimal living, which can include opting out of owning certain appliances altogether, relying on shared facilities or external services.

The threat of substitutes for Hisense is substantial, driven by the proliferation of digital devices and evolving consumer habits. Beyond traditional TVs, smartphones, tablets, and laptops offer personalized viewing, impacting demand for new television sets. In 2024, global smartphone shipments were expected to hit 1.17 billion units, underscoring the ubiquity of these alternatives.

Furthermore, service-based alternatives like meal kits and professional cleaning services can reduce the perceived necessity of owning certain home appliances. The global laundry services market, valued around $100 billion in 2024, illustrates a significant segment that bypasses appliance purchases entirely.

The increasing longevity of existing electronics and appliances also acts as a substitute, as consumers are less inclined to upgrade when older models function adequately. By mid-2024, Amazon Alexa devices were in an estimated 40 million US households, highlighting the strength of competing smart home ecosystems that can integrate various functions, potentially diverting consumer interest from Hisense's offerings.

Entrants Threaten

The consumer electronics and home appliance sector demands massive upfront capital for research, development, manufacturing plants, and establishing robust global supply chains. For instance, building a state-of-the-art semiconductor fabrication plant, crucial for many electronic components, can cost tens of billions of dollars, a prohibitive sum for most newcomers.

New entrants struggle to achieve the cost efficiencies that established giants like Hisense enjoy through economies of scale. Hisense’s large production volumes allow for lower per-unit manufacturing costs, making it difficult for smaller competitors to match their pricing and maintain profitability.

Hisense, like many established players in the consumer electronics sector, benefits significantly from strong brand loyalty. In 2024, consumer research consistently shows that brand recognition is a key driver in purchasing decisions, particularly for higher-ticket items like televisions and appliances. New entrants face the daunting challenge of building this trust from scratch, requiring substantial marketing investment to even reach the awareness level of incumbents.

Furthermore, the distribution channels for consumer electronics are deeply entrenched. Hisense has cultivated long-standing relationships with major global retailers, both brick-and-mortar and online. For a new company, securing prime shelf space or prominent placement on e-commerce platforms is incredibly difficult and costly, as these channels are already dominated by established brands with proven sales volumes and marketing support.

The consumer electronics industry, where Hisense operates, is heavily reliant on advanced technology and substantial intellectual property. New companies entering this space face a significant hurdle in acquiring or developing the necessary technological capabilities and navigating the patent landscape. For instance, in 2024, global R&D spending in the semiconductor sector alone reached hundreds of billions of dollars, highlighting the immense investment required to stay competitive.

Developing proprietary technology from scratch is an incredibly resource-intensive endeavor, demanding vast capital and specialized expertise. Alternatively, licensing existing patents from established players like Hisense can be prohibitively expensive and come with restrictive terms, limiting a new entrant's innovation and market freedom. Hisense's substantial investment in research and development, which consistently ranks among the top global patent filers, directly contributes to its technological leadership and creates a formidable barrier to entry.

Regulatory Hurdles and Compliance Costs

The consumer electronics and home appliance sectors face a complex web of regulations. These include international and regional rules on product safety, energy efficiency, environmental impact, and data privacy. For instance, the European Union's Ecodesign Directive sets energy consumption standards for many appliances, impacting manufacturing processes and product design. New companies entering this market must invest heavily in understanding and complying with these varied requirements.

These compliance costs can be substantial, acting as a significant barrier for smaller or newer businesses. Navigating the diverse global regulatory landscape, from CE marking in Europe to FCC certification in the United States, requires specialized knowledge and resources. In 2024, companies are increasingly focusing on sustainability, with regulations like the EU's proposed Right to Repair directive potentially adding further compliance layers and costs for manufacturers aiming for global market access.

The threat of new entrants is therefore tempered by the significant financial and operational burden associated with regulatory compliance.

- Safety Standards: Compliance with standards like UL certification in North America or IEC standards globally is mandatory.

- Energy Efficiency: Regulations such as ENERGY STAR in the US and EU energy labels require significant R&D investment.

- Environmental Regulations: Directives like RoHS (Restriction of Hazardous Substances) and WEEE (Waste Electrical and Electronic Equipment) impact material sourcing and end-of-life product management.

- Data Privacy: Compliance with GDPR in Europe and similar data protection laws globally adds complexity to smart appliance development and data handling.

Potential for Retaliation by Incumbents

Existing players like Hisense possess substantial financial resources and established market influence. This allows them to mount aggressive responses to new entrants, potentially through price reductions or heightened advertising campaigns. For example, in the fiercely competitive global TV market, where Hisense is a major player, established brands have historically used price wars to stifle emerging competitors.

The prospect of such strong pushback from incumbents can significantly discourage potential new companies from entering the market. Newcomers would face a challenging landscape against well-positioned rivals prepared to protect their market share, making entry economically unviable for many.

- Established brands can leverage economies of scale to offer lower prices, making it difficult for new entrants to compete on cost.

- Significant marketing budgets of incumbents can overwhelm smaller new entrants' promotional efforts.

- Rapid product development cycles by existing players can quickly render new entrants' offerings obsolete.

- Patents and intellectual property held by established firms can create significant barriers to entry.

The threat of new entrants for Hisense remains moderate due to substantial capital requirements for R&D, manufacturing, and global supply chains, with semiconductor plant costs alone reaching tens of billions. Economies of scale enjoyed by Hisense, coupled with strong brand loyalty in 2024, further elevate barriers.

Entrenched distribution channels and the need for significant marketing investment to build brand awareness present considerable challenges for newcomers. Hisense's substantial investments in proprietary technology and navigating intellectual property rights, with global R&D in semiconductors exceeding hundreds of billions in 2024, also deter new market entrants.

Regulatory compliance, covering safety, energy efficiency, and data privacy, adds significant costs and complexity. For example, EU directives and US certifications require specialized knowledge and resources, with potential new regulations like the EU's Right to Repair directive in 2024 adding further layers.

Incumbents like Hisense can leverage their financial strength to respond aggressively to new entrants through price wars or increased advertising, making market entry economically unviable for many. Established brands' rapid product development also poses a threat to new offerings.

| Barrier Type | Description | Example Impact |

|---|---|---|

| Capital Requirements | High upfront investment for R&D, manufacturing, and supply chains. | Building a semiconductor plant can cost tens of billions USD. |

| Economies of Scale | Lower per-unit costs for established players due to high production volumes. | Hisense can offer competitive pricing due to efficient mass production. |

| Brand Loyalty & Marketing | Established trust and recognition require significant marketing spend. | Consumer research in 2024 shows brand recognition is key for major appliance purchases. |

| Distribution Channels | Securing shelf space and online placement is difficult and costly. | Hisense's long-standing retailer relationships limit access for newcomers. |

| Technology & IP | Need for advanced capabilities and navigating patents. | Global semiconductor R&D spending in 2024 reached hundreds of billions USD. |

| Regulatory Compliance | Meeting safety, efficiency, and environmental standards. | EU Ecodesign Directive and US ENERGY STAR requirements necessitate R&D investment. |

| Incumbent Retaliation | Established firms can use price wars and marketing to deter new entrants. | The global TV market has seen price wars that stifle emerging competitors. |

Porter's Five Forces Analysis Data Sources

Our Hisense Porter's Five Forces analysis is built upon a foundation of robust data, including Hisense's annual reports, financial statements, and investor presentations. We also incorporate market research reports from firms specializing in the consumer electronics and appliance sectors, alongside industry trade publications.